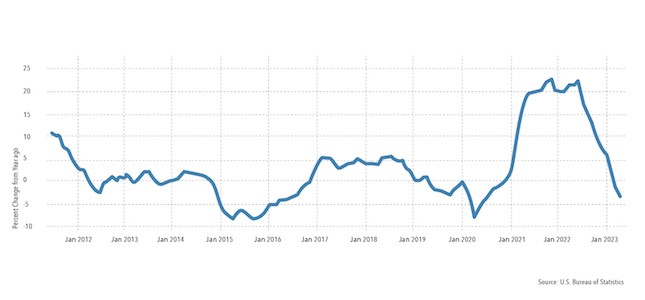

Sharp drop in prices for the full range of manufactured goods in the United States.

The April value of the index was -3.0%; in fact, that March one was only -1.09%. And in June 2022, there was an increase of 23%. The decline is because, in some industries, there is a serious decline, while in others, there is an increase (otherwise, where would the growth in consumer inflation come from, see the next section of the Review).

This situation can have only one explanation: the price decline was either in intermediate industries due to increased competition or falling demand. Or in the final ones, but there, too, there was a decrease in orders due to increased competition with imports, for which prices just increased. A typical case: high-quality American-made goods began to sell worse, and cheap Chinese imports increased sales. And in this regard, sellers have increased prices with the growth of demand.

In any case, this is a clear indicator of strengthening the crisis processes in the American economy. Note that similar processes are taking place in the Chinese economy. It is even possible that the pace of crisis processes is increasing. But here, most likely, politics makes its negative contribution.

Macroeconomics

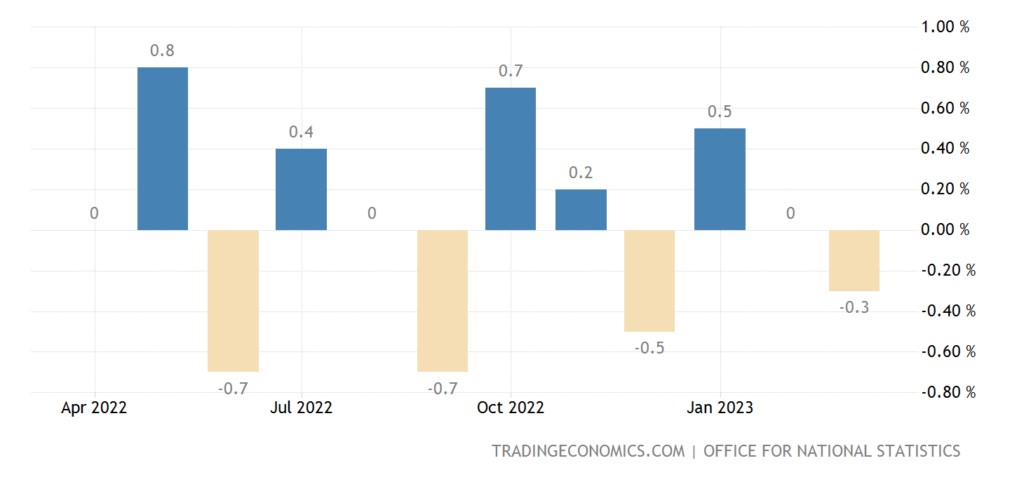

UK GDP in March -0.3% per month:

Industrial production in Germany -3.4% per month – the worst dynamics in a year:

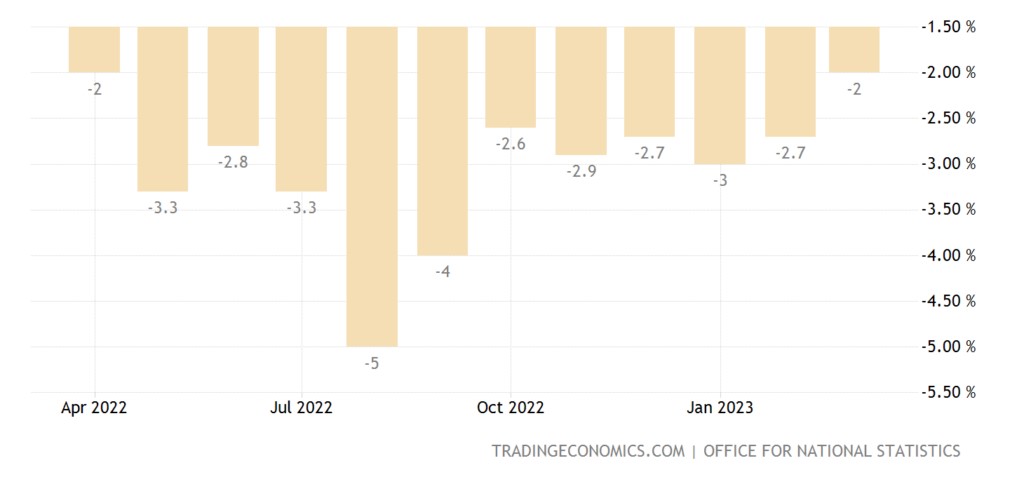

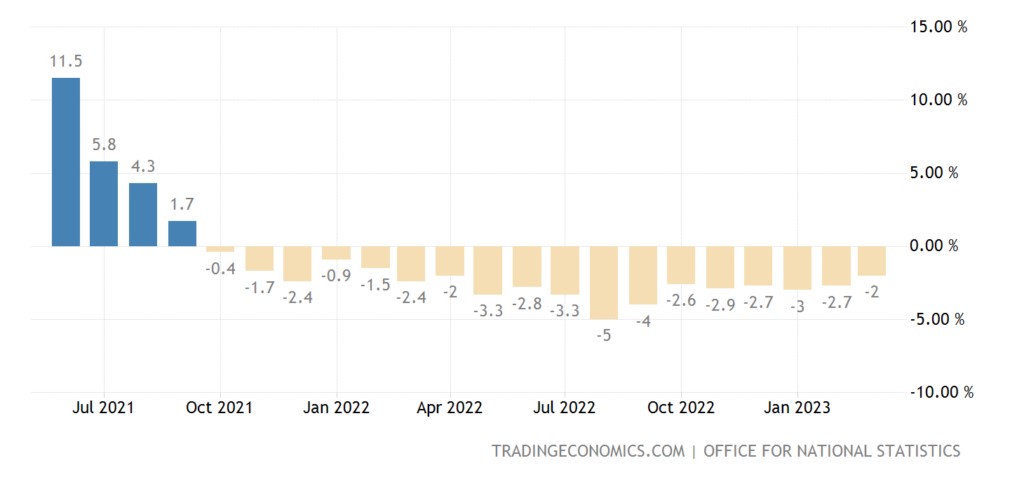

In Britain -2.0% per year – the 21st negative in a row:

Considering the systematically underestimated inflation (by 4-5 per cent), it is a very gloomy picture of a structural crisis in all its glory. The decline should be about 1% per month or 10% per year, but considering the colossal budget subsidies, it turns out to be less, a 7-8% decline.

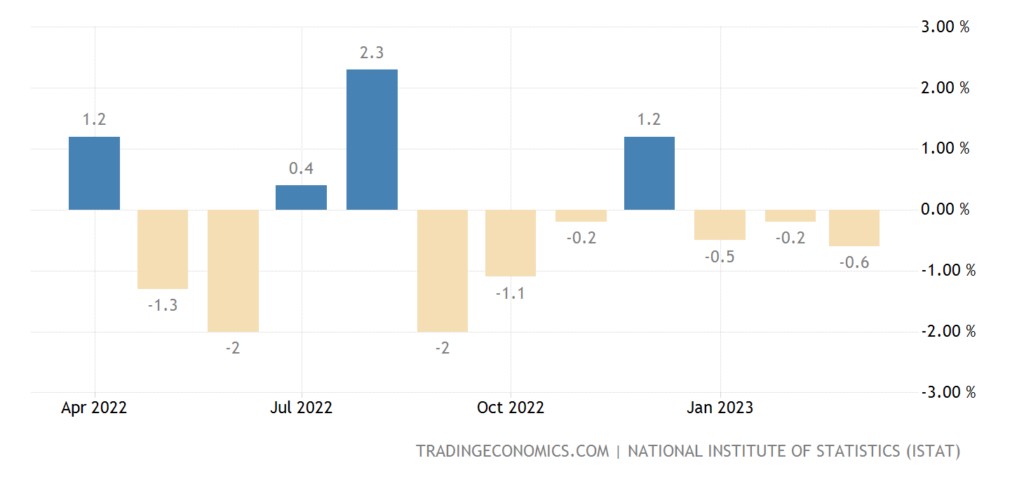

Italian industrial output -0.6% m/m – 3rd consecutive minus:

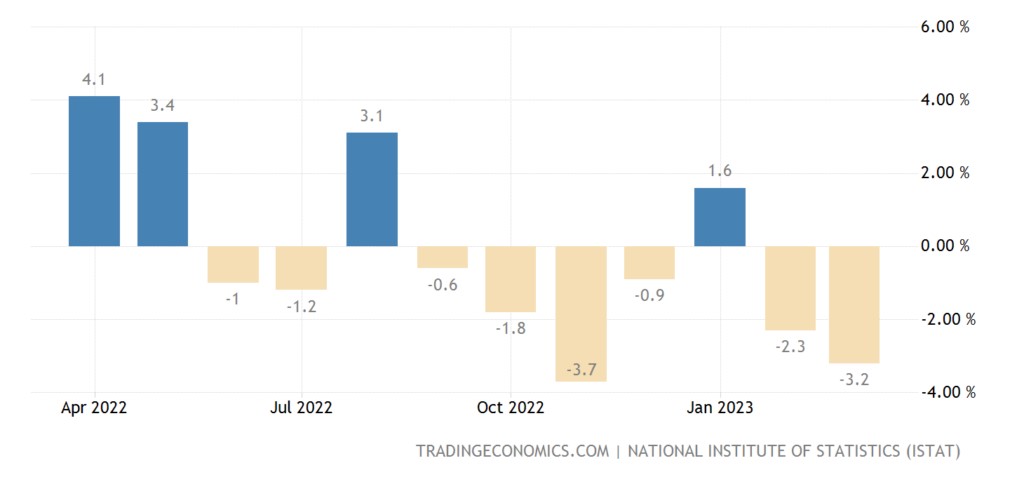

And -3.2% per year – the 6th minus in the last 7 months and the 8th minus in 10 months:

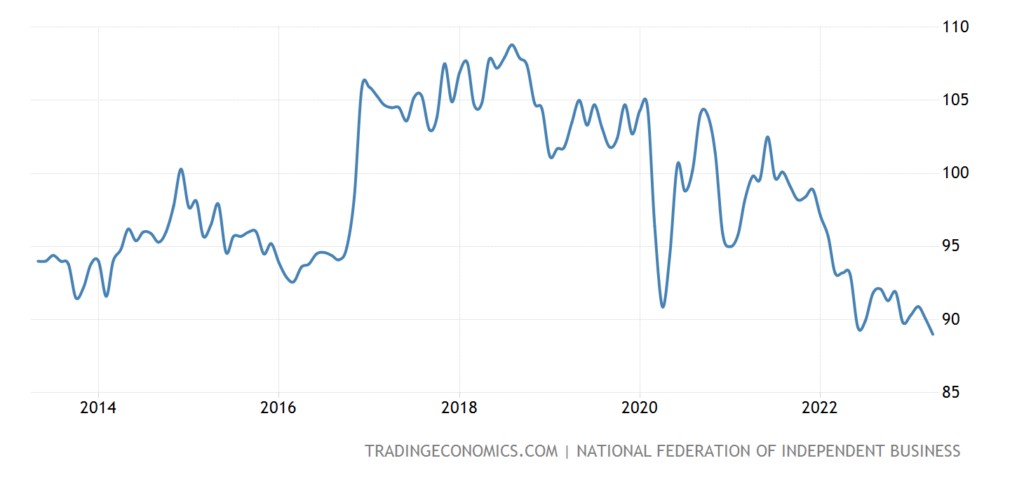

US small business optimism is at its lowest in more than 10 years:

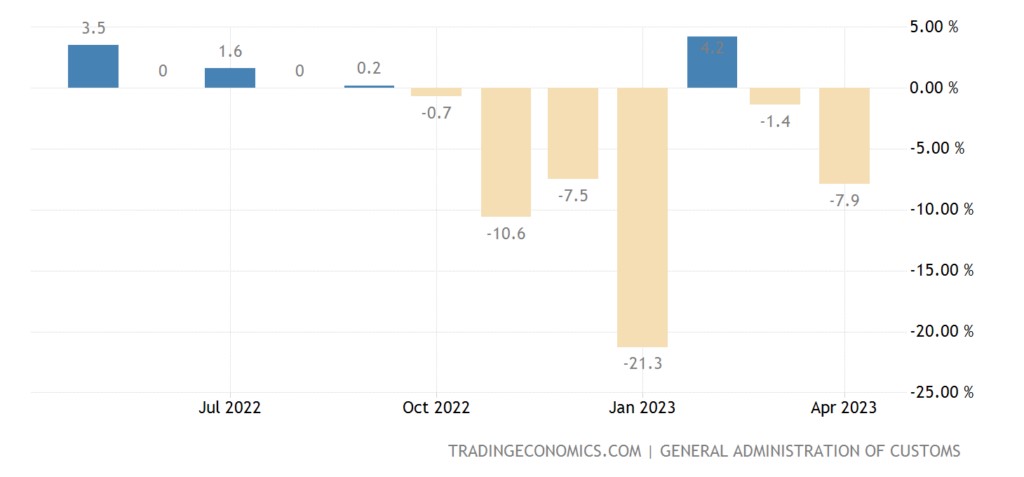

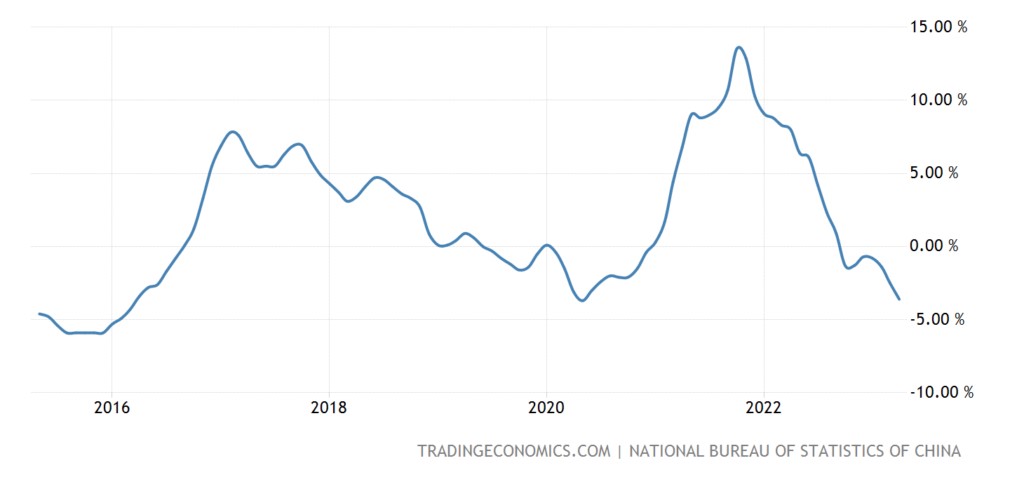

Imports in China are actively falling, hinting at weakness in demand:

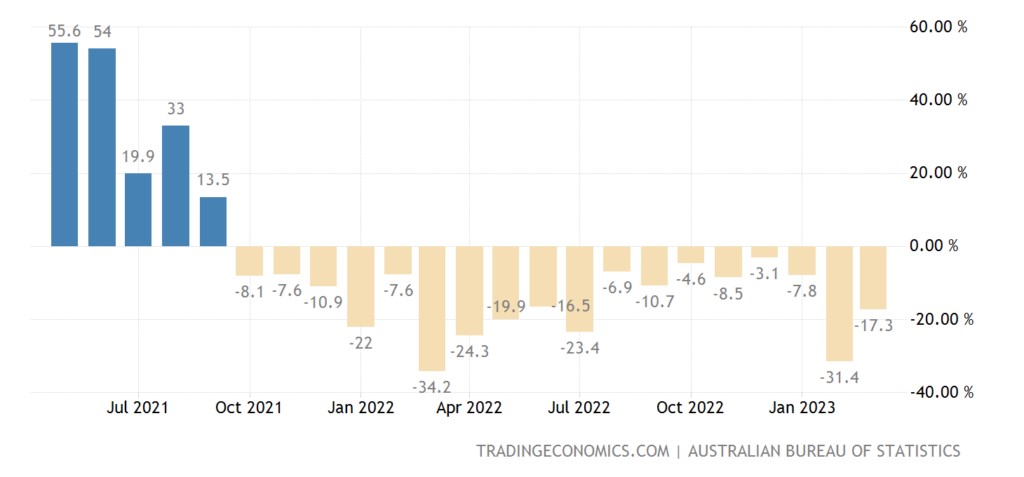

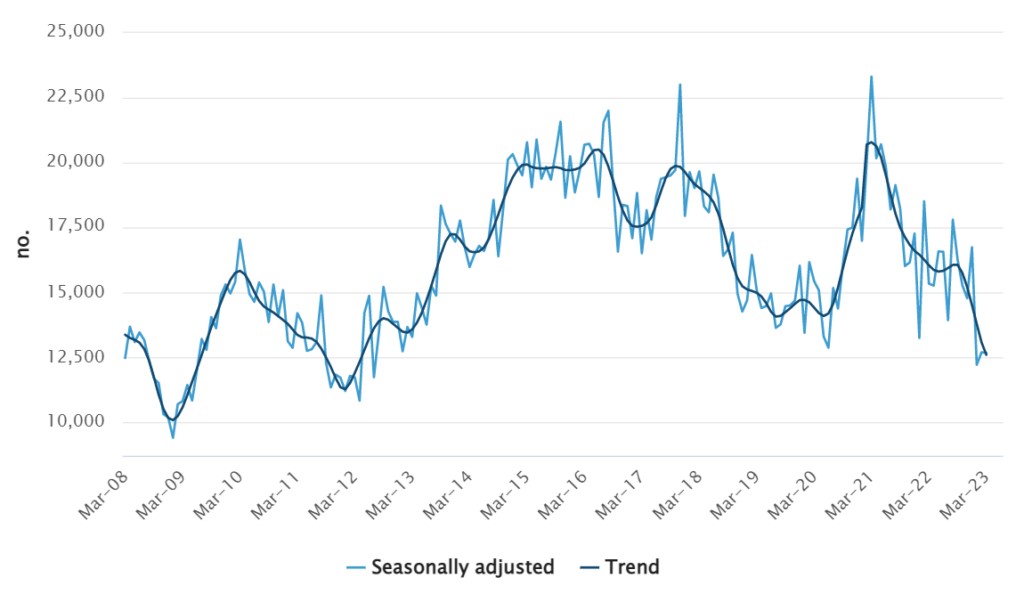

Building permits in Australia -17.3% per year – the 18th consecutive minus:

Their level is the lowest in 11 years:

The mortgage rate in Britain (7.41%) is approaching the 25-year peak of 2007 (7.74%):

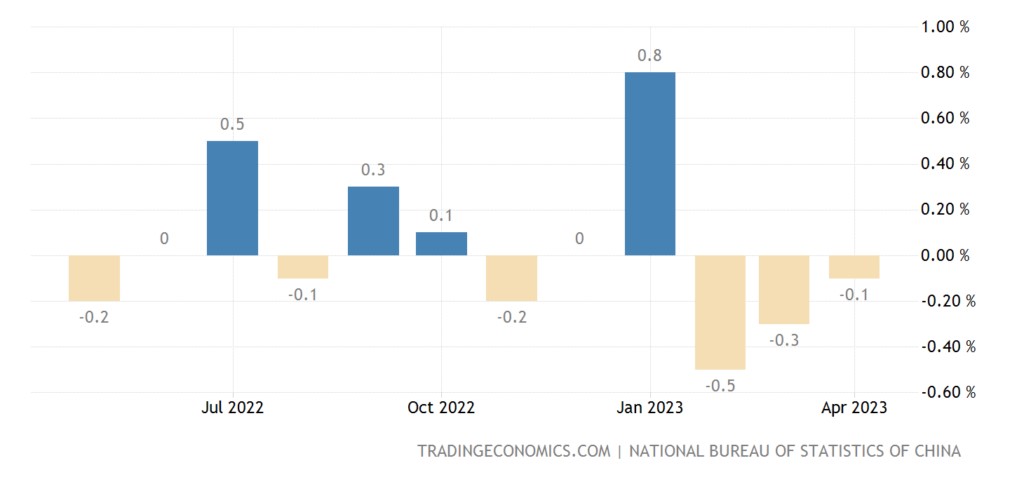

CPI (Consumer Inflation Index) China -0.1% per month – 3rd negative in a row:

And only +0.1% per year – a 2-year low, minus covid fluctuations, this is the bottom since 2009:

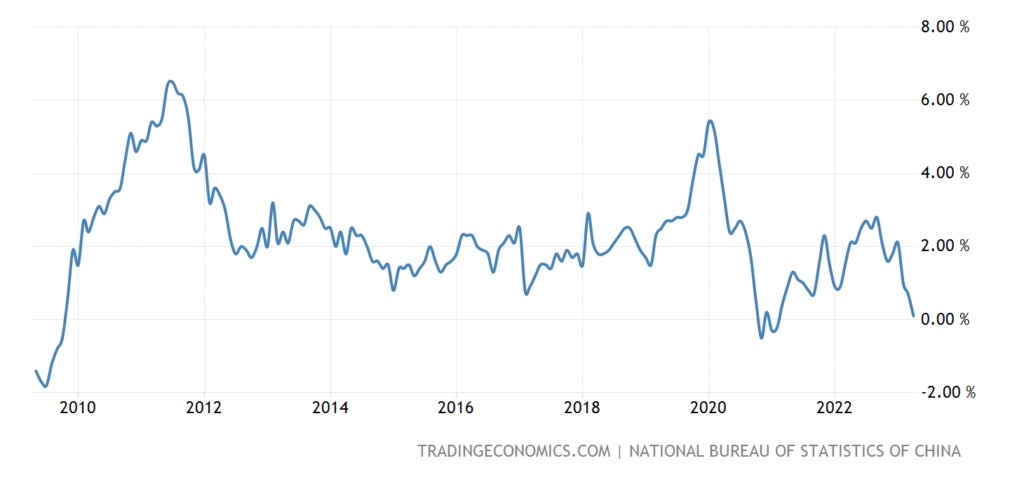

PPI (industrial inflation index) China -3.6% per year – the 7th minus in a row and a 3-year low, previously this was in 2015:

Deflationary trends in China against the backdrop of constant economic stimulus are a sure sign of very serious problems!

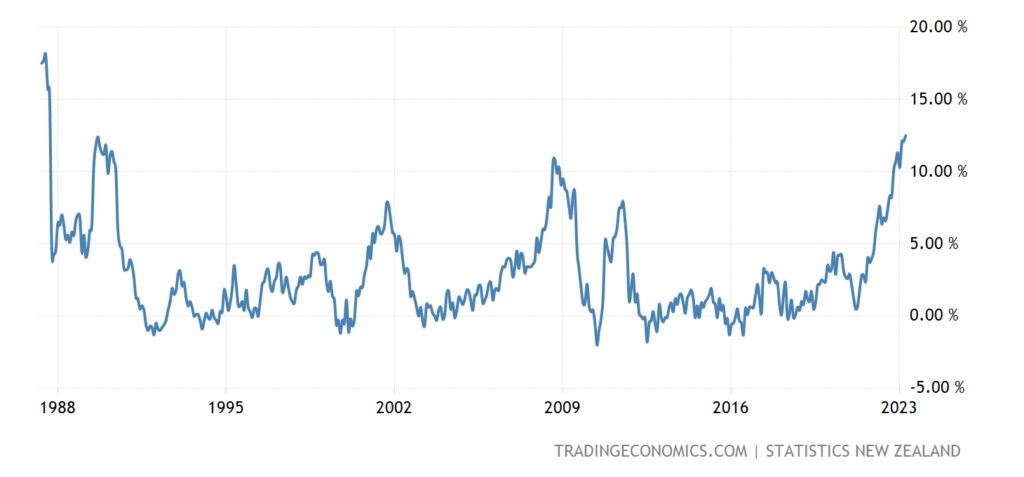

New Zealand Food Inflation +12.5% pa – 36-year high:

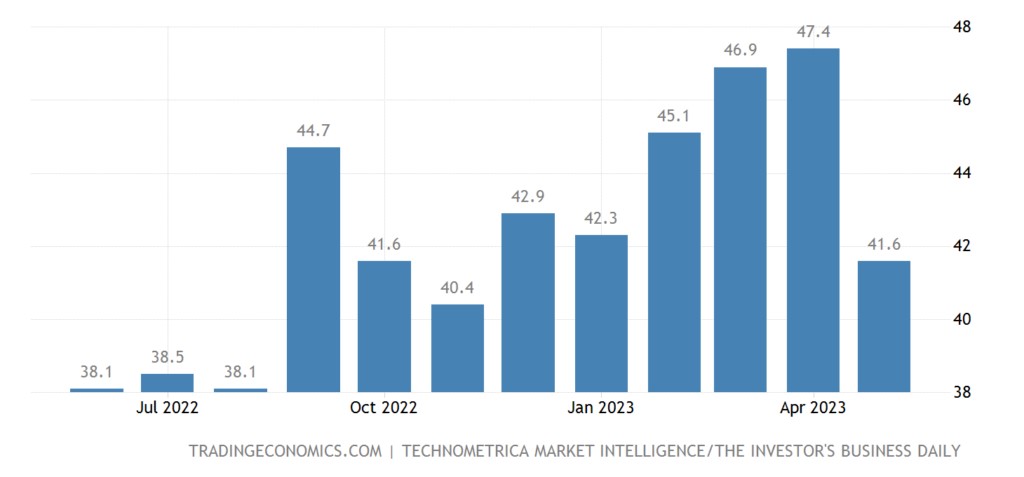

Index of economic optimism in the US (IBD / TIPP review) at the semi-annual bottom:

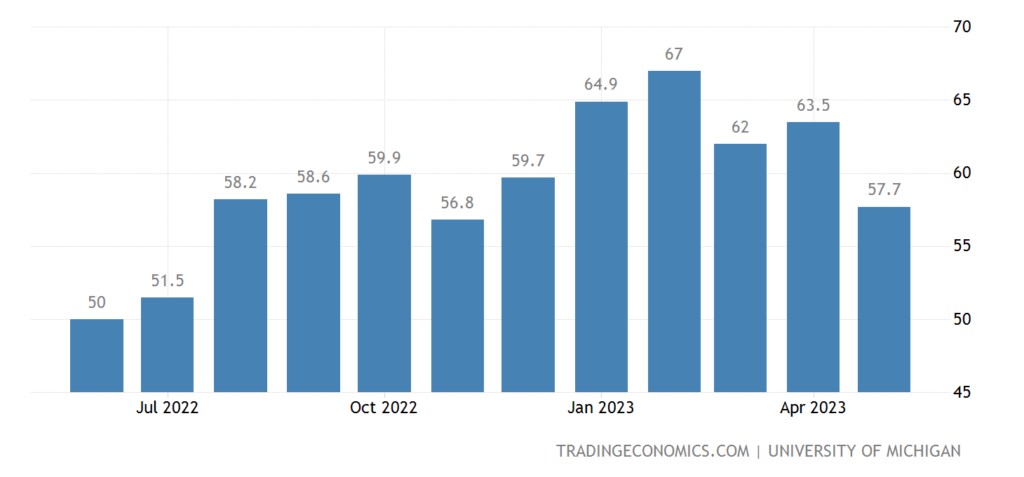

American sentiment (review by the University of Michigan) is the worst in six months:

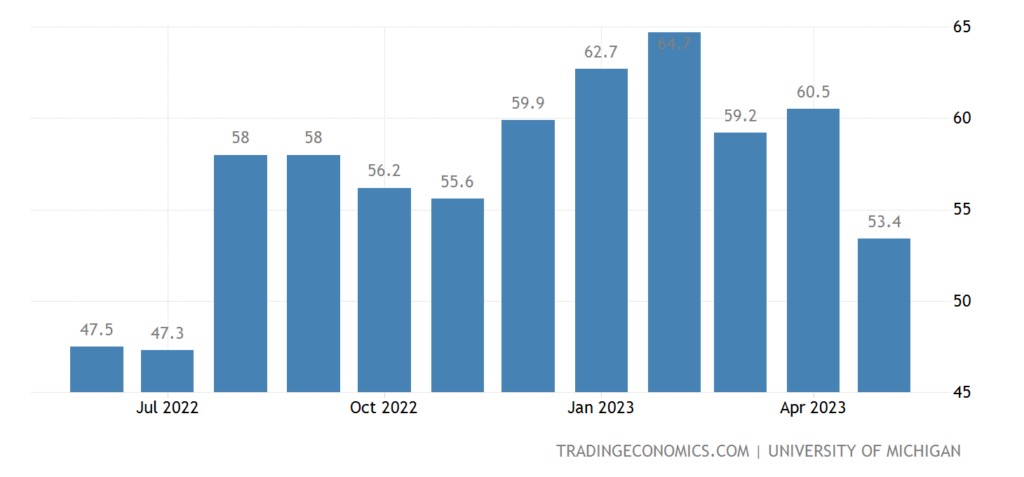

Including their expectations for six months ahead, the most pessimistic in 10 months:

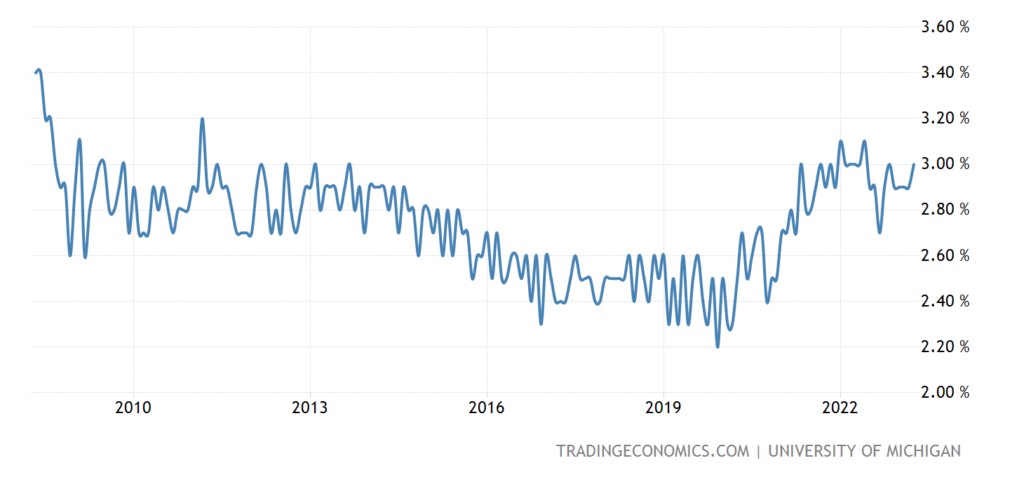

And 5-year inflation expectations are at their peak in 15 years (+3.2% per year:

No wonder: the April CPI index in the USA (4.9%) is only symbolically less than the March indicator (5.0%), and the real figures, in which citizens live, are much higher. Consumer inflation in the US is not less than 10%, and this, of course, is an indicator of a very serious crisis.

US Initial Jobless Claims Highest in 19 Months:

The same picture is in the 4-week moving average of this indicator:

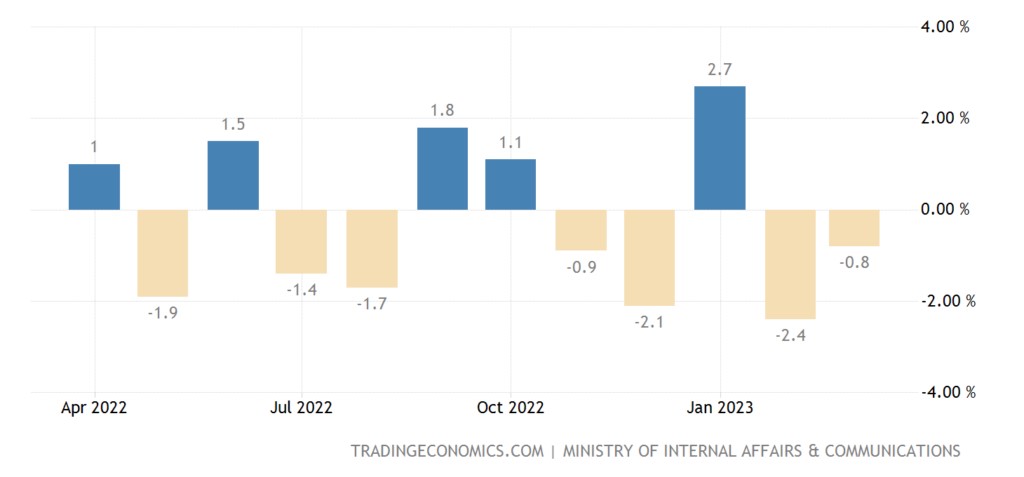

Japanese household spending -0.8% per month – 4th negative in the last 5 months:

And -1.9% per year – also the 4th minus for 5 months and the weakest dynamics for the year:

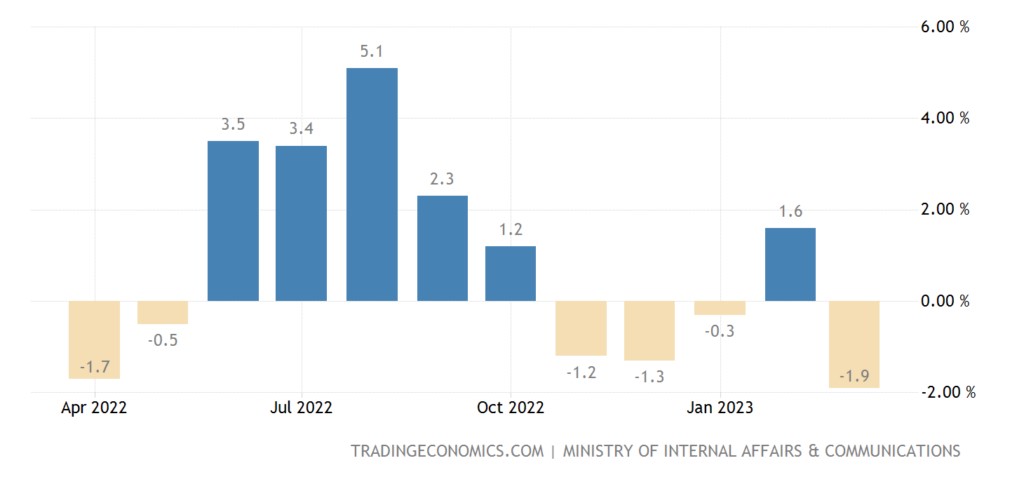

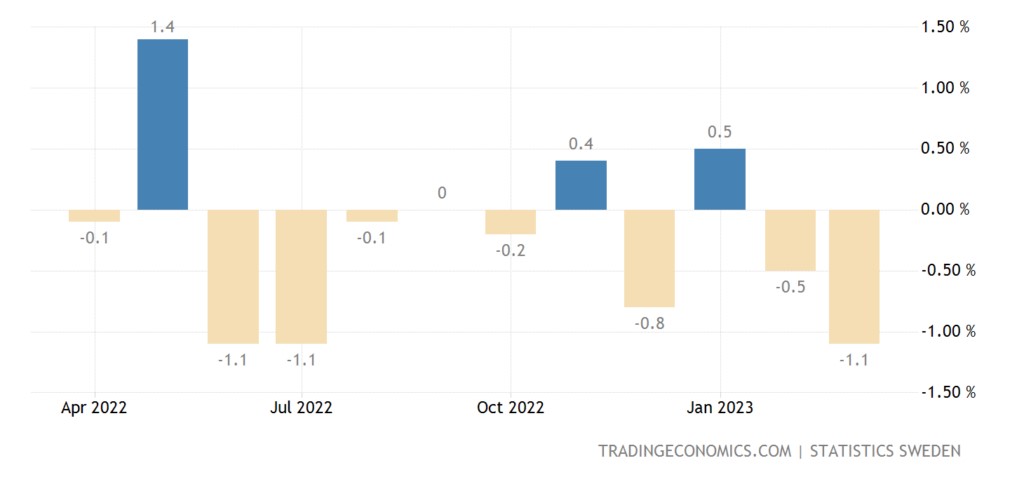

Swedes spending -1.1% per month – 2-year bottom, 3rd minus in 4 months and 8th in 10 months:

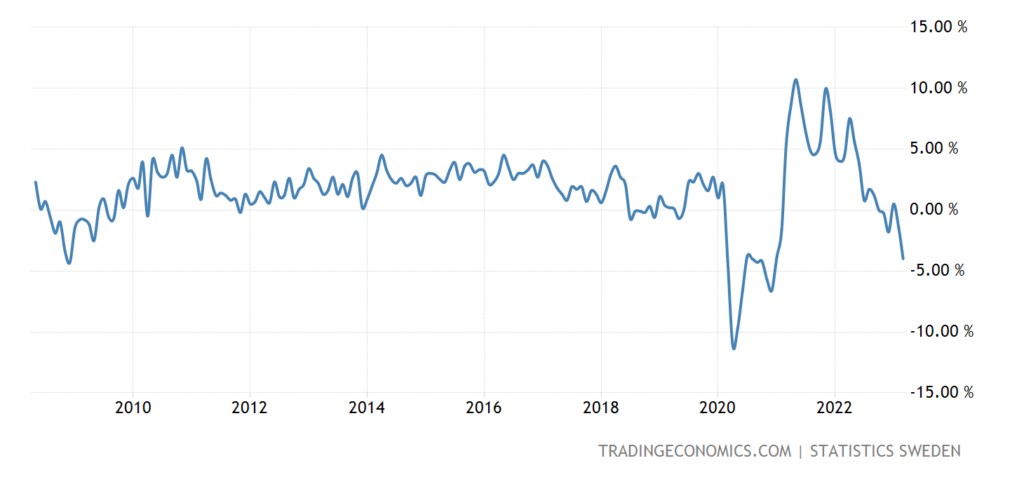

And -4.0% per year – not counting the covid failure, it was worse only once, in December 2008 (-4.3%):

2008 is the year of the beginning of the IV crisis of falling capital efficiency

The Bank of England raised the rate by 0.25% to 4.50%: Judging by the fact that the logic of the Fed is repeated, no people in the leadership of the UK monetary authorities would propose any constructive plan either.

Main conclusions

The overall picture looks depressing – and the question arises, maybe the acceleration of crisis processes is taking place? For example, since colossal resources are withdrawn from the producing economy and invested in defence production? It is difficult to answer this question since there is also statistical data with significant distortions that change regularly, and it is difficult to compare them.

Well, some additional data shows the problems of the United States.

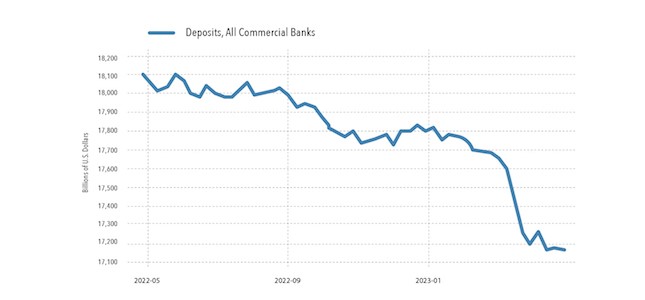

The first is the outflow of deposits from commercial banks:

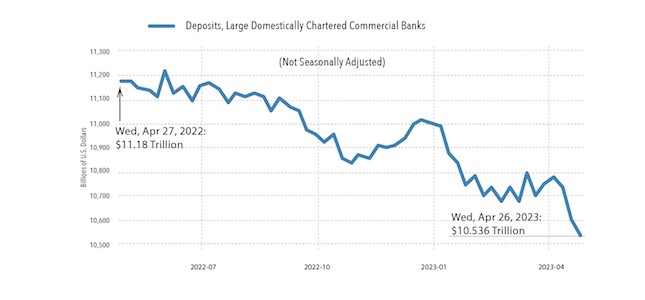

Moreover, which is typical, from all banks, and not an overflow of deposits from small banks to large ones:

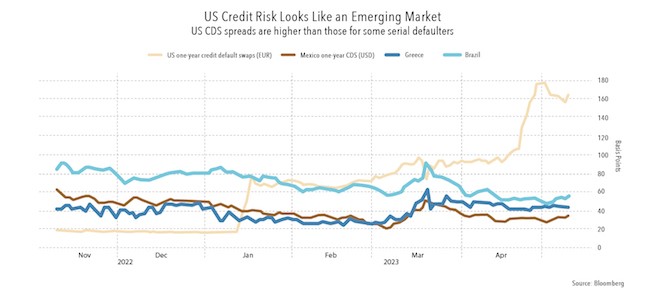

The reasons are also more or less clear, just look at the graphs of credit risks for a rather funny set of countries:

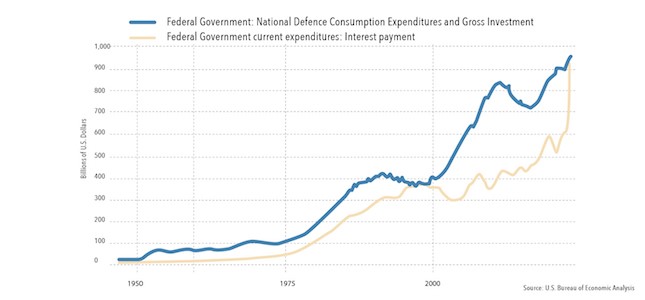

It becomes directly ashamed of the situation in the United States and the policy of their monetary authorities. And here is a schedule of current budget interest payments against the backdrop of military and investment spending:

And it immediately becomes clear that it will not resolve easily and quickly!