Top news story. The big news is that US interest rates are up 0.75%. The last time such a rapid one-off surge was in 1994, however, different hot brains offered and at once 1%. At the same time, as usual, no clear explanation of the ongoing processes was not given. However, these processes have nothing to do with the recession.

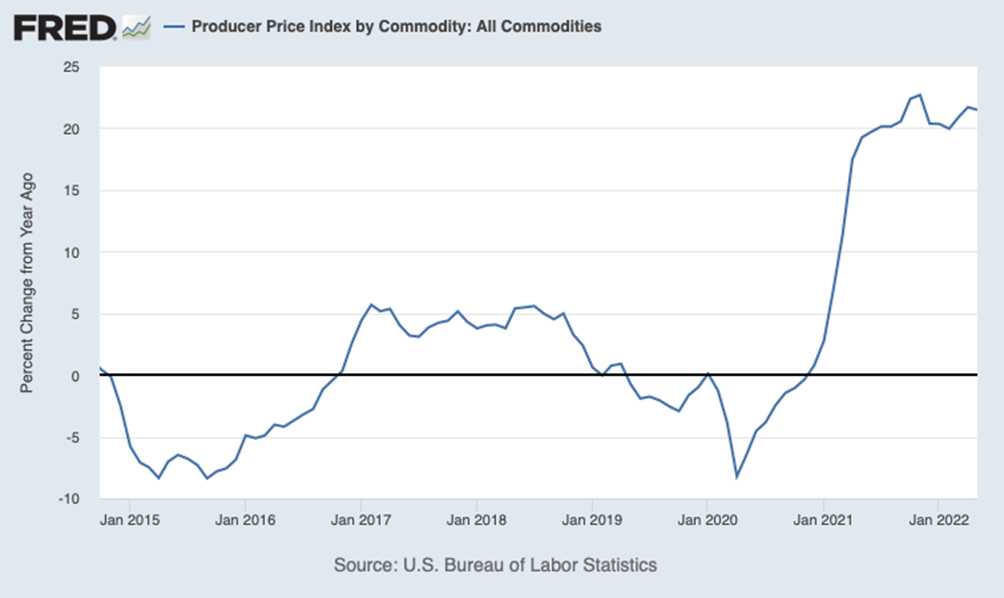

Given real inflation in industry, which has been stable above 20% since last spring (according to official data), the normal (“neutral”!) rate should be at least 18% (as in 1980). Even if we consider official CPI inflation, the rate should be raised significantly more. But because of this, consumer demand inevitably shrinks!

At the same time, GDP will decline (as happened between the fourth quarter of last year and the first quarter of this year) and, most likely, socio-political problems will force the monetary authorities, under pressure from the White House, to “load up the printing press again”. So inflation is going up again! With what performance? Just take a look at the European Union’s CPI, and you’ll find all 40 percent.

Why do we think the Fed’s leadership will toady to the White House? And because, if they could afford careless politics, they would immediately hike the rate to 20%. But we don't think there will be a harsh rate hike.

Macroeconomics

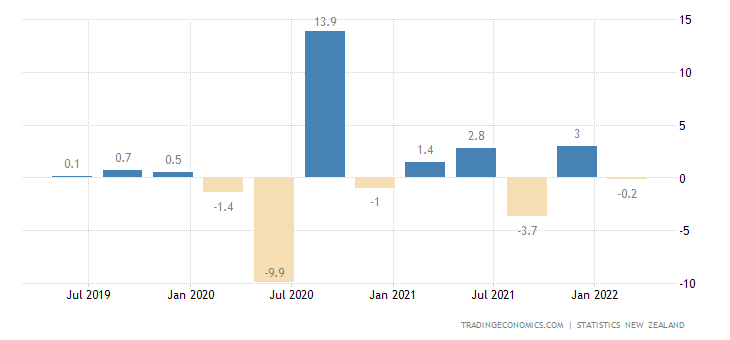

New Zealand’s GDP unexpectedly showed negative growth in Q1 (-0.2% QoQ):

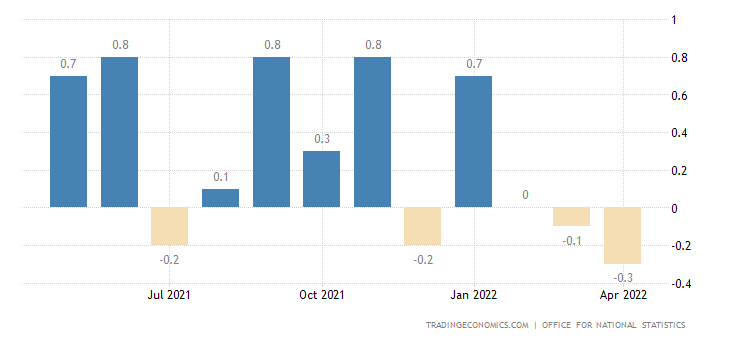

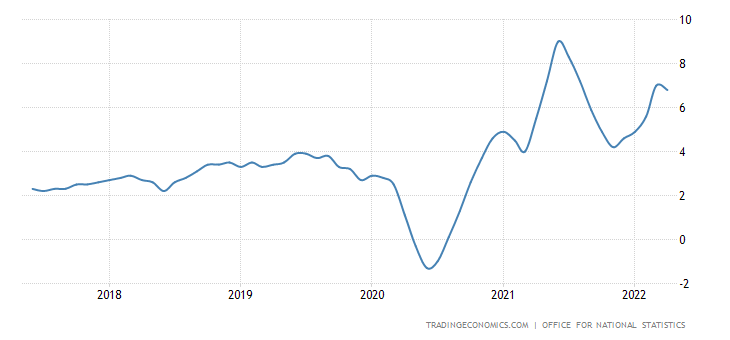

Britain’s GDP in April was -0.3% per month after -0.1% in March and zeroed in February:

A NIESR survey (National Institute of Economic and Social Research is Britain’s longest established independent research institute founded in 1938) confirmed this trend — in March-May UK GDP amounted -0.1% per quarter:

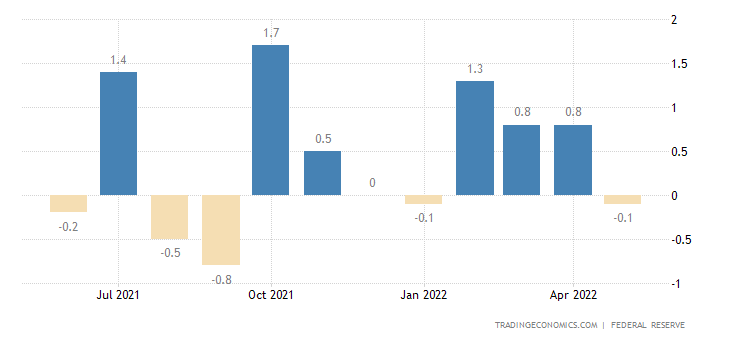

US manufacturing performed poorly at -0.1% per month:

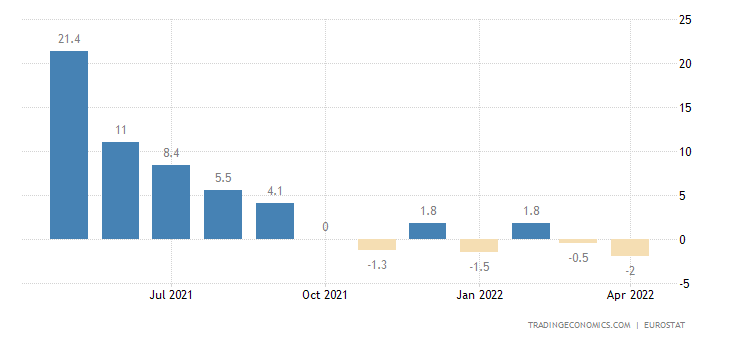

The Euro Area industrial output -2.0% per year, that’s the worst performance in 1.5 years:

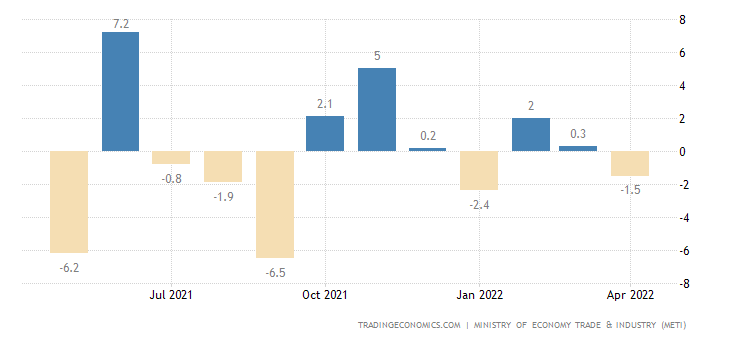

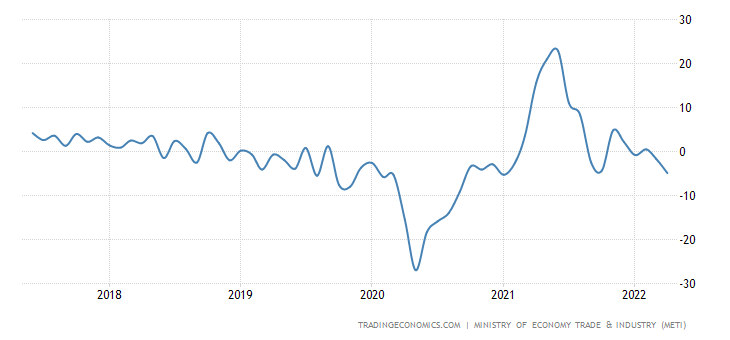

Industrial production in Japan was -1.5% MoM:

And -4.9% per year, which turned out to be a 15-month trough:

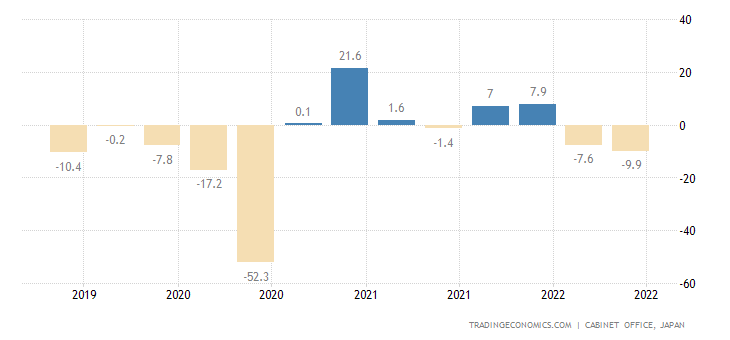

A survey of major manufacturing firms in Japan showed a 9.9% decline, that’s the worst performance in two years:

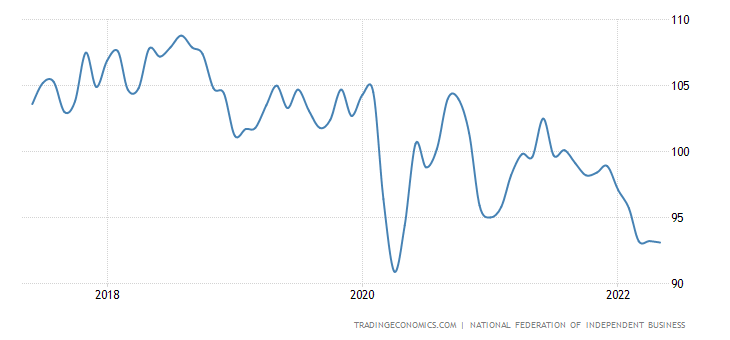

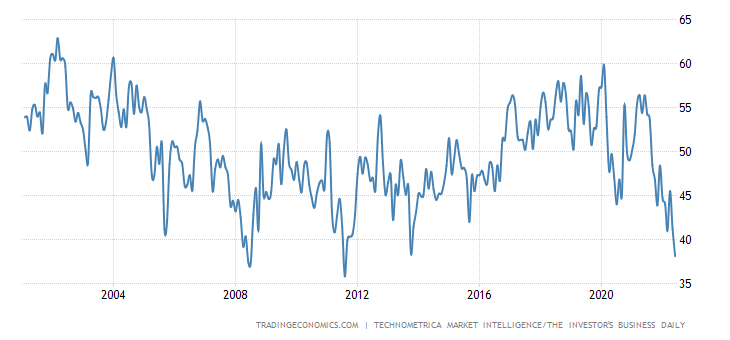

Small business confidence in the US has anchored at the trough for 2 years and is well below the multi-year average (100):

Leading indicators in the US issued -0.4% per month after the same -0.4% a month before:

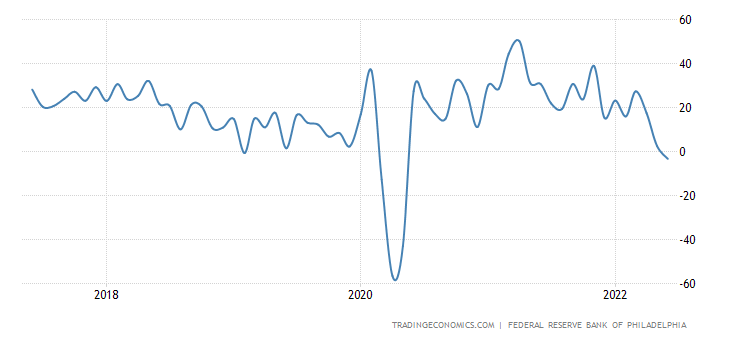

United States Philadelphia Fed Manufacturing Index turned red for the first time in 2 years:

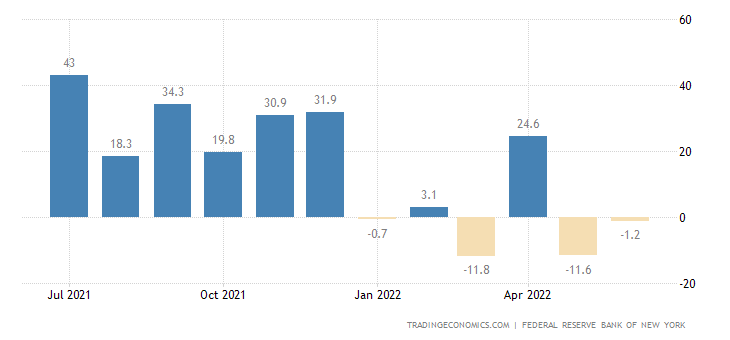

United States NY Empire State Manufacturing Index stays in the recession for two straight months:

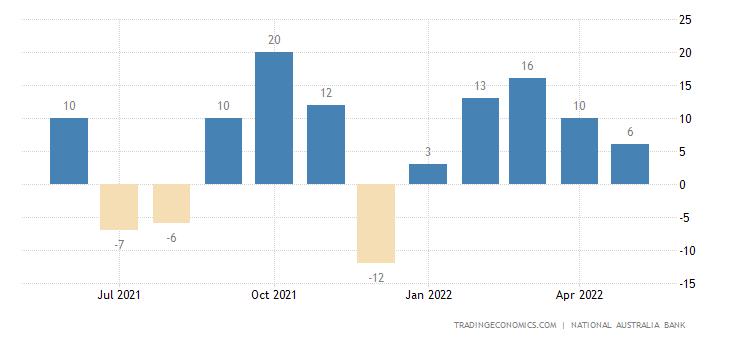

Business confidence in Australia extremely weak in 4 months:

And in South Africa — for 20 months:

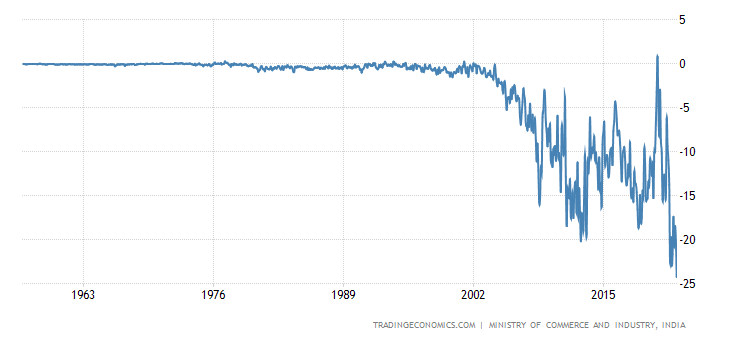

India’s trade deficit hit a record:

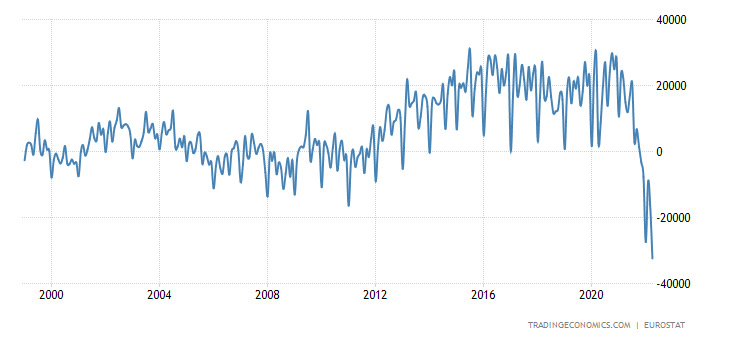

The same is true in the Euro Area:

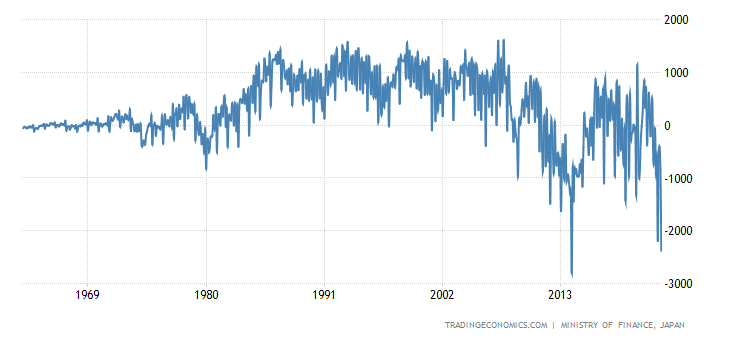

In Japan, the deficit was larger only once (in January 2014) for 60 years of data acceptance:

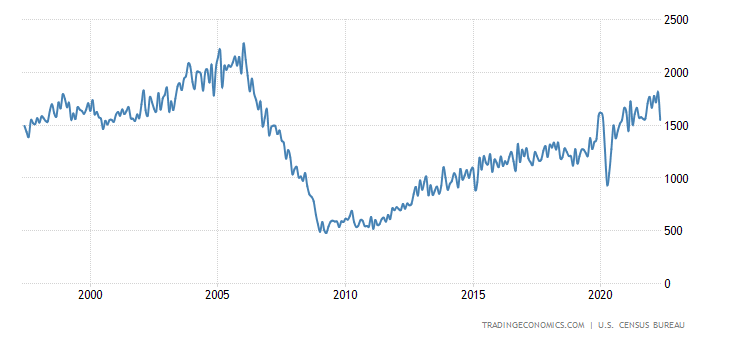

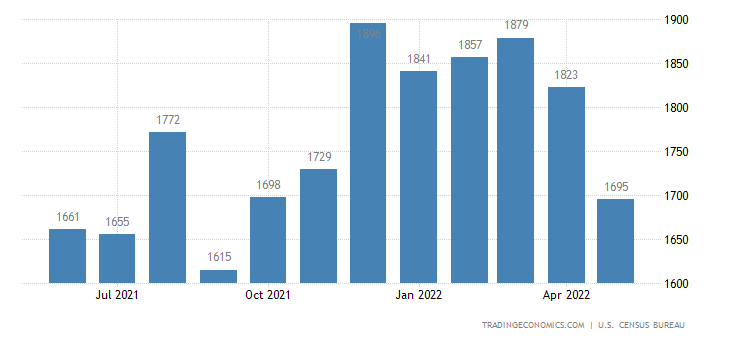

New housing starts in the US firstly gave a 16-year high, and then fell by 14.4% per month to the annual trough:

Such perturbations usually mean that observers have partially changed the methodology, although other reasons cannot be ruled out. A close study of this issue is not of interest, but those who are engaged in real estate in the United States, we would recommend that you look into the matter, otherwise your previous experience will be useless.

US building permits -7.0% rolled back to 8-month low:

United States Building Permits

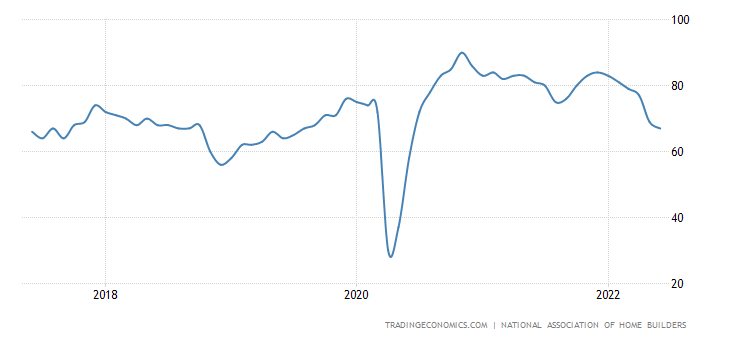

The US housing market index is at its lowest in two years:

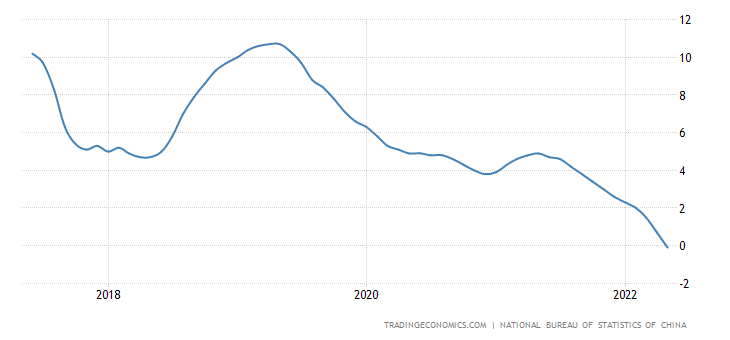

Housing prices in China’s 70 largest cities went down to an annual negative for the first time since 2015:

Given that real estate is one of the Chinese’ favorite markets, this means that the economy is cooling down.

Next, as usual, are followed by record inflationary data.

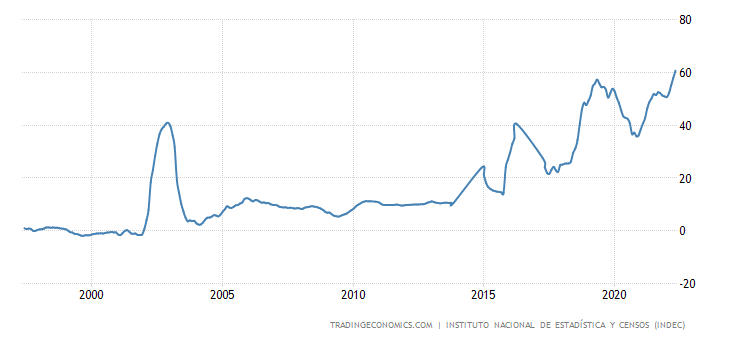

CPI (Consumer Price Index) of Argentina +60.7% per year, this is the peak since the beginning of 1992:

Sweden’s CPI of +7.3% per year is at its highest since 1991:

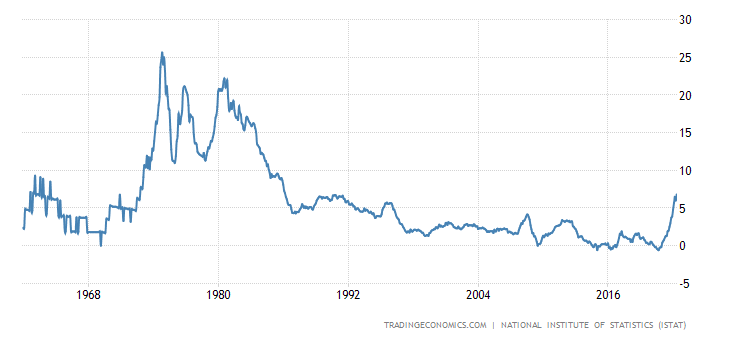

Italy’s CPI was +6.8% per year and topped since 1986:

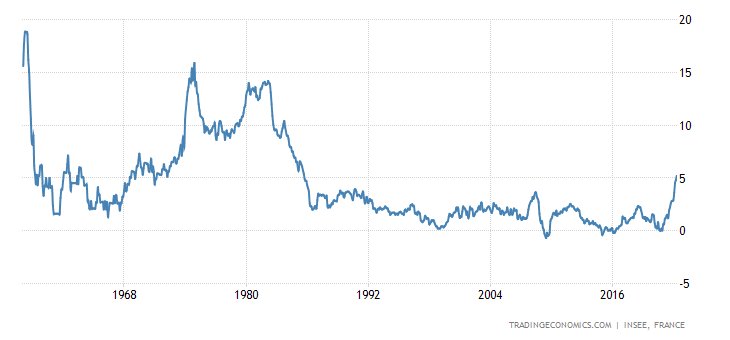

French CPI +5.2% per year climbed to the top since 1985:

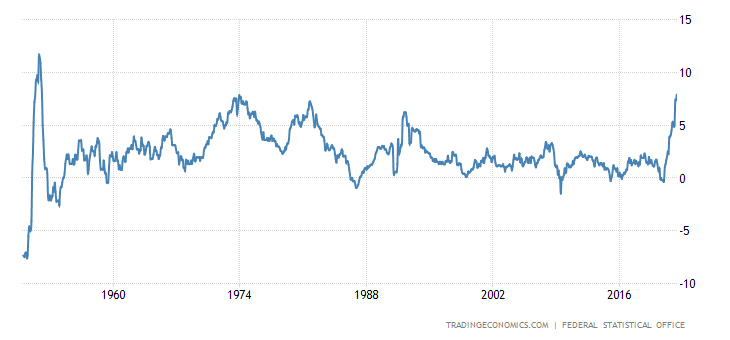

Germany’s CPI (+7.9% per year) surpassed the peak of 1974 (+7.84%) and reached the top in 70 years:

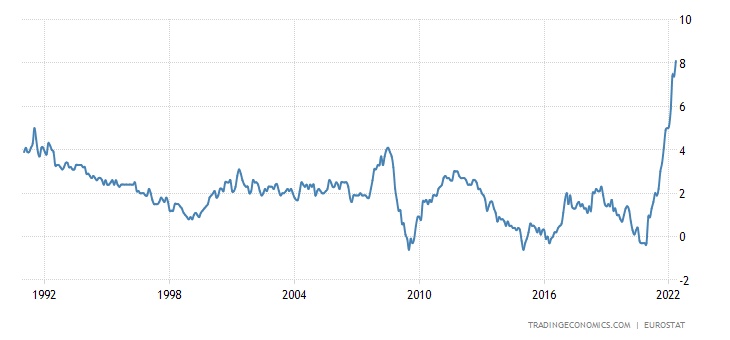

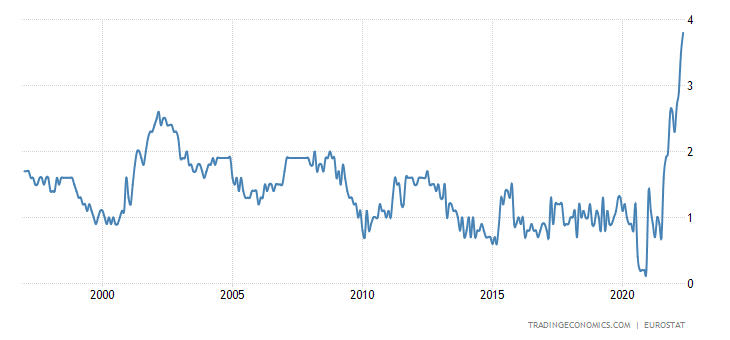

The Euro Area CPI got +8.1% YoY and hit a record high in 31 years of survey:

Core inflation rate of +3.8% per year is also similar to the record:

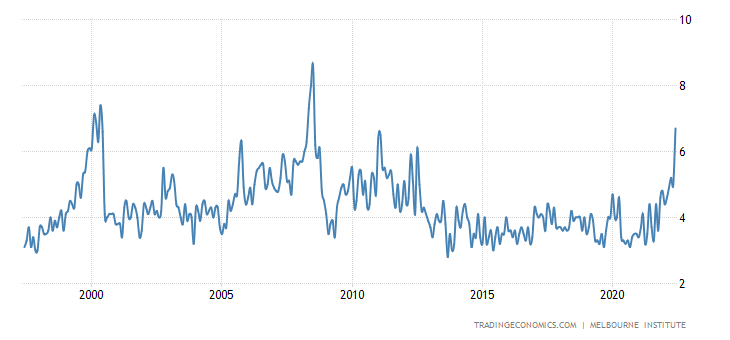

Inflation expectations in Australia are the highest since 2008 (+6.7%):

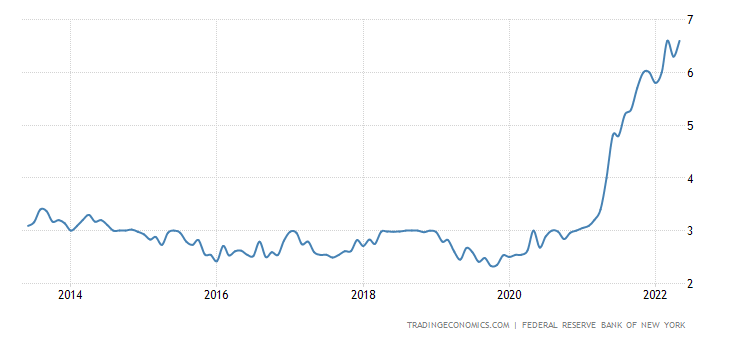

Inflation expectations in the US (survey of the FRB of New York) tied the record (+6.6%):

The US 30-year mortgage rate (5.65%) is at its peak since 2008:

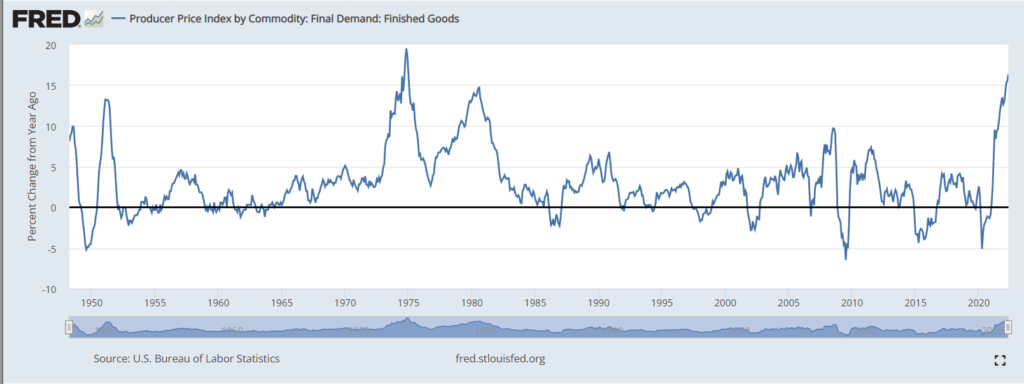

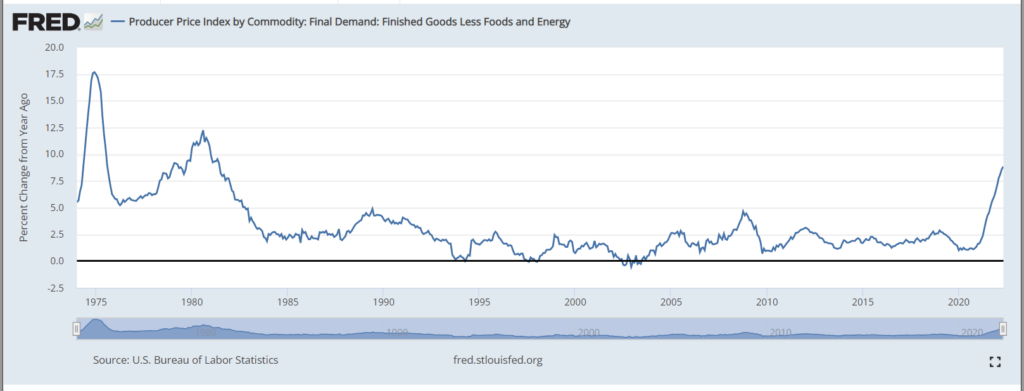

US PPI (Producer Price Index) became slightly lower, but for final goods it rose to 16.4% per year — in 75 years of observation it was higher only in 3 months (October-December 1974):

Prices for final goods less food and energy peaked since 1981 (+8.8% per year):

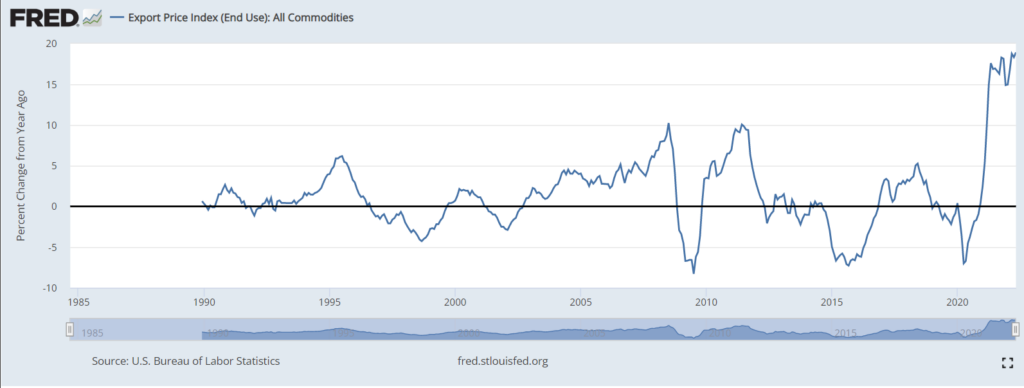

Export prices in the US are +18.9% per year, a record for 32.5 years of statistics:

As a result, US 2-year government bond yields have risen to the top since 2007:

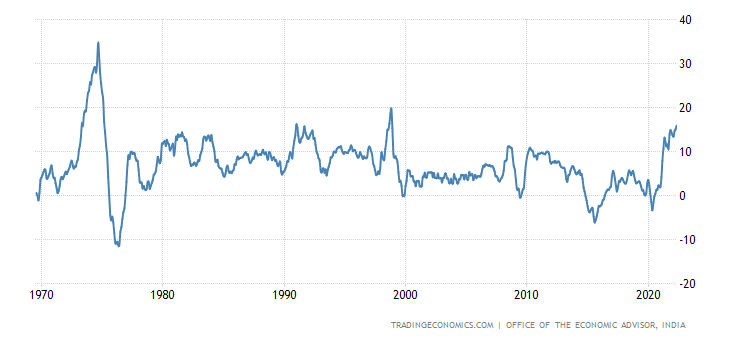

Wholesale prices in India +15.9% per year are the highest since 1998:

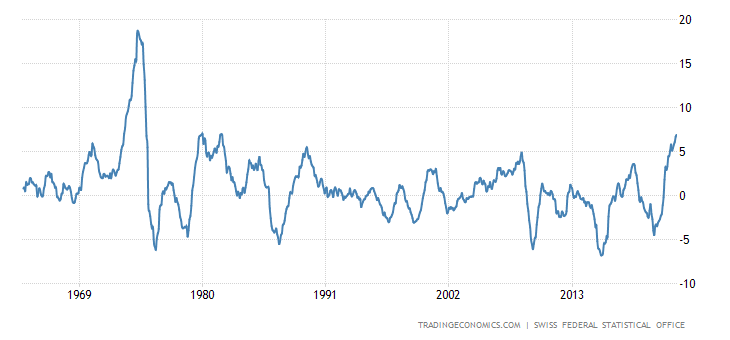

Swiss producer and importer prices at +6.9% per year are the highest since 1981:

Weekly earnings (without bonuses) in Britain, adjusted for inflation at -3.4% per year, are in record decline:

Please note that the adjustments were made for low inflation! In other words, there is a serious drop in the people’s living standard, not only in terms of expenditures, but also in terms of incomes!

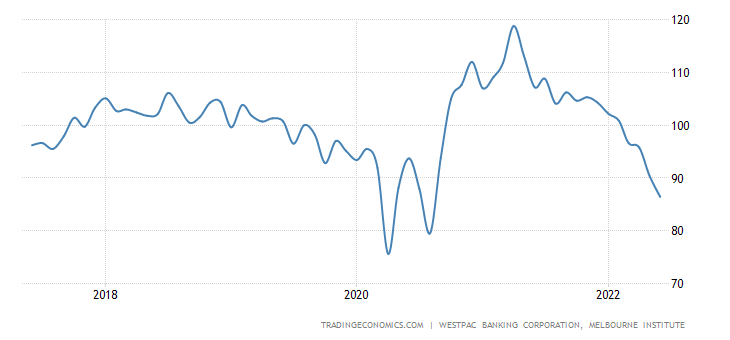

Australians are extremely pessimistic for 2 years, for the last year the consumer sentiment index is -19.5%:

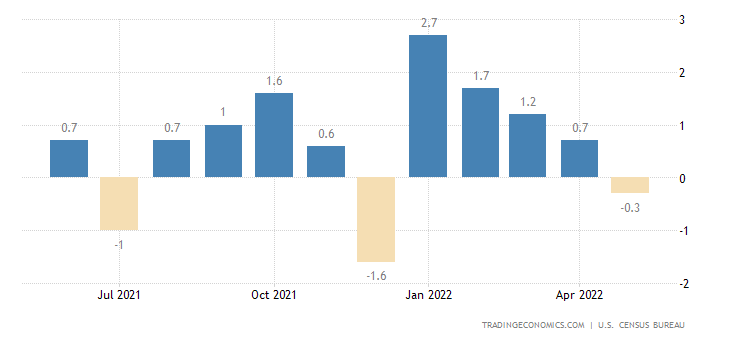

US retail sales were -0.3% MoM:

There is even a lack of will to emphasize that this is the case with undercharged inflation.

The US Federal Reserve for the first time since 1994 hiked the rate immediately by 0.75%, to 1-50-1.75%; by the end of the year, the expected rate is 3.4%, GDP, inflation and unemployment forecasts have been revised for the worse.

The Bank of England increased the interest rate by 0.25% to 1.25% and worsened all forecasts.

The Central Bank of Brazil raised the rate by 0.50% to 13.25%.

The Central Bank of Argentina increased the rate by 3% to 52%.

The Swiss Central Bank unexpectedly hiked the rate (for the first time in 15 years) from -0.75% to -0.25%.

And only the Bank of Japan has left things as they were and promises to continue to soften policy if necessary.

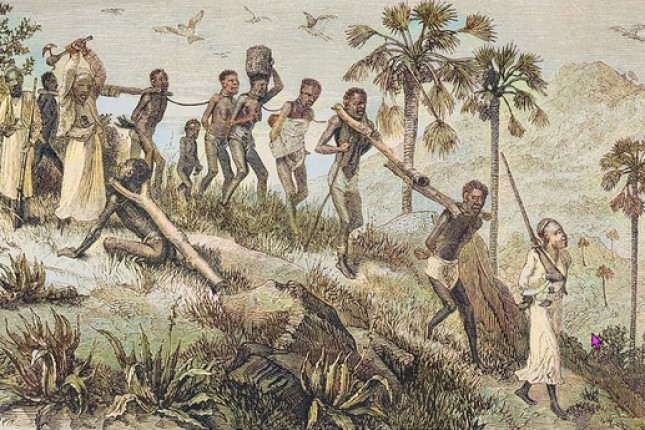

Summary. It is appropriate to quote (to wit) some of the points made by Russian President Vladimir Putin at the St Petersburg International Economic Forum. He voiced two points of principle that were not unexpected to the readers of our reviews but were first made by heads of State. First, Putin said that the old model of the world economy (and the world order in general) will not return. What it will be is debatable, but definitely not old.

The US leadership may understand this, but it does not work at all for the EU countries. What is important is to realize the emerging trends in the world economy before they manifest themselves in official rhetoric. Recall, for example, that in the summer of 2021, when US industrial inflation was already high, but consumer inflation was low enough, the Fed leadership actively argued to its listeners that the former would fall by the end of the year. We have shown that on the contrary, consumer inflation will rise.

Since we are basing ourselves on theory, and the Fed’s leadership on monetary doctrine, we have certainly been right. But such stories will be repeated quite often in the coming years precisely because the old model (for which the monetarist principles, albeit with difficulty, were applicable) will not return.

Second, Putin said that the economics of financial assets will give way to the economics of real assets. In general, it is clear to everyone that the real asset economy is in no way capable of supporting private demand, which means that living standards in Western countries will fall sharply (or even dramatically).