Sweden is the only EU country for which economists are already expecting an economic downturn this year. It may seem unexpected because in 2020, the country went through a covid recession easier than many others (-2.1% of GDP), and in 2021 it showed a GDP growth of more than 5%! What is the reason for the oddly unique drop - at a time when the Eurozone countries are expecting 0.9% of GDP growth?

In 2020, the central banks of Western countries were seriously expanding the money supply (M2). At the time, many experts greeted these moves with hostility, who feared that the extra money supply would accelerate inflation.

However, it was soon discovered that cumulative inflation in 2020-2022 in the countries where the money supply was expanded very slightly is almost the same as in the countries where M2 was enlarged strongly. China, for example, extended M2 more vigorously than most countries in the world but got inflation, there is noticeably below the global average.

However, critics of M2 expansion policies tend to sidestep the question of why countries with a more substantial expansion of the money supply did not show higher inflation rates. Naturally, as soon as rising prices appeared on the horizon, macroeconomists with such views took steps to reduce the money supply.

Sweden vs Germany: who squeezed harder

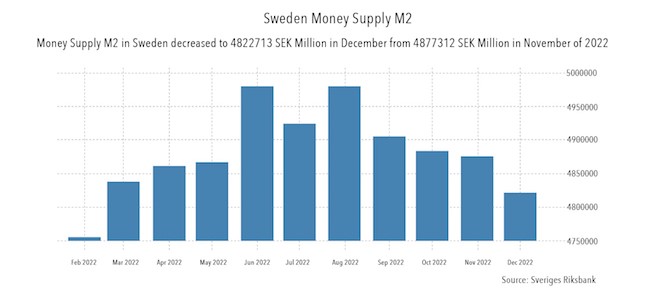

In the summer of 2022, it became apparent that energy prices soared after the start of the Russian-Ukrainian conflict, especially in Europe. Not surprisingly, the money supply there began to shrink. For example, from August 2022 to December 2022, it fell by 0.53% in Germany.

Usually, the reason for the contraction was an increase in interest rates: banks followed this up with less credit, which reduced the money supply. German financial regulators raised it just above 2%. Sweden has a similar level for long-term rates. Importantly, this rate level is still more than half the inflation rate. That is, the Swedes' real (inflation-adjusted) interest rate is still negative.

But the results of seemingly similar actions were very different. Instead of compression of M2 by half a per cent from August to December 2022, Sweden experienced a money supply compression of more than 3%.

Of course, it is not only and not so much the nominal money supply that matters, but the inflation-adjusted money supply. Price growth in Sweden exceeded 5% in 2022, which means that the accurate M2 volume (adjusted for inflation) fell by nearly a dozen per cent.

As we know, different national economies show different dependence on the dynamics of M2. However, there are no known countries where a drop of 8-9% in the real money supply does not lead to a recession. Not surprisingly, the Swedish think tank NIER has already forecast a 1.1% decline in GDP for 2023. International estimates are still more optimistic but are also close to 1% of GDP.

Everyone unanimously names housing construction as the key driver of the slump in Sweden. According to local estimates, the start of construction of new houses in 2023 will be 44% rarer than in the past. But the number of bankruptcies in the sector will grow much more than in other countries - at once by 50%.

National particulars

If Sweden and Germany have raised the rate to similar values (just over 2% for long-term loans), why is the compression of the money supply so different in these countries? It happens often.

The financial systems of different countries have differing money multipliers. A money multiplier of 3 in one country with the same money multiplier of 5 in another country would mean that with the same increase in the prime rate, country #2 would suffer from a shortage of money supply to a much greater extent.

That is, blindly copying the successful financial policies of other countries does not work. However, the Swedish financial regulators chose just that, driven by the desire to fight inflation. In 2022 it exceeded 5% and was forecasted to reach 6.5% in 2023.

Precisely because inflation has no intention of slowing down, the Swedish authorities continue to raise the rate despite the clear negative impact of such steps on the GDP of their country.

An American mistake

Admittedly, Sweden is one of many countries to face a similar situation. In the 1970s, the US suffered from declining oil supplies from OPEC countries and the resulting inflation. At the time, the Federal Reserve tried to close the issue by raising the interest rate. Reducing the money supply was supposed to bring oil prices down and make nationwide inflation return to normal.

The problem with this approach was that it just wouldn't work. Energy prices are rarely elastic. If we reduce the amount of money in the economy, people will start buying fewer Bentleys or expensive houses, but they will be much less willing to lower the temperature in their homes in winter. That is why tightening the money supply did not stop high inflation in the United States throughout the seventies.

Sweden is in a similar situation today. The prices of gas, oil and coal are determined by events in the "major" countries, on which the Swedish discount rate has no effect. Even if tomorrow Sweden stopped buying fuel altogether, the global stock exchange prices would change little, given its entire population is 2.5 times less than the population of Shanghai. That is why even a serious contraction of M2 in the Swedish economy cannot slow down inflation. It is almost entirely "imported", which makes it no easier to regulate at a rate than in the 1970s in the States.

A path between the devil and the deep blue sea?

Did Stockholm have another option in which inflation would have been about the same, but the recession would not have been so severe?

The experience of other economies in the 1970s shows that such options exist. Japan, for example, quadrupled its M2 in nominal terms in that decade, and even when prices rose, it more than doubled its domestic money supply. This happened even despite the high discount rate (seriously above inflation).

How did M2 grow when the discount rate was high? By the actions of the central bank of Japan. It was forced to issue the yen to meet the demand of Japanese exporters who exchange their dollars earned in foreign markets for the national currency.*

Based on this experience, Swedish regulators could have avoided a GDP contraction even if they had raised the discount rate to 5-6% rather than the current two per cent. However, this would have required them to implement decisive quantitative easing. That is the introduction of additional money supply in the national currency through some mechanism not related to the interest rate.

For example, through the sale of issued kronor on the currency exchange. Or, recalling the US and Japanese experience of the 2000s - by buying up assets for these emitted kronor (like shares of certain national producers or Swedish government debt).

The problem is that to take such a step, it would be necessary to refrain from copying the efforts of financial regulators in other EU countries, such as Germany - and pursue a policy of managing difficult macroeconomic variables. So far, Stockholm has failed to cope with this task.