The idea of introducing a cap on prices for Russian commodities is becoming increasingly popular in Europe. A cap has already been introduced on Russian oil (USD 60 per barrel) and natural gas (USD 2,000 per 1,000 cubic meters). Now there is talk of introducing a ceiling on gold prices.

So far, such ideas are being introduced in a veiled form. For example, in the form of an analysis, what would be the consequences of the hypothetical requirement for Russia to link the price of the Urals oil to gold, for example, at the price of 2 barrels per 1 gram. This scenario is described in the report by Credit Suisse strategic analyst Zoltan Pozsar.

It is not very clear why Russia at all should link oil to gold. Russia, as one of the leading gold-mining countries in the world, does not need gold. The Bank of Russia even suspended the purchase of gold from Russian banks in the spring of 2022: officially – to ensure demand from the population, but in reality – so as not to saturate the economy with money in conditions when the ruble is already too strong relative to the dollar and other leading currencies.

It is even less clear why the binding should be done at a deliberately unfavourable rate (2 barrels per 1 gram), whereas Zoltan Pozhar himself writes that the equilibrium price today is 1 barrel per 1 gram). To achieve a doubling of the gold price from USD 1,800 to USD 3,600 per ounce of gold? It's too complicated a plan.

The only logical explanation is that the EU realized that by starting to play fixed prices for raw materials, they would have to follow this path to the end. And they are somewhat alarmed that if prices for all types of raw materials important for financial markets are not fixed, this can create serious price distortions. And, in fact, it can destroy financial markets and the ability of the US Federal Reserve and other institutions to manage monetary policy. And this ability has already been seriously undermined by years of unrestrained emission pumping of the economies of the most developed countries after the 2008 crisis and in response to the 2020 pandemic.

And in response to this danger, Europe is preparing to use the power control tools of the main commodity markets to protect its privileged position in the global economy. Since purely currency and credit manipulations are no longer enough for this.

Cheap gold – strong dollar

Paying attention to gold is natural. Despite the promoted idea that the era of gold as a monetary asset has passed, in fact, leading financiers pay a lot of attention to it. A classic example is the policy of the coordinated sale of gold from the reserves of central banks to keep interest rates low, which was implemented in the second half of the 1990s-early 2000s. Central banks of developed countries conducted coordinated interventions to support the policy of a strong dollar and this served as the basis for launching a multi-year growth in the stock market.

The ideological foundation of this policy was the academic paper by Larry Summers "Gibson's Paradox and the Gold Standard" (1985). In it, the future finance minister in the Bill Clinton administration, the heir to the legendary Robert Rubin in this post, justified the recipe for a successful stimulating monetary policy: keep gold prices low – and you will be able to keep interest rates low. With a strong currency.

For the past ten years, the fight against inflation has not been a priority for central banks. Their attention and efforts were focused on maintaining demand, stimulating economic growth and preventing the collapse of debt markets. Waves of quantitative easing followed one after another. Since the start of the 2008 crisis, the balance sheet of the G10 central banks relative to the size of the economy has tripled, from about 15% to more than 50% of GDP.

The surge in inflation began to be perceived as a problem in the summer of 2021. However, the focus of attention was on inflation only in 2022 – primarily for political reasons. The midterm elections in the United States have dramatically increased the sensitivity of the media environment to this topic. In addition, it became possible to explain to the layman the surge in prices not by their own mistakes of economic policy, but by the result of anti-Russian sanctions caused by the conflict in Ukraine.

On the other hand, the cycle of interest rate increases has passed and it has become clear that it is unrealistic to contain inflation within the framework of the measures being implemented. Additional steps are required. So direct control of commodity prices began to be perceived as something quite acceptable. And the traditional for such situations soul-searching began: how did we fight inflation before?

The same Summers again became a popular economic commentator. In early December, in an interview on Bloomberg, he said that the economy has a long way to go to reduce inflation to the Fed's target: "I suspect they (the US Federal Reserve) are going to need more increases in interest rates than the market is now judging or than they're now saying."

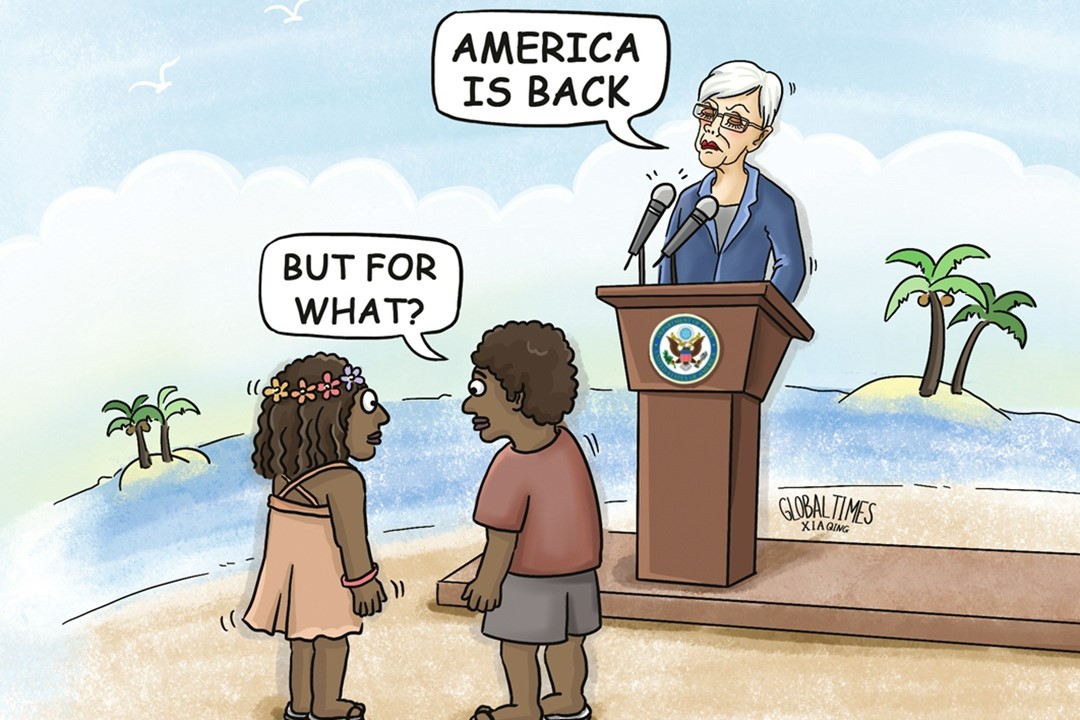

In such a situation, we can expect the most extravagant measures, such as attempts to expand the zone of direct control of commodity prices not only from Russia, but also from other countries. As you know, appetite comes with eating. The tendency to restore colonial patterns of relations in the behaviour of Western elites has been traced for a long time.

Welcome to the shade

However, the effect of such steps is unlikely to be what politicians and financiers expect. The creation of various schemes with politically motivated pricing schemes and complicated transportation and payment mechanisms will lead to the destruction of transparent models of financial markets.

It is quite possible that this is exactly the goal being set. In recent years, forces in the West have been gaining weight, which have developed a taste for various schemes for making and implementing non-transparent decisions. As an example, we can point to the essentially illegal trade in Kurdish oil from Syrian and Iraqi fields, which has been conducted for years by the US military and PMCs.

With the introduction of the price cap for Russian oil, various schemes of gray imports will inevitably arise to bypass the ceiling. Therefore, in such an important area as energy, shadow contours of doing business will be created.

Legal mechanisms in Europe are already under increasing pressure for a number of reasons – from migration processes to the weakening of the institution of the state as such. So the emergence of such fertile ground as non-market pricing for oil, gas, and in the future for gold, will only strengthen this trend. And by the way, worrying about inflation, as it is happening today, under new circumstances won't be trendy.