Due to Thanksgiving Day, this week in the USA was short. And the main events were the discussion of the maximum price for Russian oil and the recognition by the European Parliament of Russia as a sponsor of terrorism. The meaning of the latest event is that in Western banks, an operation is being prepared to confiscate Russia's reserves frozen in February after the start of a unique military process in Ukraine. In addition, this status allows the confiscation of any assets of Russian citizens.

Thus, both events are precedents that destroy entirely the model of capitalist interaction that has been operating over the past centuries. Yes, of course, the United States and a number of other countries have acted this way before (for example, with the assets of Iran and Venezuela), but in this case, the scale becomes prohibitive for the system as a whole. There is no doubt that in a normal situation, this was impossible (the history of interaction between the USA and the USSR is an example of this). Therefore, one must be aware that such actions, regardless of their consequences, mean that their organizers do not believe that it is possible to restore the previous system!

The return of the "Western" economic system to the borders of AUKUS (USA, Canada, Great Britain, Australia and New Zealand) with the liquidation of the financial system of the European Union is already being widely discussed. But what happened this week showed that this decision has most likely already been made. Secondly, the current leadership of the EU already understands its fate and is trying to find resources to survive in the coming chaos (although it does not have any strategic plan). And thirdly, the current leadership of the EU does not have political subjectivity.

And all this is economic news because it speaks of the strategic direction of the actions of various forces in the world. In particular, it can almost certainly be said that the elite of the "Western" global project (which today is behind both the "Biden team" and the leadership of the EU), international bankers, are in for challenging times.

Macroeconomics

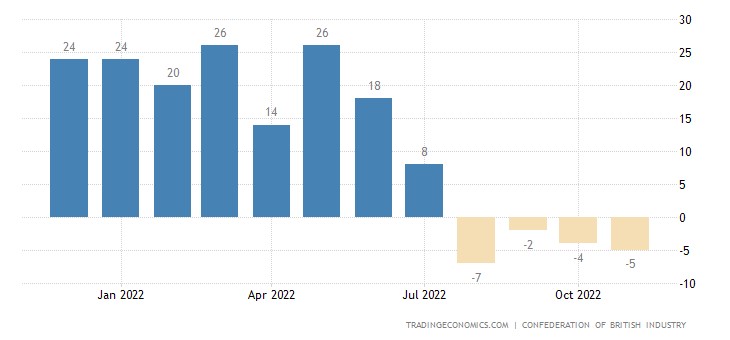

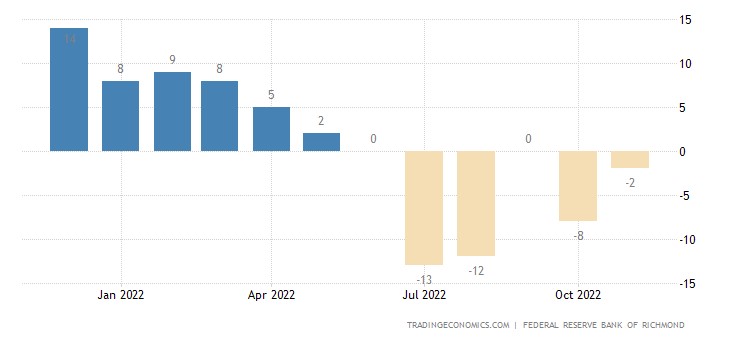

The balance of industrial orders in Britain is in the red for 4 months in a row:

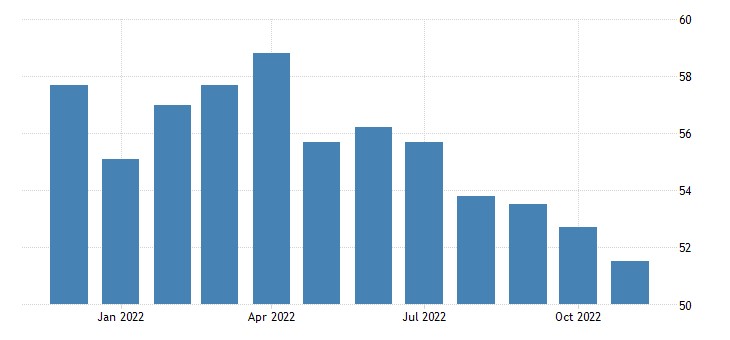

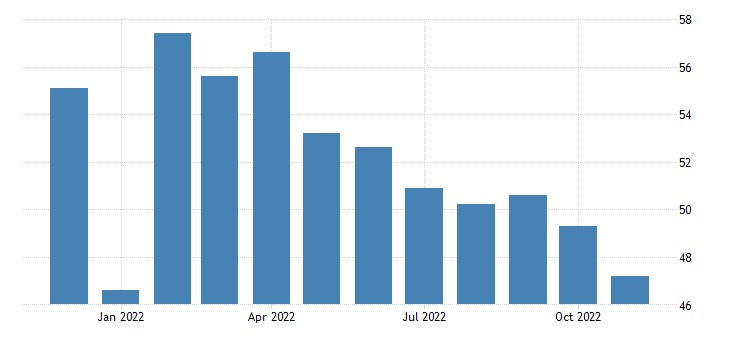

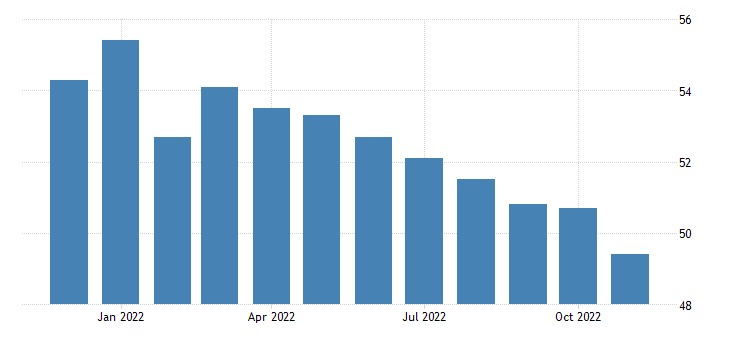

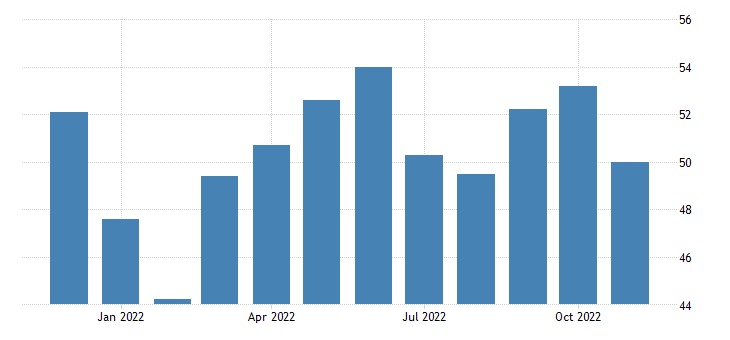

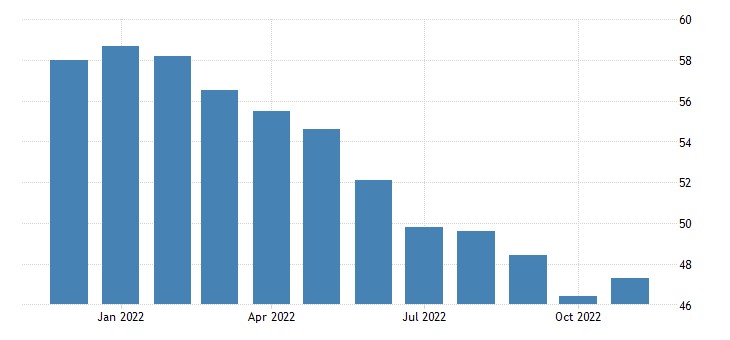

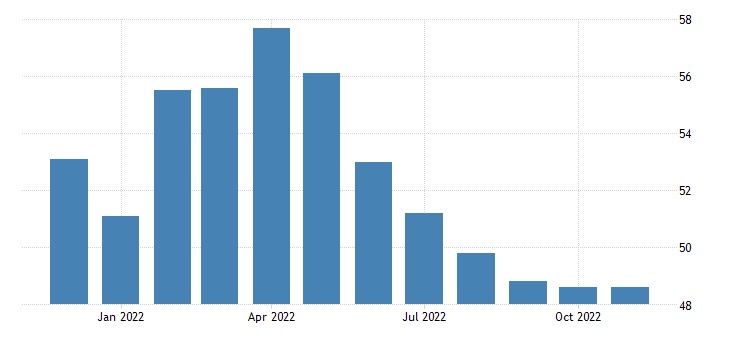

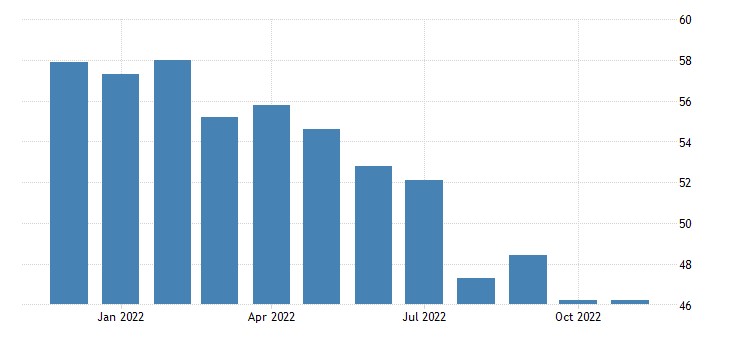

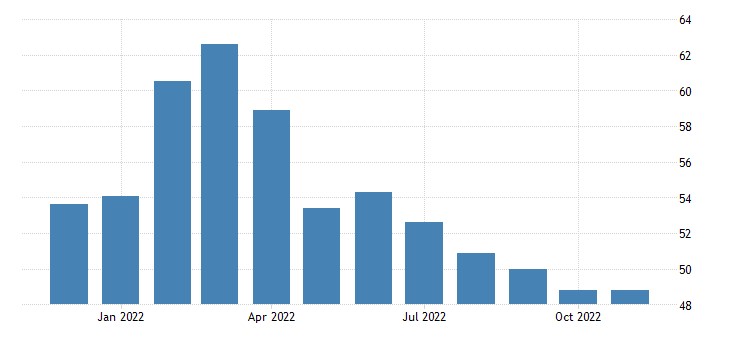

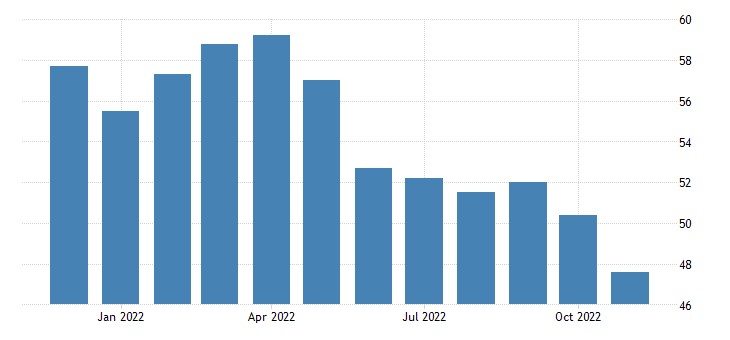

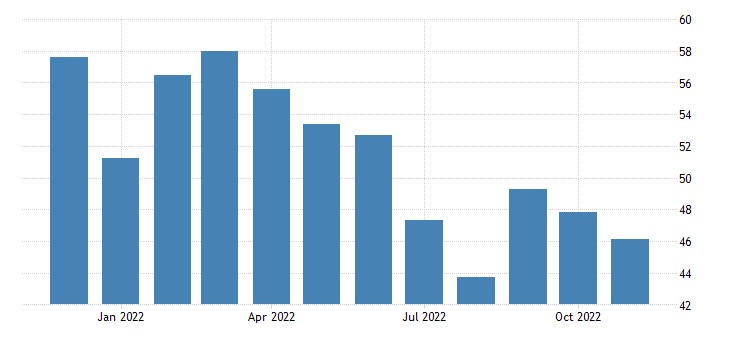

PMI (an expert index of the state of the industry; its value below 50 means stagnation and recession) of most countries of the world remain in the recession zone, both in manufacturing and in the service sector.

in Australia:

in Japan:

in the Eurozone:

in the UK:

in the USA:

And this situation allows us to confirm our recent assumption about the intensification of crisis processes in the global economy. Before that, one or another country broke into a favourable area; now, the picture is almost the same. Well, let's remember that all this is against the backdrop of low inflation.

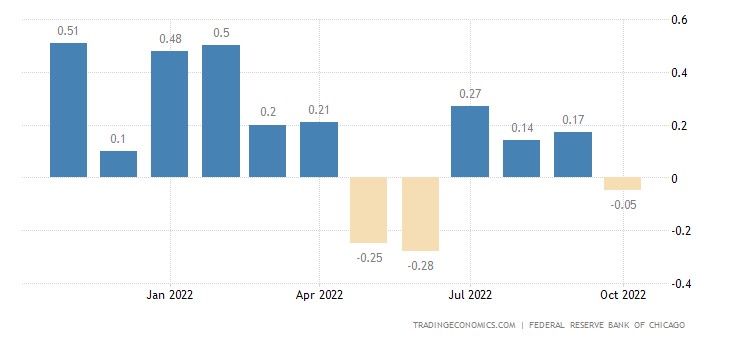

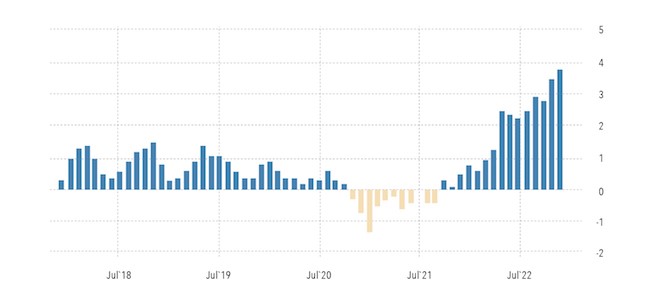

The National Activity Index in the US from the Chicago Fed has gone negative again:

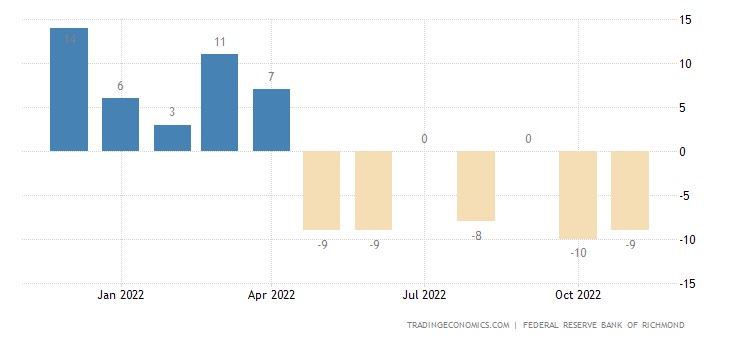

The Richmond Fed Regional Industry Index has not gone positive for 7 months in a row:

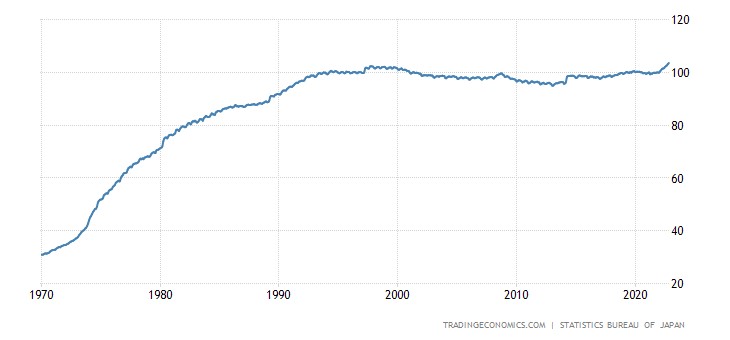

Leading indicators in Japan are at their lowest in 2 years:

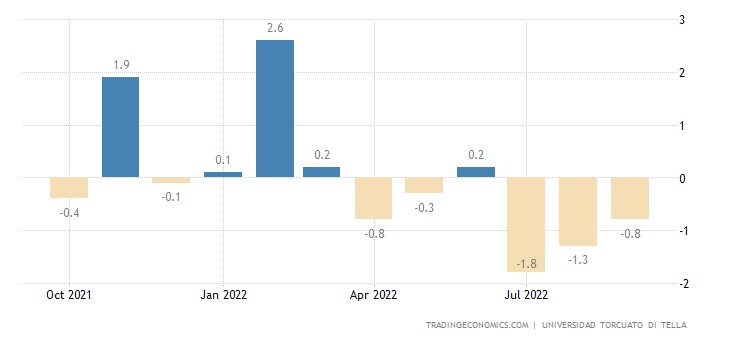

And in Argentina, they have been declining for 3 months in a row:

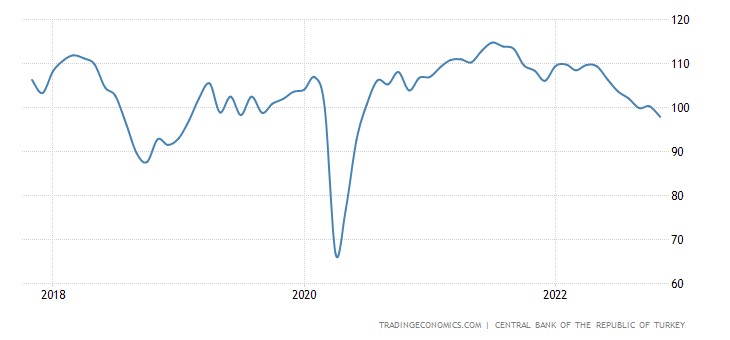

Business confidence in Turkey weakest since June 2020:

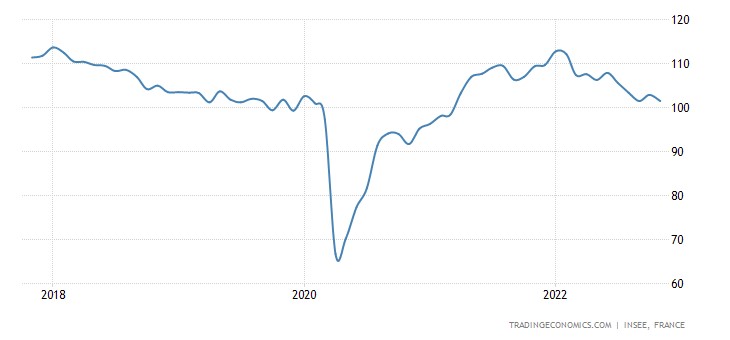

And in France – from March 2021:

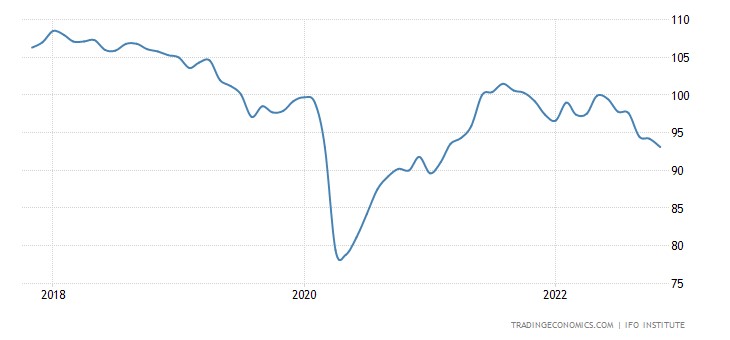

Current business conditions in Germany – from February 2021:

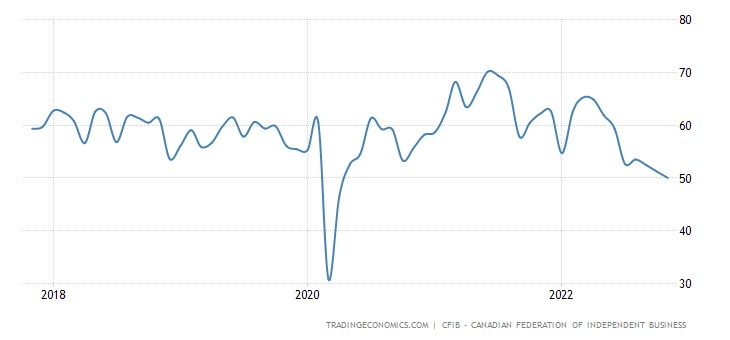

Canada Business Barometer – April 2020:

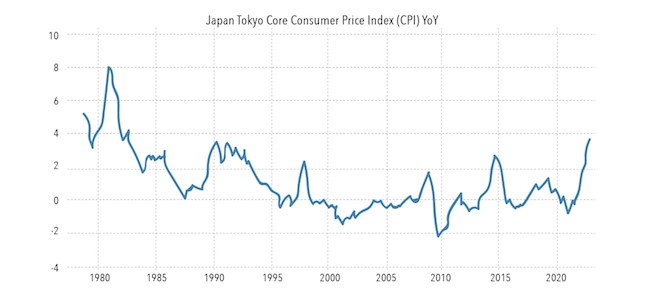

CPI (Consumer Inflation Index) in the Japanese Prefecture of Tokyo +3.8% per year – the highest since 1991:

And without fresh food (+3.6% per year) – even since 1982:

“Net” (excluding highly volatile food and fuel components) CPI in Mexico +8.7% per year – the highest since 2000:

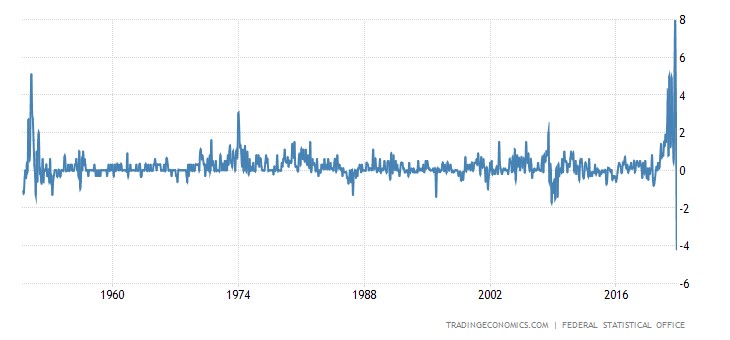

PPI (industrial inflation index) in Germany -4.2% per month – a record decline in 73 years of observation:

And this is not a positive signal, it is a powerful deflationary symptom, a sign of the beginning degradation of the real sector.

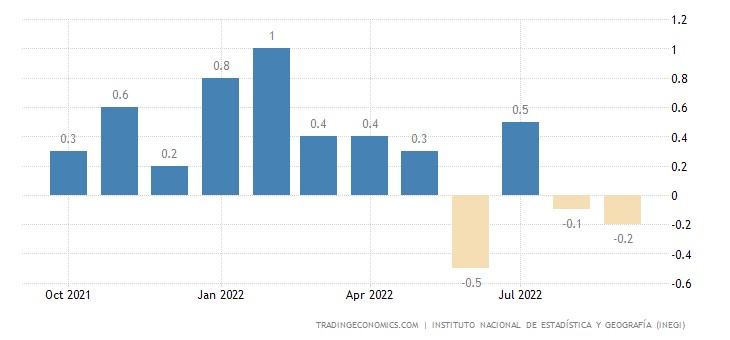

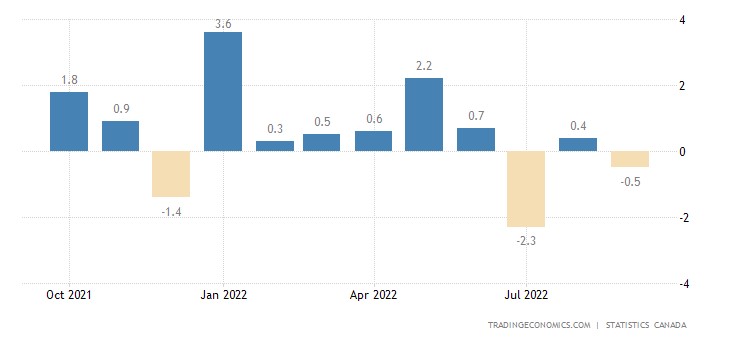

Mexico retail sales -0.2% per month – 2nd negative in a row and 3rd in 4 months:

Canada -0.5% per month:

U.S. initial jobless claims at 3-month peak:

And repeat claims for more than 8 months:

As we have already noted more than once, this indicator by itself does not mean anything; it is too distorted. But if it demonstrates stable dynamics for several months in a row, it most likely means that it coincides in a direction with actual processes.

The Central Bank of New Zealand raised the rate by 0.75% to 4.25%. They promised to continue. Central Bank of South Africa – also by 0.75%, up to 7.00%. The Central Bank of South Korea raised the interest rate by 0.25% to 3.25%.

The Central Bank of China left its monetary policy unchanged, and the Central Bank of Turkey lowered the rate by 1.5% to 9.0%. Turkey defiantly ignores the logic of the IMF.

Main conclusions

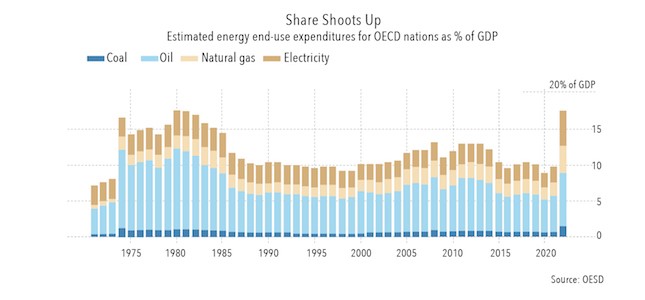

We have already voiced them in part – the scale of the crisis is growing. And its structural character is also becoming more and more evident. You can give, for example, a graph of the share of energy expenditures in the structure of GDP for OECD countries:

The question here is not in what direction the dynamics are; it is essential that the structure of the economy is changing dramatically. The only analogue comparable in scale is the "oil shock" of the 70s. But then the changes concerned only the oil sector, now – almost the entire economy. At the same time, neither the IMF, the FRS, nor expert institutions currently have models that could describe the scale of these structural changes and show what the structure of a post-crisis economy might look like.

During the week, the minutes of the FRS meeting on November 1-2 were published. Basic moments:

- The majority of Fed officials support a slowdown in rate hikes in the near future.

- Participants noted that the situation in the labor market remains tense; many noted tentative signs that it may be gradually moving towards a better balance of supply and demand.

- Participants agreed that there were few signs of easing inflationary pressures.

- Participants agreed that a slower pace of rate hikes would allow the FOMC to better assess progress towards its targets, "given uncertain delays" associated with monetary policy.

- As monetary policy approaches "rather restrictive" levels, participants stressed that the final destination of the federal funds rate has become more important than the rate itself.

- Several participants suggested that a slowdown in rate hikes could reduce financial system risks, while others suggested that a slowdown should wait for more progress on inflation.

- All participants agreed that the 75 bps increase was necessary and were the next step towards making monetary policy sufficiently restrictive.

- Participants agreed that risks to the inflation outlook remain skewed to the upside.

- Some participants said that a more stringent policy was consistent with risk management, while others noted an increased risk of over-delay.

- Participants noted that the labor market remains tight, with many reporting early signs that it may gradually move towards a better balance of supply and demand.

- Many participants expressed considerable uncertainty about the final level of the Fed funds rate needed to contain inflation, with various participants suggesting that it was higher than previously expected.

- Participants noted that, despite increased interest rate volatility and signs of tight liquidity conditions, the Treasury securities market functioned in an orderly manner.

- The Fed discussed market resilience in light of the turmoil in the UK.

- Most Fed officials support a slowdown in rate hikes in the near future.

- Several Fed officials predicted that interest rates would peak at a higher level.

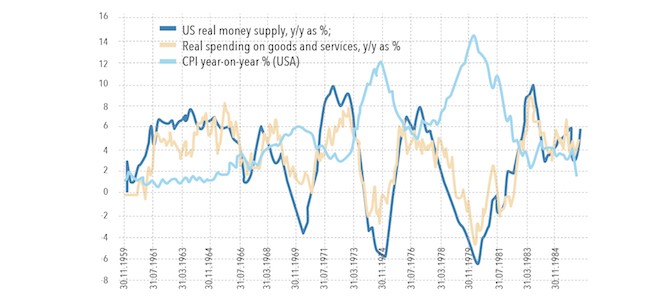

Two conclusions can be drawn. The first is that participants realize that the rate will need to be raised very high to reduce inflation. Including because inflation reacts poorly to the tightening of monetary policy.

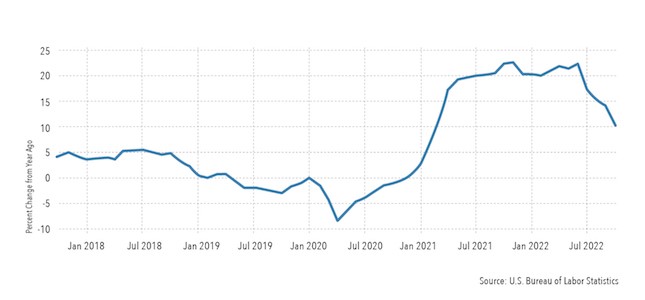

Secondly, note that the data on the total volume of industrial goods in October showed clearly optimistic results. However, at the time of the Fed meeting, they were yet to be discovered.

Total industrial inflation is slightly above 10% (and half a year ago, it was more than 23%) – this is a very good result; it would seem that there is nothing to worry about. But there is one very dangerous nuance. The data in the previous section show that the US industry is stagnating. In this situation, a decrease in inflation can signify the beginning of deflationary processes (as in Germany)!

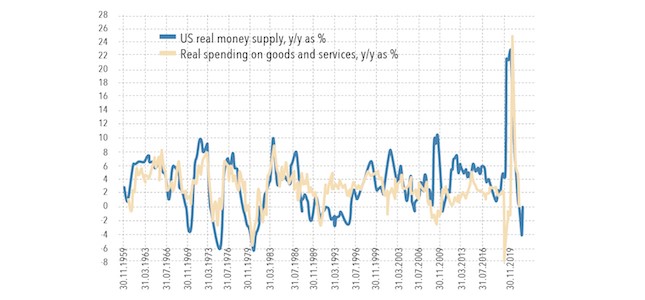

Recall the crisis of 1929-32. began after the Fed launched a monetary contraction program (to somewhat limit the overheated stock market). Now the economic contraction is a record.

And in this regard, we can assume that the leadership of the Fed is afraid of repeating the old scenario.

Recall that the analogue of the structural crisis of 1930-32 already started a year ago, and the US economy is also in recession. But since, unlike the situation almost a century ago, it follows an inflationary rather than a deflationary scenario, the collapse of the markets that occurred in 1929 has not happened yet. Underestimating inflation rates allows you to hide the recession that has begun in nominal figures. However, it still manifests itself, as can be seen from macroeconomic indicators. If the monetary contraction continues, it can easily "fall" into the scenario of the early 30s.