One of the first rules of action for the economic authorities of any country is not to give in to discouragement. The gloomiest news should be interpreted in the most optimistic way. If everything is really bad, you need to invent new words (this is how the word “recession” was invented in the late 30s of the last century) and sometimes turn a blind eye to some phenomena.

Each time it requires a special interpretation. But just last week, one of the Western countries acknowledged serious economic problems:

The Bank of England raised the rate by 0.50% (maximum in 27 years), to 1.75%; at the same time, forecasts for the economy (the recession will start at the end of this year and last for at least 5 quarters) and inflation (+13.3% y/y in autumn) are very gloomy. It should be noted that the performance of the recession continues. In reality the recession in the Western economy began at the end of the previous year, but the raise of the inflation forecast suggests that it is coming to an end. The recession has to be recognized, and along with it, a sharp drop in the standard of living of the population will have to be recognized too.

The Bank of England raised the rate by 0.50% (maximum in 27 years), to 1.75%; at the same time, forecasts for the economy (the recession will start at the end of this year and last for at least 5 quarters) and inflation (+13.3% y/y in autumn) are very gloomy. It should be noted that the performance of the recession continues. In reality the recession in the Western economy began at the end of the previous year, but the raise of the inflation forecast suggests that it is coming to an end. The recession has to be recognized, and along with it, a sharp drop in the standard of living of the population will have to be recognized too.

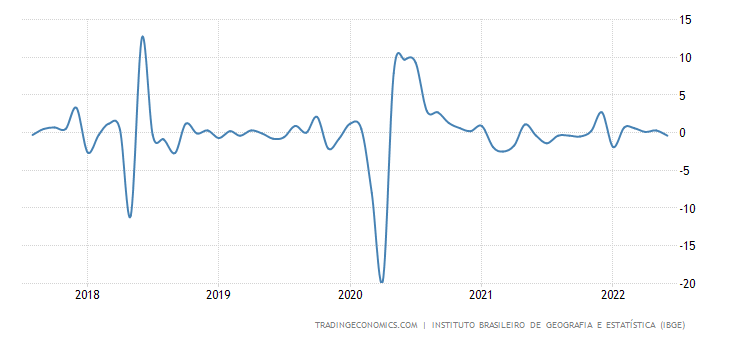

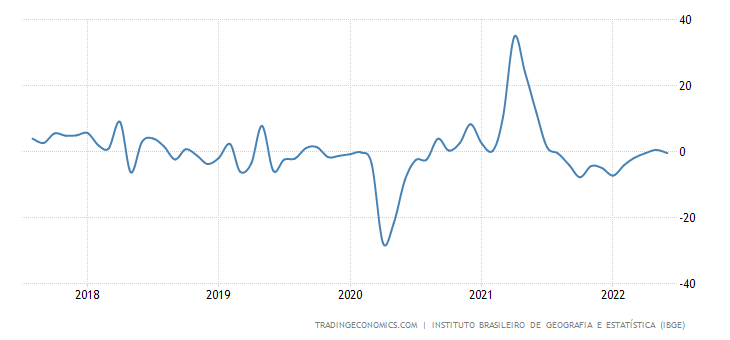

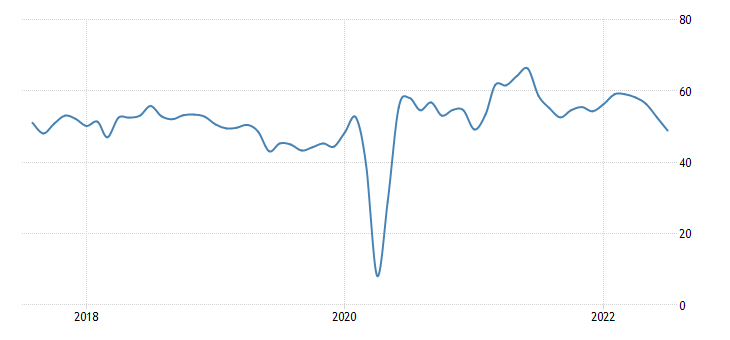

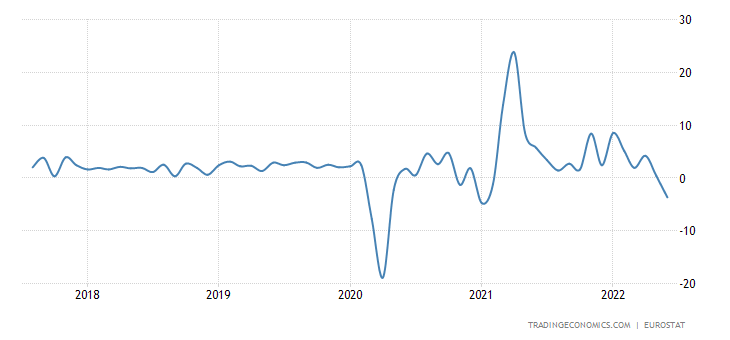

Moreover something similar has begun to happen in the United States. The EU leadership is still holding on, although statistics for individual countries look threatening there too. Let’s see what the July statistics will look like.Macroeconomics. Industrial production in Brazil -0.4% per month:

That is why the annual change, having barely gone positive, immediately returned to decline (-0.5%):

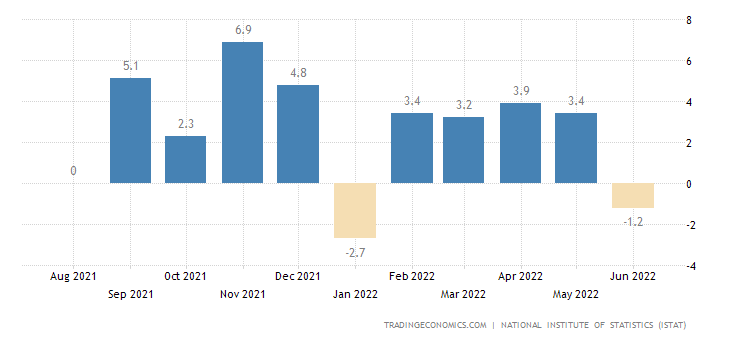

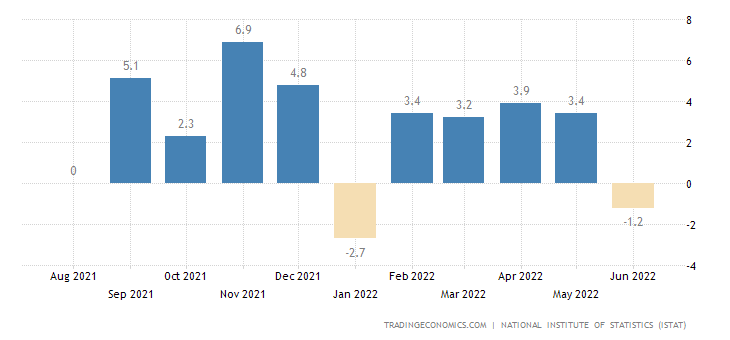

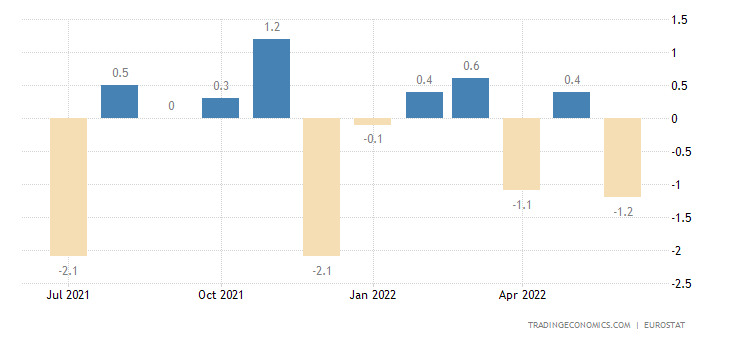

Italian industrial output -2.1% m/m – 2nd negative in a row:

Therefore, the annual dynamics also went negative (-1.2%):

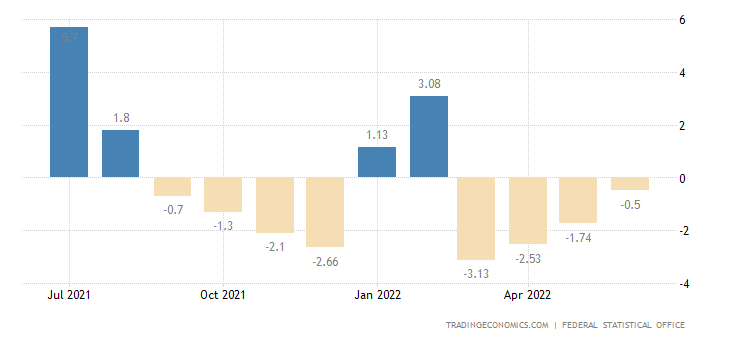

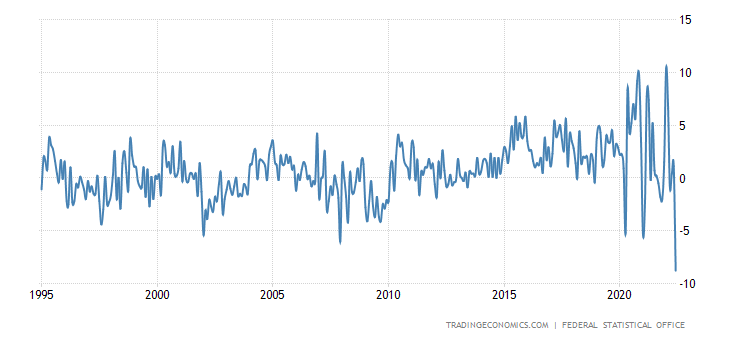

Industrial production in Germany keeps in the red for 4 months in a row:

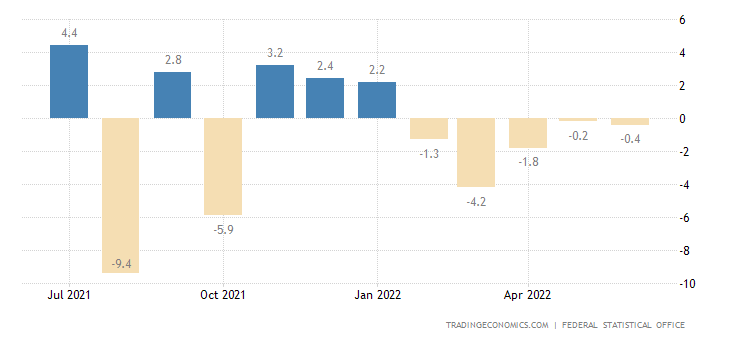

Factory orders in Germany fall monthly for 5 consecutive months:

Annual decline (-9.0%) worst in 2 years

We draw your attention – this is at low inflation. And yes, the recession has not yet begun … Or perhaps it has not yet begun … But the recession has been going on for almost a year …

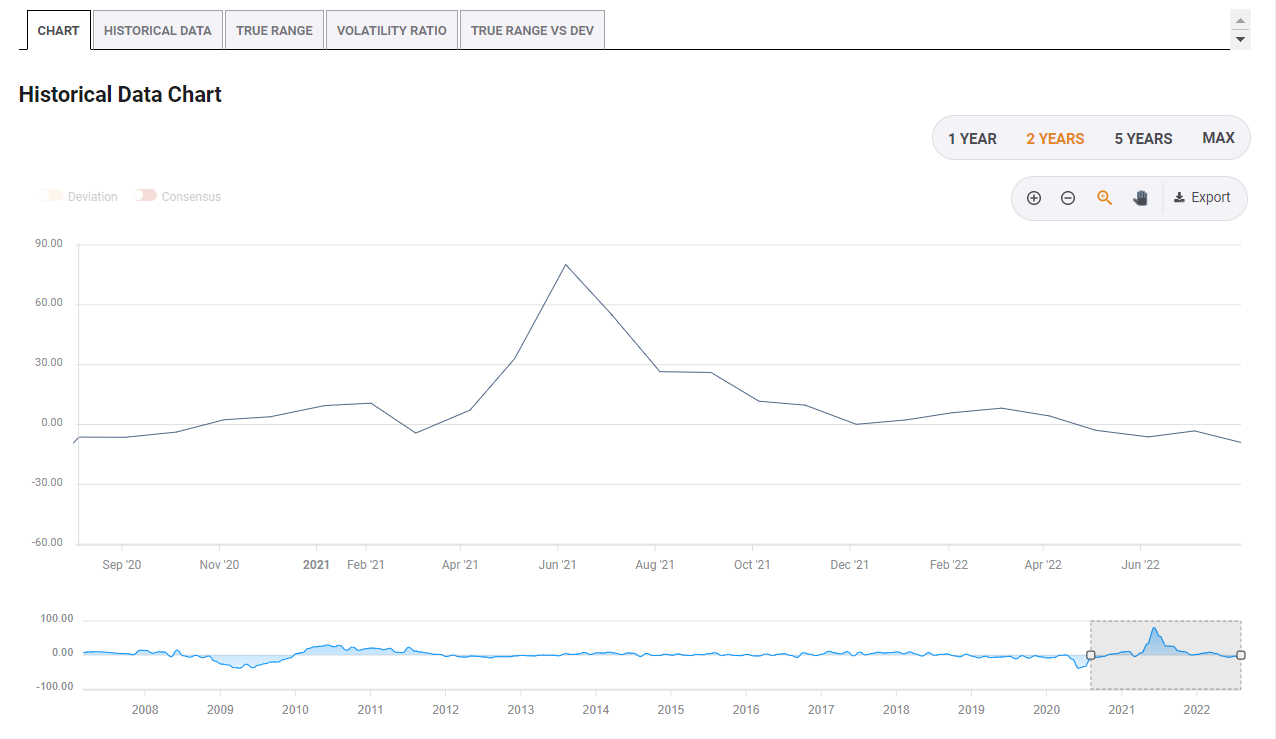

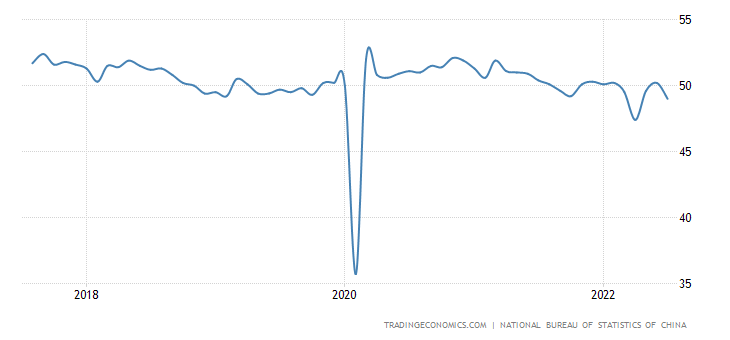

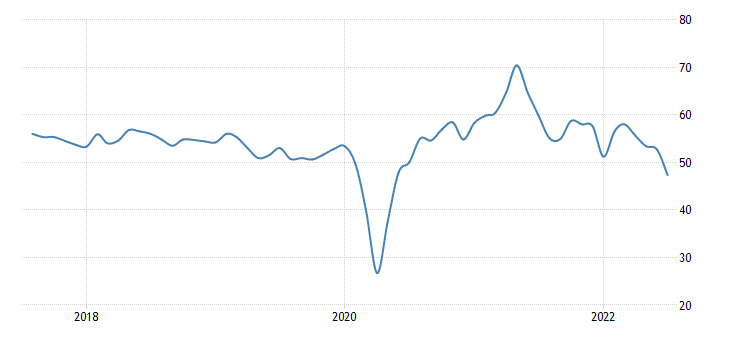

The official PMI (an expert index reflecting the state of the industry; its value below 50 means stagnation and decline) of China’s industrial production unexpectedly returned to the recession zone (49.0):

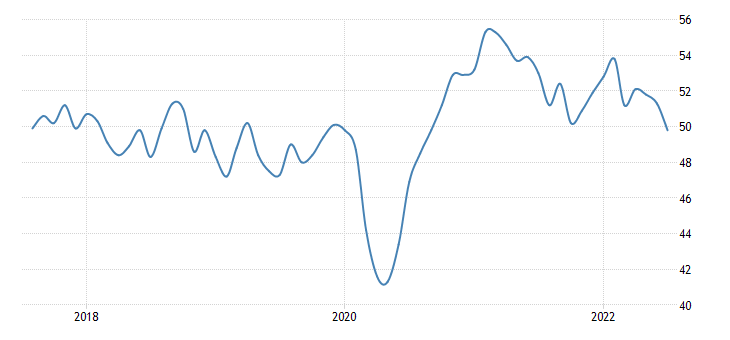

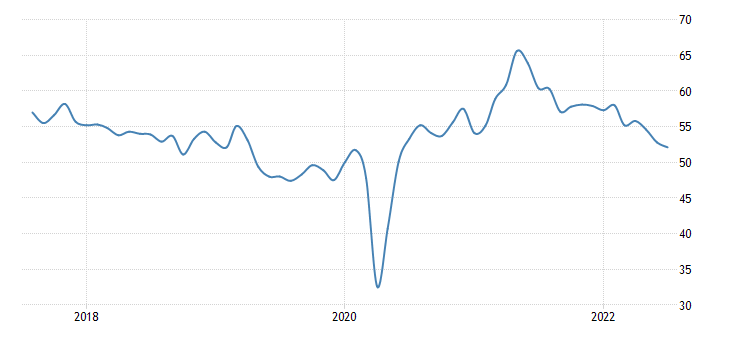

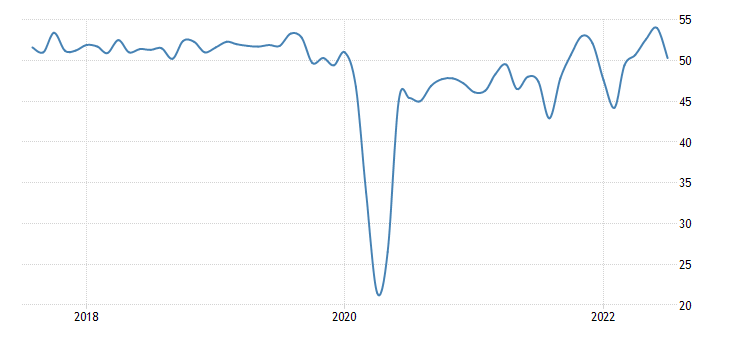

Same in South Korea (49.8 – a 2-year bottom):

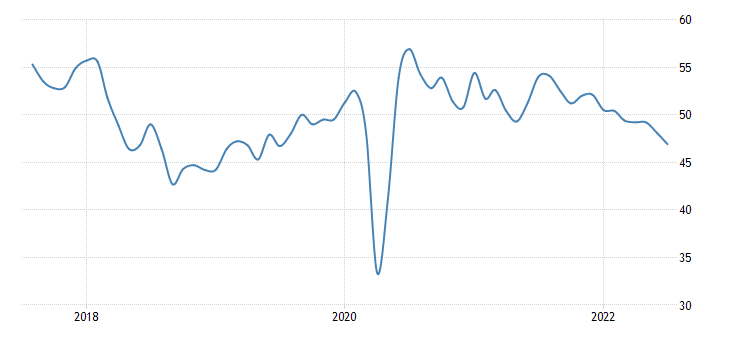

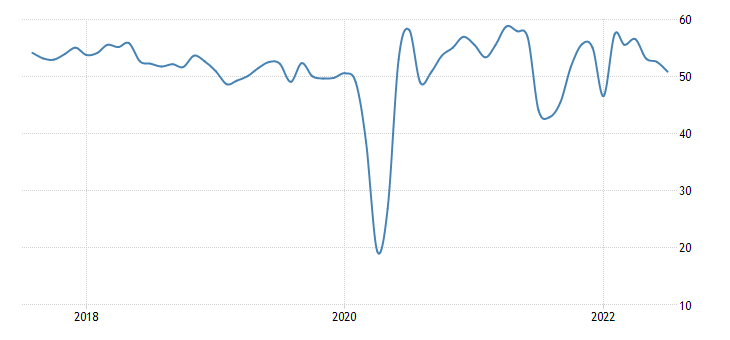

And in Turkey (46.9 is also a 2-year minimum):

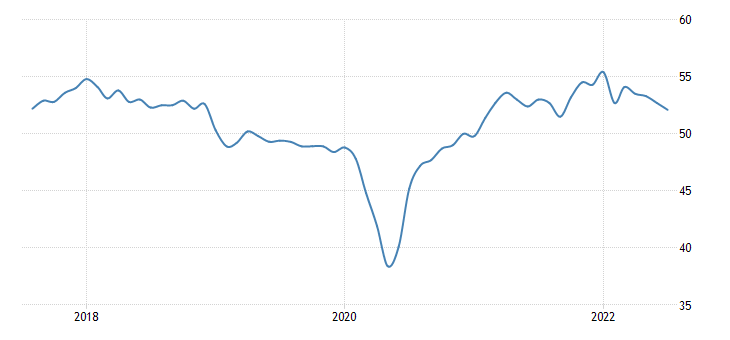

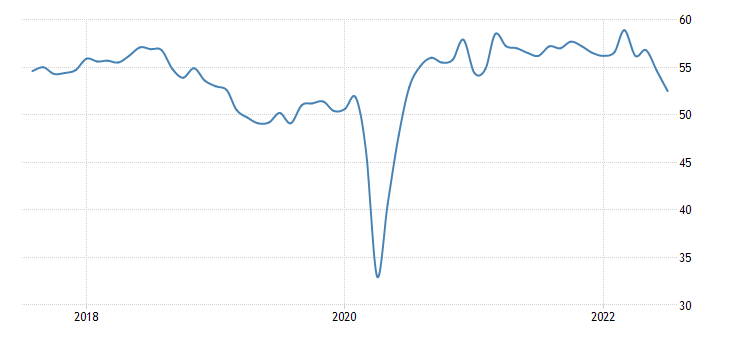

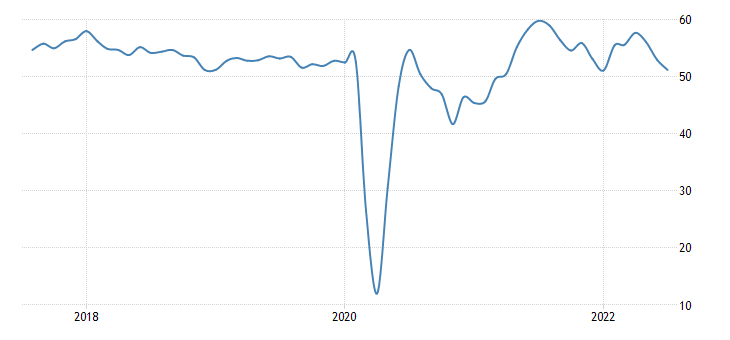

And in the Eurozone (49.8 – and there is a 2-year bottom):

In Japan, there is still a growth zone (52.1), but a 10-month low

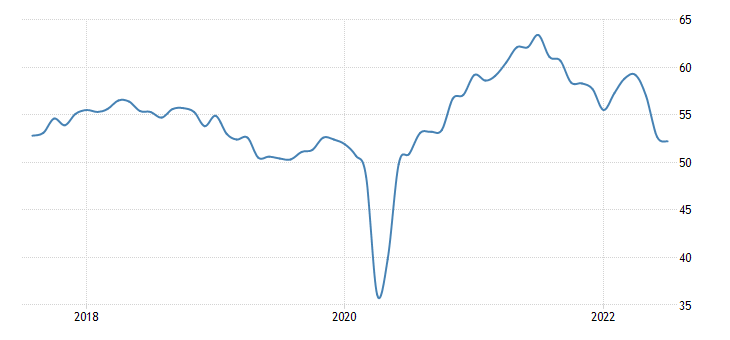

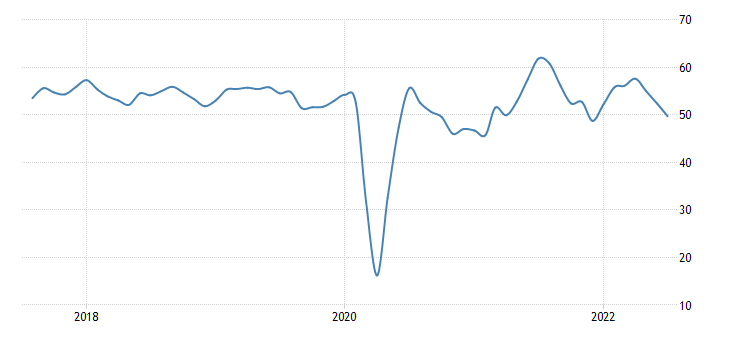

And in Britain 52.1 – bottom in 2 years:

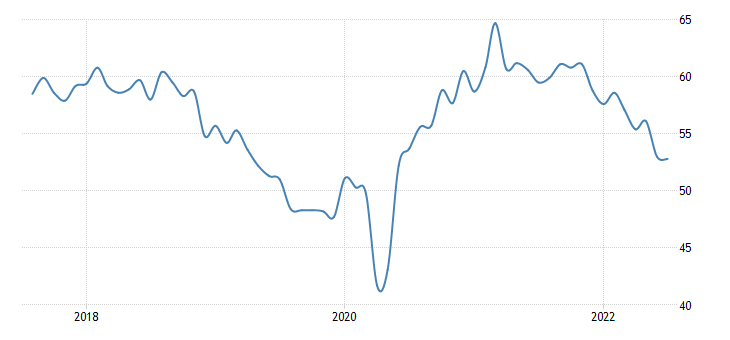

In Canada, 52.5 is also the worst number in 2 years:

In the USA, according to both versions, there is also a growth zone, but a 2-year minimum:

And again, we remind you that inflation is underestimated… Experts can take this into account, that’s why they are experts. But they also may not take it into account …

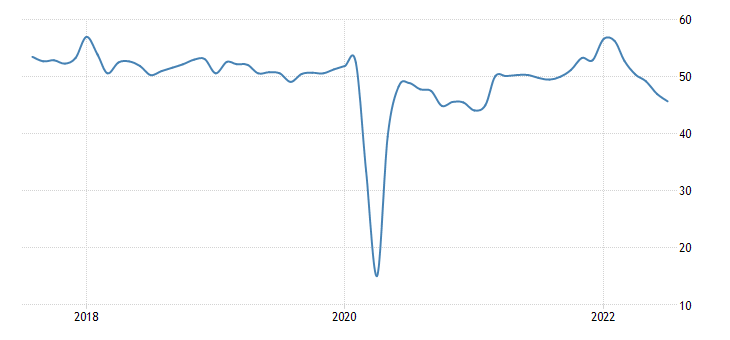

Japanese services PMI returned to stagnation (50.3):

Same in Australia (50.9):

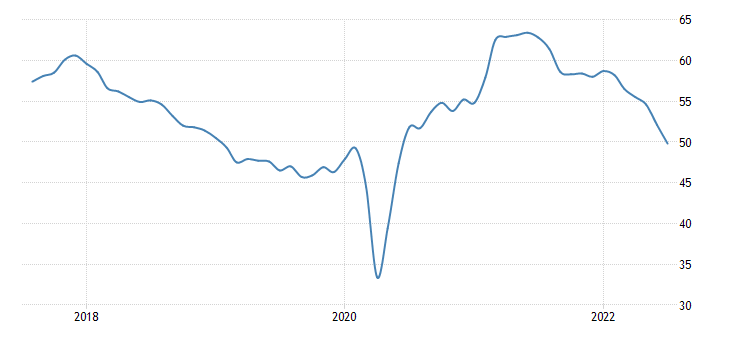

And in the Eurozone (51.2):

Mainly due to Germany, where there is already a recession area (49.7):

Deeper downturn in the US (47.3, 2-year low):

The construction PMI of the eurozone and Britain are the weakest for 1.5 years and in the recession zone (45.7 and 48.9):

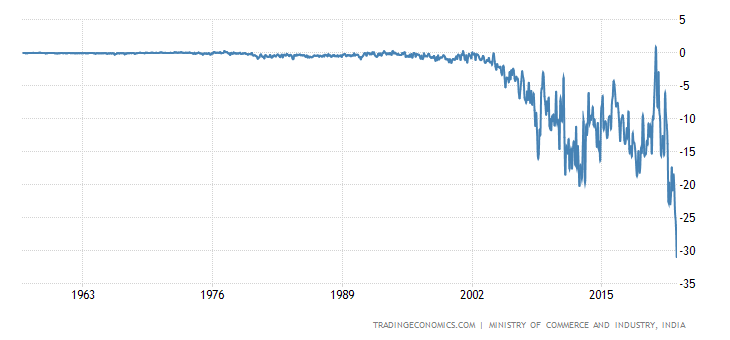

India’s foreign trade deficit by a wide margin. It is the highest in 65 years of data collection:

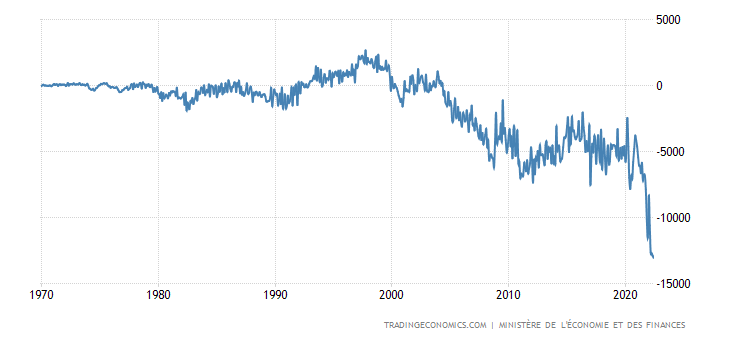

France has the same story:

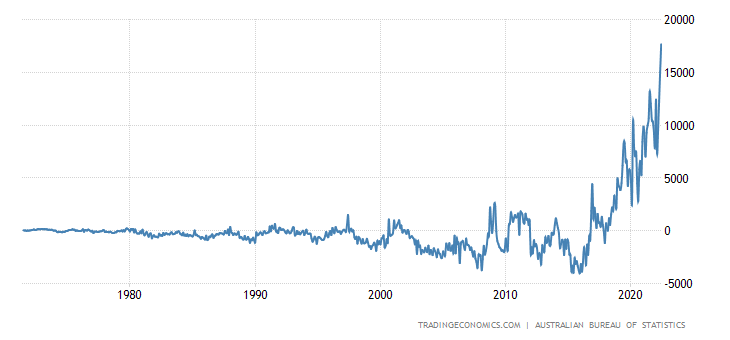

But Australia has a record (over 51 years of statistics) surplus:

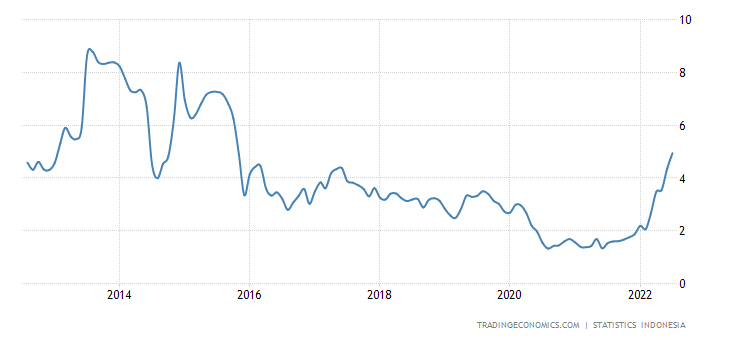

Indonesian CPI (Consumer Inflation Index) +4.9% per year – maximum since 2014:

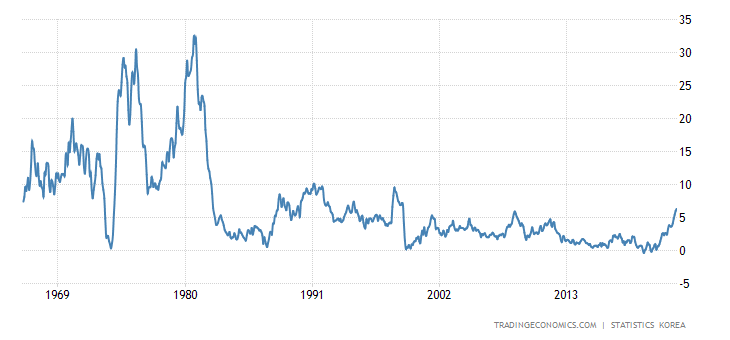

CPI of South Korea +6.3% per year – peak since 1998:

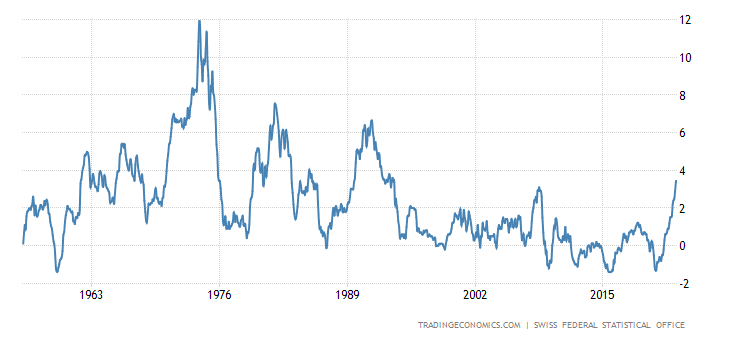

Swiss CPI +3.4% per year – the highest since 1993:

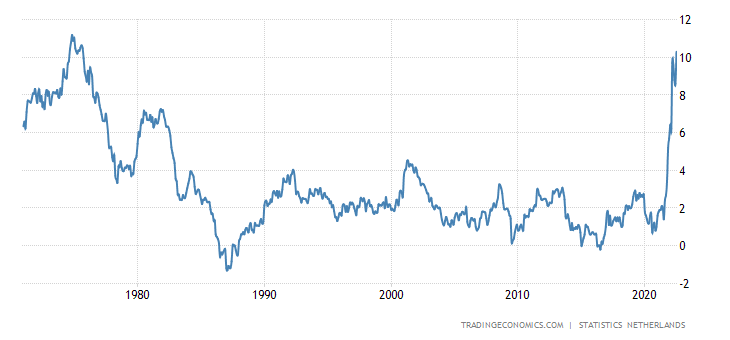

Netherlands CPI +7.5% per year – maximum since 1975:

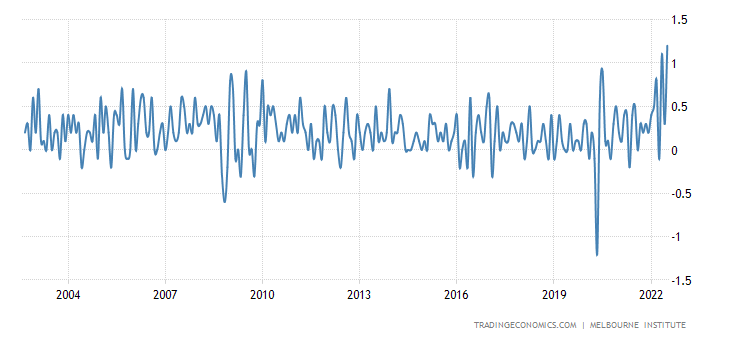

Australia’s CPI estimate from the Melbourne Institute (+1.2% per month) is a record for 20 years of observation:

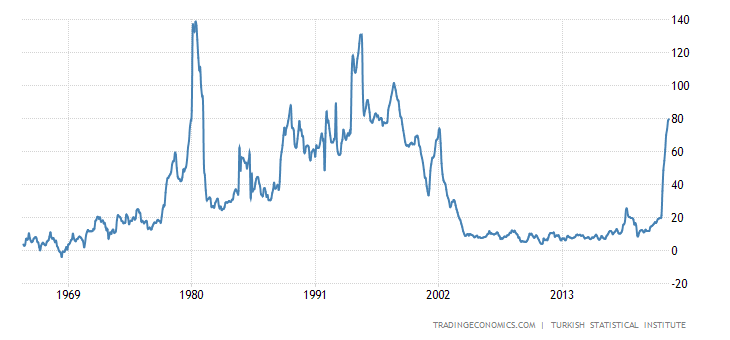

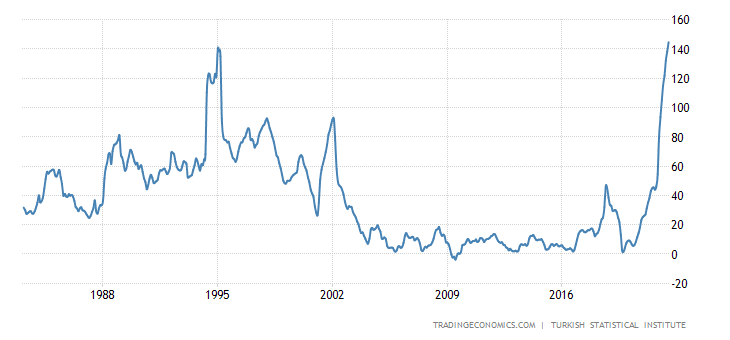

Turkish CPI +79.6% per year – maximum since 1998:

And its PPI (industrial inflation index) broke through the peak of 1995 and reached a record for 40 years of statistics: + 144.6% per year:

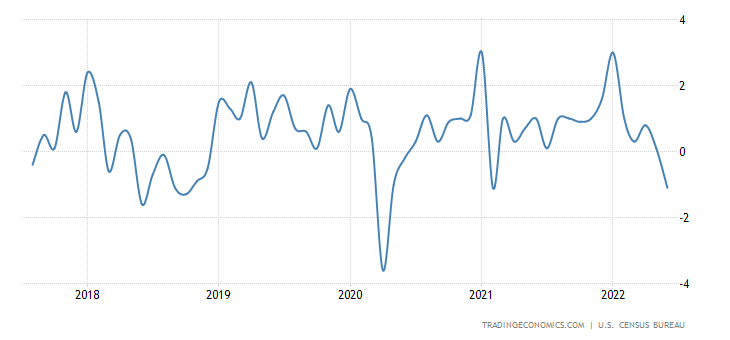

US Construction Spending -1.1% per month – Worst in over 2 years:

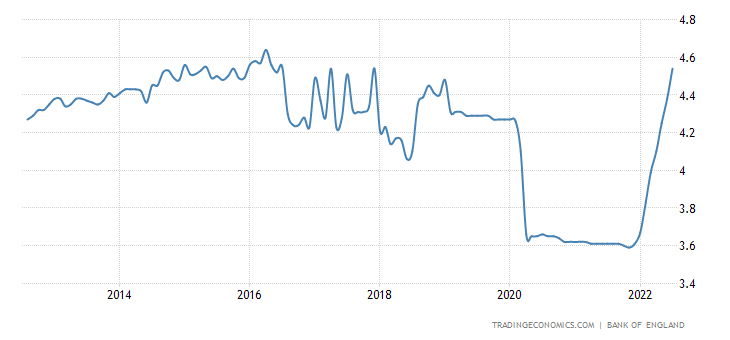

Mortgage rates in Britain are at a 5-year peak and very close to the 14-year peak of 2016:

No wonder the Bank of England is so pessimistic.

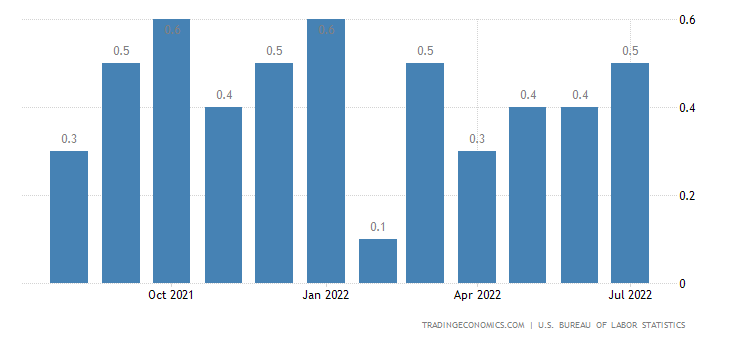

Monthly wage growth in the US (+0.5%) is the highest in six months:

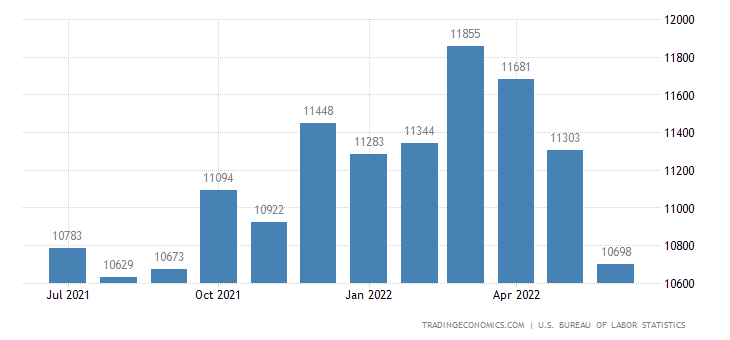

The trouble is that this corresponds to an increase of 6% per year – with official consumer inflation over 9%. And industrial inflation for the entire volume of goods, as we noted a couple of reviews ago, is 23.4% per year as of June. Unsurprisingly, the number of jobs in the US has been declining for 3 consecutive months:

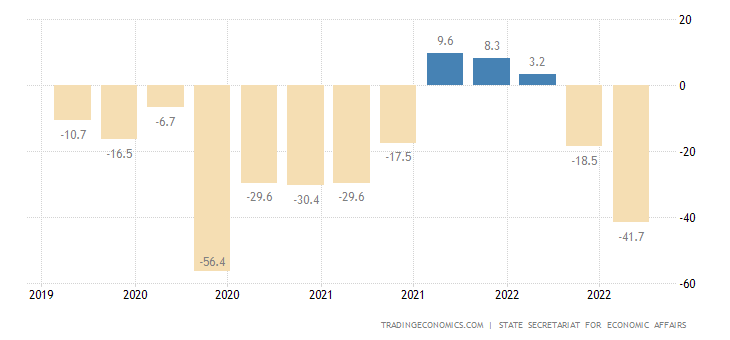

The Swiss are pessimistic for a maximum of 2 years, anti-records are not far away:

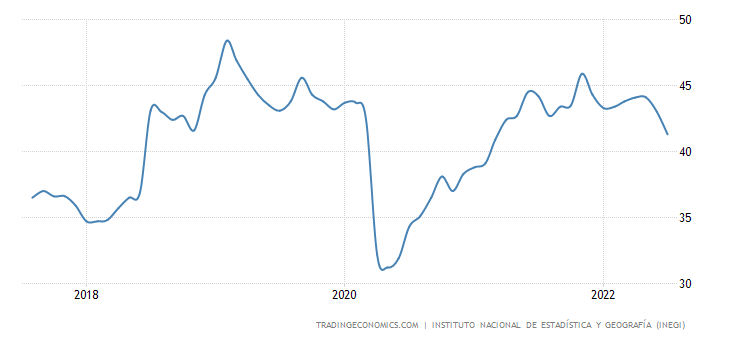

Mexicans have worst sentiment in 16 months:

Retail sales in Germany -1.6% per month:

And -8.8% per year – an anti-record for 27.5 years of observation:

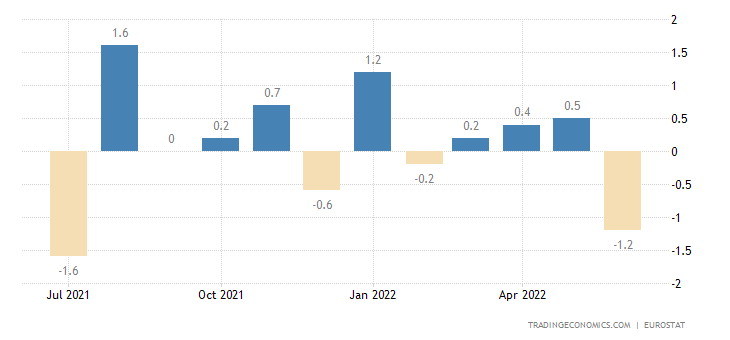

Eurozone retail -1.2% per month:

And -3.7% per year – the worst dynamics in 1.5 years:

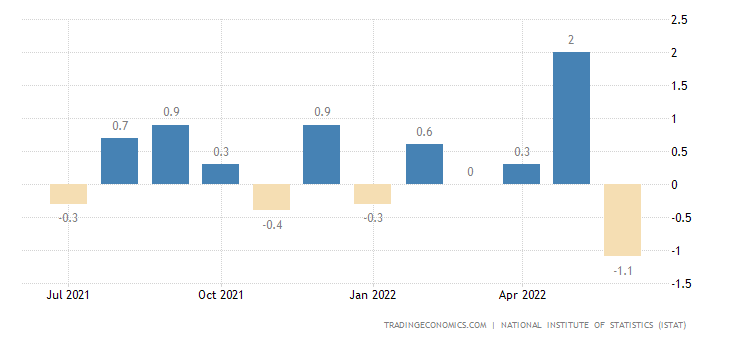

Monthly declines in retail were also noted by Italy (-1.1%):

And France (-1.2%):

And the volume of retail sales best shows the decline in the standard of living of the population …

The Central Bank of Australia raised the rate by 0.50% to 1.85%, the tightening is likely to continue.

The Central Bank of Brazil – also by 0.50%, up to 13.75%.

And the Central Bank of India raised the interest rate by 0.5% (stronger than expected) to 5.4%.

Main conclusions

The conclusions are simple – things are bad. In the summer against the backdrop of a fall in economic activity (it is impossible to refer to the fact that it is precisely because of this that the indicators are bad, since they are automatically cleared of the seasonal component; in reality the indicators are much worse than they were a year ago at the same time), the decline is actively continues and even accelerates somewhat. And it increasingly affects the leaders, China, the United States and Germany.

The performance about the definition of a recession and the recognition that it “is about” to begin is very significant: it is simply impossible to lie about the continuation of economic growth. But it should be borne in mind that over the past year a rather large potential for a decline in aggregate demand has accumulated and it will need to be legalized one way or another.

Most likely, the logic of the monetary authorities was that the “recession” would end and this failure could be smoothly distributed in a situation of economic growth. The trouble is that growth does not begin (and our readers understand that it will not begin for at least 5 years). Moreover, as monetary policy tightens, the recession will accelerate. And in this situation, an occasion must inevitably arise on which it will be possible to write off the catastrophe.

Several of such reasons have been invented over the past decades: major terrorist attacks (September 11, 2001), epidemics (covid-19), wars (special operation in Ukraine). The trouble is that it becomes more and more difficult to play them in the propaganda field: the poorer people live, the less inclined they are to listen to the current government. It is for this reason that the “premierfall” began in Western Europe and there is every reason to believe that it will continue and the blame for the economic catastrophe will have to be shifted to the previous generation of politicians.

At the same time a simple replacement is not enough – it will be necessary to remove from power and make “scapegoats” (including through mass anti-corruption campaigns) almost all existing political parties. So, we strongly advise entrepreneurs of all Western countries to take a closer look at those who cover them (roughly – “protect”), they may soon have to actively dissociate themselves from interaction with these characters.