By and large, nothing interesting happened during the week. The situation with the Zaporozhskaya nuclear power plant was revealed, but this news is clearly outside the economy. Neither Biden, nor Powell, nor Yellen, nor the EU leadership said anything new (although they did say quite a lot). The only important news, the actual closure of the Nord Stream, came after the close of the working week. And although the next one will obviously stir up the economic space of the European Union, there will be no consequences for this one.

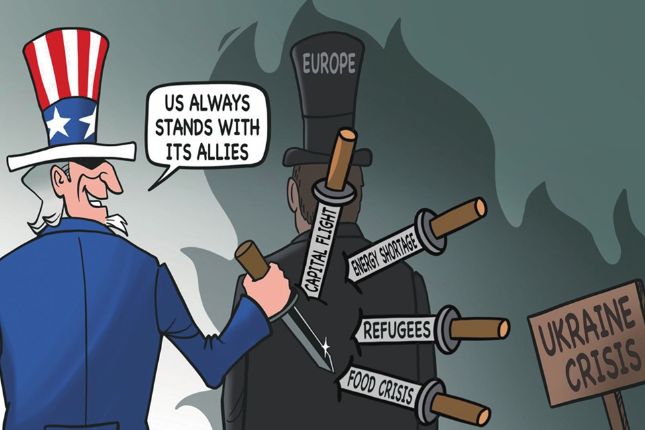

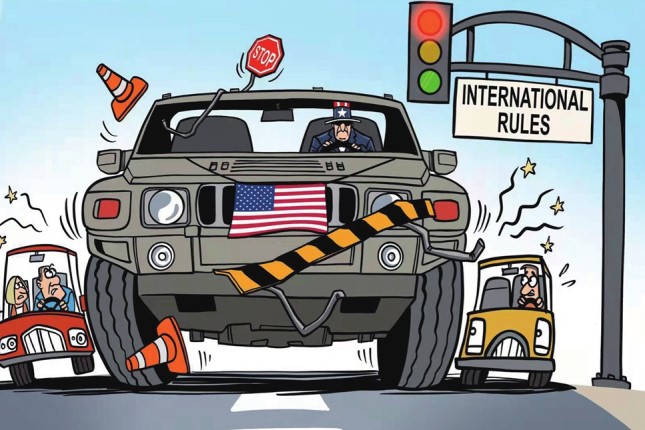

It can only be noted that the G7 decided to actively continue its attacks on Russia in terms of attempts to impose a ceiling on the prices of oil exported by Russia and limit maritime transport. No one doubts that there will be no positive consequences from all this for the world economy and specifically for the organizers themselves, but such decisions in themselves already go beyond the scope of economic expediency and represent political hysteria. The analysis of such behavior is beyond the scope of our reviews, here we recommend turning to other sources.

Macroeconomics

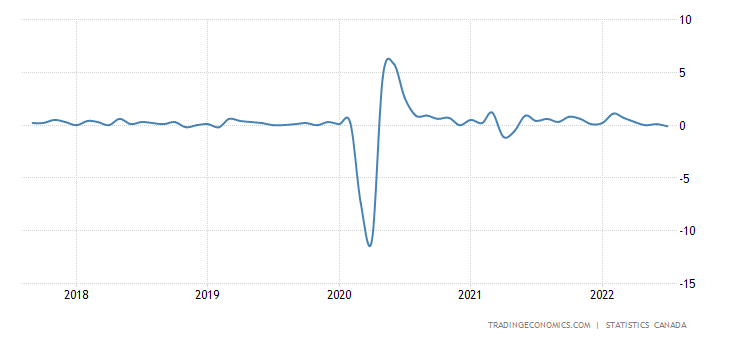

Canadian GDP -0.1% per month — 1st minus in 14 months:

Canada Monthly GDP MoM

Just in case, we remind you that this is in conditions of underestimated inflation in official reports.

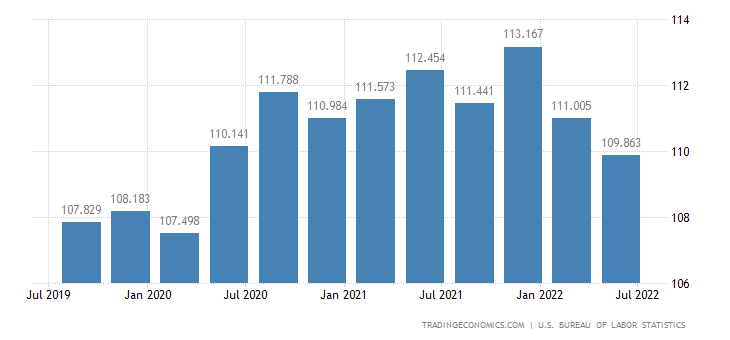

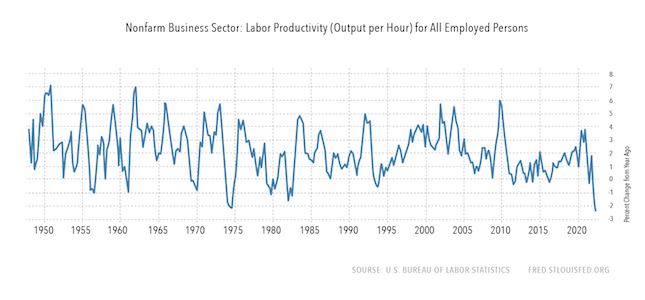

US labor productivity -1.0% per quarter:

United States Nonfarm Labour Productivity

And -2.4% per year is an anti-record for 75 years of data collection:

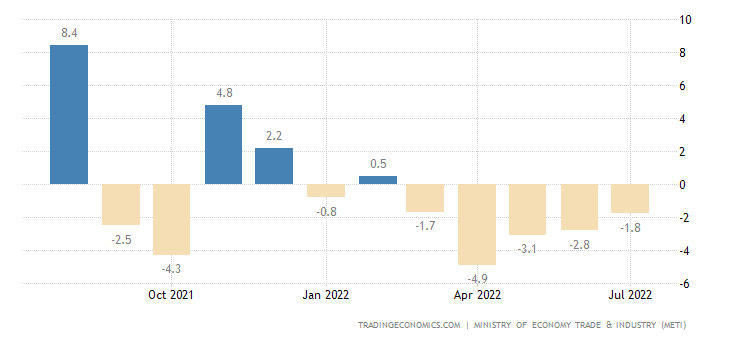

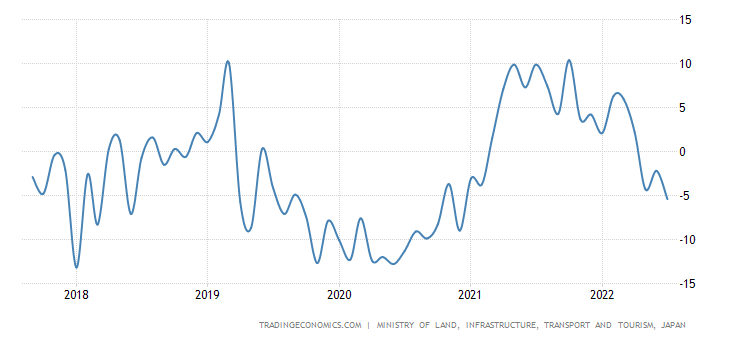

Industrial production in Japan -1.8% per year — the 5th negative in a row:

Japan Industrial Production

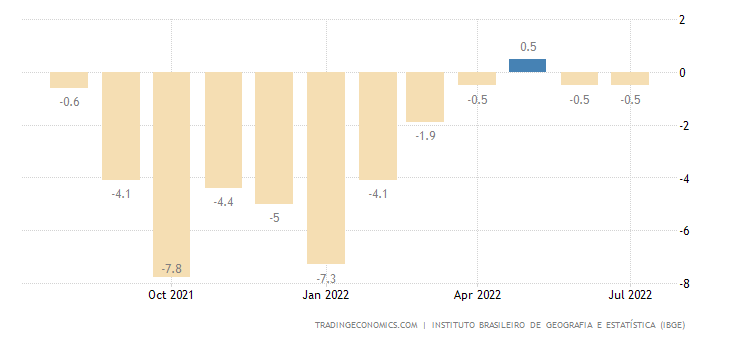

And in Brazil, its annual dynamics over the past year was in positive territory only once:

Brazil Industrial Production

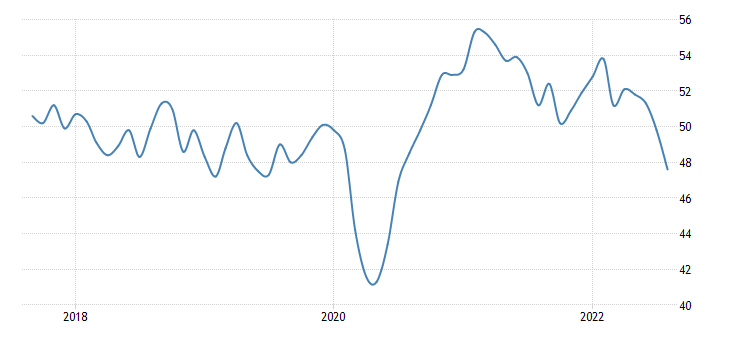

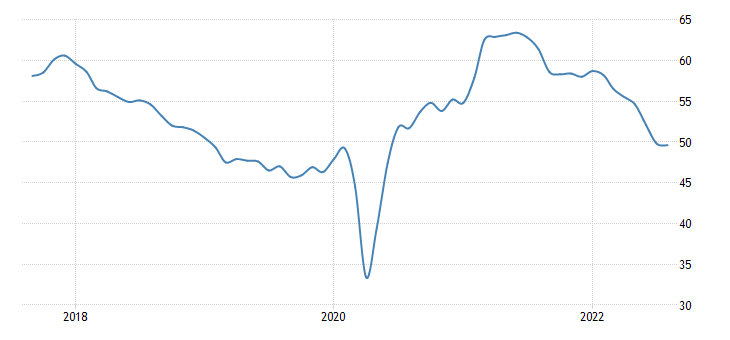

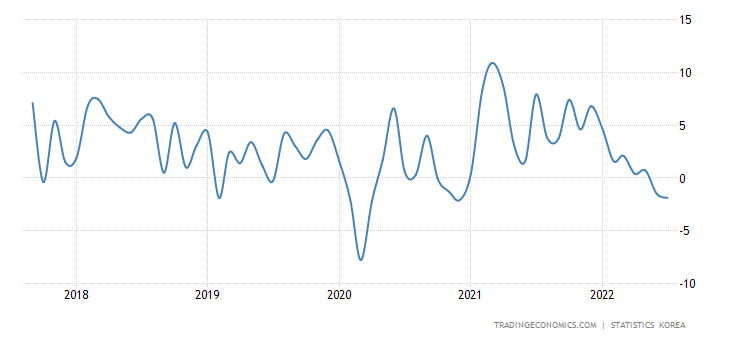

PMI (an expert index of the state of the industry; its value below 50 means stagnation and recession) of the South Korean industry (47.6) showed the worst decline in 2 years:

South Korea Manufacturing PMI

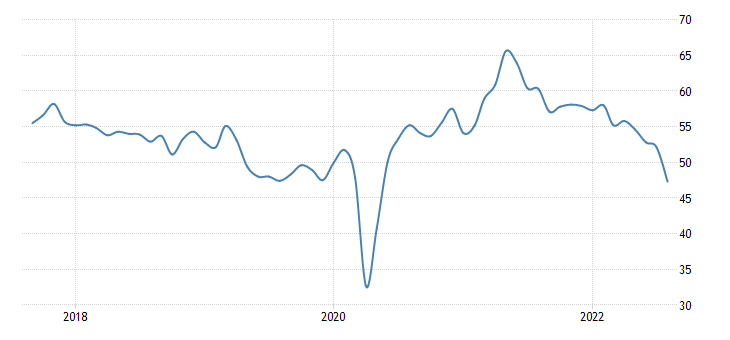

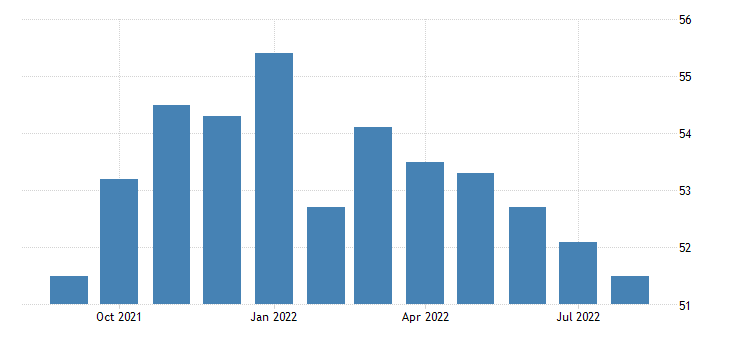

As in the eurozone (49.6):

Euro Area Manufacturing PMI

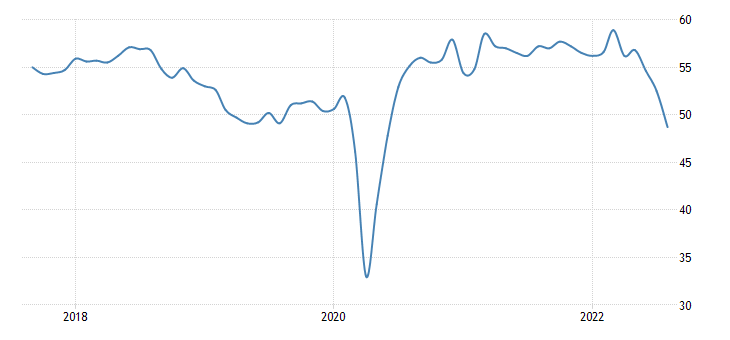

And in Britain (47.3):

United Kingdom Manufacturing PMI

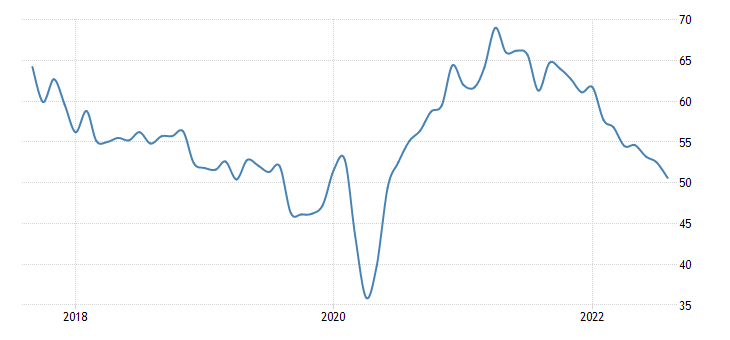

And in Canada (48.7):

Canada Manufacturing PMI

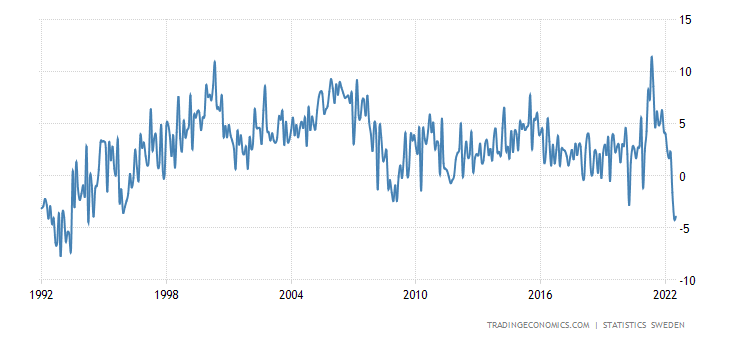

In Sweden, PMI also has a 2-year bottom:

Sweden Manufacturing PMI

And in the US, according to both versions:

United States Manufacturing PMI

And in Japan, the annual minimum:

Japan Manufacturing PMI

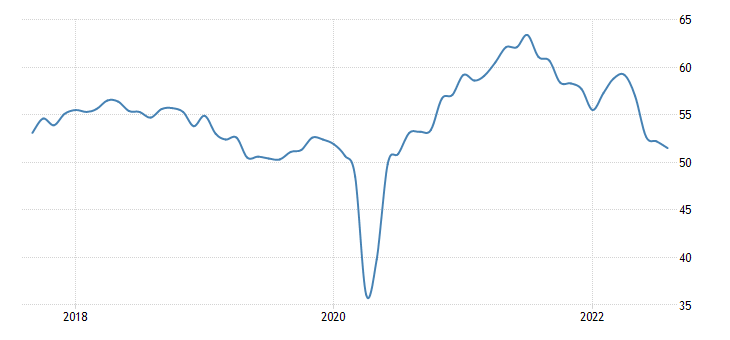

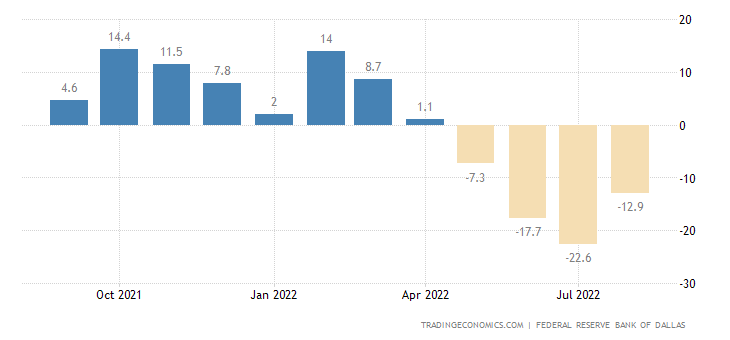

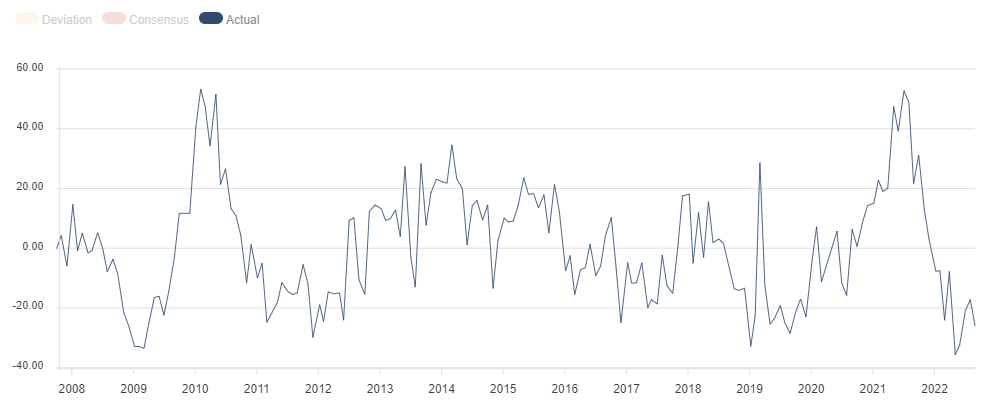

Again, we remind you that it was already in the conditions of underestimated inflation that a clear decline in industrial production was indicated. But in reality it has been going on for quite a long time in the United States — at least since October last year. The Texas

Fed Index has been in the red for 4 months in a row:

United States Dallas Fed Manufacturing Index

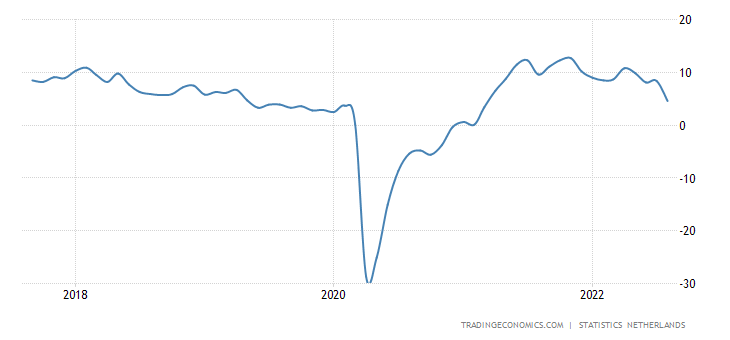

Business confidence in the Netherlands weakest in 1.5 years:

Netherlands Business Confidence

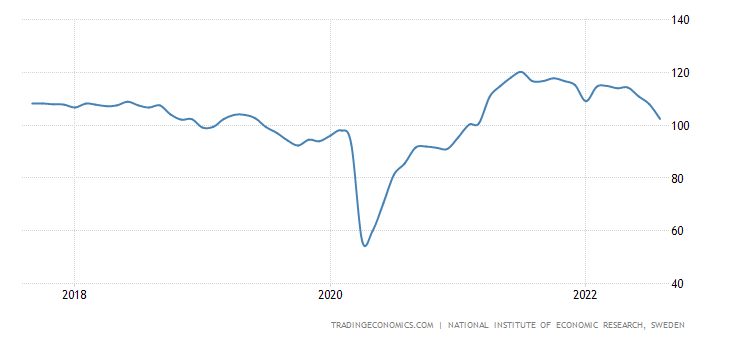

Same in Sweden:

Sweden Business Confidence

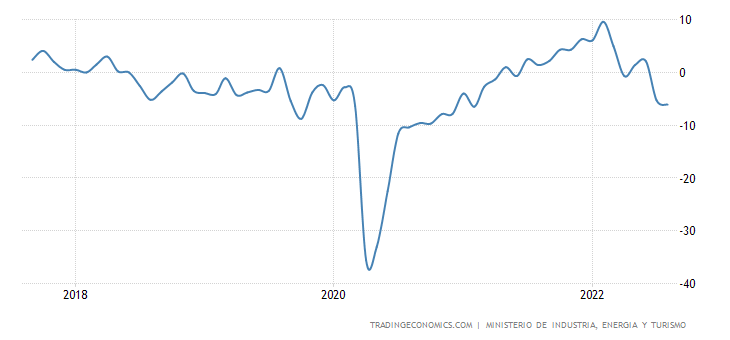

And in Spain:

Spain Business Confidence

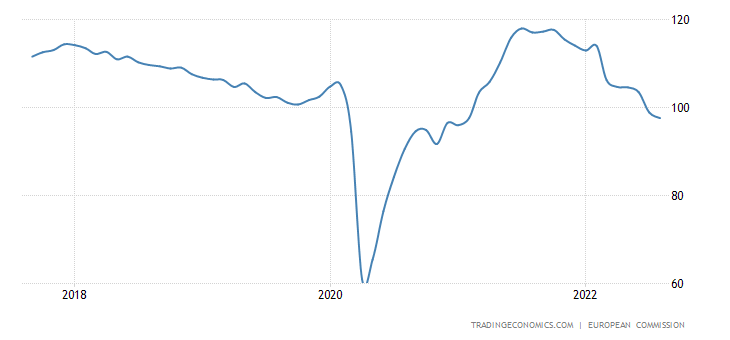

And in the Eurozone:

Euro Area Economic Sentiment Indicator

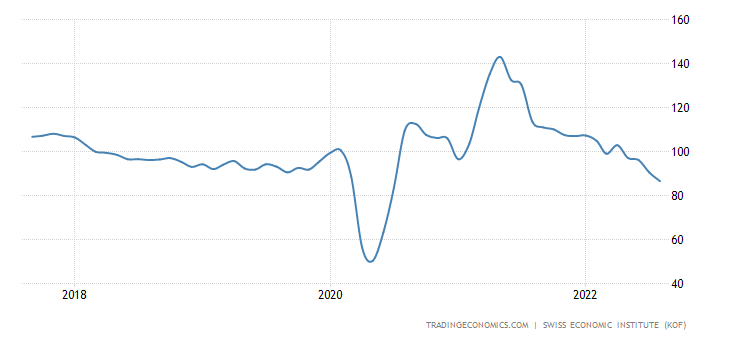

Leading indicators of Switzerland at the bottom for 2 years:

Switzerland Business Confidence

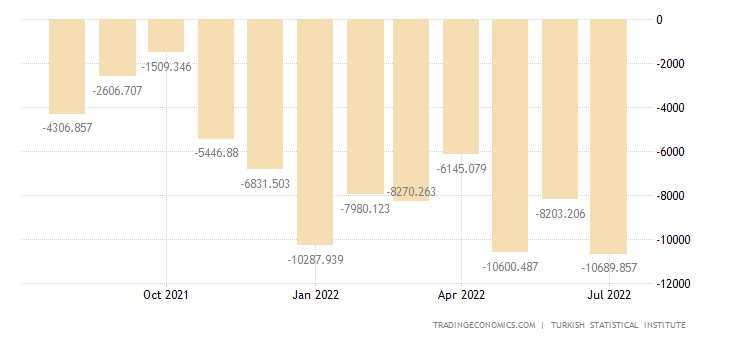

Turkey’s trade deficit is record:

Turkey Balance of Trade

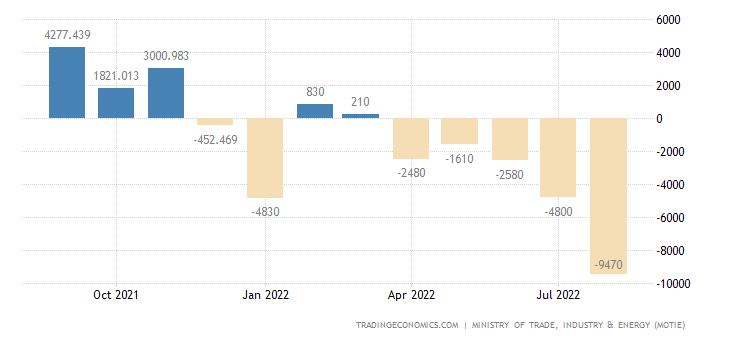

The same in South Korea:

For countries whose prosperity is built on exports, the situation is extremely dangerous. It is not surprising that Turkey does not dare to quarrel with Russia: this is the only potential market for it today. Theoretically, for South Korea — too, but she first needs to negotiate with the DPRK.

New buildings in Japan -5.4% per year — the 3rd negative in a row and the worst dynamics since the end of 2020:

Japan Housing Starts

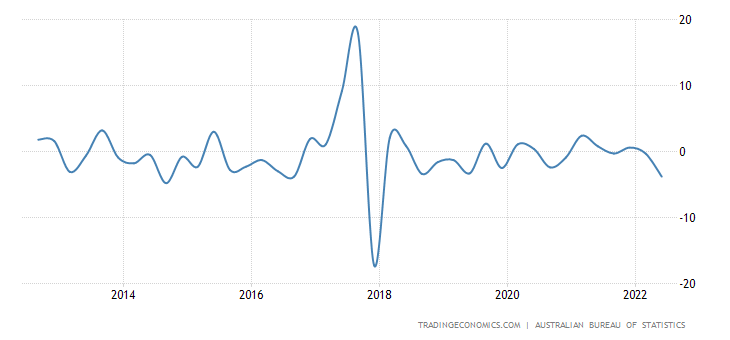

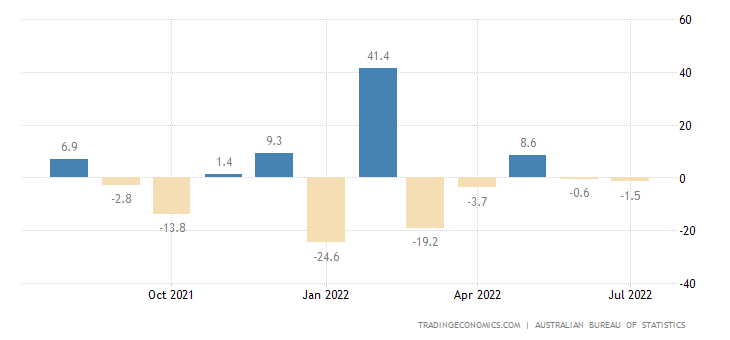

Australian construction in April-June -3.8% per quarter — an anti-record for 6 years:

Australia Construction Output

Building permits in Australia -17.2% per month —

Australia Dwelling Approvals

And -25.9% per year

Australia Building Permits (YoY)

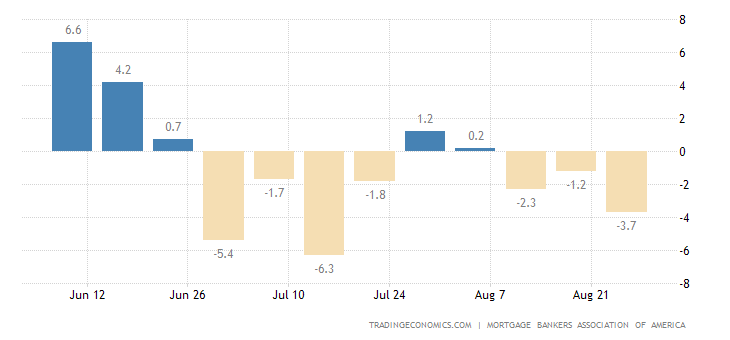

Mortgage applications in the US fell again: -3.7% per week, a drop of almost three times in a year (including refinancing — six times):

United States MBA Mortgage Applications

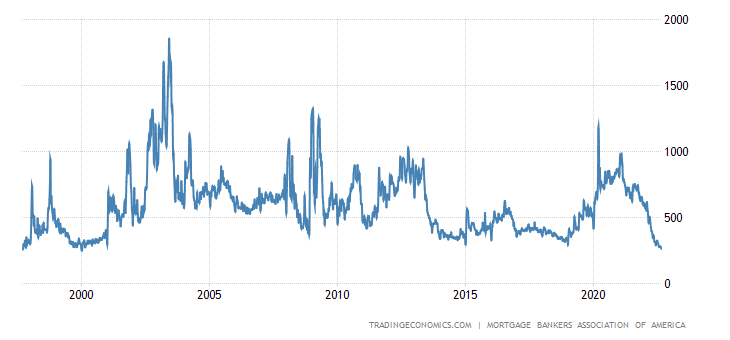

And updated the bottom since the beginning of 2000:

United States MBA Mortgage Market Index

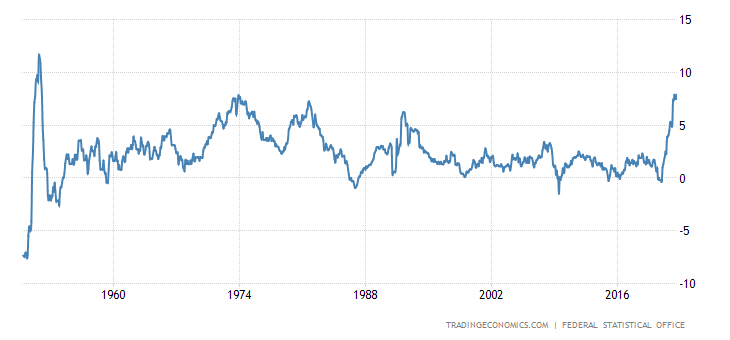

German CPI (Consumer Inflation Index) +7.9% per year — 70-year high:

Germany Inflation Rate

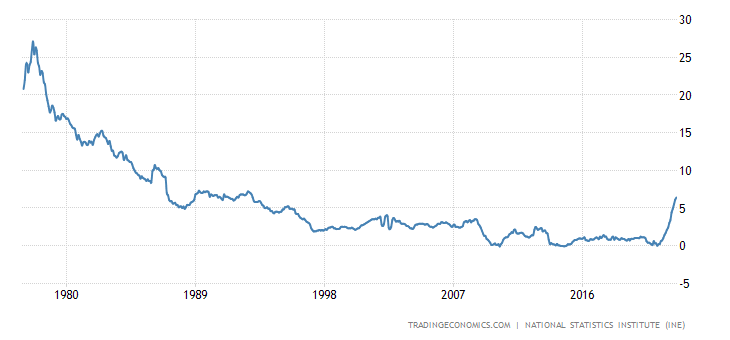

“Net” (excluding highly volatile food and fuel components) Spanish CPI + 6.4% per year — the highest since 1993:

Spain Core Inflation Rate

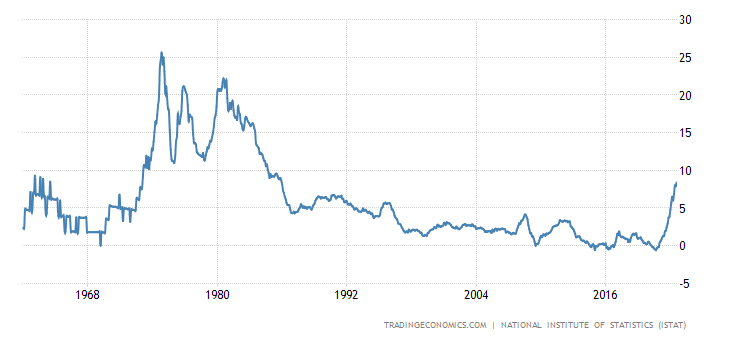

Italian CPI +8.4% per year — peak since 1986:

Italy Inflation Rate

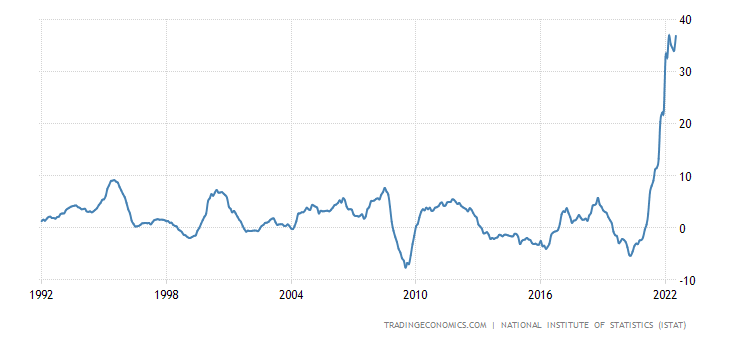

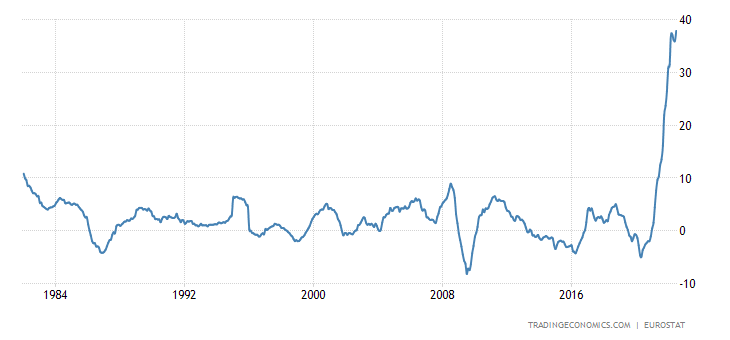

PPI (industrial inflation index) of Italy +36.9% per year — a record for 31 years of statistics:

Italy Producer Prices Change

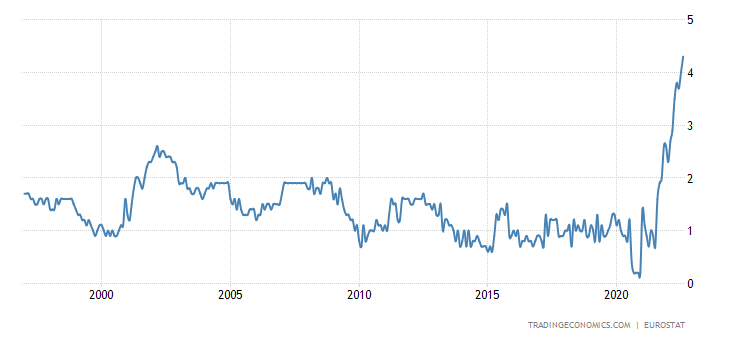

Eurozone CPI +9.1% per year — a record for 32 years of observations:

Euro Area Inflation Rate

“Net” CPI +4.3% per year is also a record for 26 years:

Euro Area Core Inflation Rate

Eurozone PPI +37.9% per year — a record for 41 years of data collection:

Euro Area Producer Prices Change

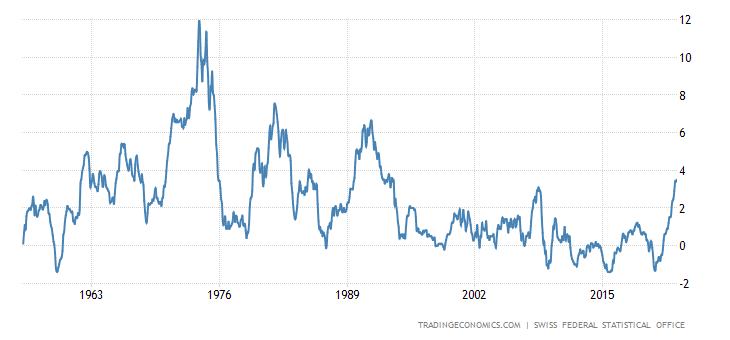

Swiss CPI +3.5% per year — the highest since 1993:

Switzerland Inflation Rate

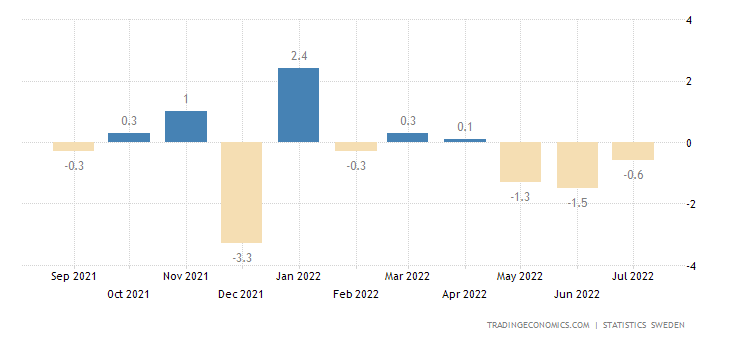

Retail Sweden -0.6% per month — 3rd negative in a row:

Sweden Retail Sales MoM

And -3.9% per year — the worst dynamics since 1994:

Sweden Retail Sales YoY

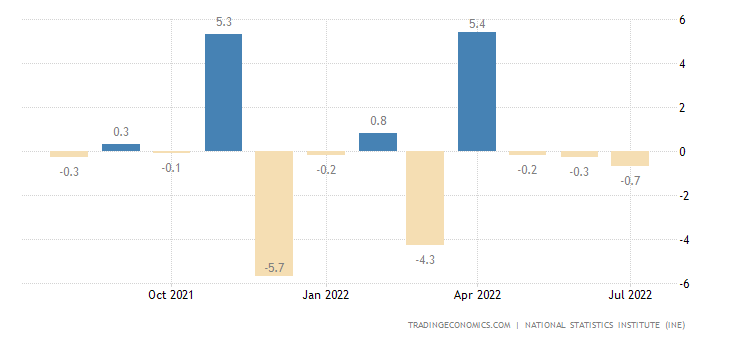

Retail sales in Spain -0.7% per month — also the 3rd negative in a row:

Spain Retail Sales MoM

And -0.5% per year:

Spain Retail Sales YoY

And for the umpteenth time — this is against the backdrop of low inflation!

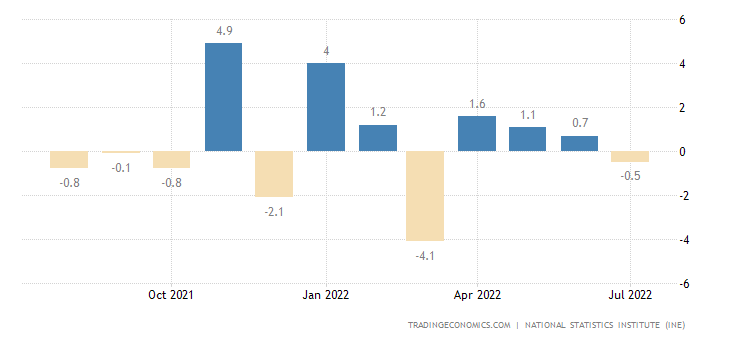

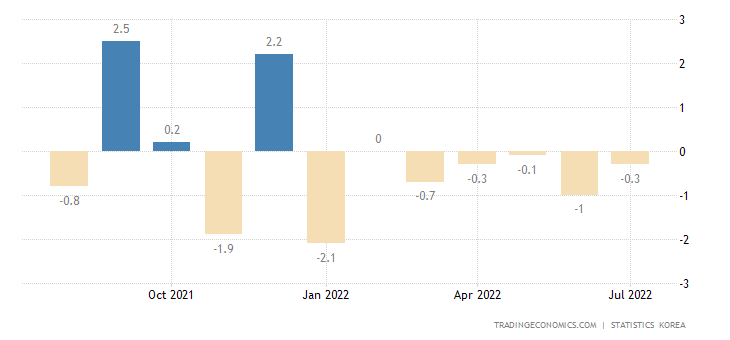

Retail South Korea -0.3% m/m — 7 consecutive months of decline or zero change:

South Korea Retail Sales MoM

And -1.9% per year — the 2nd minus in a row and the bottom in almost 2 years:

South Korea Retail Sales YoY

German retail keeps in the annual red for 3 months in a row:

Germany Retail Sales YoY

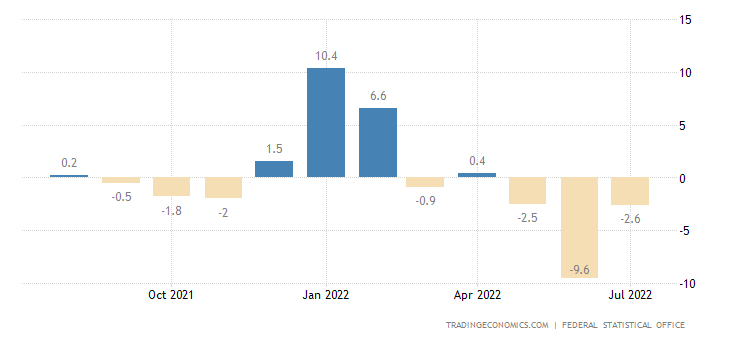

The number of unemployed in Germany is growing for 3 months in a row:

Germany Unemployment Change

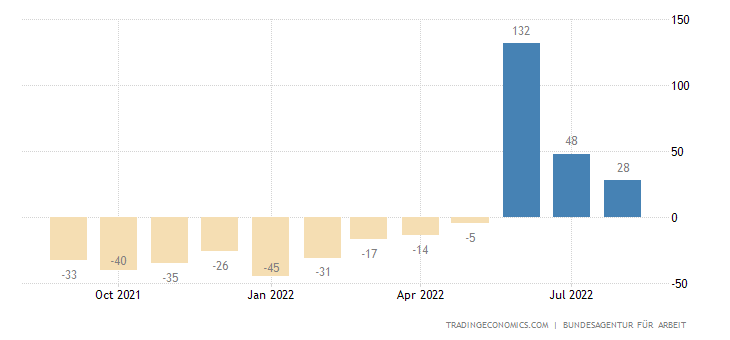

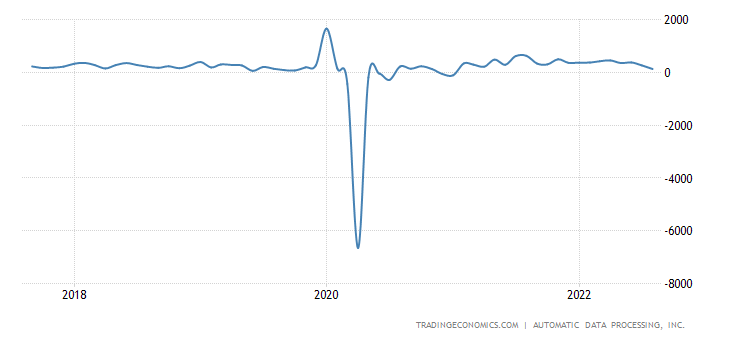

U.S. private sector employment grows at worst pace in 19 months:

United States ADP Employment Change

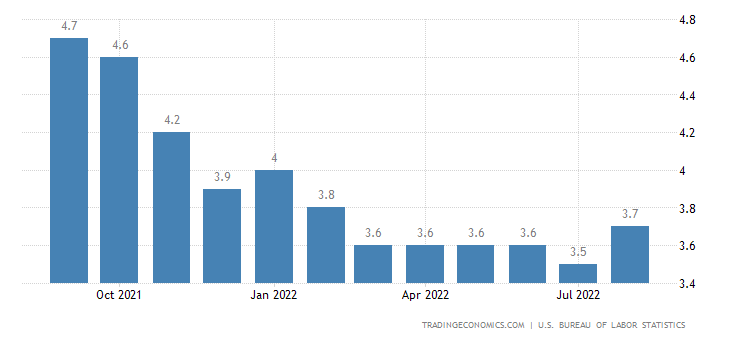

And the U.S. unemployment rate unexpectedly rose to a six-month high:

United States Unemployment Rate

However, we have repeatedly explained that labor statistics in the United States are so distorted that it is almost impossible to draw any objective conclusions on their basis.

Main conclusions

There is a regular structural crisis.

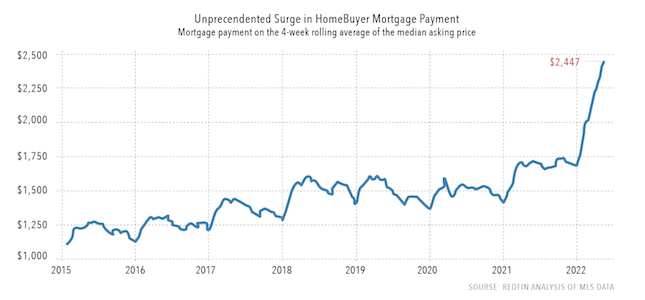

The deterioration of the situation affects, first of all, the way of life of households. In particular, in the United States, the amount of money that goes to mortgage payments has grown significantly:

Since real disposable incomes of households are also falling, and mortgage payments cannot be abandoned, this greatly affects the consumption behavior of households. Accordingly, sales volumes and production are falling.

A similar situation in Germany, here it can be clearly seen in the propensity to save:

Falling savings means that households still trust the authorities and believe that the situation will change for the better. So, they try to maintain consumption levels, and as incomes fall, they do so by reducing savings.

Since readers of our reviews understand that no improvement is overwhelmingly likely to occur in the coming years, we can expect that at some point households in Germany will dramatically change their behavior, significantly increase savings (above the average rates) and reduce consumption very significantly. This will cause a sharp drop in Germany’s GDP, and this drop will be immediately visible in the statistics.

Today, as we have already noted more than once, the decline in GDP, consumption and income is happening in reality, but in nominal figures (due to high inflation) it is not visible. Accordingly, by lowering inflation the monetary authorities have the opportunity to show a more or less optimistic picture (since the crisis is still going on and, as we see from this Review, the reality has to be acknowledged in part). But in the event of a sharp change in the consumer behavior of households, the situation changes — here the fall occurs even in nominal figures.

Some analogue was in the US at the border of 2021 and 2022. Although inflation increased in the fourth quarter of 21 (here we showed the inadequacy of the leadership of the US monetary authorities, see reviews from the beginning of autumn last year), the US authorities still showed high GDP growth in the last quarter of the year due to its underestimation. But in the first quarter of this year, budget support for households was sharply reduced and aggregate demand fell — we had to demonstrate a real drop in GDP, which cannot be turned into a plus.

So, a sharp change in the consumer behavior of households is called panic. Today, there is no panic in the world, people are annoyed, worried, they are starting to think — but so far, they believe the authorities. Somewhere in the spring, the abscess will open and panic will begin in the world. Perhaps it will be caused by a crash in speculative markets, although it is more likely that a crash can be expected after the start of the panic. An accurate analysis of this situation belongs more to the field of mass psychology than to economics, so we will confine ourselves to stating that the transition is inevitable at some point. Our experience says that this will most likely happen in February-March, but this is a purely expert opinion, under which there is no analytics.