Of course, this is the decision of the US Federal Reserve to raise the discount rate by 0.25 percentage points to 5.25% and the subsequent press conference. Details about it are in the last section of the Review, but for now, it is necessary to say about the essence of the process. The Fed's mandate does not imply political decisions; they are of a technical and financial nature. But in the current situation, the picture looks more complicated.

If the rate is seriously raised to bring inflation to the expected 2%, then the decline in production, construction, and the population's standard of living will become prohibitive. This can be done – but in this version, it is no longer a technical but a political decision.

If the rate is raised and simultaneously stimulates private demand, then this may give the opposite option – inflation will not fall. And then, what is the point of stimulating the industrial and construction recession?

If the consumption of people with low incomes is stimulated (and it has been falling for several months, which is visible from our surveys), then inflation will undoubtedly increase, which will deal an additional blow to the consumption of the middle class. And to help the entire middle class is very high inflation with the collapse of the real sector of the economy. And this is also a political decision.

You can try to evade the decision, which the Fed demonstrates. Because raising the rate by a quarter of a percentage point was almost the overwhelming opinion of market participants. The trouble is that this will continue the recession or the banking crisis; therefore, it is also a political decision.

Precisely because the leadership of the Fed does not have such a mandate, there is no doubt that it has repeatedly appealed to the White House and Biden personally with a request to make a political decision. But, judging by the behaviour of Janet Yellen, such a decision was not made. This means that the strategic planning system in the United States has been destroyed, and political conclusions can be drawn from this. Still, they are beyond the scope of a macroeconomic review. In the meantime, it can only be noted that Powell's behaviour at the press conference indicated that he was extremely nervous. And that in itself raises serious concerns.

Macroeconomics

Indonesian GDP -0.9% per quarter – 1st minus for the last year:

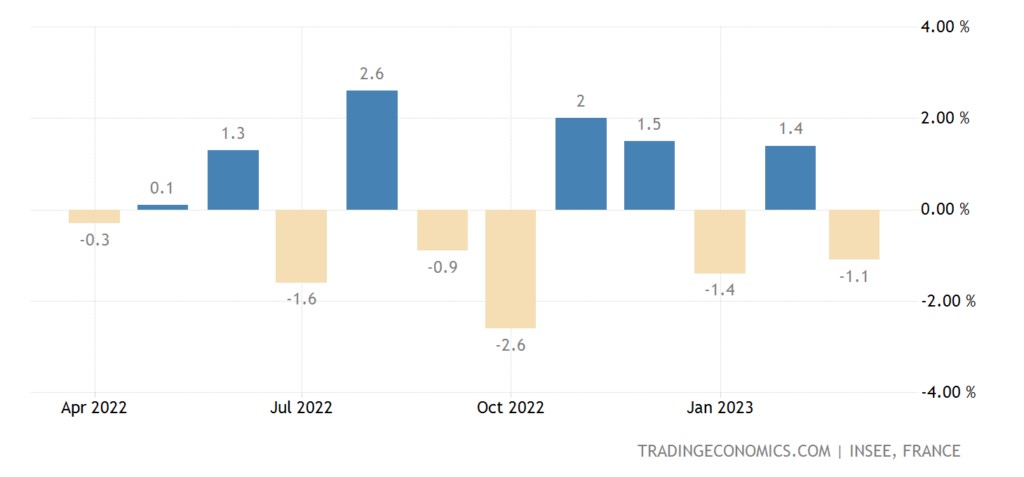

French industrial output -1.1% per month – 2nd minus in the last 3 months:

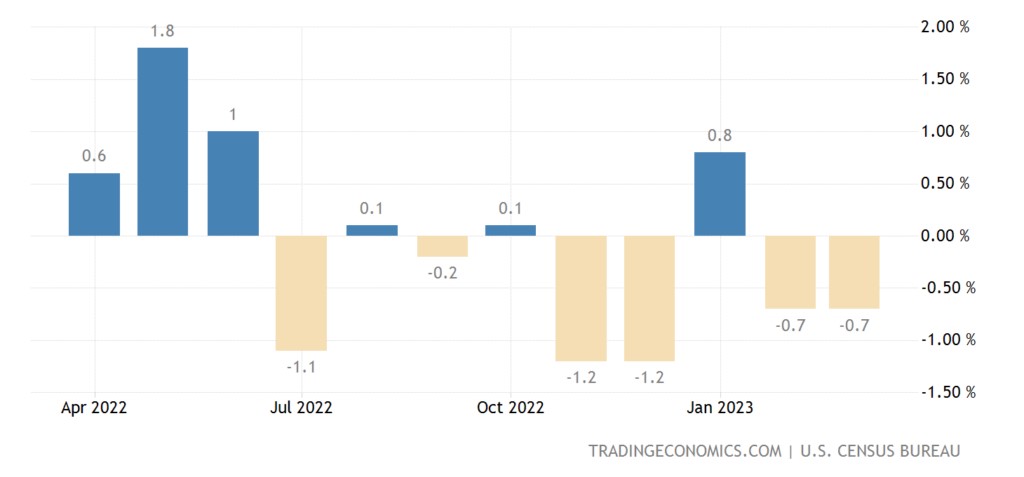

Industrial orders in the US without a volatile transport sector -0.7% per month – the 4th minus in the last 5 months:

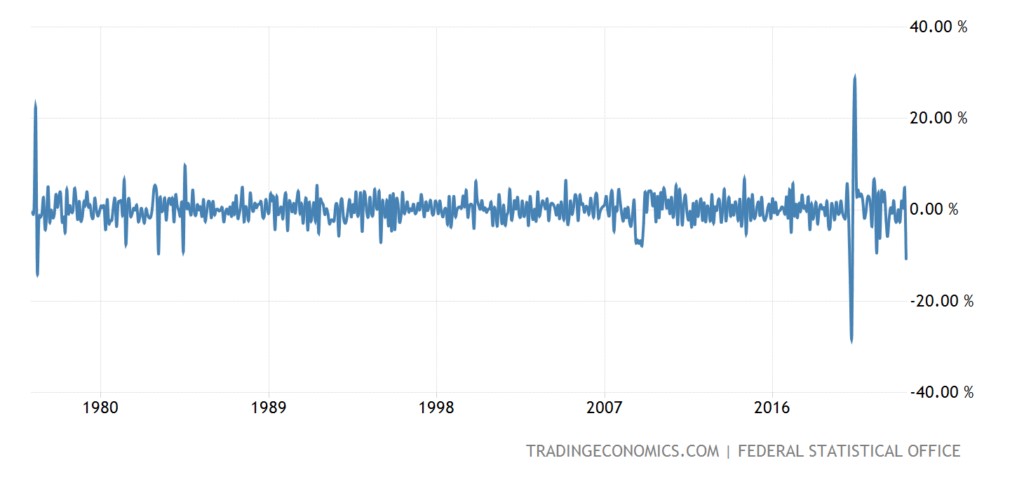

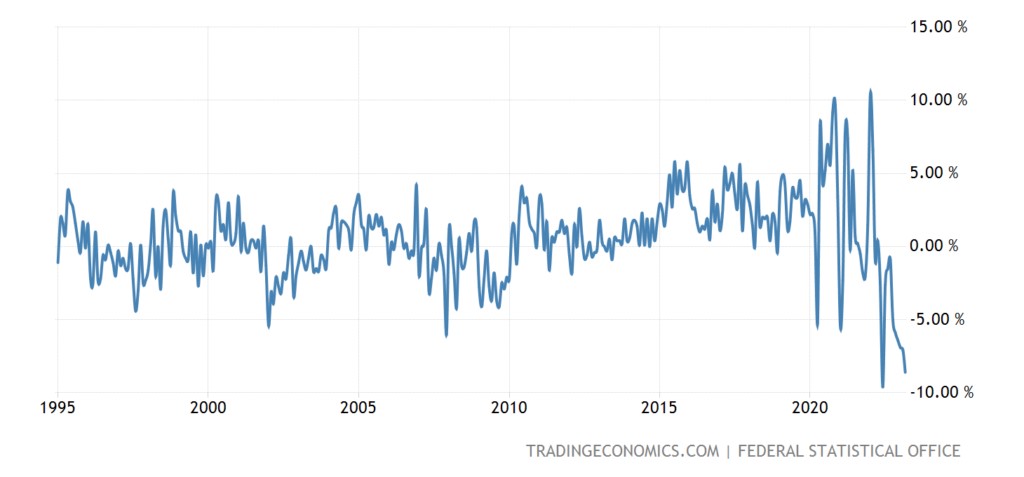

Industrial orders in Germany -10.7% per month – not counting the failure of 2020, the worst dynamics since 1976:

And -11.0% per year — the 13th monthly negative in a row:

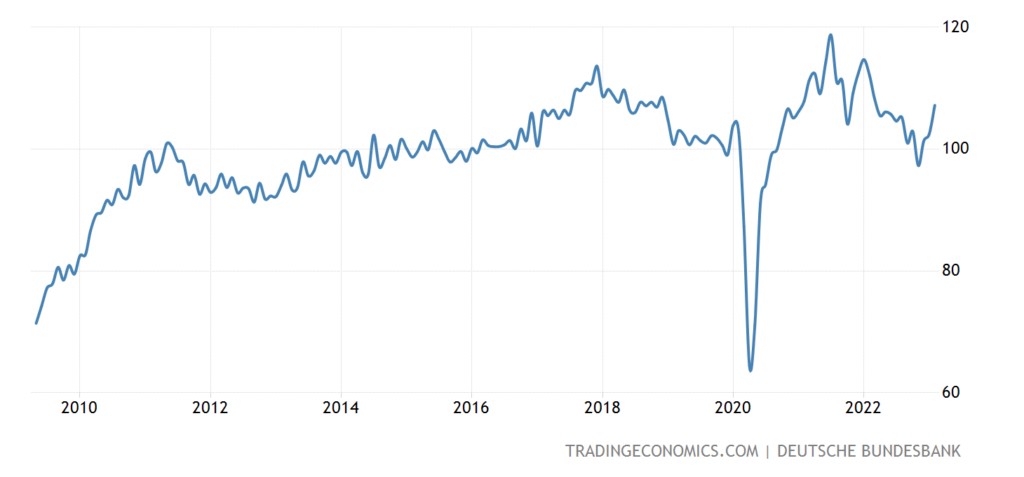

On the official chart, the level of orders is below the values of 2015; earlier numbers are not there, but judging by the indicators of previous years, orders have now sunk to the bottom since 2009:

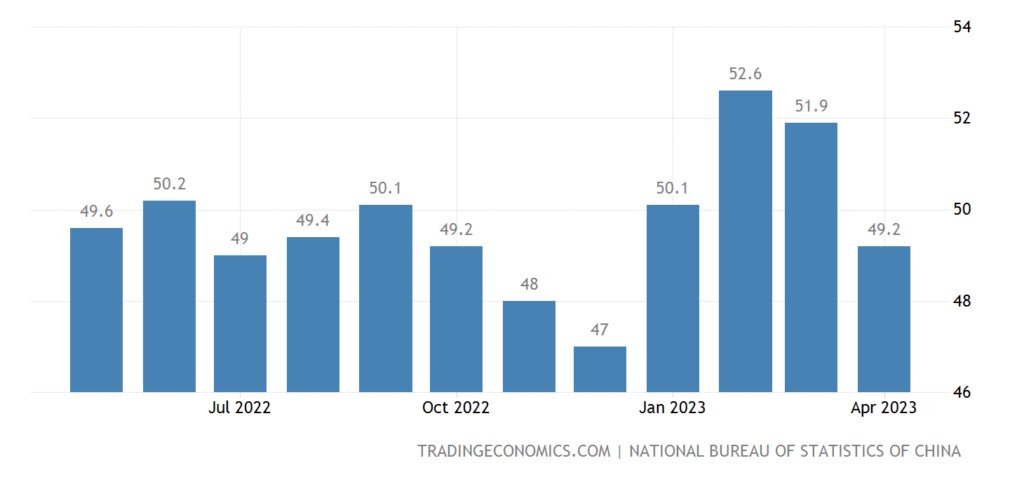

PMI (expert index of the state of the industry; its value below 50 means stagnation and recession) of China’s industry has returned to the recession zone (49.2), it is at the bottom for 4 months:

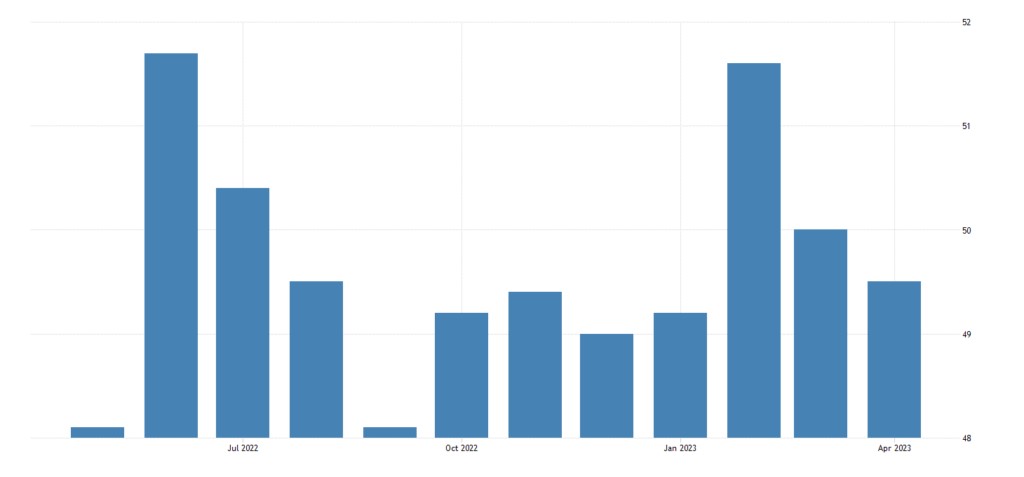

The official statistics version confirms the diagnosis (49.5):

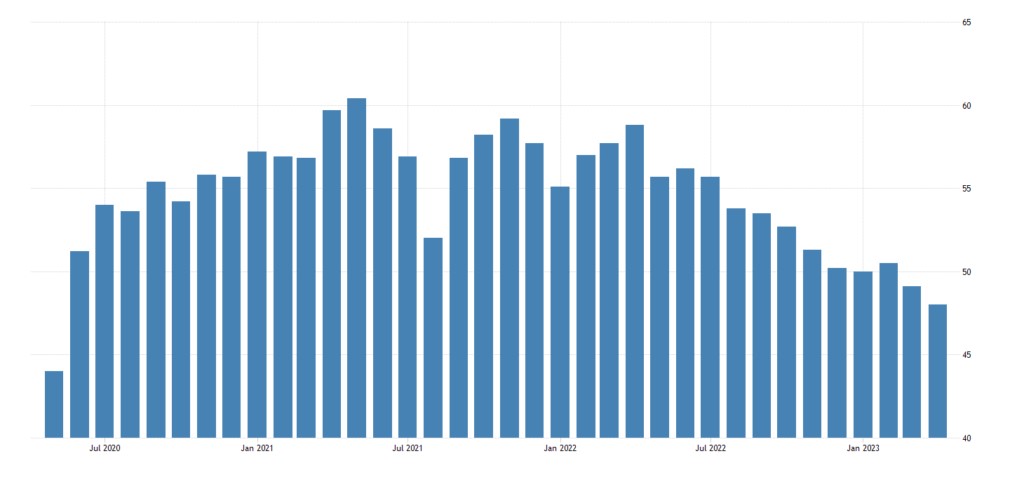

Australia has a 3-year low (48.0) –

Japan has a six-month high, but still a recession area (49.5)

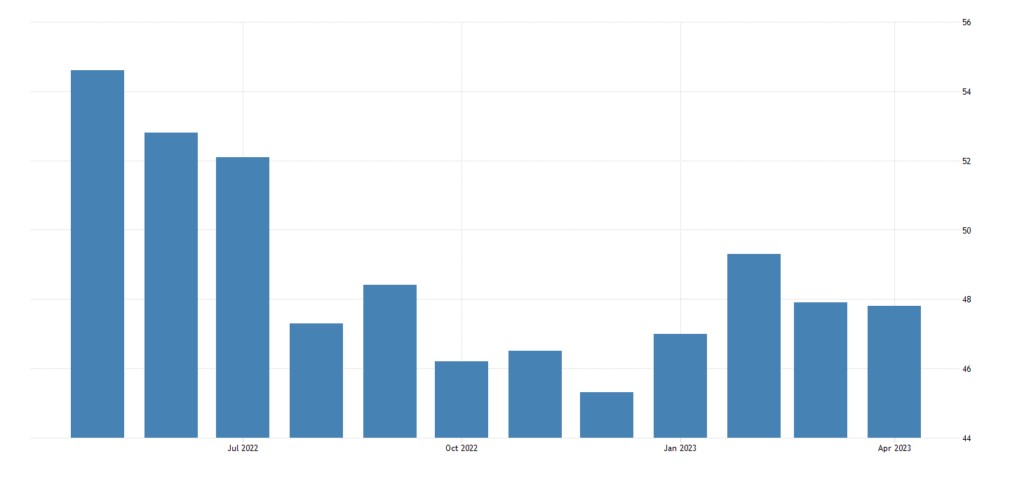

In South Korea, 10 consecutive months of decline (48.1):

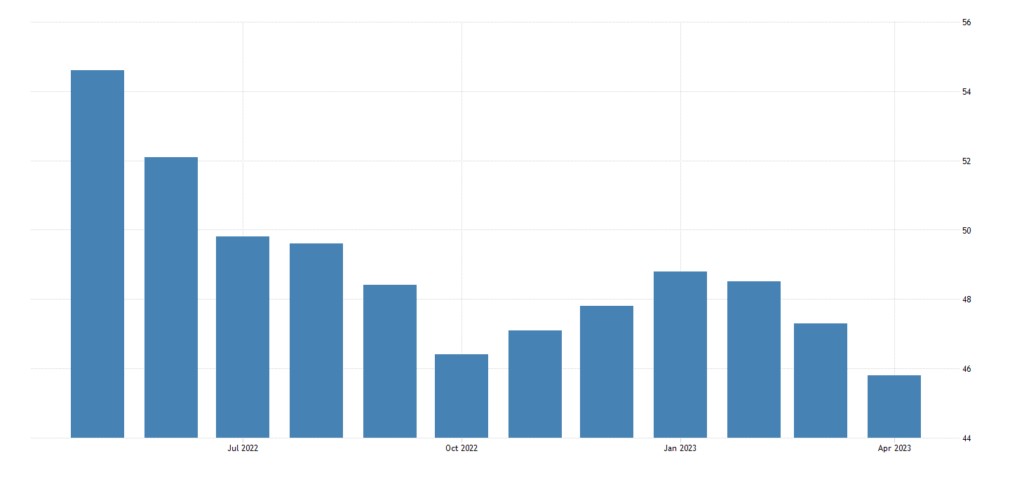

In the Eurozone the same (45.8):

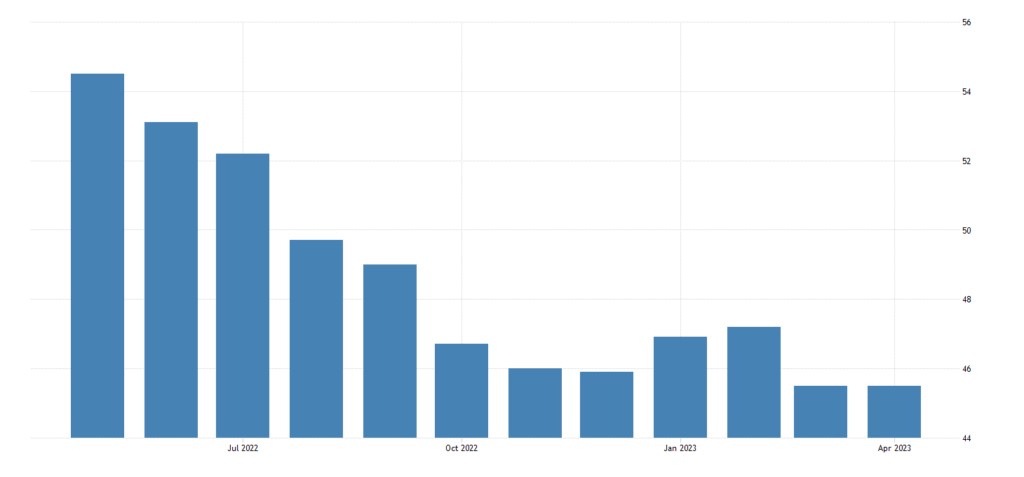

In Sweden – 9 months (45.5):

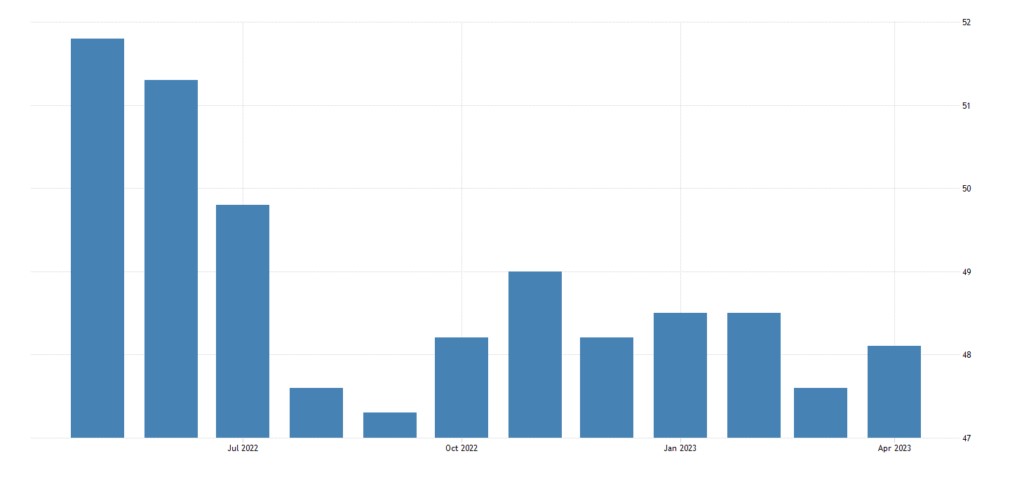

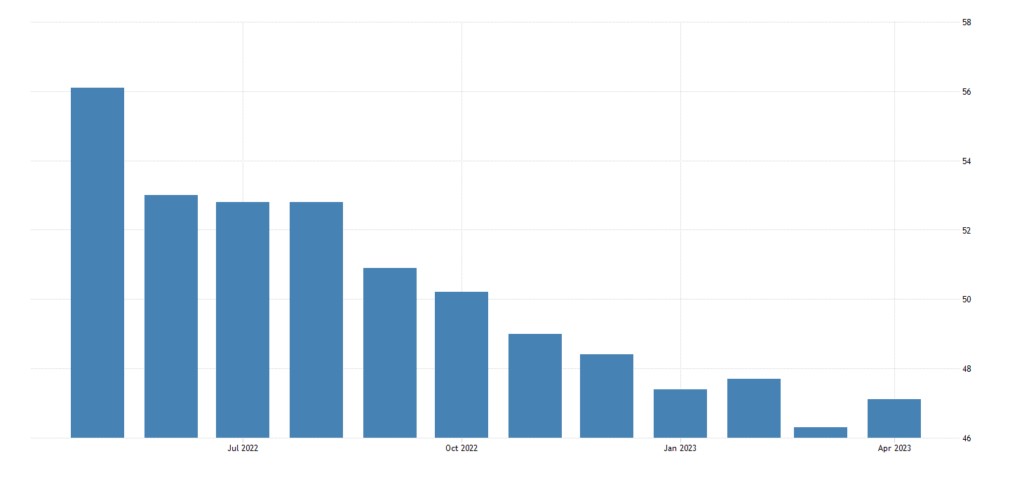

As in Britain (47.8):

In the US, there is a mini-improvement, but the figure is deep in the decline zone (47.1):

In general, it can be diagnosed that the industry of the whole world is in a steady decline. If we also consider that industry experts tend to look at the situation in their industry from an optimistic side, the picture becomes even sadder.

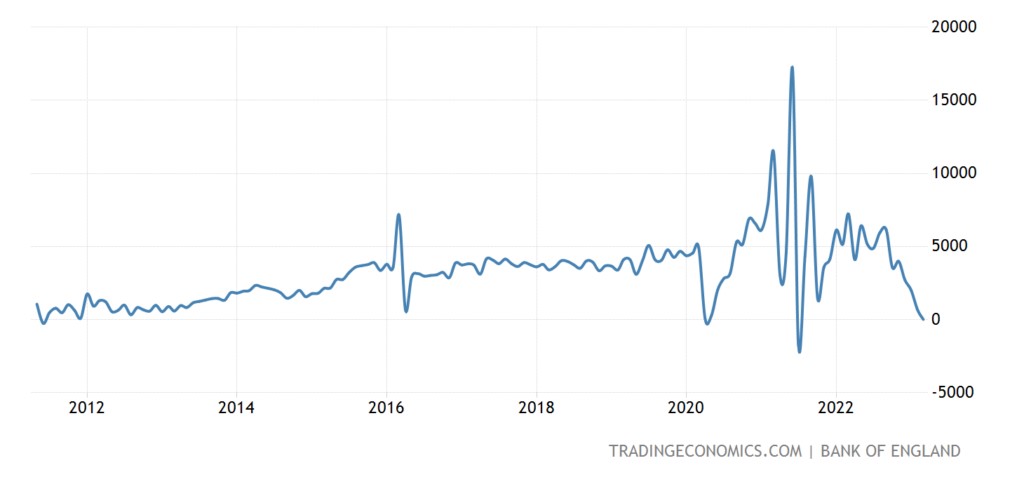

Net mortgage lending in Britain (excluding covid collapse) at the bottom in 12 years:

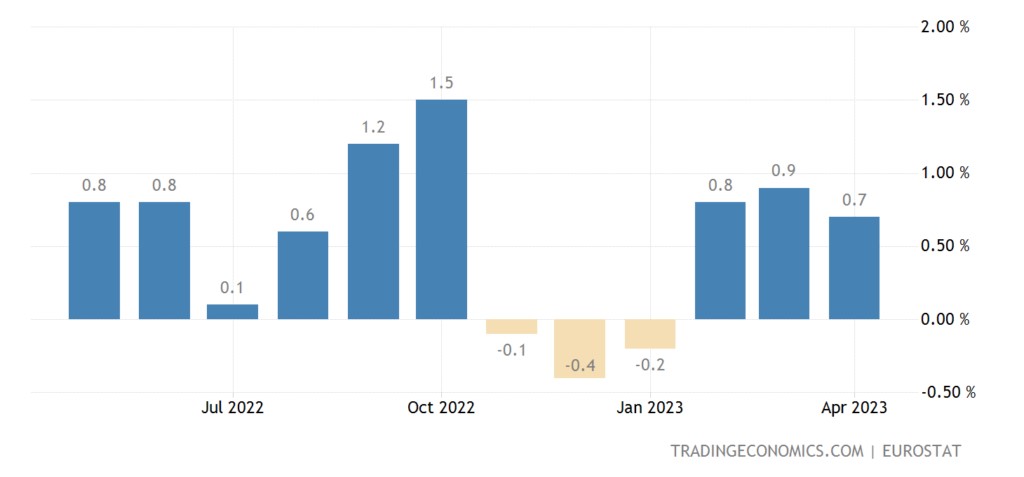

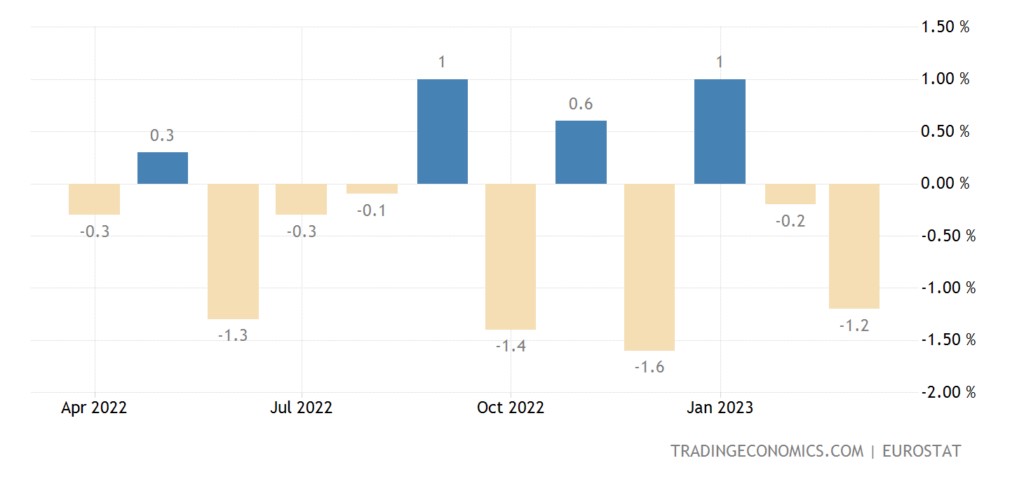

CPI (Consumer Inflation Index) of the Eurozone accelerated again – in the last 3 months, on average +0.8% per month:

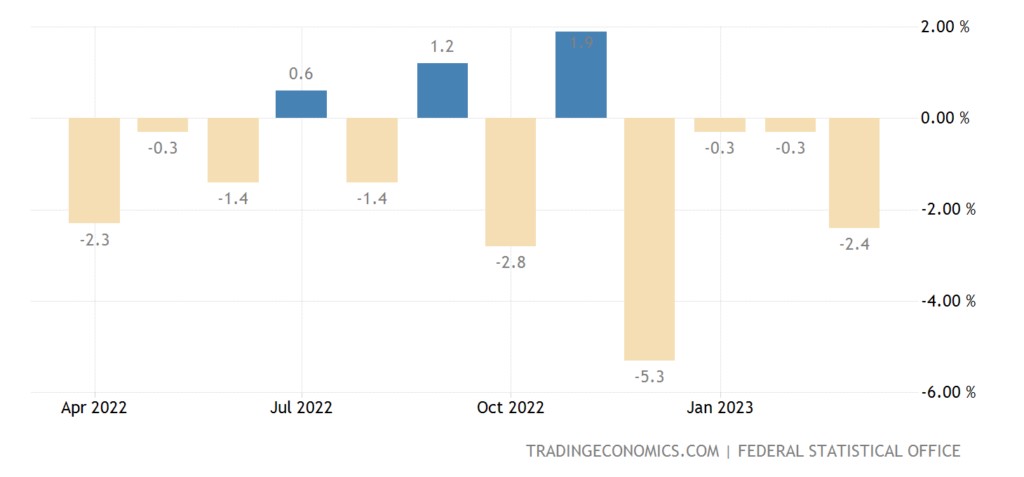

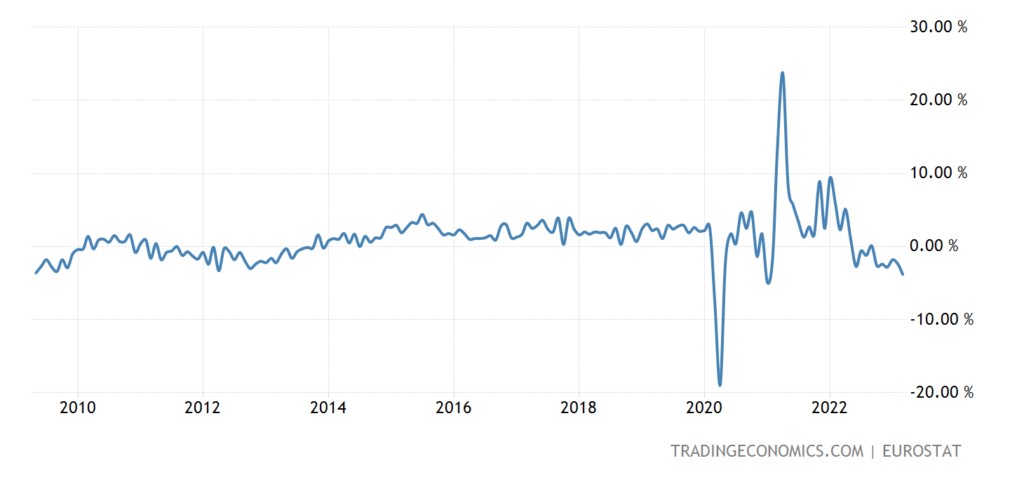

Retail sales in Germany -2.4% per month – 4th negative in a row:

And -8.6% per year – the 11th minus in a row, and the bottom in food since 1994 (-10.3%):

In the euro area as a whole, retail -1.2% per month – the 2nd negative in a row and the 3rd in the last 4 months:

And -3.8% per year — the 6th negative in a row and the 9th in the last 10 months; the worst dynamics since the beginning of 2021, and excluding covid failures – since 2009:

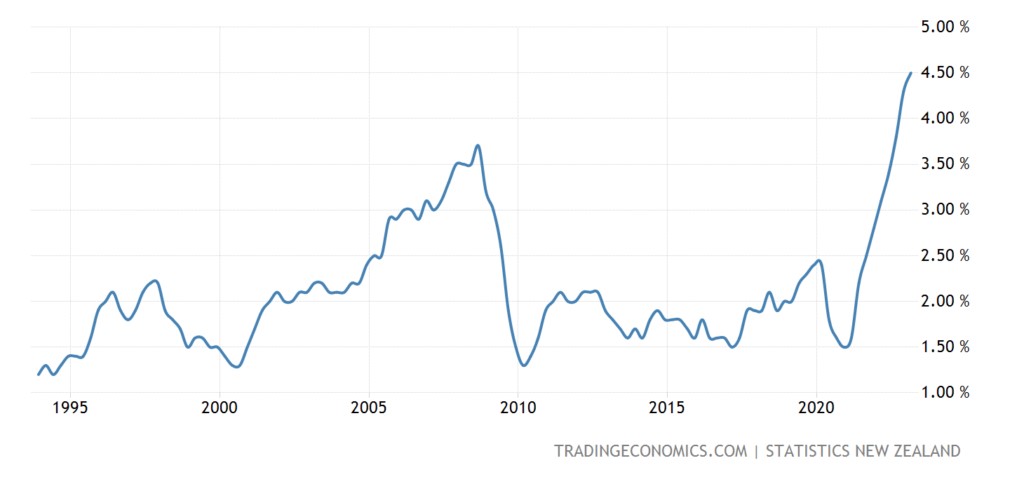

The average salary in New Zealand is +4.5% per year – a record for 30 years of observations:

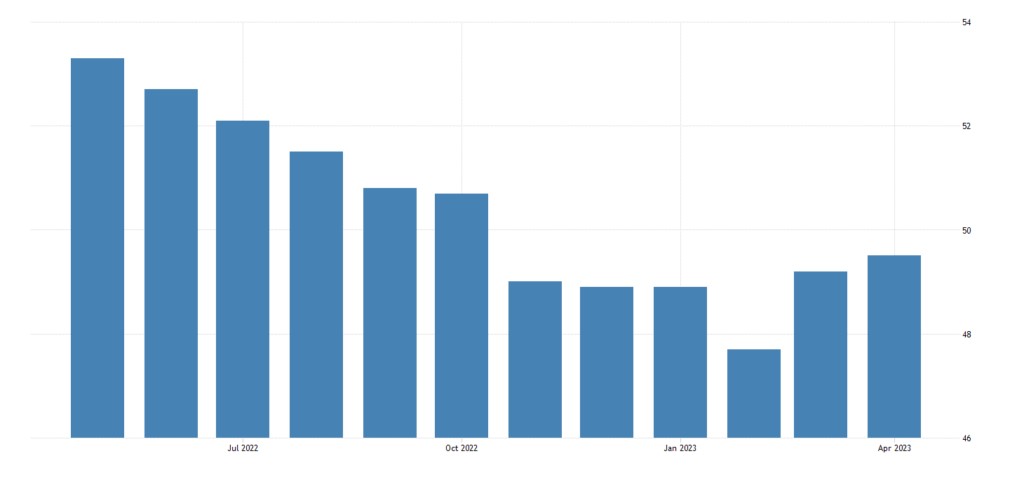

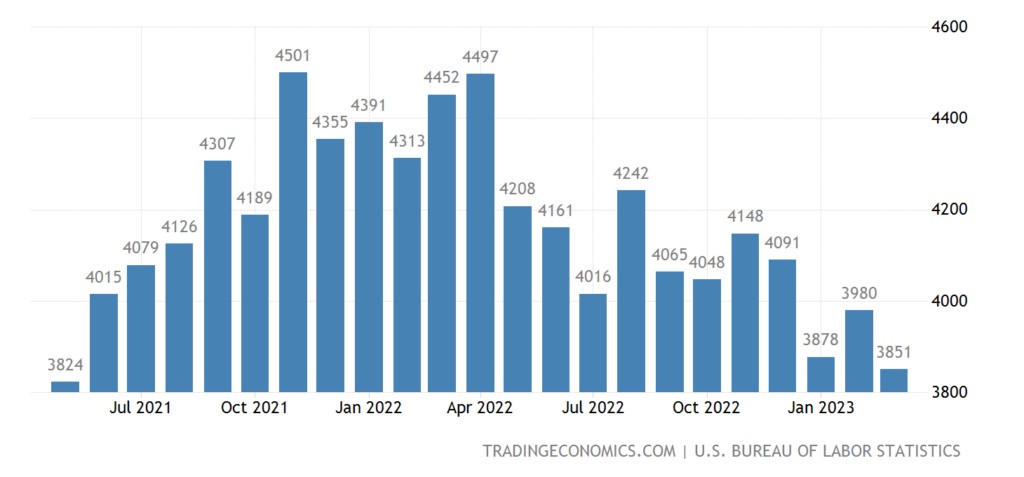

The number of available vacancies in the United States for a minimum of 2 years:

The US Federal Reserve raised the rate by 0.25% to 5.00-5.25% but removed the words about the need for further tightening of the policy from the press release.

The ECB did the identical (+0.25% to 3.75%), simultaneously declaring the termination of reinvestment of income from redeemable bonds; at the same time, further tightening is questionable. The Central Bank of Australia raised the interest rate by 0.25% to 3.85%, contrary to the expectations of a pause.

The Central Bank of Brazil left the rate in place, considering its new increase "less likely".

Main conclusions

Judging by the figures, the decline in the industrial sector in the global economy has accelerated. This contradicts the structural crisis model but may not be about the economy. If the monetary authorities in the leading Western countries (and their policies are coordinated through the IMF and other Bretton Woods structures) believed that the deterioration was temporary, they could deliberately overestimate the indicators to not frighten the townsfolk and entrepreneurs. But as discrepancies accumulate, they must be acknowledged, which requires showing slightly worse numbers. Therefore, he will not argue that the situation is rapidly deteriorating; we will note only this moment and return to it later.

Now about Powell's press conference. The main theses of the preliminary speech:

"Banking sector conditions have generally improved; We strive to learn the right lessons; We are committed to bringing inflation down to 2%; Further increase in rates – it all depends on the incoming data; Dual mandate in force; The labour market remains "very tight"; Wage growth shows signs of easing. The number of vacancies is decreasing; There is still a long way to go to bring inflation down to 2%; We are ready to do more if necessary; It will take more time to see how the tightening of monetary policy will affect the US economy!; Events in the banking segment further tighten Financial Conditions."

Powell said: "We did not make a decision on the PAUSE, but we removed the statement about the need for a further increase in the rate. We will take into account certain factors to make decisions. We are not talking about expectations. The forecast of the chairpersons of the regional reserve banks is a moderate recession. But this is not my base case. My forecast is a moderate growth of the US economy. The labour market is stabilizing. There is some progress, but inflation is still high. Many banks are now focused on their level of liquidity. The US debt ceiling is a risk to the future outlook. However, this is not a factor in the decision of the Fed. There are no plans for further consolidation of banks. We don't want big banks to buy small banks. We have a diversified banking system, but with the First Republic, there was no other choice."

So far, nothing is new; only (indirectly) the position that the Fed will not make fundamental decisions on its own has been confirmed. But what happened next was this:

"It is crucial to raise the US debt ceiling limit. There is no clear understanding of how much the "banking crisis" has affected the degree of tightening of financial conditions. We need to see more data to announce that the Fed's rate ceiling has been reached. In general, we will not have to raise interest rates further. We will need to look at the data for a few more months. We may already be close to a relatively restrictive monetary policy. We need to see more data to announce that the Fed's rate ceiling has been reached.

All in all, we won't have to raise interest rates too much any further! It will take a few more months to look at the data. We may already be close to a fairly restrictive monetary policy. (to the Fed rate ceiling).

Again and again – the same thing. Powell categorically rejects the requirement to formulate his strategy, whether the Fed will necessarily bring inflation to 2% or retreat due to a decrease in the population's standard of living. We have already noted that such a dilemma is outside the Fed's mandate, but Powell cannot openly admit this, as this would immediately sharply raise estimates of the risk of a serious system collapse.

We continue to quote Powell's answers: "A recession can be avoided! The probability of this is higher than its inevitable onset. There are no guarantees, but the labour market may continue to cool without significant unemployment. I do not think that the level of wages is the main driver of inflation. If there is a recession, I hope it will be mild. The Fed's attention will now turn to strengthening lending activity! Now it would be inappropriate to start cutting rates. Service Sector (No Housing) — No significant progress in reducing inflation. The Fed's inflation forecasts do not imply a rate cut."

Everything is the same, just in the other direction. We won't raise it yet, but we won't lower it either. We have no grounds for making such decisions.

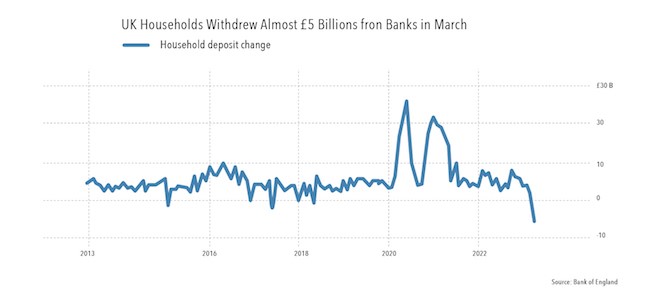

It is panic and recognition of one's impotence. How soon market participants will understand this is a question, but the situation in the banking sector shows that depositors have less and less confidence in the monetary authorities:

The picture of the state of the banking sector on the NASDAQ site shows readiness for a sharp collapse. People are actively withdrawing money from deposits, for the USA we showed a picture in previous reviews, today we will show for the UK:

This, as you know, is a March picture, since then the situation is unlikely to have improved much.

Actually, this is a pure illustration, anyone can see similar pictures in the news feeds every day. And precisely for this reason, we expect quite strong events at the end of May – beginning of June, by the time when it will be absolutely necessary to increase the US national debt ceiling. Even if the ceiling is increased, the US Treasury will immediately enter the public debt market with huge borrowings, which will increase the dollar deficit and lead to its appreciation. And if it is decided to declare a technical default …