The US could announce a default on its national debt on June 1. Secretary of the Treasury Janet Yellen warned about this in a letter to Congress and called to raise the debt ceiling without delay. Speaking in New York about raising the debt ceiling, President Joe Biden added fuel to the fire: "If we default on our debt, the whole world is in trouble."

The procedure for raising the national debt ceiling is usually routine. According to the Congressional Research Service, the ceiling has been raised 102 times since the end of World War II.

The process did not always go smoothly – from time to time there were shutdowns, when the federal government was forced to suspend various expenses including salary payments to civil servants and the financing of social benefits and health insurance programs. Only President Trump had two shutdowns, but the most severe shutdown came in 2011, when for the first time in history the credit rating agency Standard & Poor's lowered the US's long-term credit rating to AA+.

However, the current Democrat-Republican confrontation on the matter may prove to be even more painful, with more severe consequences, inasmuch as the conflict overlaps with several other developing crises.

First, the dollar's hegemony is under unprecedented pressure today. The decision to freeze Russian assets led to a sharp increase both in developing countries' interest in the use of national currencies in mutual settlements, and people and companies' interest in broadening the popularity of new means of settlement. Everyone is looking to reduce the risk of the US arbitrarily using its privileged position as the issuer of the reserve currency.

Second, there is a regional banking crisis unfolding in the US. Mobile banking and the panic that quickly spread through social networks led to banks being particularly vulnerable to bank runs. Three of the four largest bank collapses in US history – First Republic, SVB, and Signature Bank – all took place in the last two months (Washington Mutual went bankrupt earlier during the global financial crisis of 2008). The three recently failed banks together owned assets of USD 532 billion, exceeding the USD 526 billion (adjusted for inflation) in assets owned by the 25 banks that crashed in 2008.

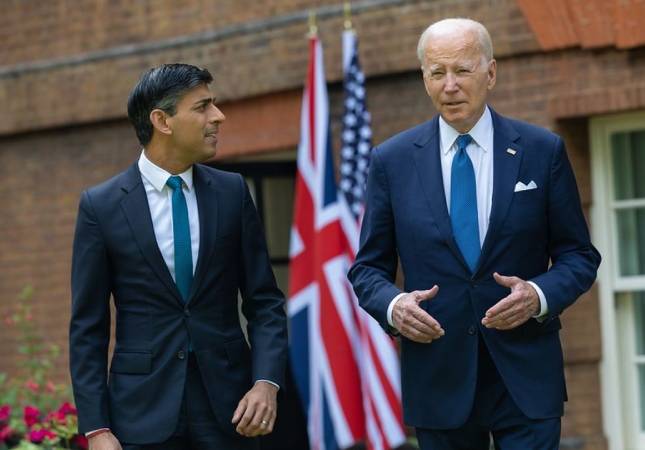

Third, the US is the main sponsor of Ukraine in its military conflict with Russia, for which, according to CFR, it allocated USD 76.9 billion in financial resources and tangible assets over the course of a year. The expediency of allocating and the effectiveness of using these funds against the background of the rampant growth of the national debt and the cost of servicing it raise more and more questions in the US. At the same time, the Democrats Biden and Yellen are calling on Congress to raise the ceiling without any conditions, while the Republican are demanding that the increase be accompanied by budget cuts. In response, Biden has declared that he will veto any savings plan.

To counter Russia, the US tried to mobilize its financial system, but only managed to damage its stability. Thus, according to FT, the share of the dollar in comparison with other world currencies has decreased from 73% in 2001 to 55% in 2021 – 18% over the course of 20 years. And in 2022 alone, this figure fell to 47%. This does not mean the dollar will completely lose its importance for the world economy anytime soon, but the processing of accelerating the decentralization and diversification of the system of international settlements and reserves is underway, and nothing can stop it now.

Debt zugzwang

The US government is the largest debtor in the world. The current debt ceiling was set at USD 31.4 trillion in 2021, which was hit in January of this year. The debt is already USD 31.46 trillion by now, according to FiscalData.treasury.gov. For comparison, Japan is the second largest debtor, with a national debt of USD 9.8 trillion.

The situation looks better when taking the size of the economy into account – the US has a debt of "only" 123% of GDP, while Japan's is 265%. But still, it is the size of the debt that economists find difficult to reconcile with stable economic development. An optimal national debt is typically considered to be about 40-60% of GDP.

The main problem is the growing cost of servicing the debt, i.e., paying off interest. In 2022, USD 460 billion, or 13% of the budget, was spent on interest payments, and this year, due to rising interest rates, that number could reach USD 700 billion, or 19% of the budget. According to some estimates, in the next 10 years, the US government will spend up to USD 10 trillion on debt interest payments alone.

Of course, the debt alone cannot undermine America's financial hegemony. After all, it is essentially 100% domestic, denominated in dollars, and the Federal Reserve can simply print as much as needed.

Japan is often cited as an example of the fact that even a huge national debt is not a final verdict on the financial system. They have a debt 2.5 times the GDP, and yet their economy is running smoothly, they say. Indeed, as long as the US Federal Reserve and international financial institutions managed to control global inflation, Japan was able to afford low interest rates without any particular consequences, but today it is facing more and more problems.

No one is creating such conditions for the US today. The combination of a huge debt and inflation, which leads to an increase in rates and the cost of debt servicing on the one hand, and the emerging distrust of the dollar on the other hand, means American financial authorities do not have their typical freedom to maneuver. And the problem of debt, which no one was particularly worried about before because there were always dollars at hand, has now turned into a problem of the dollar itself.

Technology changes everything

There also new factors that make the current situation more dangerous for the US – the widespread use of mobile payment and investment services and the growing influence of social networks have led to a sharp acceleration in crisis processes. Banking apps have made deposit withdrawals a matter of hours, if not minutes. SVB clients withdrew USD 42 billion in one day on March 9, and the bank collapsed the next day. This used to take days and weeks, which would have given the bank and the regulator time to find a solution.

At the same time, the US banking system itself is in an unstable state, with growing unrealized losses due to aggressive rate hikes after a long period of ultra-soft monetary policy. In its recent review, American Banker Magazine refers to two scholarly works estimating the total unrealized losses for US banks at the end of 2022 to be somewhere in the range of USD 1.7 to 2 trillion – only slightly less than the total equity capital of the entire US banking system, which currently sits at USD 2.2 trillion. At the same time, the total volume of uninsured deposits is about USD 9 trillion, which creates a significant risk for the entire system if people begin withdrawing funds en masse.

In mid-April, Bloomberg published a forecast that the largest banks – JPMorgan Chase, Wells Fargo, and Bank of America – will disclose in their annual reports that deposits fell by USD 521 billion compared to last year. With rising rates, depositors are looking for the most profitable investment tools, and mobile banking gives the chance to make moves with the kind of ease and speed that could not even have been dreamed of in 2008.

In the US, they understand that the future of money is in digital technology. Thus, in November 2022, Citigroup, HSBC, Mastercard, and Wells Fargo announced a joint project to launch and test digital dollar tokens. However, with the rate at which the project is being implemented, the giants of classical banking are losing out to new technological players. And the main trend in this area is diversification. For example, in the Ethereum cryptocurrency system, only about 40% of nodes are located in the US, with another approximately 20% in Germany.

In its new State of the Industry Report on Mobile Money (2023), GSMA refers to the development of non-bank mobile payment services as something mainstream. By the end of 2022, the volume of digital transactions through mobile money providers amounted to USD 1.26 trillion – 22% more than a year earlier. Leading the way, with transactions amounting to USD 832 billion (+22%), is Sub-Saharan Africa − a region where the banking system is weak but mobile communications are well developed. It is just such regions, with the weaker players of the previous technological order, that usually show the main direction the industry is headed.