The global confrontation in the field of resources is ramping up.

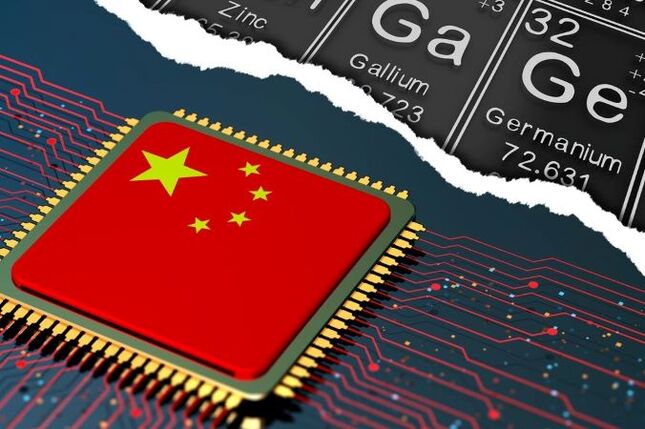

In early July, China announced that starting August 1, it will impose restrictions on the export of gallium and germanium and products made from them, requiring exporters to obtain a license. The official reason for the new restrictions is to protect limited resources in order to support domestic producers and ensure national security.

China's announcement came just a few days after the Netherlands announced controls on the export of advanced chip manufacturing equipment. The Dutch decision was made under pressure from the United States, which continues its attempts to limit China's capabilities in the production of advanced electronics.

Analysts at Bloomberg also note that Beijing announced export restrictions just a few days before US Treasury Secretary Janet Yellen's visit to China. This should give Beijing additional leverage to push Washington to lift trade restrictions that could hinder China's development.

However, the likelihood of the parties reaching an agreement is not great. The fact is that the confrontation between China and the US is only part of the picture, though the most vivid and obvious and therefore attention-grabbing part. In reality, it is more about the formation of a new geo-economic structure in which technologies and strategic resources will be more clearly divided among competing economic blocs.

Gallium and germanium: Case value

These metals are of great importance for high-tech industries. Gallium is widely used in microelectronics. Two of its compounds, gallium arsenide and gallium nitride, are used in the production of LEDs, solar cells, semiconductors, and highly specialized integrated circuits—for the production of chips for cell phones and satellite communications, in particular. Germanium is used in high-speed computer chips, solar panels, fiber optics, and infrared devices, such as night vision devices.

Thus, gallium and germanium are of great importance for microelectronics, renewable energy, and electric transportation, as well as the telecommunications and defense industries. Therefore, Beijing’s decision to impose export restrictions is a serious signal to the US and the West as a whole that pressure on China in the high-tech field will come at a cost for them.

According to the US Geological Survey, China accounts for 98% of global gallium production and 68% of germanium production. These figures refer to primary production. Taking into account secondary use and high-quality products, China produces 80% of gallium worldwide and 60% of germanium, according to the industry organization Critical Raw Materials Alliance (CRMA).

At the same time, the direct consequences of these restrictions should not be overestimated. Gallium and germanium are not rare metals and are not particularly difficult to find or extract. However, the time and resources that the West will have to invest in developing its own production, as well as the increase in the cost of the final product, are significant. The world is already experiencing a shortage of microchips (2020-2022), which has affected 169 industries from the production of gaming consoles to the automotive industry. As we saw in the example of the collapse of semiconductor production in Texas in February 2021 (due to record freezes and resulting power outages), the disruption of established chip supply chains can have global economic consequences. So Chinese restrictions on the export of gallium and germanium are not as innocuous as Western media outlets are trying to portray them today.

China provides large volumes of production at low prices and assumes significant environmental costs associated with primary metal production. It will not be easy or painless to quickly find a replacement for Chinese supplies.

Gallium and germanium are used in computer chips. Photo: ISTOCKPHOTO

It is also important to note that China has not banned exports, but has only created a mechanism to control their volume. Moreover, "punishing the West" is not the only possible goal of this mechanism. For example, in 2022, Chinese geologists warned that due to the increasing cost of extracting raw gallium and the depletion of resources, China may be forced to process gallium from Japan and the US instead of producing it domestically – and this despite the fact that the country still relies on Japan and the US for the supply of high-quality products made from this metal. Therefore, for China today, it is important not so much to maintain a share in gross gallium production, but to reduce dependence on Western high-tech products.

The era of China as the world's factory is coming to an end. The world is rapidly moving towards the formation of economic macro-regions. "Today, national security, technology, and economic leadership are more important than globalization," Morris Chang, founder of the microchip production giant Taiwan Semiconductor Manufacturing Company, said recently.

China needs a new strategy for the new era.

Rare Earths: A warning

Apparently, restrictions will not be limited to the export of gallium and germanium. According to a recent report by Nikkei from Beijing, as early as 2023, China may introduce new restrictions on the export of rare earth metals, which play a key role in precision machining, the production of rare earth magnets used in electric motors (including electric cars), robots, aircraft (military and others), and mass-market items such as cell phones.

This will not be China's first step in this direction. Beijing first introduced an export licensing system for rare earth metals back in the 1990s. Then it gradually increased taxes to squeeze out Japanese and other companies that relied on Chinese supplies. As a result of this policy, by 2010, China had a virtual monopoly on the industry, producing 98% of the world's rare earth metals.

However, in 2010, there was a sharp shift. Beijing temporarily suspended exports to Japan in response to a collision between a Chinese fishing vessel and the Japanese coastguard near islands claimed by both countries. The incident sparked a surge of interest in alternative sources of raw materials.

As a result, by 2022, China's share had dropped to 70%. At the same time, global production volume increased almost threefold, from more than 100,000 to 300,000 tonnes per year.

Today, the US accounts for 14%, and Myanmar and Australia for 4% and 6% respectively. The remaining countries account for 6%. However, at the same time, the US's sole operating mine – Mountain Pass in California – is partially owned by a Chinese state-owned company, and the raw materials mined in the US are sent for processing to China.

But China's position is still very strong. According to the Asia News Network, it has an 84% share of the global neodymium magnet market and over 90% of the samarium-cobalt magnet market (with the majority of the remaining share belonging to Japan). Most rare earth metals, regardless of whether they are mined in China or not, are sent to China for processing, as raw material processing is often associated with high environmental risks. However, the US is still a leader in the production of products using rare earth magnets.

There are several projects in the pipeline that will reduce China's share. For example, at the end of June, the industry resource Mining.com compiled a ranking of ten projects that will reduce China's influence, primarily on the US. Of the ten projects, five are located in Canada, two in Greenland, and one in the US.

The reduction of China's share in the rare earth metals market is only a matter of time. Like with gallium and germanium, the important thing for Beijing is not so much to maintain a share in gross production as to create high value-added industries.