Well, there is two news. Although it’s completely different, both of it have one important consequence, which allows it to be mentioned in this section. The first is the increase in rates by the central bank immediately by 0.75%, to 1.25%. Actually, given the assessment that is taking place in the EU today, there is nothing surprising in this, something else is important here. This rate hike suggests that even the hard-nosed ECB leadership, which has watched inflation drop to record levels for many months, has finally acknowledged that something unusual is happening is not supported by theory.

Of course, such an increase is not enough, if, of course, we set ourselves the goal of reducing inflation to acceptable levels.

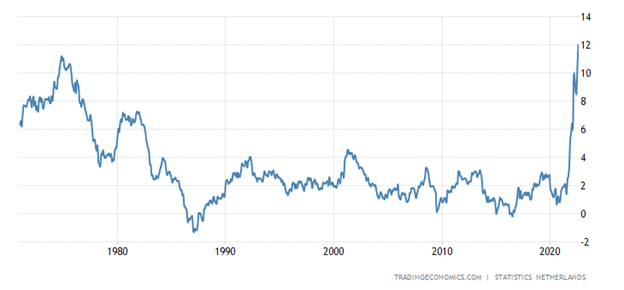

Eurozone CPI +9.1% per year – a record for 32 years of observations:

Euro Area Inflation Rate

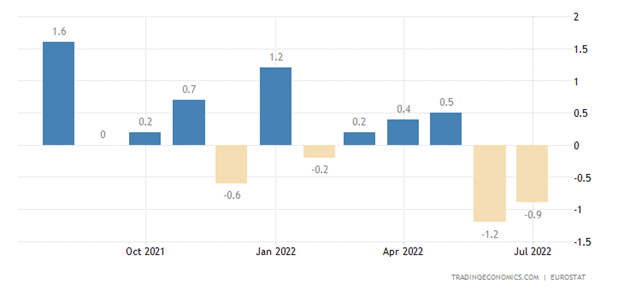

“Net” CPI +4.3% per year is also a record for 26 years:

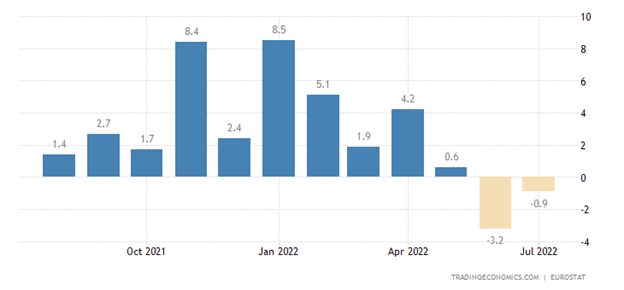

Eurozone PPI +37.9% per year – a record for 41 years of data collection:

Euro Area Core Inflation Rate

Euro Area Producer Prices Change

Moreover, based on the concept of a structural crisis, it can be said with certainty that this is generally impossible. But the leadership of the ECB proceeds from liberal economic theory, which does not see the structural causes of the crisis and, accordingly, the structural component of inflation. And for this reason, it is struggling with a purely monetary phenomenon.

As the experience of the United States has already shown, the rate hike does indeed reduce the monetary component of inflation, but at the same time increases the structural one. Accordingly, there will be no significant effect if the situation does not worsen at all. But judging by the actions of the ECB and Fed management, as well as the EU and US monetary authorities in general, they continue the logic of tightening monetary policy with the appropriate effect.

The second news is the death of Queen Elizabeth II of Great Britain. Formally, this news is not economic, but in reality, everyone understands that London’s policy may fundamentally and radically change as a result. And Great Britain is one of the three subject players on the pan-European field (the other two are Russia and the Vatican, understood as the coordinator of the old landed elites).

As an example, we can cite an analysis proceeding from the theory of Power. Johnson’s resignation (which he was actively forced by certain groups in the British elites) can be seen as the elimination of a strong player on the eve of the change of the monarch. Johnson is not only a person who has been personally playing politics at the world level for four years now, but also a part of the British establishment from the moment of birth (even a distant relative of the Queen according to unofficial information). Unlike Liz Truss, who has a fairly simple origin.

Johnson’s resignation not only shows that he has been removed from the most relevant alignments, but also that the group in the British elite that exercises real control after the death of the Queen is not oriented towards the Tory (Conservative) party. And, accordingly, to the policy of sharp confrontation towards Russia including the sanctions war, which was led by Johnson.

Note that this does not mean at all that they will not continue in terms of the sanctions war. But, with a high probability, this particular policy will be built into a completely different context, including the economic one. So, we are very likely to face a major change in UK policy and in the very near future the contours of this policy will begin to emerge.

In other words, both events can be seen as the threshold of major changes in world politics and economics. And these changes may begin in the coming weeks.

Macroeconomics

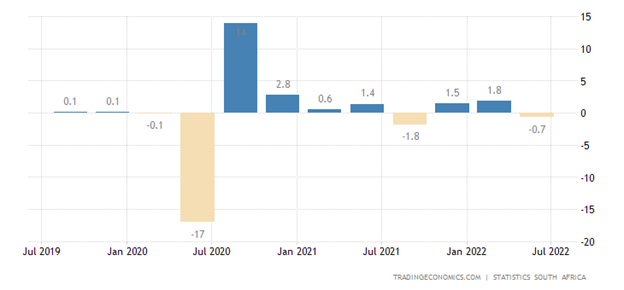

South African GDP -0.7% per quarter:

South Africa GDP Growth Rate

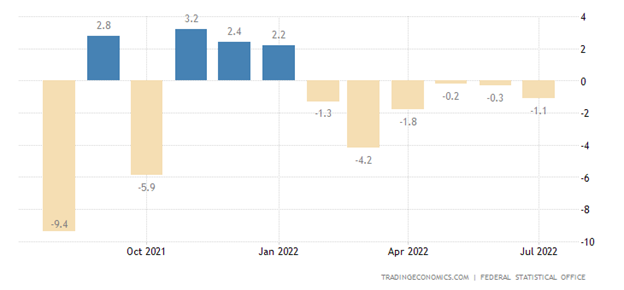

German factory orders -1.1% m/m – 6th negative in a row:

Germany Factory Orders

And -13.6% per year – not counting 2 months of covid failure in 2020, this is the bottom in 13 years:

Germany Factory Orders n.s.a. (YoY)

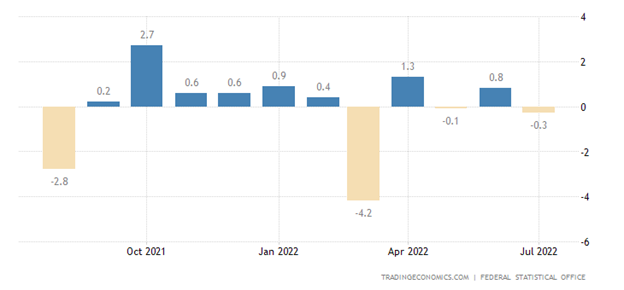

Industrial production in Germany -0.3% per month:

Germany Industrial Production MoM

And -1.1% per year – the 5th negative in a row:

Germany Industrial Production

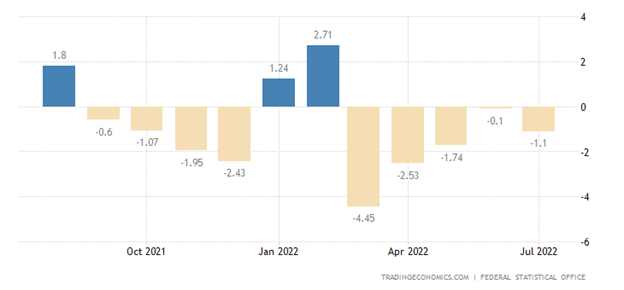

Industrial production in France -1.6% per month – the worst dynamics in 1.5 years:

France Industrial Production MoM

And -1.2% per year – the 8th minus for the last year:

France Industrial Production

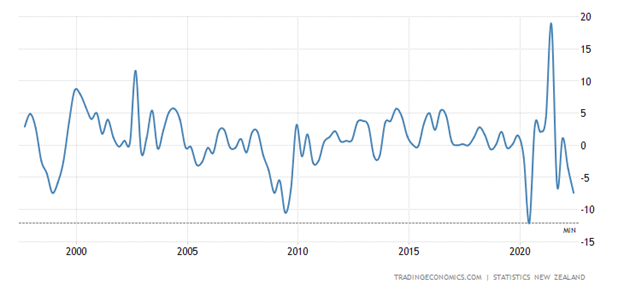

New Zealand manufacturing sales -7.4% per year – apart from the covid dip, bottom since 2009:

New Zealand Manufacturing Sales

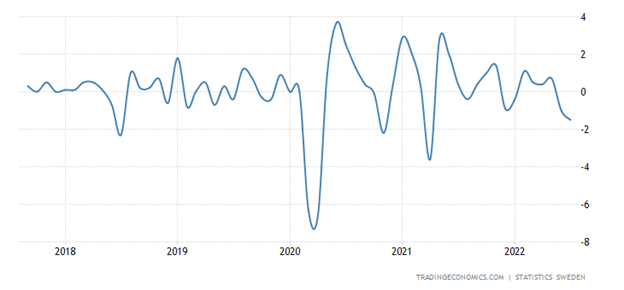

Production in the construction sector in Sweden -8.7% per year – the worst dynamics in 10 years:

Sweden Construction Production Value Index YoY

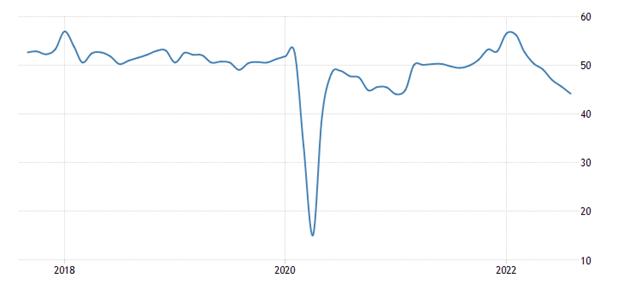

Construction PMI (an expert index describing the state of the industry; its value below 50 means stagnation and recession) of the eurozone is the weakest in 19 months and far in the recession zone (44.2):

Euro Area Construction PMI

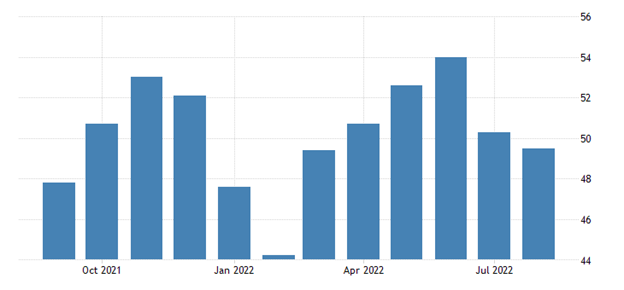

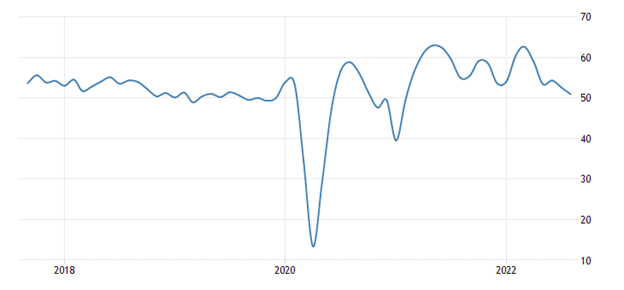

PMI of the service sector of Japan for the first time since March went into a recession zone (49.5):

Japan Services PMI

In Germany (47.7) it has been there for 2 months in a row and is already at the bottom for 1.5 years:

Germany Services PMI

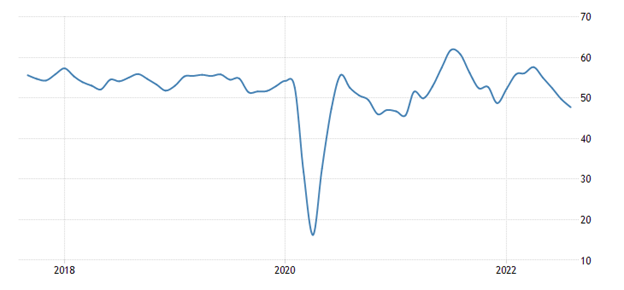

As in the euro area as a whole (49.8):

Euro Area Services PMI

In Britain, there is still a stagnation area (50.9), but also a minimum since February 2021:

United Kingdom Services PMI

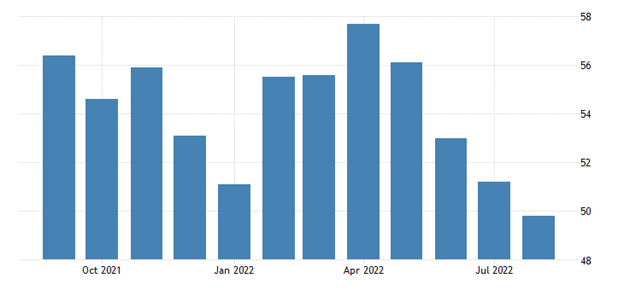

US in deep recession (43.7) and worst reading in 27 months:

United States Services PMI

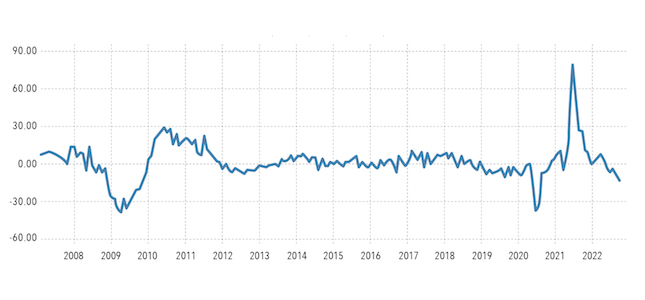

Eurozone investor confidence from Sentix (the index is calculated based on the results of a survey of investors and leading Eurozone analysts; its value above zero indicates the prevalence of optimism, below zero – the prevalence of pessimism) is the worst in 28 months and the anti-records of 2020 and 2008:

Eurozone Sentix Investor Confidence

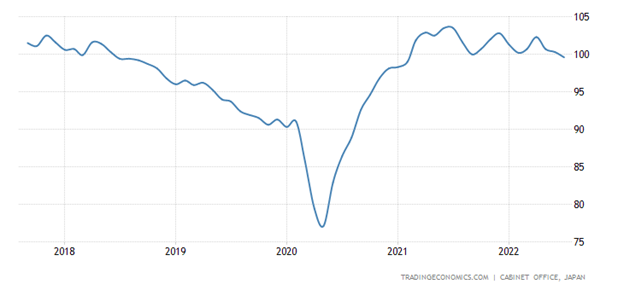

Leading indicators in Japan are at their lowest in 1.5 years:

Japan Leading Economic Index

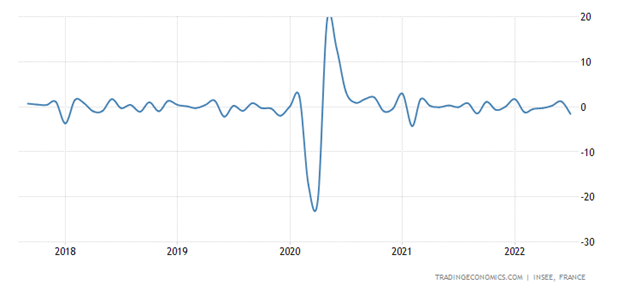

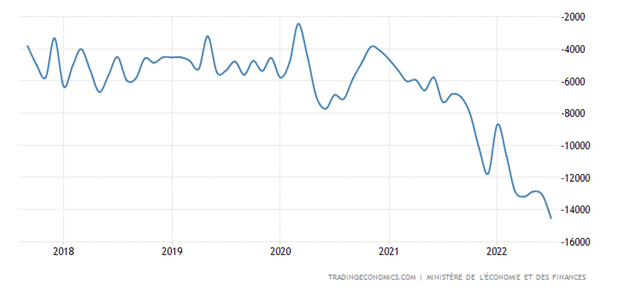

France’s trade deficit is on record:

France Balance of Trade

RMB loans in China +10.9% per year is a 20-year low:

China Outstanding Yuan Loan Growth

Whereas in India, the same figure is the highest for 9 years (+15.5% per year):

India Bank Loan Growth

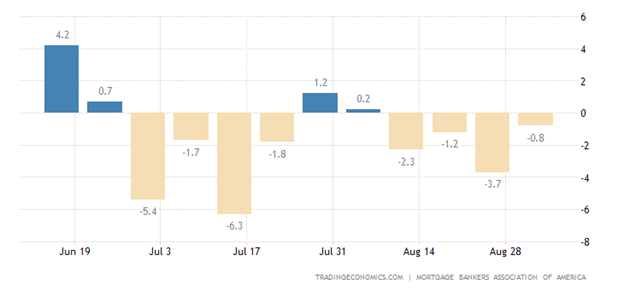

US Mortgage Applications Fall 4 Weeks in a Row:

United States MBA Mortgage Applications

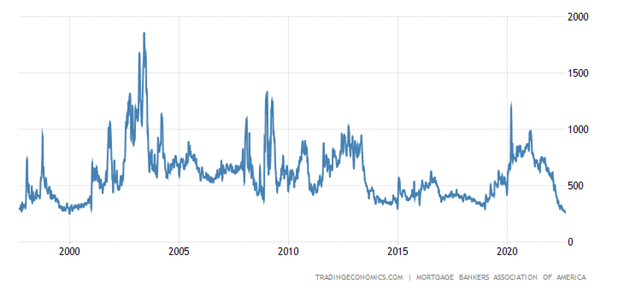

And again, updated the 22-year low:

United States MBA Mortgage Market Index

Since the loan rate of only 0.04% fell short of the 14-year peak in mid-July:

United States MBA 30-Yr Mortgage Rate

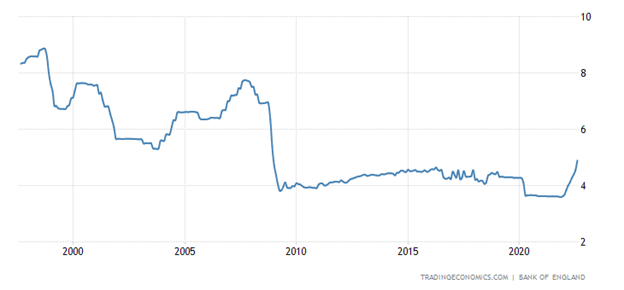

And in Britain, the mortgage interest rate in August confidently updated the 14-year high:

United States MBA 30-Yr Mortgage Rate

And in Britain, the mortgage interest rate in August confidently updated the 14-year high:

United Kingdom BBA Mortgage Rate

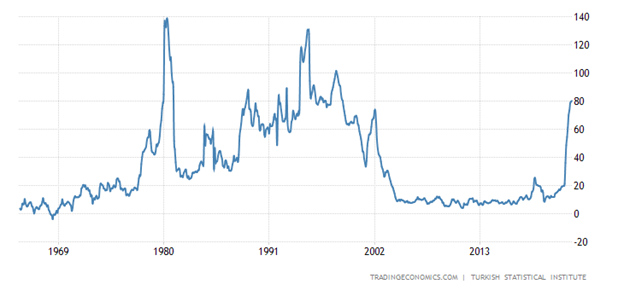

CPI (Consumer Inflation Index) Turkey +80.2% per year – maximum since 1998:

Turkey Inflation Rate

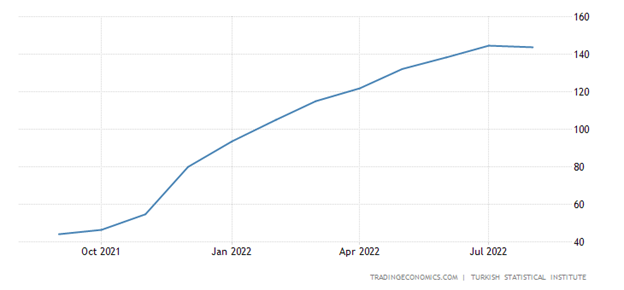

But its PPI (industrial inflation index) has already slowed down a little – to + 143.8% per year after a record + 144.6% earlier:

Turkey Producer Prices Change

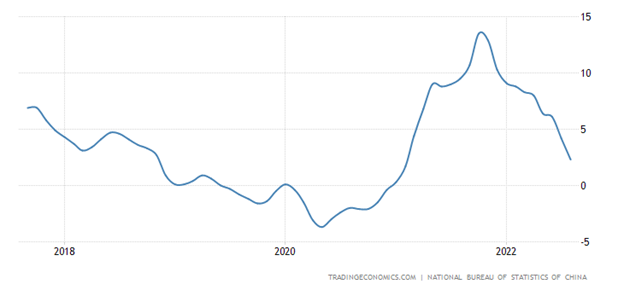

And in China, PPI is at the 18-month bottom (+2.3% per year):

China Producer Prices Change

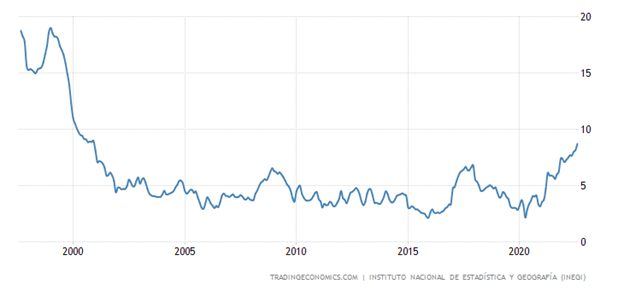

Mexico CPI +8.7% per year – the highest since 2000:

Mexico Inflation Rate

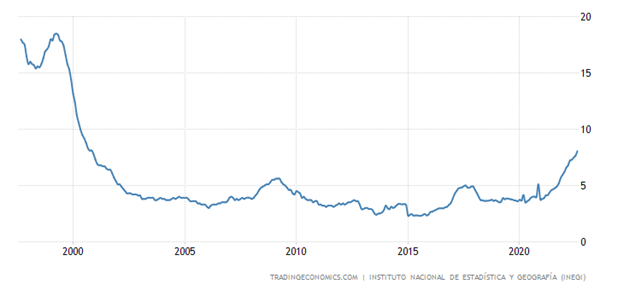

The “net” (minus the highly volatile components of fuel and food) CPI has the same peak (+8.05% per year):

Mexico Core Inflation Rate

CPI of the Netherlands +12.0% per year – a record for 52 years of observation:

Netherlands Inflation Rate

The volume of retail sales in the eurozone (-0.9% per year) has been in the red for 2 months in a row:

Euro Area Retail Sales YoY

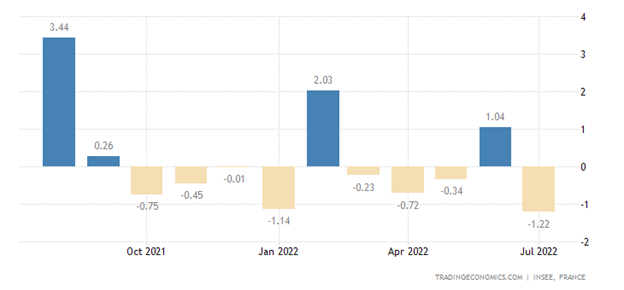

And in France, 2 consecutive monthly reductions (-0.9% per month):

France Retail Sales MoM

Japanese spending -1.4% per month:

Sweden Household Spending Falls for 2nd Month

Number of U.S. Unemployment Claims Maximum for Six Months:

United States Continuing Jobless Claims

However, as we have noted more than once, US labor statistics cannot be trusted.

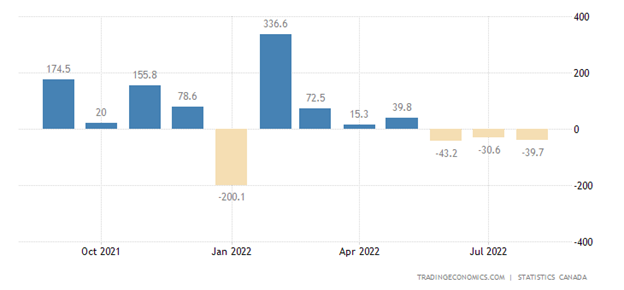

Employment in Canada has been declining for 3 consecutive months:

Canada Employment Change

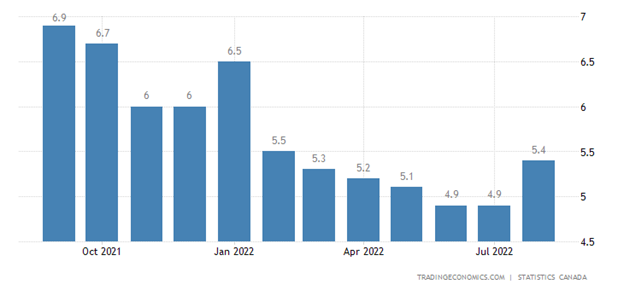

Why unemployment jumped to a six-month peak:

Canada Unemployment Rate

Mexicans are pessimistic at the most in 1.5 years:

Mexico Consumer Confidence

The ECB raised the interest rate by 0.75% to 1.25%; its head said that the end of this process is still very far away.

The Central Bank of Australia raised the rate by 0.50% to 2.35%, ready to continue tightening policy

The Central Bank of Canada increased the interest rate by 0.75% to 3.25% (the peak since 2008) – and it also promised to continue.

Main conclusions

It is highly recommended to compare the current review with the previous one. They are very similar – individual countries and regions are changing, but the overall picture of a regular recession, obscured by an underestimation of inflation indicators, remains the same.

It was not in vain that we noted the two main events of the week – they show that the situation in the socio-political sphere in many countries, primarily in developed countries and the EU, is becoming intolerable. No, of course we are by no means trying to explain that revolutions await us – this is simply impossible. But within the framework of inter-elite relations within these countries and between them, relations are rapidly escalating.

Today we do not see any clear political forces that would propose any alternative actions. Even the US Republican Party is more likely to criticize the Democrats and the Biden administration than to prepare any plans. And this means that the picture of the structural crisis that took shape by the beginning of this autumn will continue. Until some managerial and political structures start to frankly break down.

Who will be the “weak link” is not yet clear. England, Germany, and even the USA are next in line. We can only monitor the situation and warn our readers about especially dangerous moments.