Of course, the news is the resignation of British Prime Minister Liz Truss. But not because she set a record for the shortest tenure as prime minister. She went to this post with a program of economic reforms, and quite radical ones at that.

It no longer makes sense to discuss this program – the actual collapse of the pension system and other problems forced the British government to abandon this program. It is possible that Truss was supposed to put this program into practice at the cost of her authority and position. Still, as a result, instead of a kamikaze hero who sacrificed his career for the country's sake and the people, it turned out to be zilch; the plane did not even take off, falling apart immediately in the process of starting the engine.

There may be several reasons for this, from the weakness of Truss, who was unable to overcome bureaucratic difficulties, to the objective problems of the country's economy. It may have reached such a state that any attempt to interfere only stimulates a sharp decline. However, such a situation for a structural crisis is quite common.

In any case, the Truss story has shown that reforms in the current situation are a dangerous business. Secondly, it became clear that there are no easy ways out of the crisis. And thirdly, it significantly weakened all liberal governments in all countries of the world (including the already weak Biden administration in the United States), as it set a clear negative example.

Macroeconomics

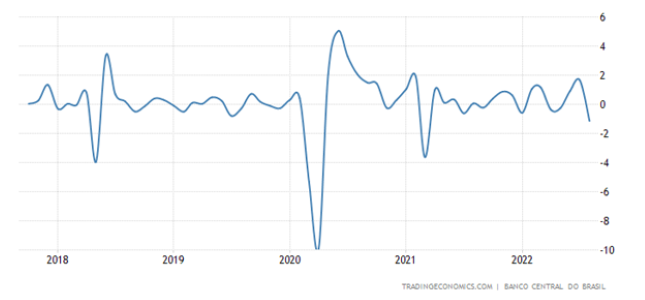

Economic activity in Brazil fell at the worst rate in 1.5 years (-1.1% per year):

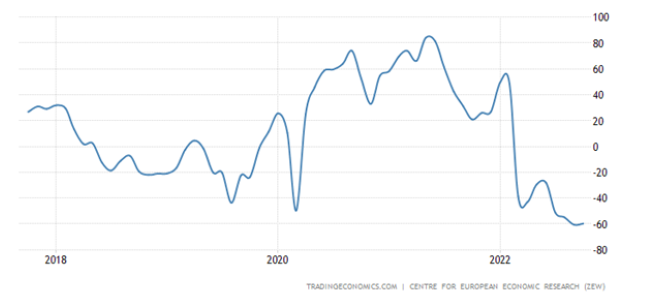

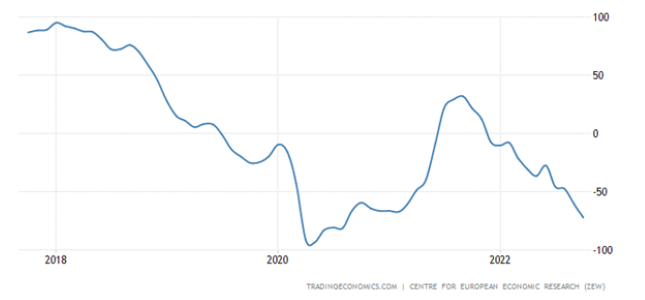

Eurozone economic sentiment (ZEW review) remains near record lows:

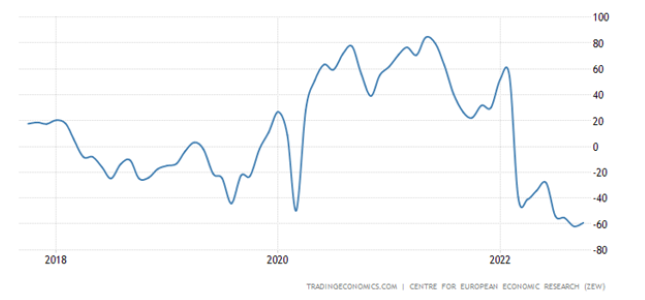

As in Germany:

Moreover, in the latest assessment of the current situation it continues to deteriorate:

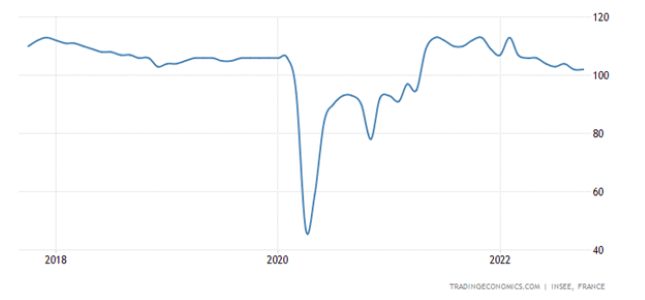

The business climate in France is the worst in 1.5 years:

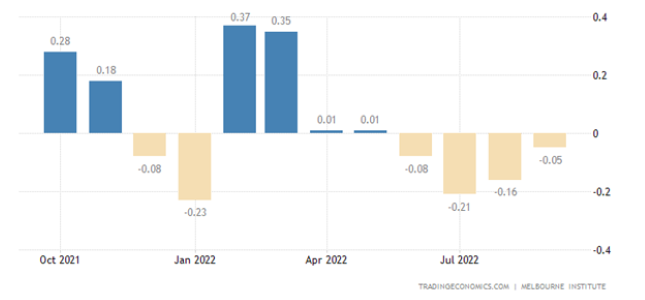

Australia’s leading indicators are down for 4 months in a row:

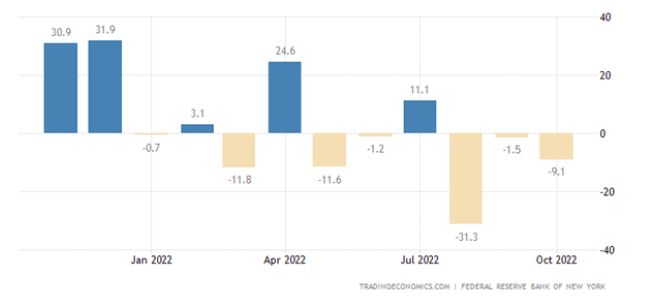

The New York Fed index is in the red for the 3rd month in a row and the 5th in the last six months:

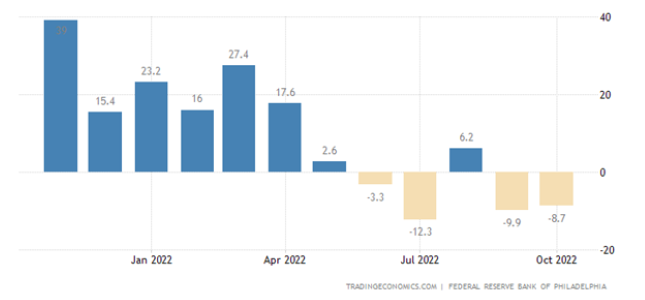

The Philadelphia Fed index also stayed in the red:

The US leading indicators decline for 6 months in a row:

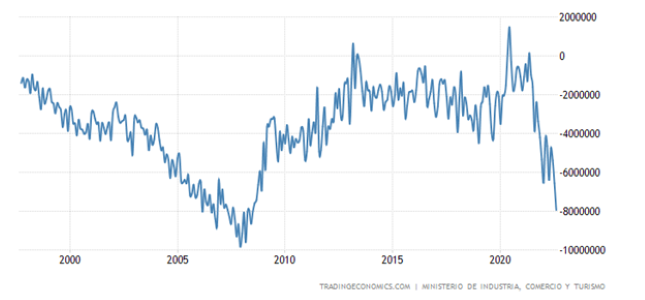

Spain’s trade deficit is at its highest since 2008:

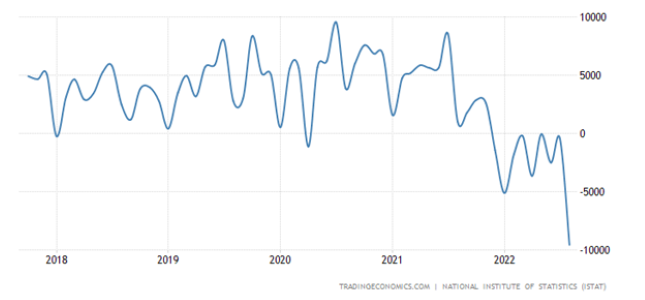

And in Italy it is at a record high:

The US housing market index has been deteriorating for 10 consecutive months, and it has halved over the past six months and (minus the covid dip of April-May 2020) has sunk to the bottom in 10 years:

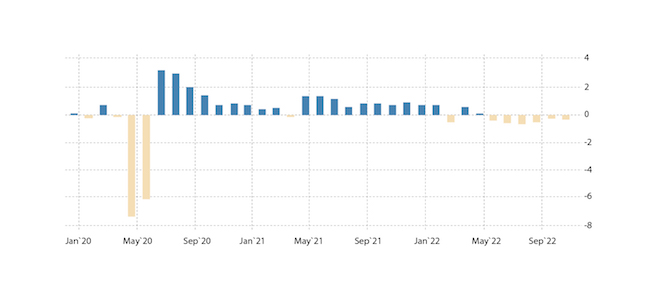

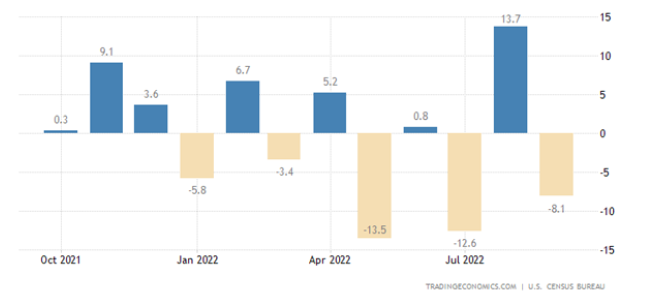

The number of new buildings in the US -8.1% per month:

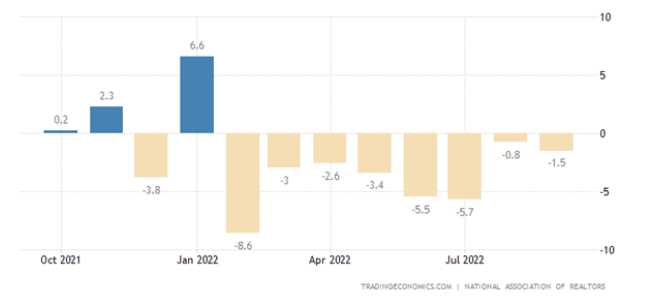

The US existing home sales fall for 8 consecutive months, at the bottom of 2.5 years:

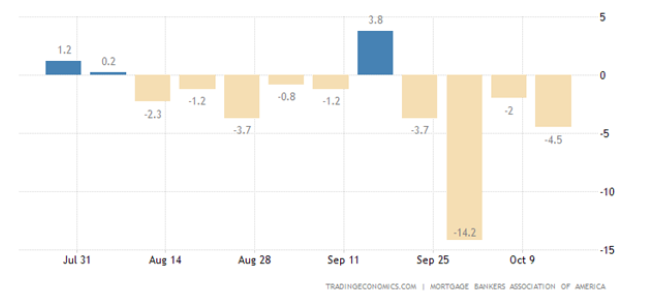

Mortgage applications in the US continue to fall (another -4.5% week):

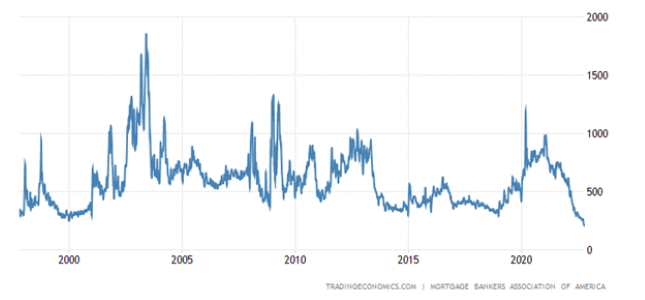

And updated the 25-year low:

As the loan rate broke through the peak of 2006 and reached a 20-year high (6.94%):

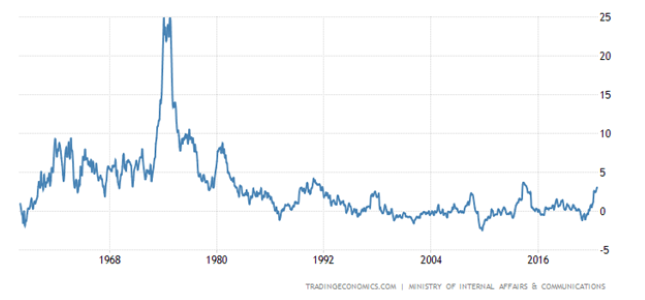

Japan CPI (Consumer Inflation Index) +3.0% per year (September to September) – 8-year high:

Without fresh food, +2.8% per year – a little more, and there will be a 40-year peak:

Italian CPI +8.9% per year – the highest since 1985:

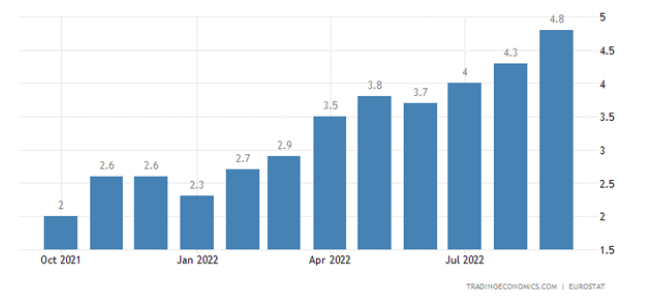

Eurozone CPI +9.9% per year – a record for 32 years of statistics:

The “clean” (excluding highly volatile components of food and fuel) CPI also has a record (+4.8% per year):

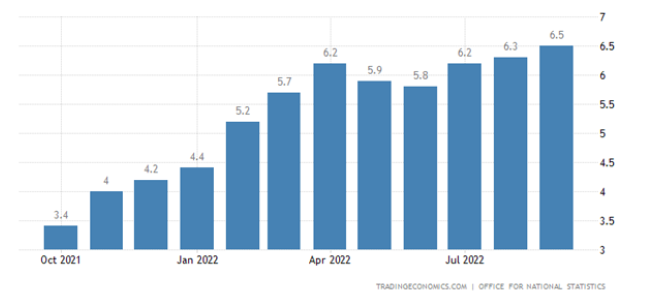

UK CPI +10.1% per year – a record for 34 years of observation:

“Net” CPI is also a record (+6.5% per year):

The retail price index is the highest in 42 years:

Not surprisingly, with such indicators, the reform attempt failed. Still, they need to start with at least a small margin of safety.

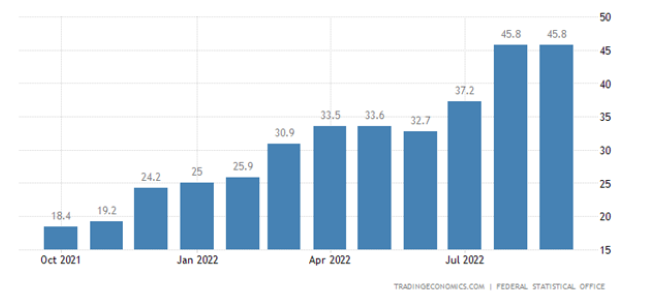

PPI (industrial inflation index) in Germany remained at a record high (+45.8% y/y, like a month ago):

We remind you that the situation is reminiscent of last year's autumn in the United States when consumer inflation followed industrial inflation. Only in the USA, it is about 20%, and in Germany, it is more than twice as high. However, it is possible that a more favorable result for the US is the result of creative work with primary information, such as the use of hedonic indices.

Loan growth rate in India (+17.9% per year) is very close to the record high:

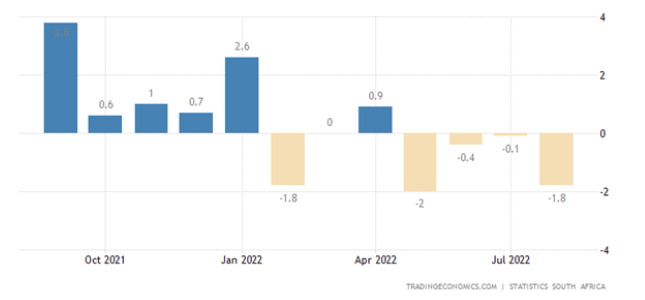

Retail sales in South Africa have been declining for 4 months in a row:

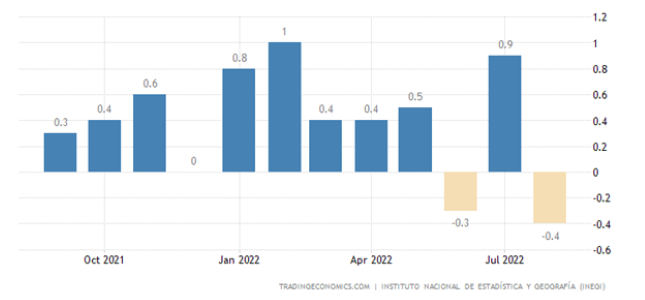

Retail Mexico -0.4% per month – 2nd minus in 3 months:

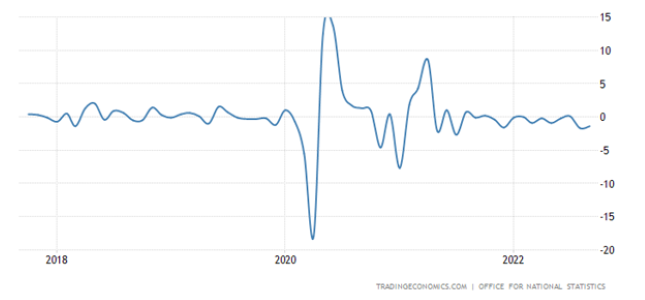

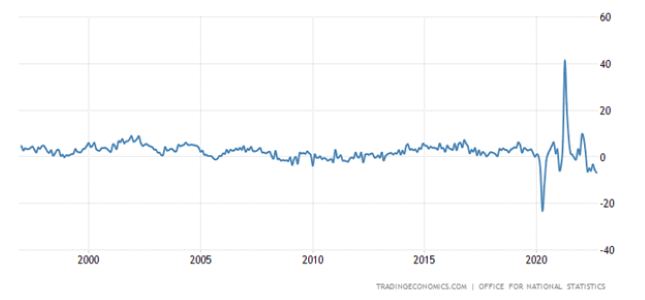

UK retail -1.4% per month – over the past 11 months there was only 1 plus (and that +0.1%):

And -6.9% per year – not counting the covid failure of 2020, this is an anti-record for 26 years of data collection:

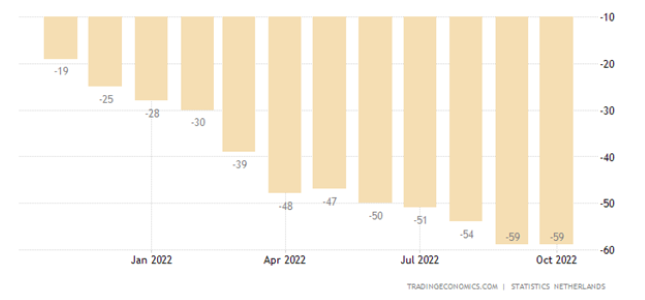

Dutch sentiment remains record bad:

The Central Bank of Indonesia raised the rate by 0.50% to 4.75%.

The Central Bank of Turkey cut the rate by 1.5% to 10.5%.

The Central Bank of China left the rate unchanged.

Main conclusions

The structural crisis continues actively. Attempts are being made to compensate for problems, primarily for households (Germany just recently allocated another 200 billion euros for this), but to compensate for structural issues, trillions are needed, which it is not clear where to get it from and, most importantly, which will still increase inflation.

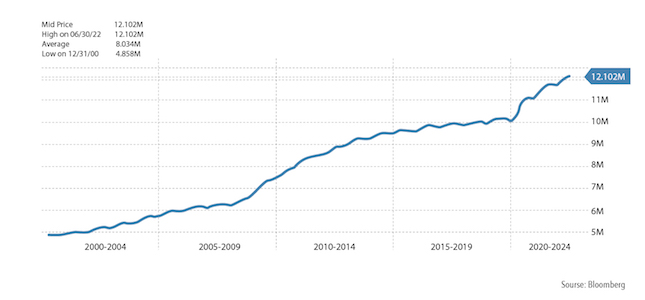

For example, here is a graph of the total debt of the EU countries:

Those who wish can calculate the growth rate of debt themselves and compare it with the economy's growth rate over the same period. Let us recall that if GDP growth is achieved due to debt growth of a similar scale (in absolute terms), then this is not quite a growth. Accountants have long learned to transfer debt growth figures to GDP growth, and if these indicators are not placed side by side in reports, then no one will notice anything. The trouble is that any entrepreneur knows the actual cost of such growth.

By the way, if under such a scheme for a particular enterprise, its capitalization is actively growing, then the owner can quickly "jump off" with a serious profit. True, there is a danger of falling under the article on fraud, but, as you know, whoever does not risk does not drink champagne. Another thing is that if you realize that today the monetary and economic authorities of almost all countries of the world are guided by similar principles, then it becomes a little uncomfortable.

It can be noted that inflation in the US has slightly improved, but data on the real estate market (which, theoretically, is somewhat more difficult to falsify) is actively deteriorating. And the question arises, is this an accurate picture of the beginning of some improvement, in which the real estate market lags behind price indicators, or, nevertheless, some artefact associated with the creative work of statisticians?

There is no answer to this question so far, although the hypothesis of an improvement in the situation with inflation seems doubtful. Theoretically, this can happen when deflationary tendencies strengthen (demand falls), but statistics do not yet show such an effect. In general, as it is often the case with a structural crisis, while different indicators show opposite signals.