The main economic event of the week — information about Ukraine on the agenda of the Western, first of all, of course, American media sharply became less. Of course, we can suspect that the budgets allocated to this issue at the beginning of the year have dried up, and political conclusions can be drawn from this, but let's focus on the macroeconomics. Therefore, let’s say that this means that economic policy and the current state of affairs will get more and more space.

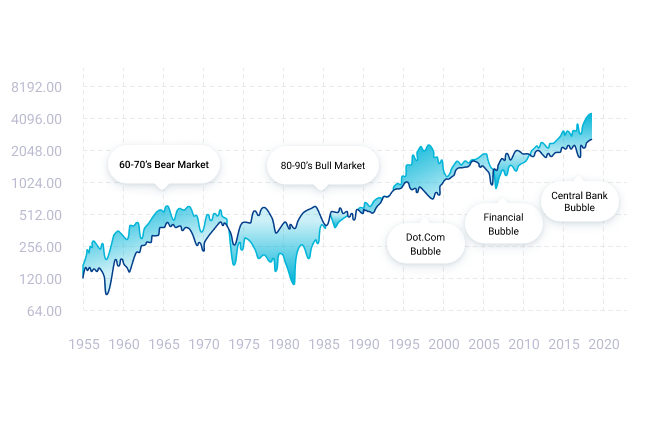

The situation seems more or less normal. The stock market has improved, the dollar is growing, but the prices are worrying. But there are other things that ordinary people say in less detail, first of all, a serious bubble has formed in the stock market:

Second, there has been renewed speculation that, with tightening monetary policy, capital inflows to corporate debt markets could begin to be severely constrained by soaring default risks.

Third, there are significant difficulties in debt financing for the US, whose credibility has been severely eroded since the default of the US — the repudiation of its obligations to operate with Russian dollar assets.

In fact, if we overcome the “conspiracy of silence” (for the sake of which various “third-party” issues are raised, from Russia’s special operation in Ukraine to monkeypox), then objective information will reach the American society that the financial and economic model within which the United States existed for the last decades, is no longer viable.

The consequences of this are a separate topic. But the mainstream economy of the West still does not have the corresponding theory.

Macroeconomics

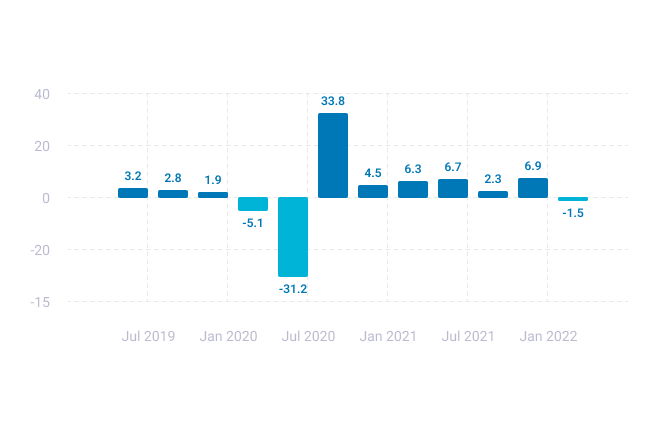

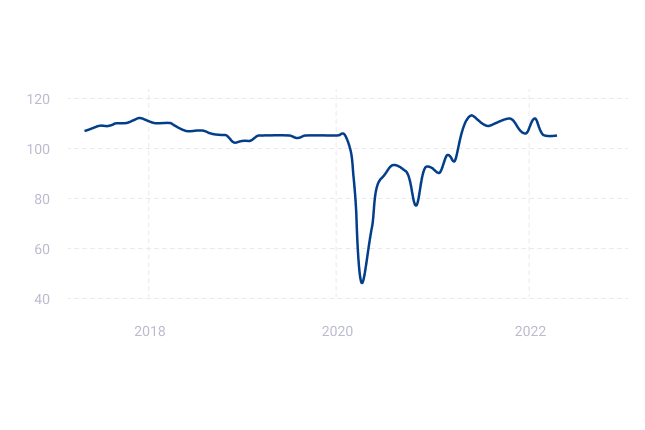

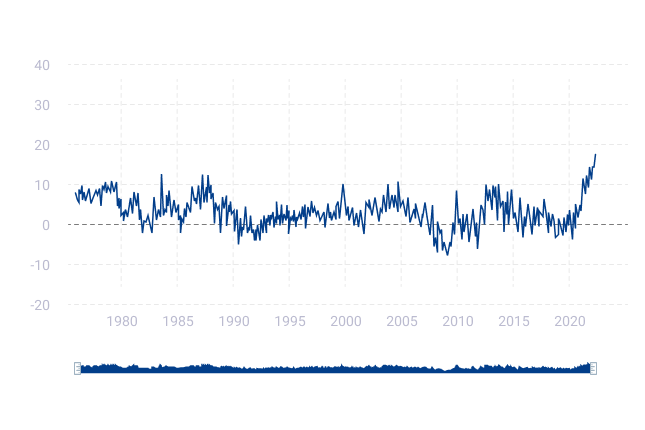

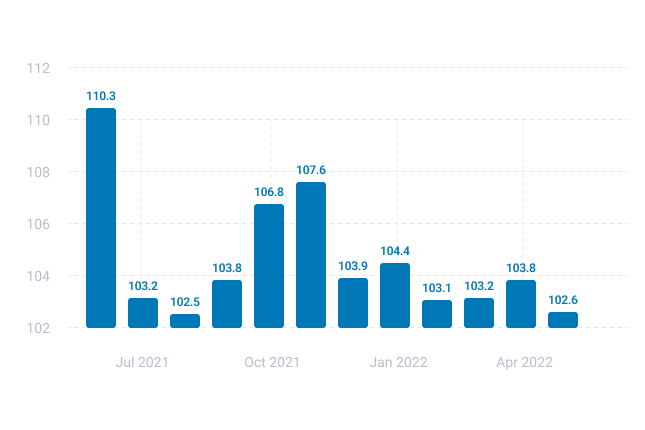

US GDP growth rate -0.4% per quarter:

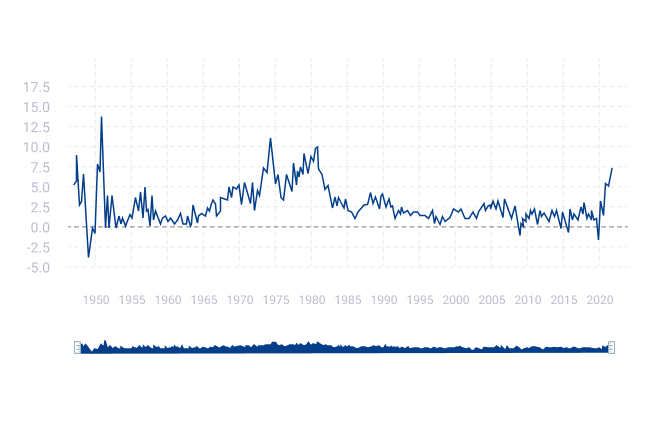

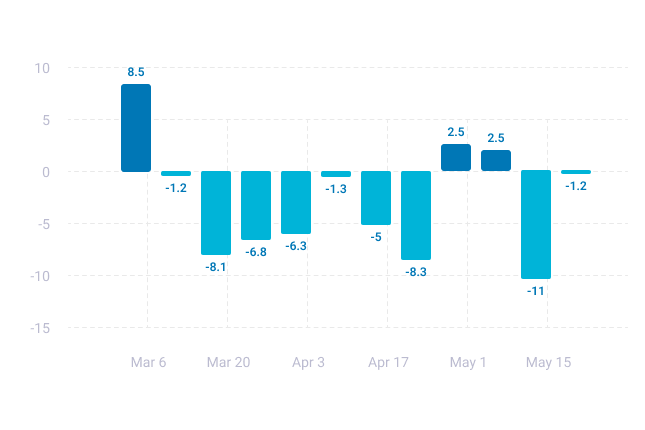

Implicit price deflator +2.0% per quarter, this is the peak since 1981:

Consumer price expenditures rose 1.8% QoQ and also climbed to the top since 1981:

PMI (Purchasing Managers’ Index, industry peer review, below 50 means stagnation and recession) of the Euro Area industry is at the trough for 1.5 years, new orders for the first time in 2 years heave fallen into the red zone:

UK manufacturing PMI is the worst in 16 months:

And the service sector — for 15 months, and inflation is a record for 26 years of survey:

Business confidence in France is the weakest in 14 months:

And the business climate in 13 months:

Italian producer sentiment is worst in 13 months:

United States Richmond Fed Manufacturing Index slumped from +14 points to a two-year low of -9 points:

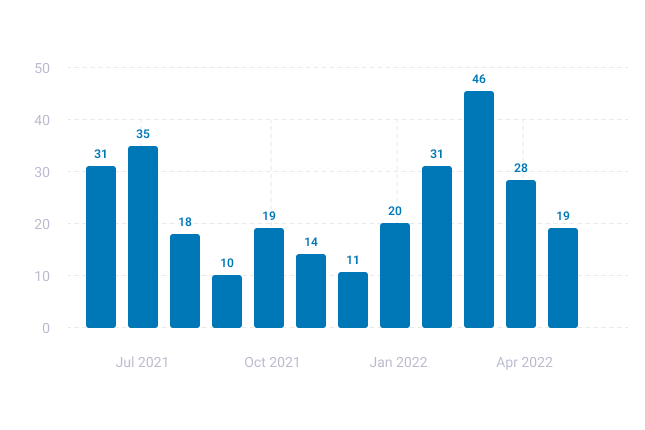

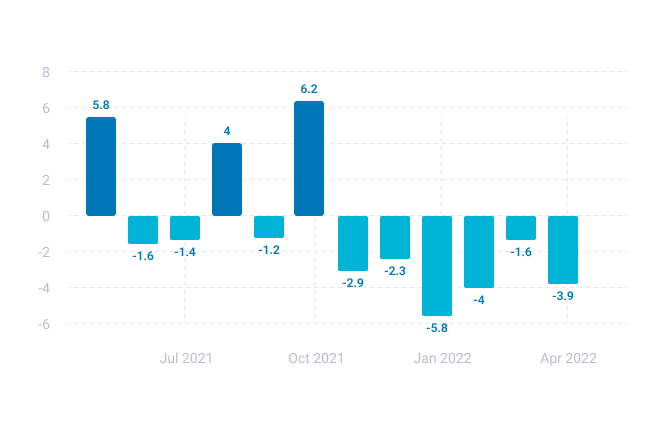

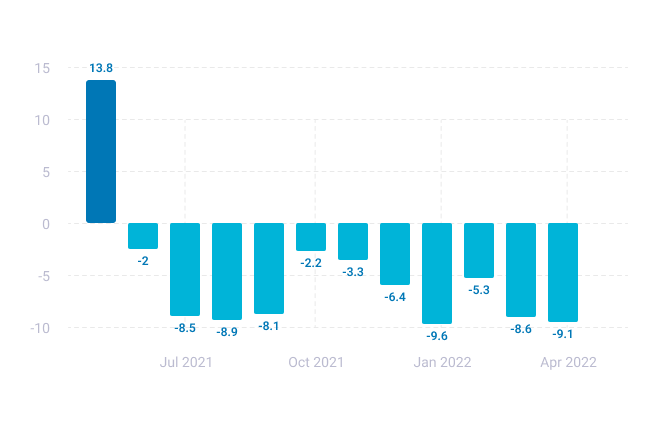

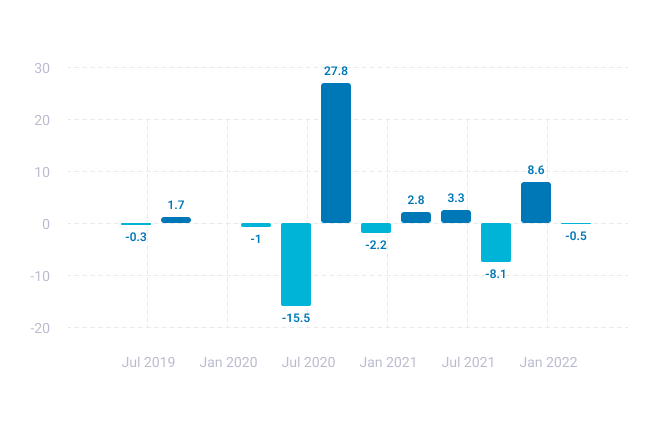

U.S. pending existing home sales -3.9% MoM — 6th consecutive monthly negative:

And -9.1% YoY, this is the 11th consecutive negative:

New home sales in the US -16.6% per month fell to a 2-year low (almost -45% from the peak of 2020):

Median price +19.6% per year, average +31.2%, the latter is a record for 46 years of observation:

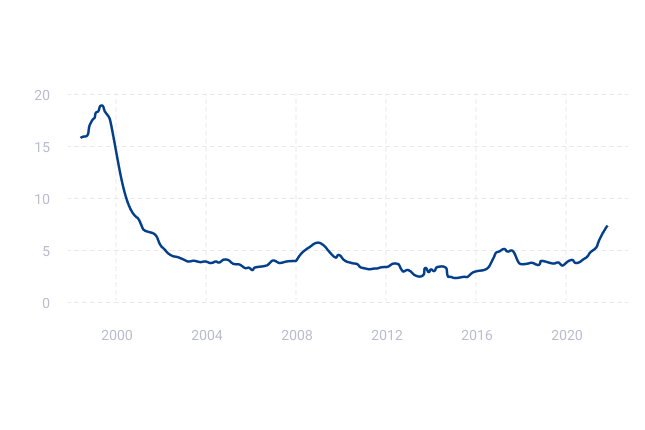

U.S. mortgage applications continue to decline:

Mexico core inflation rate (Consumer Price Index less highly volatile food and energy components) of Mexico +7.2% per year, that’s a peak since 2002:

Brazil CPI +12.2% per annum, topped its highest since 2003:

South Africa’s PPI (Producer Price Index) hit a record high (+13.1% per year):

South Koreans are extremely pessimistic in nine months:

And the French — for 8 years:

American consumers are the most depressed since 2011:

New Zealand retail sales -0.5% QoQ:

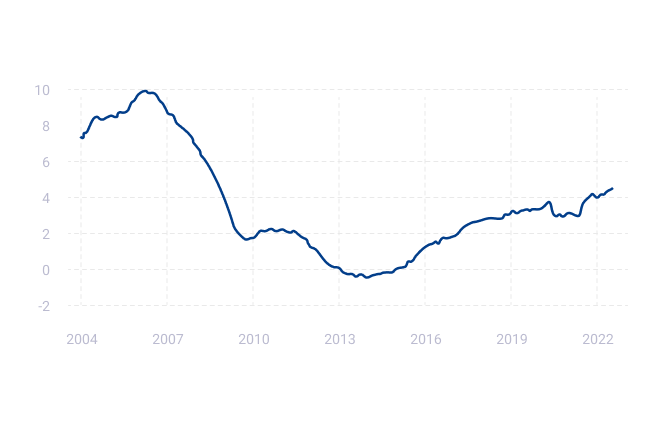

Household credit growth in the Euro Area +4.5% per year, it is the highest since 2008:

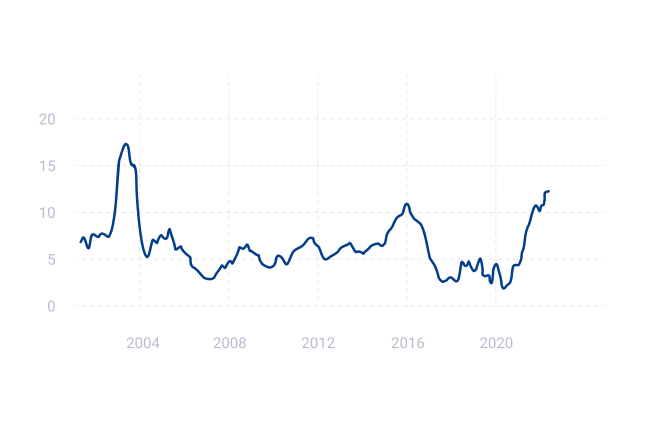

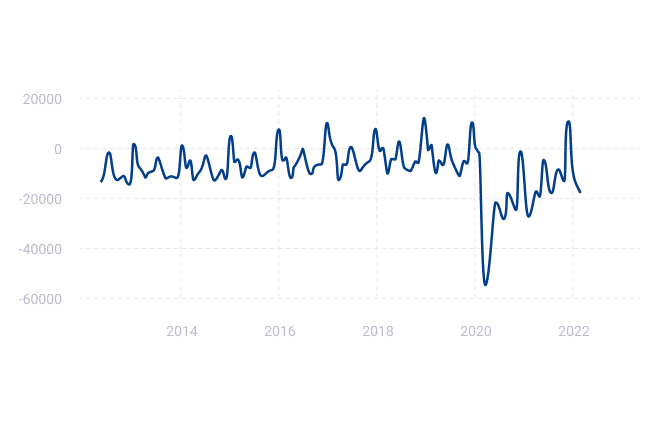

Britain’s budget deficit is gaining pace:

The Central Bank of New Zealand hiked the rate for the 5th time — by 0.5% to 2.0%.

The Central Bank of South Korea did it for the 5th time too, by 0.25% to 1.75%.

The Central Bank of Indonesia has left the rates in place, but will increase the rate of reservation from 5% to 9% in 3 months. The Turkish Central Bank did not change anything.

The minutes of the last meeting of the Fed confirmed that in the next few meetings the rate will be raised by 0.5% each time, but later a pause is possible in order to assess the consequences of their acts.

Summary

This week’s Davos Economic Forum was held, and in previous years the main news of the week would have been its outcome. But this time it will not work for a very simple reason: the economy in Davos has been left out of discussion!

This is due to a very simple and sad reason: Davos is the main strategic forum of the international financiers, the founders of the Bretton Woods dollar system and the main economic beneficiaries of the late XX – early XXI century. But today, in the context of the beginning destruction of the Bretton Woods system, there is simply nothing to say! It is impossible to tell the truth, and there is no one to do it, there is simply no explanation for current events in terms of liberal theory. Although they almost exactly repeat the events of the early 1930s. And it’s too late to tell stories, too, because things are changing so fast that every lie starts falling apart like a house of cards in a matter of weeks. One of the most important of them is the reliability of dollar assets and US debt, and this unfulfilled fairy tale has hit the US with a boomerang — how to raise money for new treasury bills is not very clear.

It should be noted that the lack of economic theory has an extremely negative impact on the US political system: none of the parties and their political groupings is able to propose any well-behaved strategy. And local offers are quickly collapsing under the pressure of the developing crisis, while the EU has simply run out of politicians discussing real events, they prefer to live in a liberal fantasy, virtual reality, and it is simply impossible to make them responsible to the peoples living in the EU.

And let’s not forget the general and widespread distortion of statistics. Both the US and the EU seriously undercharge inflation (perhaps there’s a double-digit undercharging in some sectors of the economy), so talk of a “recession” starting soon is pure nonsense. And because the “recession” is a cyclical crisis and is not related to the current economic processes. And because a pretty serious downturn has already started and has been going on for at least six months. Of course, with this inflation rate it will be impossible to hide this for a long time, so pretty soon it will be necessary not only to recognize the reality, but also to show the world the already accrued recession. And the only positive thing is that the readers of our Reviews know the real state of affairs and can make the only right economic and management decisions!