One can consider the extremely important news about the announcement by Argentina and Brazil of the beginning of the process of creating a single currency. The problem is that for now, this is a political declaration, and it will be possible to talk about real progress in this direction only after some time and if this progress really happens.

Some records were reached during the week (for example, for the first time since 1930, the nominal money supply in the US showed a year-on-year decline of -1.3%), but all of them cannot be grounds for any strategic conclusions. Thus, the reduction in the money supply was compensated by the issuance of additional loans (that is, not monetary, but credit emission) and (possibly) an increase in the velocity of money circulation.

In general, there is no doubt that the political processes will cause purely economic consequences in a reasonably short time, but the ending week turned out to be quiet. However, this could be the calm before the storm.

Macroeconomics

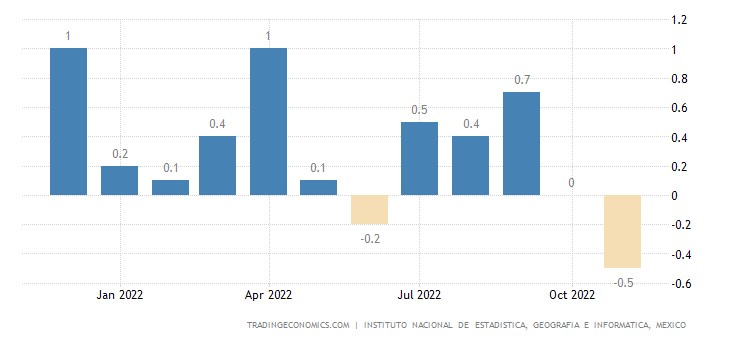

Mexico’s GDP decline accelerated to -0.5% m/m:

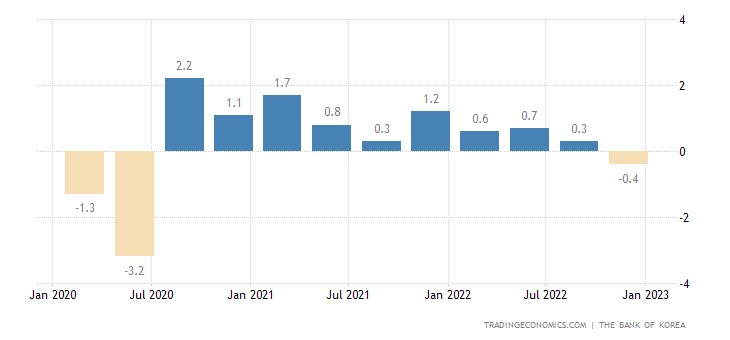

South Korea’s GDP -0.4% qoq – first decline in over 2 years:

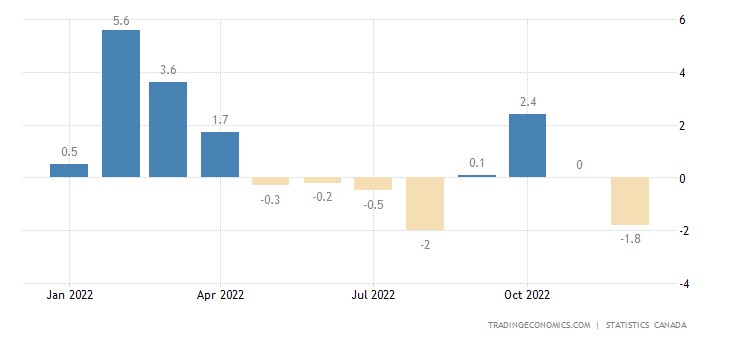

Canadian Manufacturing Sales -1.8% m/m – 6th negative in last 8 months:

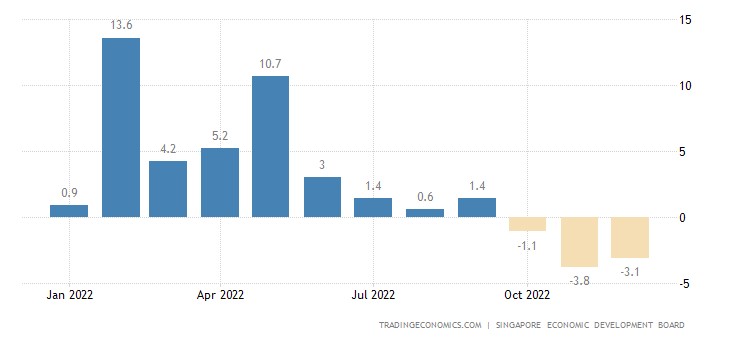

Singapore’s manufacturing output -3.1% y/y – 3rd consecutive minus:

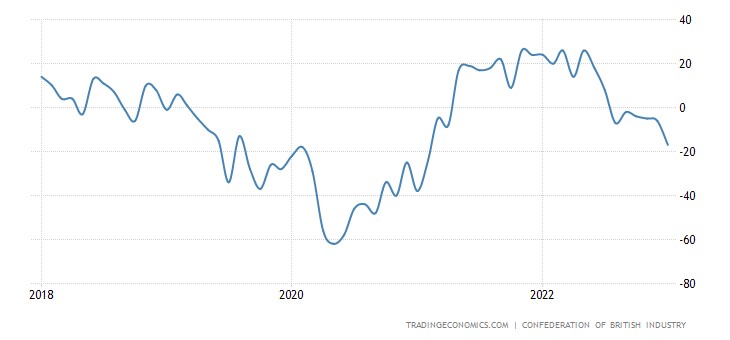

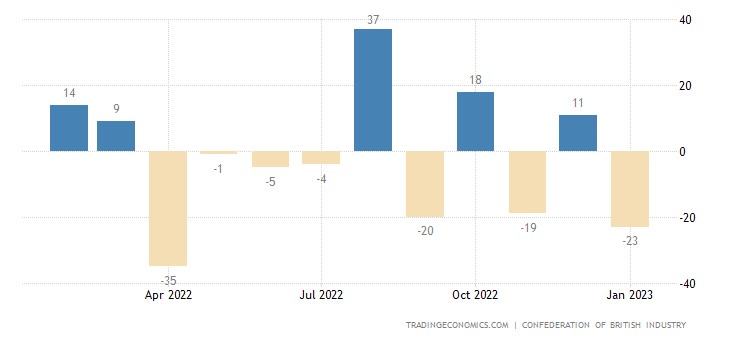

The balance of orders in the UK industry in the red for 6 months in a row, the current value is the worst in 2 years:

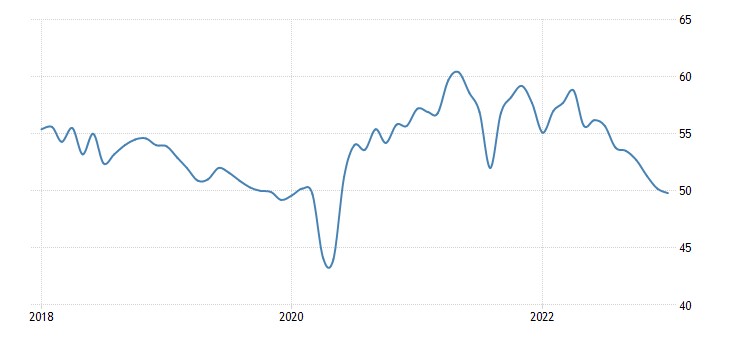

Manufacturing PMI (an expert index of the state of the industry; its value below 50 means stagnation and recession) of Australia went into a recession zone for the first time in 32 months:

It has been in Japan for 3 consecutive months:

In the USA – also 3 months:

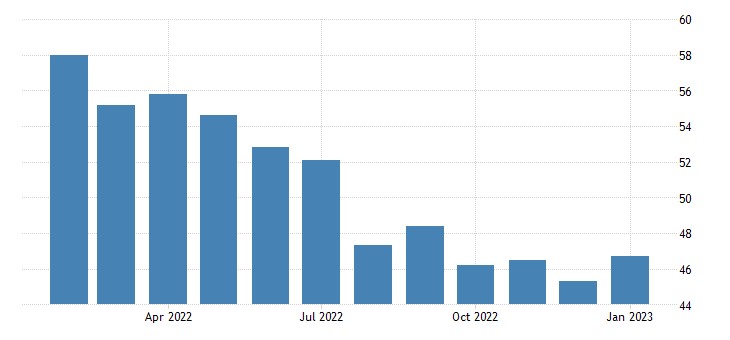

In Britain – 6 months:

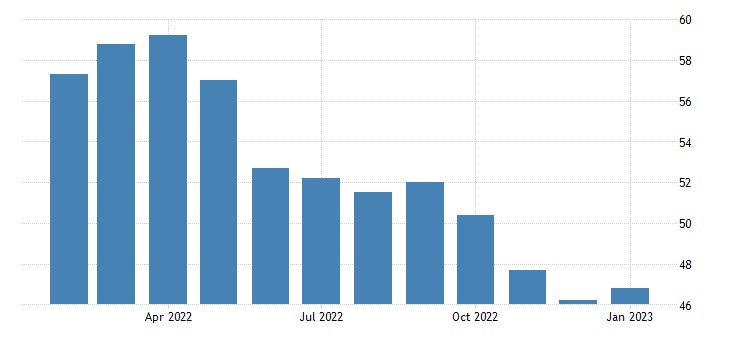

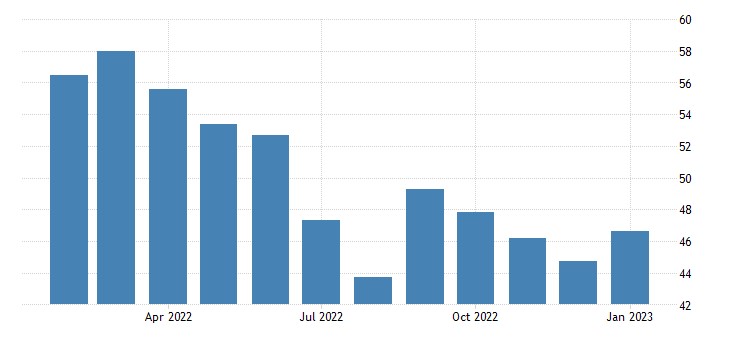

In the Eurozone – 7 months:

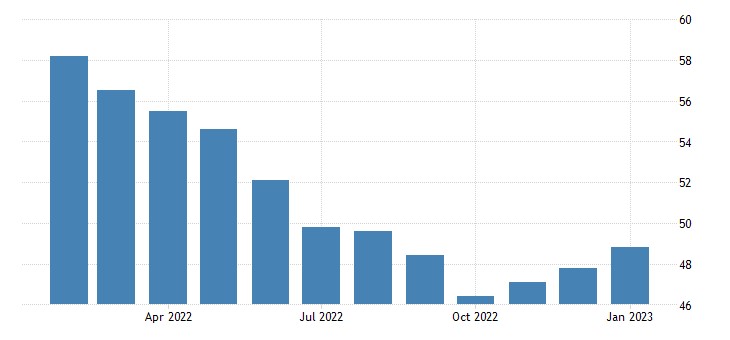

UK and services PMI have been in decline for 5 months:

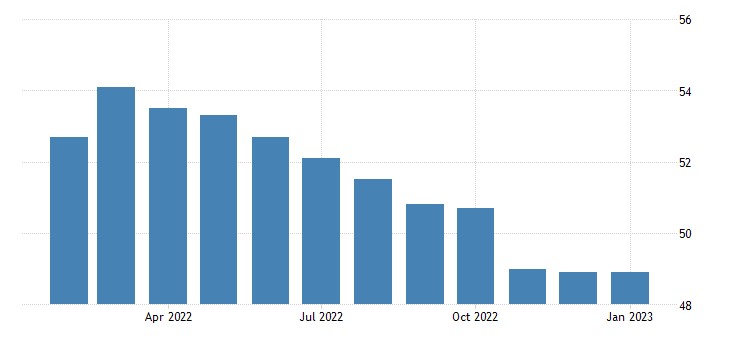

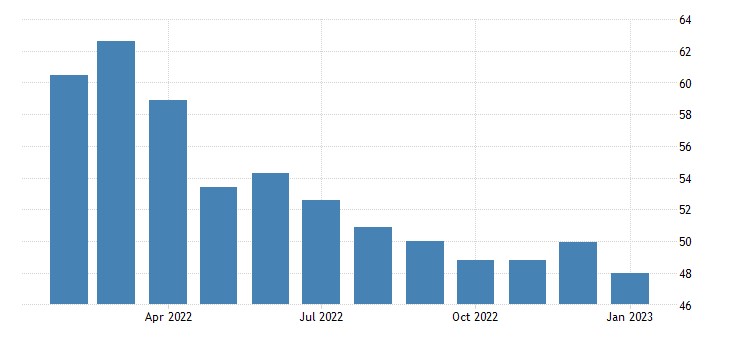

And in the USA – 7 months:

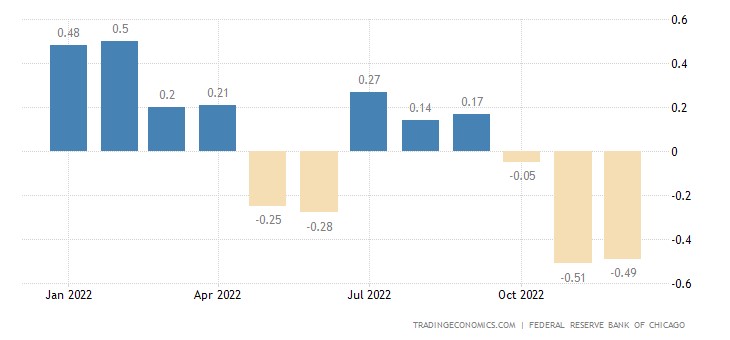

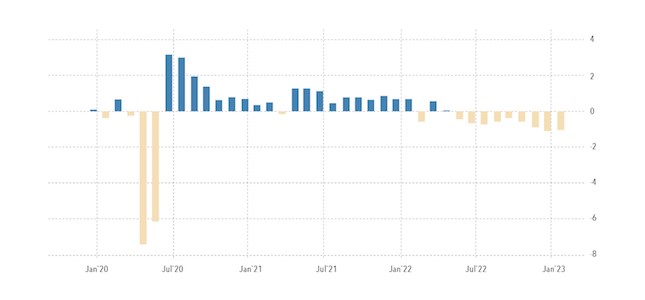

The National Activity Index in the USA from the Chicago Fed keeps in the red for 3 months in a row:

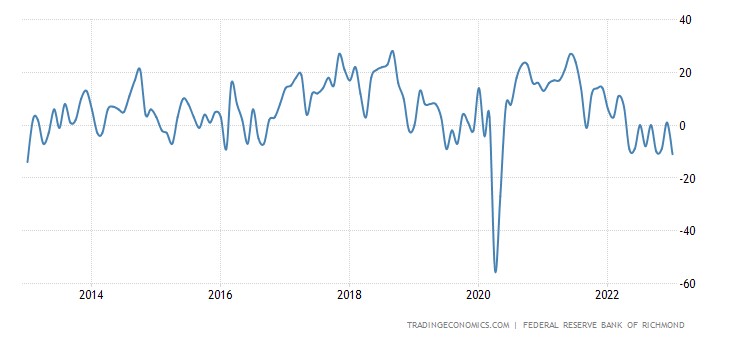

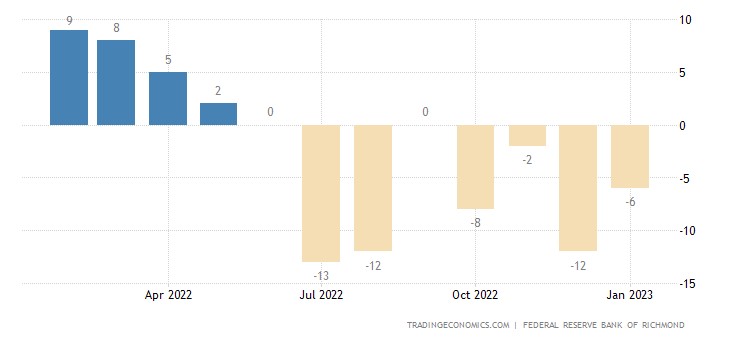

The Richmond Fed Manufacturing Index is the worst in 10 years (excluding 2 months in covid 2020):

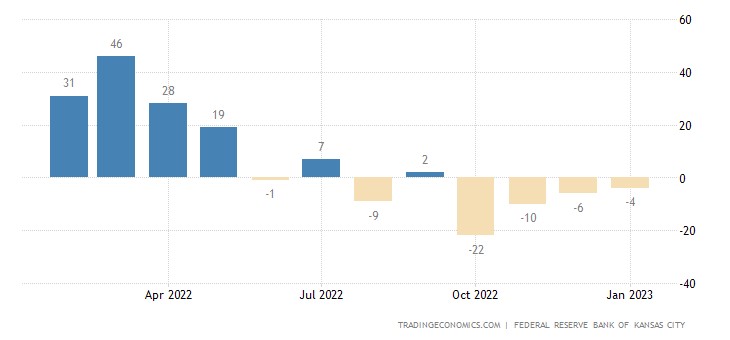

And in the service sector of the same region, the 8th month of decline is already:

Richmond Fed has 4 consecutive months of decline – and manufacturing industries:

And for the economy as a whole:

Leading indicators in the US fall monthly for 9 months in a row:

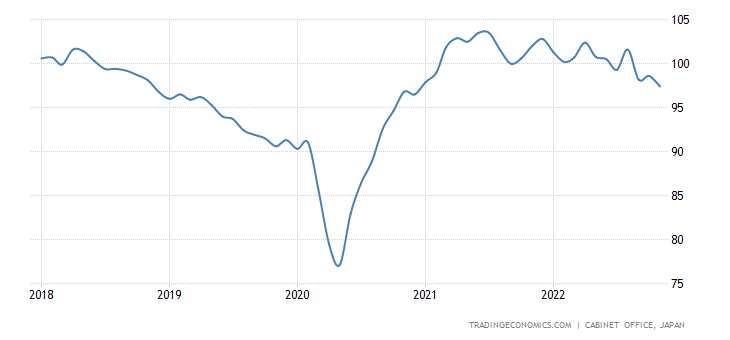

In Japan, they are at a 2-year low:

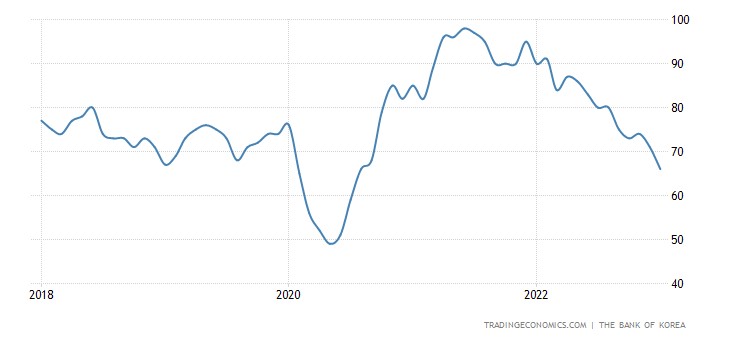

Business in South Korea is the most pessimistic in 2.5 years:

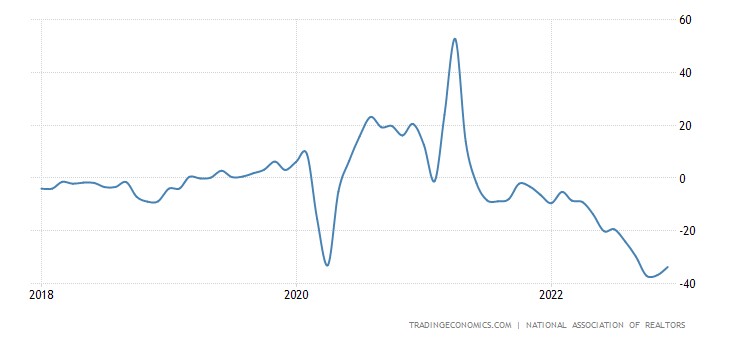

Annual dynamics of pending home sales in the US has been in the red for 19 consecutive months:

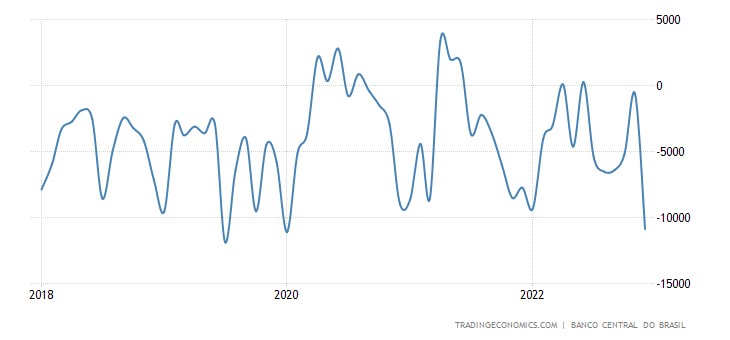

Brazil’s current account deficit at its 3-year peak:

Australian CPI (Consumer Inflation Index) +7.8% per year: the highest since the beginning of 1990:

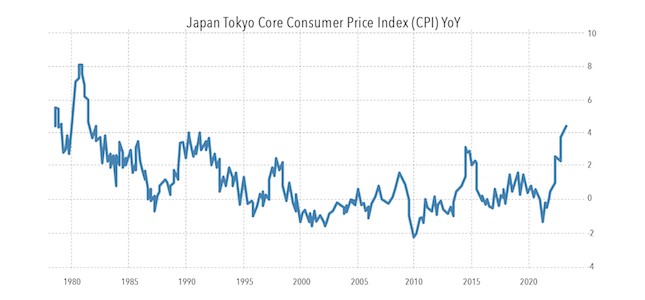

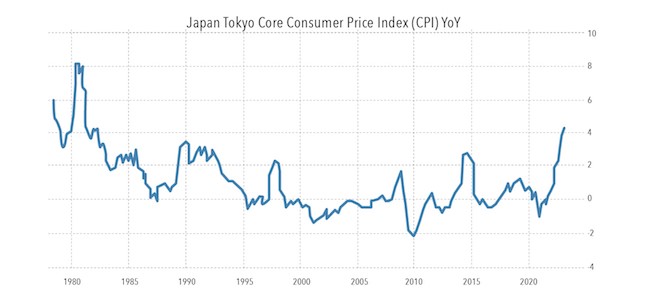

Tokyo Prefecture CPI +4.4% per year – 42-year high:

Prices without fresh food have the same peak (+4.3% per year):

UK retail sales balance is worst in 9 months:

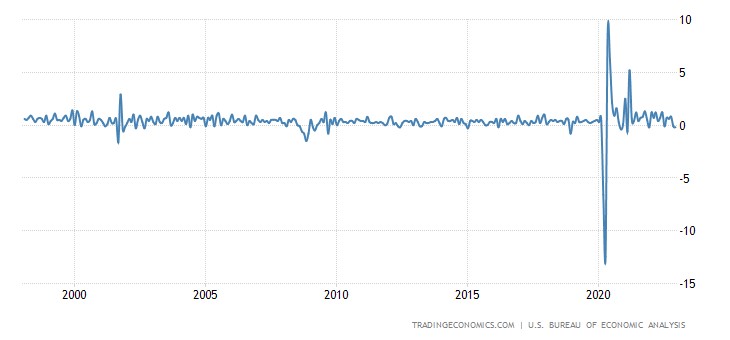

Private spending (nominal!) in the US has been falling for 2 months in a row – the first time since 2020, and before that it was only 10 years ago:

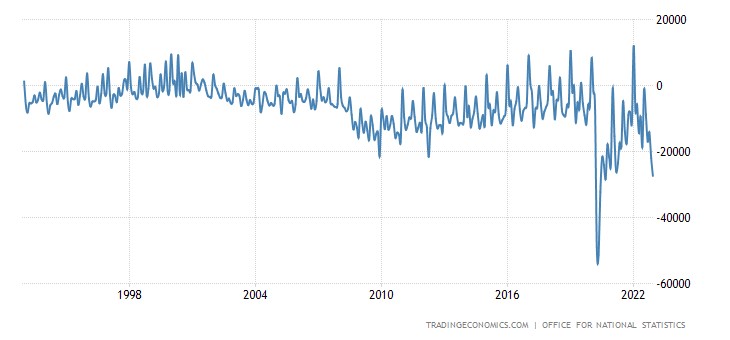

Britain’s government budget deficit is the worst in history, apart from the covid surge in 2020:

The Central Bank of Canada raised the rate by 0.25% to 4.50% and announced the end of the policy tightening cycle.

The Central Bank of South Africa raised the rate by 0.25% to 7.25% – less than expected.

Main conclusions

This is a typical picture of a structural crisis. For example, in the United States, the main problems from the inflationary sphere gradually moved to the construction sector and from it to the industry. In other regions of the world, there are also problems in the industry. Retail sales are also falling, indicating a reduction in household income (recall that household spending forms about 70% of GDP).

It was not for nothing that we wrote in the previous section that private incomes in the United States are falling in nominal terms – the fact is that the same methodology for assessing inflation, adopted today in the world, systematically underestimates it. If even nominal incomes are falling, what can we say about real ones? There is a similar situation with GDP in almost all countries: the official recession may not even begin (as we have already written more than once, this word is not applicable to current processes at all), but the economic recession has been going on for more than a year (in the United States – from the end III quarter of 2021).

Finding fault with the words of the monetary authorities is pointless – they are obliged to follow the official figures if they are announced. But this situation is unacceptable for those engaged in real business. It is for this reason that we try to reveal the real background of the cases as much as possible and give an objective understanding of the economic processes taking place in the world. Of course, we cannot give exact values of statistical indicators, but it is in our power to show the direction of their distortion and (if possible) estimate its scale.