Speeches by the leaders of two of the three main countries in the world today: Putin and Biden, and the publication of a peace plan around Ukraine by China.

Why is it so important? The fact is that the inadequacy of the "old" Bretton Woods model is already clear to almost everyone, and the only question is who will be the first to offer some alternative and take the initiative in its implementation. In the US, an alternative model has been proposed ("industrialization of AUKUS") but has not yet been recognized in official policy. Accordingly, there were considerations that Biden might say something on this subject, at least in response to Putin.

Putin (who started first) quite directly began to talk about leaving the dollar zone, redistributing the main logistics areas, about, in fact, Russia leaving the system of Bretton Woods humanitarian standards (for example, in education). At the same time, he did not say anything about Eurasian integration, the post-crisis monetary system and other topical issues related to the division of the dollar system into currency zones.

In fact, this means that he has moved away from declaring a direct economic confrontation with the Bretton Woods elites and will expect a further weakening of the relevant institutions as the crisis develops. At the same time, one can make an assumption, based, among other things, on his previous speeches, that he proceeds precisely from the option of the collapse of a single dollar system into several currency zones.

In response to this, Biden should, theoretically, either offer his own version of the collapse of the Bretton Woods system (note that AUKUS – this is exactly within the framework of Putin's approach – the dollar currency zone) or explain how the United States will stop the crisis processes. Neither option was proposed, from which one can most likely conclude that the current US leadership has no idea how to stop the crisis and what to do in the process of its intensification.

Theoretically, this was already evident from the message to Congress two weeks earlier, but then it was still possible to assume that Biden and his team simply did not consider the economic crisis a serious enough topic for discussion. Inflation, according to Biden, has almost been overcome. Soon, the monetary authorities will cope with the fall in aggregate demand and employment at record highs – what more could you want?

In reality, everything is not so good at all (see the next section of the Review), and the whole world was waiting for what the answer to Putin would be, in essence, in the financial and economic sphere. As already mentioned, there was no response.

China talked more about diplomacy. He also practically refused to answer Putin (to support or refute his theses). Still, the fact that Biden evaded an answer as part of a potential economic discussion was not emphasized. Since it is impossible to assume that China's leaders do not understand the complexity of the economic situation, it is not yet ready to take the lead in the economic sphere. This means that all negative global economy and finance processes will continue unhindered.

Macroeconomics

Argentina’s GDP went into annual minus for the first time in almost 2 years (-1.2% per year):

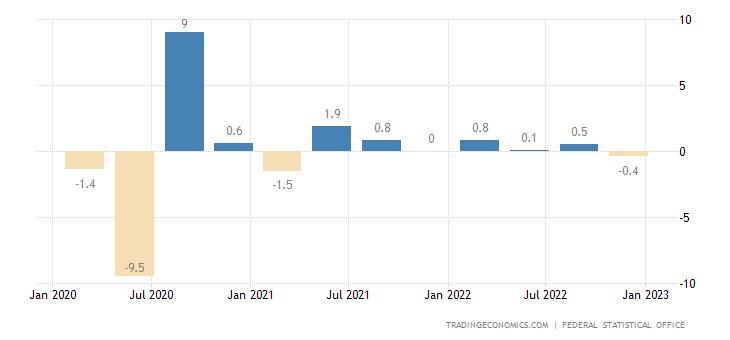

The same in Germany, only in quarterly dynamics (-0.4% per quarter):

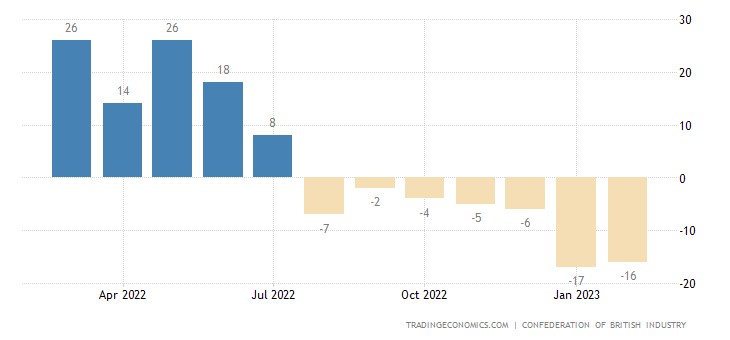

UK industrial orders balance in negative zone for 7 consecutive months:

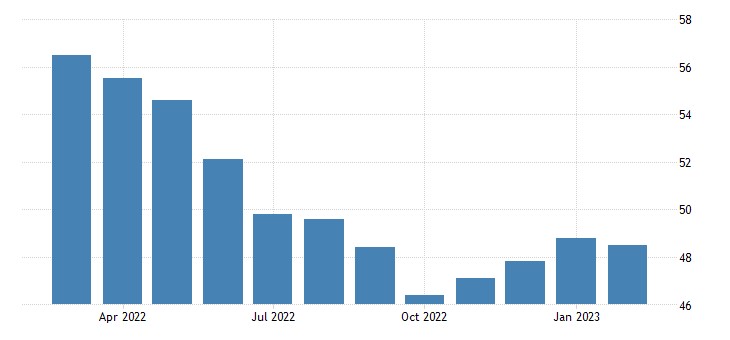

PMI (expert index of the state of the industry; its value below 50 means stagnation and decline) of the Japanese industry 47.4 – at least 2.5 years, and before that it was only in 2012:

In the Eurozone, this indicator has been in the recession zone for 8 months in a row:

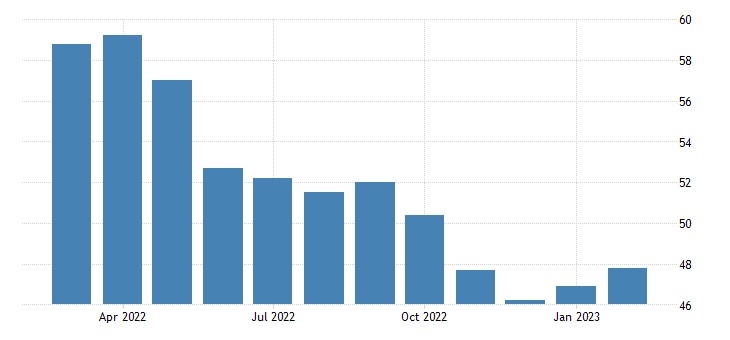

And in the USA – 4 months in a row:

Business in South Korea has been pessimistic since 2020, and before that, since 2009:

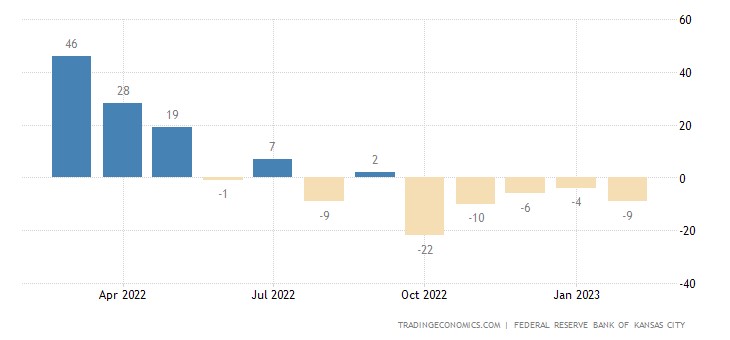

Activity in the Kansas Fed zone in the US has been in the red for 5 consecutive months:

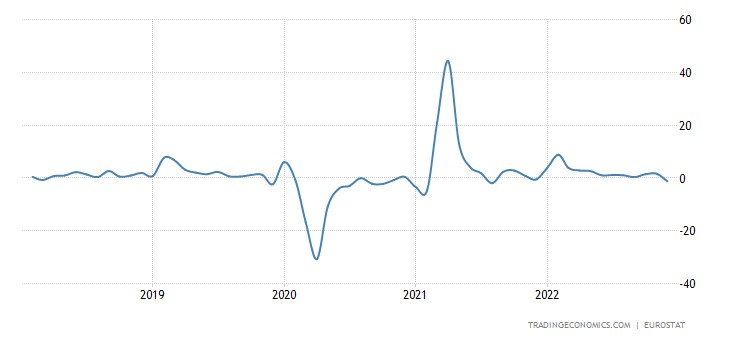

Construction activity in the eurozone -2.5% m/m (minimum for 27 months) and -1.3% y/y (1st minus for the year):

US existing home sales have been falling for 12 straight months and are nearing 2008/11 lows:

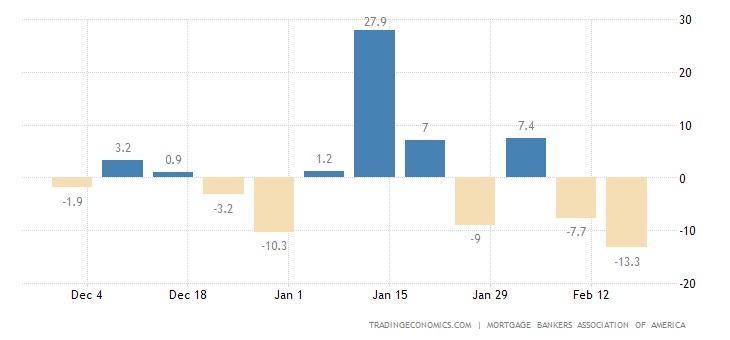

Mortgage applications in the US -13.3% in a week after -7.7% a week earlier:

At the same time, loans for the purchase of housing (and not for refinancing) -18.1% per week to a minimum since 1995:

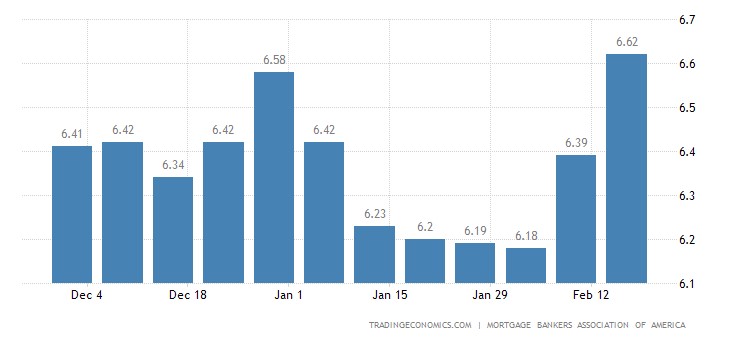

This is despite the fact that the loan rate, although it is growing again, is still at 0.5% of the autumn peaks:

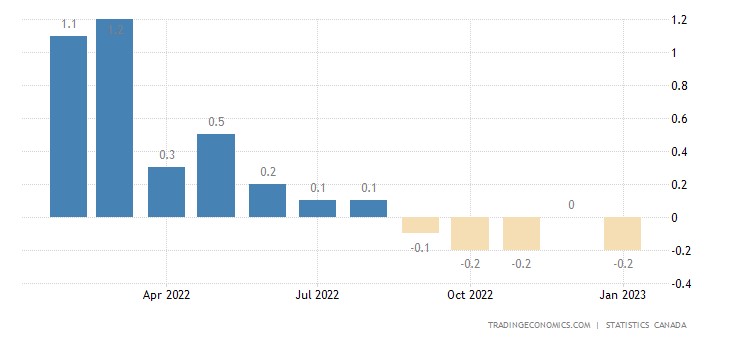

New home prices in Canada have been falling for 5 months in a row:

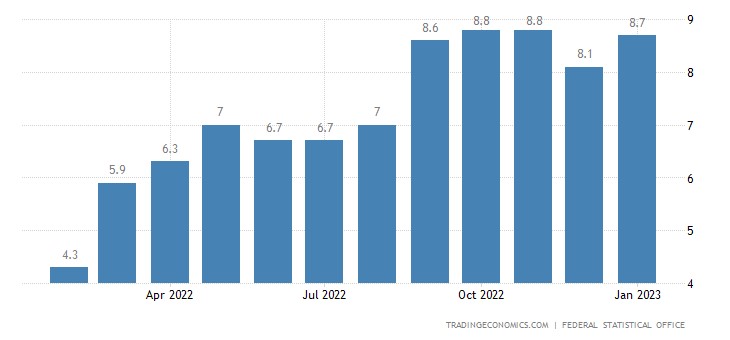

CPI (Consumer Inflation Index) Germany +8.7% per year after +8.1% a month earlier – only 0.1% from the 70-year peaks in October-November:

And “net” (minus the highly volatile components of food and fuel) inflation has renewed its 30-year high (+5.6% per year):

“Net” Eurozone CPI (+5.3% per year) record for 32 years of observation:

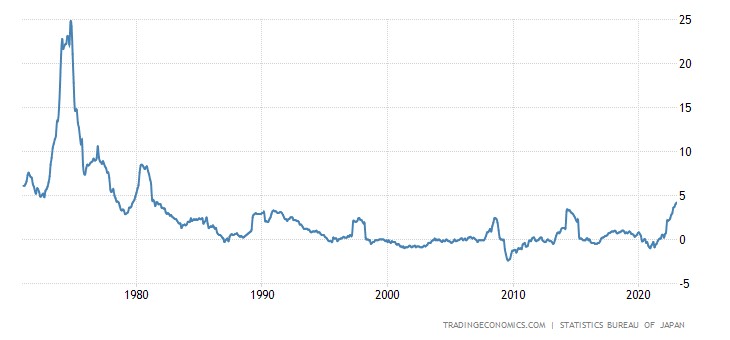

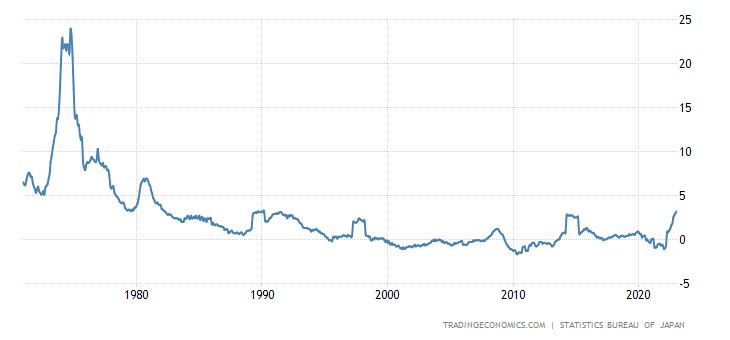

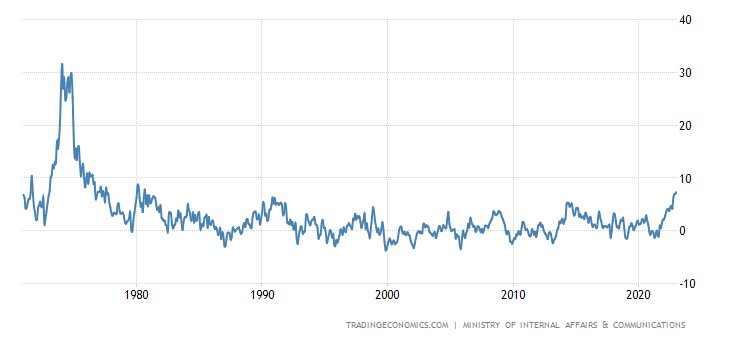

CPI Japan +4.3% per year – the highest since 1981:

Prices without fresh food have the same peak (+4.2% per year):

And to the same 42-year peaks, inflation broke through without food and fuel (+ 3.2% per year):

Moreover, food prices (+7.3% per year) are already near the top of 1980:

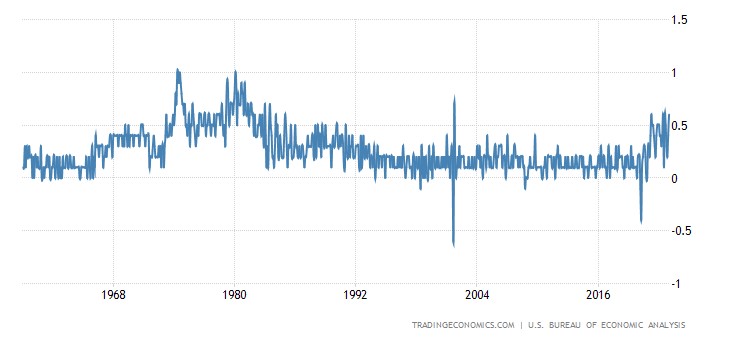

Net consumer basket price index (PCE) in the US +0.6% per month – a repeat of the peak since 2001 (due to terrorist attacks); higher numbers were only 40 years ago:

These figures show that our assumption, expressed in the previous review, that the period of inflation decline is ending has a right to exist. Since February data for the US will be only three weeks away, we will monitor the situation, but waiting for an exact answer will take some time. In any case, the published minutes of the last meeting of the US Federal Reserve showed a reluctance to quickly roll back monetary tightening. That in itself is a signal that the situation with inflation is not the best.

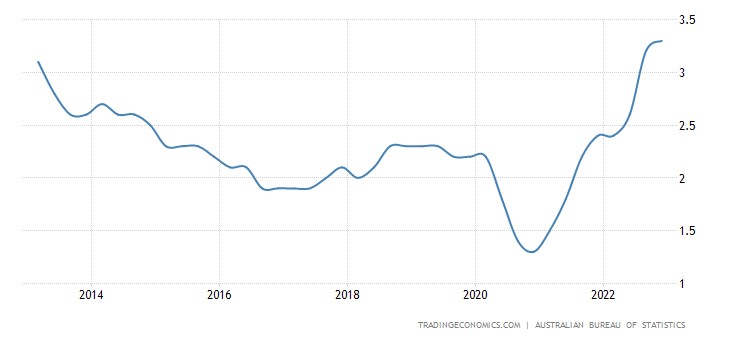

Annual wage growth in Australia (+3.3% per year) is the highest in 10 years:

The Central Bank of China left the previous monetary policy like the Central Bank of South Korea. The Central Bank of Turkey, on the background of a catastrophic earthquake, reduced the interest rate by 0.5% to 8.5%. The Central Bank of New Zealand raised the rate by 0.50% to 4.75%, promising to continue tightening.

Main conclusions

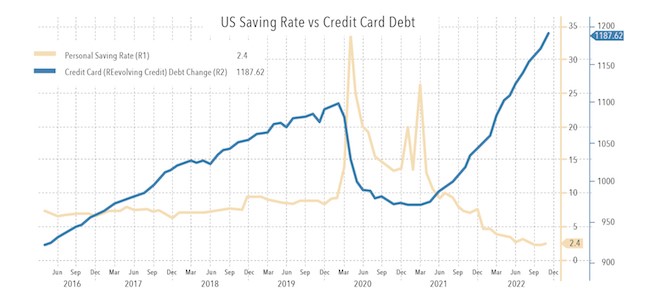

The US monetary authorities do not want to ease monetary policy, while industry in developed countries is shrinking, the construction sector in the US is in a deep recession, prices are clearly on the rise, and aggregate private demand is declining (especially if we take into account the real level of inflation). The latter, by the way, is supported, in the United States at least, in many ways, by an increase in the loan burden and a decrease in savings:

These negative processes will inevitably continue (with the exception of inflation growth, since its growth is still an assumption, although it is very likely) if the easing of monetary policy is not started. At least in the form of supporting household demand.

The trouble is that even such support, not to mention a rate cut or an increase in the monetary base, will cause a sharp increase in inflation. Despite the fact that even now, after a year and a half of raising the rate in the United States (and at a record pace in history), it is three times more than the US monetary authorities would like. So Biden's silence is largely due to objective reasons.

Another thing is that the political situation urgently demanded (and continues to demand) from Biden to decide on economic policy. This was not done, which means a serious downgrading of the "Biden team" within the framework of the US political processes, but this issue is already beyond the scope of macroeconomic reviews.