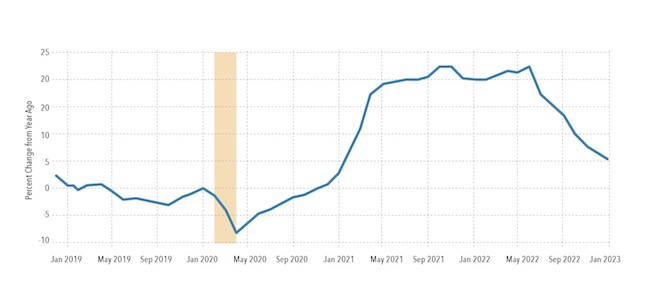

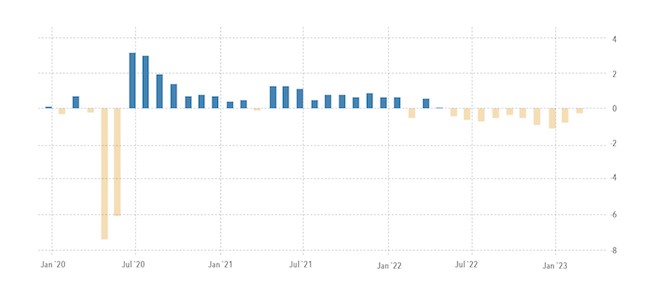

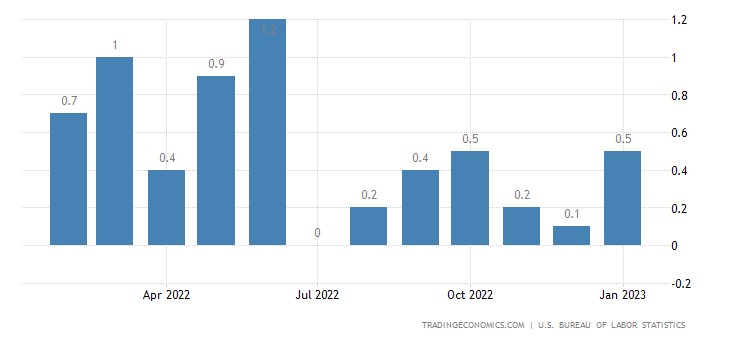

The first symptoms were the last two weeks – but it seems that they have become a trend, and inflation has begun to rise again. Weekly consumer inflation (CPI index), which last week in the US was 0.1%, this week rose to 0.5%, which is higher than even the already increased forecast of 0.4%. Maybe this is the effect of a change in methodology, and consumer inflation has been slightly raised, so there is much more to reduce?

Indeed, it is somehow indecent to show deflation in the current situation, and there is nowhere to lower the official figure of 0.1%. How can one demonstrate a positive effect? Here, last year's inflation was slightly reduced, and the current one was somewhat raised (in order not to show annual inflation growth, there is room to reduce it!). However, it is still difficult to talk about the details of this situation, and we will closely monitor it. The coming weeks will likely provide a lot of food for thought.

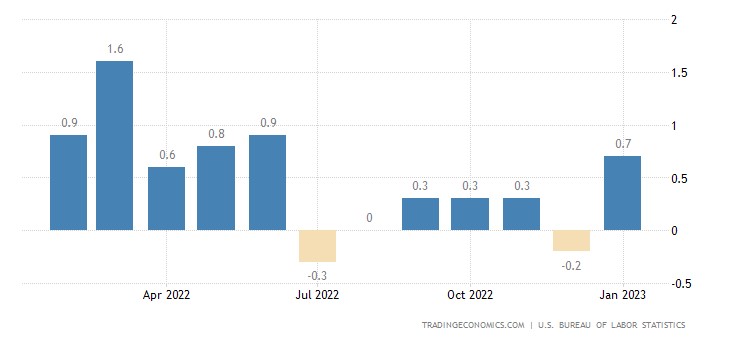

By the way, industrial inflation (for the total volume of goods) fell a little:

Whether the methodology has been changed here is a separate question. The trick is that oil prices were falling. This may be a market effect associated with a fall in spores. But at the same time, as seen from the next section of the Review, industrial inflation indices, limited in terms of volumes of goods, grew during the week. So, we may generally be dealing with local distortions associated with the process of changing methods. As new statistical technologies are developed, these problems will be solved in the coming months, and the picture will become more regular.

But suppose we draw any conclusion from what happened, assuming that the data correspond to reality, at least in part. In that case, we can assume that, apparently, it has not yet been possible to launch the investment process in the United States (except for the military-industrial complex). And investment resources were shifted to compensate for current problems.

Macroeconomics

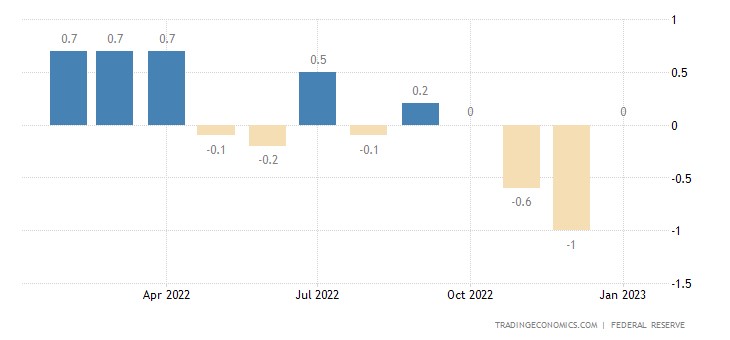

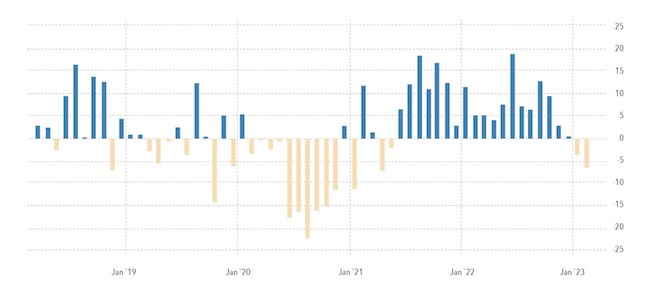

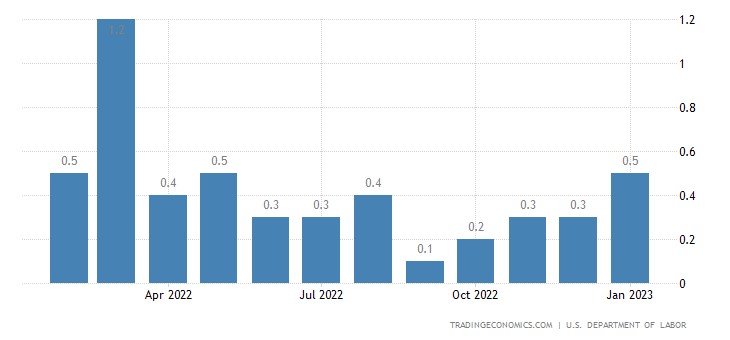

US industrial output fails to rise for 4 months in a row:

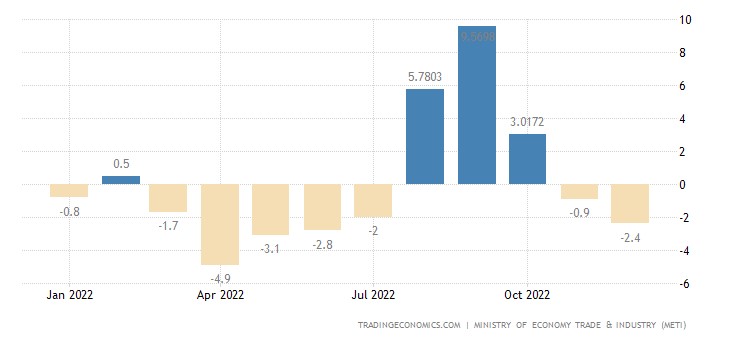

Industrial production in Japan -2.4% per year – 2nd negative in a row:

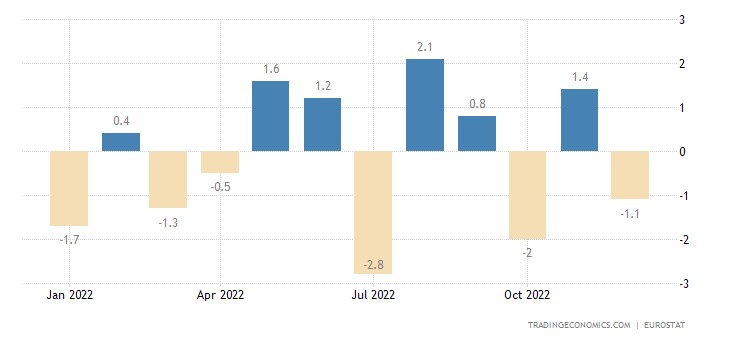

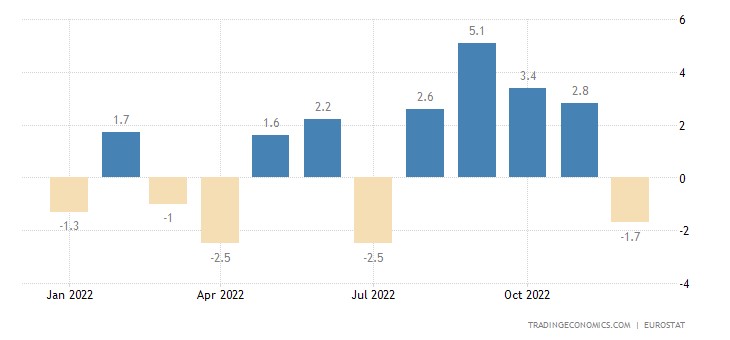

Eurozone industry output -1.1% per month:

And -1.7% per year:

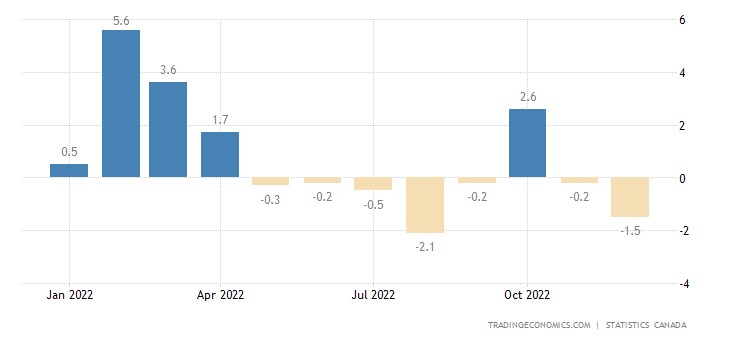

Manufacturing sales in Canada -1.5% per month – 7th negative in the last 8 months:

Orders in mechanical engineering in Japan -6.6% per year – the 2nd negative in a row and the worst dynamics in almost 2 years:

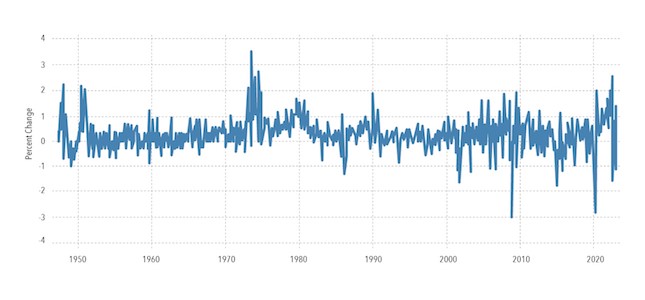

Estimates of the US economy do not change:

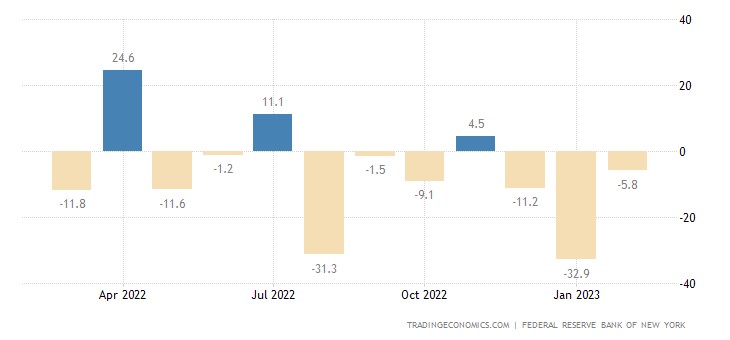

The New York Fed index has been in the red for the last 3 months and 6 of the last 7 months:

The Philadelphia Fed index is negative for 6 months in a row, excluding the collapse of 2020, it is the worst since 2009:

Leading indicators in the US have been falling monthly for 10 consecutive months:

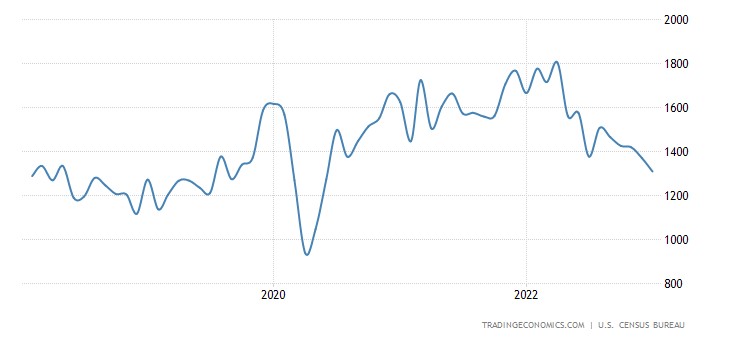

The number of new buildings in the US has been declining for 5 months in a row:

It is minimal for 2.5 years:

The picture is similar for building permits:

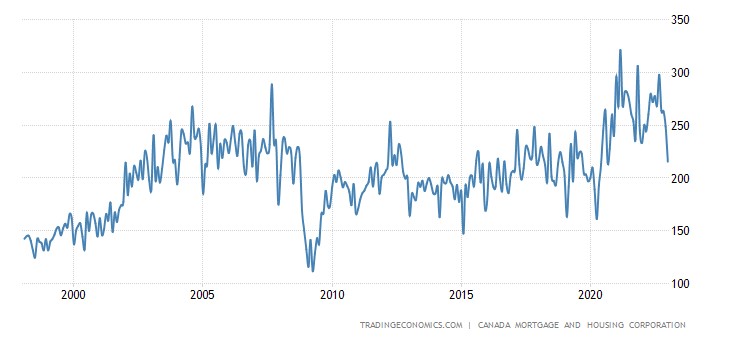

New buildings in Canada -13% per month to averages over the past 20 years:

Housing prices in China -1.5% per year – the 9th negative in a row and only 0.1% to an 8-year bottom:

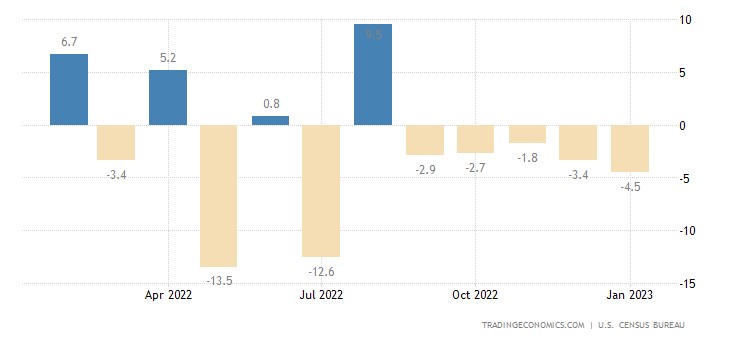

Inflation in the US, as we have already noted, accelerated in January to a 7-month high of +0.5% per month:

Industrial inflation index PPI (it is considered, unlike the indicator given in the first section of the Review, for a limited set of goods) reached a 7-month high of +0.7% in January:

“Net” (minus the highly volatile food and fuel components) PPI is the highest for 10 months (+0.5% per month):

PPI for final goods soared by 1.4% m/m in January:

If the trend manifests itself in full, we will see this in the next couple of weeks, but the real scale can only be understood by mid-March, when the February data is released.

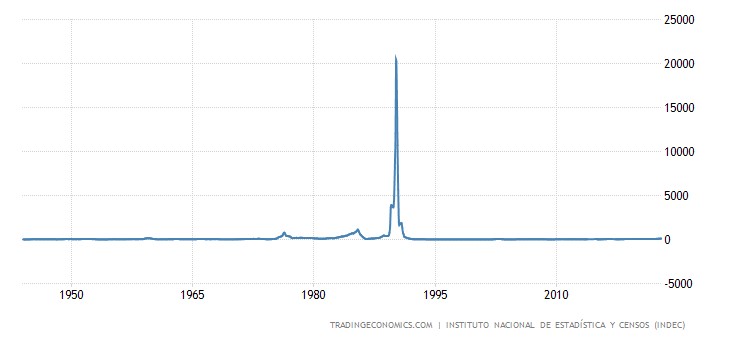

CPI Argentina +98.8% per year – the highest since 1991

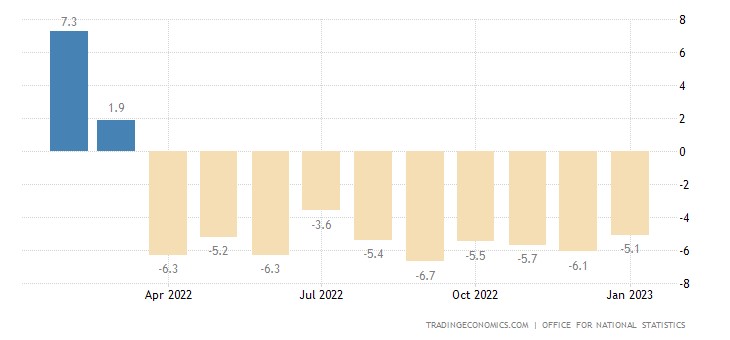

Retail UK -5.1% per year – the 10th negative in a row:

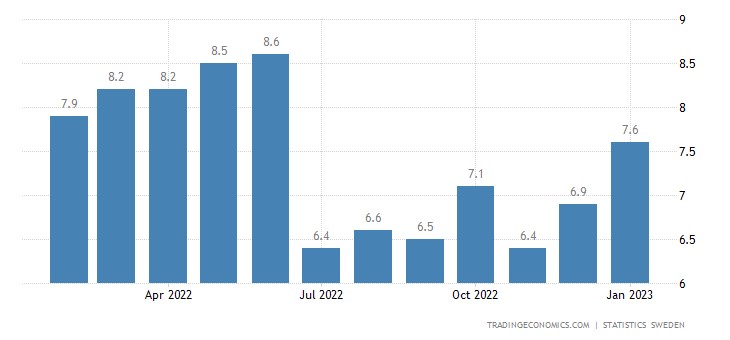

Unemployment in Sweden is the highest in 7 months:

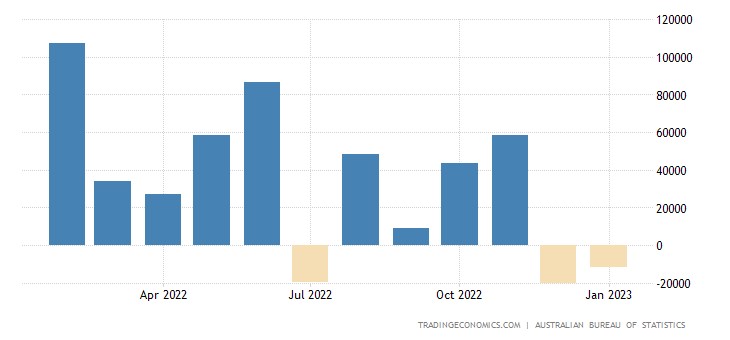

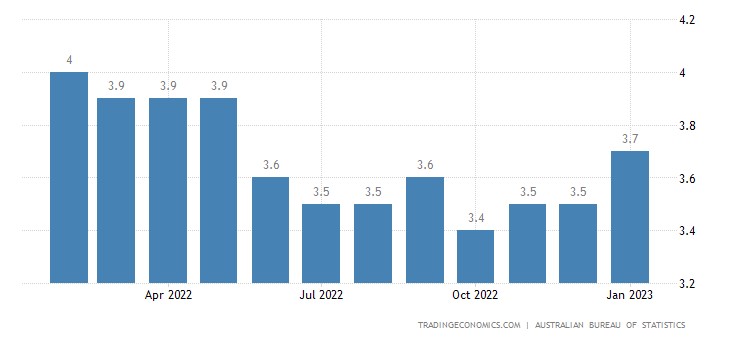

Employment in Australia has been declining for 2 months in a row:

And the unemployment rate is at its peak in 8 months:

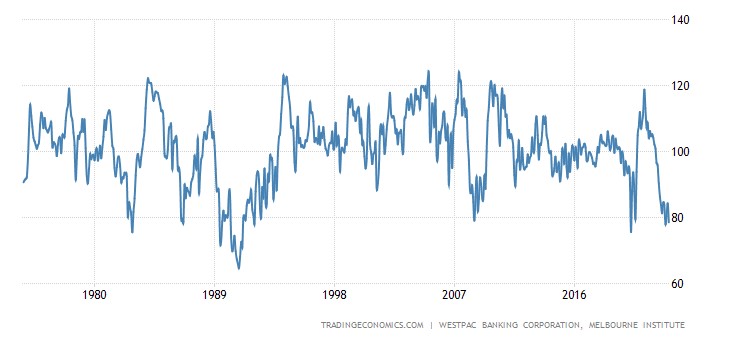

That is why the mood of the Australians is near a 33-year low:

The Central Bank of Indonesia left the rate unchanged.

Main conclusions

The fall in industrial production and the construction sector is visible to the naked eye, both in the US and in other countries. The main problem is the apparent stagnation of the investment process. This can be seen from the fact that another serious growth of the stock market has begun, and this time it is not accompanied by large emission injections from Central Banks. The question is, where does the money come from?

And from there, from the sector investment. It is unprofitable to invest in the construction of new capacities in the face of falling consumer demand, so they began to direct money to speculative operations. The only exception is budget investments, but there is such a colossal scale of corruption that one can only be horrified. Numerous programs for developing new weapons have been launched in the United States over the past 20 years. Still, only one has been completed … Everything else is missing, although the money was allocated carefully and even in excess of the original calculations.

The situation is similar in the European Union, so all attempts to stimulate growth through budgetary mechanisms are doomed to failure, although they may create some activity. The problem here is systemic – for the success of state programs, it is necessary to have state institutions of management and control, which are absent since they are considered signs of socialism. As a result, there are simply no chances for implementing such strategies before a radical change in the ruling elites, firstly, and a change in governing mechanisms (the second is impossible without the first).

At the same time, it is possible to solve each specific problem. They lowered inflation, albeit not to the levels they wanted. However, the desired 2% can be drawn on paper, but it is another matter that this will have nothing to do with reality. But the specificity of a structural crisis is that it migrates from one industry to another. They raised the stake to fight inflation – problems began in the construction industry. They began to squeeze the money supply – the population's standard of living, and the volume of retail sales began to fall. If tomorrow we start to maintain the volume of sales, inflation will start growing again.

Only one question remains: why is inflation growing if demand is falling and money is not being printed? The answer, most likely, is that the decline in demand and the general degradation of technical systems (primarily in the US) lead to an increase in fixed costs. Roughly speaking, infrastructure costs per unit of products sold are growing much faster than inflation. By the way, loan servicing can also be included here – the rate is increasing, but the amount of debt has not disappeared. And as a result, producers are forced to raise prices even in a situation of reduced demand.

The only alternative is to increase household emission support, but this will inevitably increase inflation … The nose is pulled out – the tail is stuck …