Theoretically, an increase in the basic rate of the European Central Bank from 0 to 0.5% was to be the main news. There have been only four times in history when the ECB has been so zealous, and the last one was back in 2011. However, this is not the kind of thing that the leadership of the European Central Bank surprised the whole world. It’s interesting to note, that we considered such a situation in one of the recent reviews. And we assessed it as phantasmagoric in terms of the degree of inadequacy.

It is a question of that the ECB simultaneously began to tighten monetary policy and announced a new emission program! Actually, it is slightly different from the quantitative easing program, but, nevertheless, the combination of pressing the gas and brake pedals at the same time has not brought anyone to good.

The essence of the innovation is as follows. The ECB has announced a new Transmission Protection Instrument (TPI) – a tool for transmission protection. In the description of TPI, the ECB writes that the tool was introduced to counter the unreasonable erratic market movements that took place in mid-June, when the European debt market collapsed.

The point is that the ECB will be able to buy back securities in the secondary market for securities issued in European jurisdiction, where there is a deterioration in financial conditions, allegedly unjustified by the fundamental factors of each particular country.

The scale of purchases under the TPI will depend on the severity of the risks and «Purchases are not restricted ex ante». In other words, when financial conditions destabilize, there will be buying until rates and interest spreads normalize.

TPI’s purchases will focus on public sector securities (marketable debt securities issued by central and regional governments and agencies, as defined by the ECB) with remaining maturities of one to ten years. If necessary, consider purchasing private sector securities.

The Board of Governors will redeem securities subject to a number of conditions, such as:

• Compliance with the EU fiscal system:

• no excessive deficit procedure;

• no serious macroeconomic imbalance;

• fiscal sustainability: in establishing that the public debt trajectory is sustainable;

• prudent and sustainable macroeconomic policy within the framework of the EC recommendation.

But these are formal procedures; in reality, purchases will take place wherever they break through, regardless of budget policy, the amount of debt, and so on. What happens as a result of such an exotic policy is a complex question. The reasons why the ECB has chosen this path are clear – it is necessary to leave a back door in order to “plug holes” at the request of politicians, which will almost inevitably arise. Another thing is that it is completely incomprehensible why in such a situation to tighten monetary policy. It is clear that the effect of this will be completely insignificant. Or there is an example from Paul Volcker of the 70s and raise the rate to (at least in our case) 30 percent … Something we doubt that they will decide.

Macroeconomics

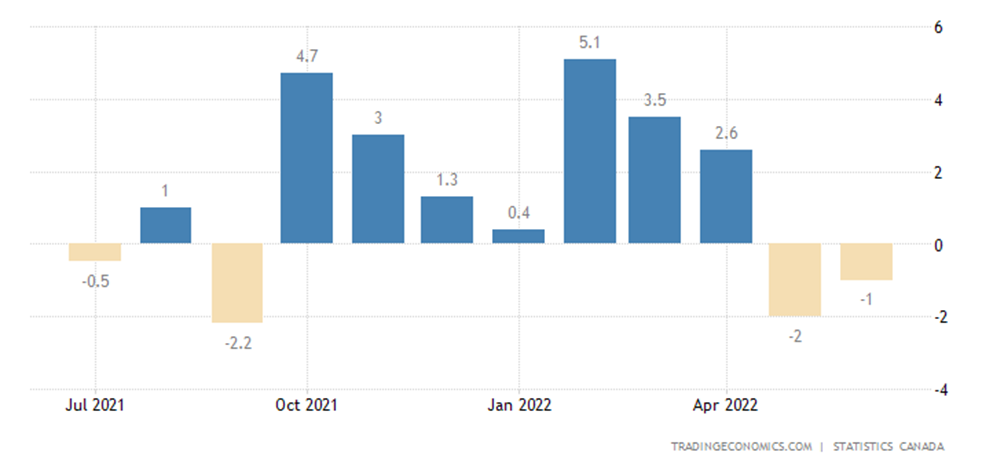

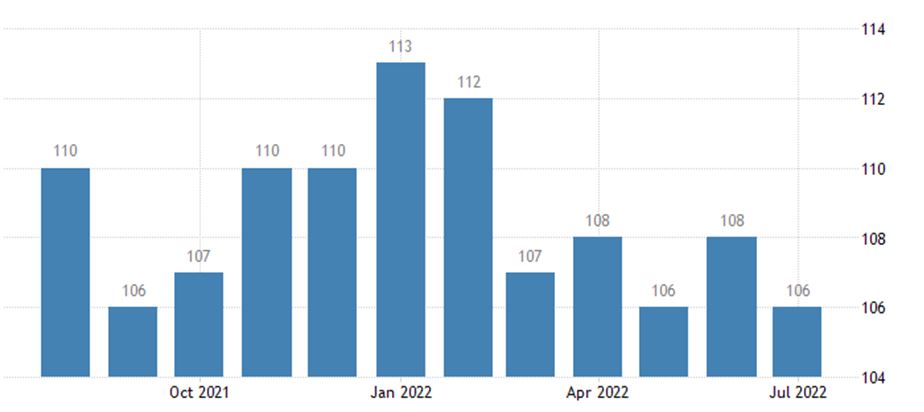

Canadian Manufacturing industry sales fall monthly for a second consecutive month

Canada Manufacturing Sales MoM

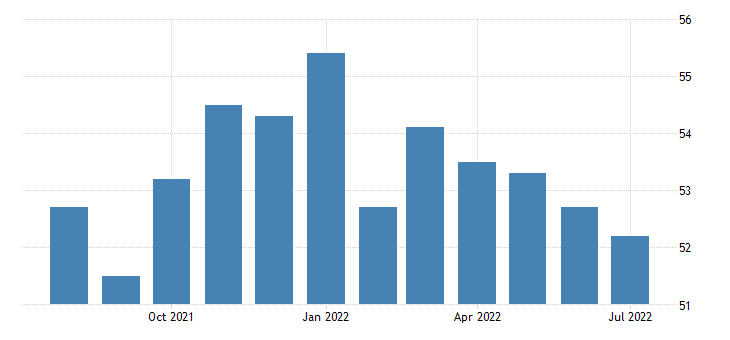

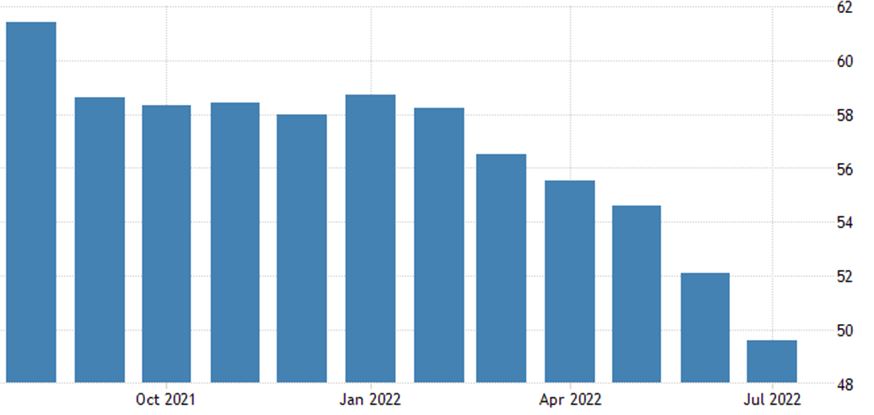

PMI (expert index of the state of the industry; its value below 50 means stagnation and decline) of the Japanese industry is the weakest in 10 months:

Japan Manufacturing PMI

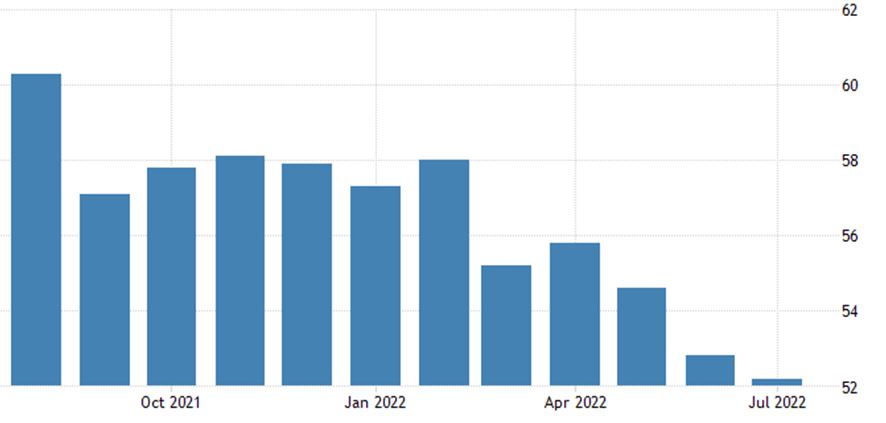

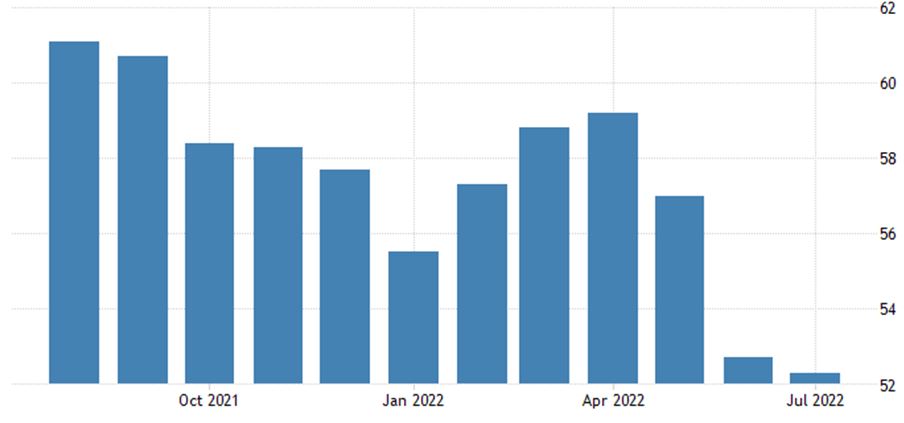

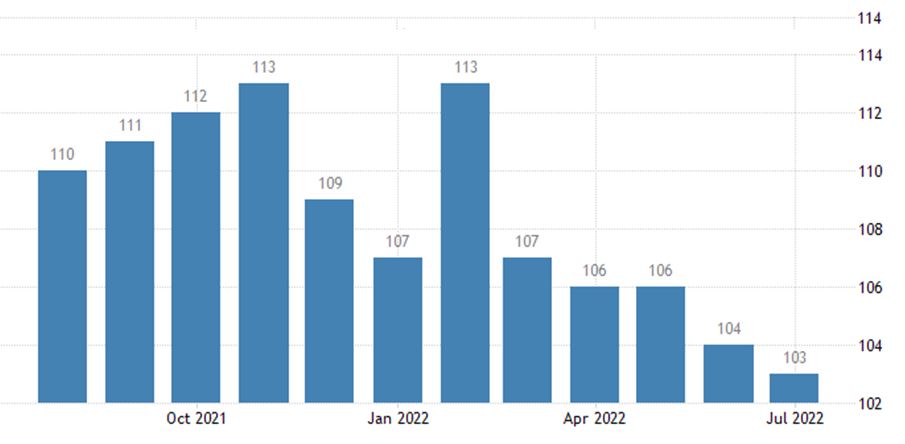

In Britain, this is the weakest figure in 2 years:

United Kingdom Manufacturing PMI

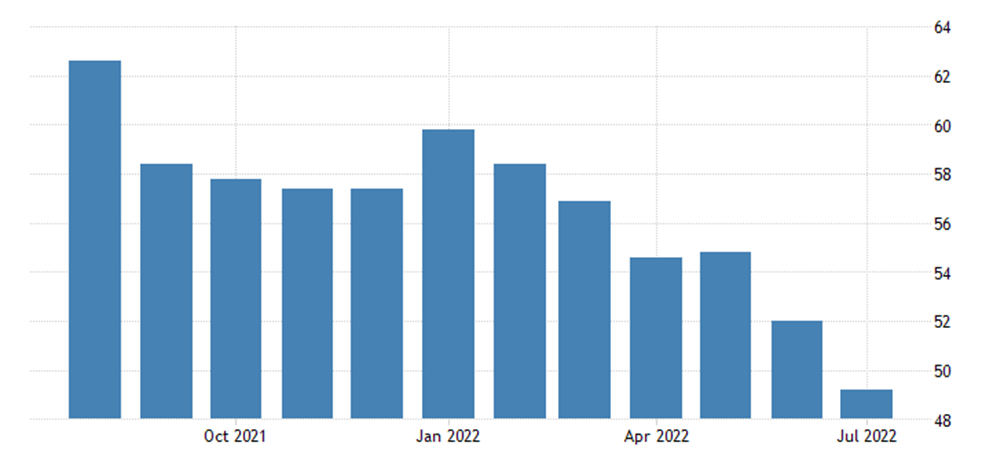

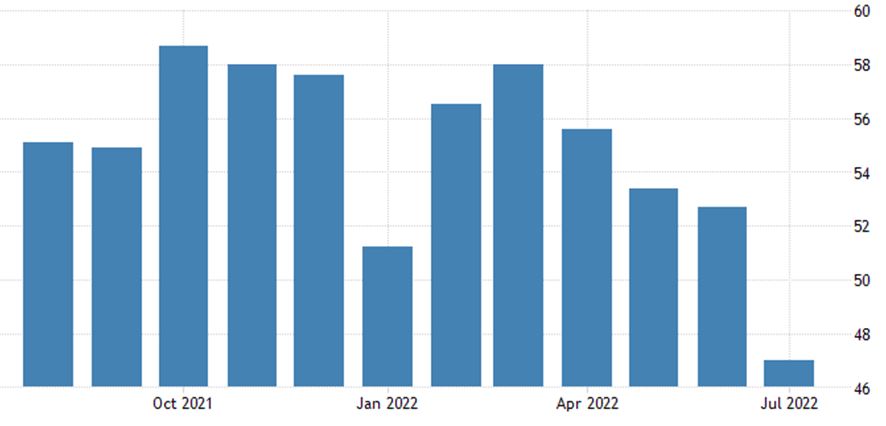

Germany – 49.2 — for the first time in 2 years, there is a decline in activity, which, however, is not surprising given such high inflation:

Germany Manufacturing PMI

Germany Manufacturing PMI

Therefore, the PMI of the eurozone as a whole (49.6) also went into it, and the output component is the worst since 2012:

Euro Area Manufacturing PMI

Euro Area Manufacturing PMI

US manufacturing PMI is the weakest in 2 years:

United States Manufacturing PMI

United States Manufacturing PMI

As well as the PMI of the US service sector – moreover, it went into the recession zone (47.0):

United States Services PMI

United States Services PMI

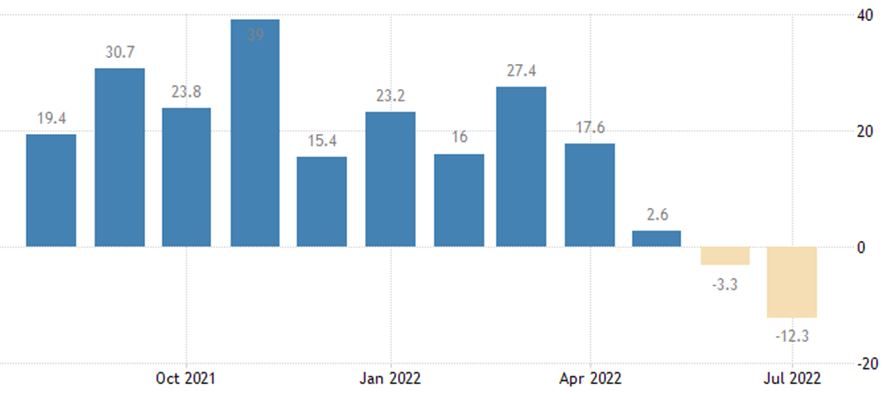

It has to be said, by inertia, experts proceed from official inflation … Well, or at least they underestimate it. In reality, the situation is worse. Philadelphia Fed index deepened into minus and bottomed in more than 2 years:

United States Philadelphia Fed Manufacturing Index

United States Philadelphia Fed Manufacturing Index

Leading indicators in the US amplify the decline: -0.8% m/m after -0.6% and -0.4% earlier.Business confidence and business climate in France are the worst in 15 months:

France Business Confidence

France Business Climate Composite Indicator

France Business Climate Composite Indicator

Australia Leading Economic Index

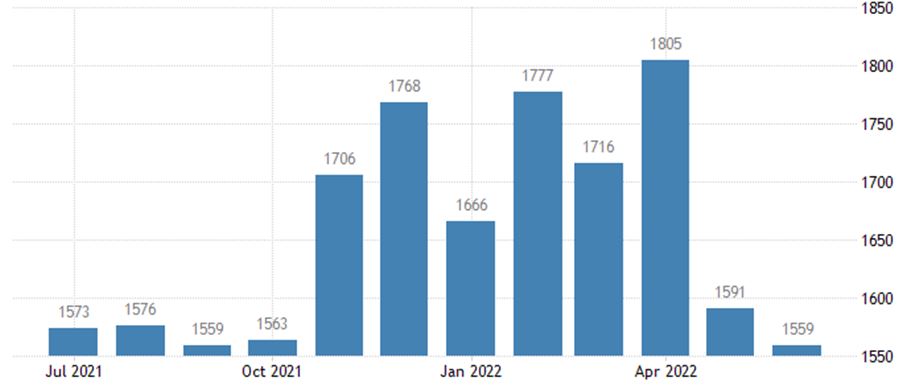

The number of new buildings in the US is the lowest in 9 months:

United States Housing Starts

United States Housing Starts

As well as building permits are:

United States Building Permits

United States Building Permits

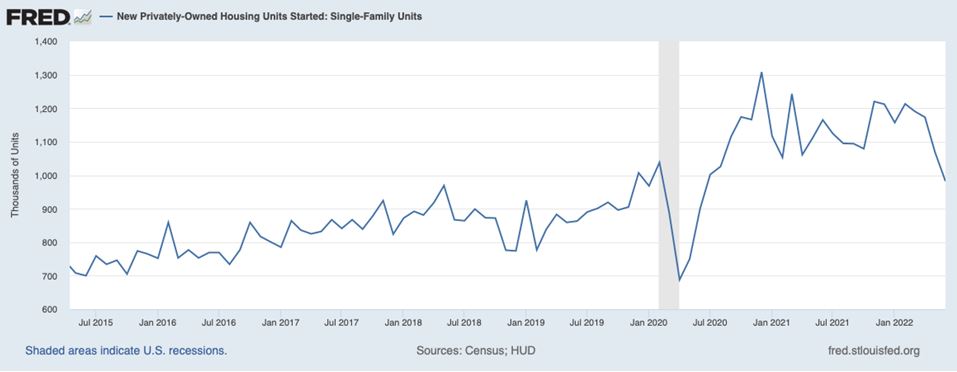

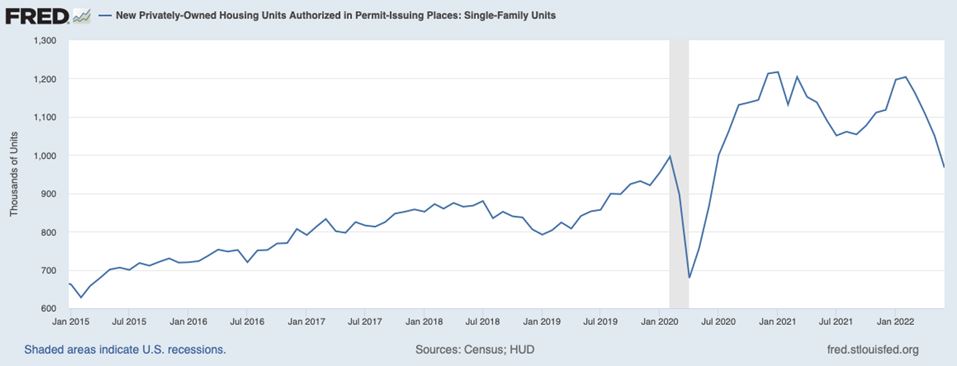

Moreover, for single-family houses, both indicators are already at a two- year bottom:

New Privately-Owned Housing Units Started: Single-Family Units (HOUST1F)

New Privately-Owned Housing Units Authorized in Permit-Issuing Places: Single-Family Units (PERMIT1)

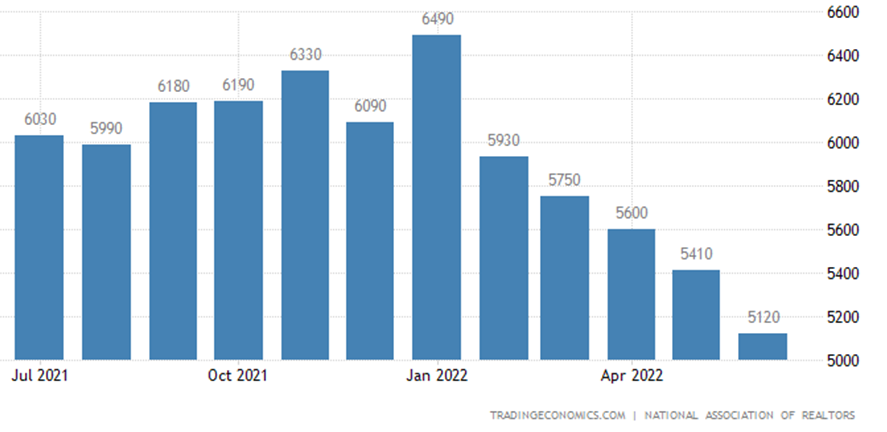

US existing home sales -5.4% m/m, the 5th straight loss to 2-year low:

United States Existing Home Sales

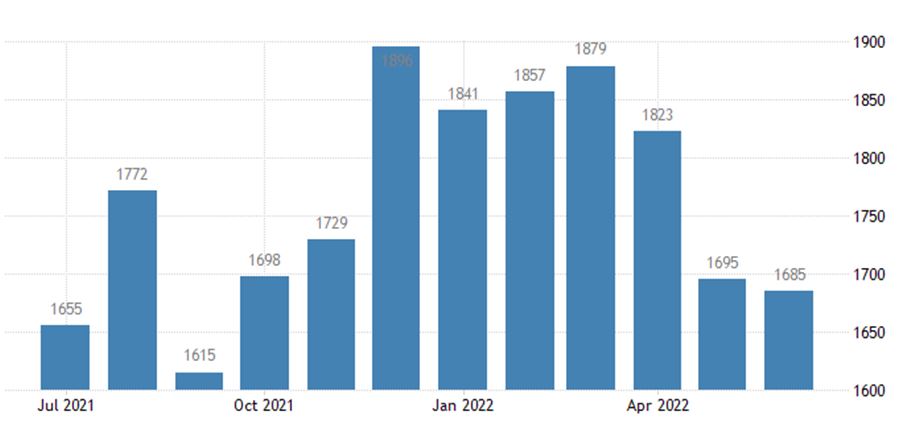

And the US housing market index is the worst in 2 years, without taking into account the COVID-19 failure of 2020 – in 7 years:

United States Nahb Housing Market Index

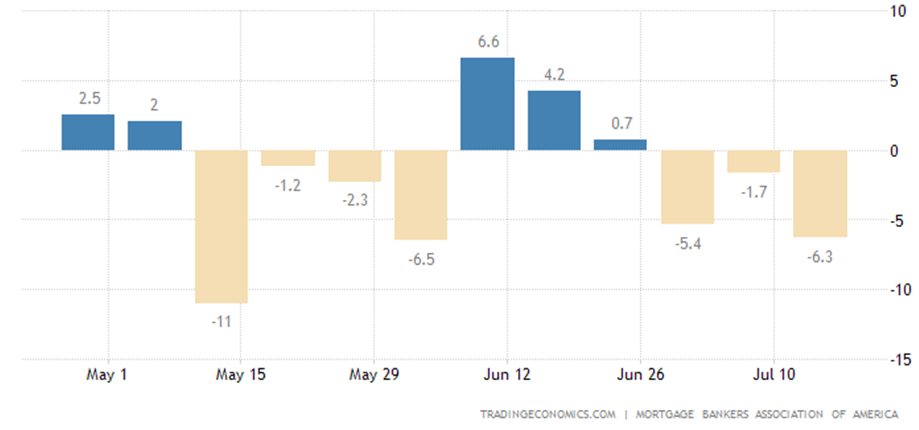

Mortgage applications in the US -6.3% per week, the 3rd negative in a row:

United States MBA Mortgage Applications

United States MBA Mortgage Applications

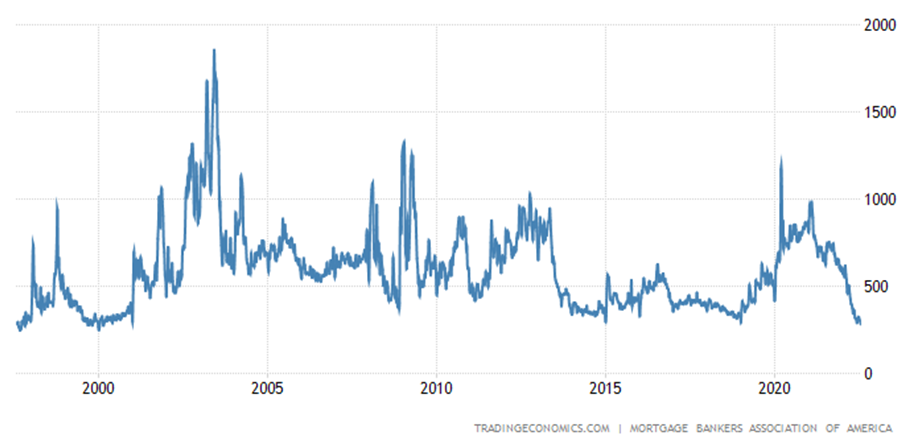

Before a minimum since 2000:

United States MBA Mortgage Market Index

United States MBA Mortgage Market Index

As usual, the inflation data is hilarious.

CPI (Consumer Inflation Index) of South Africa +7.4% per year – that is a peak since 2009:

South Africa Inflation Rate

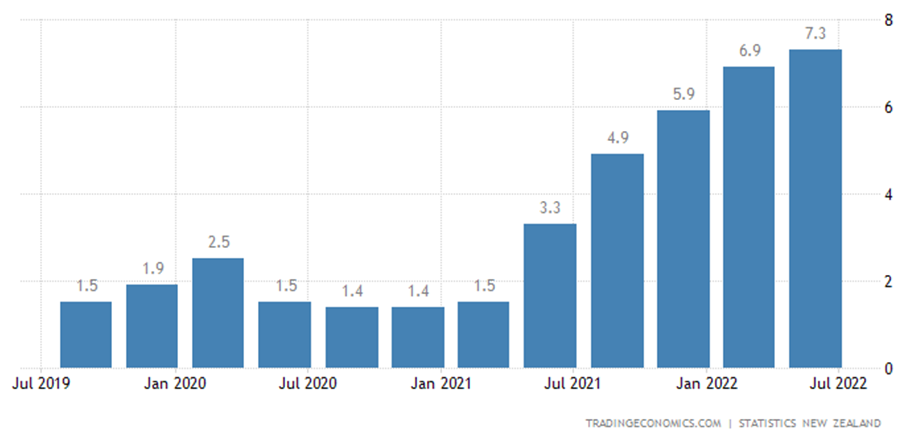

New Zealand’s CPI +7.3% per year -that is the highest since 1990:

New Zealand Inflation Rate

New Zealand Inflation Rate

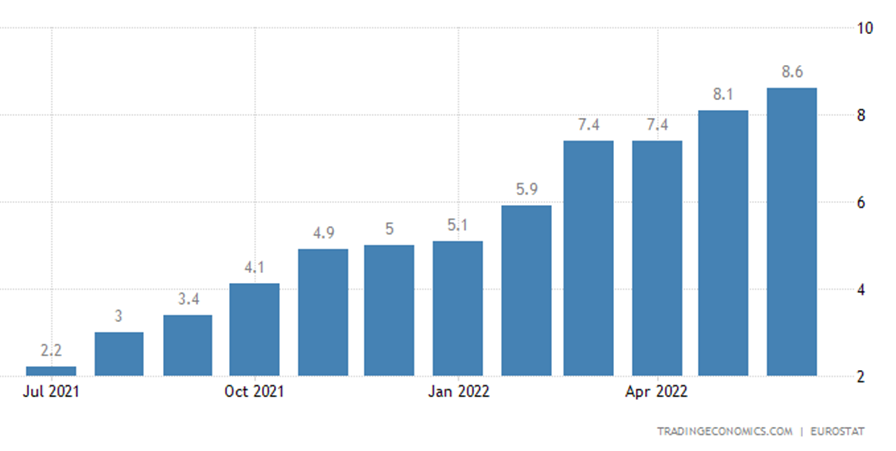

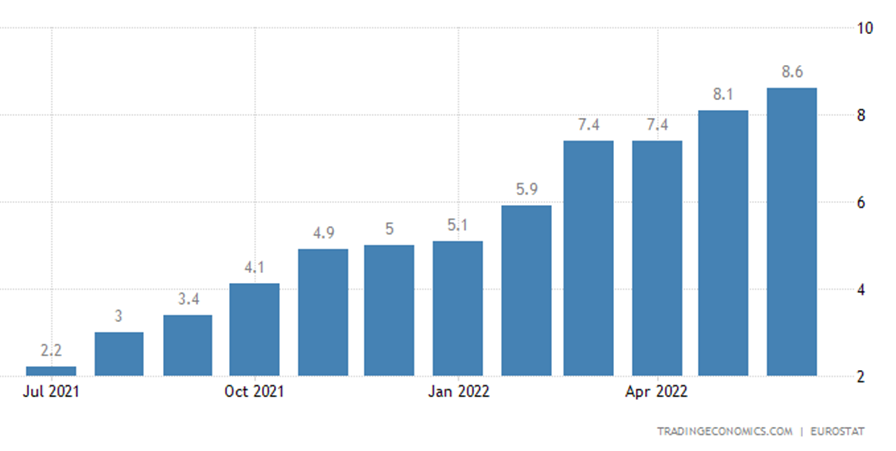

Eurozone’s CPI +8.6% per year – that is a record for 31.5 years of observations:

Euro Area Inflation Rate

Euro Area Inflation Rate

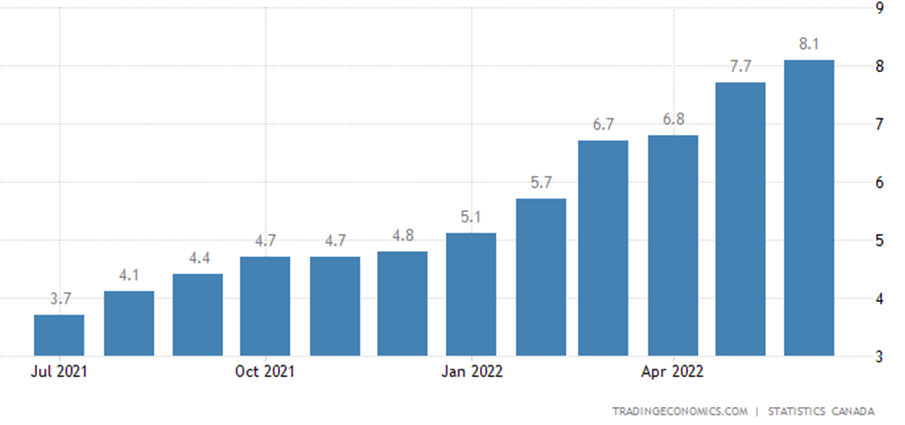

Canadian CPI +8.1% per year – a peak since 1983:

Canada Inflation Rate

Canada Inflation Rate

Net CPI +6.2% per year. This is a record for 38 and a half years of the existence of the survey:

Canada Core Inflation Rat

Canada Core Inflation Rat

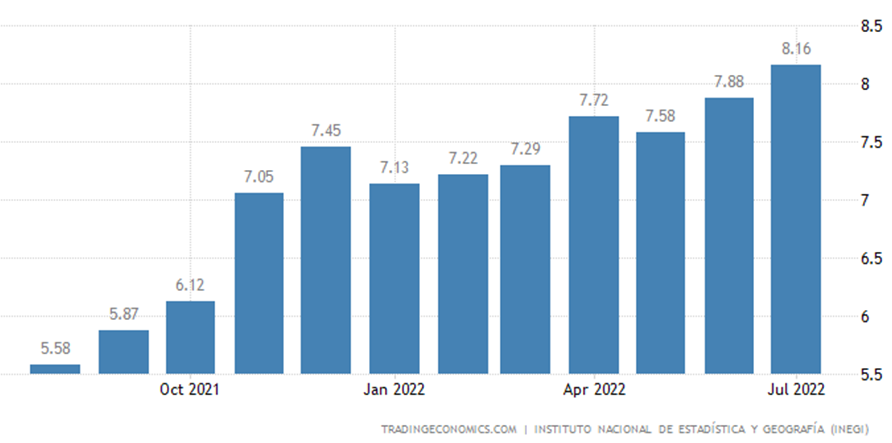

CPI of Mexico +8.2% per year – the highest since 2001:

Mexico Mid-month Inflation Rate YoY

Mexico Mid-month Inflation Rate YoY

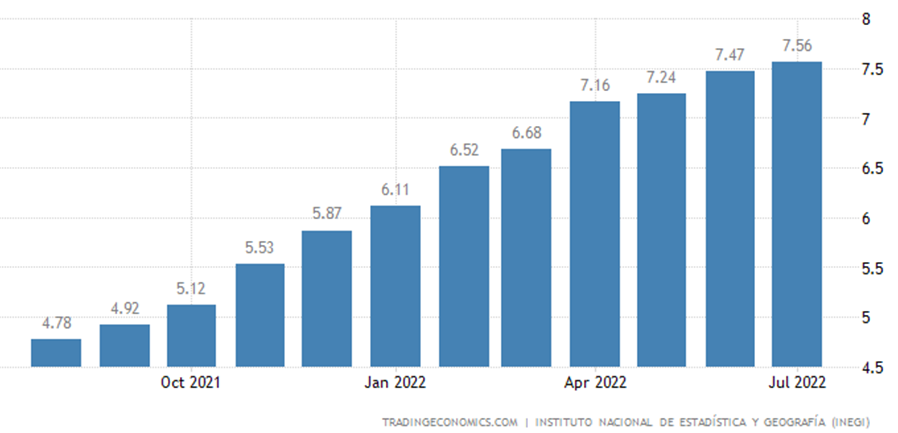

Without food and fuel + 7.6% per year. That is also a peak since 2001:

Mexico Mid-month Core Inflation Rate YoY

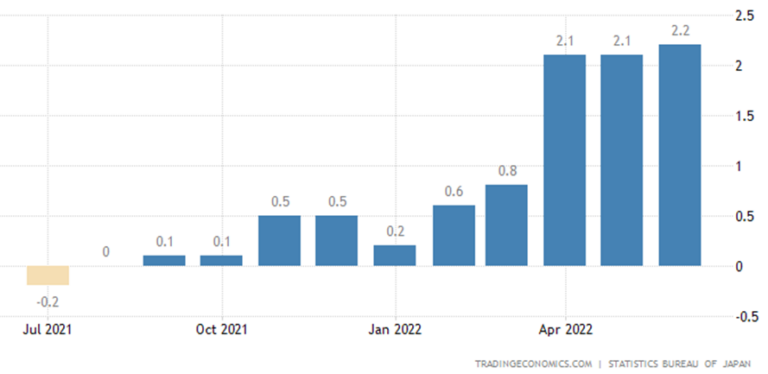

Japanese CPI excluding fresh food +2.2% per year – the highest since 2015:

Japan Core Inflation Rate

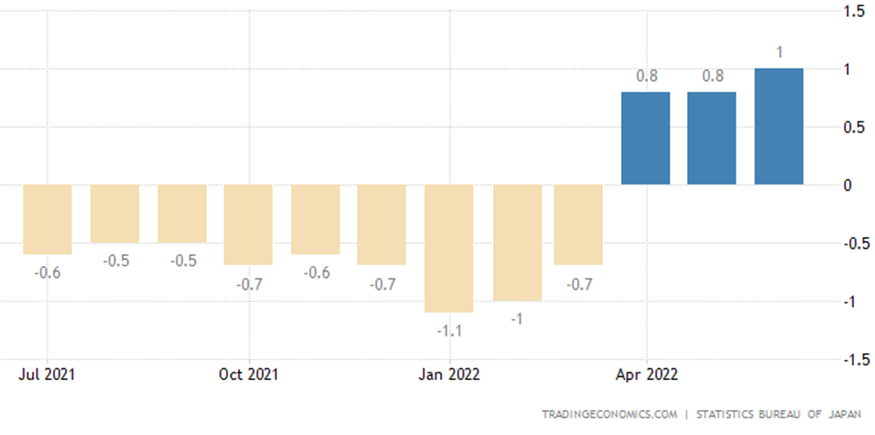

Without food and fuel +1.0%. This is a peak since 2016:

Japan CPI Core Core

Japan CPI Core Core

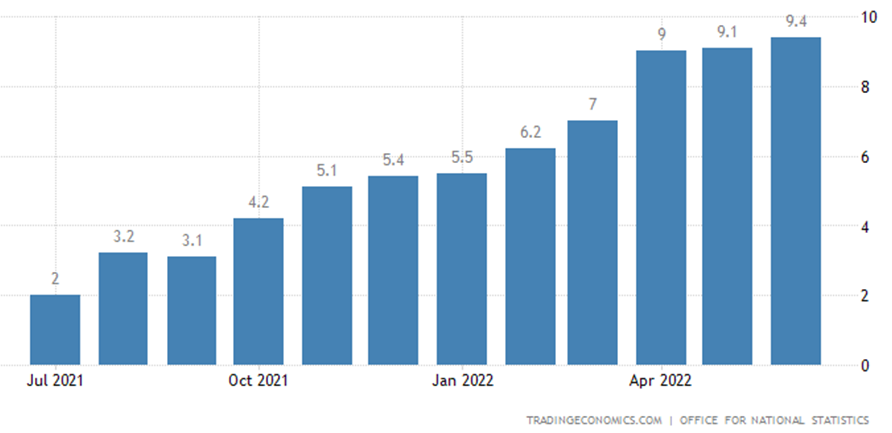

UK’s CPI +9.4% per year. That is a record for 33 and a half years of statistics:

United Kingdom Inflation Rate

United Kingdom Inflation Rate

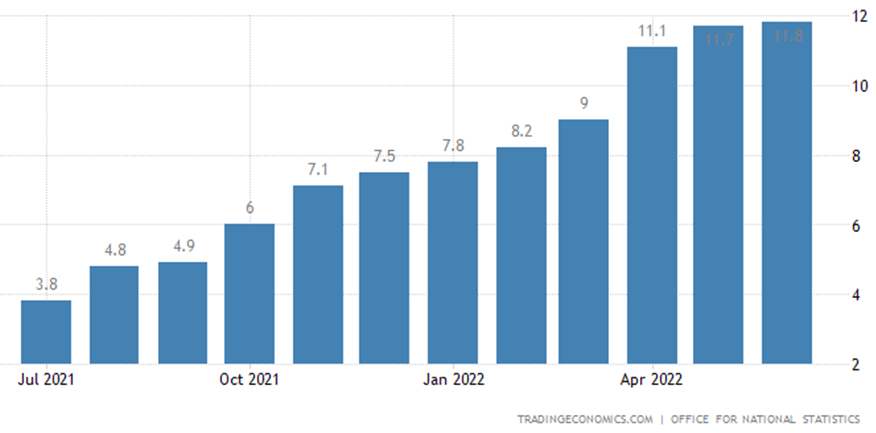

An older retail price index +11.8% per year, the highest in forty years:

United Kingdom Retail Price Index YoY

United Kingdom Retail Price Index YoY

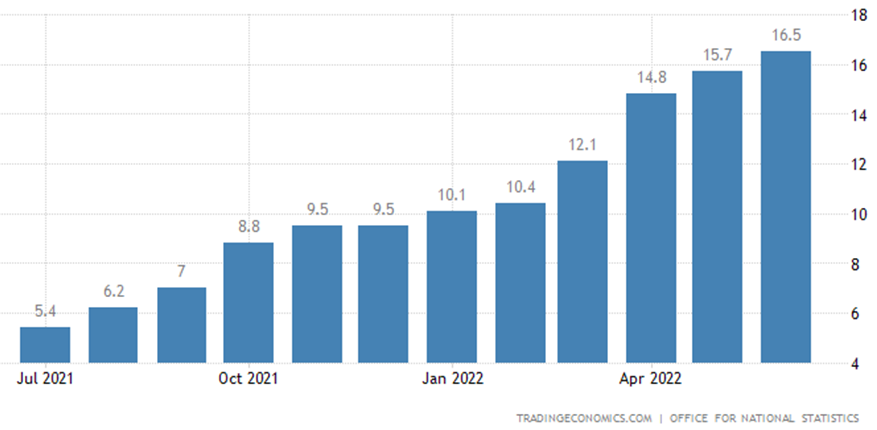

UK PPI (industrial inflation index) +16.5% per year, this is the top since 1980:

United Kingdom Producer Prices Change

United Kingdom Producer Prices Change

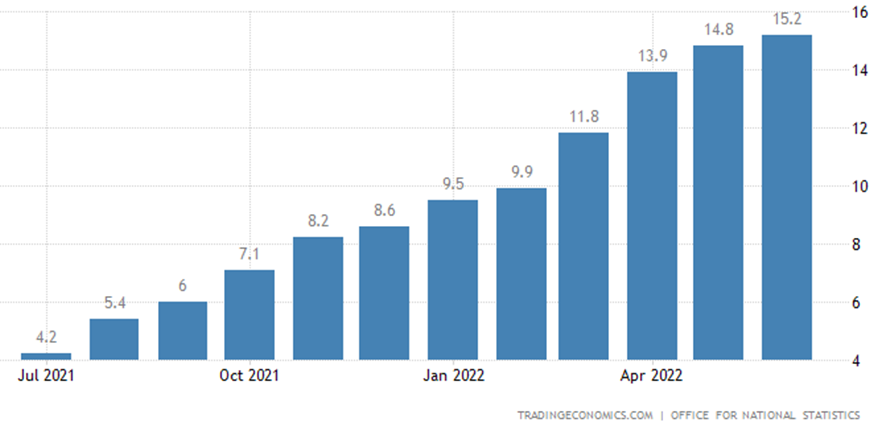

Net PPI +15.2% per year – a record for 25 years of data collection:

United Kingdom Core Producer Prices YoY

United Kingdom Core Producer Prices YoY

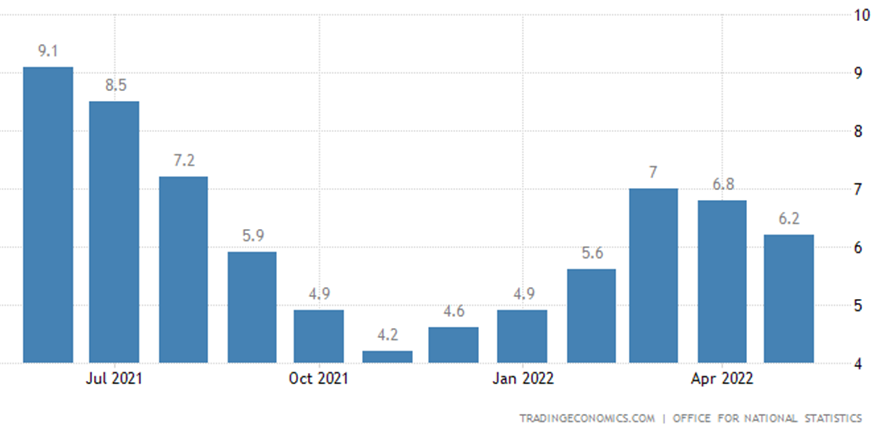

Regular salaries (without bonuses), taking into account inflation in Britain – 2.8% per year – a historical anti-record

United Kingdom Average Weekly Earnings Growth

United Kingdom Average Weekly Earnings Growth

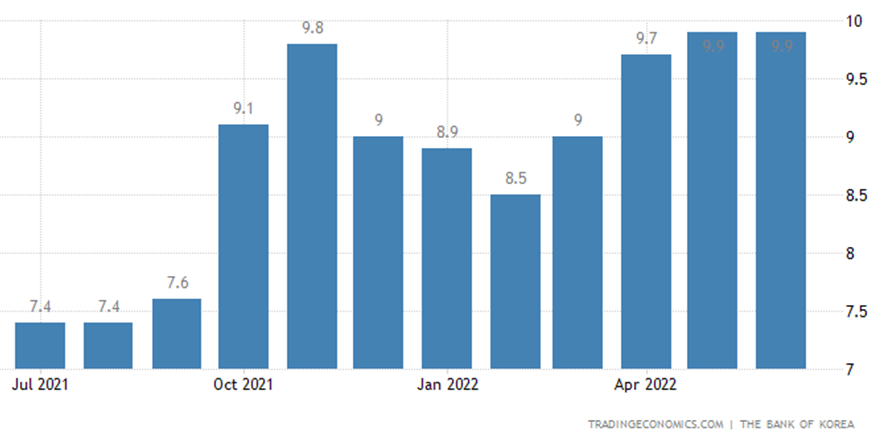

PPI of South Korea +9.9% per year, that is the highest index since 2008:

South Korea Producer Prices Change

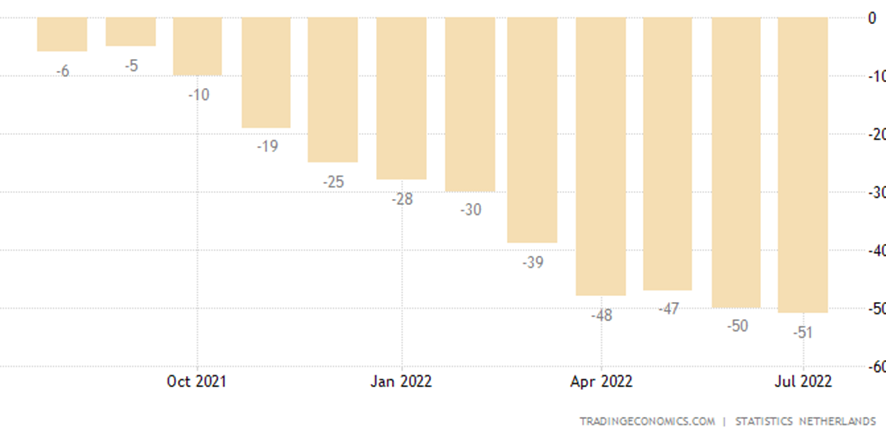

The mood of the Dutch is record bad:

Netherlands Consumer Confidence

Netherlands Consumer Confidence

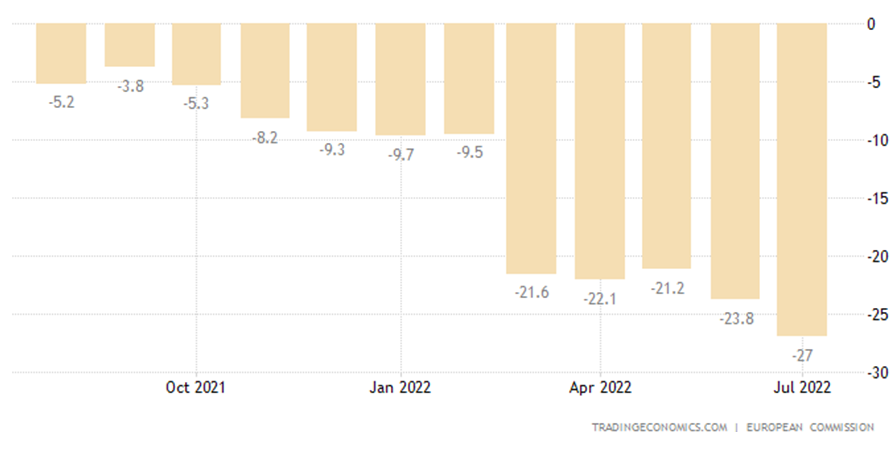

The same picture is in a whole euro zone.

Euro Area Consumer Confidence

Euro Area Consumer Confidence

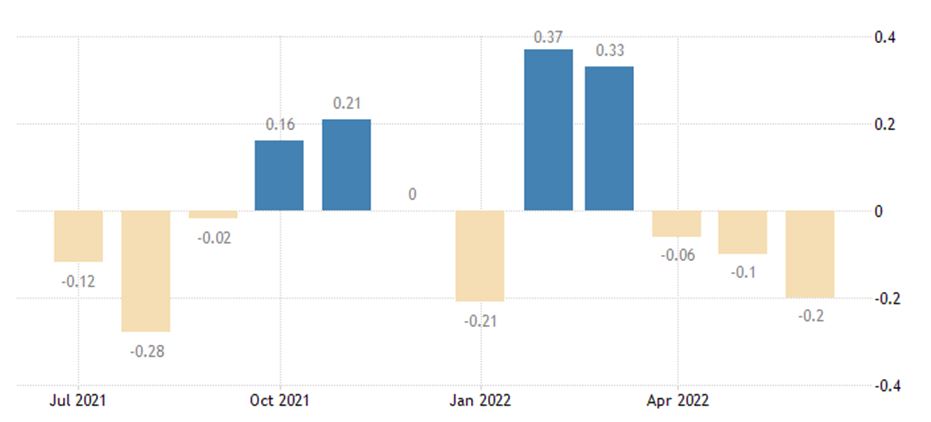

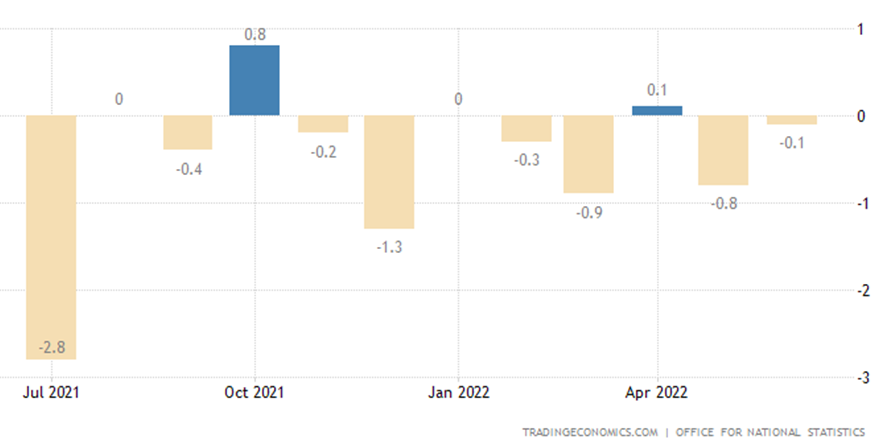

Retail sales in Britain are -0.1% per month. Over the past year there have been only 2 pluses:

United Kingdom Retail Sales MoM

United Kingdom Retail Sales MoM

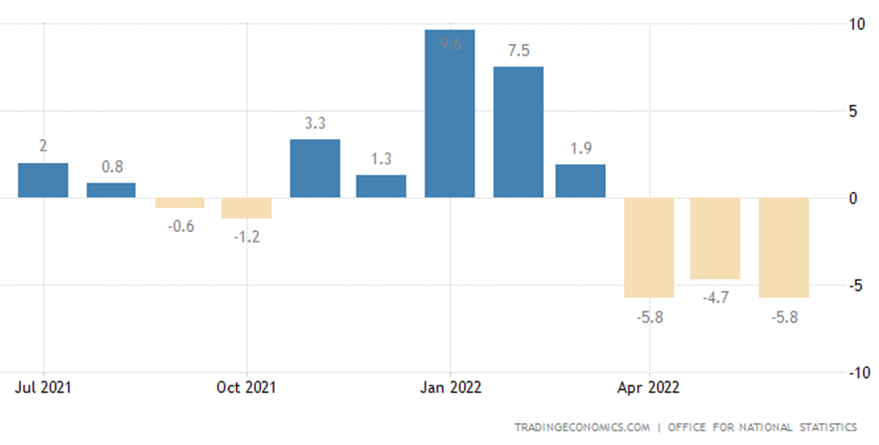

And -5.8% per year – the 3rd negative in a row and the worst dynamics in 2 years:

United Kingdom Retail Sales YoY

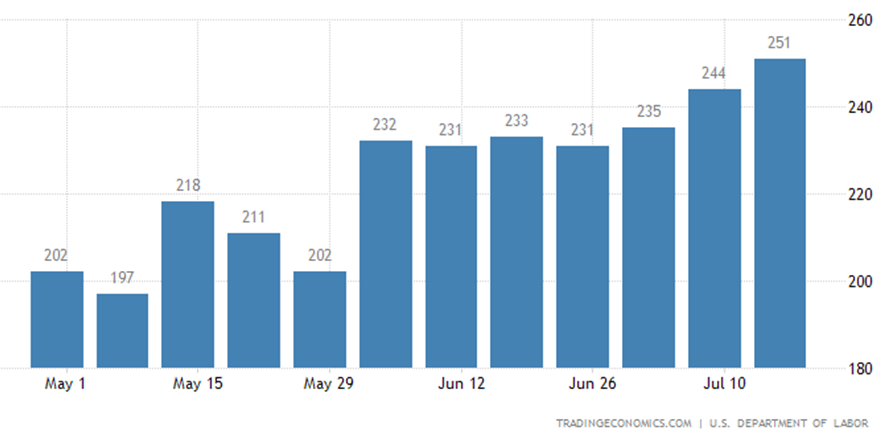

U.S. Initial Jobless Claims are the highest in 8 months:

United States Initial Jobless Claims

United States Initial Jobless Claims

The ECB raised the rate by 0.5% to 0.5%, promising to continue tightening.

The Central Bank of South Africa raised the interest rate by 0.75% to 5.50%.

The Central Bank of China has left everything as it is, but it is worried about the growing defaults in the real estate market, the Central Bank of Japan has not changed anything either and will continue to buy government bonds indefinitely.

The Central Bank of Indonesia did not raise rates, but may do so later despite the rise in inflation. The policy of the Central Bank of Turkey remains the same.

The Bank of Russia cut the key rate by 1.5% to 8.0% and promises to continue easing.

Main conclusions

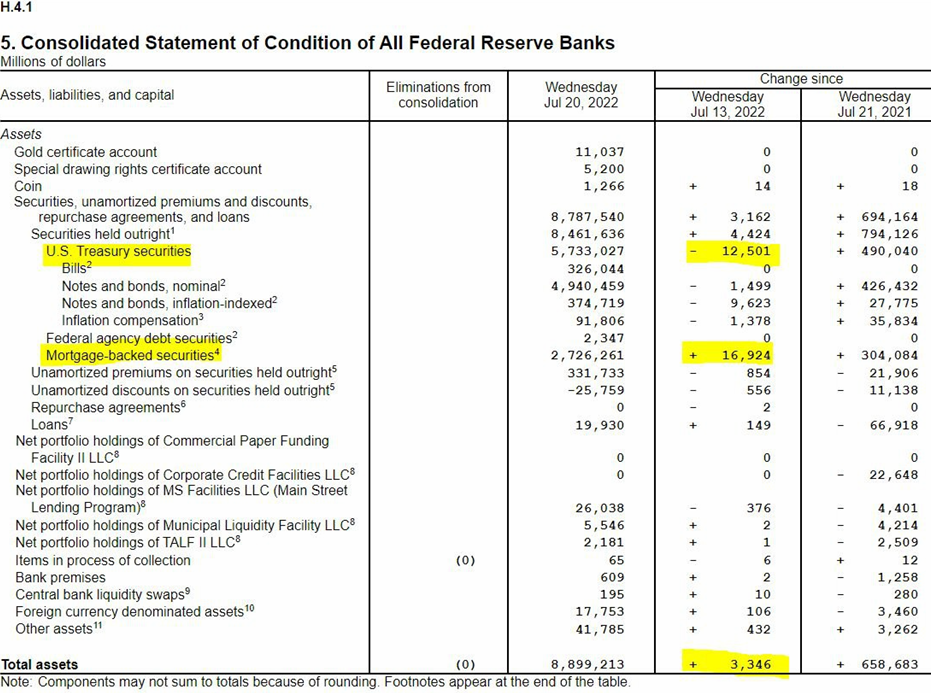

The crisis continues. At the same time, there are serious suspicions that the US Federal Reserve followed the example of the ECB (or vice versa?) and also quietly increased its balance sheet (read, started issuing):

It is clear why – something needs to be done, somehow stop the decline. But then, the same question: why raise the rate? The trouble is that the financiers want to raise the rate, because they can’t do anything else in the conditions of inflation. And they demand to “plug holes” – politicians who do not understand anything, but can deliver an incredible amount of trouble.

It is clear why – something needs to be done, somehow stop the decline. But then, the same question: why raise the rate? The trouble is that the financiers want to raise the rate, because they can’t do anything else in the conditions of inflation. And they demand to “plug holes” – politicians who do not understand anything, but can deliver an incredible amount of trouble.

However, obviously the financiers also do not understand something, but they do not dare to say about it. As a result, politicians who do not understand anything require results from financiers that they cannot achieve. And quite phantasmagoric actions begin.

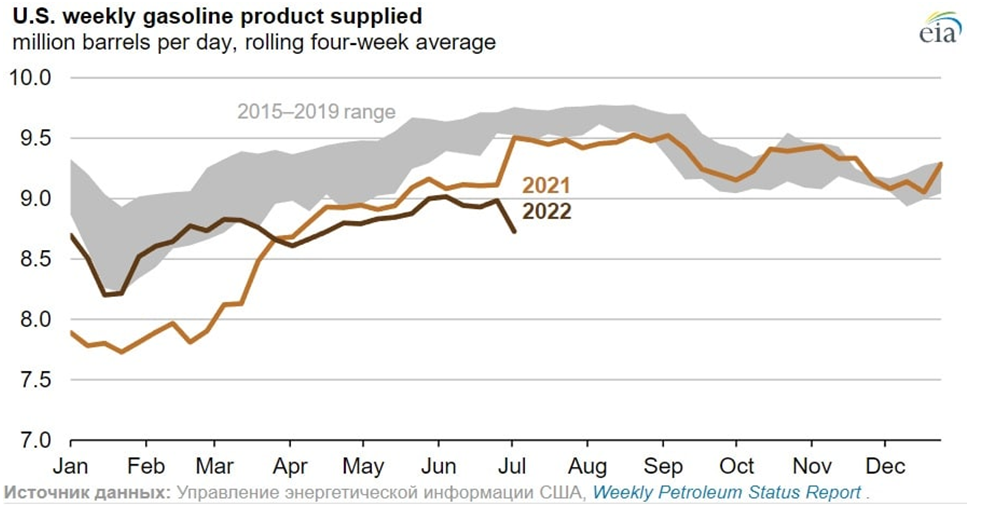

Politicians, by the way, can also be understood. Their aggregate demand began to fall, and this is in the election year – real disaster!

Another thing is that they can’t clearly say what they need. Powell, the head of the Fed, and his associates have already said that “very soon” inflation will drop to 2% (it was this in previous reviews). It is not clear what they are guided by.

It should be noted that in the world this situation is viewed quite critically, which is clearly seen from the dynamics of non-residents in US government securities.