As recently as April 2022, the yuan was the fifth most traded currency on the planet - accounting for just 7.0% of all transactions. It was clear that its role would grow over time: in 2018, it traded for just 4.3% of all payments on the planet. One and a half times in four years is a faster path than the dollar once showed (as it was slowly supplanting the British pound sterling).

Why does the Kremlin need currency?

However, the outbreak of hostilities in Ukraine dramatically changed this trajectory. Western sanctions have made it unthinkable for the Kremlin to continue using the dollar and the euro. Meanwhile, Moscow's model of managing its currency and money supply requires reserves in a foreign currency.

It seems pretty bizarre that before World War I, Russia owned the world's largest reserve of gold. Why wouldn't Russia again turn to gold when it rejects dollars and euros?

The answer is simple: the Russian Central Bank considers "inexpedient" to accumulate gold in foreign exchange reserves. But why?

Deputy Head of the Central Bank Alexei Zabotkin is correct: the accumulation of gold in foreign exchange reserves in the current conditions would provoke the growth of the ruble money supply. The Central Bank cannot buy gold abroad under the current sanctions. Russia has much of its gold (mined at 20 billion dollars annually). But the producer would have to pay for it in rubles (the Central Bank no longer has access to dollars and euros). The producer will put these rubles in the bank account, automatically increasing the ruble mass.

Meanwhile, money supply growth is unacceptable to the Russian Central Bank for ideological reasons. The Central Bank ignores Friedman's rule, according to which the money supply should constantly grow at a certain pace. Otherwise, long-term and sustainable economic growth is simply impossible.

According to Milton Friedman, with their normally low inflation, the money supply growth should be 3-5% per year under US conditions. If its growth is slower, the economy will begin to suffocate from lack of money, ending in a severe recession. The Great Depression, as Friedman has shown, happened precisely for this reason.

In Russia, according to historical data on M2 growth, an increase in GDP of 3.0% or more has always been observed only when the real (inflation-adjusted) money supply growth rate is at least 10% per year (the figures in Friedman's rule vary from country to country). And arguably, because the current head of the Central Bank, Elvira Nabiullina, has a negative view of ruble money supply growth at this rate, Russia's average GDP growth rate corresponded to protracted stagnation in 2009-2021.

So, once Friedman's rule is ignored, a foreign currency is necessary for the Central Bank. There is no other ideologically acceptable way for it to accumulate reserves.

The best option to displace the dollar?

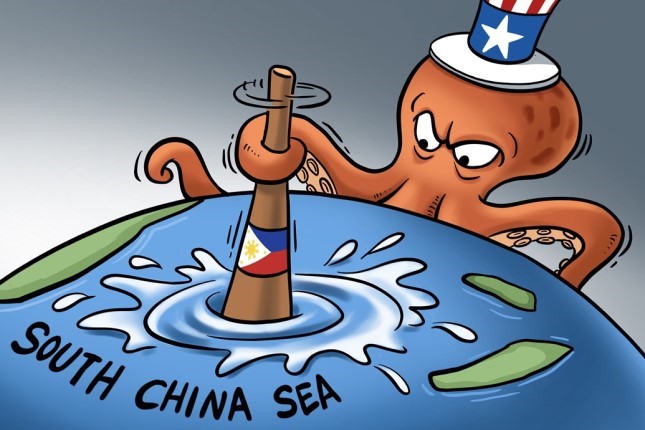

The WSJ recently published a piece arguing that Moscow is turning to the yuan as a substitute for the dollar - even though it "gives China too much leverage over its economy.

The WSJ proceeds from the erroneous assumption that Russia needs the yuan to access the global commodity and debt markets. It is largely cut off from the Western markets after the sanctions.

As demonstrated by the settlement in rubles with European buyers of Russian gas, the inability to trade in dollars and euros does not deter Russian exporters. Equally, the Kremlin has no problems with the lack of borrowed capital. Due to adjusting the rules on reserve funds, Moscow can now easily swap its foreign currency reserves, frozen in the West, for the Central Bank rubles.

It has happened more than once during the year of fighting in Ukraine. There is a ruble emission by the Central Bank, and no foreign currency is needed for its implementation.

The WSJ describes the situation this way because it did not look closely enough at the Central Bank's views on why Russia needs foreign exchange reserves in the first place (as we described above).

Nevertheless, the question raised by the WSJ deserves attention. Does the increased share of gas and oil payments in yuan (as well as the yuan accounts that can now be opened in Russian banks) give China leverage over Russia?

The answer to this question is straightforward. The yuan's share of calculations and bank savings in Russia is still many times lower than that of the dollar and euro in February 2022.

Has the high share of Western currencies helped the West in any way to influence the Kremlin? Judging by the events in Ukraine, the answer is unequivocally negative. Accordingly, the much smaller share of the yuan in Russian financial affairs will matter even less.

It is more important to address another question. Is the yuan the best option to replace the dollar? The fact is that, unlike Russia, the PRC authorities are aware of Friedman's rule.

Just look at China's M2 growth rate to see that the yuan money supply is growing even faster than the dollar money supply. And this is one of the key reasons why the Chinese economy is growing faster than the US.

Source: Federal Reserve Bank of St. Louis.

This awareness of the Chinese authorities of Friedman's rule has negative consequences - for the Central Bank of Russia. The country that accumulates too much yuan will have leverage over the financial system of the PRC. What if, having accumulated trillions of yuan, the Central Bank of Russia suddenly wants to exchange them for rubles? Or rupees? Or the Hong Kong dollar or any of the currencies of the petroleum monarchies of the Middle East?

The exchange rates of these currencies against the yuan would be dramatically destabilized. Oil imports from the Middle Eastern monarchies could become very expensive for China.

Theoretically, the Chinese authorities can compensate for this by accumulating large reserves of all relevant currencies in advance. But in practice, it is challenging large reserves of multiple currencies are difficult to manage. They have to be kept in some securities with a good reliability rating, and not all countries have such public bonds in principle.

Because of all this, one can be sure that China will keep Moscow from accumulating yuan reserves worth hundreds of billions of dollars. The Kremlin is not inclined to ignore the concerns of its Chinese neighbour, so it is doubtful that the Russian Central Bank's attempt to replace dollar and euro reserves with yuan reserves would succeed.

Will the transition to the yuan undermine the dominance of the dollar?

Finally, there is another interesting question. Does it make sense for the PRC to take a risk and let Moscow accumulate a lot of RMB to undermine the dollar's dominance in world markets?

There are some doubts it would. To begin with, the share of currency in current accounts does not depend on the amount lying dead in the reserves of any central bank. Its share depends on the actual trade which is done in it.

Russia's share in the world economy is too low, about 3.0% of GDP at PPP. Its share in world trade is comparably low. Even a total conversion of all Russian foreign exchange to yuan will not help it reach the percentage of the British pound in global transactions (more than 12.5%).

Few countries would want to follow Russia's example of switching to the yuan. A typical world nation today would never risk going against the will of the US as openly as Moscow does. Consequently, the chances of freezing its dollar reserves are negligible. Meanwhile, the dollar is objectively much more convenient than the yuan regarding convertibility.

It will always be so as long as the Chinese financial authorities do not want an excessive accumulation of the yuan in the hands of foreigners.

From Beijing's perspective, avoiding such accumulation is more important than trying to replace the yuan with today's dollar. China's economic growth depends on the stability of the yuan money supply. And ensuring it with a large share of foreigners in RMB assets will be objectively tricky.