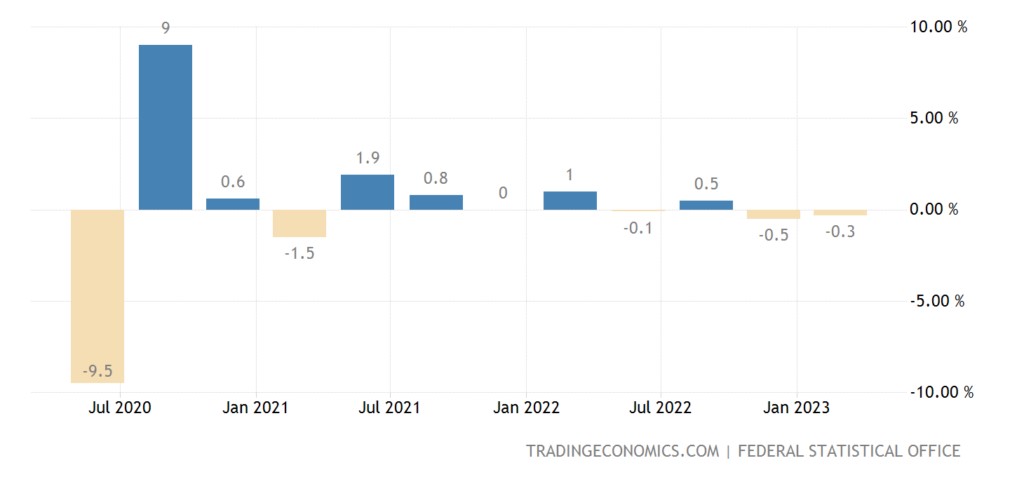

The main news is the official entry into the recession of the German economy. GDP data for the first quarter of 2023

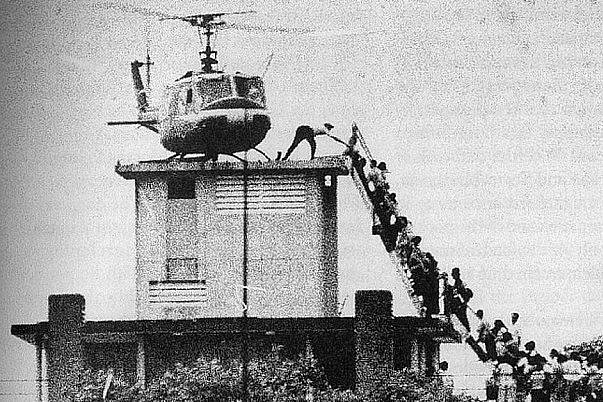

-0.3% — 2nd negative in a row:

And -0.5% per year – the first decline in 2 years:

At the same time, there are no mistakes, and there cannot be, since household spending is -1.2% (expenditures in the 1st quarter of this year amounted to 447.9 billion US dollars, and in the 4th quarter of the previous year, they were 454.3 billion dollars.

And here, it is necessary to describe the situation in more detail. We did this repeatedly, but for a long time, so repeating makes sense. The fact is that a structural crisis has been going on in the Western economy since the fall of 2021. The decline in the US economy in 2022 was about 6-8% (it makes no sense to say, more precisely, GDP is an accounting indicator highly dependent on the methodology), but it is masked by underestimated inflation. In addition, in the US, an increasing share of GDP is the capitalisation of fictitious financial assets, which (for now) can still be increased.

The term "recession" is utterly incorrect since the economic mechanisms of a structural and cyclical crisis are fundamentally different. The structural one is proceeding slowly and consistently (the rate of decline is about 1% of GDP per month or 10% per year), but the state's stimulating policy partially offsets them. In the European Union (and Germany), the PEC crisis began, as in the United States, in 2008 and turned into a structural recession in the autumn of 2021.

Since liberal economics does not recognise crises of falling capital efficiency (PEC-crisis), the element of which is the structural recession of the economy, the statistical data are chasing the picture of a cyclical crisis. For this reason, the term "recession" is constantly used, which has no relation to reality. But as a result, an adequate description of the situation is impossible. For example, the US monetary authorities in the fall of 2021 sincerely believed that inflation growth was a local surge that would end quickly.

The situation in Germany is aggravated by political moments, particularly by rejecting cheap Russian pipeline gas. This has already hit the EU economy and will hit it even harder. Still, the discussion of the reason for such behaviour goes beyond the scope of macroeconomic topics. So far, we are only seeing results.

Macroeconomics

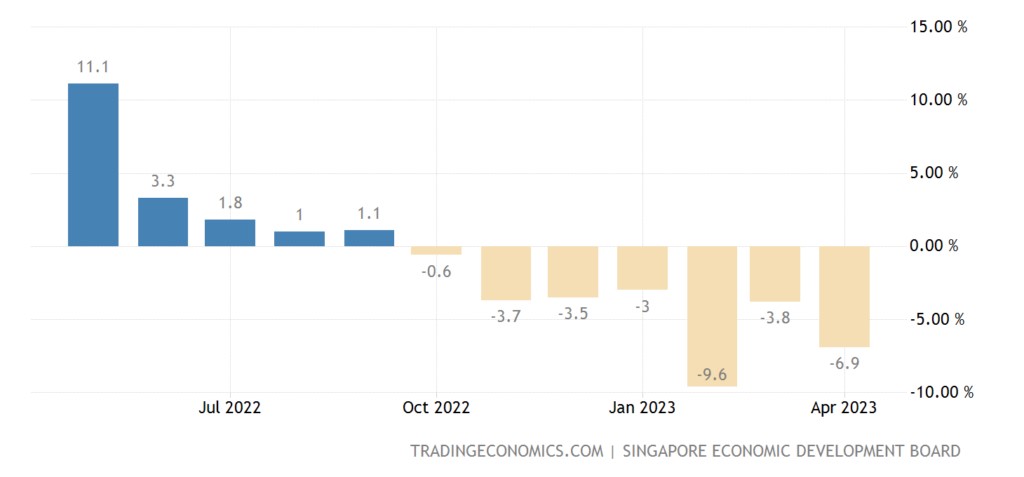

Singapore's GDP declined by -0.4% qoq:

The decline in the output of Singapore's manufacturing industries is even more substantial, -6.9% per year – the 7th monthly minus in a row:

This means that the decline in GDP will continue.

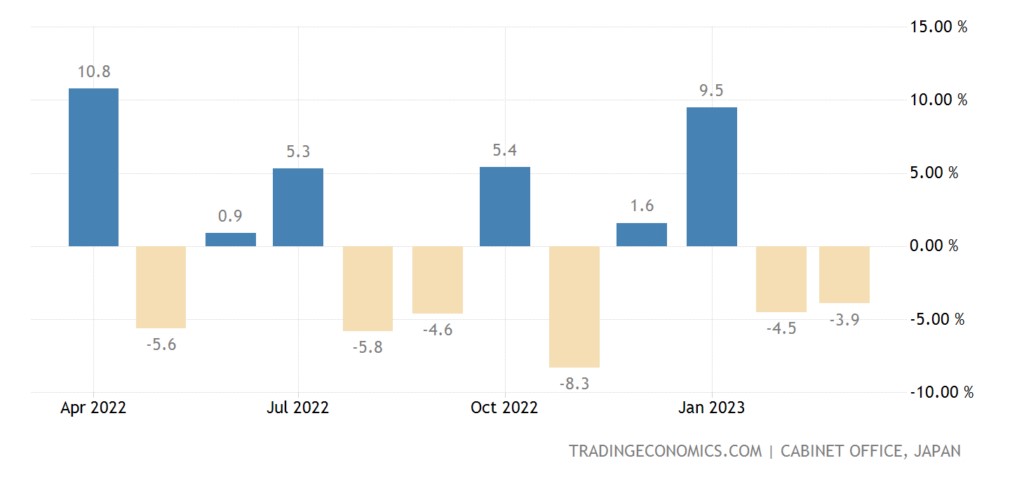

Net engineering orders in Japan -3.9% m/m – 2nd negative in a row:

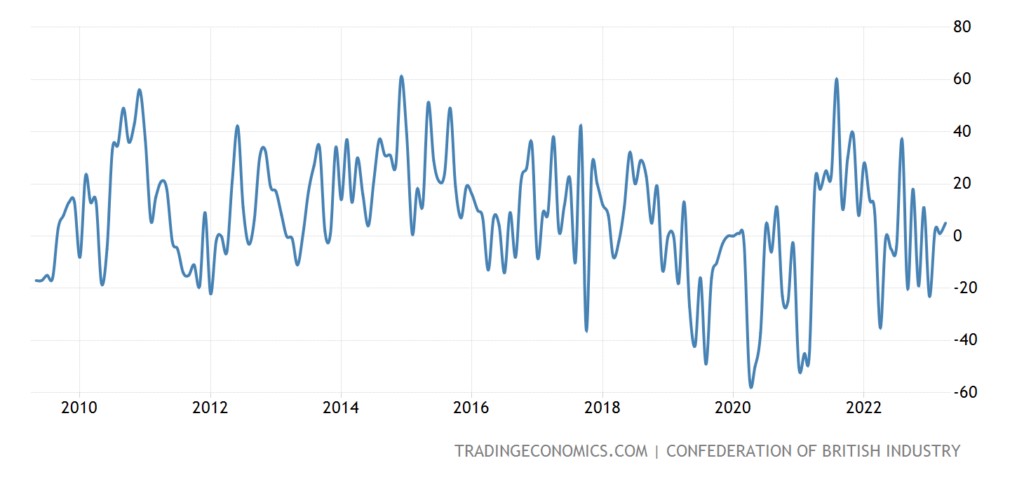

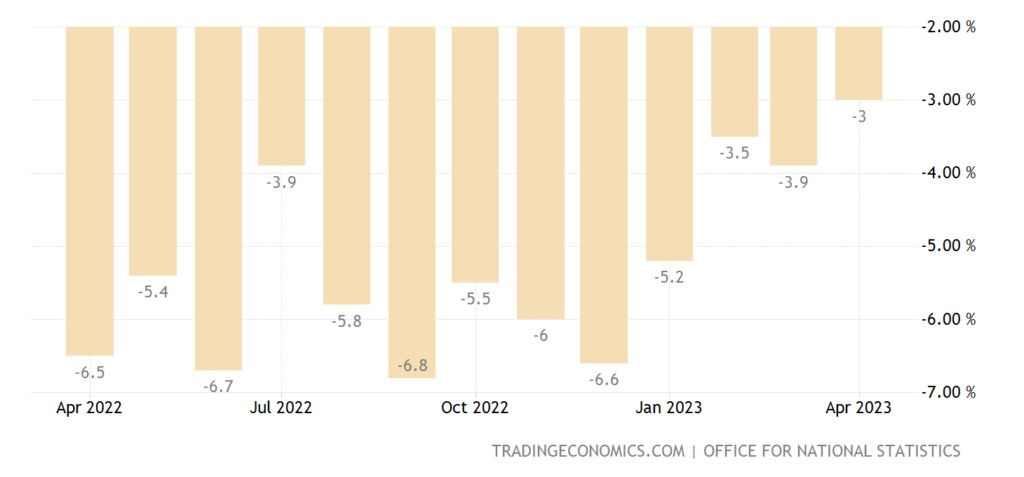

The balance of industrial orders in Britain has been negative for 10 months:

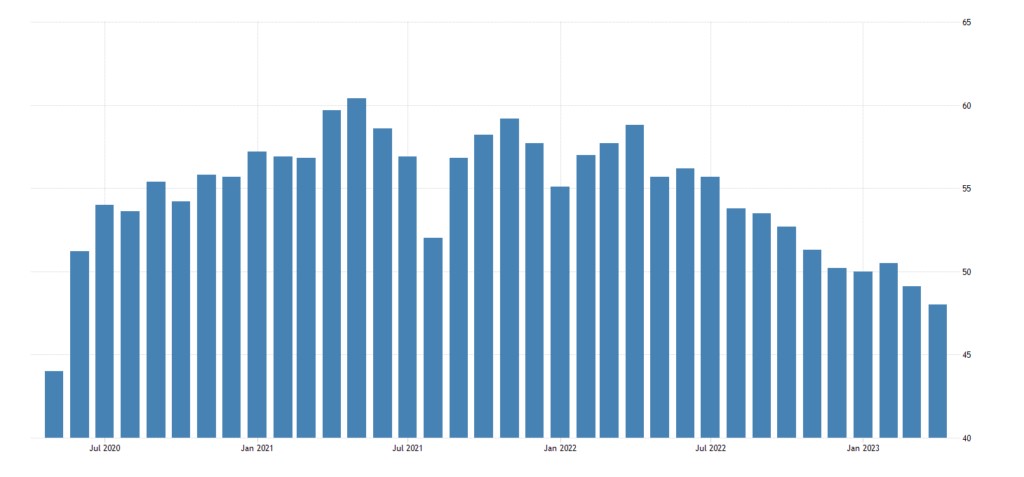

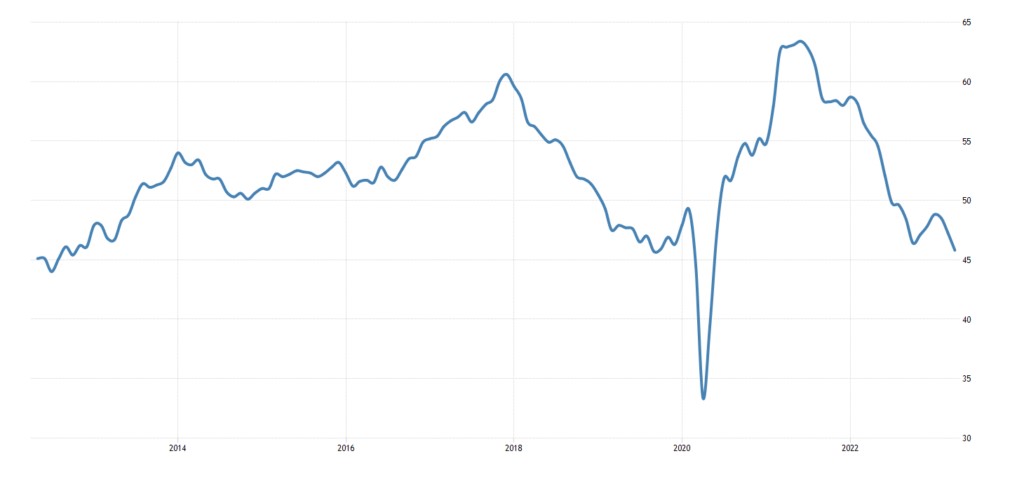

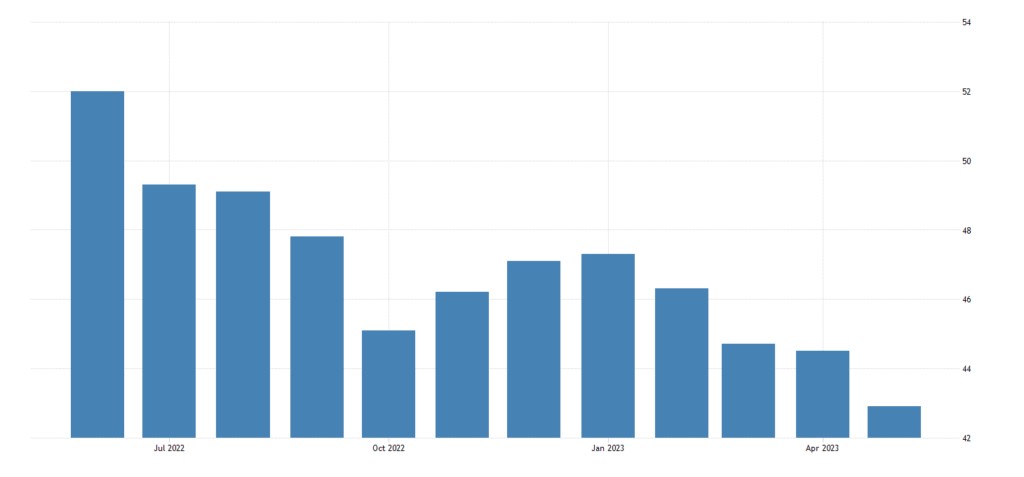

PMI (expert index of the state of the industry; its value is already 50 means stagnation and decline) of the Australian industry remains at a 3-year bottom (48.0):

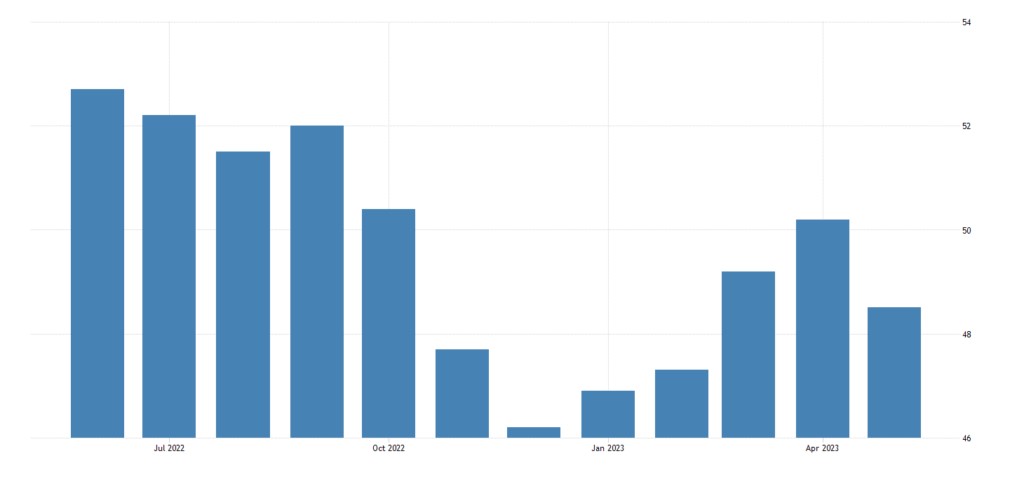

The US as a whole returned to the recession zone (48.5):

This is not surprising given the data from the regional reserve banks that we have released in recent weeks.

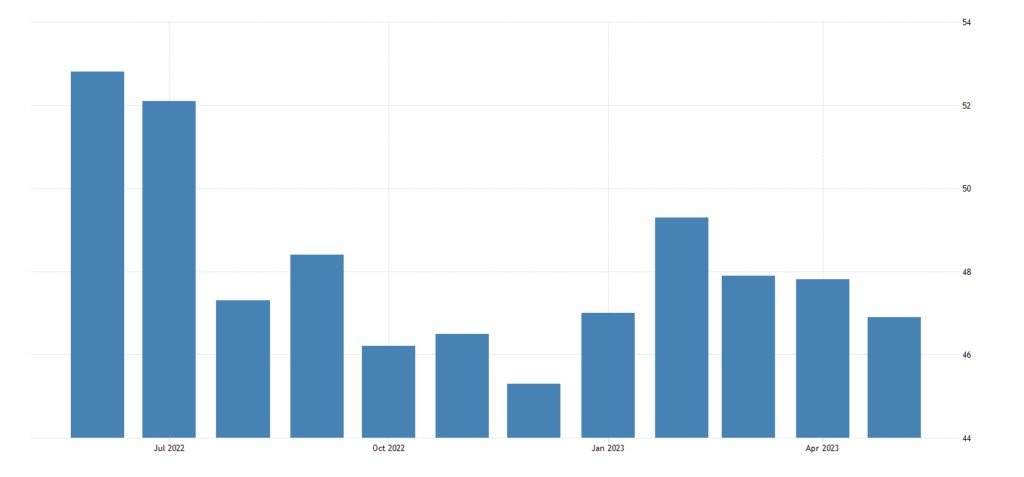

In Britain, the 10th month of decline in the industrial sector and a 5-month low (46.9):

In the eurozone, the worst numbers for 3 years (44.6), and excluding covid – for 11 years; Decline Month 11:

Mainly because of Germany, where the depression zone is already nearby (42.9):

Additional confirmation of harmful data on GDP.

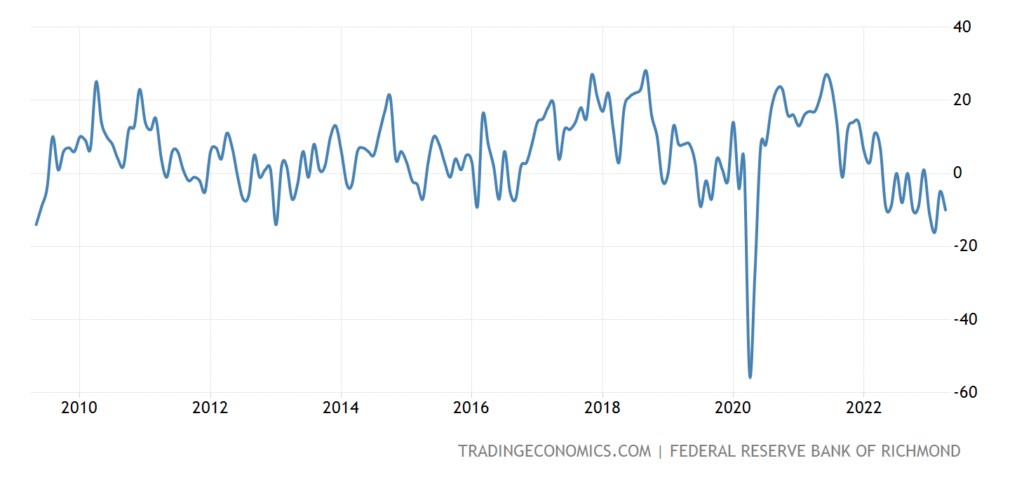

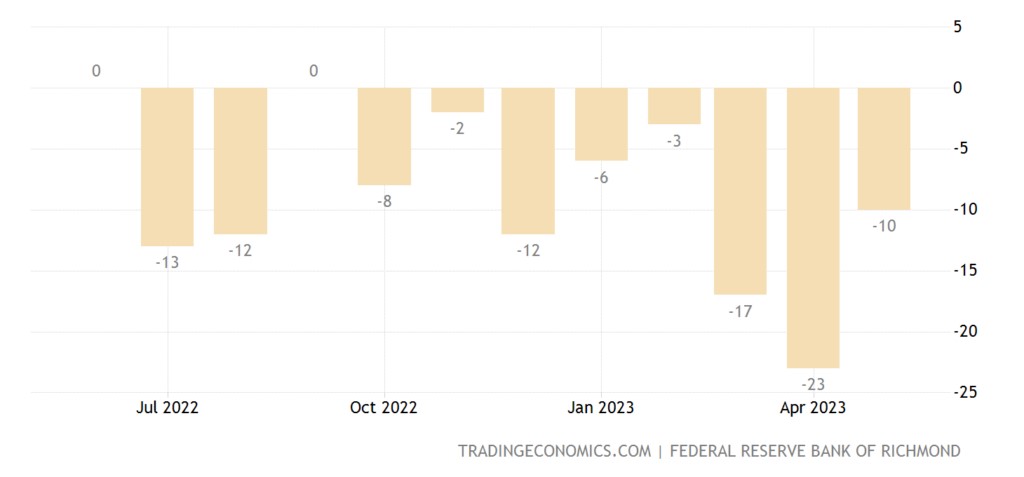

Richmond Fed manufacturing index near a 14-year low (excluding Covid dip):

Service sector activity in the same region has been in the red for 12 consecutive months:

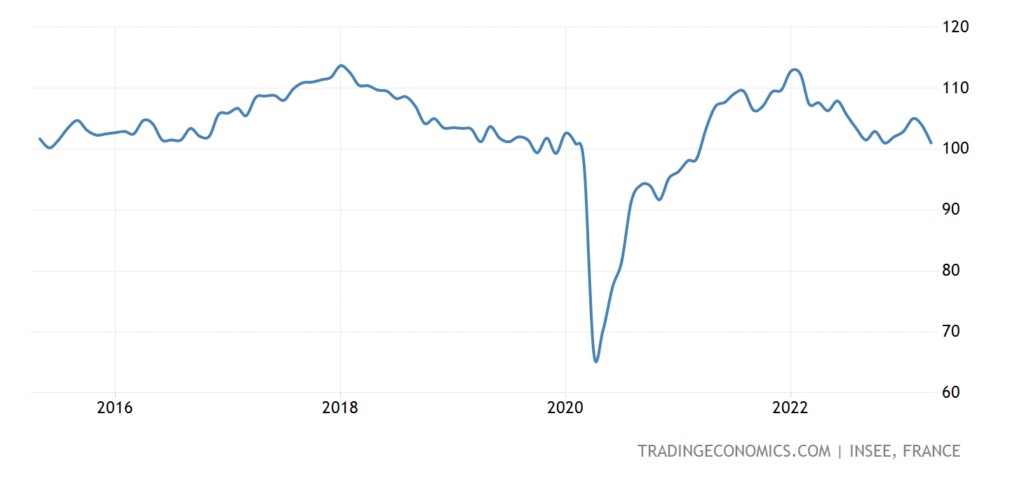

Business confidence in France at the bottom in 26 months, and without the covid recession in 8 years:

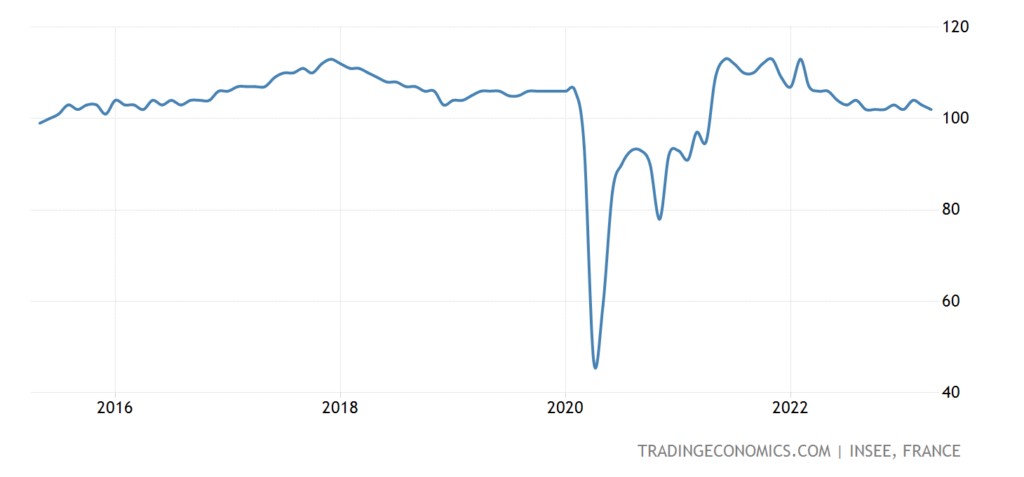

The same with the business climate in the same country:

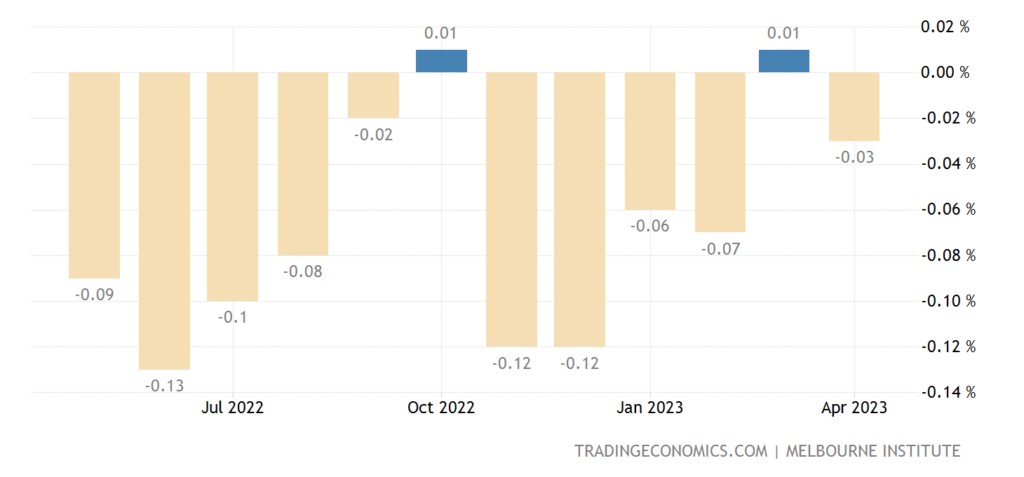

Leading indicators of Australia have not been growing monthly for half a year; they have only 1 plus per year (and that is only +0.03%):

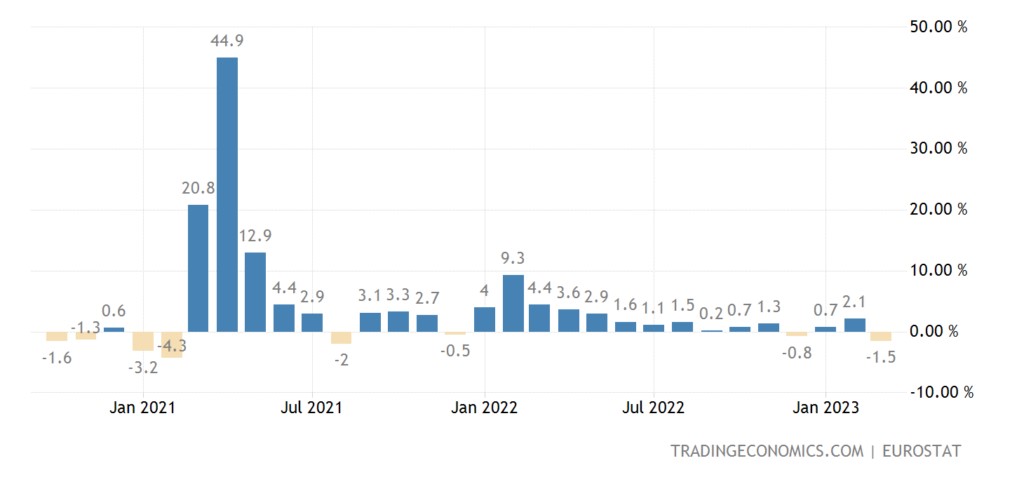

Eurozone Construction Production -1.5% p.a. – 19-month low:

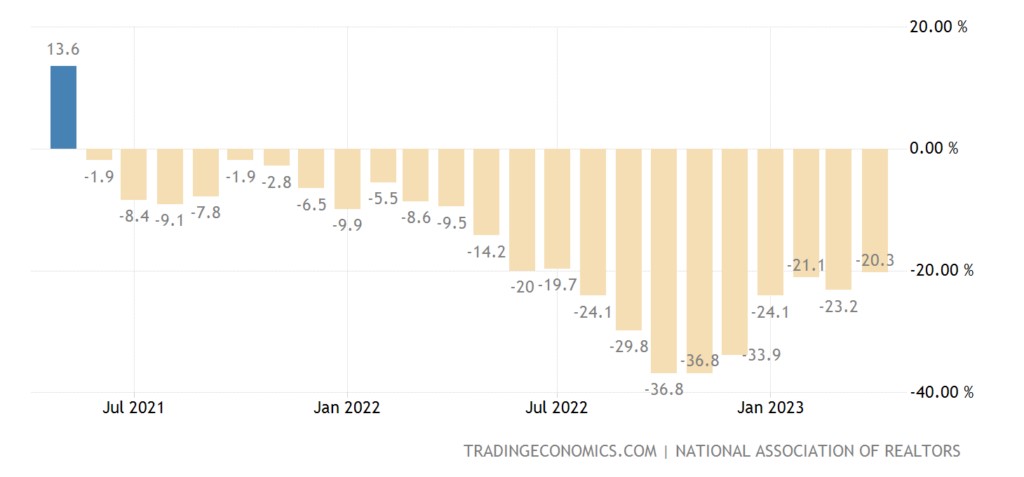

US pending sales of existing homes have been in the annual red for 23 months:

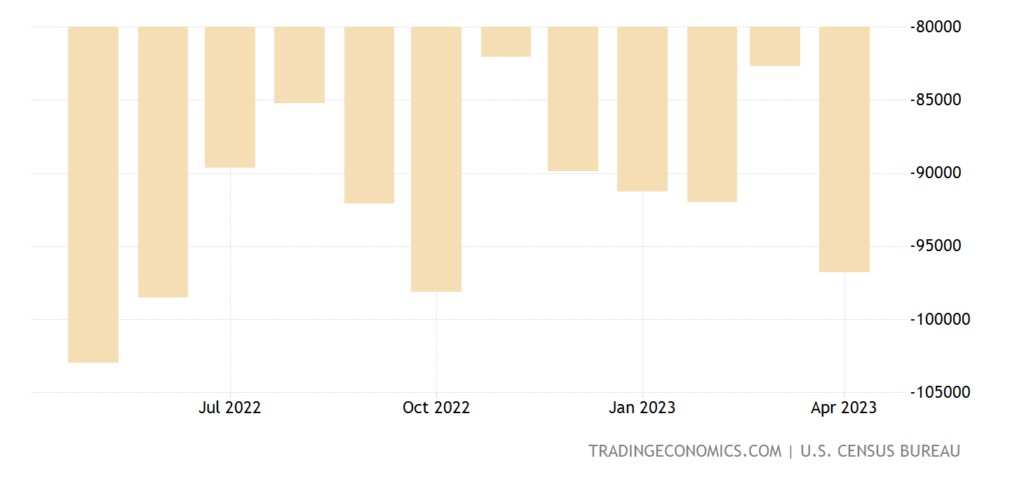

US merchandise trade deficit at its six-month peak:

This is to question the need for the reindustrialisation of AUKUS in general and the United States in particular.

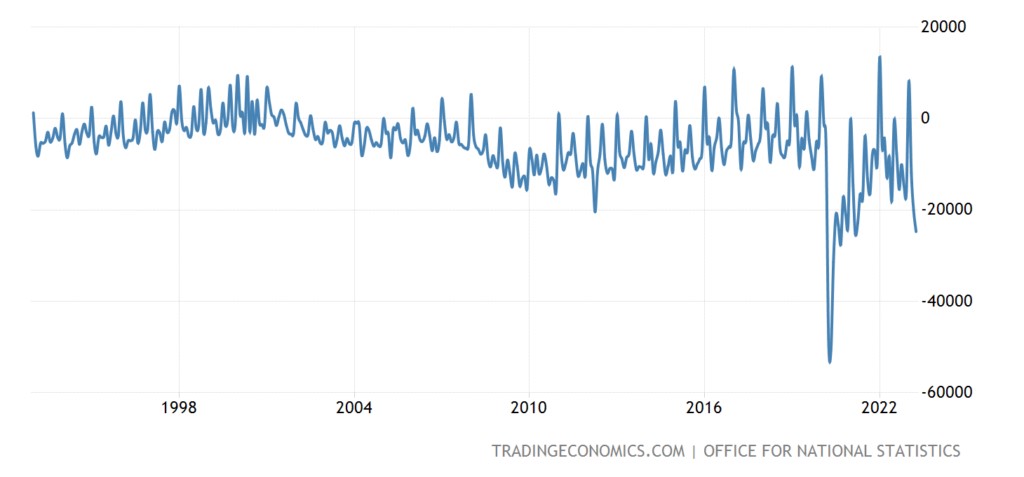

The UK budget deficit is a record, except for its surge in the pandemic:

Britain's net CPI (consumer inflation index) is at a record high (+6.8% per year):

The exact figure in South Africa at its peak since 2017:

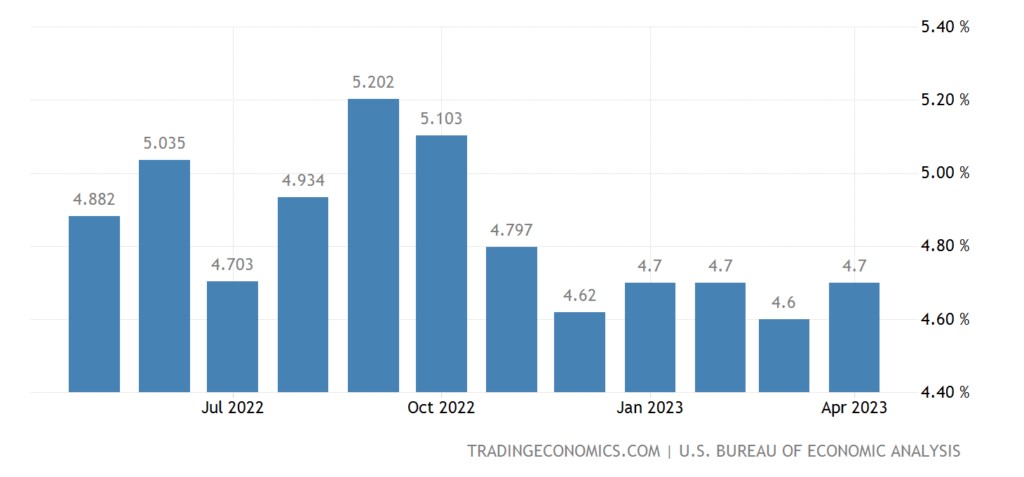

Net consumer basket price index in the US +4.7% per year – a maximum for 5 months:

So, how to ease monetary policy in such a situation? How much will inflation rise? Even the official, most likely, not less than 10%.

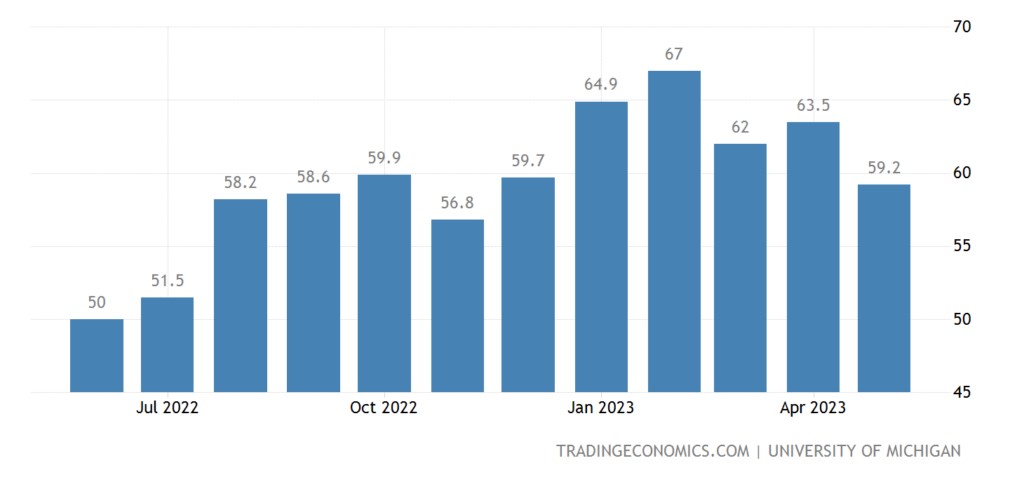

As a result, the mood of Americans (review by the University of Michigan) is the worst in six months:

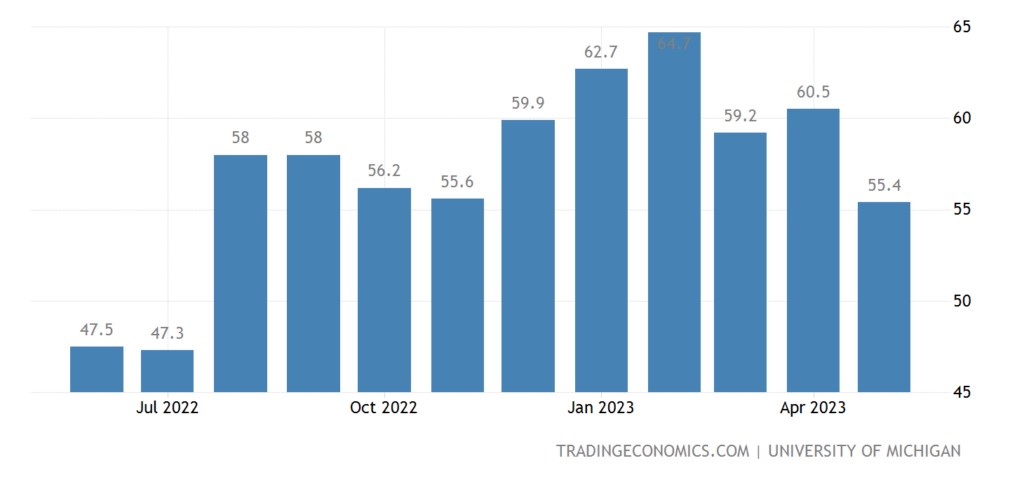

Including their expectations – for 10 months:

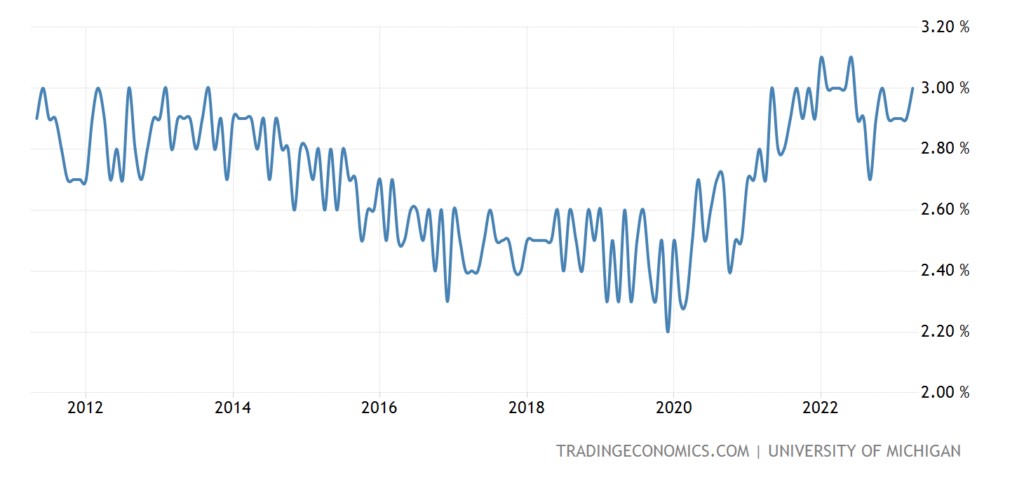

But inflation expectations for the next 5 years are the highest in 12 years:

It must be assumed that consumers understand what they expect, regardless of official figures.

UK retail sales are back in the red, and industry employment downturn worst since February 2009:

And its volume is -3.0% per year – the 13th minus in a row:

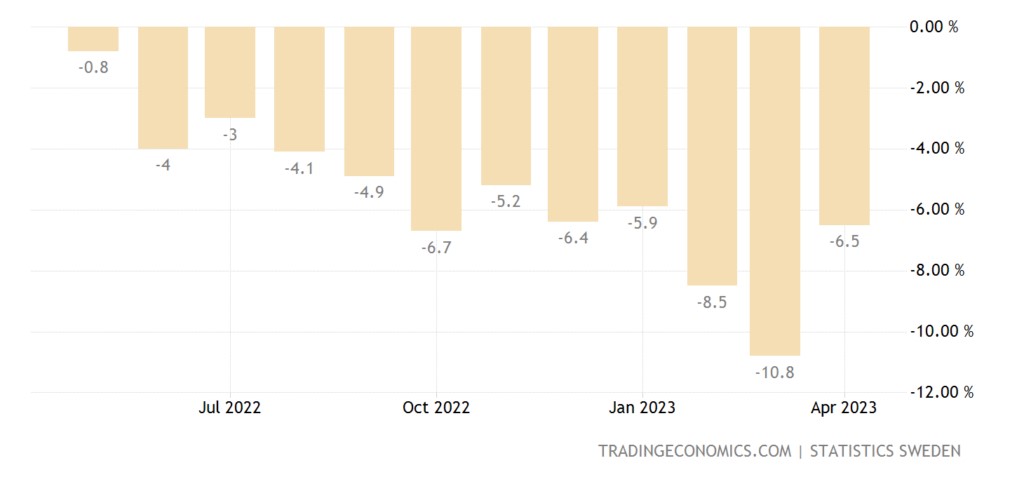

Retail Sweden -6.5% per year — the 12th negative in a row:

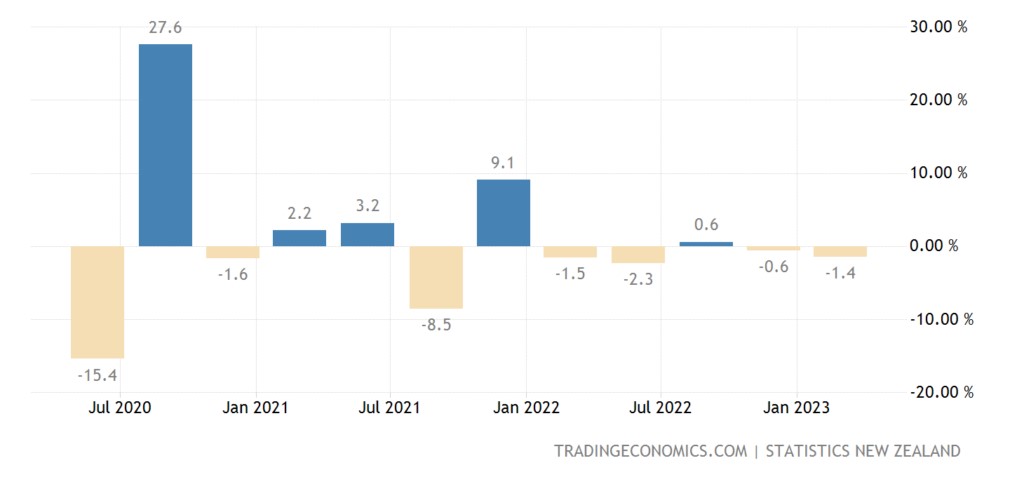

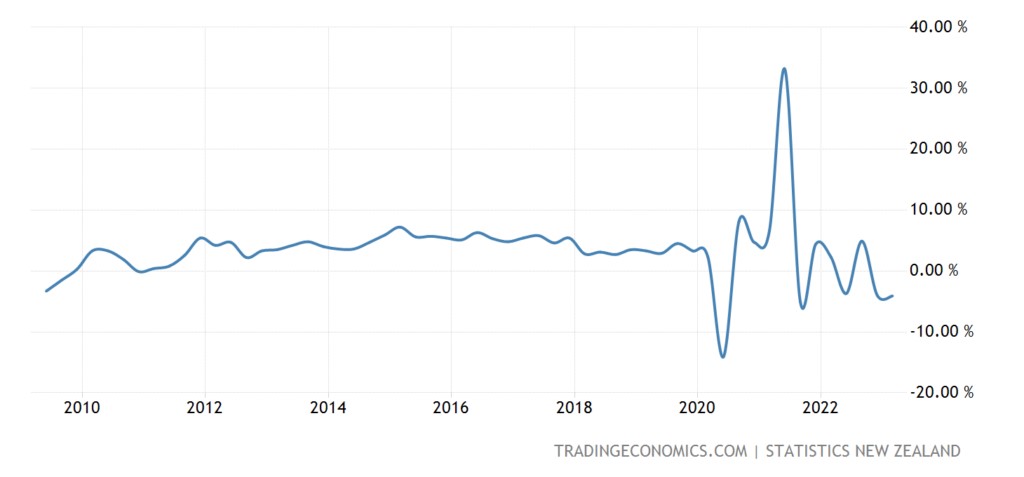

Retail New Zealand -1.4% qoq – 2nd negative in a row and 4th in the last 5 quarters:

And -4.1% per year – excluding covid jumps up and down, this is the bottom since 2009:

The Central Bank of China, as did the Central Bank of South Korea, left its monetary policy unchanged. Nothing changes both the Central Bank of Indonesia and the Central Bank of Turkey. Only the Central Bank of South Africa raised the rate by 0.50% to 8.25%.

Main conclusions

In general, the structural crisis continues at its usual pace. Slightly changing industries and regions, but the overall picture remains the same. A few words need to be said about the budget debate in the United States. It continues, but its factual background has become clear to the American elite, and therefore the demagogic component has fallen dramatically.

And then there were the consequences. Many rating agencies have already announced that they are preparing to downgrade the top US rating (which will automatically lead to a downgrade of all US companies since a company's rating cannot be higher than the country's rating). In contrast, China’s largest rating agency CCXI downgraded the US rating from AAA to AA +. Given that it is affiliated with Moody’s, you can expect that everything else is not empty words.

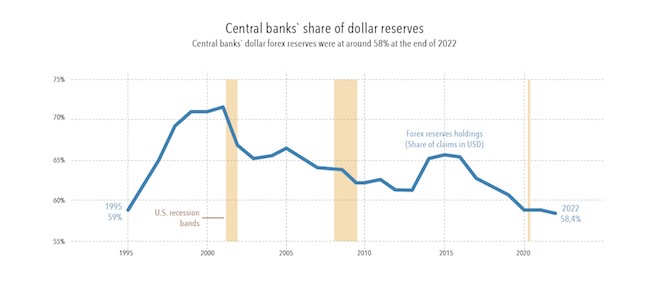

In addition, central banks began to reduce their dollar reserves:

While the dollar is still more than 50%, the trend is already apparent. And, most importantly, now there is no alternative in the form of German marks/euros since it is clear to everyone that the economic situation in Germany / the EU is even worse than in the USA.

Even the IMF has had its say in issuing a worrisome review of the US economy:

- The recent bank failures may be a prelude to more serious financial stability problems;

- The Fed keeping interest rates high risks causing more difficulties for the banking system and non-banks;

- Tighter financial conditions will trigger an increase in bankruptcies and a deterioration in the quality of loan portfolios;

- The US economy could slow down dramatically in 2024, creating a recession;

- Downturn in business activity with a stronger dollar and high-interest rates has severe consequences for the rest of the world.

The issue of monetary policy in the US remains open. However, a clear upward trend in inflation will significantly limit the Fed’s leadership from raising the rate. The US leadership does not have a good way out today. We need to wait for the completion of the structural recession, which has just begun.

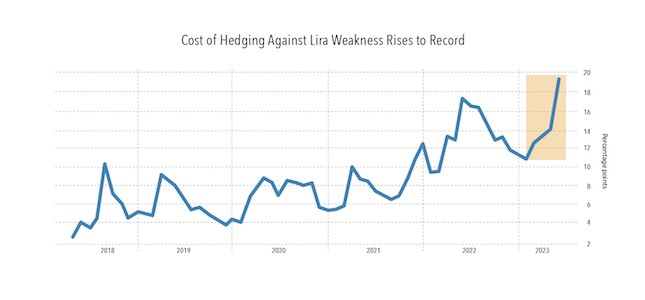

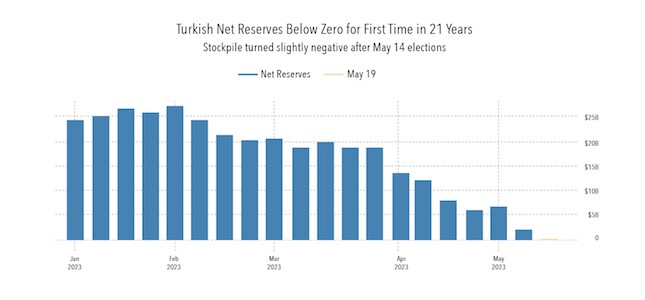

Separately, a few words should be said about Turkey, especially since there is a second round of elections over the weekend. The Central Bank of Turkey is actively selling gold to keep the lira, but it is obvious that whoever wins the elections will have to change the economic policy. And make foreign policy much less ambitious.

Let’s see how it all ends.