Intermittent meetings between representatives of the Democratic Party and Republicans have not yet led to a result – the inevitable raising of the national debt ceiling. It is highly likely that the US could avoid defaulting this time too. Moreover, it is nor clear that a default will happen at all. But the current turmoil surrounding the debt ceiling poses far greater dangers than an actual default, suggesting that America's political elites have lost the ability to negotiate amongst themselves. This could not but deal the heaviest blow to the economy.

Politics against the economy

As U.S. Treasury Secretary Janet Yellen has repeatedly declared, it is unlikely that even emergency measures - without raising the debt ceiling, of course - will be able to fund American government spending after June 1. Currently, the debt ceiling is only $31.4 trillion. This is very little: the US budget deficit by the end of the year is estimated at two trillion dollars. It can be financed only through new government borrowings, hence the ceiling must be raised by at least the same two trillion.

Generally speaking, a US debt-ceiling crisis should not have arisen this year: The United States can afford much larger national debt. From the technical and economic point of view, the national debt expressed in the national fiat currency can be as large as necessary in the world today. As we know from the experience of the United States, the Fed can buy government bonds with the dollars it issues. Since there is no legal limit on the amount of the Fed's issuance, it can buy as many as 2, as many as 20 trillion bonds right tomorrow. That is, even if investors do not want to buy them (and they want to), there would be no problem with obtaining additional funds by this way.

All that stands in the way of this is the US debt ceiling regulation. Until 2011 there was no problem to raise it: Congress simply voted positively on the issue, understanding that otherwise the government would go into the shutdown.

However, in 2023 the Republican Party in Congress took a hostile stance to another inevitable raising of the national debt ceiling. They put forward a condition: the ceiling will be raised if the Democratic Party agrees to return budget spending to 2022 levels. Understandably, this demand was unacceptable from the start. The new 2023 spending includes politically sensitive items for Biden - from increased military aid to Ukraine to green growth investment. The White House cannot backtrack on such issues, they are too important to it - and certainly more important than what the Republican Party thinks.

Democrats point to the fact that the debt ceiling has been raised three times under Trump without any preconditions such as a cap on government spending. Republicans, predictably, ridicule these claims by pointing out that government spending did not rise as fast under Trump (before the Covid-19 pandemic) as it did under Biden. Both sides can't help but realize that their arguments are counterproductive. Republicans should surmise that expecting Joe Biden to be flexible in political dialogue is ridiculous. Democrats have no choice but to recognize that ignoring Republicans' demands will not encourage them to engage in dialogue.

So why is no one willing to concede, to take a step towards their opponent? After all, as you know, politics is the art of the possible and, moreover, the art of compromise. And without compromise, one cannot achieve even what is possible. Understandably, both parties would like to do everything without taking into account the views of their opponents - but outside of a one-party political system, this is simply not possible.

Immediate consequences

Since nobody wants to concede, an agreement to raise the debt ceiling by 1 June looks very doubtful. However, a default by the USA looks even more doubtful.

The experience of the past years shows that in case of serious problems with financing government spending it is relatively easy for Washington to go for a government shutdown. Such a measure would drastically reduce current spending and give time for political maneuvering around the debt ceiling - at least for weeks. As unready for political dialogue as Republicans and Democrats are, neither party is ready to be branded as the culprit in the run-up to next year's presidential elections.

Far more realistic is something else - a review of the U.S. credit ratings. In fact, the process is already under way - European credit rating agency Scope has already said on 5 May 2023 that it plans to review the US credit rating from AA to a lower one. A similar thing happened during a comparable crisis in 2011, when the Obama administration and Republicans could not reach an agreement on raising the ceiling for a long time.

The second consequence is even more important from a practical point of view: a serious correction on the stock markets is possible. Recall that in 2011 the S&P 500 fell by 16% in the last month before the default was due to expire. This time the situation is potentially even worse. The fact is that in 2011 the parties went straight into months of negotiations - back when the prospect of a default due to the failure to raise the ceiling was only on the horizon.

In 2023, on the other hand, there has been much talk about it since January, but no real cross-party talks on the issue - only an exchange of accusations in the public space. The culture of dialogue has declined in the last 12 years to the point where Republicans and Democrats are behaving like Twitter bickers and not like politicians of the Obama era, let alone the 20th century.

It also means that the tensions in the stock exchanges will become far more serious than they have been in the past. Adding fuel to the trouble is the fact that the US economy was recovering in 2011 and in 2023 almost all indicators point to a greater likelihood of a recession in the second half of the year. Purchases of cars and durable goods in the US are declining and freight traffic has fallen. Remember that in 2007 the volume of freight traffic started to fall many months before the actual crisis.

Under such conditions, even a government shutdown without an explicit agreement to raise the debt ceiling could trigger a serious panic, similar to the September 2008 stock market turmoil. And such a panic, in turn, could further deepen and intensify a future recession by reducing the willingness of banks to make new loans.

Alternatives to the crisis?

Purely hypothetically, there are also options where none of this - despite the parties' confrontation in Congress over the ceiling - would happen.

Such options include the proverbial "trillion dollar coin". In theory, the US Treasury could issue such a unit of currency in the form of a platinum coin, and by law the face value could be anything (unlike the face value of banknotes, which have separate legal regulations). By transferring such a coin to the Fed, the Treasury will receive the same amount of non-cash dollars from the Fed in exchange.

Technically, this is the only painless solution to the national debt ceiling problem. Yes, a trillion dollars is very small amount, and one such coin is not enough to cover the US budget deficit this year. But, firstly, a second (or fifth) can be issued. Secondly, even six months would give some time for a dialogue on raising the debt ceiling.

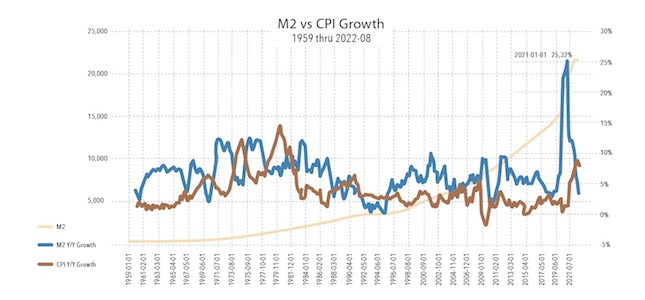

However, such a solution is rather unlikely. The fact is that the Fed is not run by Ben Bernanke now, but by people who believe that money supply growth is linked to rising prices in the USA. And against rising prices the Fed has declared a crusade. The trillion-dollar coin will actually be a money supply build-up at a high rate. The Fed would not be thrilled. Actually Janet Yellen has already said that the Fed might not accept such a coin.

Caption: All attempts by economists to find correlations between the money supply (in blue) and its growth rate and inflation have been fruitless, the correlation has never even risen to 0.78, which for a large economy means essentially no correlation. However, that doesn't matter: what matters is that the Fed believes there is a correlation. The Fed's acceptance of a trillion-dollar coin is therefore questionable. Credit: Benjamin Truitt

The second option: issuing a new type of premium bonds, e.g. new government bonds with higher interest rates that are not tightly regulated by the ceiling. This method has its disadvantages: It would increase the cost of servicing government debt and would also likely hit both the credit ratings and the US stock markets.

In addition, Biden can invoke the 14th Amendment (Section 4) to increase the ceiling by his own authority. Once again, the credit ratings and stock markets would be shaken because it would cause a constitutional crisis and necessitate an intervention by the Supreme Court.

The conclusion to be drawn from all this is that whatever the specific cure for the debt ceiling crisis, the side effects of all the cures will be the same: falling stock markets and a likely recession. Any other options are almost ruled out because of the general decline in the political culture of the US two-party political system.