The main news is not specific, but analytical: the liberal bankers who run the global dollar (Bretton Woods) system have no plans to save the situation in the global economy. There are many signs of this: the resignation of the UK Finance Minister Quasi Kwarteng, who held his post for only 38 days, the speech of Josep Borrell at the last conference of EU ambassadors (I remind you that he is the EU foreign policy coordinator). And finally, the publication of the minutes of the meeting of the US Federal Reserve System.

It is relevant to take into consideration that the current Prime Minister of Great Britain, Liz Truss, went to her post for a reason, she went with the reform of finance. During her work, it became clear that the reform was not feasible, while the pound sterling collapsed, the kingdom’s pension system was on the verge of collapse, and the Bank of England began unlimited emissions. See the next section for other indicators of the country’s economy.

Josep Borrell acknowledged for the first time at an official level that the economic well-being of the European Union was built on cooperation with Russia and China. If this interaction does not take place, the EU does not have a positive scenario for the development. Barrell also said that the EU has relied too much on US security guarantees and there are serious concerns that those guarantees will not be honoured. Therefore, the EU must build a new security system.

If we recall the recent speeches of Angela Merkel (today she is a private individual), who said that the European Union needs a new security architecture, which can only be built with Russia, it becomes clear that this topic is becoming fundamentally important for the EU economic elite and should be ignored, as even the liberal political elite of the region fails. The only question is that for the implementation of this task, some economic resource is needed, which still is necessary to be found somewhere.

As for the minutes of the Fed meeting, the main conclusions about the situation look like this:

– Participants agreed that it would be appropriate at some point to slow down the pace of rate hikes when assessing the cumulative impact of policy adjustments;

– Fed officials have decided that they need to adopt and maintain more restrictive policies in order to achieve their goal of lowering elevated inflation;

– Many participants expressed their assessment of the ways federal funding needed to achieve the goals of the committee;

– Many participants indicated that once the policy reaches a sufficiently restrictive level, it would be appropriate to keep it at that level for a certain period of time;

– Several countries need to calibrate the tightening of the Fed to reduce risk;

– Many participants emphasized that the costs of doing too little to reduce inflation outweigh the costs of doing too much;

– It would be critical to adjust the pace of further tightening to reduce the risk of significant adverse effects on the economic outlook;

– As policies become more restrictive, the risks will become more bilateral;

– Emphasize the importance of maintaining the restrictive position for as long as it is necessary;

– Unemployment may rise above the forecast;

– Tightening of monetary policy in other countries may have an impact on the US economy through side effects;

– Several officials mentioned the risk of a wage/price spiral.

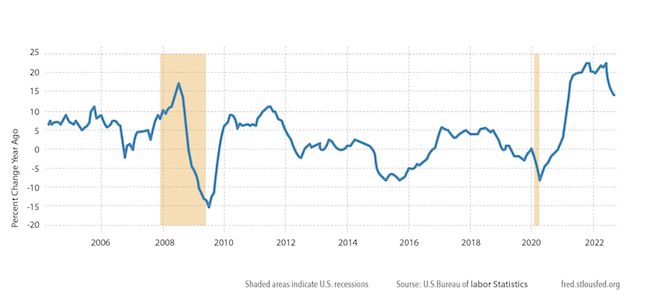

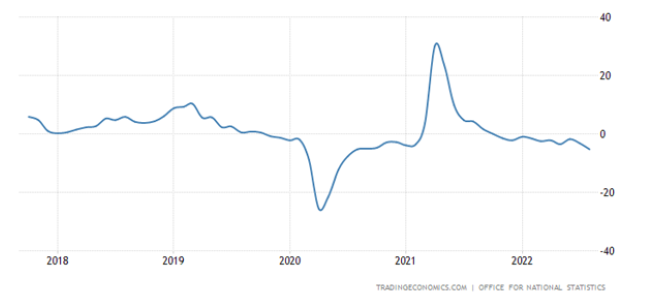

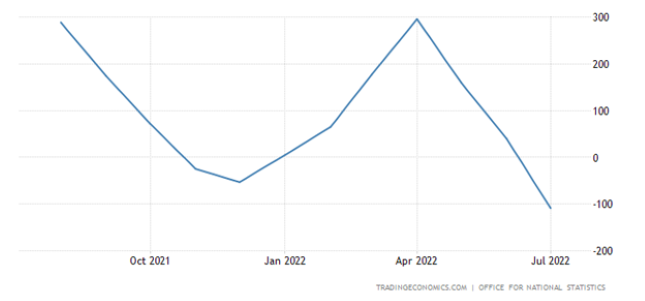

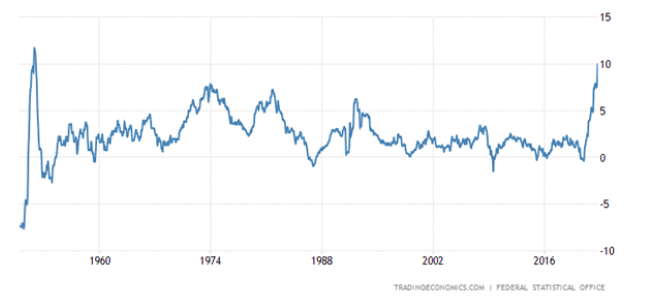

There are suspicions that this situation has already resulted in political conclusions (almost obvious about the Liz Trust government, not yet about the Biden administration), but this topic is beyond the scope of the macroeconomic review. However, the situation has not yet become irreversible, as can be seen from the graph of aggregate industrial inflation, which even slightly decreased in September:

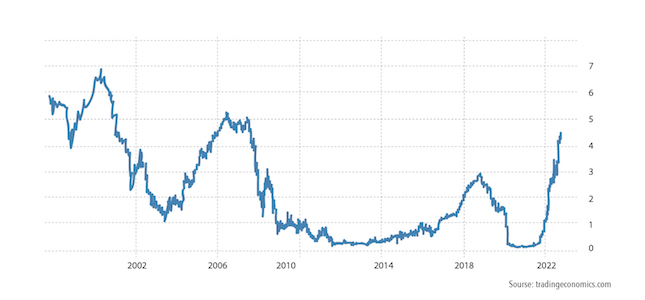

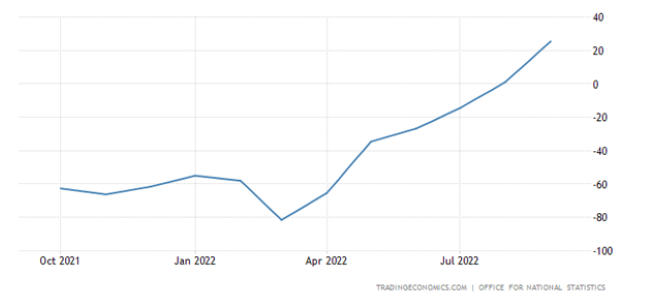

The approach to statistics before the elections (the midterm elections in the United States will take place in just over three weeks) is very creative, so we should learn the results in a month. The graph of the yield of 2-year US government bonds reinforces the suspicions – they updated the 15-year peak above 4.5%:

Macroeconomics

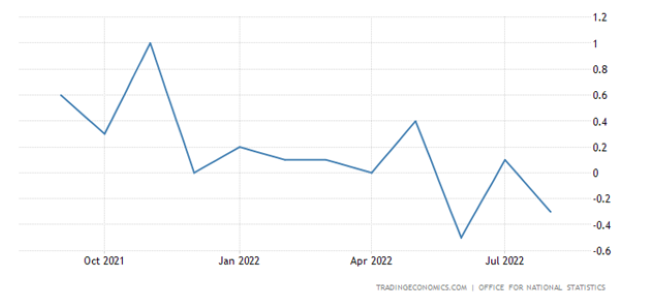

Let’s start with the UK. UK GDP in June-August -0.3% per quarter:

Separately for August, too -0.3% (per month):

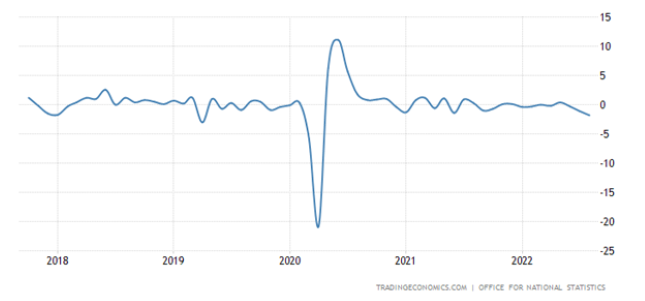

UK industrial production -1.8% m/m – 3rd consecutive minus and worst performance in 2.5 years:

And -5.2% per year – the indicator has been in the red for almost a year:

UK jobless claims rise for 2 consecutive months:

And employment began to decline actively:

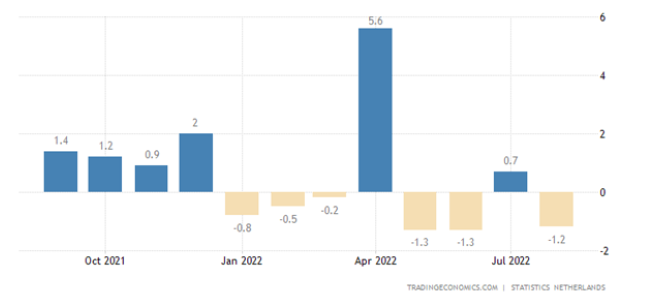

Dutch manufacturing output -1.2% per month – 3rd minus in 4 months and 6th in 8:

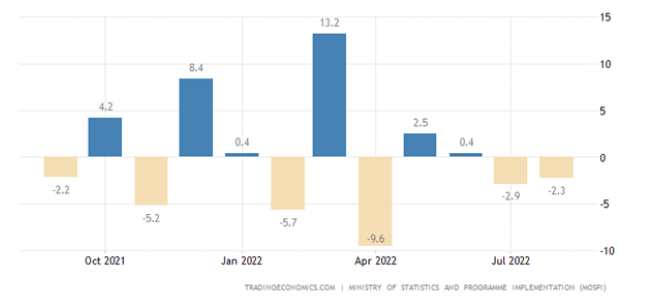

Industrial production in India -2.3% per month – 2nd negative in a row:

Why the annual dynamics also went negative for the first time in 1.5 years:

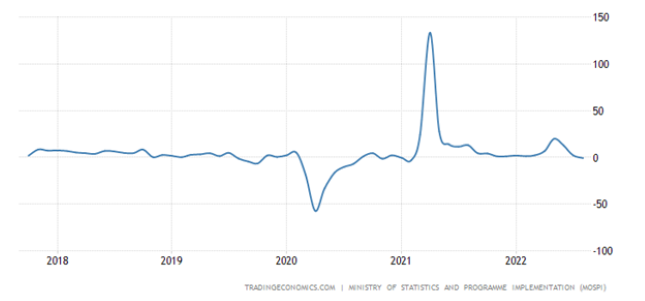

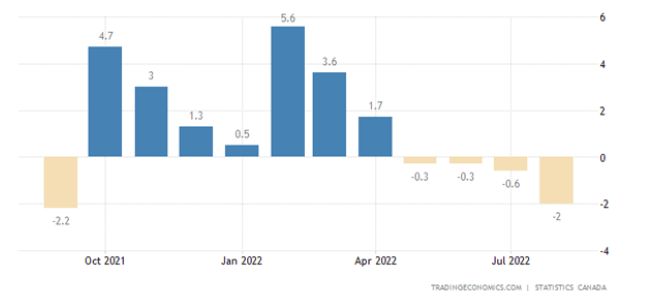

Canadian manufacturing sales decline for 4 consecutive months:

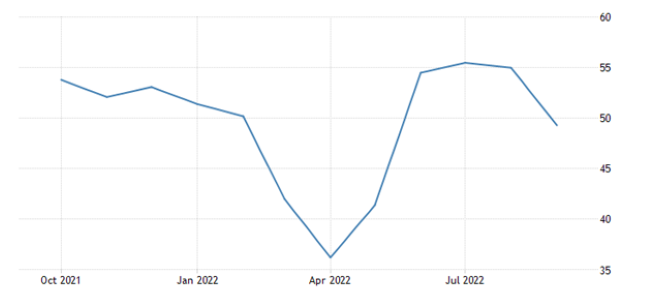

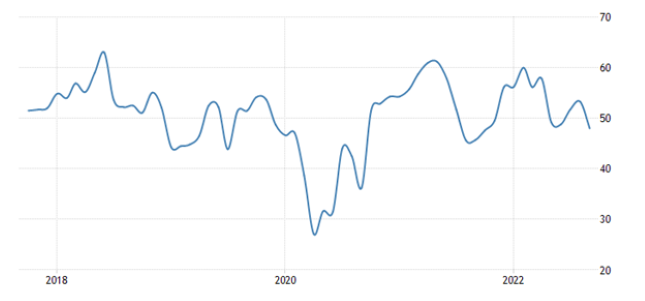

PMI (expert index of the state of the industry; its value below 50 means stagnation and recession) of the Chinese services sector returned to the recession zone after a 3-month pause (49.3 points):

Similar to Australia (48.0: 11-month low):

Japanese industrial firm sentiment is worst in 20 months:

Eurozone investor confidence from Sentix near record lows:

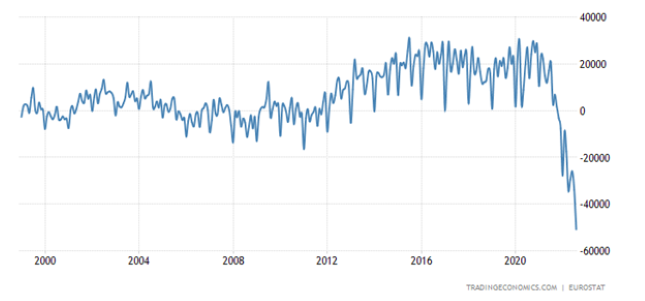

Eurozone trade deficit at record high (-50.9 billion euros):

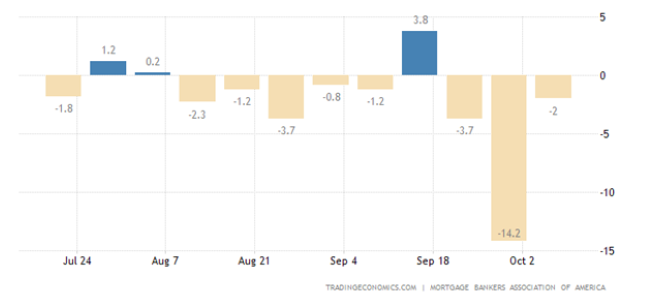

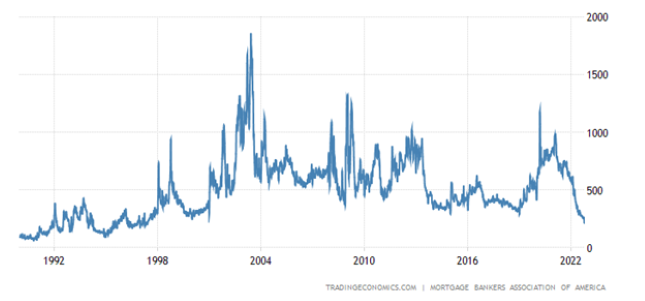

Mortgage applications in the US fell again (another -2.0% per week):

To a low in over 25 years:

Because 30-year mortgage rate (6.81%) at its peak since 2006 and only 0.05% from 2001 levels:

CPI (consumer inflation index) of Germany confirmed as +10.0% per year – 70-year high:

Swedish CPI +10.8% per year – the highest since 1990:

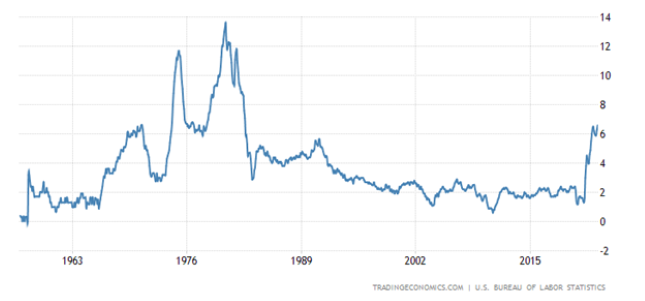

“Net” (excluding highly volatile food and fuel components) US CPI broke through the peak of March and updated the 40-year high (+6.6% per year):

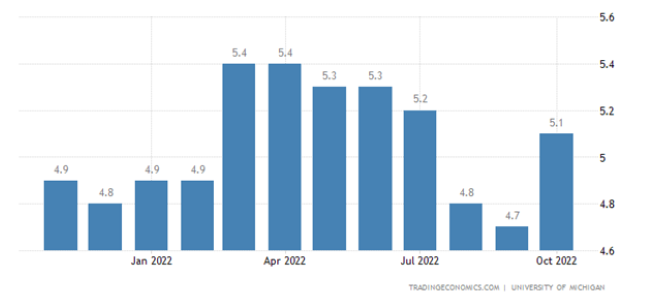

Inflation expectations in the US (from the University of Michigan) jumped again, but so far below the peaks of spring:

However, as we noted in the previous section, the situation in the US does not yet look catastrophic. However, for a highly diversified economy, 15% per year (according to the most optimistic estimates) is still unacceptable. And this situation has been going on for more than a year, see the graph in the first section of this Review.

China CPI +2.8% per year – 2.5 year high:

But at the same time, China’s PPI (industrial inflation index) is only +0.9% per year – at least for 20 months:

Either the statistics are distorted, or a complex combination of deflationary and inflationary trends, typical for markets with strong structural distortions. It refers to China.

The Central Bank of South Korea raised the rate by 0.5% to 3.0%. To be continued.

Main conclusions

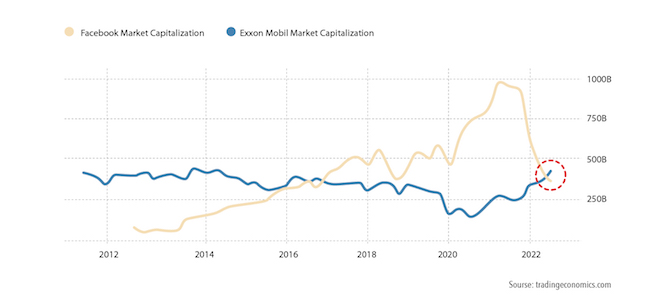

It seems that the structural crisis is not only continuing, but even accelerating. As a result, many indicators return to more or less familiar indicators. Here, for example, is the capitalization of two well-known companies:

In fact, a normal situation is returning, in which value added appeared in the real sector, and the financial sector was auxiliary. Over the past 40 years, the situation has turned upside down and become more and more distorted (since issue dollars provided profits primarily to companies in the financial sector), but, apparently, everything is returning to normal.

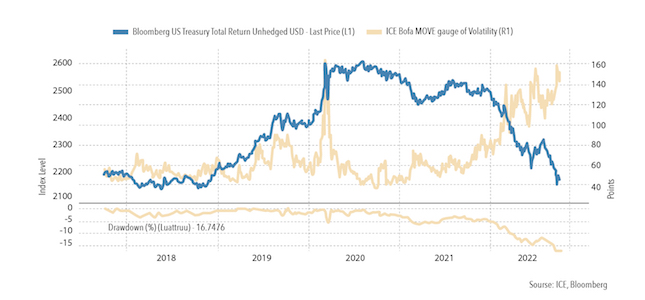

Well, an additional argument in favor of increasing risks is the volatility chart for US government securities:

It is an illustration that shows how tight the financial markets are today. And this, by the way, is an inevitable increase in the risk component in prices, including due to an increase in insurance premiums.

In general, the basic conclusion is clear: apparently, the crisis is growing.