Despite many countries desiring to reduce their dependence on hydrocarbons, the global demand for gas will continue to grow over the next eight years, according to the latest expert forecasts.

However, there is quite a significant gap between predictions. If in the Stated Policies Scenario (STEPS) the IEA estimates a 3.4% increase in gas demand by 2030 compared to the previous year, then OPEC is more optimistic (12.8%). At the same time, experts have noted the increasing importance of LNG, which can also be seen from an historical retrospective.

Growing competition

From 2019 to 2021, LNG trade increased by 8.5% worldwide to 372 million tonnes, and in the first ten months of this year, the supply volume reached 87% of all imports in 2021. About 63% of deliveries in January-October were to the Asia-Pacific region and 32% to Europe. But what is interesting is that compared with the whole of 2021, imports to the former region dropped by 23%, while imports to the latter jumped by 30%.

Of course, this is due to decreased pipeline gas flows to EU countries. But, by the way, EU states increased their imports of Russian LNG by 49% YoY in January-October of this year. However, the leading suppliers of liquefied gas to the region were the United States, Algeria, and Qatar.

In the Asia-Pacific region, the supply decline was driven mainly by China and India due to sensitivity to high prices and the slowdown in economic growth caused by quarantine measures in China. India’s LNG imports fell 20% YoY in October, with storage capacity reaching its limit as buyers preferred cheaper oil products.

In China, LNG imports are expected to decline by 14% YoY to 69 million tonnes by the end of the year (Wood Mackenzie estimates), which would dethrone China from the " pedestal of importers " (Japan would become the leader). Nevertheless, in mid-October, China announced plans to increase the pace of construction of LNG storage and reception facilities.

Thus, Europe had to compete with South Korea and Japan, where demand for gas soared during the heat wave, for a finite supply carried by a limited number of ships. However, if anti-COVID restrictions are finally lifted, China could begin to increase purchases again, which would lead to a deficit in Europe, with the market balance continuing to recover due not to an increase in supply, but to lower demand.

The fight for tankers

The competition for volumes between regions could be a harbinger of serious upheavals in the gas market. A real struggle for tanker capacity has already unfolded between suppliers. According to Bloomberg, Shell chartered the YIANNIS LNG tanker for $400,000 a day—the highest price in the history of the Atlantic Basin shipping market. And India’s GAIL, in turn, is forced to pay about $360,000 to charter the SCHNEEWEISSCHEN.

Because of the focus on energy security, the entire market has returned to a long-term approach to supply and transport. Thus, to hedge future risks, traders are buying up ships (currently, the main owners of LNG tankers are Greece, Japan, and Qatar).

For example, as of August 2022, customers of the British shipping company Clarkson had placed orders worth $24.1 billion—nearly a 55% increase over the whole of last year. And according to Rystad Energy, there are 257 vessels on the order book worldwide (for comparison, the total fleet at the end of 2021 was 588 tankers).

At the same time, South Korean shipbuilders will not have spare capacity to fulfil new orders until 2027, which, in turn, is reflected in the cost of construction ($240 million per ship as of the middle of this year, versus $190 million a year ago). Chinese shipyards have also secured orders for LNG tankers until 2026.

It is expected that the situation will improve after the observed shortage of LNG transportation by tonnage (about 6% in 2021), and by 2026-2027, the surplus could amount to 10-15%.

Europe’s hope

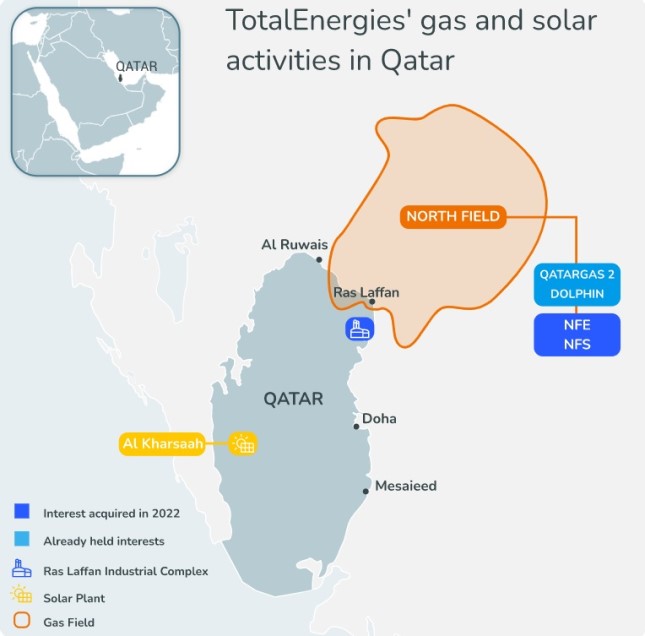

Among the main tanker customers is Qatar, one of the largest LNG exporters, with an operating capacity of 77 million tonnes (about 20% of global demand for liquefied natural gas in 2021). But this capacity has been fully tapped in recent years. By the end of 2025, it is planned to launch the North Field East project with a capacity of 33 million tonnes per year, and by 2027—North Field South with a capacity of 16 million tonnes. At the same time, Qatar has already contracted about half of its existing and under-construction capacity, and shipments are focused on LNG end users.

Another promising, albeit still young player in the LNG market is the United States. The country’s operating liquefaction capacity as of April 2022 was estimated at 86 million tonnes. Since its introduction in February 2016, the load has remained at a high level (averaging 85% over this period and 102% in 2021). By 2024, it is planned to commission several projects currently under construction: Golden Pass Export, Plaquemines LNG T1-T9, and Gulf of Mexico Floating (18, 10, and 2.8 million tonnes, respectively). By 2027, the total volume of new facilities will reach 40.8 million tonnes (Golden Pass Export, Plaquemines LNG T1-T9, Corpus Christi III).

At the same time, most of the existing and under-construction facilities in the US are already more than half contracted (most agreements were concluded with traders and portfolio players with a flexible choice of delivery point). In addition, the US has a number of announced projects, but they are speculative, at the pre-FID stage.

It is with these countries—Qatar and the United States—that Europe’s hope lies, with its plans to abandon Russian pipeline gas (according to the RePowerEU plan, LNG purchases will increase by 50 billion cubic meters, or by about 35 million tonnes by 2027). New LNG regasification projects are already being actively announced in the region to ensure future imports (in particular, Germany decided in October to build terminals on the coasts of the North and Baltic Seas).

Qatar offered to sell the EU its liquefied natural gas under 20-year contracts without resale (the global share of such contracts was 39% last year as opposed to 12% in 2020), but so far, the parties have not reached a consensus due to Brussels’ plans to stop using non-environmentally friendly fuels (though Germany is close to reaching an agreement).

Moreover, LNG sellers are asking customers to pay much higher rates on new long-term contracts. For example, industry-leading suppliers are offering 10-year contracts starting in 2023 at rates around 75% higher than similar deals signed last year.

Long-term prospects

Speaking about the long-term prospects for LNG trade worldwide, it should be noted that the key driver increasing the demand for LNG may be the active growth of the economies of Asia-Pacific countries (mostly China and India). The region imports gas mainly in the form of LNG and is responsible for about 70% of the growth in global supplies of this energy resource.

There could also be a transformation in the ranking of key LNG importers in the long term. If last year the four largest buyers were China, Japan, South Korea, and India, then by 2040, India could become the second most voluminous importer. And Europe, which is developing renewable energy and other non-fossil types of energy resources, will begin to reduce imports by the same period.

According to various sources, worldwide demand could vary from 610 to 760 million tonnes in 2040 and from 770 to 800 million tonnes in 2050.

The long-term balance of supply and demand will largely depend on whether both new liquefaction and regasification projects are launched on time, as well as on how viable speculative projects prove to be.