This week has proved to be rich in various events, which not so long ago would bring new information about the situation in the world economy, good signs and other points. These include the G7 and NATO Summits and the ECB Forum on Central Banking, held in Portugal. And the main news of the week was that all these events did not bring anything good, on the contrary, the reports of the monetary authorities once again sounded a note of pessimism.

Federal Reserve Chairman Jerome Powell, speaking at the European Central Bank forum in Portugal on Wednesday, sent a disturbing message about the state of the US economy, recognizing that there is no guarantee of so-called “soft landing”, and a recession is possible.

Moreover, according to Powell, he cannot guarantee that the Fed will be able to reduce inflation again while maintaining a strong labor market. This means that interest rates continue to rise, which could lead to higher unemployment.

The Fed Chairman also added that he intends to use all the instruments at his disposal to ensure economic stability, although he recognized that there is a risk that the Fed will go too far and trigger a recession. His comments came after the US Central Bank hiked interest rates in an attempt to keep inflation in check.

He was echoed by ECB leader Christine Lagarde, who believes that it is unlikely to be able to return to the previous conditions of low inflation, inflation expectations are much higher than before. At the same time, Lagarde hopes that fiscal policy will be aimed at supporting the most vulnerable, not the general population. And finally, obscure wording (as can be seen from the next section of this Review): “Activity in the services sector is supporting growth and the recovery in this sector is expected to strengthen over the coming months.” The leaders of the G7 states have completely avoided the discussion of the economy, although a number of other participants of the G7 summit have expressed doubts about the effectiveness of the sanctions aggression in such a severe crisis. And, thus, the economic crisis continues to develop vigorously.

Macroeconomics

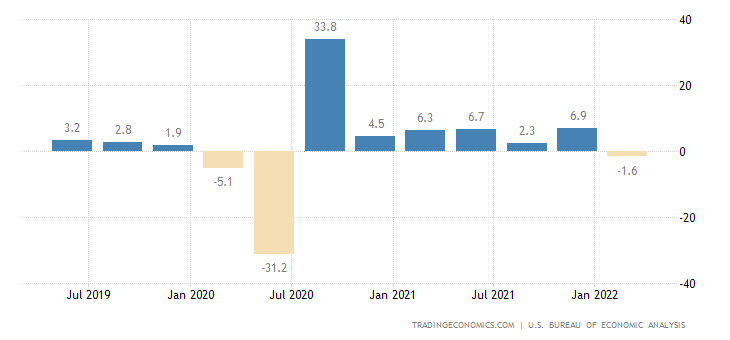

US GDP in Q1. issued -0.4% per quarter:

United States GDP Growth Rate

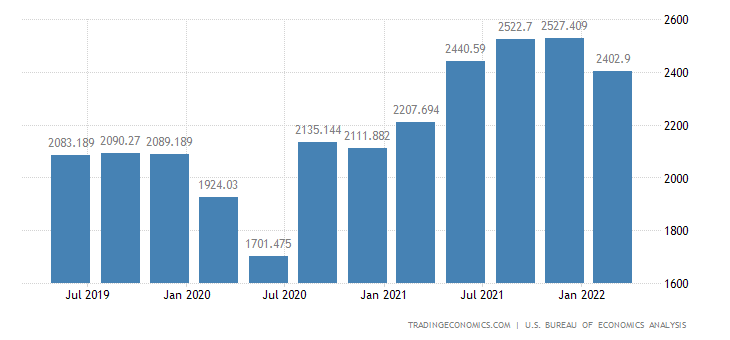

Corporate profits were the weakest in the year:

United States Corporate Profits

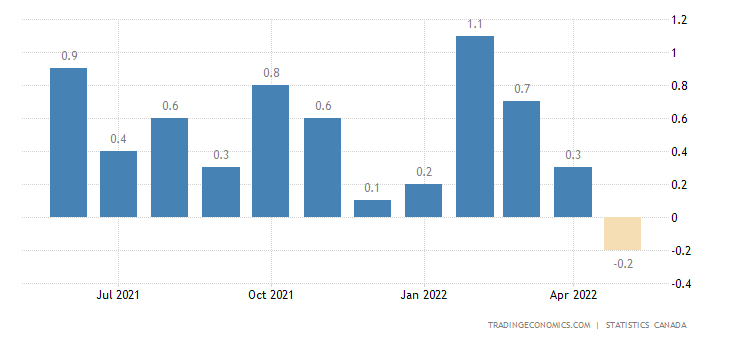

Canada’s GDP in May was -0.2% m/m, the 1st negative for the last year:

Canada Monthly GDP MoM

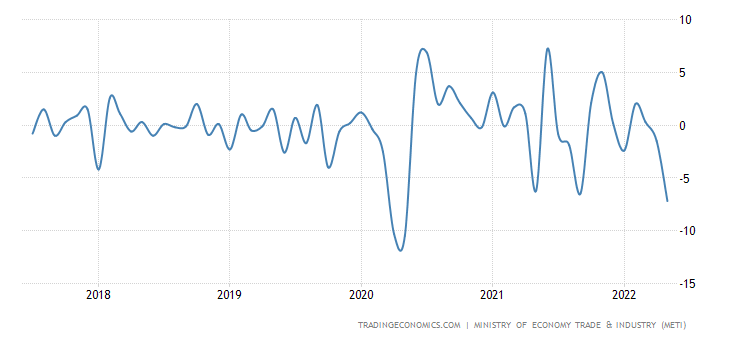

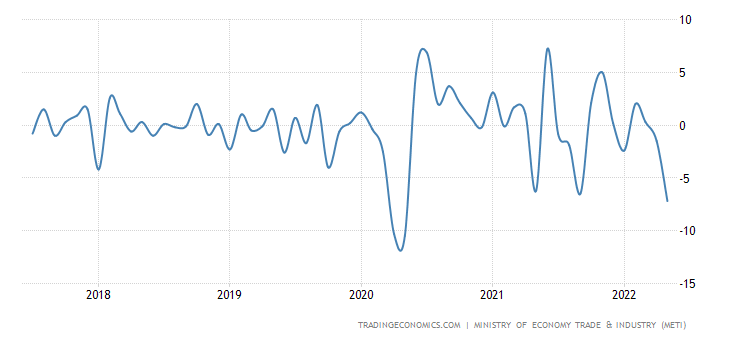

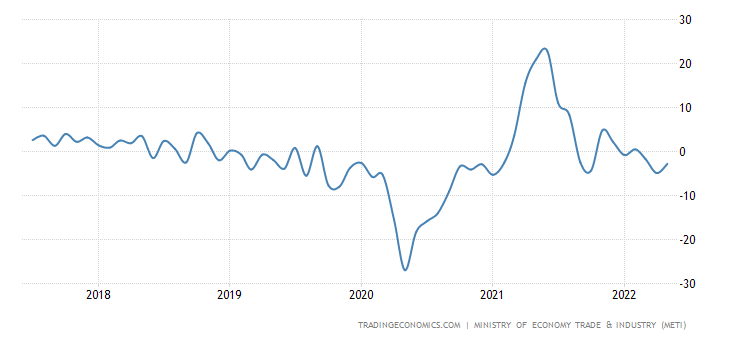

Industrial production in Japan -7.2% per month, that’s the worst performance in 2 years:

Japan Industrial Production MoM

And -2.8% per year, the third consecutive negative:

Japan Industrial Production

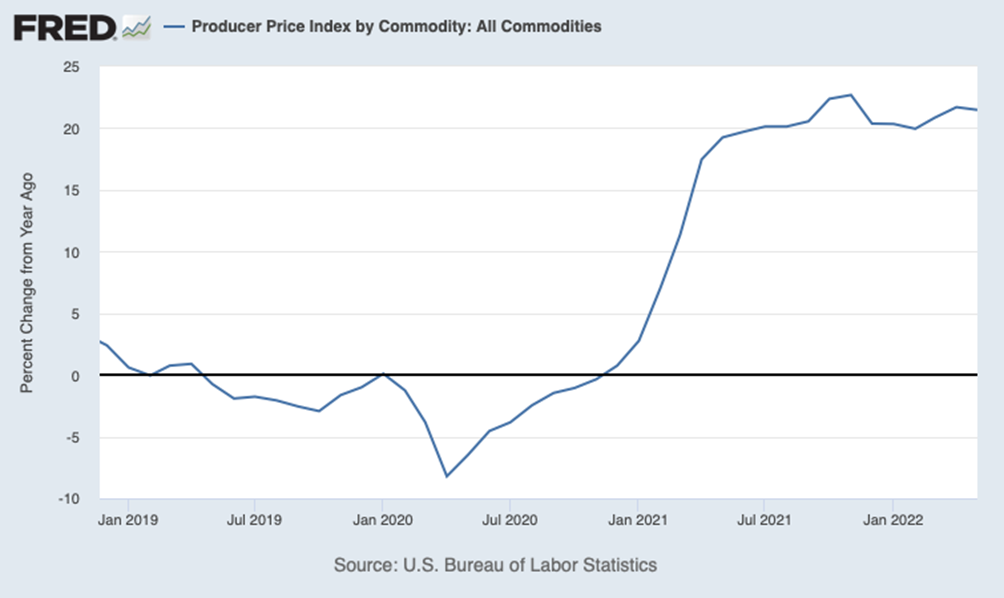

Traditionally, we note that these data were obtained under conditions of extremely undercharged inflation. The reality is much bleaker, we gave a rough estimate of objective GDP figures for the US a couple of weeks ago. For example, US GDP deflator data now stands at 8.3% (Q1 2021 by Q1 2022, forecast was 8.1%). This figure is almost exactly the same as the CPI, with US PPI holding around 20% for a long time:

Yes, the share of industry in GDP today is less than 20%, but, nevertheless, its impact is not so small that the GDP deflator (i.e., inflation throughout the economy) is almost less than consumer inflation. This discrepancy suggests that there is a strong inflation data garbling.

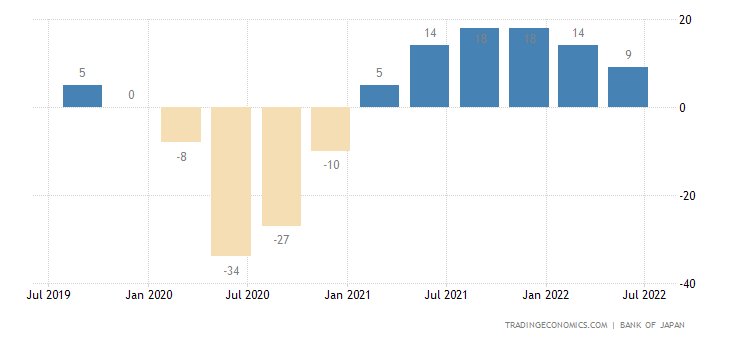

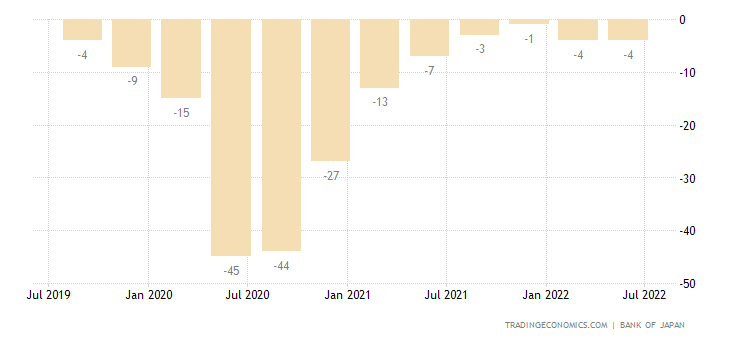

In Japan, the business confidence of major producers is the lowest in 5 quarters:

Japan Business Confidence

And for 4 quarters for small businesses:

Japan Small Business Sentiment

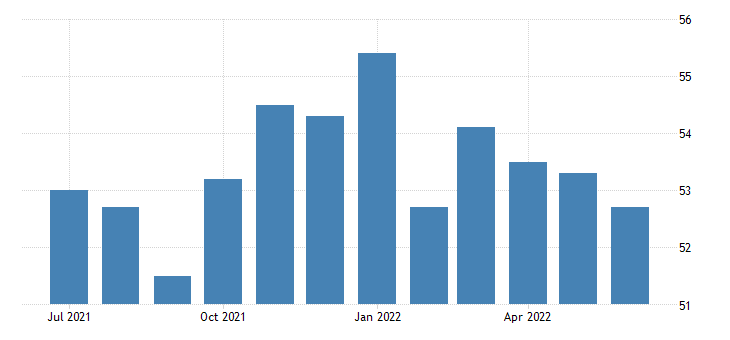

And the PMI (Purchasing Managers’ Index, industry peer review, below 50 means stagnation and recession) of the Japanese industry settled on a 9-month trough:

Japan Manufacturing PMI

In Indonesia — on a 10-month bottom:

Indonesia Manufacturing PMI

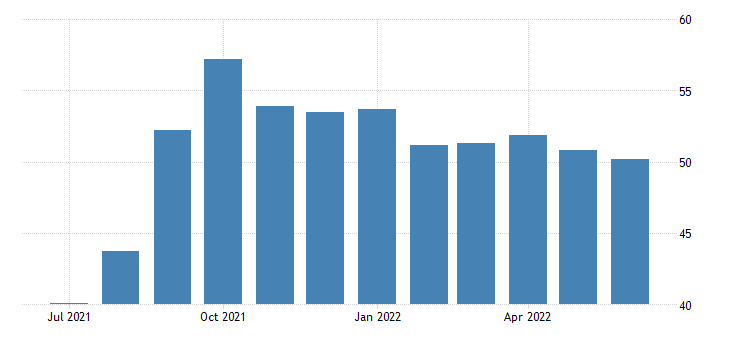

And in Turkey — on the 25-month trough:

Turkey Manufacturing PMI

In developed countries, manufacturing PMI is the weakest since 2020.

In the Euro Area:

Euro Area Manufacturing PMI

In Britain:

United Kingdom Manufacturing PMI

In Switzerland:

Switzerland Manufacturing PMI

In Sweden:

Sweden Manufacturing PMI

In the US, according to S&P Global:

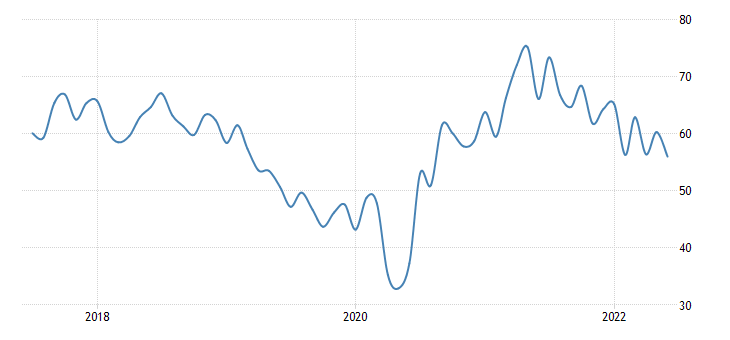

United States Manufacturing PMI

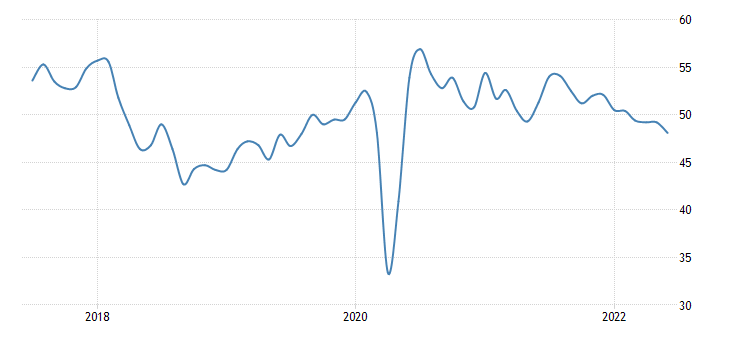

In the US according to ISM (new orders and employment went to the red zone) —

United States ISM Purchasing Managers Index (PMI)

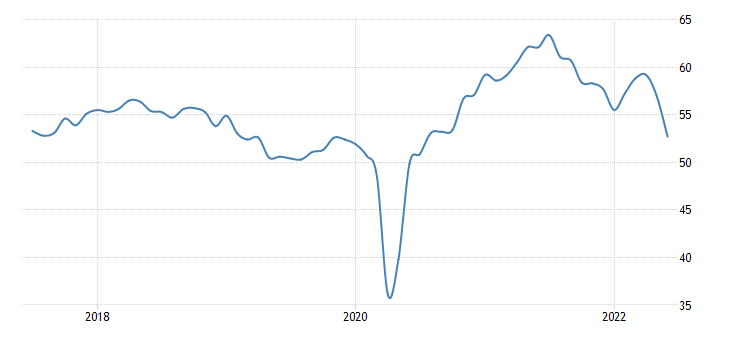

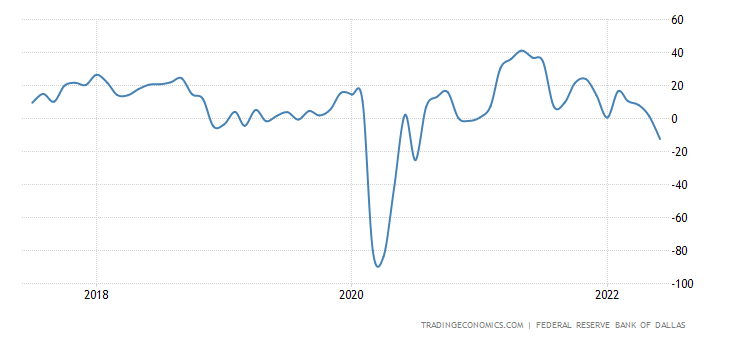

United States Dallas Fed Manufacturing Index is at its lowest level in 2 years and is heavily anchored in the red zone:

United States Dallas Fed Manufacturing Index

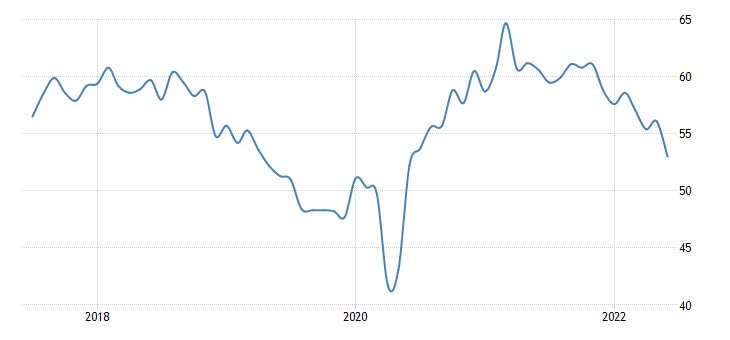

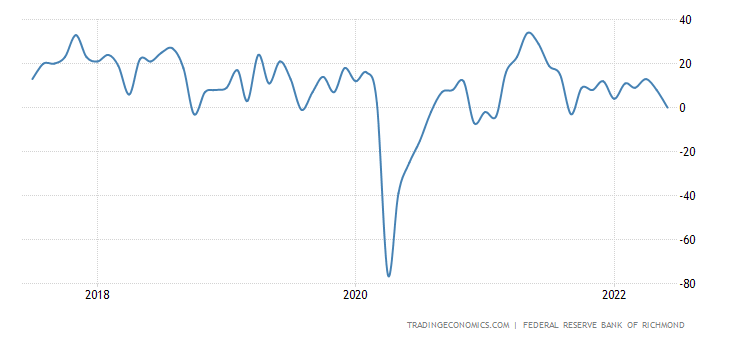

The same for the similar Richmond Fed index (Mid-Atlantic region of the USA):

United States Richmond Fed Manufacturing Index

The Chicago PMI (an indicator of business activity in the Midwest) shows a similar picture:

United States Chicago PMI

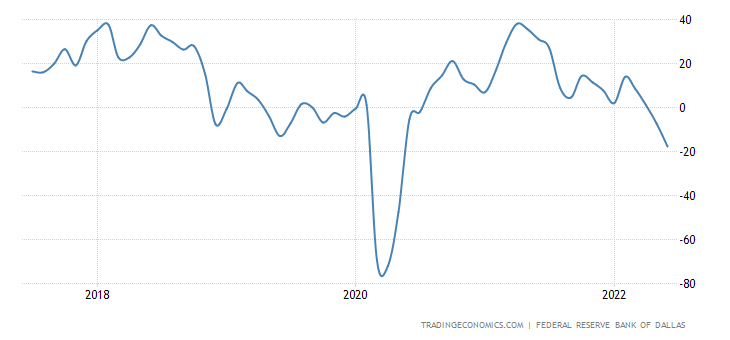

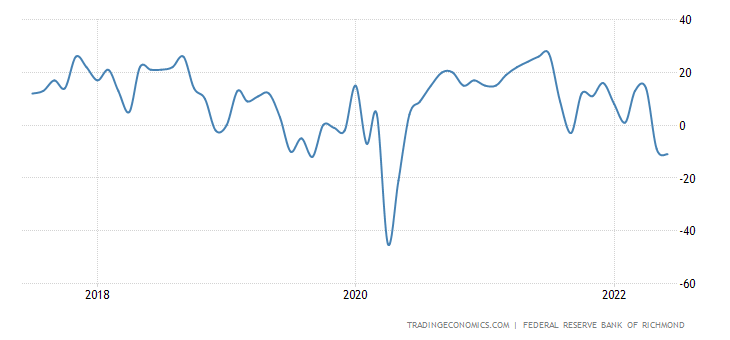

A similar story with the indicators of the service sector of the same regions:

United States Dallas Fed Services Index

United States Richmond Fed Services Index

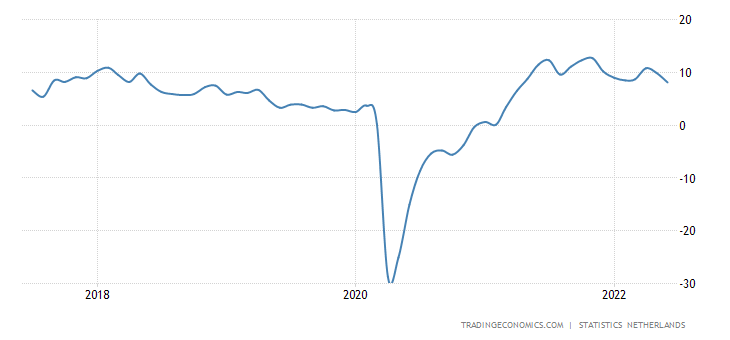

Business confidence in the Netherlands is the most stunted in 14 months:

Netherlands Business Confidence

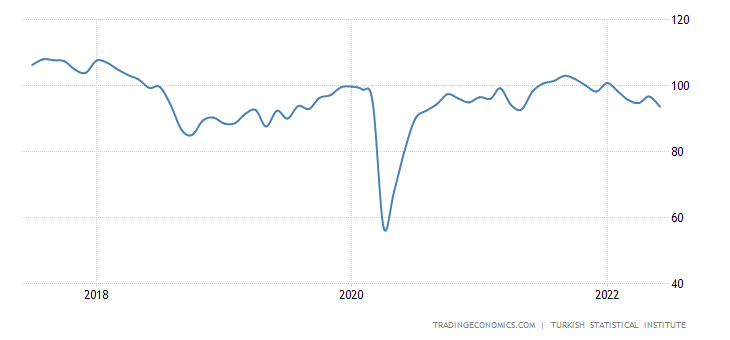

In Turkey — for 13 months:

Turkey Economic Confidence Index

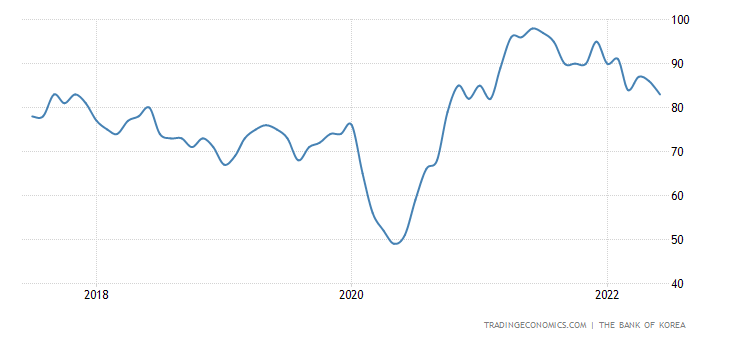

In South Korea — in 16 months:

South Korea Business Confidence

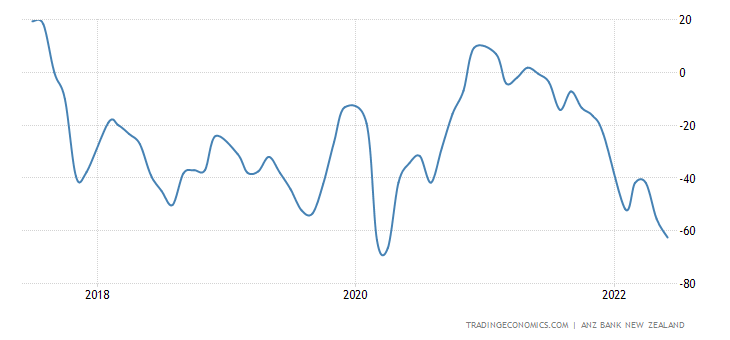

In New Zealand, in 26 months and approaching a record low:

New Zealand Business Confidence

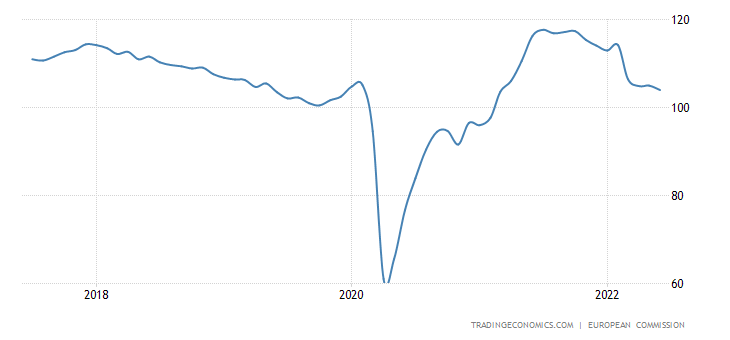

Economic sentiment in the Euro Area is at its lowest in 15 months:

Euro Area Economic Sentiment Indicator

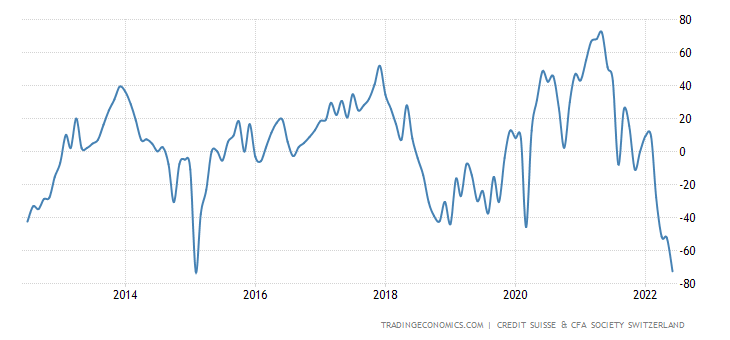

And in Switzerland since 2015:

Switzerland CS-CFA Society Economic Sentiment Index

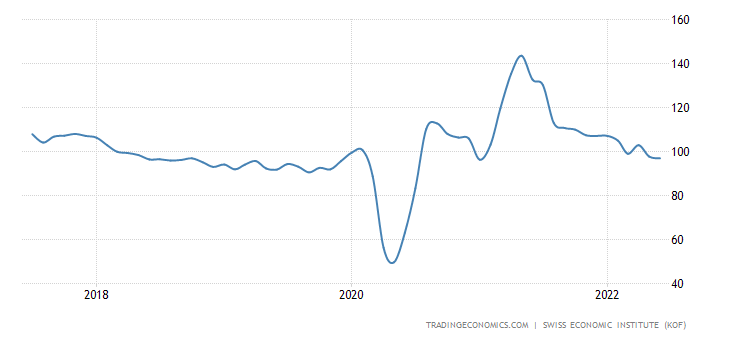

Swiss leading indicators hit 17-month trough —

Switzerland Business Confidence

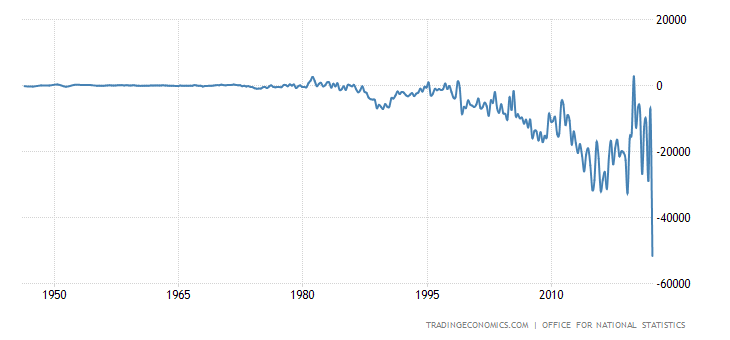

Britain’s current-account deficit is the highest in almost 80 years of observation:

United Kingdom Current Account

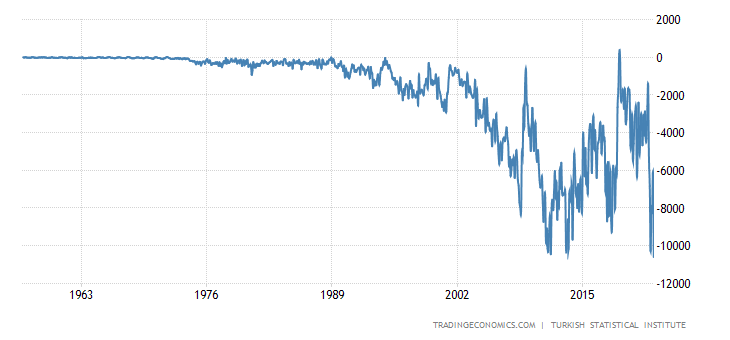

Turkey’s trade deficit is at its highest in 65 years of data acceptance:

Turkey Balance of Trade

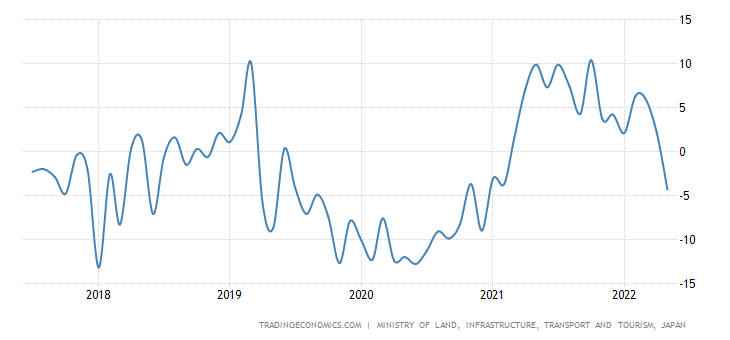

Japanese housing starts returned to negative annual values after 15 months:

Japan Housing Starts

Pending home sales in the US -13.6% per year — 12th consecutive negative and the worst performance in 2 years:

United States Pending Home Sales YoY

Housing prices in the top 20 cities in the US (S&P/CoreLogic/Case-Shiller survey) 21.2% a year have soared to a record high:

United States Case Shiller Home Price Index YoY

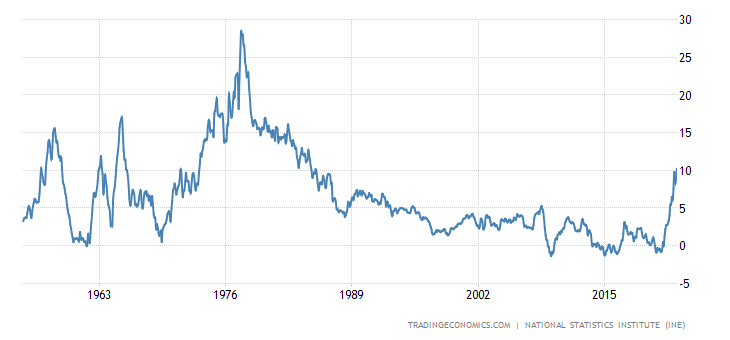

CPI (Consumer Price Index) of Spain +10.2% per year, topped since 1985:

Spain Inflation Rate

Spain Inflation Rate

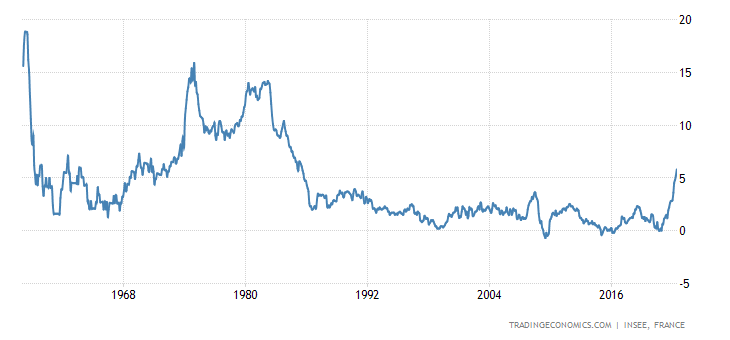

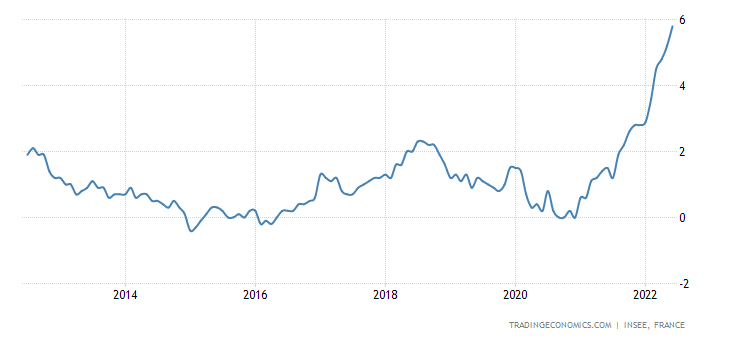

CPI of France +5.8% per year also reached the peak of 1985:

France Inflation Rate

France Inflation Rate

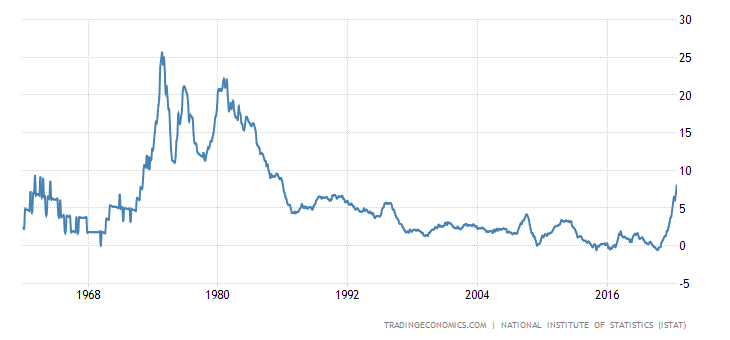

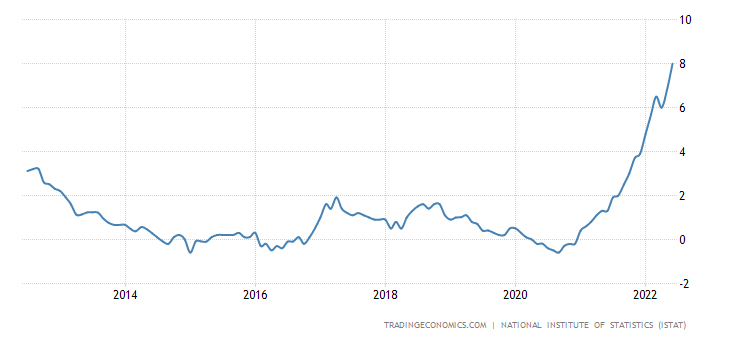

Italy’s CPI +8.0% per year has been at its highest levels since 1986:

Italy Inflation Rate

Italy Inflation Rate

The Euro Area CPI +8.6% per year set the record for 31.5 years of statistics:

Euro Area Inflation Rate

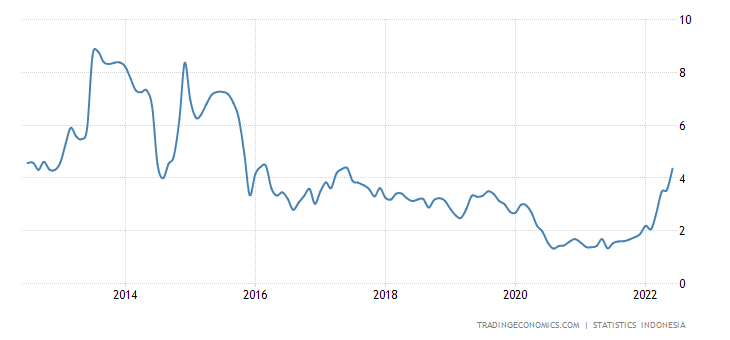

Indonesia’s CPI of +4.35% has climbed to the top since 2017, and food (+6.23%) since 2016:

Indonesia Inflation Rate

PPI (industrial inflation index) of South Africa +14.7% per year, also showed a record level, but only for 9.5 years of observation:

South Africa Producer Prices Change

Record high inflation expectations of Swedes for 36.5 years of data collection were seen (+10.6% per year):

Sweden Consumer Inflation Expectations

Sweden Consumer Inflation Expectations

The Euro Area household credit growth rate was +4.6% per year and peaked since 2008:

Euro Area Household Credit Growth

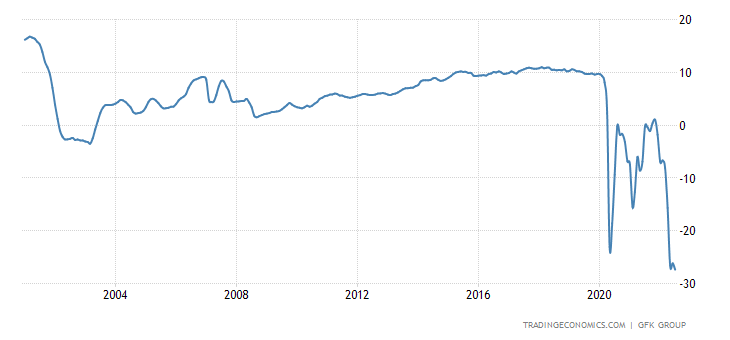

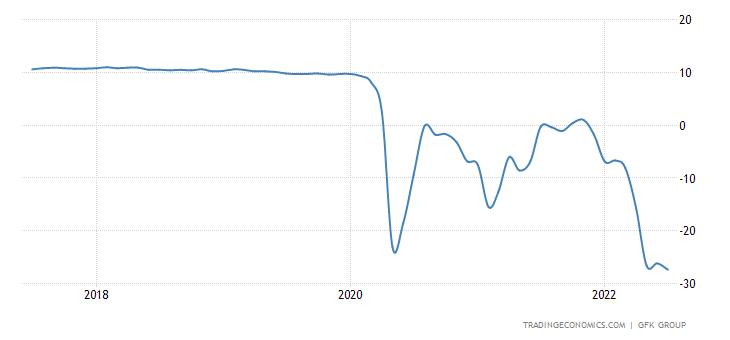

The sentiments of the Germans have refreshed the record low, as well as their expectations for their income:

Germany GfK Consumer Climate

Germany GfK Consumer Climate

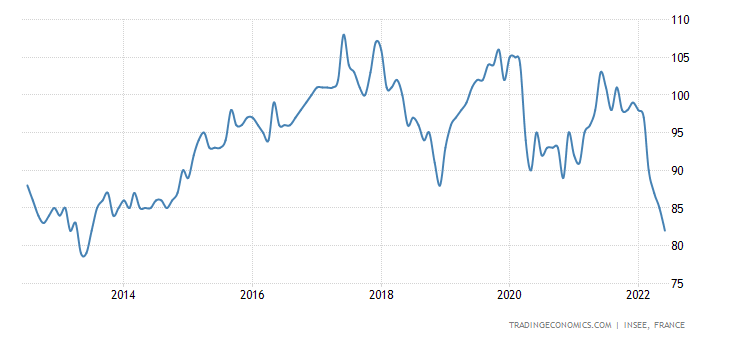

The French have been extremely pessimistic since 2013, when their confidence was the weakest in 50 years of observation:

France Consumer Confidence

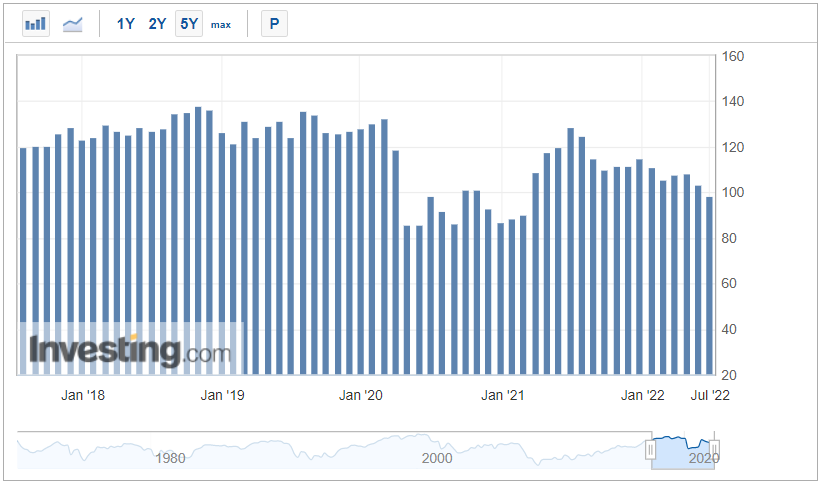

Americans have the lowest confidence in 16 months according to the Conference Board:

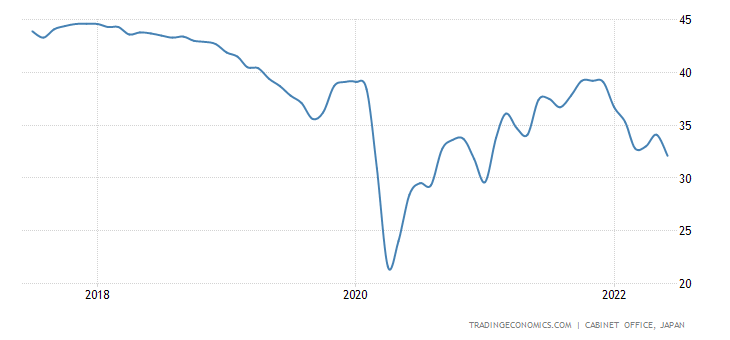

The Japanese — for 18 months:

Japan Consumer Confidence

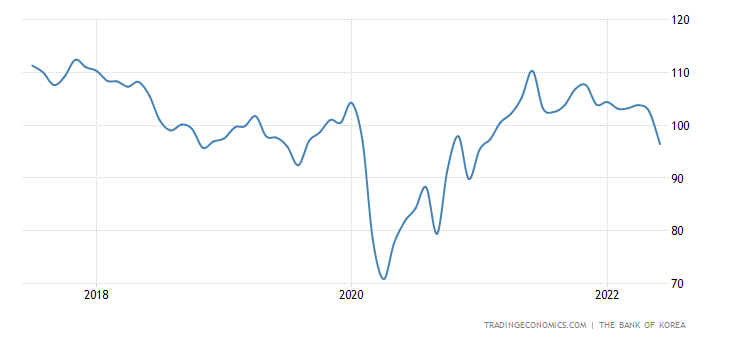

For South Koreans — in 17 months:

South Korea Consumer Confidence

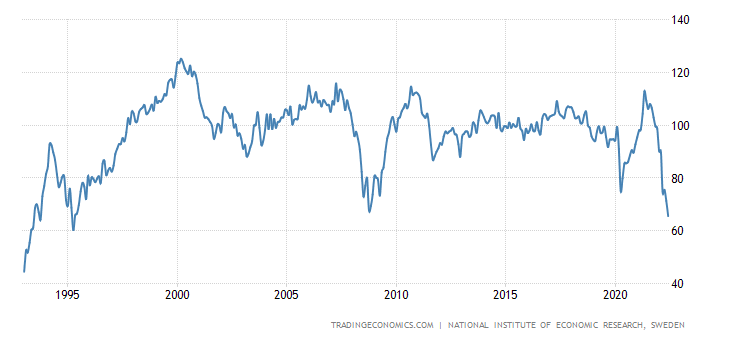

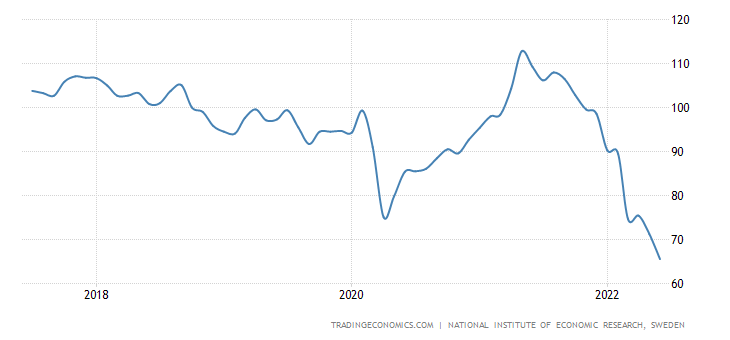

Sweden Consumer Confidence

Sweden Consumer Confidence

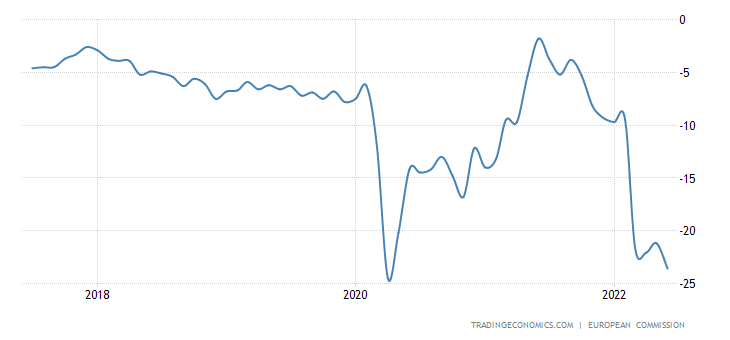

In the Euro Area, in 26 months and close to a trough:

Euro Area Consumer Confidence

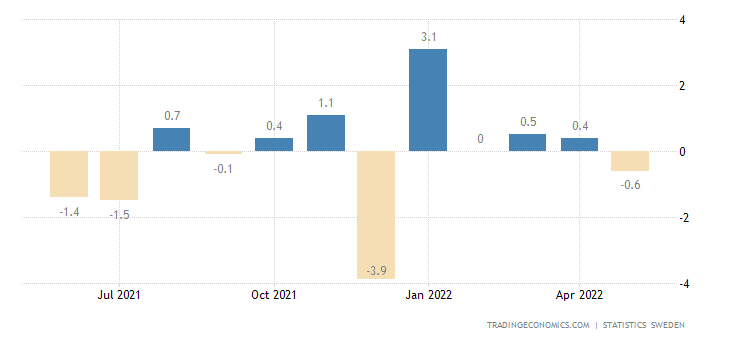

Retail sales in Sweden went down both for the month (-0.6%) and for the year (-2.3%):

Sweden Retail Sales MoM

Sweden Retail Sales YoY

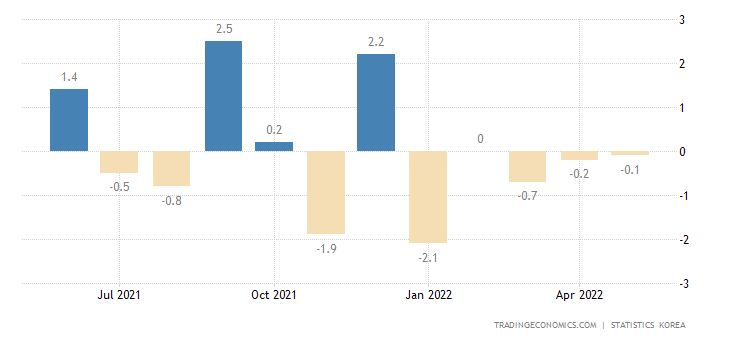

Retail South Korea -0.1% per month — the last monthly positive was six months ago:

South Korea Retail Sales MoM

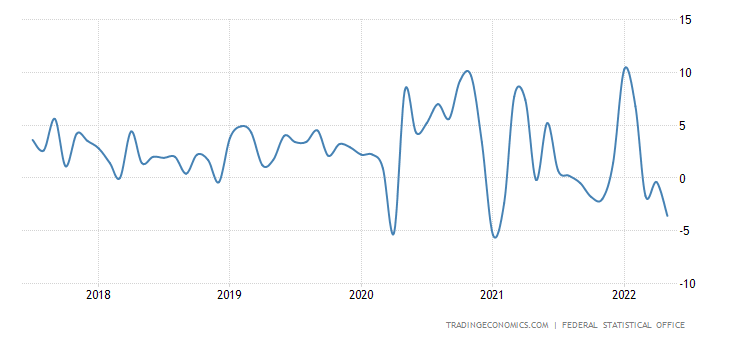

Retail sales in Germany -3.6% per year, that’s the 3rd consecutive negative:

Germany Retail Sales YoY

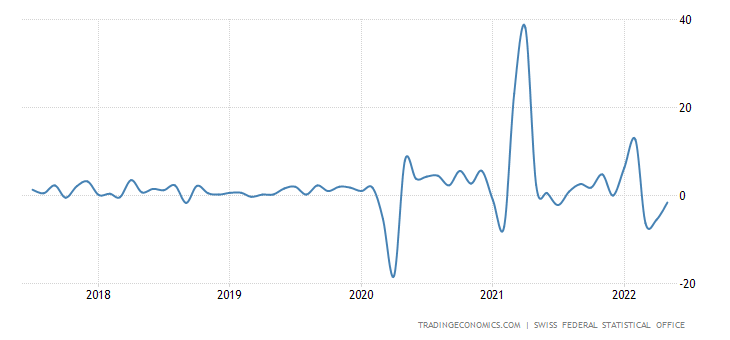

The 3rd annual negative is also seen in Switzerland (-1.6%) —

Switzerland Retail Sales YoY

The Swedish Central Bank hiked the rate by 0.50% to 0.75% and accelerated the pace of asset sales from the balance sheet.

Summary. The classic picture of a structural crisis — despite falling demand and significant monetary tightening by monetary authorities across countries — is one of rising inflation. The reason for this phenomenon — the monetary component of inflation, of course, is decreasing, but there is growth of the structural component — has been repeatedly explained by us, and the course of events is fully consistent with the Crisis of capital effectiveness theory (cf. M. Khazin, “Reminiscences about the Future”). And of course, whatever Powell says, there is no recession in such a situation and cannot be, it is a full-blown structural downturn.

This raises the main question: will monetary authorities in the world’s major countries and regions, especially the US and the EU, in such circumstances continue to tighten (i.e., raise the cost of borrowing) monetary policy? In theory, it was this kind of tightening that led to the stock market crash of 1929, but it was the collapse that preceded the structural crisis of early March-April 1930. Today, the structural crisis is already three quarters, and financial markets have not collapsed yet. This is natural, since the crisis was in the deflationary scenario then, and now in the inflationary scenario that supports speculative markets (although if inflation is taken into account on a real scope, the fall of these markets in recent months will be more significant than in nominal value). But the trouble is that monetary tightening may still lead to a crash.

At the same time, the political problems of the elite of the «Western» global project (which is now politically controlled by both the US and the EU) lead to the fact that no one really engages in economic policy. And the sanctions protection of Ukraine only speeds up the course of negative processes. The US elections could change that, but they won’t happen until November. At the same time, in order to really change something, it is necessary at least to introduce the topic of the real causes of the crisis into the public discourse. Whether the Republicans can do it fast enough is a big question.

However, our readers, unlike monetary authorities of major countries, are well acquainted with the causes of the crisis, which allows them to expect a good working week!