There are boring weeks when it is unclear what to talk about. The past week has been highly combative – at least three events are worth discussing. The first is the ongoing banking crisis. We noted in the previous review that the crisis was manageable at the first stage, but since the banking sector situation is difficult, continuation is possible.

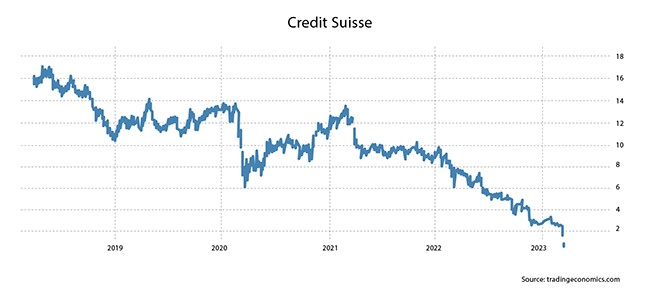

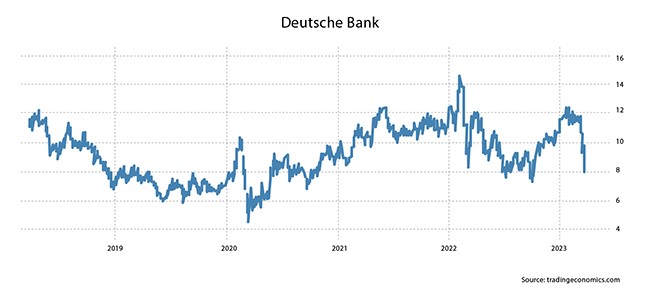

It happened. You can see how bad things are on the price charts of Credit Suisse and Deutsche Bank (the former has already gone bankrupt, but the latter has not yet).

But the week was not less important events. In particular, the visit of Chinese President Xi Jinping to Moscow. Formally, this event is political, but it completes the destruction of the "unipolar" world. This inevitably entails destroying the Bretton Woods dollar system, which, we agree, is the most important economic event. However, the statement of the inevitability of this event does not mean that it will happen tomorrow …

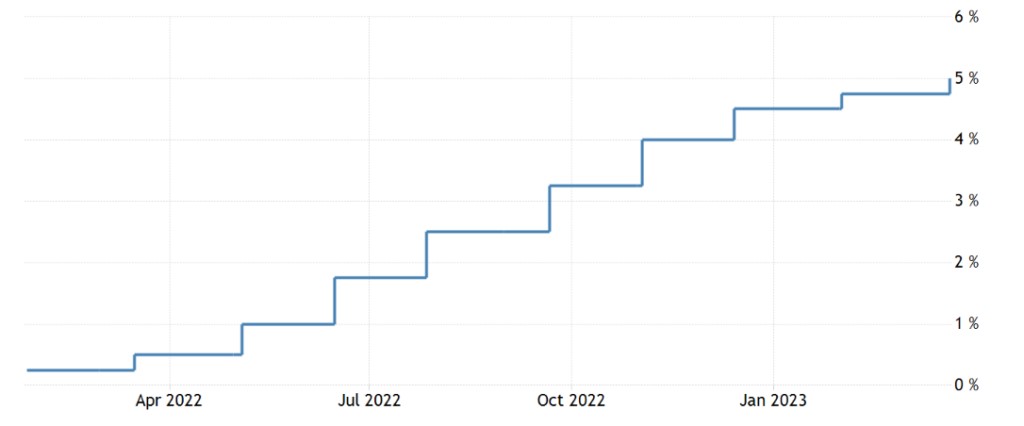

And for this reason, we consider the meeting of the US Federal Open Market Committee, which raised the rate by 0.25% (bringing it to 5%), and the press conference of its head Powell, to be the main event of the week. The rate was raised, although hotheads said it was impossible to do this in the conditions of the banking crisis, two times less than planned at the beginning. But the most interesting thing was said by Powell at a press conference:

- Isolated banking problems, if left unresolved, can threaten the banking system;

- Savings of all depositors are safe;

- The Fed, Treasury and FDIC have taken decisive action earlier;

- We remain firmly committed to bringing inflation to 2%;

- Inflation remains too high;

- Higher rates and slower growth put pressure on businesses;

- Ready to use all tools to ensure the security of the banking system;

- The labour market is still very "dense";

- Inflation has eased slightly, but the strength of recent data points to inflationary pressures;

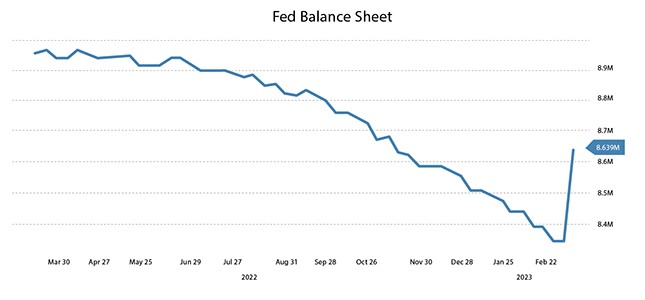

- We continue the process of significant reduction of our balance sheet;

- The process of inflation recovery is a long way;

- We will carefully monitor the input data and the actual and expected effects of credit conditions. We use this as the basis for our decisions;

- Too early to say how we should respond to the banking crisis

In addition, in response to questions, Powell said:

- Bank tension can be considered as the equivalent of raising rates;

- Credit tightening in banks – easing monetary policy from the Fed;

- Banking stress – compensates for the lack of tightening of the Fed's monetary policy;

- The Fed took into account all the events in the banking segment in its forecasts for the rate ceiling for 23-24 years;

- Disinflation is in force! (this is happening here and now);

- Still no progress in the service sector;

- There should be an easing of demand through the future balance in the labour market;

- There are no serious holes in the banking system;

- The purpose of the SVB supervisory investigation is to find out what went wrong;

- The US banking crisis – the consequences are not yet known;

- Rate cuts in 2023 – not our main expectation! The collapse of the SVB Bank – cannot be 100% the reason for the Fed to turn around;

- Changes are needed in the US banking system – I immediately understood this;

- Recent provision of liquidity to banks – boosted our balance sheet, Yes;

- But this does not change the Fed's position on the main goal – to reduce inflation in the US to 2%;

- We have tools to protect depositors when the economy is threatened, and we are ready to use them;

- It's too early to tell if recent impacts are changing the chances of a soft landing;

- There is a path to a soft landing of the US economy;

- Depositors' deposits are safe;

- Developments in the banking sector do not give 100% confidence that everything will be bad.

And now, I will explain. Firstly, Powell admitted that there is a crisis in the banking sector (initially, after reaching the desired goal, allowing the issue in favour of banks, there was a desire to quickly close the topic). Secondly, he acknowledged what we have been writing about in several reviews – that inflation began to rise again, even before the banking crisis began. Thirdly, he constantly repeats that the situation is under control and that the goal of 2% inflation has not gone away.

The latter is important since the head of the Treasury (US Department of the Treasury) and Powell's predecessor as head of the Fed, Yellen, said in her press conference that there would be no guarantees for all deposits in the US. An exception was made for Silicon Valley Bank but it will remain an exception. But the most important point in Powell's speeches is an attempt to maintain high credibility for the Fed. Because if the confidence of the markets is lost, it will be impossible to keep from the crisis.

But there are problems with this. Even considering that most observers do not understand macroeconomic patterns, they understand that inflation has begun to grow (and, taking into account the new issue, it will continue to grow). The Fed has no desire to raise the rate since even its current value severely impacts the banking system worldwide.

Powell "talks" about inflation, including the threat of raising the rate, but almost no one is sure that he will dare to seriously raise the rate. And the desired indicator of 2% is still very, very far away. Moreover, this distance has begun to grow again. And if you also take into account Powell's hints that to reduce pressure on inflation, it is necessary to lower the population's standard of living of the population …

What to do in such a situation? We must agree to a decrease in the population's standard of living until a constant state is reached between household income and expenditure. The trouble is that the GDP and living standards fall will be too great (more than 50% of real US GDP and 2/3 of nominal) to say it out loud and even directly begin to act in this direction. The trouble is that these indicators will still be achieved, and the longer the US authorities resist, the worse the crisis will be.

Macroeconomics

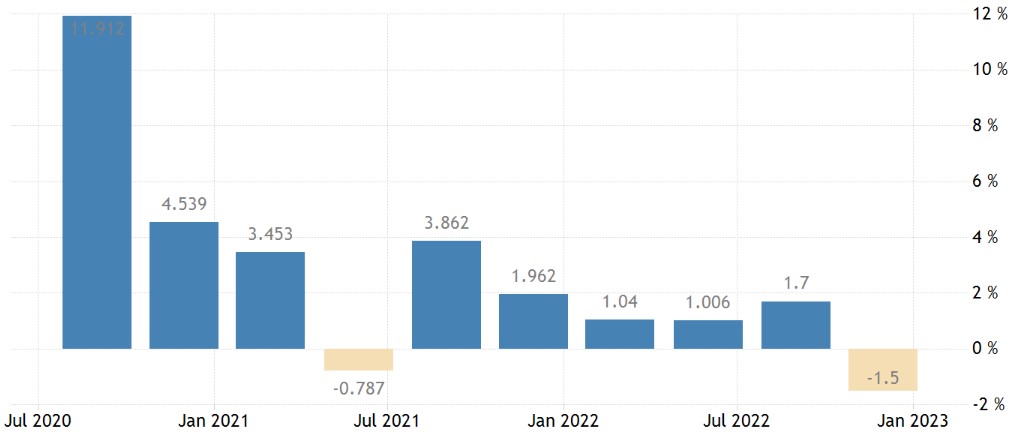

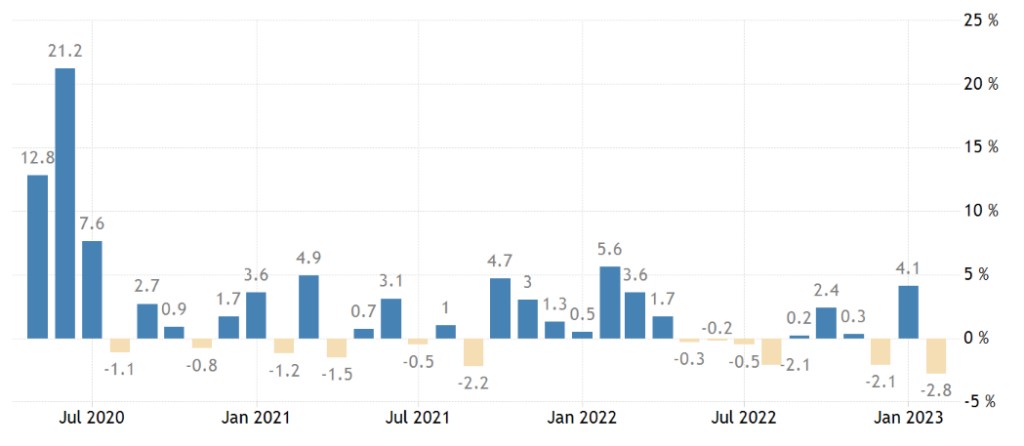

Argentina’s GDP -1.5% per quarter – the worst dynamics in 2.5 years:

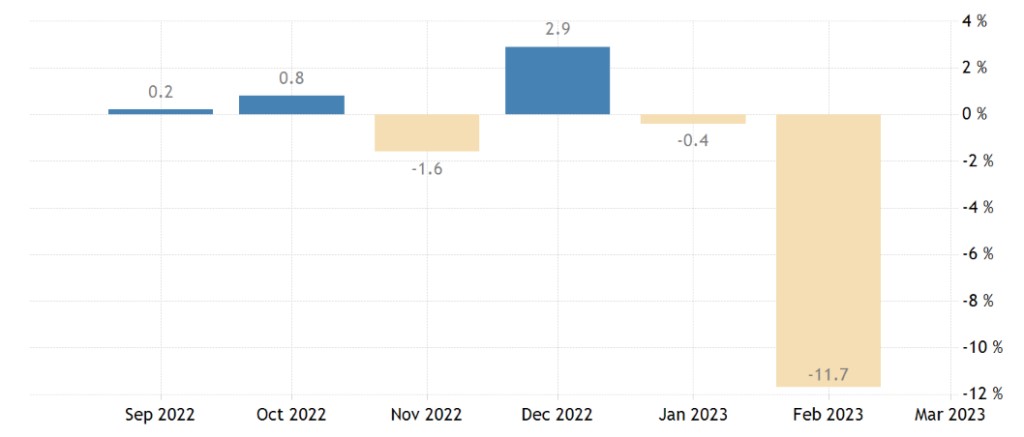

Singapore manufacturing output -11.7% m/m – 2.5 year minimum:

And -8.9% per year – the weakest indicator since 2019:

Canadian Manufacturing Sales -2.8% m/m – 3-year bottom:

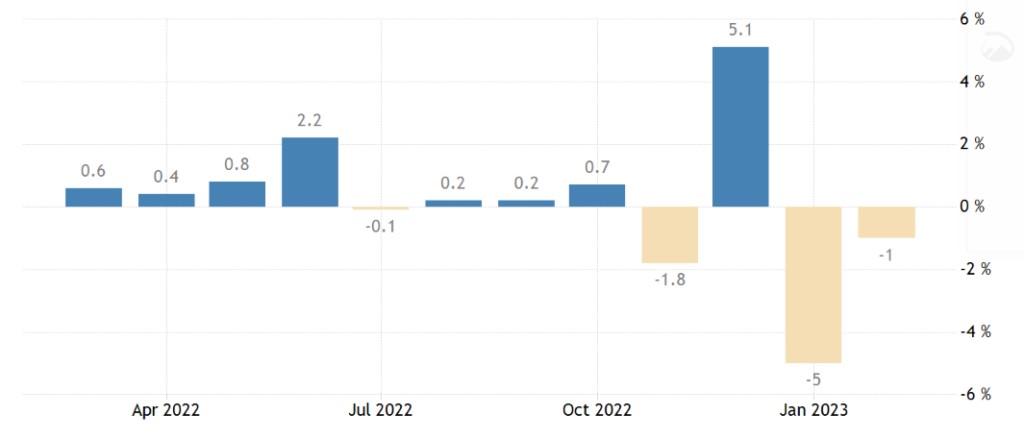

US durable goods orders -1% m/m after -5% earlier – 3rd minus in 4 months:

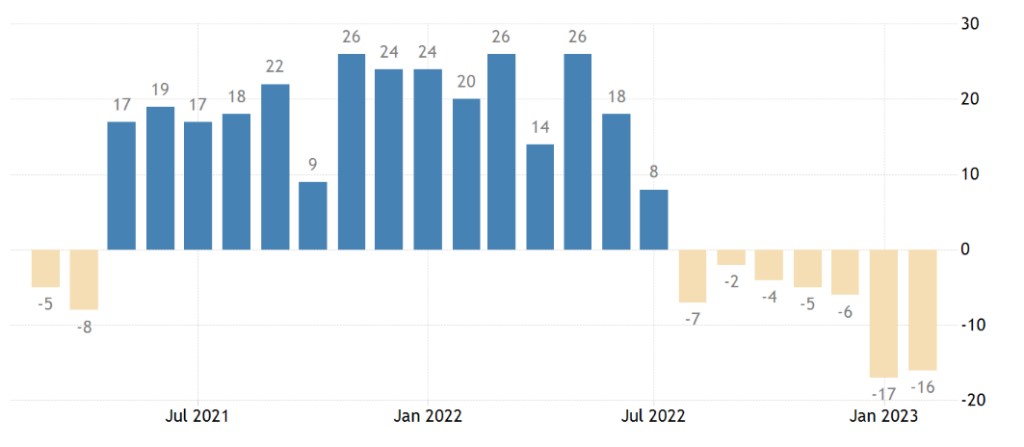

Order balance in the UK industry is the worst in 2 years, in the red for 8 months in a row:

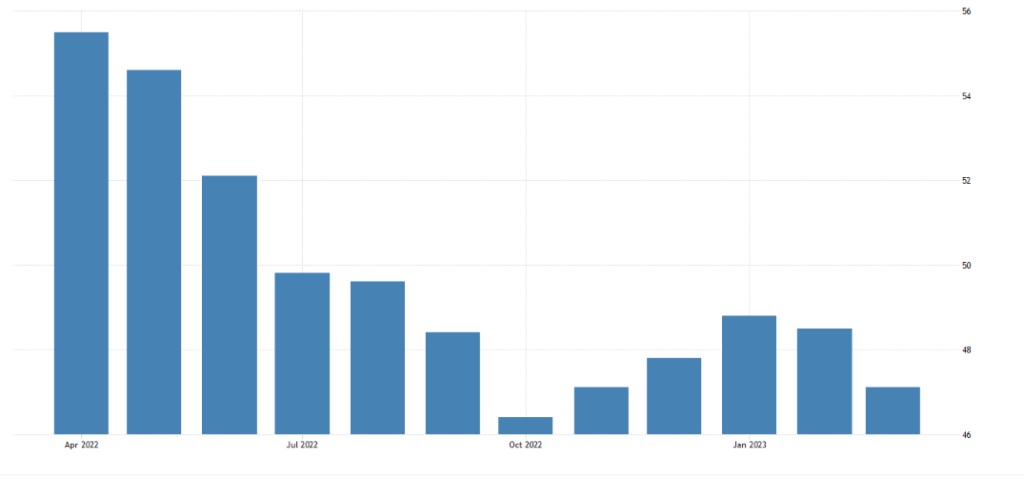

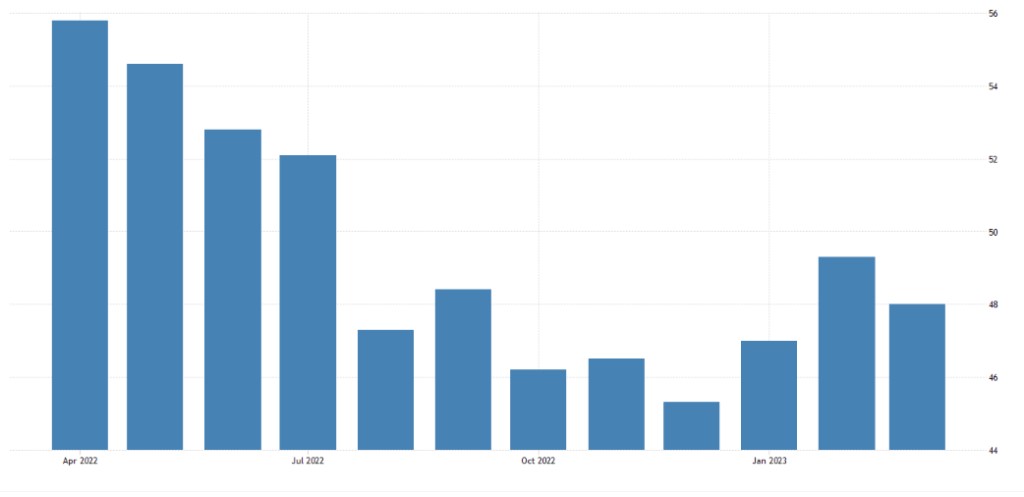

PMI (expert index of the state of the industry; its value below 50 means stagnation and recession) of the Australian industry (48.7) is the lowest in 3 years:

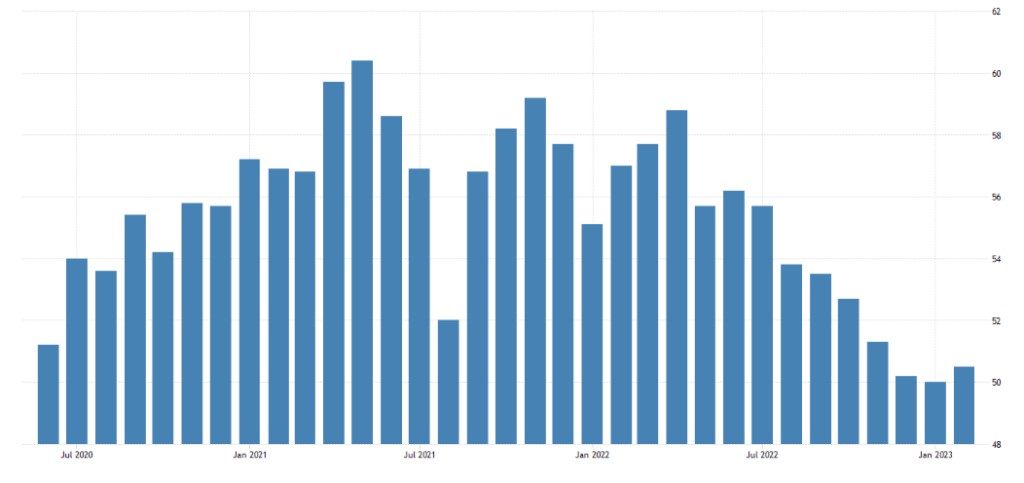

Eurozone 47.1 is the 9th consecutive month in the downtrend zone:

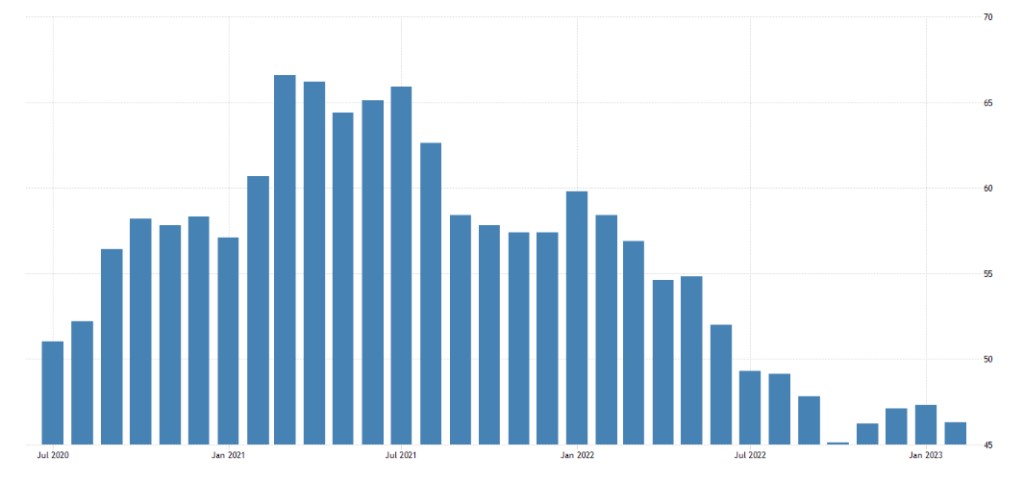

Mainly due to Germany (44.4) where the 3-year bottom is:

In the UK, PMI (48.0) has been in recession for the 8th consecutive month:

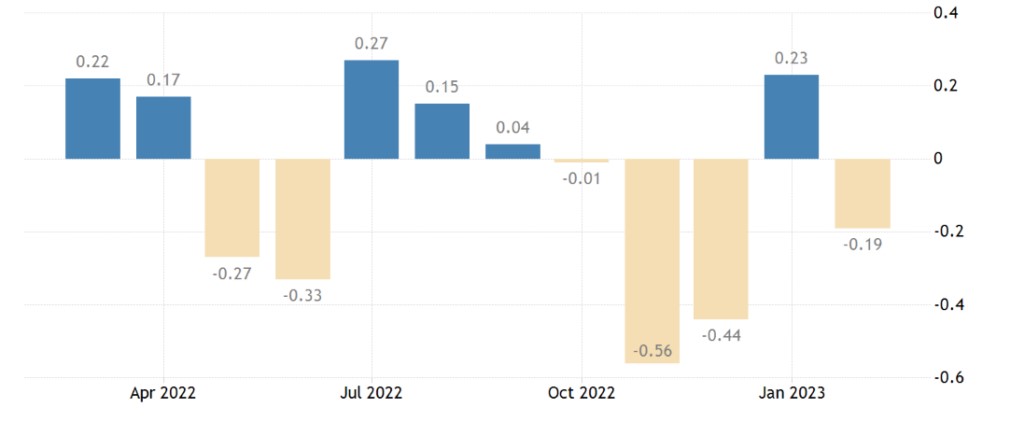

The National Activity Index in the USA from the Chicago Fed is -0.19 – the 4th minus over the past 5 months:

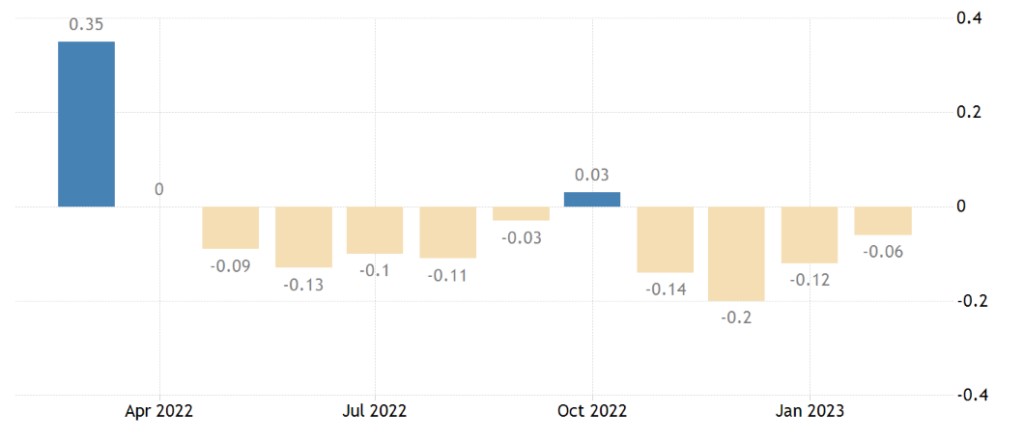

Australia’s leading indicators have been falling for 4 consecutive months and 10 months out of the last 11:

UK Food Inflation +18.0% pa – 46-year high:

UK retail sales -3.5% per annum – 11th consecutive minus:

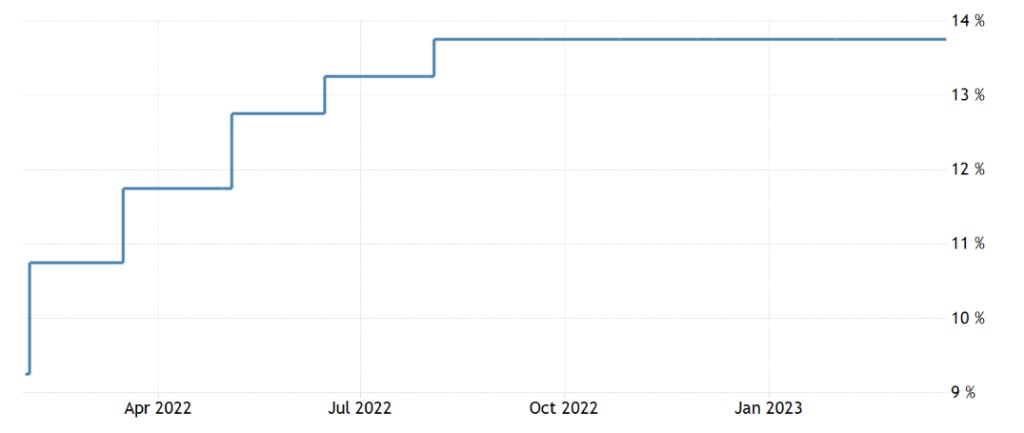

The Central Bank of Brazil kept its monetary policy unchanged,

as well as the Central Bank of Turkey.

The Central Bank of China kept rates in place, but have reduced the reserve ratio for banks by 0.25%.

The Fed raised the rate by 0.25% to 4.75-5.00%, slightly worsened the forecasts for the economy.

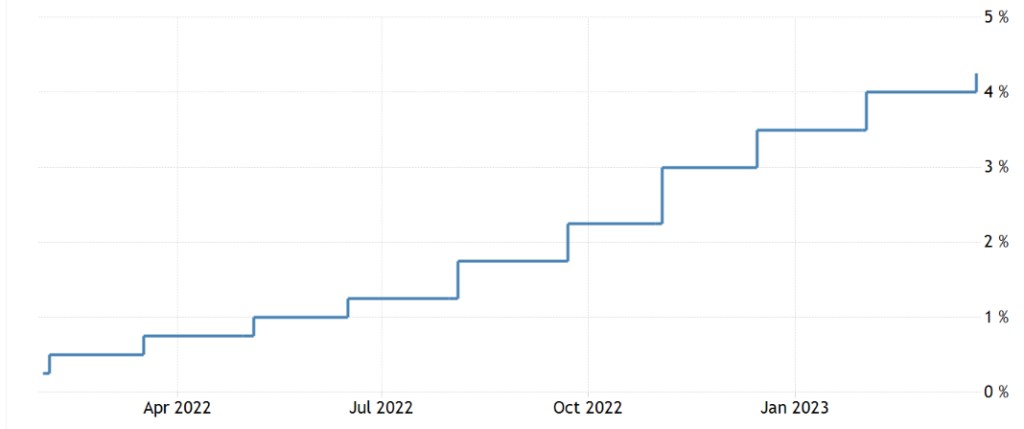

The Bank of England raised interest rates by 0.25% to 4.25% on the back of a sudden rise in inflation.

Main conclusions

The structural crisis continues in full accordance with the theory: the rate of economic decline is not growing, but not falling either: in some sectors, the situation seems to be improving, but new negative indicators appear every month.

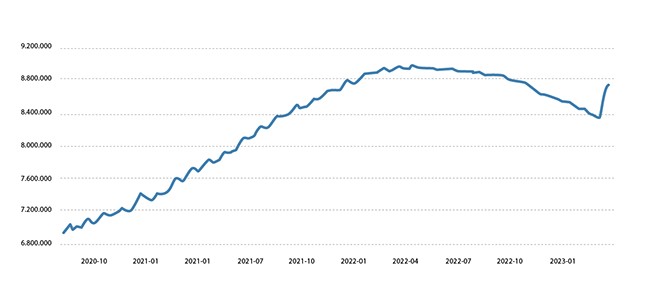

Consequently, the monetary authorities have to do something; they can only make one thing: print money. And, accordingly, to the 300 billion dollars of emission last week, another 100 were added, not this one:

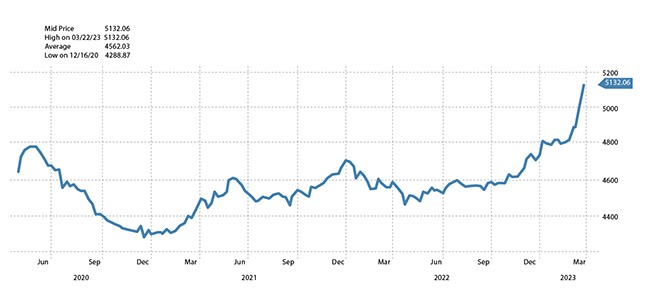

We will see how this money manifests itself in inflation, but for now, we note that the money that is withdrawn from bank deposits (“the panic of depositors”, which has not yet been completely stopped, especially taking into account Yellen’s statement, see the first section of the Review) people are storing in purely speculative instruments:

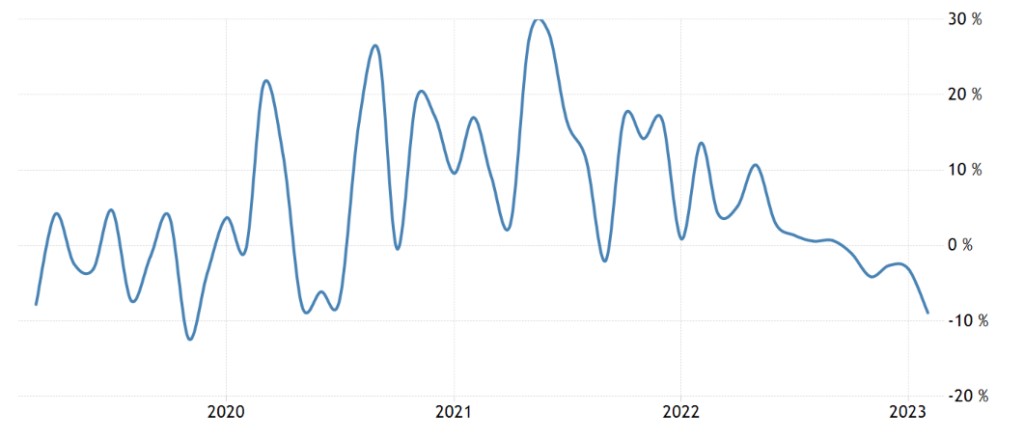

This, of course, does not add stability to the markets. By the way, in recent weeks, the Fed has derailed almost half of its annual work to reduce the balance sheet:

So, we will see how the situation in the European Union will develop, particularly whether they will be able to keep Deutsche Bank from bankruptcy, which, in reality, is more of an all-African bank than a German one. But the main threat, of course, is the position of the US monetary authorities, who have demonstrated their complete helplessness regarding real control over the situation.

However, considering the time lag between emission and inflation growth (which reaches 2-3 months), we can practically say with certainty that there will be no market collapse in the US (this does not apply to the EU) before the start of summer.