Liberal textbooks often write that raising the rate weakens the monetary component of inflation. However, these textbooks do not say that it strengthens the structural component. Because it is liberalism that runs the global and American financial systems, they miss the structural component of inflation and ignore its rise. But reality makes a difference.

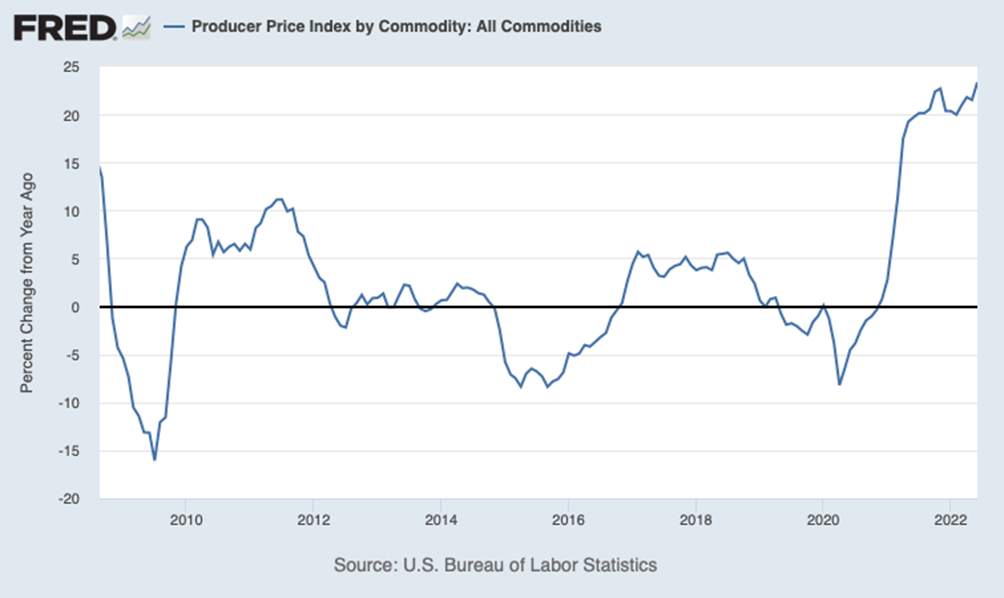

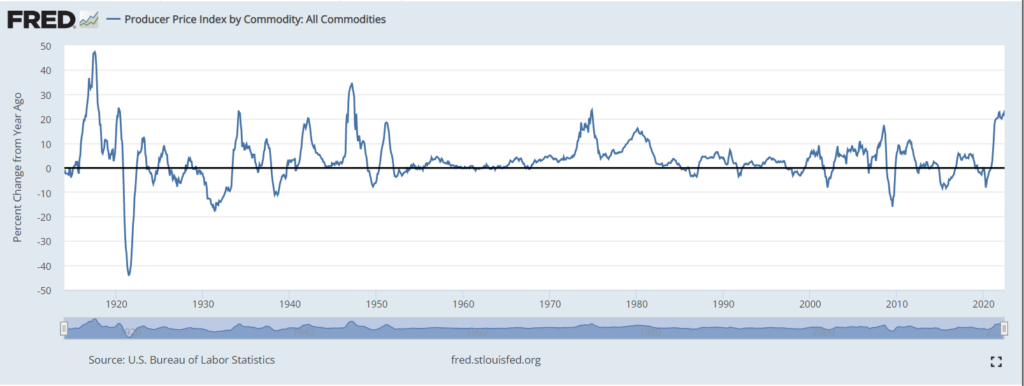

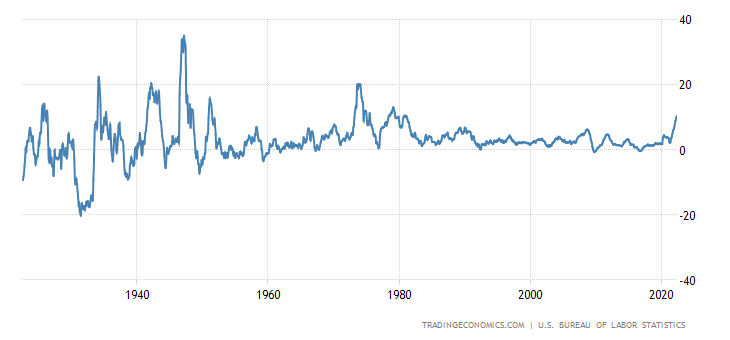

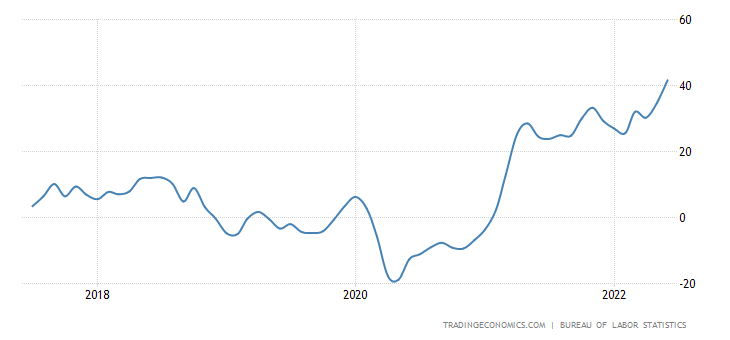

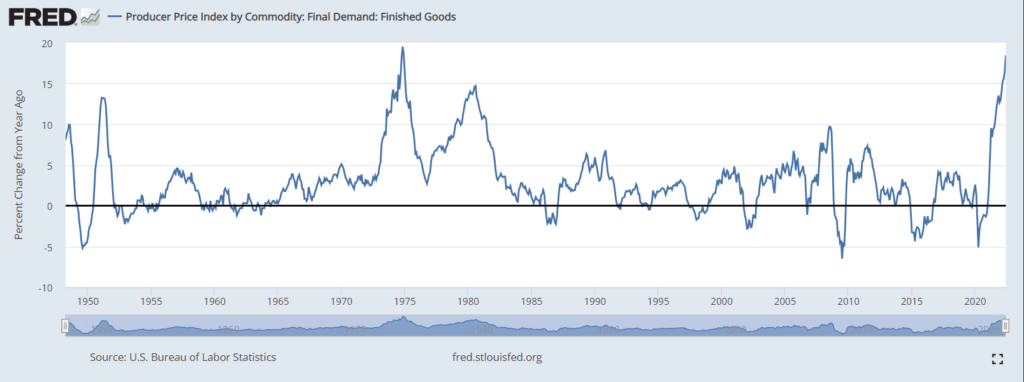

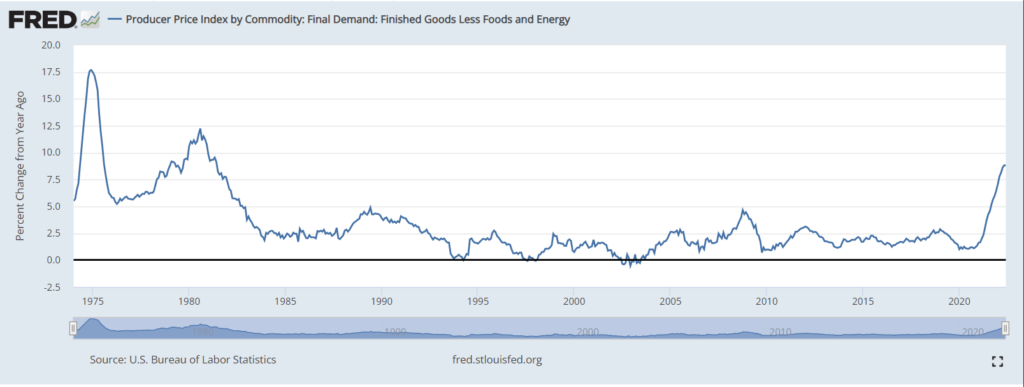

And so, the rise in prices of total manufactured goods reached 23.4% per year — the peak of 1974 was exceeded, the highest since 1947 was reached:

On the one hand, we cannot but be inspired that our prediction came true. On the other hand, we will have to state that the extent of inadequacy of the monetary authorities of the United States and, by and large, the entire dollar system, goes beyond the boundaries of the reasonable.

On the one hand, we cannot but be inspired that our prediction came true. On the other hand, we will have to state that the extent of inadequacy of the monetary authorities of the United States and, by and large, the entire dollar system, goes beyond the boundaries of the reasonable.

Macroeconomics

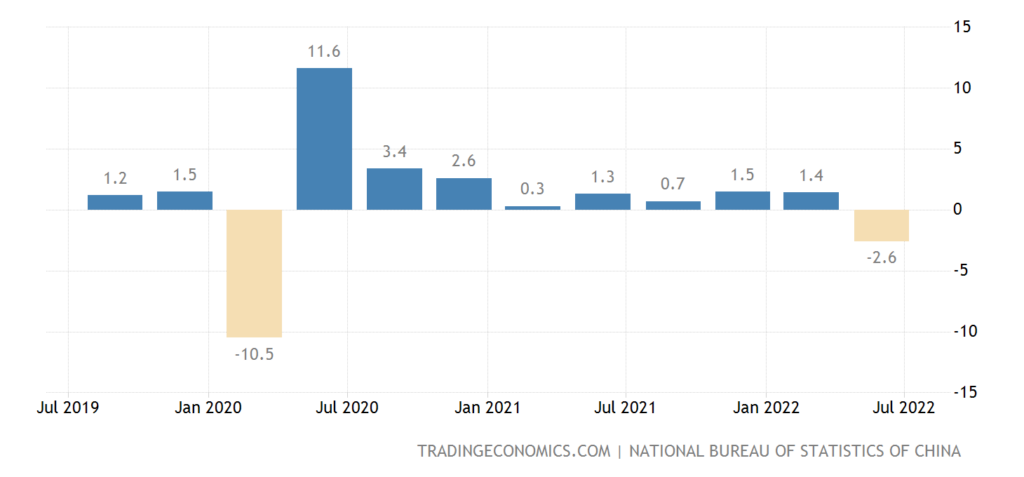

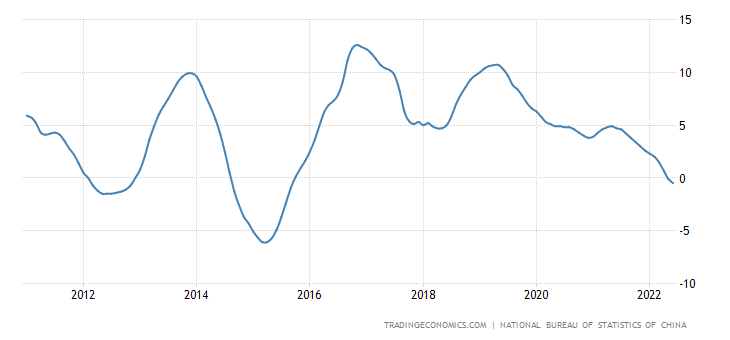

China’s GDP -2.6% QoQ, slowdown was almost twice as much as expected:

China GDP Growth Rate

And this against the backdrop of undercharged inflation and taking into account the growth of exports to the United States is an extremely pessimistic picture.

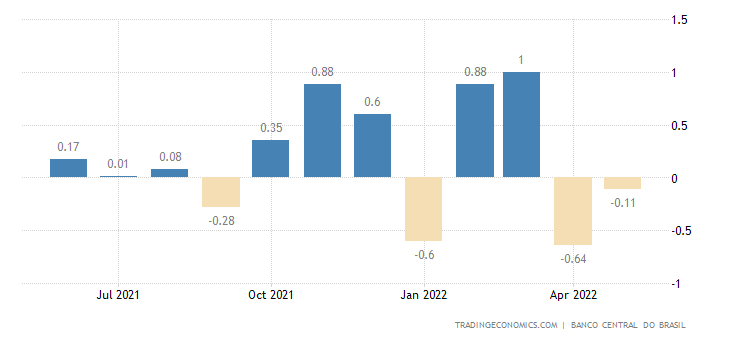

Economic activity in Brazil has been declining for 2 straight months:

Brazil IBC-Br Economic Activity Index

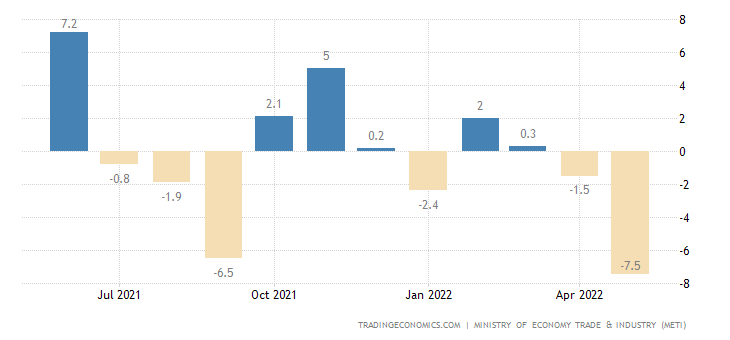

Industrial production in Japan -7.5% per month, this is the worst performance in 2 years:

Japan Industrial Production MoM

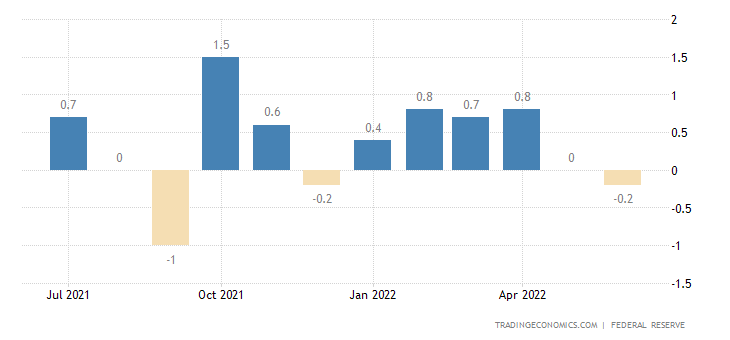

In the US, industrial output shows no growth for 2 consecutive months:

United States Industrial Production MoM

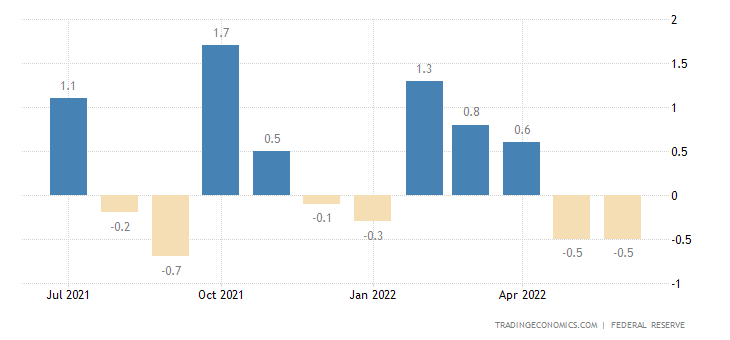

Manufacturing industries issued -0.5% per month in May and June:

United States Manufacturing Production MoM

As usual, these figures are given against the background of underinflation.

PMI (Purchasing Managers’ Index, industry peer review, it’s value below 50 means stagnation and recession) of New Zealand is at its lowest in 10 months and in the red zone (49.7 points):

New Zealand Manufacturing PMI

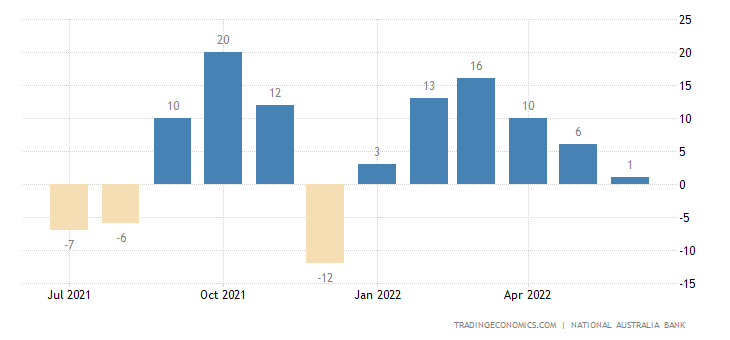

Business confidence in Australia has weakened to the extreme in six months:

Australia Business Confidence

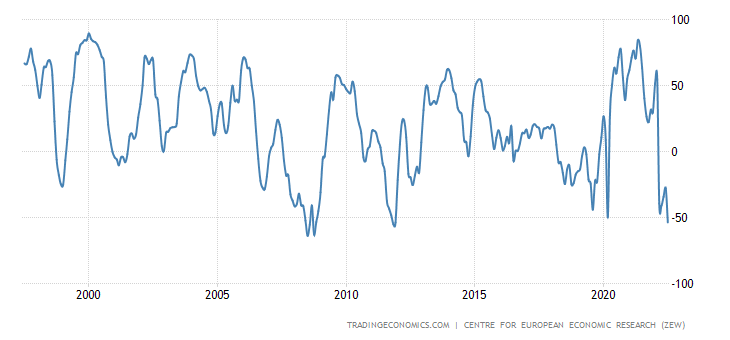

And in Germany (ZEW survey) — for 11 years:

Germany ZEW Economic Sentiment Index

Germany ZEW Economic Sentiment Index

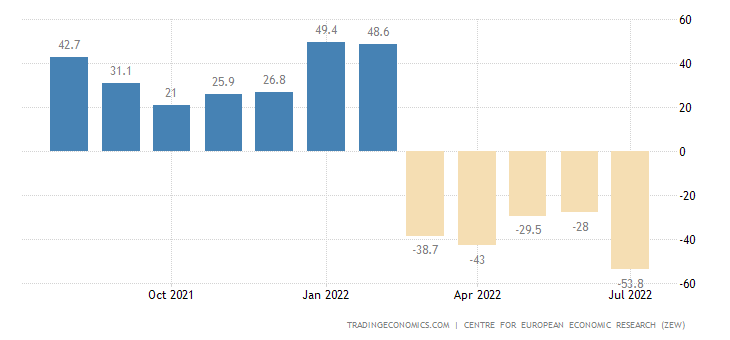

Similarly, in the Euro Area:

Euro Area ZEW Economic Sentiment Index

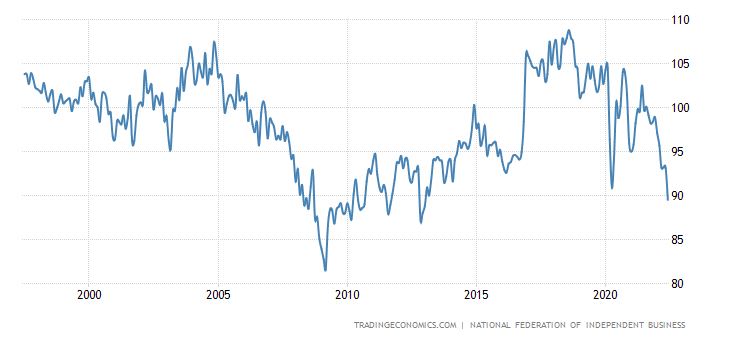

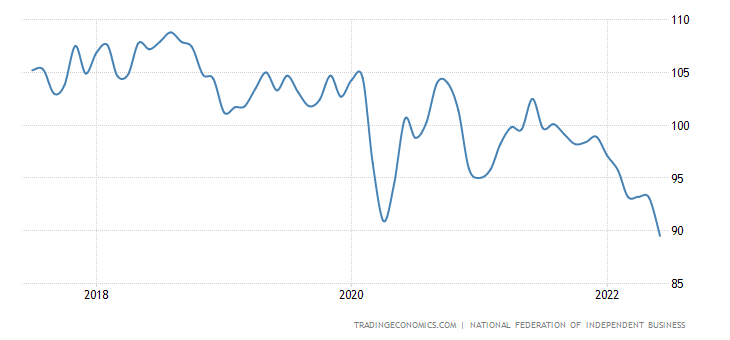

US small business has been extremely pessimistic since 2013, with expectations at an all-time low:

United States Nfib Business Optimism Index

United States Nfib Business Optimism Index

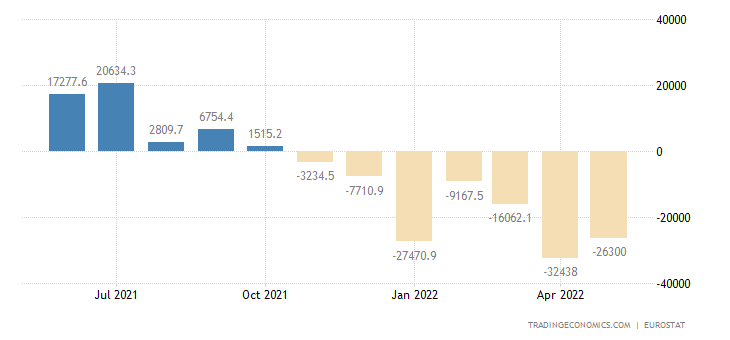

In the Euro Area, the foreign trade deficit has been running for more than six months:

Euro Area Balance of Trade

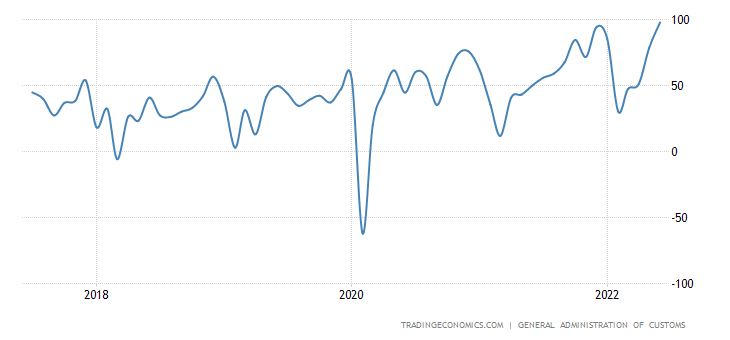

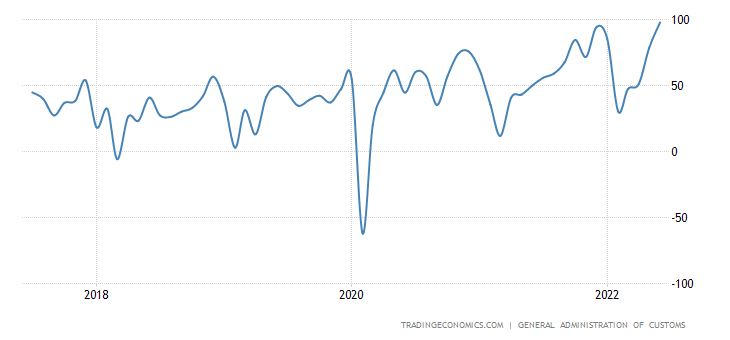

China’s trade surplus at a record high (nearly +$100 billion, twice as high as a year ago):

China Balance of Trade

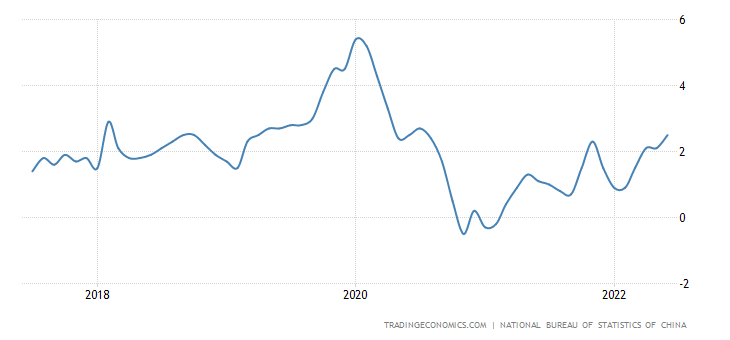

CPI (Consumer Price Index) of China +2.5% per year climbed to a two-year high:

China Inflation Rate

But its PPI (Producer Price Index; +6.1% per year) is the lowest in 15 months

China Producer Prices Change

Such an unexpected performance (the opposite movement of two key inflation indices) may result from two processes. Either the indicators are highly distorted, for both industry and households, or the industrial crisis has triggered deflation that has yet to catch up with the consumer sector. We will keep in view of the situation.

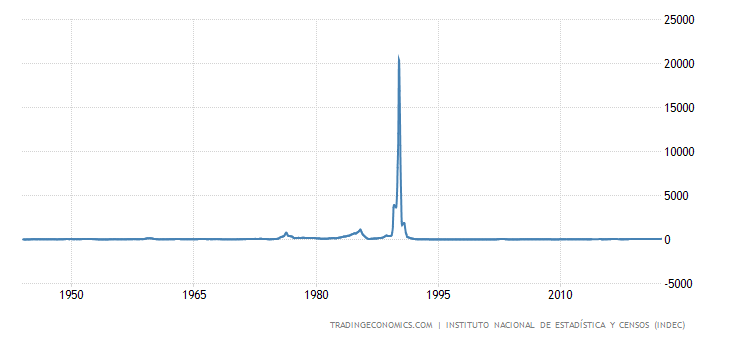

Argentina’s CPI +64.0% p.a. topped since 1991:

Argentina Inflation Rate

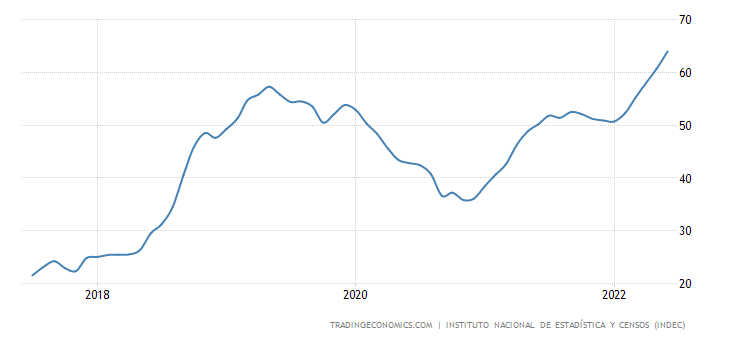

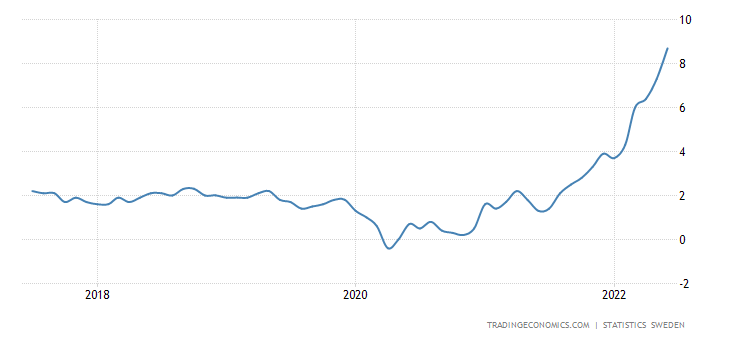

Sweden’s CPI is +8.7% per year and is also at its peak since 1991:

Sweden Inflation Rate

Sweden Inflation Rate

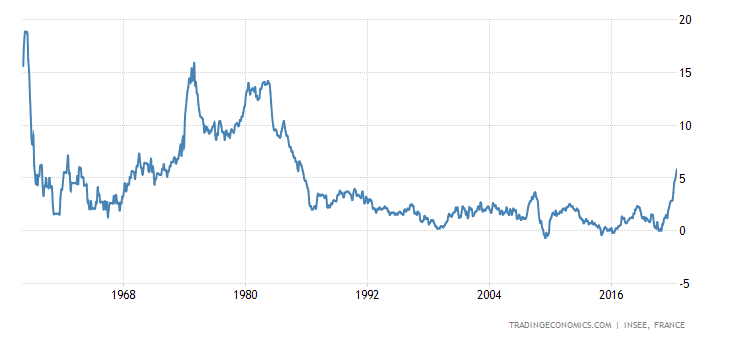

French CPI +5.8% per year is the highest since 1985:

France Inflation Rate

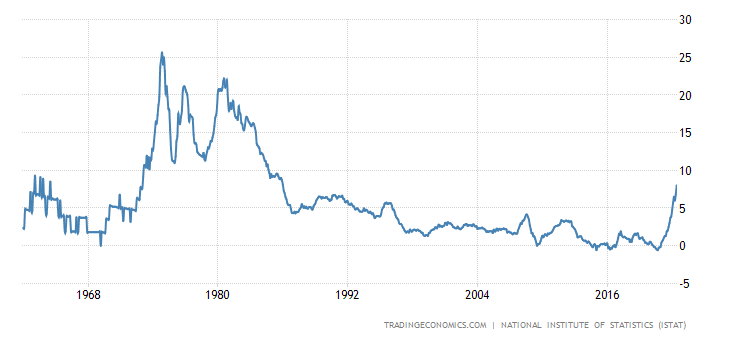

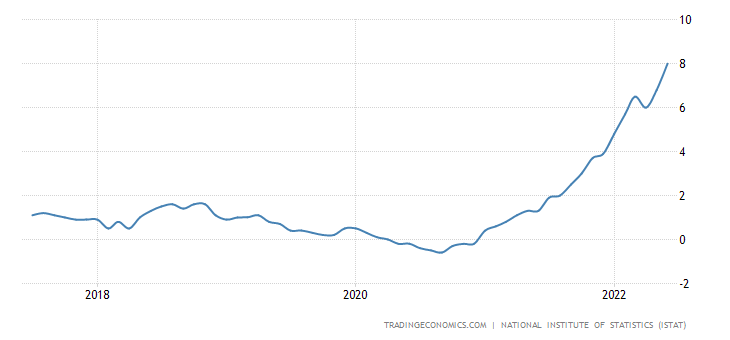

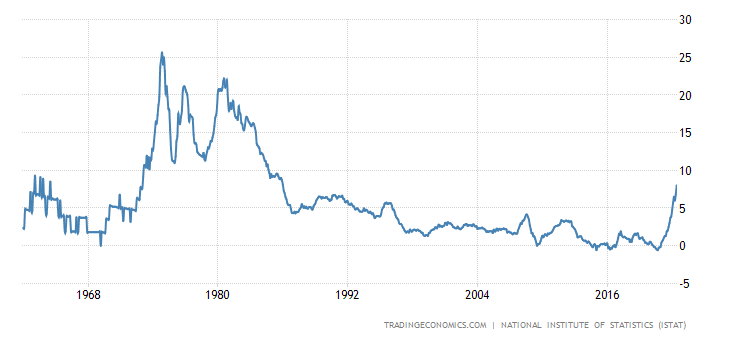

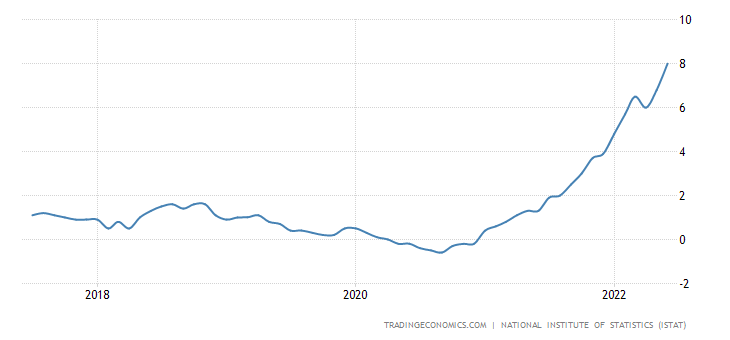

Italy’s CPI of +8.0% per year is also at its peak since 1985:

Italy Inflation Rate

Italy Inflation Rate

Spain’s CPI is 10.2% per year, and there’s the biggest increase since 1985:

Spain Inflation Rate

Spain Inflation Rate

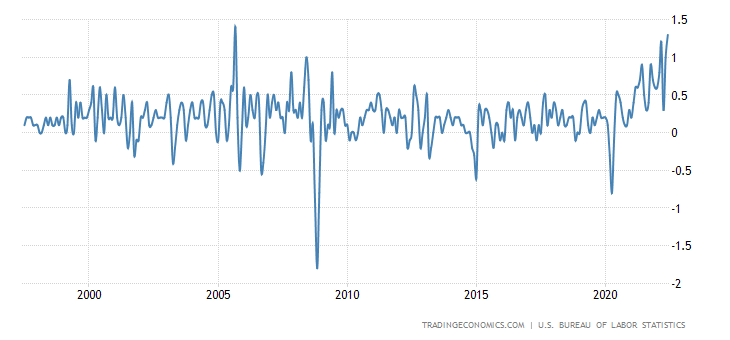

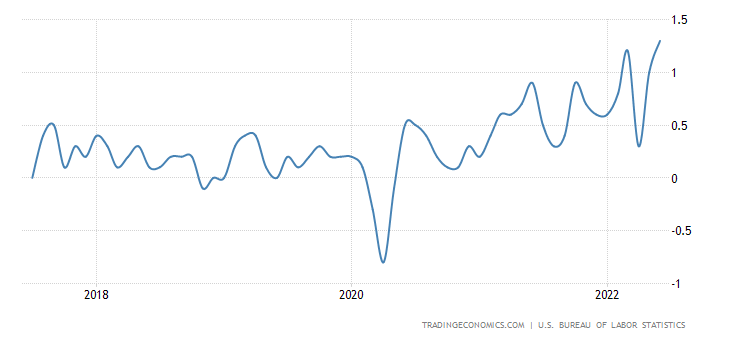

US CPI +1.3% per month, it is the highest since 2005:

United States Inflation Rate MoM

United States Inflation Rate MoM

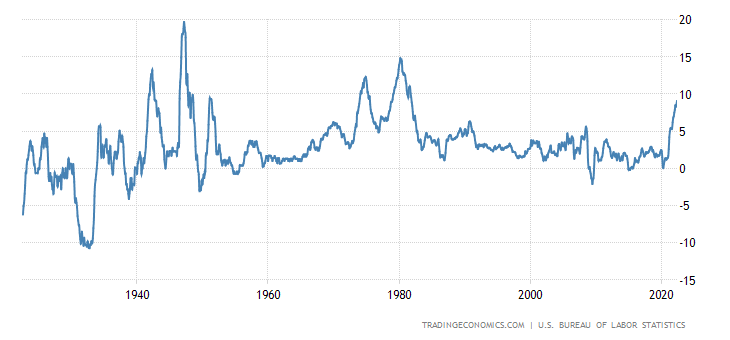

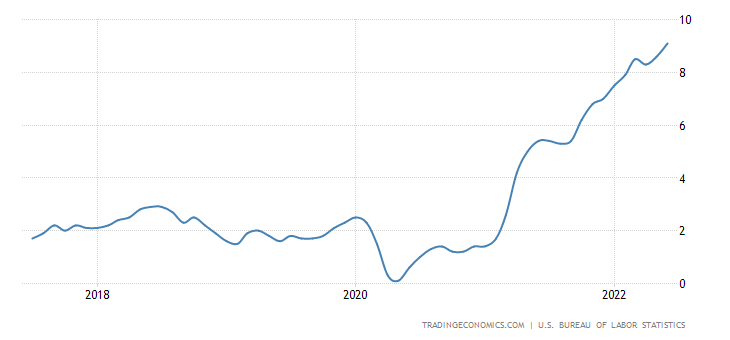

And +9.1% per year, the highest since 1981:

United States Inflation Rate

United States Inflation Rate

Including food +10.4% per year, which is also a peak since 1981:

United States Food Inflation

Energy is +41.6% per year, close to the record high of 1980:

United States Energy Inflation

United States Energy Inflation

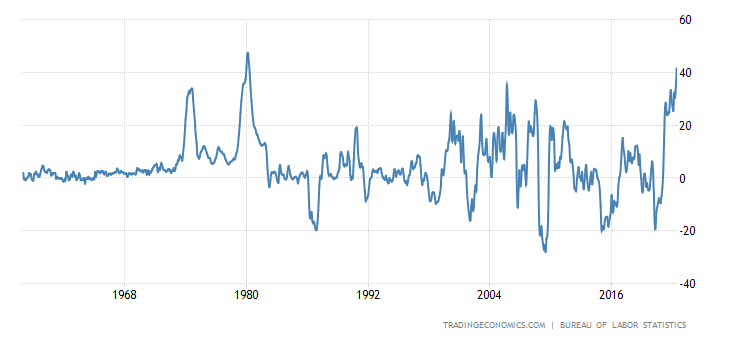

The US PPI (CPI) has slowed down, but the key components are not: finished goods 18.4% per year, and already close to the record peak of 1974:

Less food and energy +8.8% is at its highest since 1981:

Well, we already wrote about the full volume of manufactured goods.

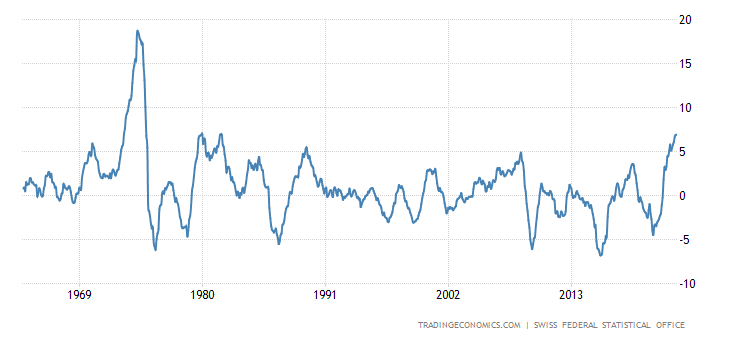

The PPI of Switzerland was +6.9% per year and repeated the 41-year high:

Switzerland Producer and Import Prices YoY

Switzerland Producer and Import Prices YoY

Housing prices in the 70 largest cities in China -0.5% per year fell to a seven-year trough (which confirms the stagnation hypothesis):

China Newly Built House Prices YoY Change

China Newly Built House Prices YoY Change

Mortgage applications in the US decreased again (-1.7% per week):

United States MBA Mortgage Applications

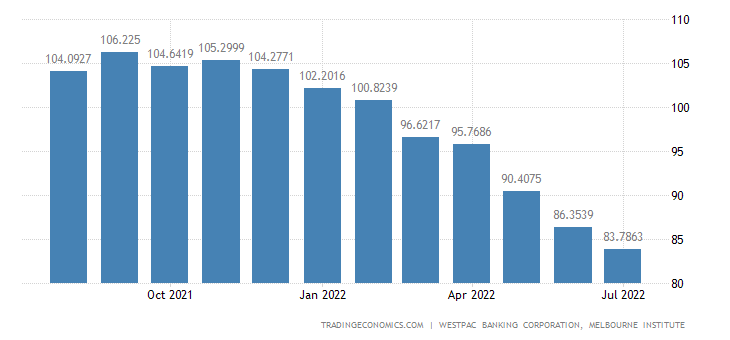

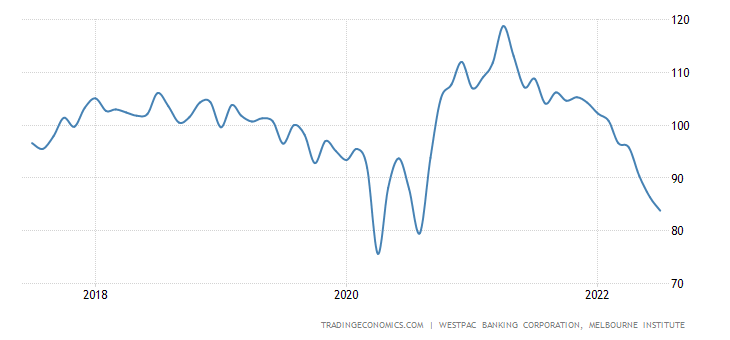

Australian sentiment is down eight months in a row and confidently sinking to 2020:

United States MBA Mortgage Applications

United States MBA Mortgage Applications

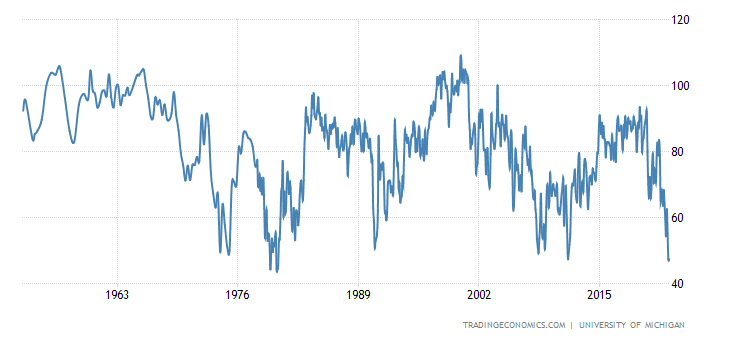

American consumer expectations (sentiment component) are the lowest since 1980:

United States Michigan Consumer Expectations

The South Korean Central Bank hiked the rate by 0.50% to 2.25%, promises to tighten further.

Similarly, the Central Bank of New Zealand (0.50% to 2.50%, to be continued).

The Central Bank of Canada turned out to be even more diligent (1.0% to 2.5%) — I wonder if the US Federal Reserve will follow suit.

Summary

Inflation continues to rise, but the monetary authorities of the world’s major economies, living on liberal textbooks, are only reinforcing the rhetoric for tightening monetary policy. Let’s remind just in case that “tightening” is an increase in the value of borrowed money, “softening” is the other way around. According to the experiment, as a result of this policy, inflation will only increase more (and stronger than the rate), resulting in a negative spread between the yields of debt instruments and inflation. At present, the real yield on US core debt ranges from -7% to -9%. Of course, this is not noticeable in nominal value, due to the undercharge of inflation indicators, but those who are trying to save their capital cannot but see it. Thus, if the rate will be hiked further, this spread will increase, and it is already having a negative effect.

No one wants to make a loss-making investment, which means that the US federal budget and corporations will soon have problems (which will lead to lower wages and job losses). In fact, the US is already sharply reducing its budget deficit. Over the past 12 months, there were 1.05 trillion compared to 4 trillion in March 2021, and for the 2022 accounting year (October 2021-June 2022), $515 billion compared to 2.24 trillion in June 2021, 2.74 trillion in June 2022, and an average deficit of 626 billion in 2017-2019.

An even more significant reduction was noted in the first half of the calendar year 2022 — the deficit sharply narrowed to 137 billion dollars, last year it was 1.66 trillion, in 2020 it was 2.4 trillion, the average value of 2017-2019 was 375 billion deficits for the first half of the year.

The budget deficit of January-June 2022 repeated the values of 2015, i.e. nominally the lowest in 15 years, in other words, a new wave of emissions is likely — it is hard to expect that before the elections the Democrats will go for a sharp deterioration of the situation of households. And if they do, the Republicans will triumph to an unprecedented degree, after which they will be forced to insist on increased borrowing. Given that investors are unlikely to be interested in a -10% yield, the issue is inevitable in any case, and already at an increased rate. One of the leaders of the Fed, J. Bullard, clearly shows how inadequate US monetary authorities are. In his speech this week, he said: “The Fed should now set a target rate of 3.75% by the end of 2022.” He further noted that inflation is becoming more widespread and sustainable; accordingly, he said, the US must move in a stronger direction, and it must act quickly to try to suppress inflation as quickly as possible. And finally, he concluded phenomenally: “If the Fed plays its cards right, inflation could fall relatively quickly to 2% within the next 18 months.” Such a policy, as we have seen, will increase the monetary component of inflation while maintaining structural. And a reduction in the rate (if this step is decided in the context of the economic collapse) in the crisis can not provide a rapid reduction of the structural component. As a result, US inflation rates will begin to rapidly approach Western European ones, that is, to 30-40% instead of 20%.

All this is compounded by the looming change of political elites in the developed countries (In the United Kingdom already, in Italy almost, in France and Germany, and in the United States it is very close). In such a situation, serious reforms do not begin, so the monetary authorities will be given the freedom of action (with relative irresponsibility) and they will be able to do a lot of bad things, which is extremely dangerous situation.