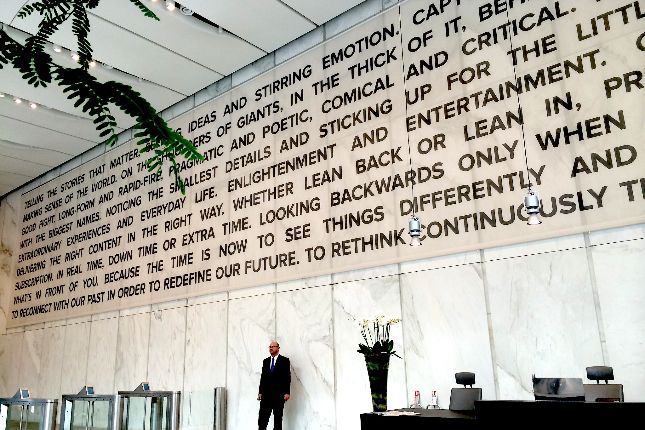

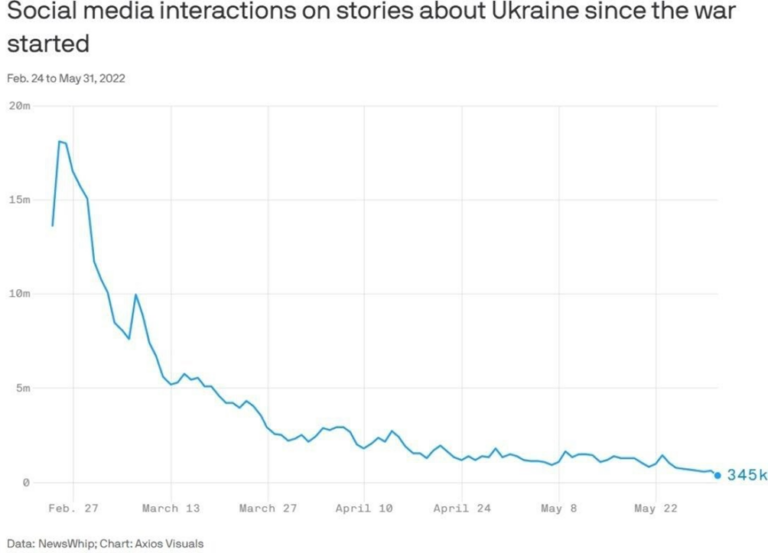

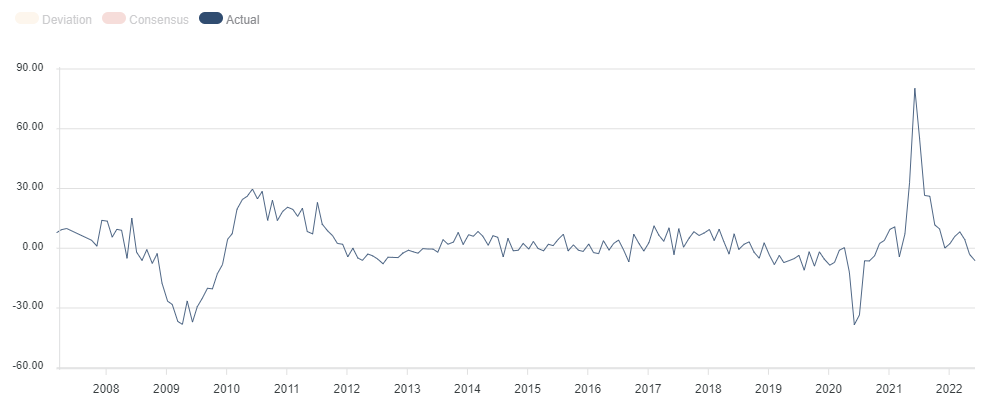

The main thing is that society is gradually coming to an understanding of the inadequacy of monetary authority, which is quite clearly imaged in the media. One of the main reasons for this was that the authorities gave the people initially a wrong explanation of the causes of inflation. Namely, “Putin is a trespasser”, which is clearly seen on the graph of the number of publications devoted to Ukraine since the end of February 2022:

The decline in interest in this issue clearly indicates that it will not work to put it up to Putin. And Janet Yellen, the United States secretary of the treasury, is making it worse. “There’s nothing to suggest a recession is in the works”, she said. And this is certainly true, because the term “recession” does not correspond exactly to the current situation. But the economic downturn, and a significant one, began to occur since the end of last year (that is, at least two quarters), and it is impossible to ignore it. In Yellen’s interpretation, “recession” and “structural recession” are identical events, and the public has already realized the fallacy of this notion.

Further, she assumes that oil prices are expected to reach new sky-high levels. And then, Yellen made a rather banal statement and said, “Inflation is a global problem. That’s where I come in. I guess I see the bulk of inflation as reflecting demand and supply factors.” Her speech, however, was somewhat weakened by her own apologies for missing the issue during her tenure at the Fed. She went on to elaborate on her unfortunate idea that it would be wise for a large number of countries to create a cartel to limit the price of Russian oil. Recall that cartels are banned by current American legislation, but the reminder of Putin’s influence on oil prices just causes Americans to giggle.

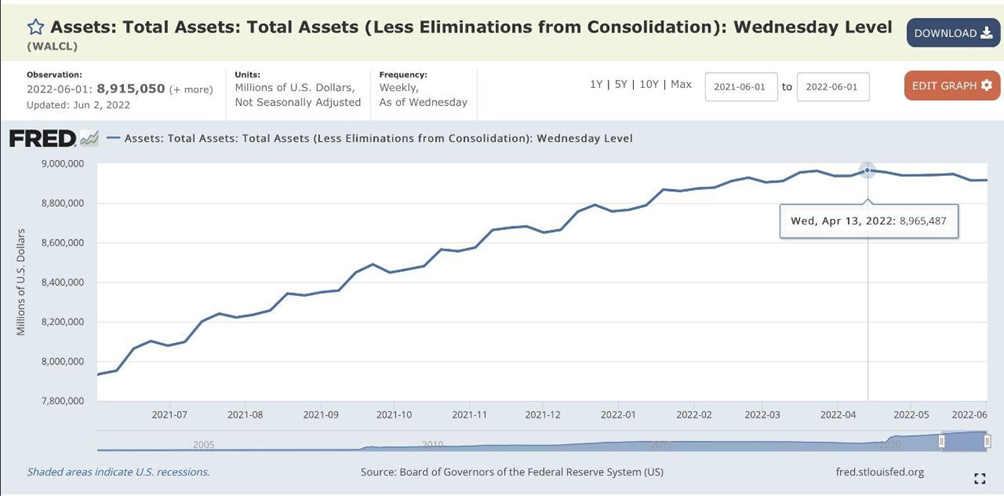

Moreover, “Is there a recession risk? Of course, there’s a recession risk,” the Treasury secretary said. “But is it likely? I don’t think so.” Then she added: “Cryptocurrencies can present serious risks to retirement savings. Cost-effectiveness has increased but does not stimulate inflation. I see the risks of boosting energy and food prices.” It seems really important that the US monetary authorities themselves were surprised by the rise in inflation — they began to tighten monetary policy and reduce the money supply:

They quite confidently raised the rate, and there was this confusion. In fact, Yellen’s naive “recession” rhetoric shows that they have no clear explanation for what happened. As opposed to our readers.

Macroeconomics

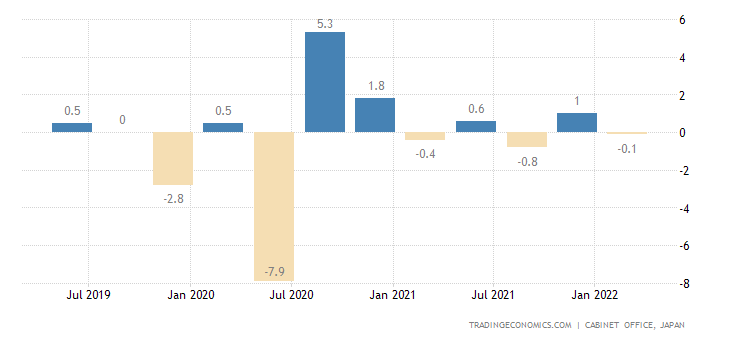

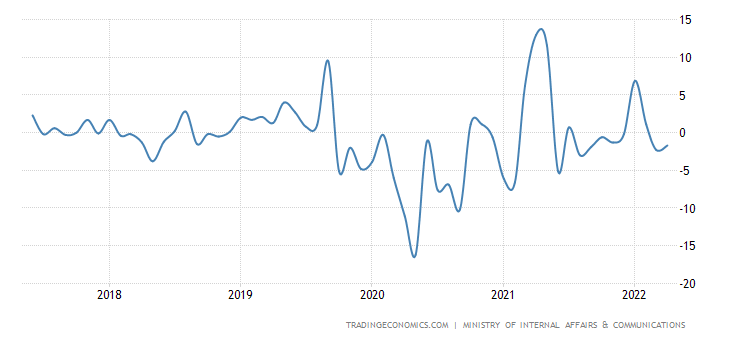

Japan’s GDP fails to reach a stable positive — it’s -0.1% per quarter again:

Japan GDP Growth Rate

This is why the annual growth was almost nullified (+0.2%):

Japan GDP Annual Growth Rate

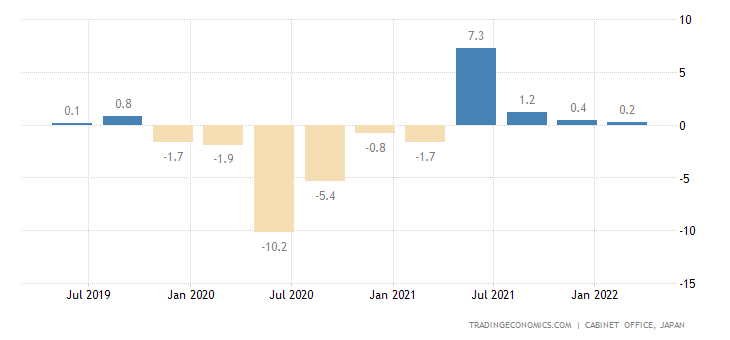

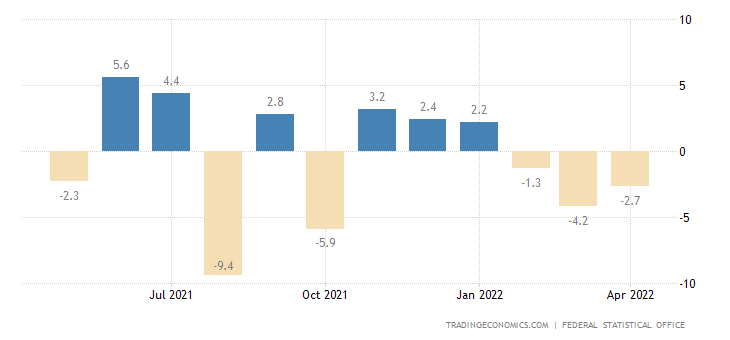

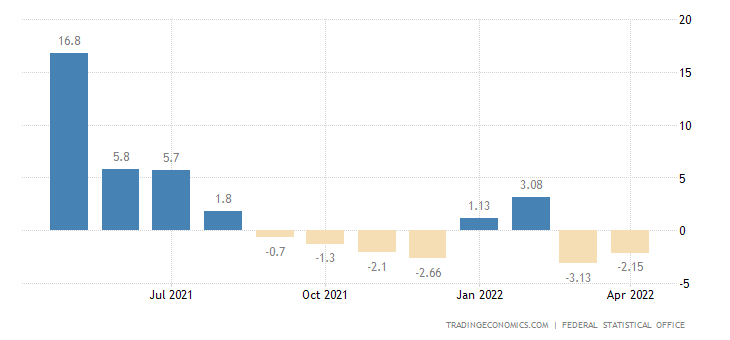

Industrial orders in Germany show a third consecutive monthly loss:

Germany Factory Orders

Why their annual decline (-6.2%) is the worst since September 2020:

And the annual production performance remains in the red for two consecutive months:

Germany Industrial Production

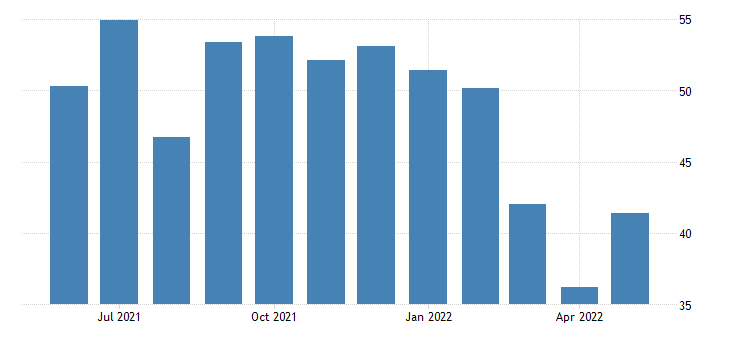

PMI of China’s services sector (Purchasing Managers’ Index, industry peer review, below 50 means stagnation and recession) is steadily hanging deep in the recession zone (41.4 points):

China Services PMI

In Australia, the same indicator also went into the red (49.2 is a seven-month trough):

Australia Performance Services Index

As well as the PMI of the construction sector in the Euro Area (also 49.2, this is a 15-month low):

Euro Area Construction PMI

UK services PMI is still in the growth zone (53.4), but the growth rate is the slowest in 15 months:

United Kingdom Services PMI

Recall again that the scale of any industry is taken in price terms (sales), so that against the backdrop of lowered inflation, it is not inconsiderably overcharged. So expert judgment is overly optimistic.

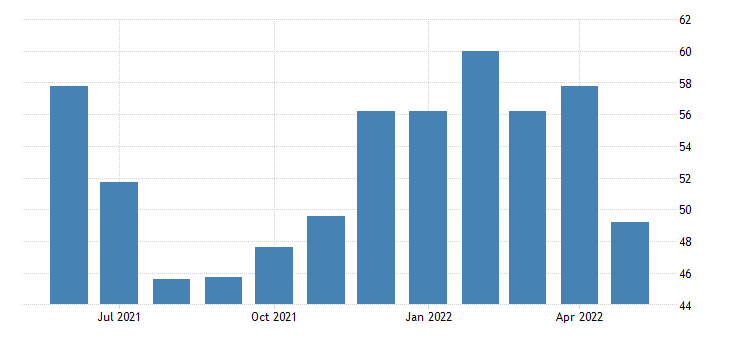

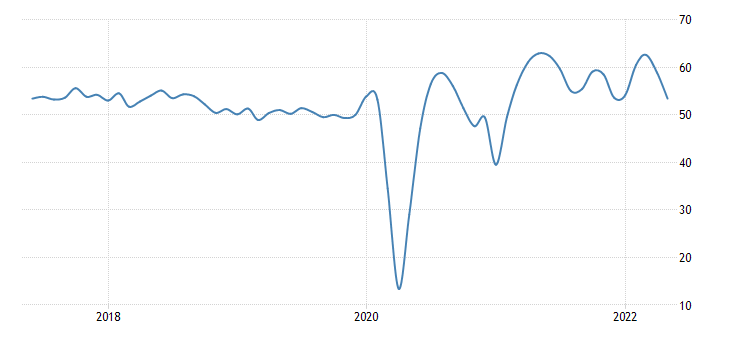

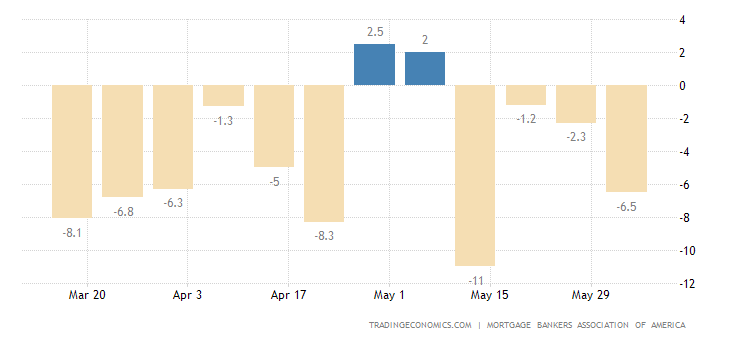

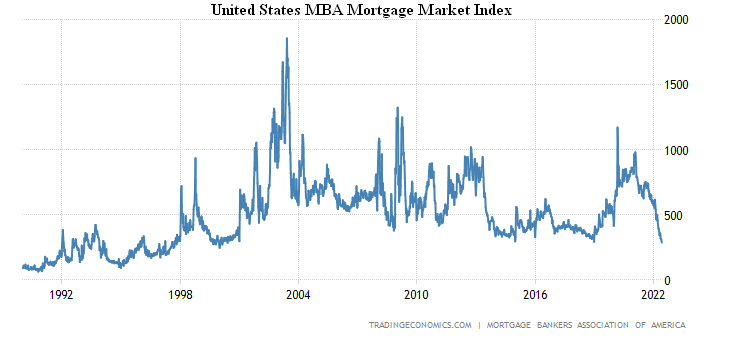

Mortgage applications in the US dropped down again (-6.5% per week):

United States MBA Mortgage Applications

After breaking the trough of 2018 and hitting a 22-year low:

The same situation is separately in the refinancing section:

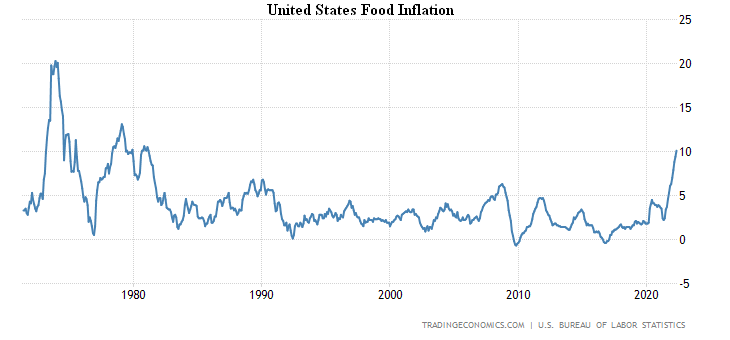

US CPI (Consumer Price Index) +8.6% per year is the highest since 1981:

According to the Melbourne Institute, Australia’s CPI is +1.1% per month, which was a record for 20 years of observations:

Annual growth is also record (+4.8%):

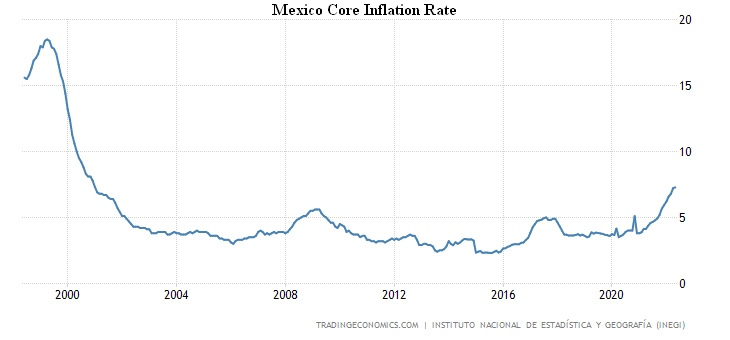

Mexico core inflation rate +7.3 per year is at its highest since the beginning of 2001:

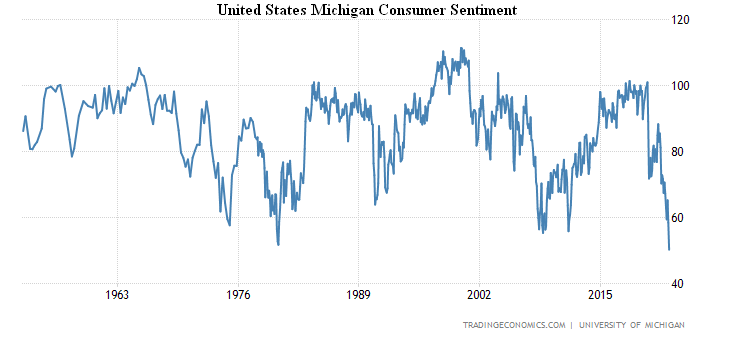

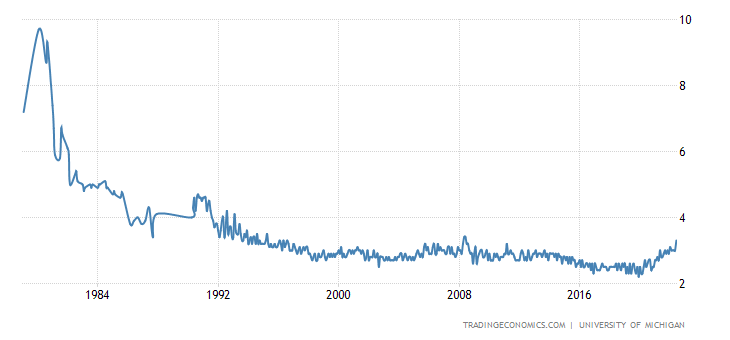

U.S. consumer sentiment, according to the University of Michigan, is the worst in 70 years of observation:

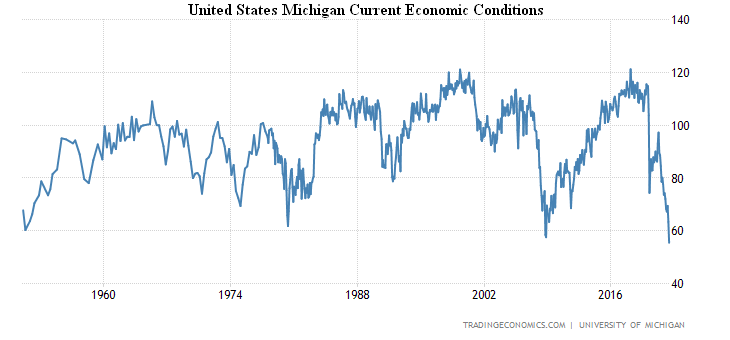

The same is true for their assessment of current economic conditions:

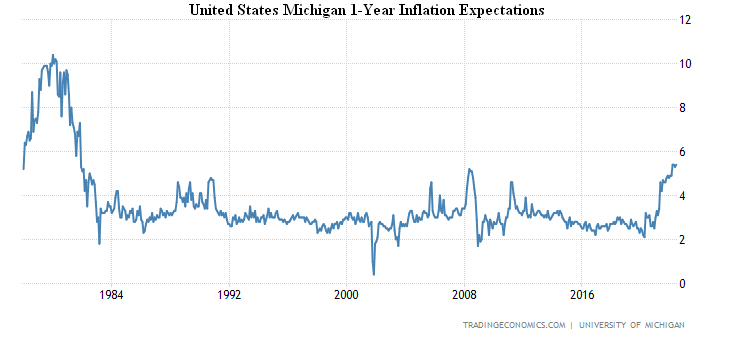

At the same time, annual inflation expectations returned to a 40-year high (+5.4%):

And 5-year inflation expectations renewed the peak since 2008:

United States Michigan 5-Year Inflation Expectations

Canada set a record for the new highest prices for 10-year government bonds, they are at their peak since 2011; in other countries there are also peak values, but usually since 2014/18:

Japanese household spending is anchored in the annual negative:

Japan Household Spending YoY

New Zealand manufacturing sales amounted -3.5% QoQ and -3.3% YoY:

New Zealand Manufacturing Sales

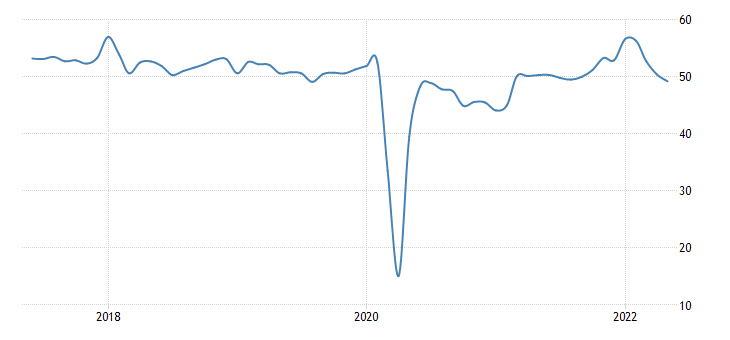

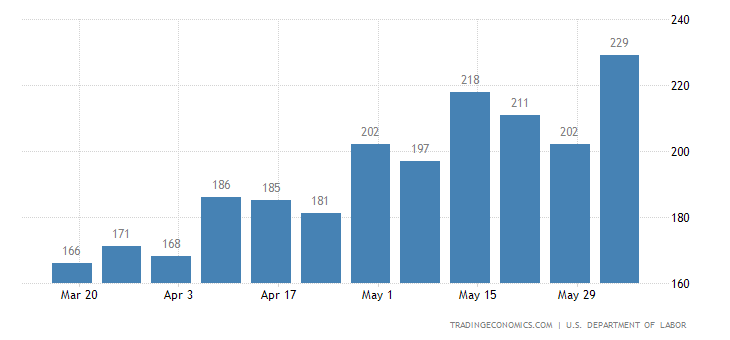

Initial jobless claims in the US reached a 5-month peak:

United States Initial Jobless Claims

However, given the distortions in labour statistics aimed at showing an optimistic picture, these data are of little use.

The Australian Central Bank hiked the rate by 0.50% to 0.85% and intends to tighten the policy further.

The Central Bank of India raised the interest rate by 0.5% to 4.9%, revised the inflation forecast upwards.

The ECB left the rate unchanged but is going to raise it by 0.25% in July and 0.50% in September. As a result, the stock markets in the EU countries started to crash, let’s see what happens next week.

The Bank of Russia cut the rate by 1.5% to 9.5%, promising further policy easing.

Summary

High inflation, which is also not shown in official figures (which limits wage growth), leads to lower bank incomes in both areas: corporate and personal insurance.

In theory, this looks less scary, but it means refinancing debt will be more and more difficult, and with rates rising, the amount of money that both corporations and households will be able to spend on consumption will start to go down seriously. Let me remind you that a decline in demand automatically exacerbates the structural crisis of the economy, which in our case means an increase in the structural piece of inflation.

This is precisely what the monetary authorities of the Western countries do not understand and, accordingly, cannot give a response appropriate to the situation. And indicators of rising prices in the energy sector are not Putin, these are restructurings of the economy. Gasoline prices in the US (all-time high):

US heating oil (same):

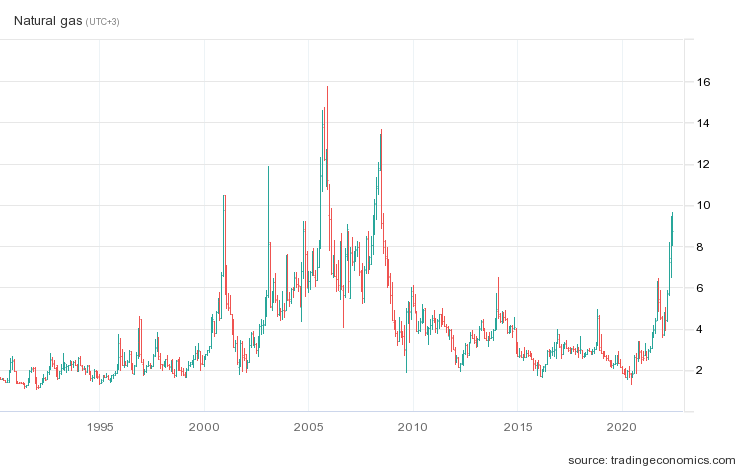

And natural gas in the US (peak since 2008):

We believe that the key to the discussion of current economic problems in the coming weeks will be a dispute between the monetary authorities, who will offer increasingly sophisticated explanations about the situation, and the opposition (in a broad sense) incriminating officials in lies and fraud. Perhaps if markets in the EU are hit hard enough, it may even lead to individual resignations. Not in the US, of course.