There was a lot of fundamentally important news this week, and each could claim the championship. The earthquake in Turkey took this country out of active politics in the region for quite a long time; the EU, in fact, refused to support the ceiling on Russian oil prices; an American journalist gave out as a very likely version that the Americans had undermined the Nord Streams …

But, most likely, the main news was Biden's appeal to Congress and his subsequent statement (contrary to earlier leaks) that he is "not ready" yet to announce that he will run for the next presidential term. In his speech, Biden spoke about the fact that new jobs are being created in the United States, about the successful fight against inflation, and called for support for his proposals to raise taxes for the wealthiest Americans. At the same time, the word "crisis" was said so often that no one had any special illusions.

The new presidential term should be said separately. Many perceived such a statement as, in fact, a refusal. Maybe this is not so, but there is a hypothesis that this is not an accident or a mistake. The truth is that everyone in the US understands that the model of financial capitalism in the Bretton Woods version has exhausted its potential. And while there was no alternative model, the supporters of this liberal model had a chance of retaining power.

But about six months ago (we wrote about this in our reviews), a plan appeared, deepening Trump's plan "Make America Great Again" (that is, the re-industrialization of the United States). The essence of the changes was reduced to three positions:

- Industrialization should be done not on the scale of the United States but on the scale of the AUCUS association.

- It was recognized that it was necessary to bring down the Bretton Woods financial model (which, like a sponge, sucks money out of the real sector).

- This should not be done by Trump.

At first, of course, this adapted plan was proposed by the Republicans. Still, it gradually won the minds of the entire American establishment, except for the most frostbitten members of the Biden team and the direct beneficiaries of international financial institutions. But, apparently, not so long ago, it was recognized by almost everyone, and it has already become more or less public. Well, it's time to remove Biden. And it is possible that the statement made is just from this series. However, we will soon see.

Macroeconomics

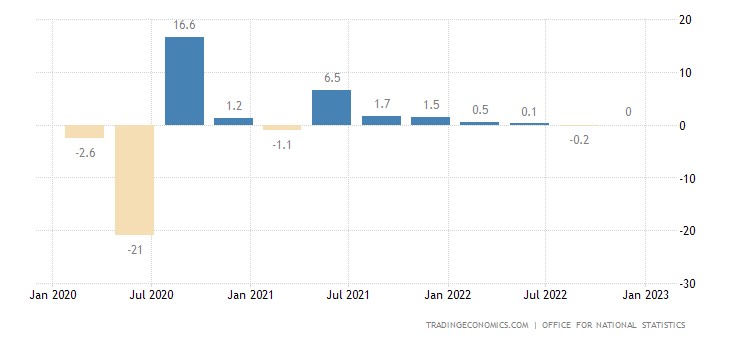

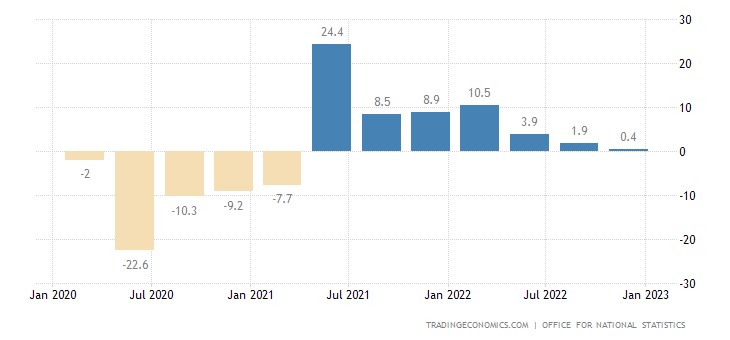

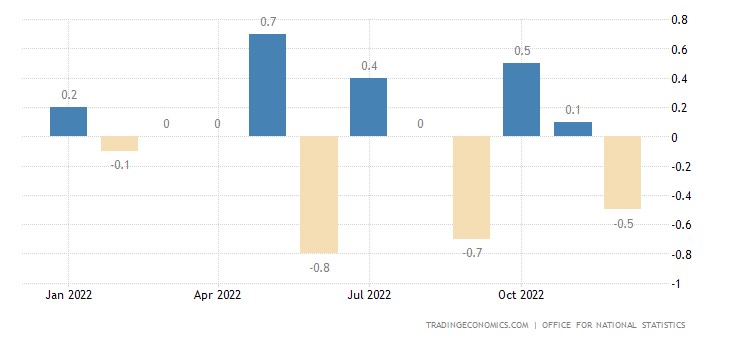

UK GDP 0.0% QoQ after -0.2% QoQ:

And only +0.4% per year:

And separately for December, GDP was -0.5% per month:

And already -0.1% per year:

Industrial output in Argentina -2.7% per year – the worst figure in more than 2 years:

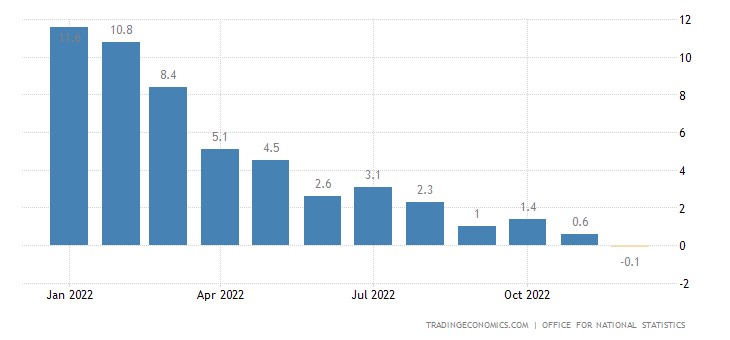

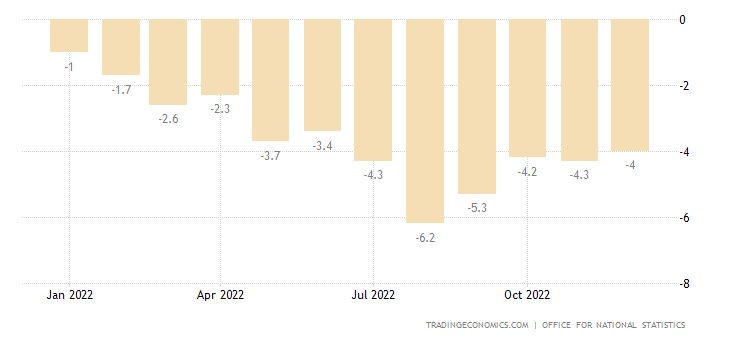

In Britain -4.0% per year – the 15th negative in a row:

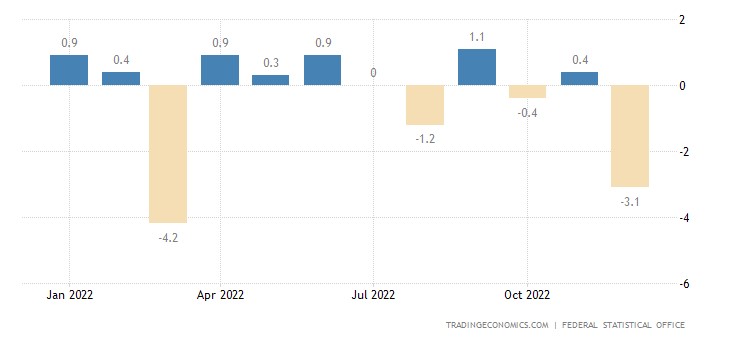

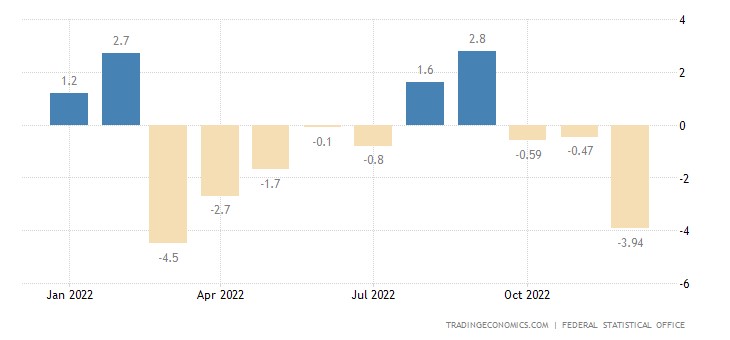

Industrial production in Germany -3.1% per month – 9-month minimum:

And -3.9% per year – also the 9-month bottom and the 8th minus for the last 10 months:

Industrial orders in Germany -10.1% per year – 10th negative in a row:

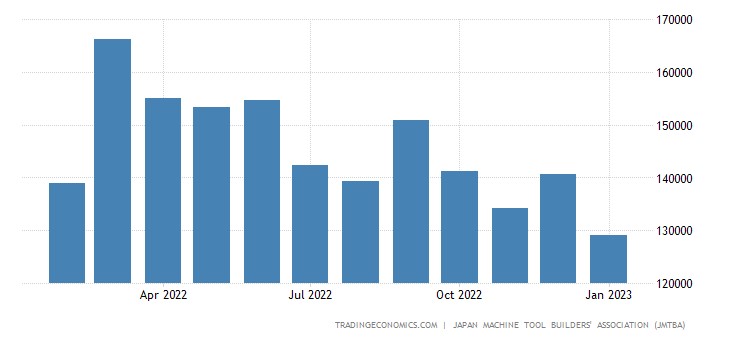

Machine building orders in Japan -9.7% per year, including foreign -13.2%:

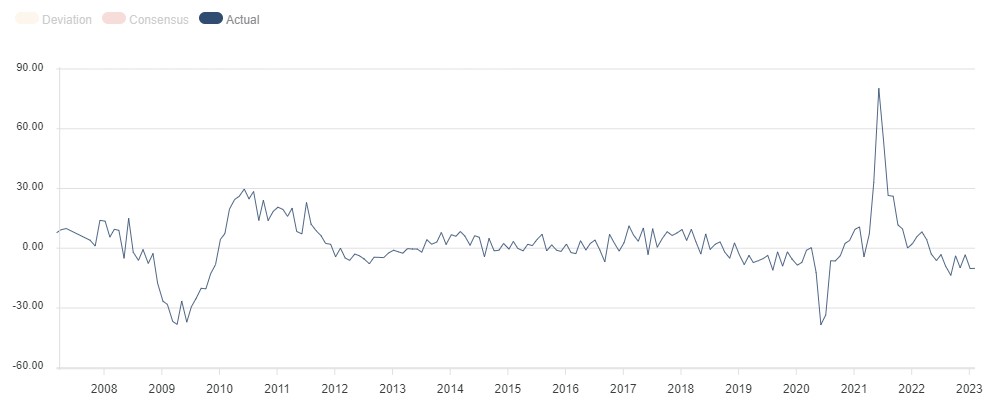

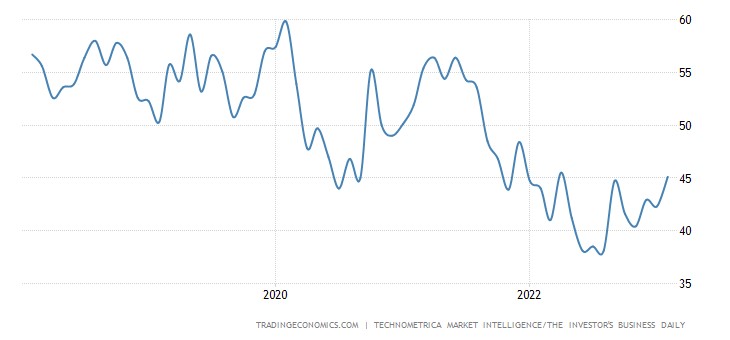

The US economic optimism index remains in the zone of pessimism for 18 months in a row:

Leading indicators in Japan are the worst in 2 years:

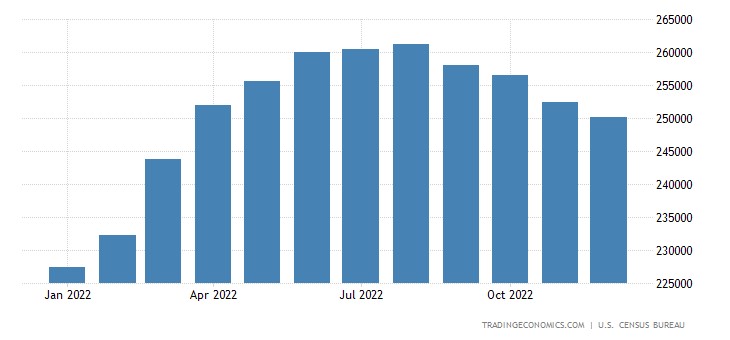

US exports fall for 5 consecutive months and are at their lowest in 9 months:

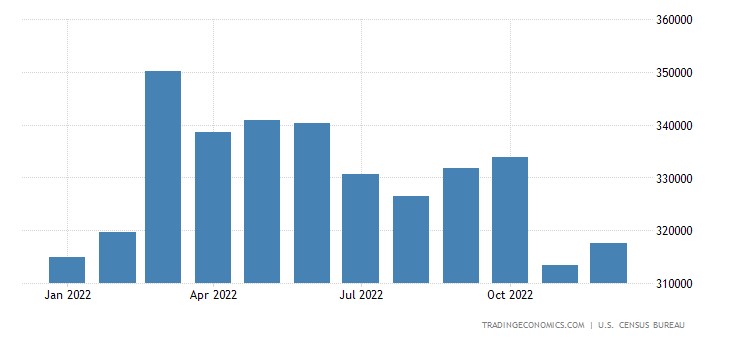

Imports have only slightly moved away from the annual bottom of the previous month:

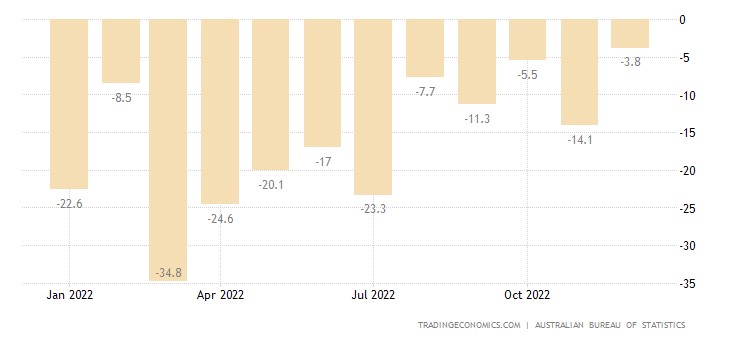

Building permits in Australia -3.8% per year – 15th consecutive negative:

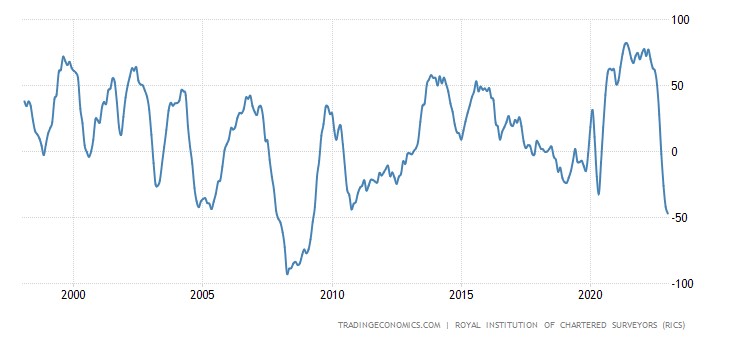

The UK house price balance of -47 is the weakest value since April 2009:

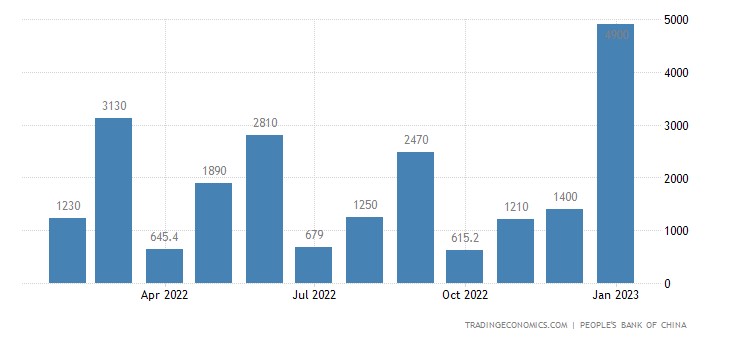

Bank credit in China soared to a record $4.9 trillion in January. yuan:

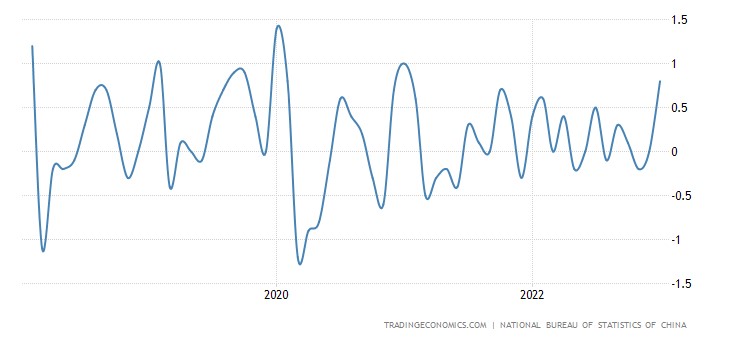

China CPI (Consumer Inflation Index) +0.8% per month – 2-year high:

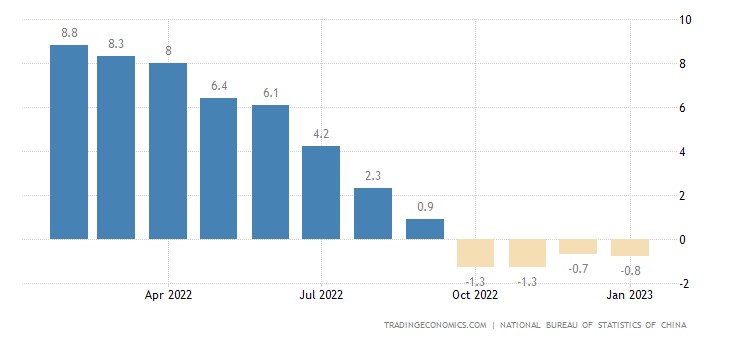

PPI (industrial inflation index) of China (-0.8% per year) keeps in the annual minus for 4 months in a row:

The first is a demonstration of a decrease in the profitability of trade and an increase in the cost of logistics. The second is a purely depressive signal that correlates well with the numbers of economic stagnation in China from previous surveys.

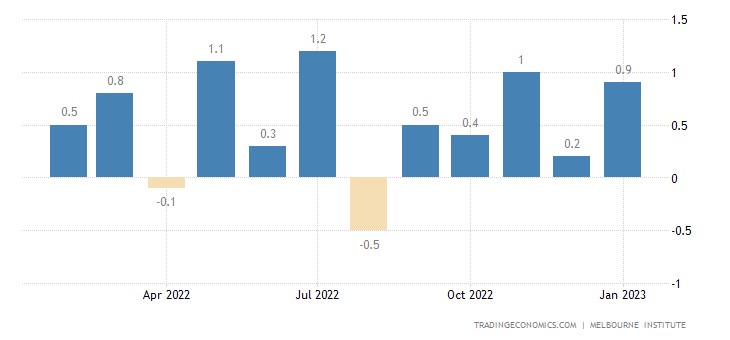

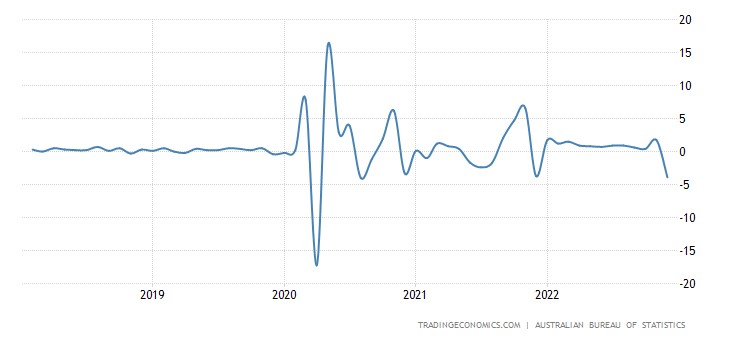

The estimate of inflation (read: consumer) in Australia from the University of Melbourne jumped sharply, up to +0.9% per month:

And up to a record +6.4% per year

Retail sales in Australia -3.9% per month – the worst dynamics in 2.5 years:

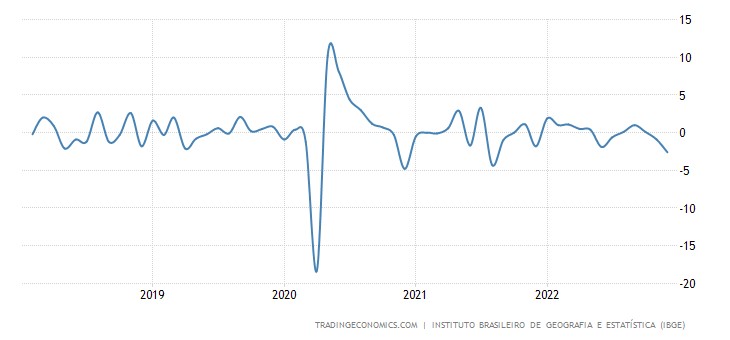

Brazil Retail -2.6% per month – minimum for 1.5 years:

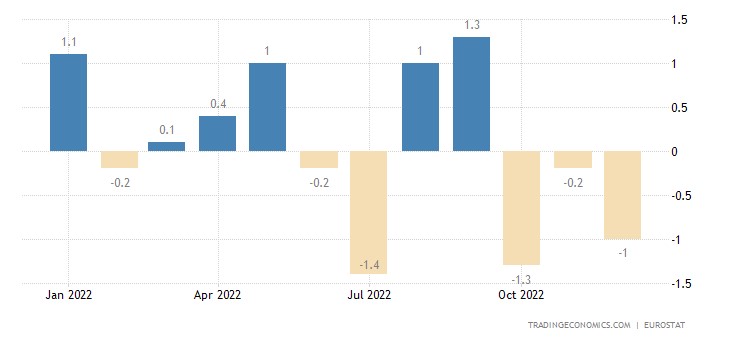

French retail -1.0% per month – 3rd negative in a row:

And -0.5% per year – also the 3rd negative in a row:

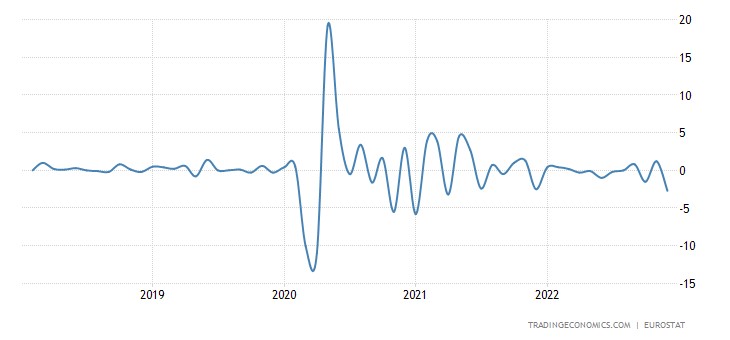

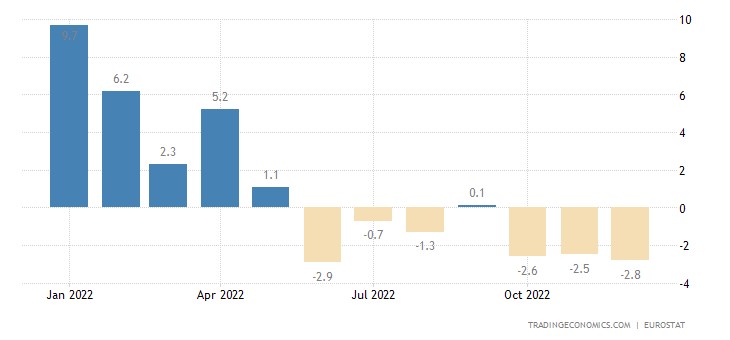

Eurozone retail -2.7% per month – minimum since April 2021:

And -2.8% per year — the 6th minus in the last 7 months:

In other words, the possibilities of households in the European Union are gradually climbing into a covid recession without any epidemic and quarantine.

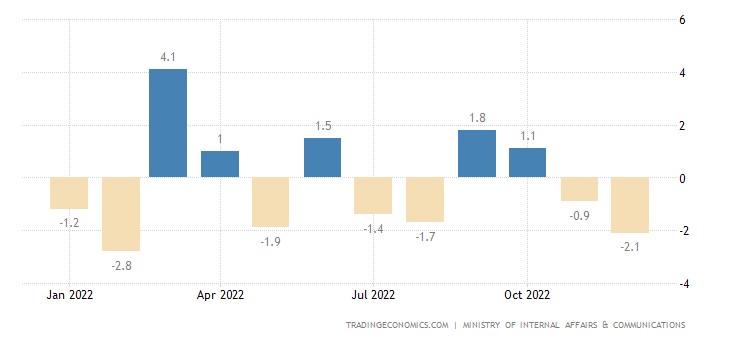

Household spending in Japan -2.1% per month – 2nd negative in a row and bottom in 10 months:

And -1.3% per year – also the 2nd negative in a row:

The Central Bank of Mexico raised the rate by 0.5% to 11.0%. The Central Bank of Australia raised the rate by 0.25% to 3.35% and promised to continue tightening the policy. The Central Bank of India raised the rate by 0.25% to 6.50%.

Main conclusions

A few charts to justify Biden’s words about the crisis:

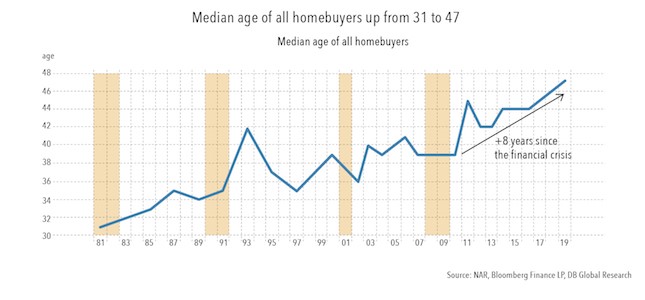

Average age of a homebuyer. It turns out that if before the start of the 4th PEC crisis (see M. Khazin “Memories of the Future. Ideas of the Modern Economy”) in 2008 this age rarely exceeded 40 years, now it has risen to almost 50 … Of course, this can mean a lengthening of the psychological perception of youth, but the economic component also cannot but play a fundamental role.

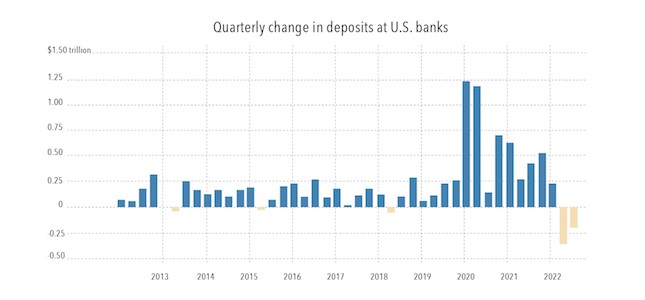

Further, local problems are already purely Biden’s. Quarterly changes in deposits in US banks. There are no comments here.

Next, the state of retail (in both the US and the EU):

As we have repeatedly shown, this indicator has replaced inflation in the dynamics of the crisis (the specifics of the structural crisis, it is constantly moving from industry to industry). Now industry and retail sales come first. Theoretically, the volume of construction competes with them, but, most likely, in the near future governments will begin to support mortgages (this is too important a social factor). At the same time, of course, inflation can jump up again …

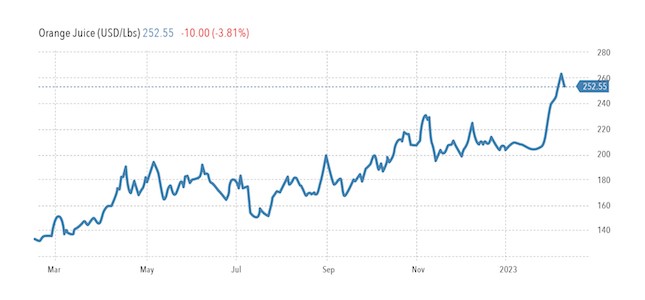

By the way, here is the price chart for orange juice:

In 2022, credit card debt in the US reached a record high of $960.6 billion. This is 18% more than a year ago! The average debt per person is $5,805. And the credit card rate in 2022 was at a peak level of 18.94% per annum.

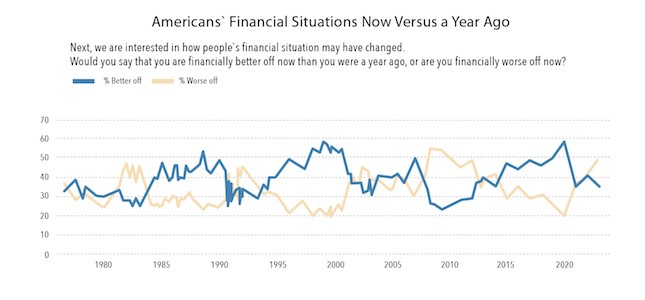

And finally, an assessment of the future of financial markets from American citizens:

One must think that it is not in vain that citizens look at life with such pessimism.

One more critical circumstance can be noted, which explains a lot in the somewhat hysterical behaviour of the authorities of the EU countries (primarily Germany) and the entire EU. If we are discussing implementing the "Trump plan" in the new edition, eliminating the Bretton Woods system becomes fundamental. But! A significant part of the income of Germany and other economic leaders of the EU is received from that part of private demand, which is subsidized within the framework of this system. In other words, its elimination means a rapid collapse of the German economy (and the EU) with all the ensuing consequences!

Reasoning that the "Trump plan" will not be implemented can only be accepted in one case: if an alternative plan is proposed. But in this case, we can recall the continuation of the basic rule of strategy in chess, which we put in the title of this review: worse than the absence of a plan is only the presence of two plans at the same time.