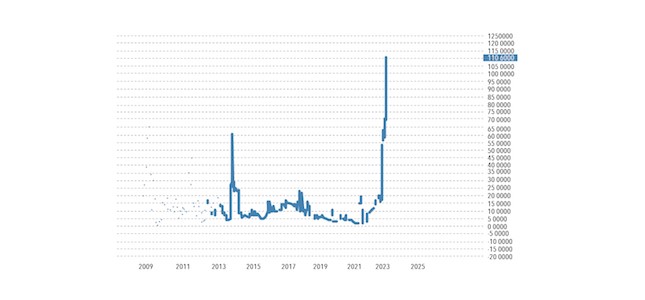

Formally, the main economic news was the resumption of the banking crisis in the United States, in the figure – the graph of the cost of shares of First Republic Bank:

However, if taking as news not only what happened but also what should have happened, but did not happen, then the main news, of course, is not this but the fact that Biden announced that he was running for a second presidential term.

The bottom line here is that for the first time, not just an abstract character (who may be overlooked during the election campaign) but the incumbent president (that is, in fact, one of the leaders of the election race) does not have any program of economic actions. Well, that is none.

Biden disagrees with the concept of "industrialization of the AUCUS", which is understandable since he represents the interests of transnational bankers, for whom this concept is unacceptable. Since it does not imply for them the preservation of a "place under the Sun." But he does not offer any alternative vision. Accordingly, there is no reason to prefer the policy of continuing to increase rates to the policy of reducing them or, say, the policy of "non-intervention in the affairs of the economy."

Moreover, there is not even an understanding of what basis to negotiate with the Republicans in the House of Representatives to overcome the upper threshold of public debt. Accordingly, there are no negotiations; only demands from the Biden administration that the threshold needs to be raised. But the Republicans will not agree to this. As a result, the expectations of a default in the market are becoming more confident.

For another two weeks, this situation can be tolerated, but the April inflation data, which will be released in mid-May, will most likely require some action. The trouble is that this situation, most likely, will not be able to bring Biden out of lethargy. And this means that the response will again be quite situational and, most importantly, some actions of part of the US authorities will contradict others.

Macroeconomics

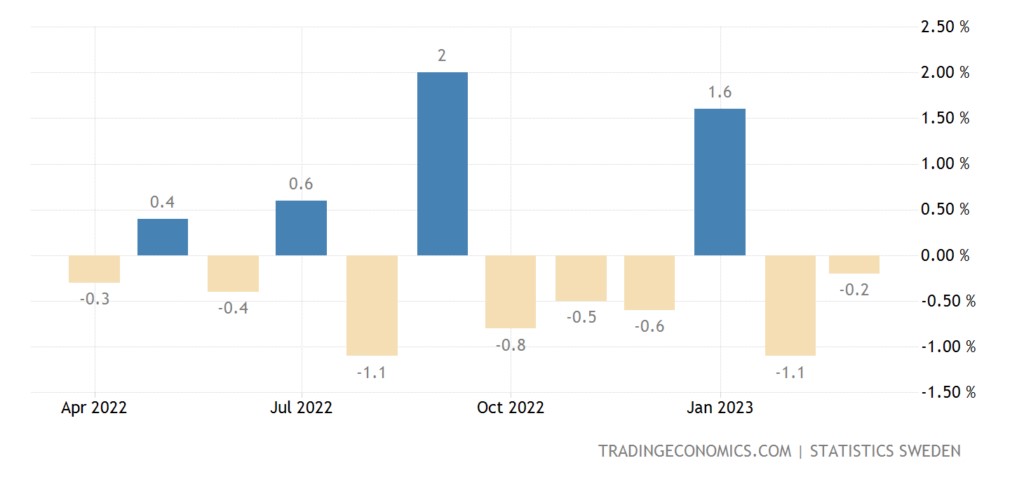

Swedish GDP -0.2% per month – 2nd minus in a row and 5th in the last 6 months:

US GDP grew twice weaker than expected:

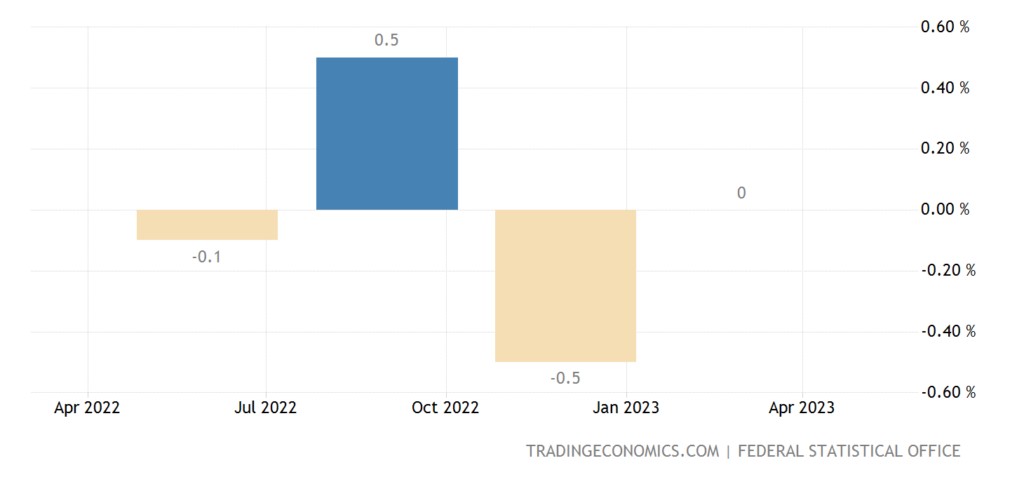

German GDP 0.0% QoQ after -0.5% QoQ:

And -0.1% per year – the 1st decline in 2 years:

This is all with obviously low inflation! The picture is much sadder, according to our estimates, US GDP fell by 6-8% last year, in this case the situation will be similar. For Germany, however, the situation is more complicated since it partially compensates for the decline at the expense of other EU countries.

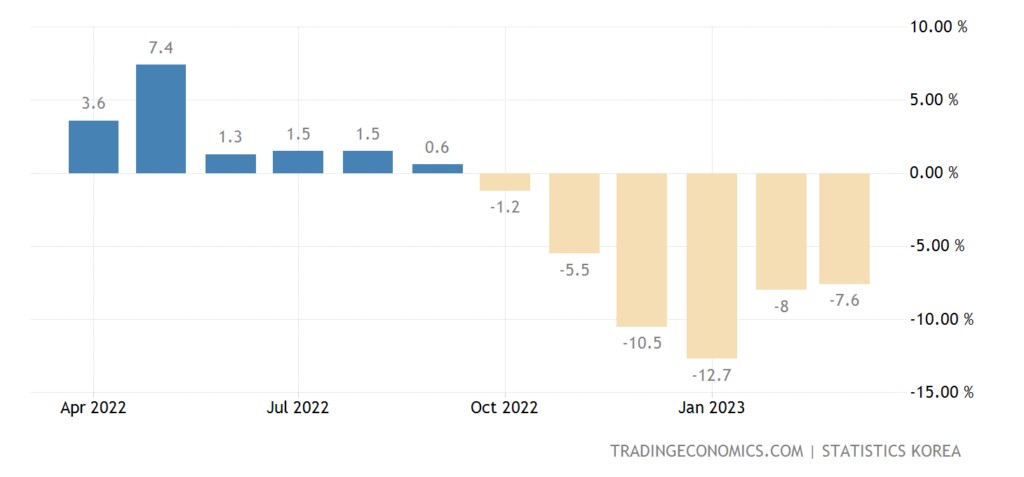

Industrial production in South Korea -7.6% per year – the 6th negative in a row:

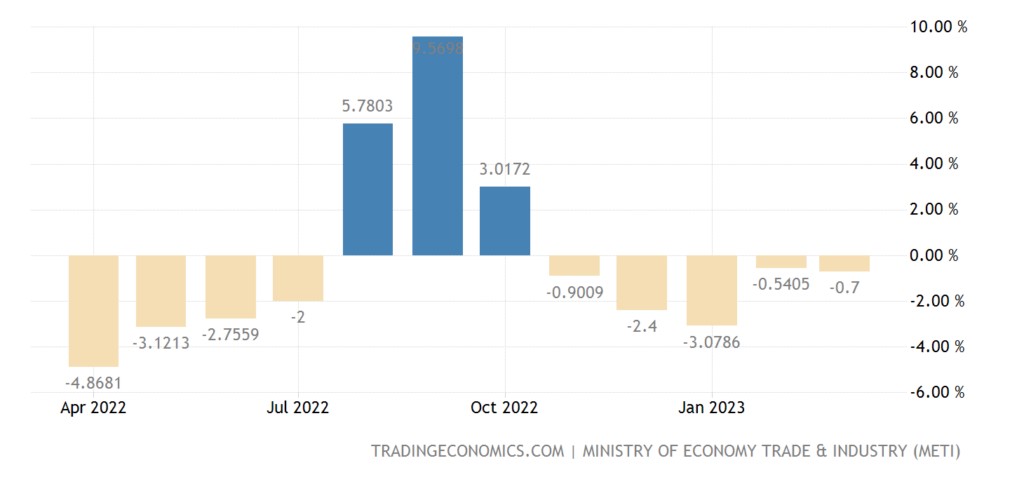

In Japan -0.7% per year – the 5th negative in a row:

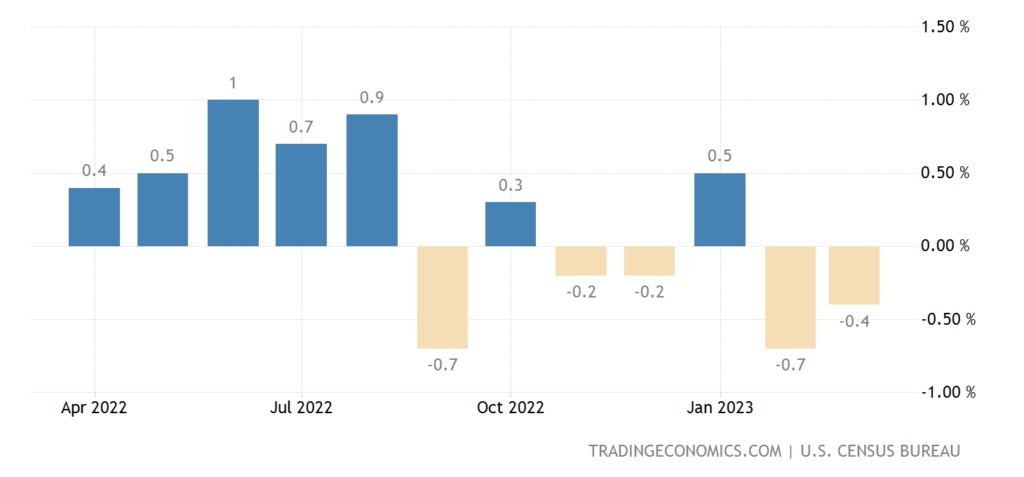

Non-military capital goods orders (excluding aircraft) in the US -0.4% per month – 2nd negative in a row and 4th in the last 5 months:

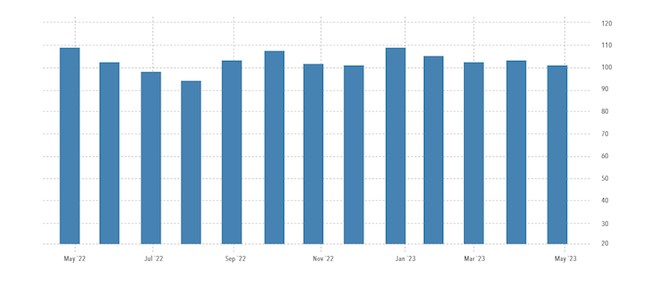

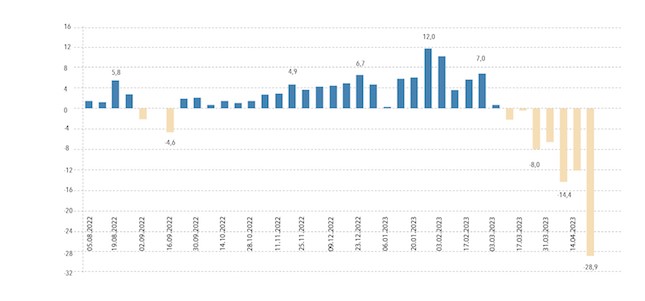

UK industrial order balance is worst in 2 years, down 9 months in a row:

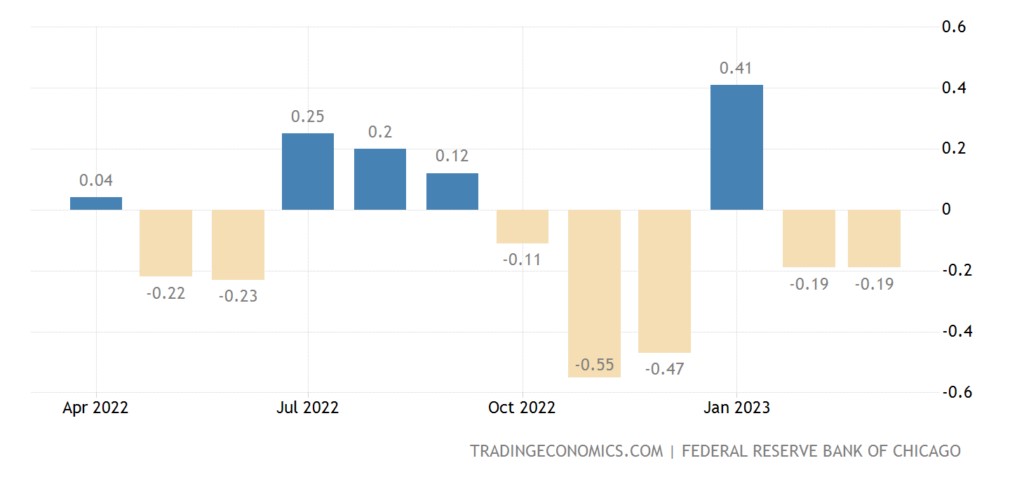

Chicago Fed National Activity Index -0.19 – 2nd minus in a row and 5th in the last 6 months:

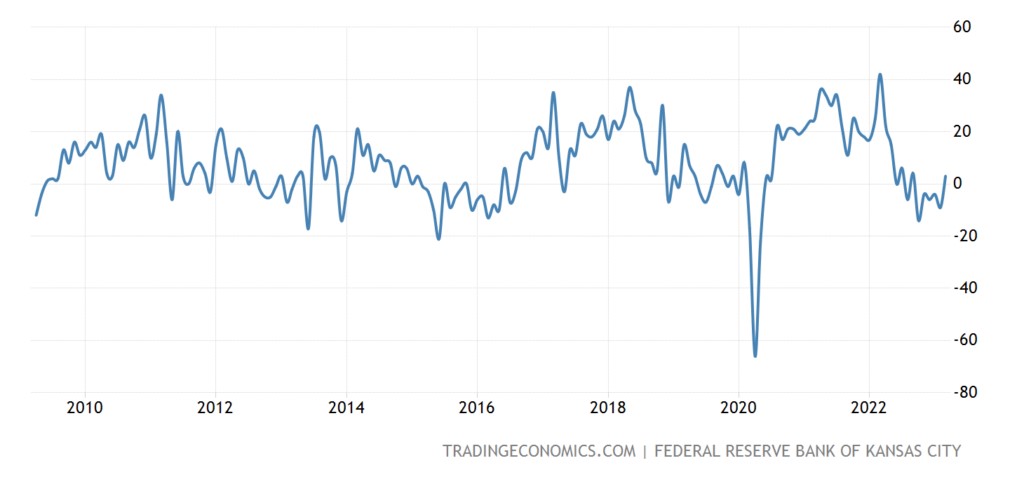

The activity of the manufacturing sector of the Kansas Fed is the weakest in 3 years, and before that – since 2009:

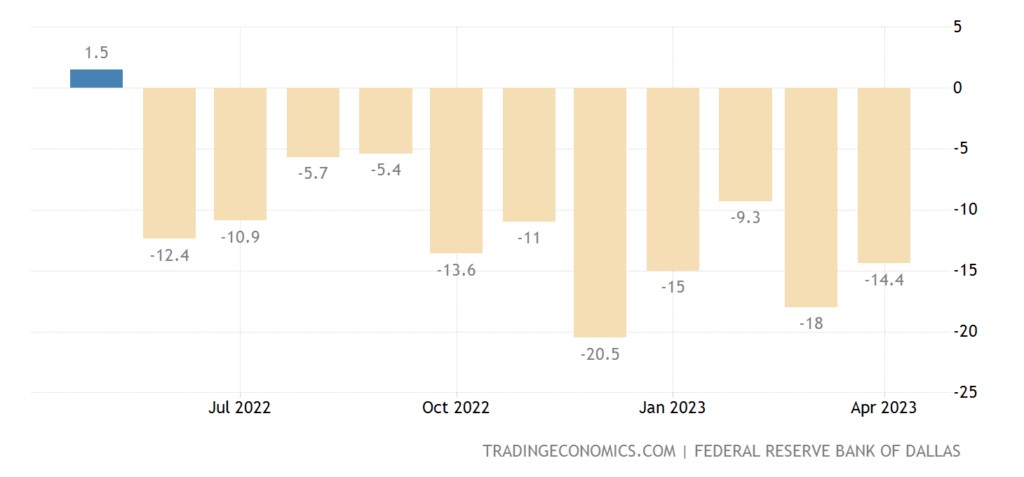

The index of industry activity in the Texas Fed zone almost repeated last year’s 3-year low:

And the same service sector index has been in the red for 11 months in a row:

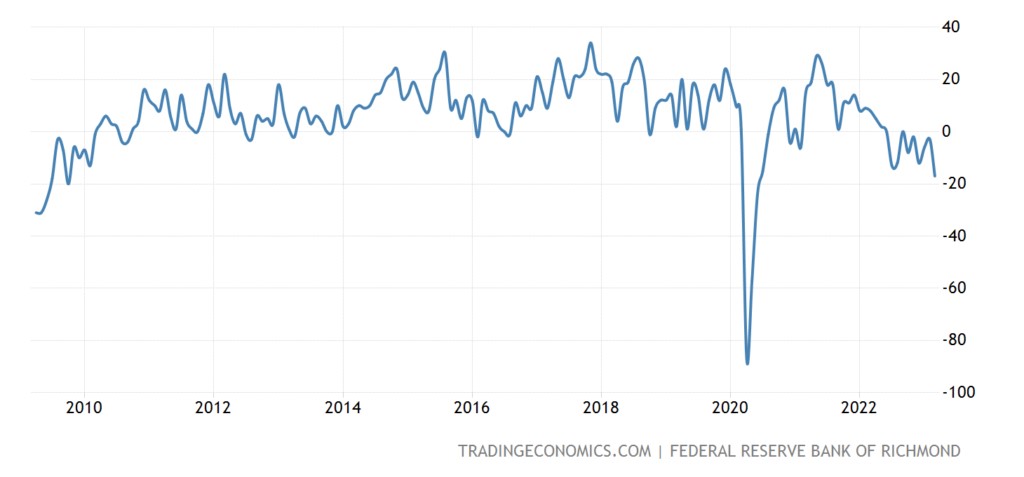

The similar indicator of the Richmond Fed is the worst since 2009, except for the failure of 2020:

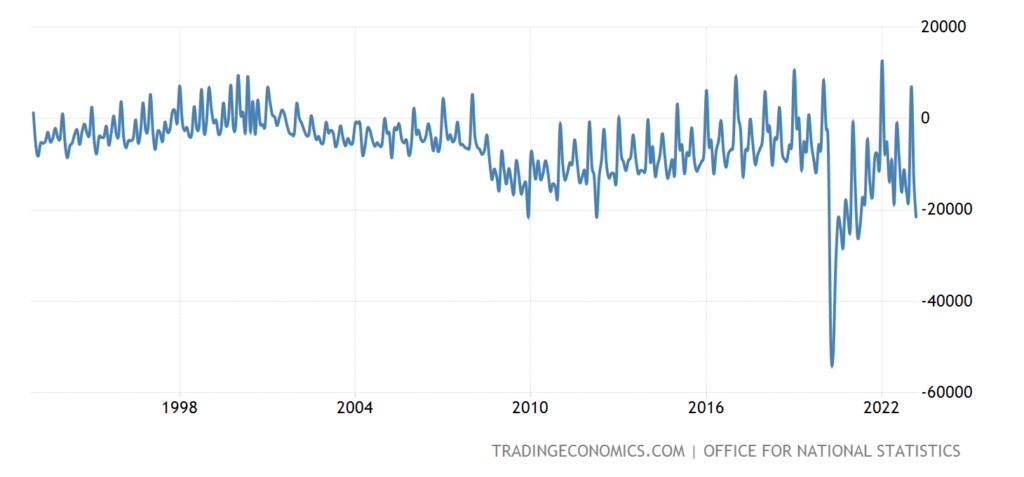

Britain’s budget deficit is a record, except for the rise in spending due to covid in 2020/21:

U.S. pending existing home sales -23.2% per year – 22nd straight loss:

The growth in housing prices in the US (+0.4% per year) is the smallest in 11 years:

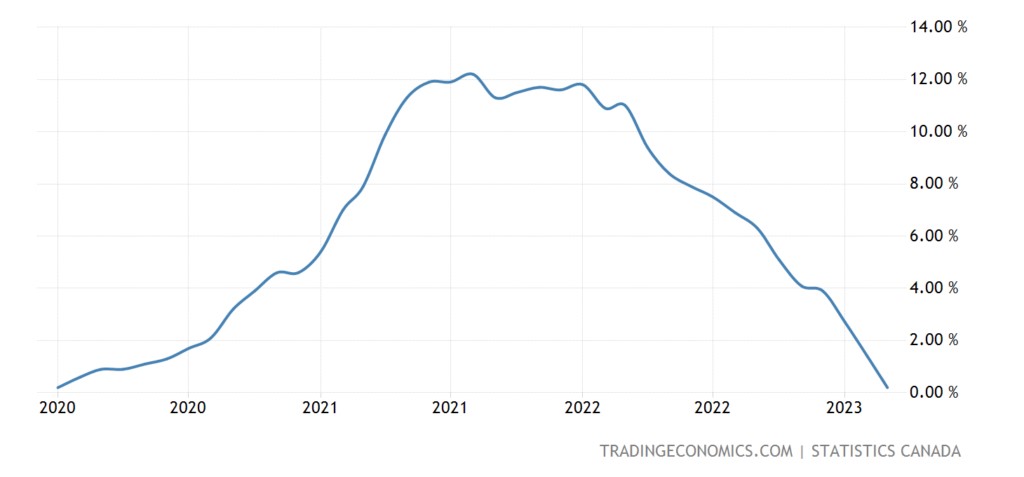

Prices of new buildings in Canada +0.2% per year – minimum since January 2020:

The median-weighted CPI (consumer inflation index) of Australia remains a record (+5.8% per year):

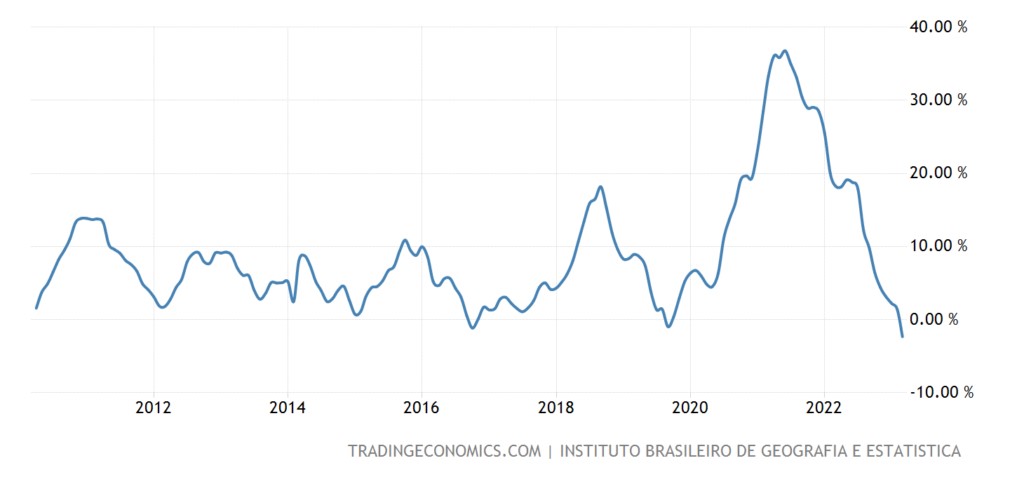

PPI (industrial inflation index) Brazil -2.3% per year – 13-year low:

Consumers in the US are the gloomiest in the last 9 months:

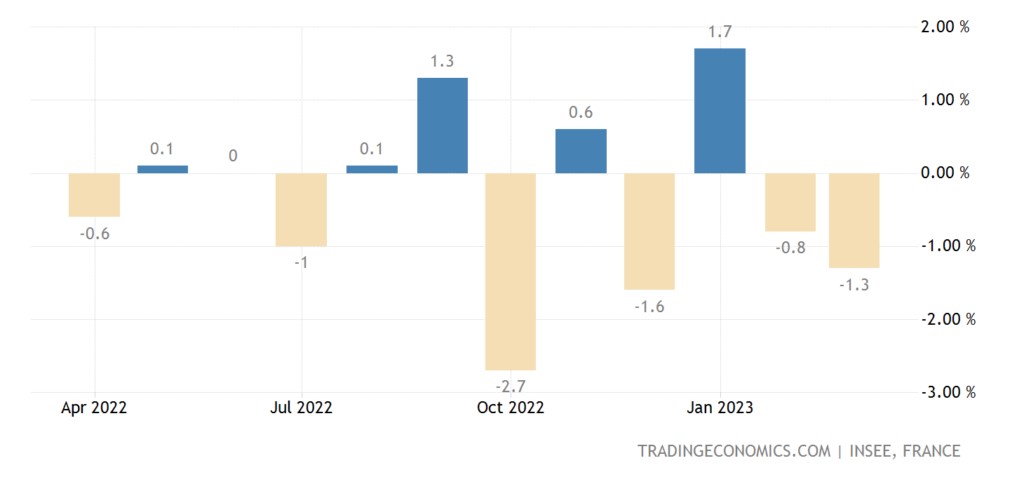

French household spending -1.3% per month – 2nd negative in a row and 3rd in the last 4 months:

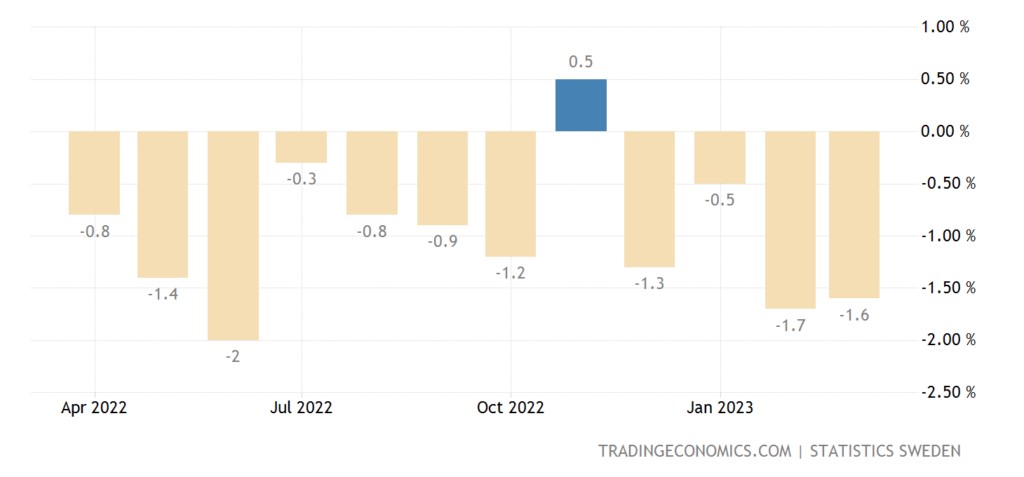

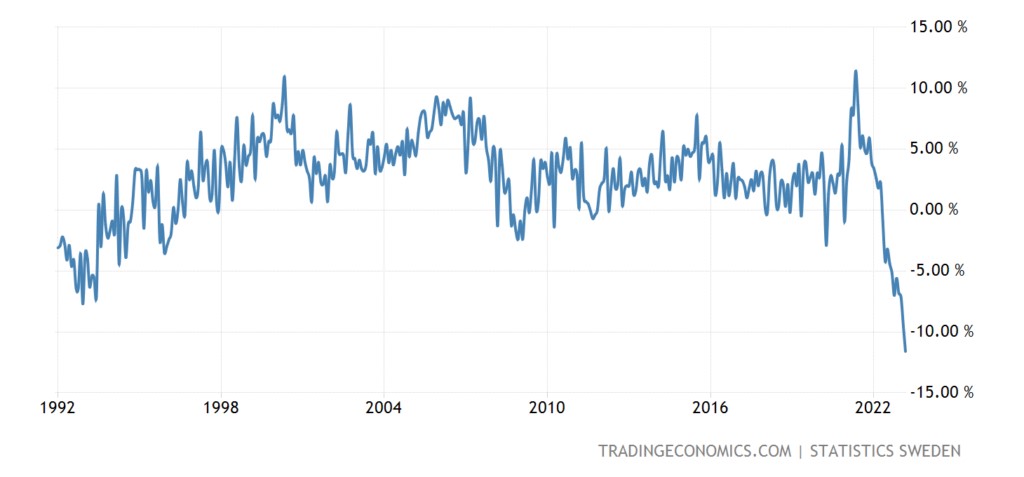

Retail sales in Sweden -1.6% m/m – 4th negative in a row and 11th in the last 12 months:

And -11.6% per year is an anti-record for 31 years of observations:

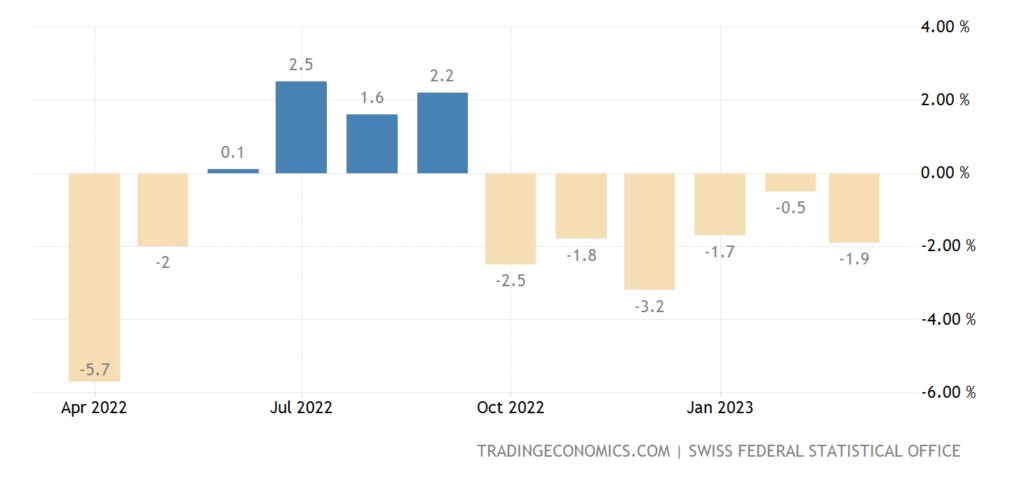

Retail Switzerland -1.9% per year – 6th negative in a row:

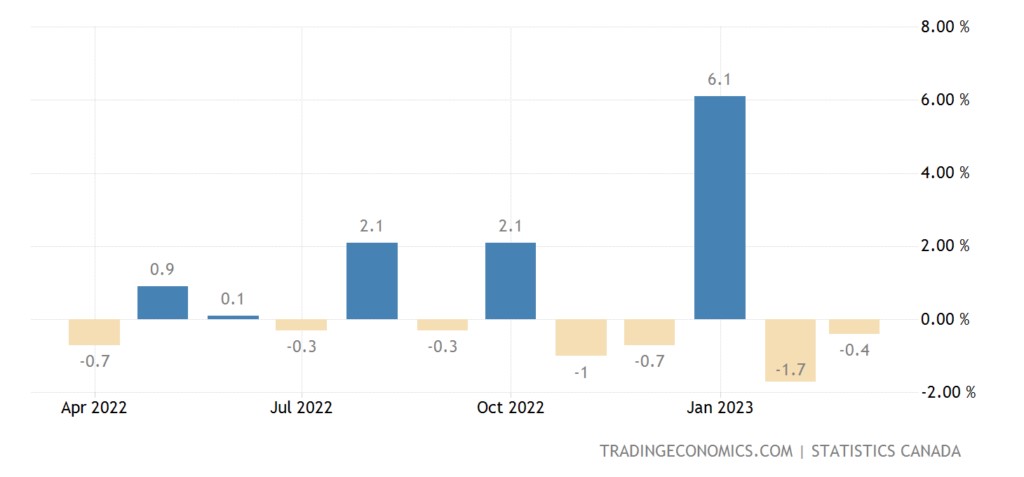

Wholesales in Canada -0.4% per month – 2nd negative in a row and 4th in the last 5 months:

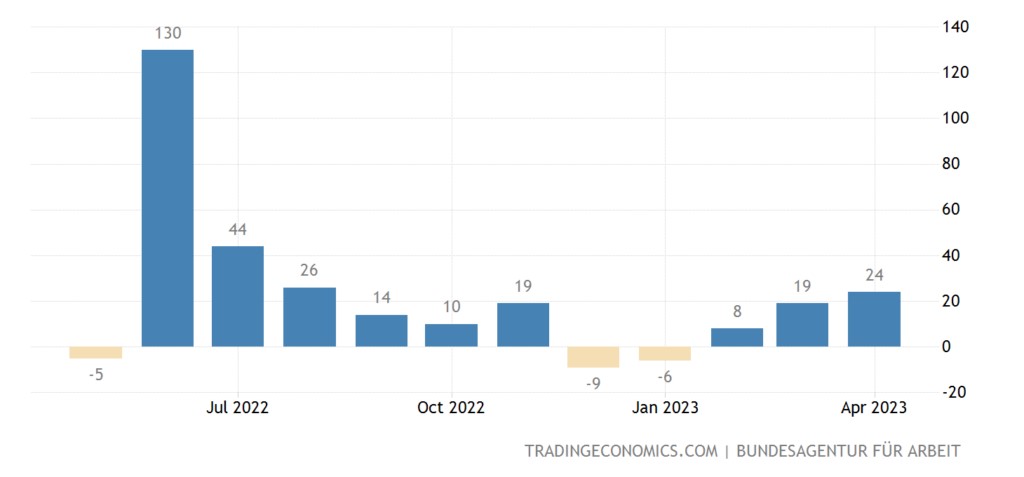

The number of unemployed in Germany has been growing for 3 months in a row, and the growth is accelerating:

Why is its absolute value at its peak in almost 2 years:

This is to the question of the state of German industry, who is interested in production if there is no one to buy its products. Germany is moving to a model of budgetary stimulation of demand (everyone is on benefits), which cannot be considered a successful development mechanism.

The Central Bank of Argentina raised the interest rate by 10% to 91% amid inflation of 104%. The Central Bank of Sweden raised the rate by 0.5% to 3.5% and is ready for 2 more increases of 0.25% each. The Central Bank of Turkey again did not change anything in its policy, even though inflation in Turkey is comparable to that in Argentina (consumer inflation is lower, but industrial inflation is higher).

At the first meeting under the new head, the Bank of Japan left the rate unchanged but removed the mention of the need to keep the interest rate at the current level or lower.

Main conclusions

In addition to the previous section, the Turkish state has started selling gold:

Things in the Turkish economy are not very good at all, it is already clear that tying the Turkish economy to the EU economy will no longer lead to success. And what to do in such a situation? Theoretically, step up work on inclusion in the Eurasian Economic Union, but for this, Erdogan must first win the elections.

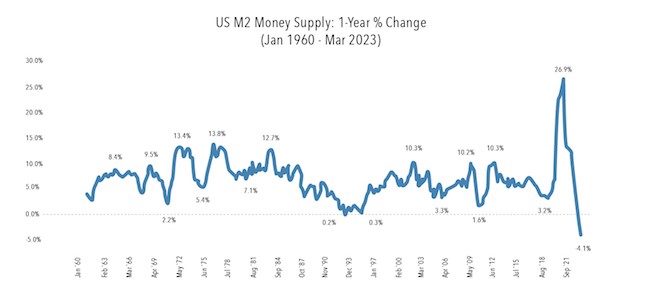

In the US, the economic downturn continues and it is supported by the monetary authorities (the Fed and the Treasury) by reducing the money supply:

That is, while the fight against inflation continues. But Biden is entering the election campaign, and against this background, it is somehow strange to stimulate a recession. Yes, and Biden's rating showed an absolute minimum of 37%. In general, proceeding from this and realizing that there is still no strategy, by the summer, the monetary authorities will begin to stimulate the economy a little. With rising inflation, of course. However, this is not certain; with economic (and other) logic today, the US authorities could be doing better.

In conclusion of the American data, the first release on the GDP deflector for the 1st quarter was released. It turned out to be 4.9%, with expectations of 4.7%; however, considering that this is only the first estimate, it is too early to draw far-reaching conclusions here. Although, of course, 4.9% is certainly not, say, 3.5%.

As for all other data, the picture remains stable; the structural crisis continues, and no deviations from the theoretical concept are observed. Every week new negative data, and for the most part, in new sectors. Accordingly, you can show those in which the deterioration was a few weeks ago and say: "Well, look, the deterioration is over!" And that's why the structural crisis always manifests itself in new places!