One of the world's largest oil companies, Britain's BP, has said it will retain its stake in Russian assets. This follows from the company's financial report published on August 2. According to the company, "Russian counter-sanctions are preventing BP from divesting its stake in Russia's Rosneft and assessing the 'probability of a scenario involving an exit from the asset'". However, as shown by the example of other majors, BP appears to be stretching the truth. As it has done so many times in its history, the company seems to be trying to wait out the crisis and is in no hurry to give up its stake in an asset that has been its primary source of net profit.

After Russian troops entered Ukraine, BP was one of the first major international oil and gas companies to announce its decision to withdraw from Russia. The company announced the decision as early as February 27. Since then, French TotalEnergies, Anglo-Dutch Shell, and Norwegian Equinor have left Russia. BP, as it turns out, has stayed, though it has reported a "loss" from the impairment of Russian assets of USD 25.5 billion in its 1Q 2022 results. In other words, the book value of the British stake in Rosneft has dropped to nil, while no steps have been taken to exit the assets.

Moreover, the asset with a zero value will bring BP a dividend for the second half of 2021 in the amount of USD 700 million. Yet the company refuses to recognise this money as income because it "does not fully understand the process of withdrawing funds from Russia". "Despite public statements about breaking off its partnership with Rosneft, BP hasn’t so far initiated any procedure to withdraw either from the capital of Rosneft itself or from the joint venture shareholdings. BP continues keeping a shareholding in Rosneft and dealing with its Russian partner under the existing shareholder agreement," the Russian business newspaper Vedomosti quoted a source close to the Russian company Rosneft as saying.

BP continues to be Rosneft’s largest private shareholder with a 19.75% stake and continues to own shares in major joint projects, including Taas-Yuryakh, Kharampurneftegaz, and Ermak Neftegaz. During his speech at the St Petersburg Economic Forum in June, Rosneft head Igor Sechin underlined that the Russian business had brought BP USD 36 billion in revenue with only USD 10 billion in total investment.

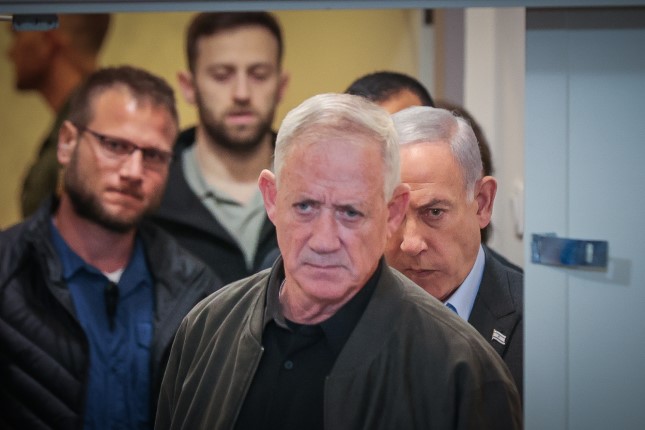

Rosneft CEO Igor Sechin at the St. Petersburg Economic Forum in June 2022 Photo: RIA Novosti / Alessandro Rota.

In other words, despite the UK government being notable for its aggressive rhetoric against Russia and taking the lead in the sanctions race, the country's oilmen don’t seem to care about European or Atlantic solidarity. They hope to "wait it out" until either the confrontation will ease up or the Russian regime will change. In that case, remaining the only player in the game, they will be able not only to preserve money and assets but also conceal their immense tax revenues.

However, such unscrupulousness in the British oil industry is hardly surprising. BP, backed by the government, has played dirty political games whenever it found itself in times of trouble.

The Anglo-Iranian Oil Company, BP's forerunner, had the rich fields in Iran as one of its main assets. In 1951, the democratically elected government of Mohammad Mosaddegh dared to nationalise the Iranian oil industry. Then followed a coup d'état involving British intelligence and the CIA in Iran. As a result, Mosaddegh was overthrown, and control of oil production in Iran was taken over by a consortium of Western companies, in which BP held a 40% stake.

BP did not disdain to collaborate with the apartheid regimes in South Africa and Rhodesia in violation of UN sanctions during the years of their darkest and cruellest unpunished activities. Since then, the company has not shied away from illegal activities such as handing out bribes and putting pressure on journalists and the media. In 2019, for example, BP was accused of bribing a business person with almost USD 10 billion in exchange for a contract in Senegal. In 2021, Bloomberg wrote that BP fired an oil trader after he had raised concerns about the company paying huge bribes in Nigeria.

GMD NNPC Dr. Maikanti Baru with the head of marketing & origination of BP’s oil trading business, mr. John Goodridge, after the dsdp agreement signing in Abuja. Photo: extractive360.com

In 2007, BP CEO John Browne stepped down abruptly from BP after it was revealed that he had used company resources to put pressure on Associated Newspapers media holding company, which includes Daily Mail, Mail on Sunday, and Evening Standard. He aimed to prevent the publication of an interview with Canadian citizen Jeff Chevalier, with whom the head of the company had a four-year affair.

In 2021, Greenpeace criticised BP after the company hired Welund private investigators to spy on an activist leading a peaceful campaign against BP's corporate sponsorship of the British Museum.

BP is not doing too well in oil production either, which is the company's core business. The company is blamed for some of the most significant accidents in the global oil industry. According to media reports, the accidents happened mainly due to BP's economising on basic safety measures. Over the past twenty years alone, accidents left dozens of company workers dead and hundreds injured, and caused substantial environmental damage.

At the same time, the company has always managed to get away with it. According to the media, this is due to the company’s exceptional corruption and constant intimidation of activists. Indeed, contrary to logic, neither the explosion at the Texas refinery in 2005, nor the oil spills in Alaska in 2006 and 2009, nor the explosion of the Deepwater Horizon oil platform in 2010, nor the pollution of the Lake Michigan refinery in 2016-2018, nor the oil spill in Mauritius in 2019 have led to any serious consequences for BP.

Oil spill off the coast of Mauritius. Photo: Reuters.

So now, for the sake of profits, British oilmen are willing to turn a blind eye to what is happening in Ukraine and wait out and increase their revenues. And it would be naive to assume that BP is playing its "solo" game without real comprehensive support from the UK government. For example, according to the Financial Times, London has refused to support its EU allies and ban marine insurance for Russian oil shipments. It just won’t have its BP suffer losses!

Main photo: British Petroleum. Shutterstoc.