The main news is, of course, the rate hike by the US Federal Reserve. By 0.5%. The discussion of American experts, discussed by us in two previous reviews, showed the desire of the Fed leadership to slow down the process of tightening monetary policy. Moreover, we explained that this is because the world economy, like the US economy, is falling. In the face of a clear economic deterioration, raising the rate is scary. There is already a negative experience of the early 30s.

But the inflation rate is still well above the targets. And if we take into account that it is systematically underestimated within the framework of current statistical methods, then the picture looks even more unpleasant. And in this situation, the Fed leadership chose an intermediate option: they raised the rate, but not as much as they could. It was this option that was voiced as a result of discussions. Still, the publication of these discussions without a description of the actual economic situation (see the next section of this Review) seems partially correct.

It will be possible to talk about what the inflation picture will be like at the end of the year only in mid-January. But let's not forget that the monetary authorities know this (or, at least, they can build pretty plausible hypotheses), so we can assume that the situation in the financial sector of the American economy is also not very good. Well, we will discuss the comments of the head of the Fed, Powell, in the last section of the Review.

Macroeconomics

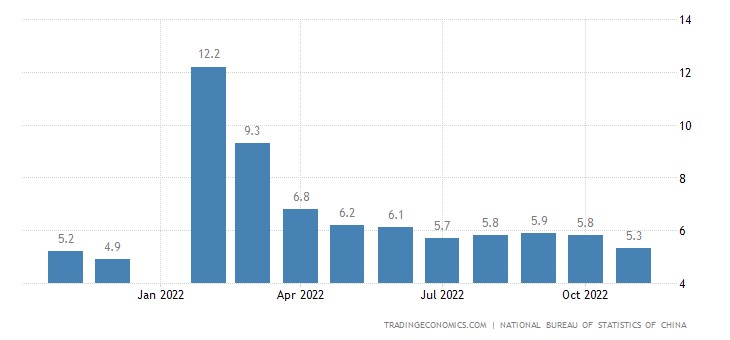

First of all, we note that the crisis is actively continuing in China. Investments in fixed assets +5.3% per year – annual minimum:

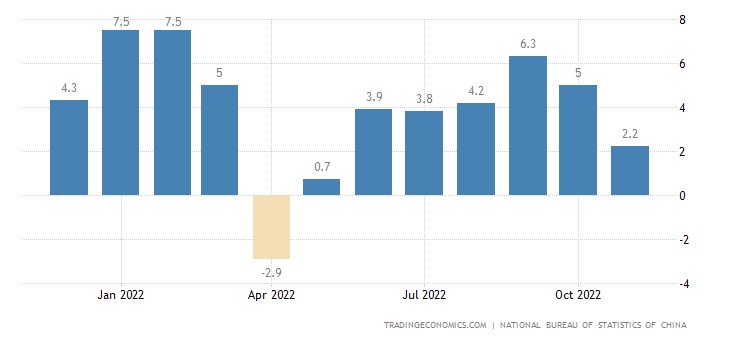

Industrial production +2.2% per year – semi-annual bottom:

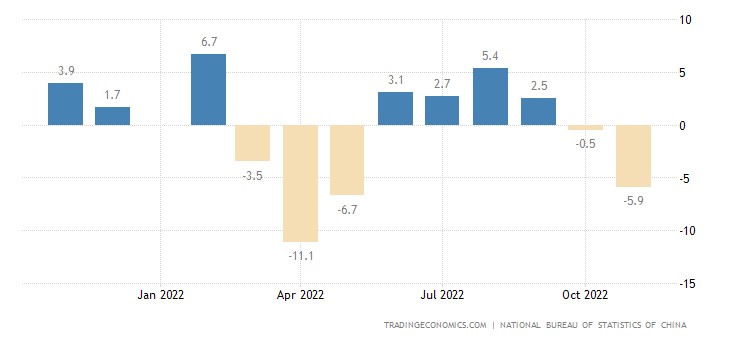

Retail sales -5.9% per year – also the worst dynamics in half a year:

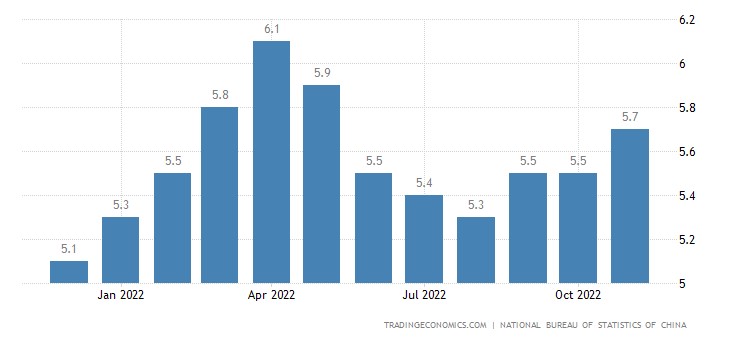

Unemployment 5.7% – half-year peak:

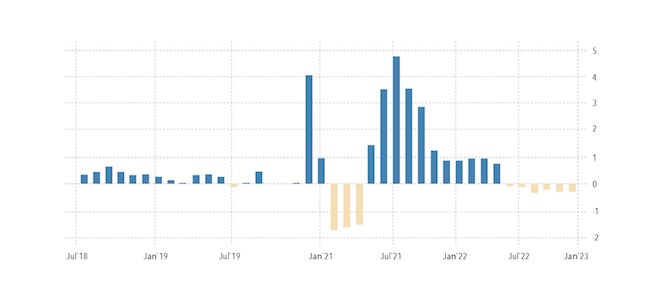

Housing prices in the 70 largest cities of the country -1.6% per year – an anti-record for more than 7 years:

UK GDP estimate from NIESR -0.3% per month – 6th negative in a row:

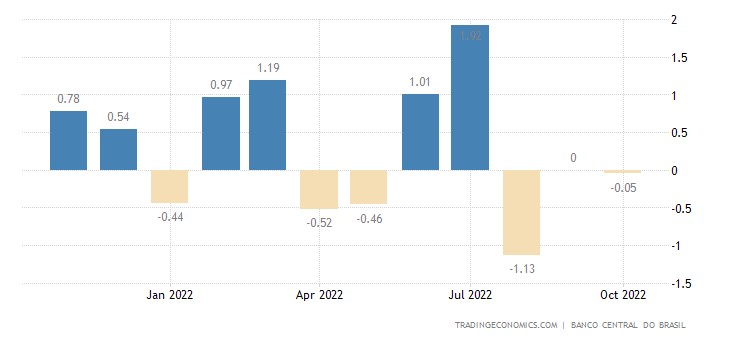

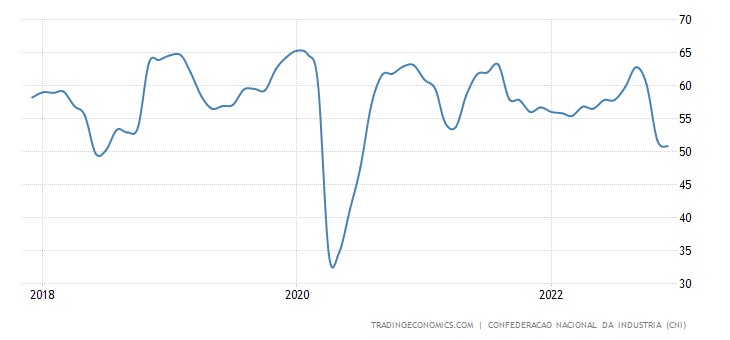

The economic activity index in Brazil has been declining or standing still for 3 consecutive months:

US industrial production -0.2% per month – 2nd negative in a row and 3rd in the last 4 months:

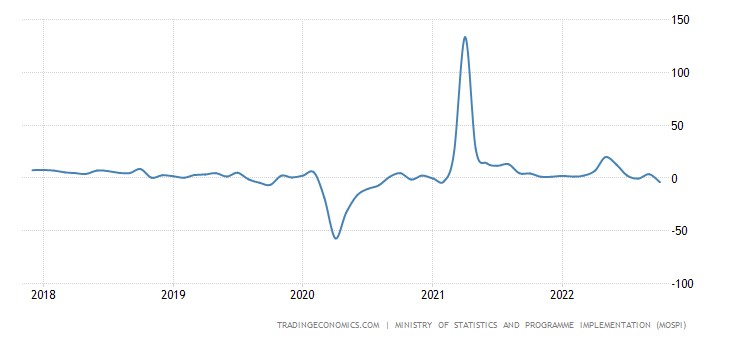

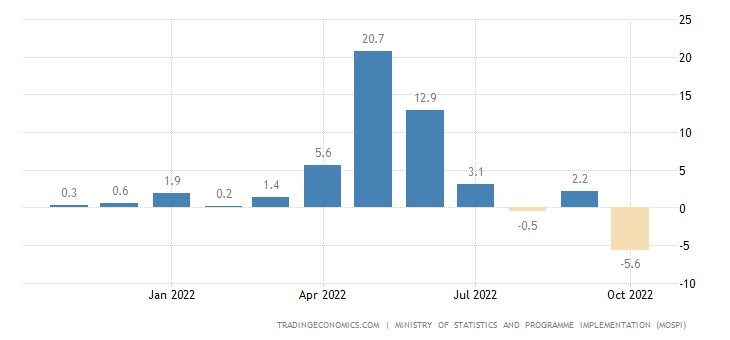

Industrial output in India unexpectedly flew into an annual minus (-4.0% per year), the worst in 26 months:

The decline in manufacturing industries is especially strong (-5.6% per year):

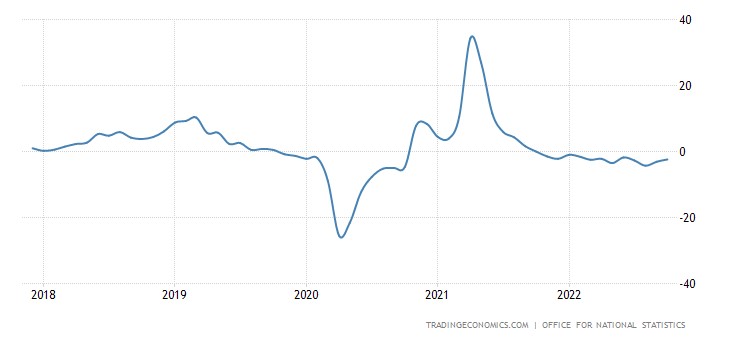

Industrial production in Britain keeps in the red for 13 months in a row:

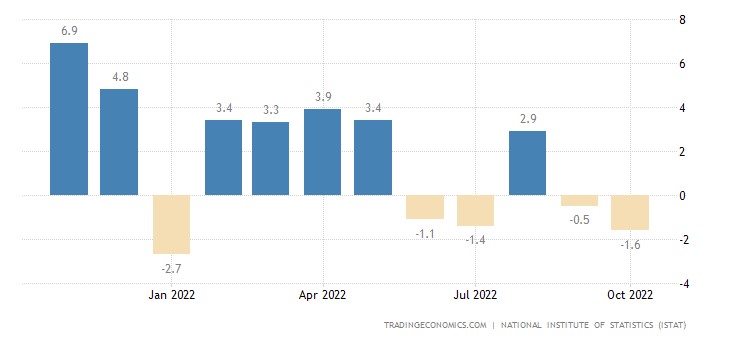

Output in the Italian industry -1.0% per month – the 2nd minus in a row and the 4th in the last six months:

And -1.6% per year – also the 2nd negative in a row and the 4th in the last 5 months:

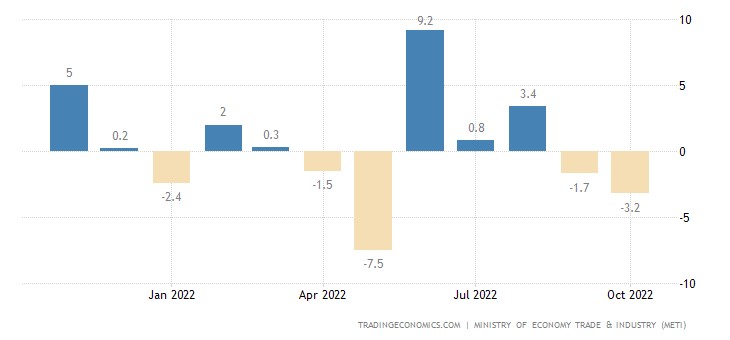

In Japan, industrial production -3.2% per month – the 2nd negative in a row:

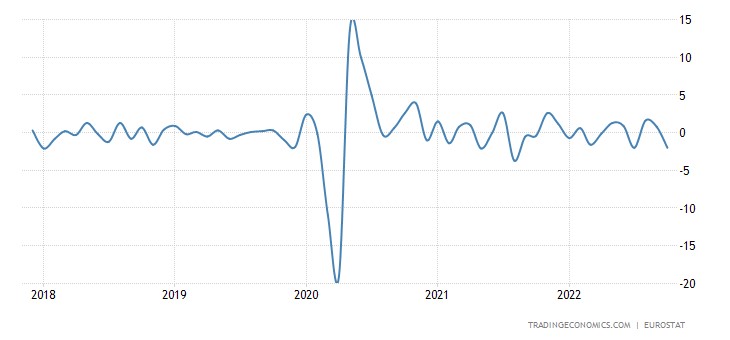

In the Eurozone -2.0% per month – the worst dynamics in 14 months:

Production in the extractive industry of South Africa -10.4% per year – the 9th negative in a row:

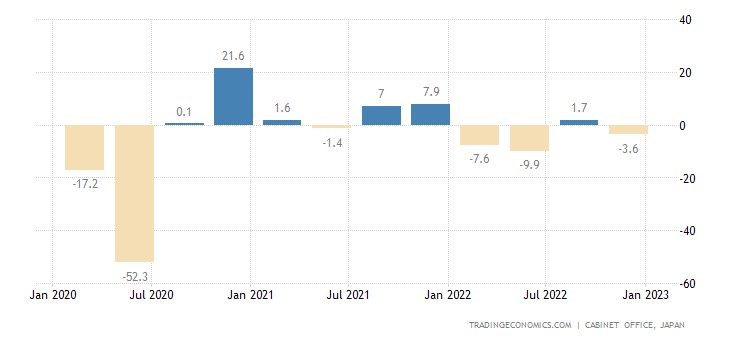

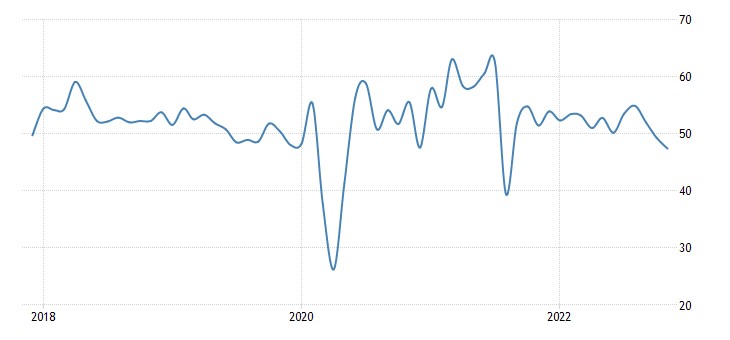

Business sentiment in Japan’s industry has been deteriorating for 3 of the last 4 quarters:

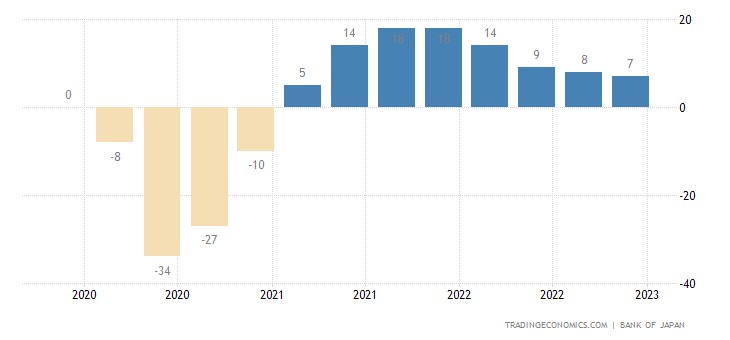

And the review of the Central Bank Tankan (similar in essence) is minimal for 7 quarters:

Business confidence in Brazil weakest in 29 months:

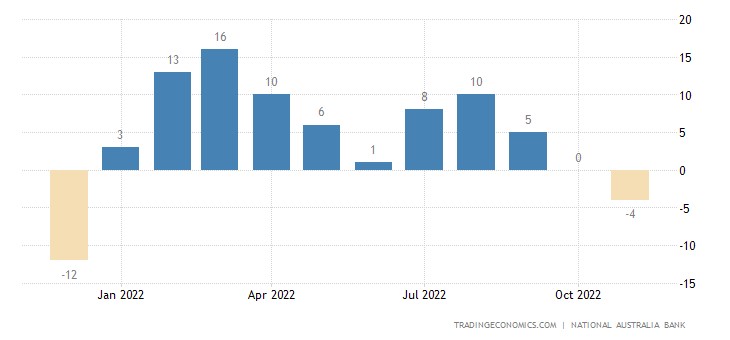

And in Australia, it went negative for the first time in the last year:

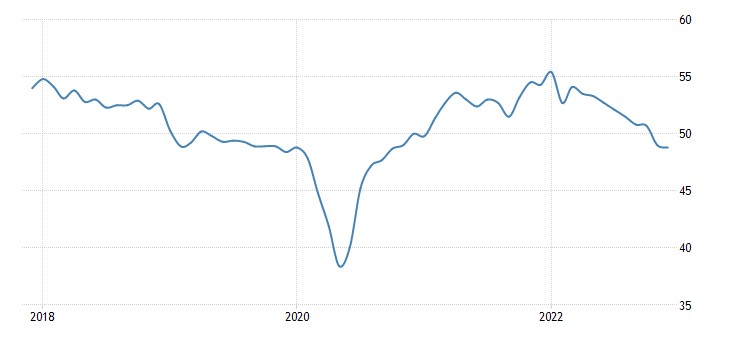

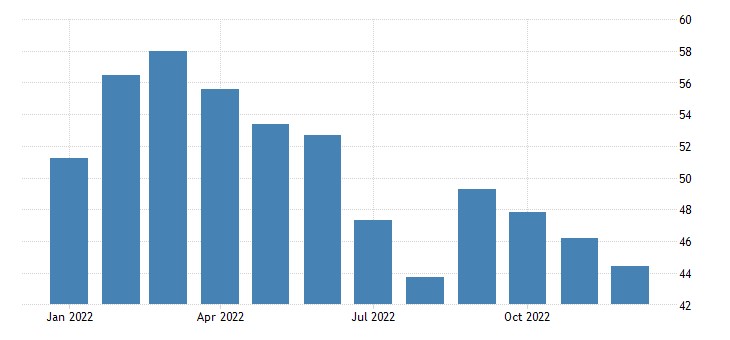

Preliminary assessment of the PMI (expert index of the state of the industry; its value below 50 means stagnation and recession) of the Japanese industry in the recession zone and at the bottom for 26 months (48.8):

In New Zealand, at least since April 2020 (47.4):

In Britain – from May 2020 (44.7):

In the US – the same since May 2020 amid employment problems (46.2):

Note that in the US, information has appeared about the understatement of unemployment data. It is difficult to verify how much they correspond to reality, but we have written more than once that labor statistics are significantly distorted towards improvement.

The service sector in the US is also clearly not shining (44.4):

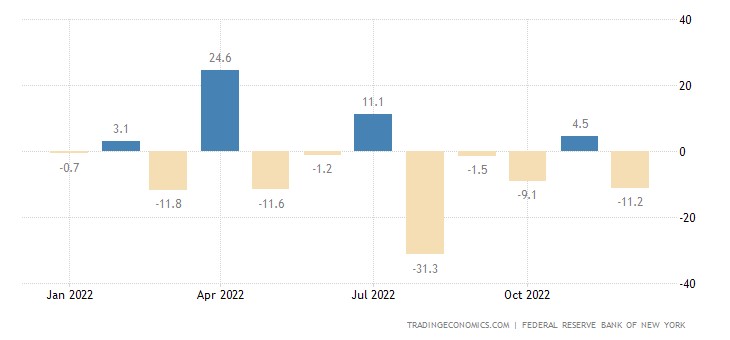

New York Fed index in minus 4 of the last 5 months:

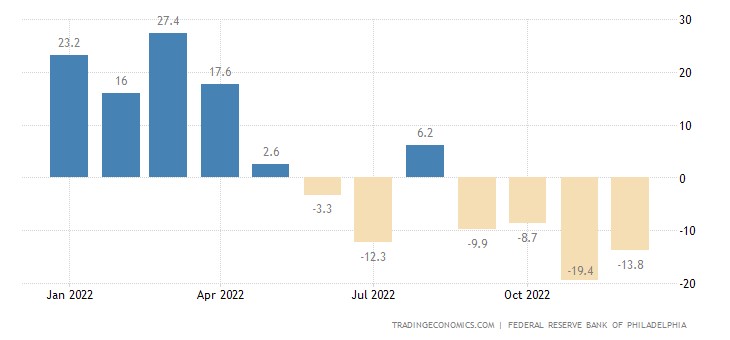

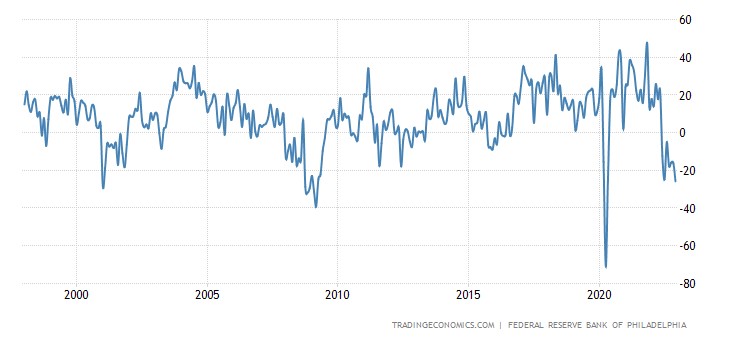

And the Philadelphia Fed index has been negative for the last 4 months:

Moreover, his new orders are the worst since the covid collapse of 2020, and before that – since 2009:

French CPI (Consumer Price Index) +6.2% per year – the highest since 1985:

CPI Italy +11.8% per year – also the peak since 1985:

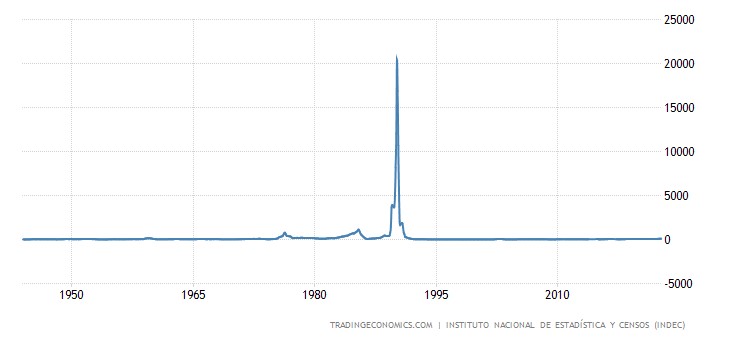

CPI Argentina +92.4% per year – the highest since 1991:

Food prices in New Zealand +10.7% per year – the highest since 1990:

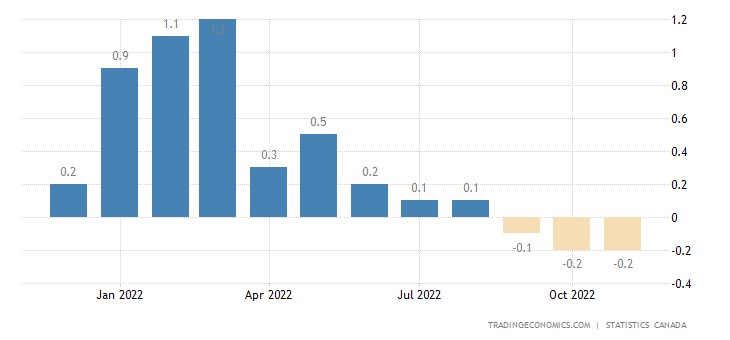

New home prices in Canada (-0.2% per month) have been declining for 3 consecutive months:

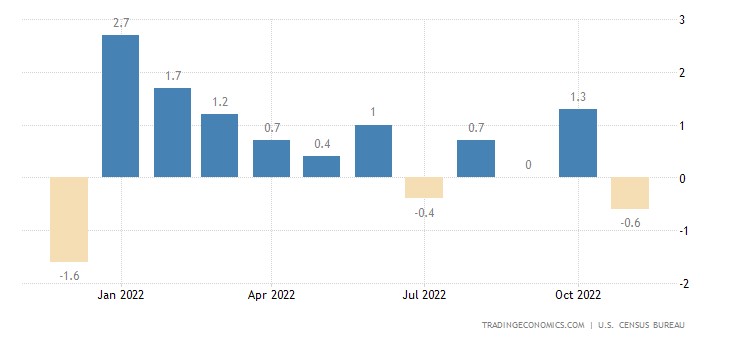

US retail sales -0.6% m/m, worst year ever:

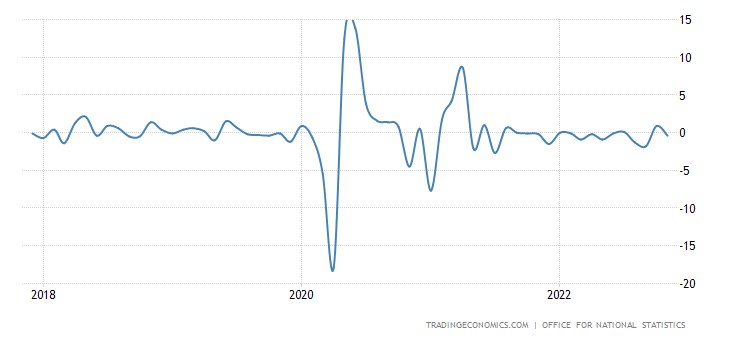

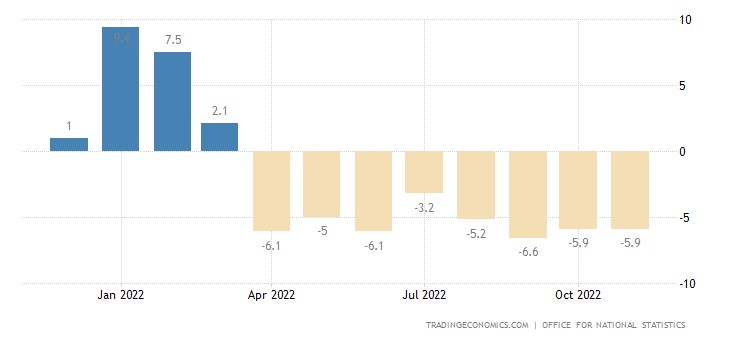

Retail UK -0.4% per month – over the past 15 months there were only 2 pluses:

And -5.9% per year — the 8th monthly loss in a row:

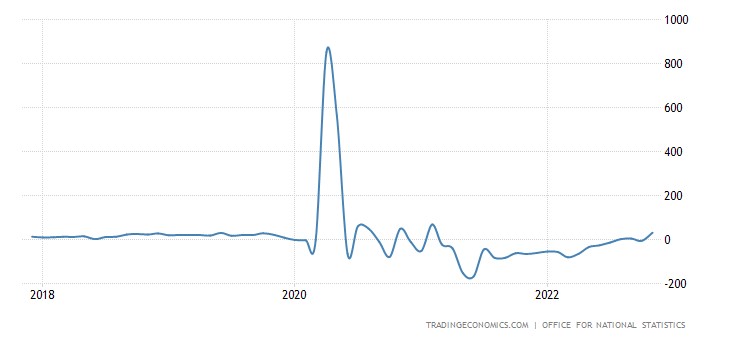

The number of registered unemployed in Britain increased by the most in 21 months:

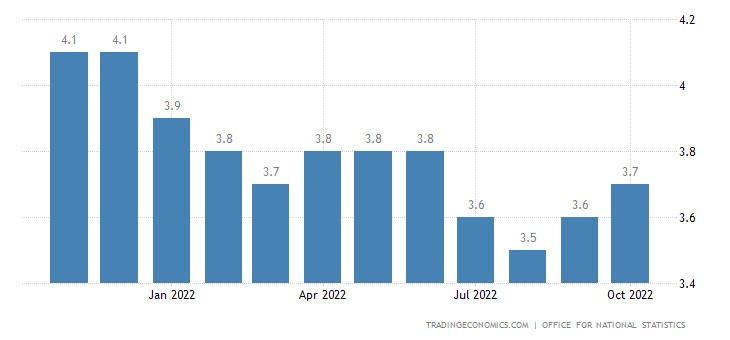

And the unemployment rate is rising:

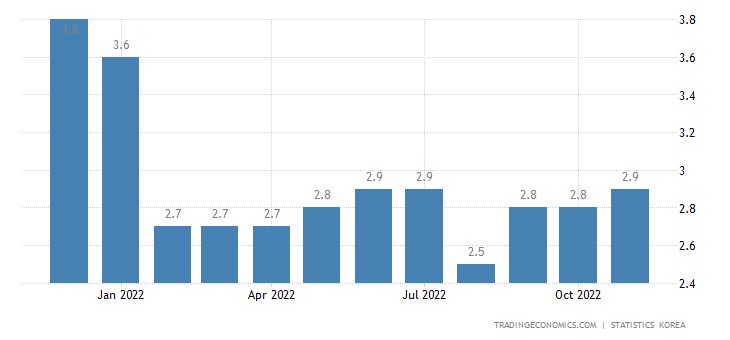

In South Korea, the unemployment rate is at its peak in 10 months:

The number of recipients of unemployment benefits in the United States in a maximum of 10 months:

The US Federal Reserve raised the rate by 0.50% to 4.25-4.50%, raised its forecasts for peak interest rates and inflation and lowered its estimate of GDP next year.

The Central Bank of Saudi Arabia increased the interest rate by 0.5% to 5.0% (it always copies the Fed since the rial is pegged to the dollar).

The Central Bank of Switzerland raised the rate by 0.5% to 1.0%. The Bank of England increased the interest rate by 0.5% to 3.5%, but 2 out of 9 board members voted for the unchanged rate.

The ECB raised the interest rate by 0.5% to 2.5%, waiting for a recession. The Central Bank of Mexico raised the rate by 0.5% to 10.5%.

Main conclusions

Following the Fed meeting, Powell said:

– Does not see the possibility of lowering rates until we are sure that inflation is declining sustainably;

– Expects housing inflation to ease sometime next year. Non-housing service inflation will take a long time to fall;

– Considers it right not to slow down the pace of rate increases. We think that moving so fast, and we should move to a slower pace of rate hikes, which will allow us to better balance risks;

– By now, we expected faster progress in terms of inflation;

– China is facing a challenging situation when it comes to lifting restrictions. It is difficult to say how the end of the zero COVID policy in China will affect US inflation;

– We are not thinking about changing our inflation target. Failure to raise rates sufficiently will cause the most pain;

– If reports of a decrease in inflation continue, the likelihood of an increase in unemployment will decrease significantly;

– The full impact of the tightening is yet to be felt;

– We expect that further rate hikes will be necessary to become sufficiently restrictive;

– The US economy has slowed significantly since last year. Higher interest rates affect fixed investment;

– The labour market remains tight. Although the number of vacancies has decreased compared to the beginning of the year, the market remains unbalanced;

– Meanwhile, the monthly inflation rate slowed down in October and November. But inflationary risks remain skewed upwards;

– Financial conditions fluctuate in the short term, but they must reflect policy restraint over time;

– our forecasts are not a plan; there is no certainty in the economy;

-The Fed is taking drastic measures to curb demand. Our decisions will be based on the totality of incoming data.

Powell confirmed our forecasts from previous months. Inflation is falling, but slower than he would like (because he does not take into account the structural component), and the recession in the US economy is intensifying (by and large, this is the first time). The Fed's forecasts could look better so far. The latter is obvious – if you do not have a model for the development of the situation, the forecast cannot be successful.

Thus, there is only one question: what needs to happen for the Fed to stop raising rates? The collapse of financial markets? It is inevitable in the face of increasing debt service costs, but whether it will happen tomorrow or in a few months is a question. The deterioration of the economic environment for Powell will not be a sufficient reason for easing monetary policy.

One crucial psychological moment is taking place today. Instead of inflation, the economic downturn itself becomes the main event. Recall that this is not a "recession" since the world is not experiencing a cyclical recession but a structural one, and it has been going on for more than a year. But so far, it has been masked by understated inflation (let me remind you that if inflation is underestimated by a few per cent, this automatically increases economic growth by about the same amount).

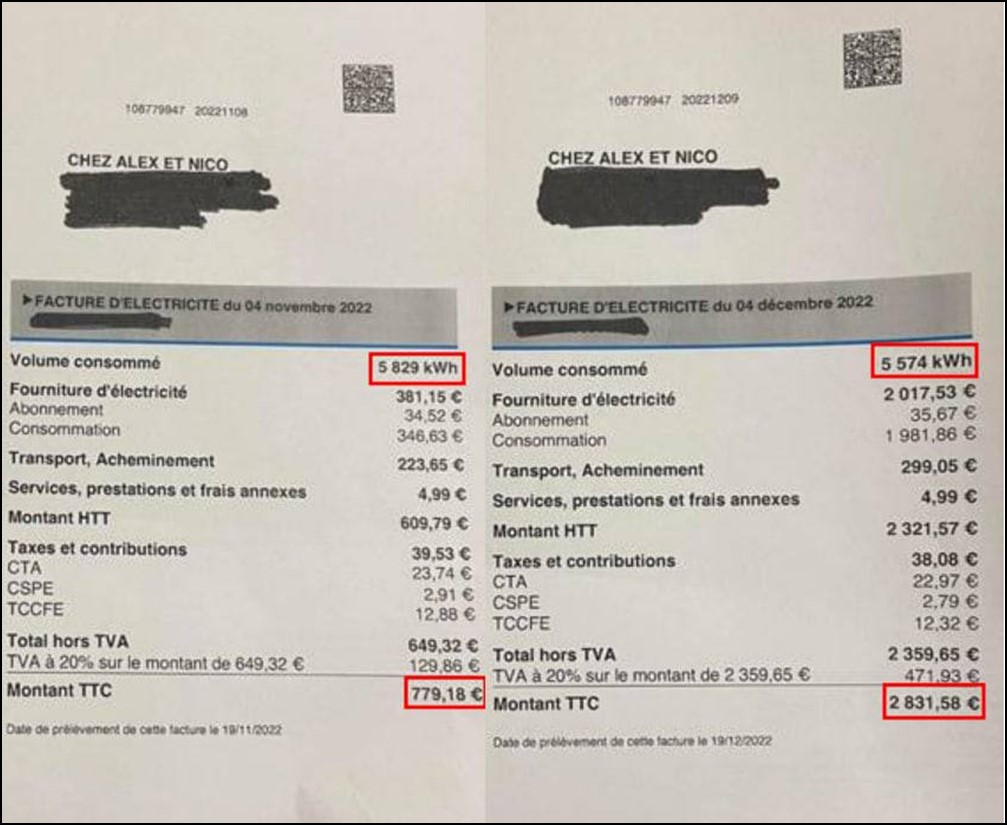

The actual recession of the US economy in 2022 will be around 7-8%, but it is impossible to calculate this for sure as there are no relevant statistics. As for the euro area, inflation starts to fall slightly, which is natural since the economy is shrinking, which entails a drop in demand. However, the accumulated price upside potential is relatively high. Look at the electricity bill in France for a small bakery:

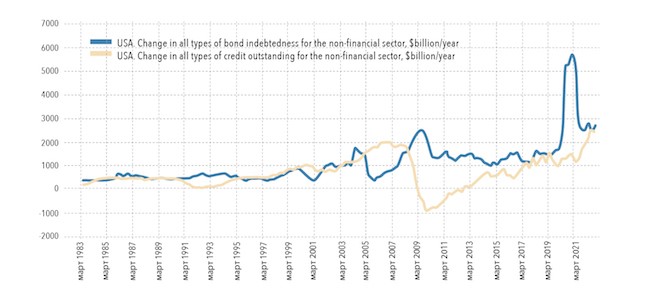

At the same time, changes in the policy of the FRS in the US lead to the fact that the structure of borrowings is changing. The issuance of bonds is sharply reduced, which is natural, and market participants begin to treat them quite suspiciously. But loans, on the contrary, begin to grow (banks are not very afraid of defaults since money is still cheap for them.

In any case, the New Year holidays are approaching, with business activity falling, and we will learn some severe news after the start of the new year.