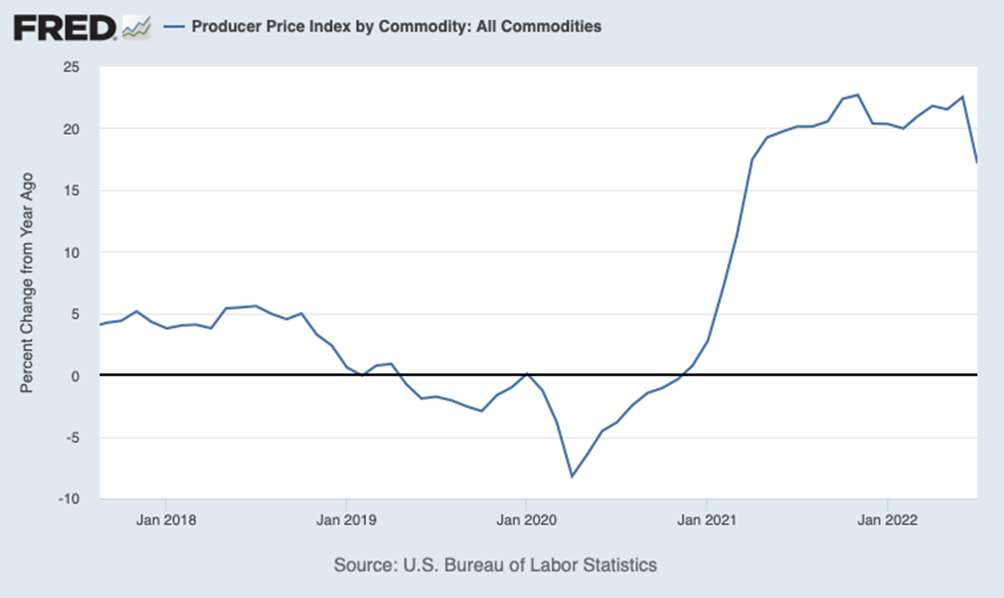

Inflation fell in the USA … Indeed, it fell:

And it caused indescribable joy: “On Wednesday, US markets showed growth against the backdrop of the publication of positive July inflation data: Nasdaq Composite rose by 2.9%, S&P 500 – by 2.1%, Dow Jones Industrial Average added 1.6%. The main drivers of the rally were the technology sector and the secondary consumer goods sector. Investors expect the Fed to loosen monetary policy amid easing inflationary pressures: US price growth slowed to 8.5% y/y and 0% m/m (consensus 8.7% y/y and 0.2% m/m , previous readings of 9.1% y/y and 1.3% m/m, respectively), core inflation (excluding food and energy) was 5.9% y/y and 0.3% m/m (consensus 6.1% y/y and 0.5% m/m, previous values 5.9% y/y and 0.7% m/m). Yields on 10-year Treasuries fell from 2.797% to 2.786%, on 2-year ones – from 3.269% to 3.214%.

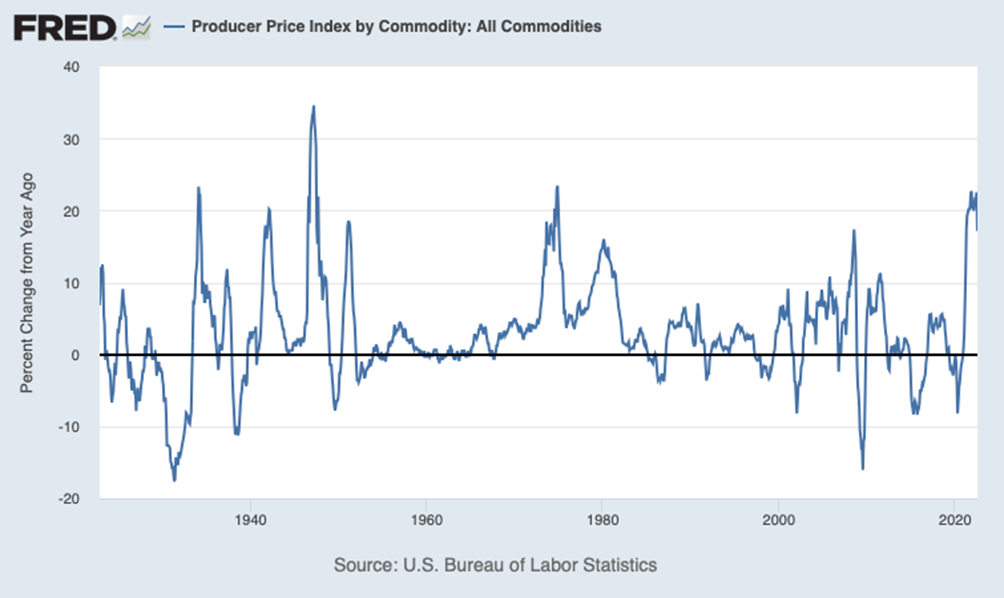

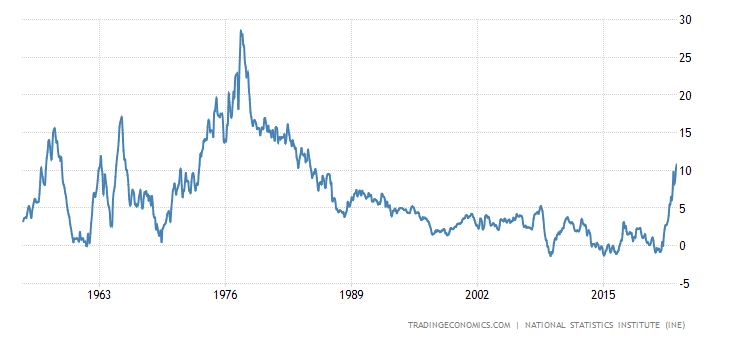

Note that there are no references to the above chart (so as not to remember that not so long ago it broke the record of the 70s and is now second only to the peak of 1947).

And there are no guarantees that tomorrow inflation will not rise again, since the decline is mainly due to a sharp drop in gasoline prices. Elections, you know, are coming soon and American voters are very sensitive to gas prices!

Do you know what it’s called? This is economic degradation. And if someone thinks that the service sector is not so important, and in the energy sector in the world everything is getting much better (as in the USA), you can give the following graph:

Well, it’s some kind of France! Of course, this is France. But! If the fall in the price of gasoline in the United States were of a market nature, then gasoline would already be actively sailing to France in order to make a profit. Because there were world markets not so long ago. But today they are no more. And locally, prices can be lowered by administrative methods. So?

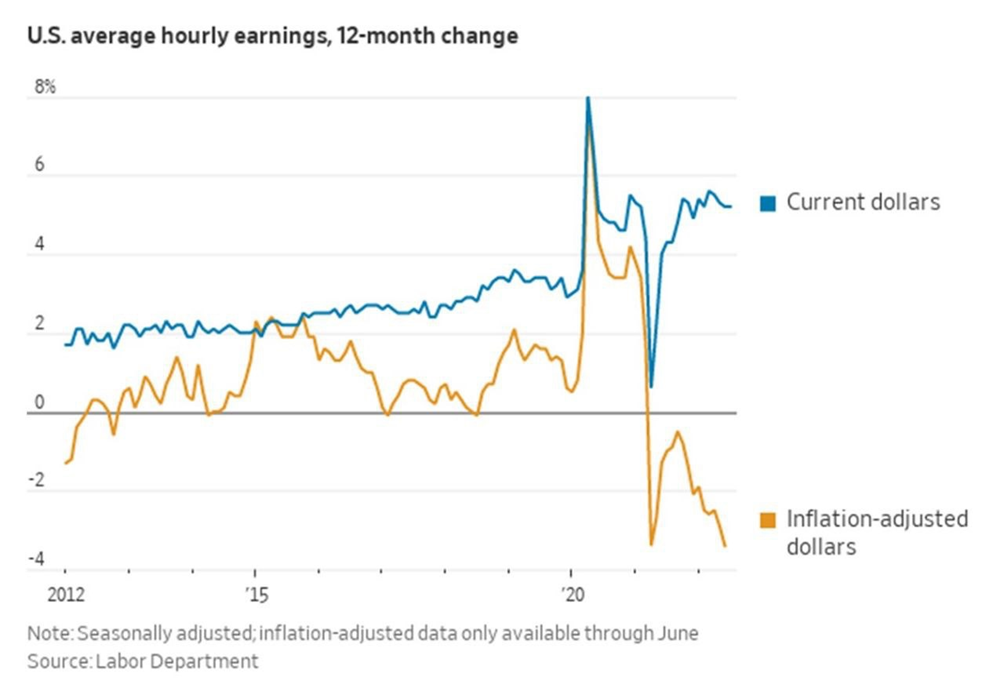

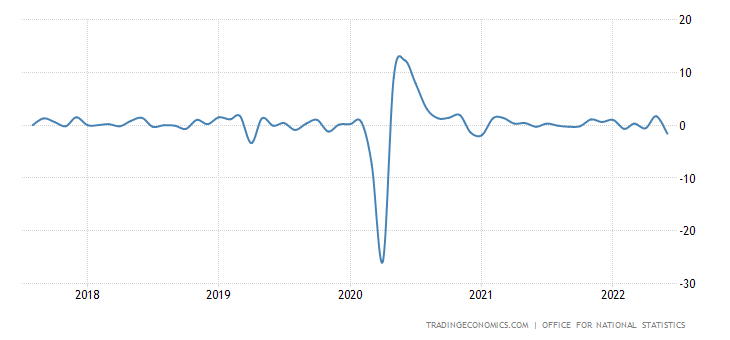

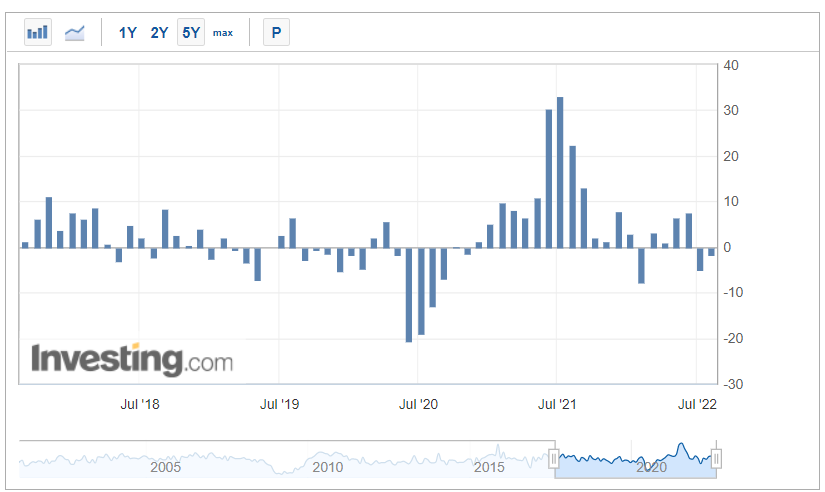

And then people’s incomes fall. In the USA:

And there is no guarantee that they will start growing. But they will not start, there are no economic grounds for this. Therefore, the fact that such a local phenomenon as a slight decrease in inflation has become the basis for serious optimism in financial markets suggests that there are no real chances for serious growth.

Macroeconomics

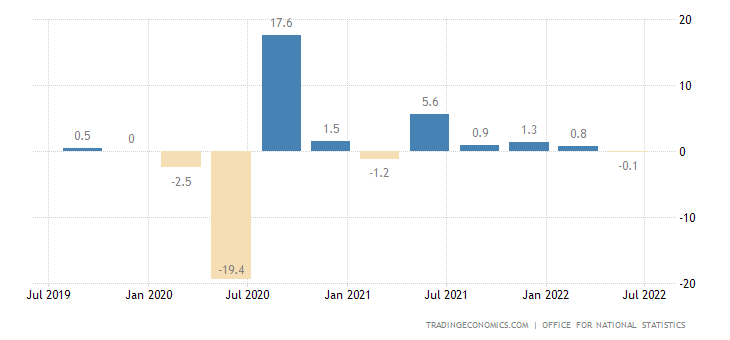

UK GDP -0.1% per quarter in April-June:

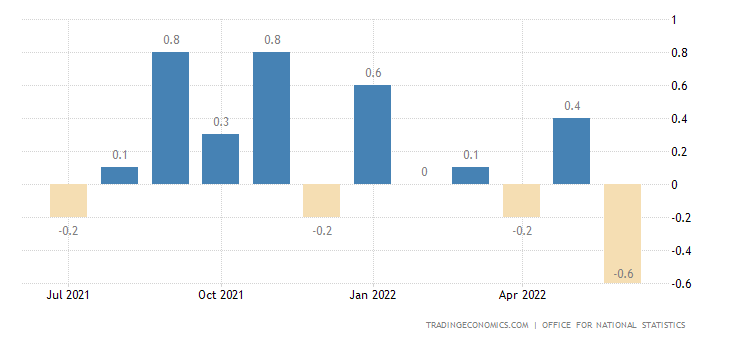

Separately for June -0.6% per month:

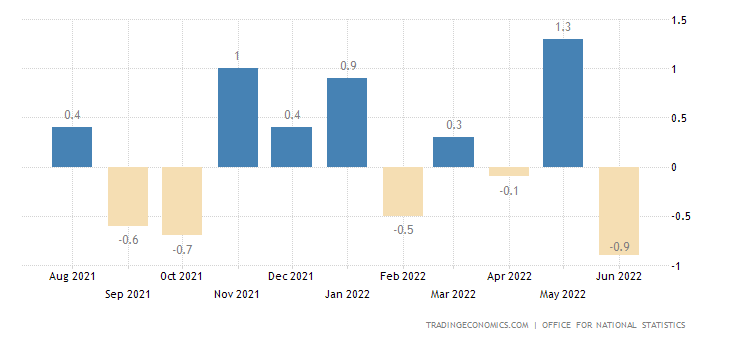

UK industrial output -0.9% per month – yearly minimum:

In the manufacturing industries -1.6% per month – the worst dynamics in 1.5 years:

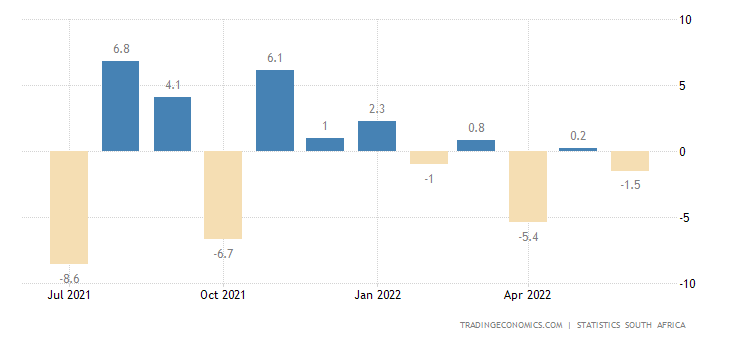

Industrial production in South Africa -1.5% per month:

And -3.5% per year – the 3rd negative in a row:

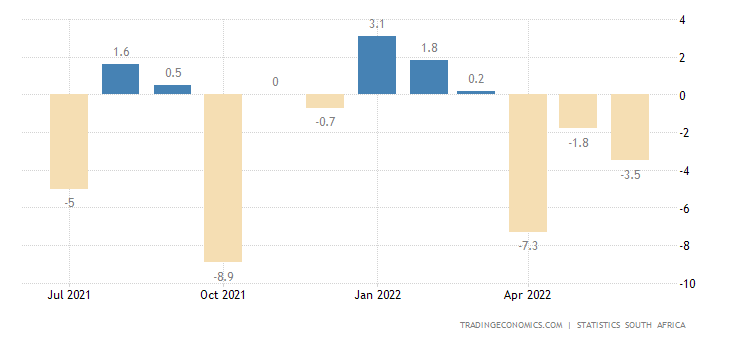

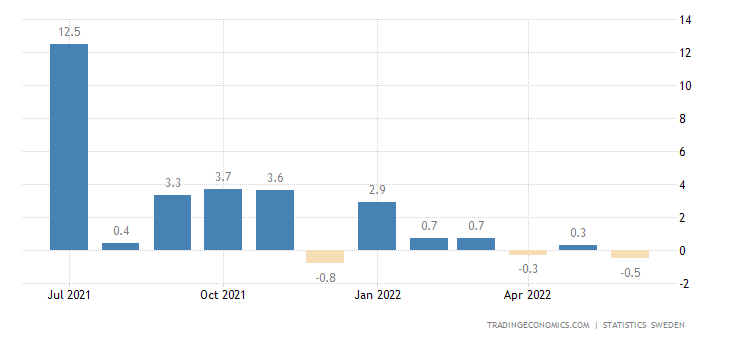

Swedish industrial orders for the 2nd month in a row show a yearly loss:

Industrial output also went there (-0.5% per year):

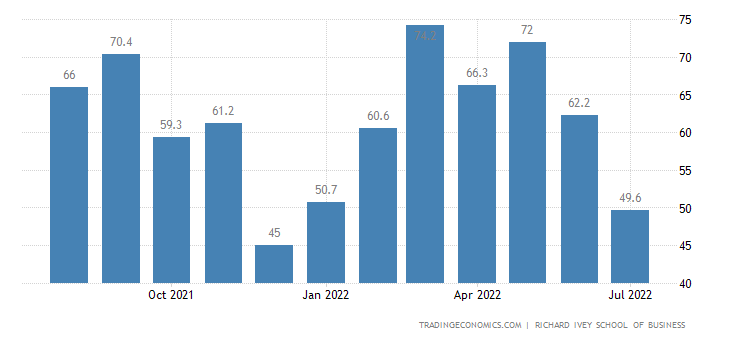

PMI (expert index of the state of the industry; its value below 50 means stagnation and recession) of Canada unexpectedly went into the recession zone (49.6):

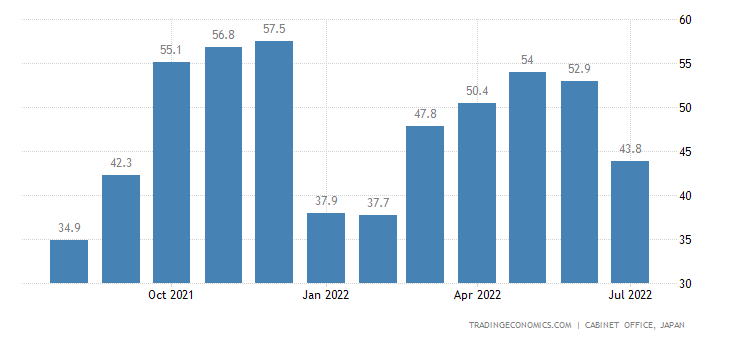

Index of economic observers in Japan at the bottom for 5 months:

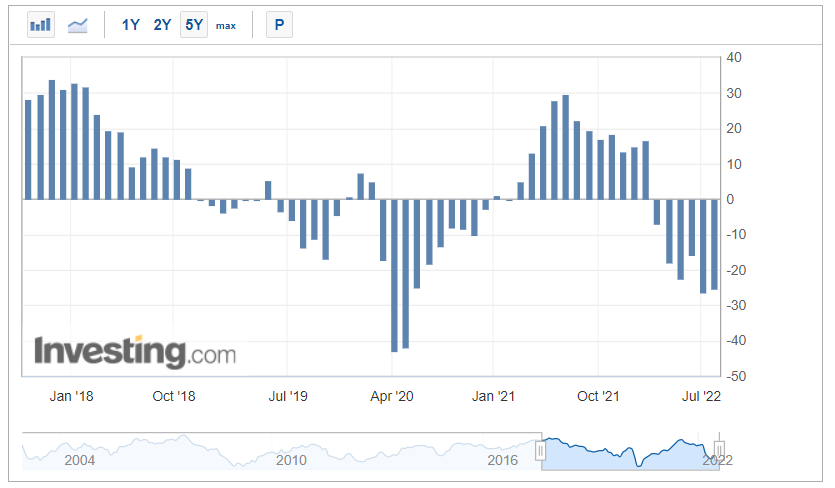

Investor confidence in the euro area is at a 2-year low:

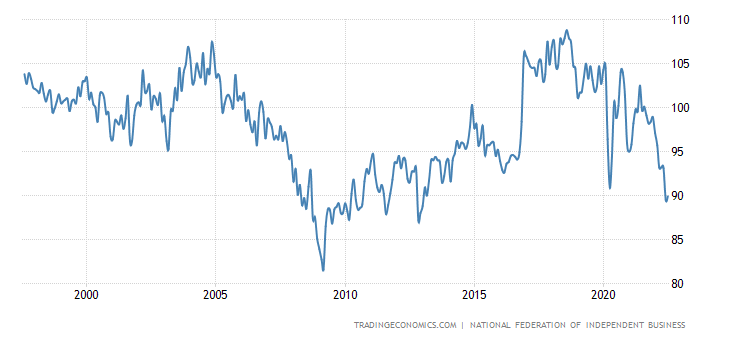

U.S. small business sentiment is only slightly off a 10-year low:

China’s foreign trade surplus in July is a record one (over $100 billion per month):

Or otherwise the United States is buying cheap products, they are not ready to produce themselves.

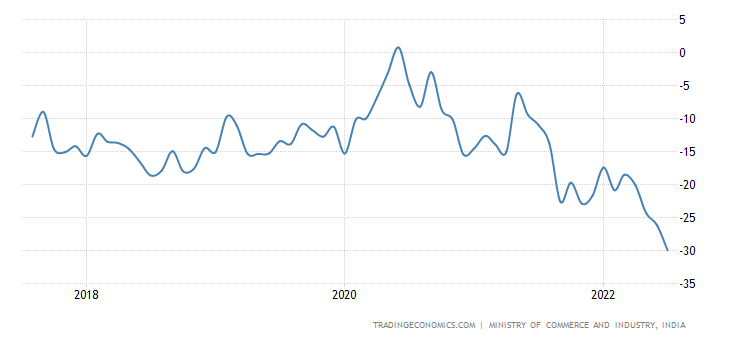

And India has a record deficit:

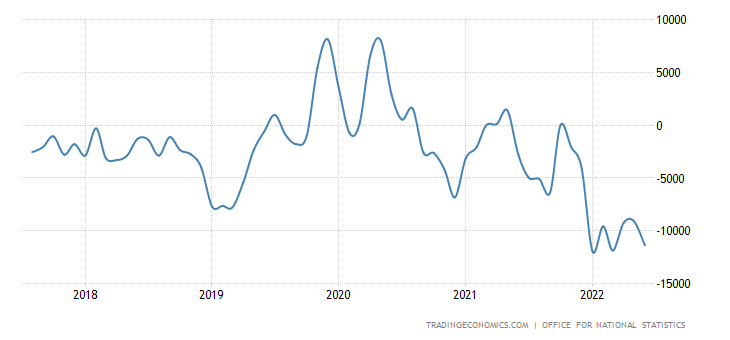

In Britain, it is close to a record:

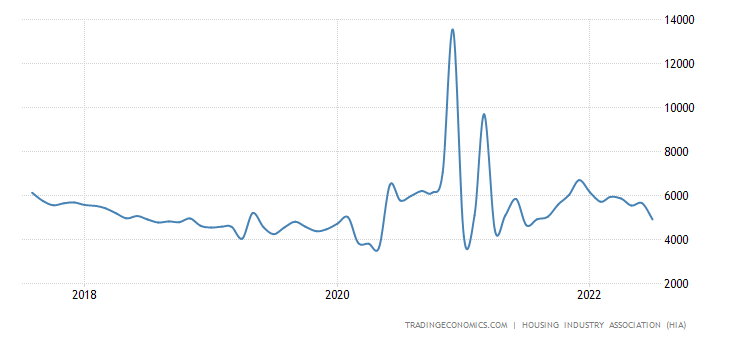

New home sales in Australia -13.1% per year – approaching record lows:

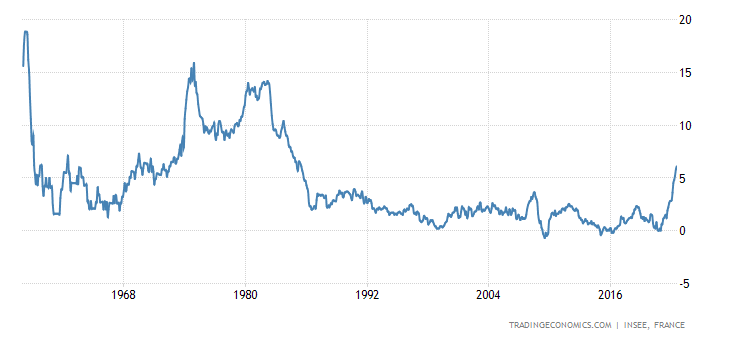

French CPI (Consumer Inflation Index) +6.1% per year – the highest since 1985:

Spanish CPI +10.8% per year – peak since 1984:

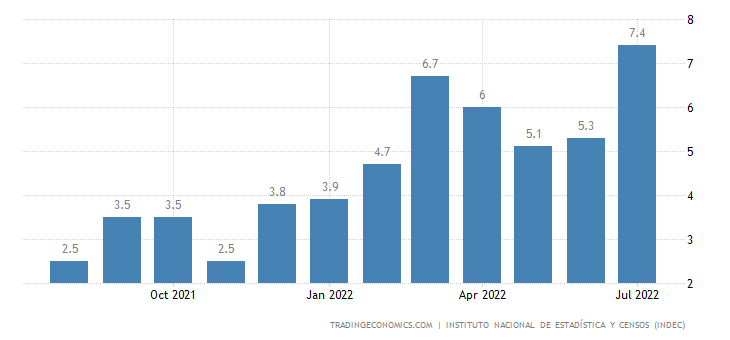

CPI Argentina +7.4% per month – a record:

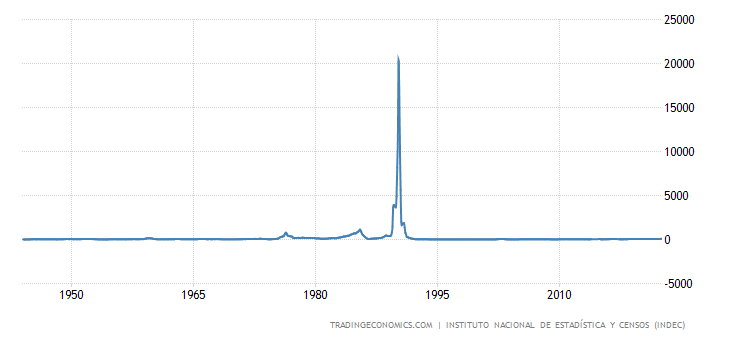

And +71.0% per year – the top since the beginning of 1992:

However, here it will be difficult to break the record.

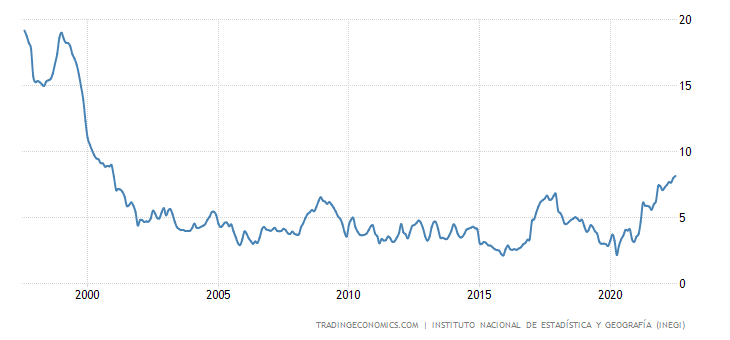

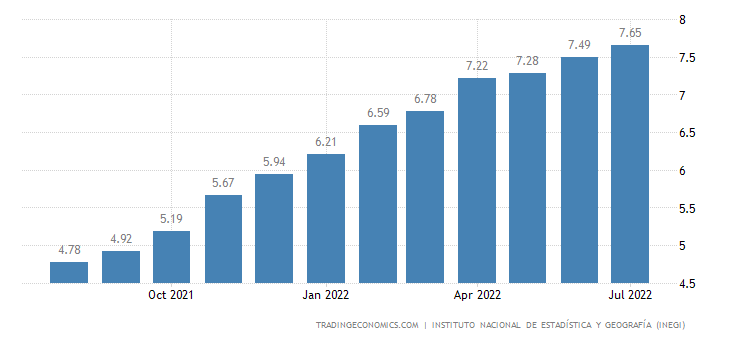

Mexico +8.15% per year – maximum since 2000:

The “net” (minus the highly volatile components of fuel and food) CPI has a similar peak (+7.65% per year):

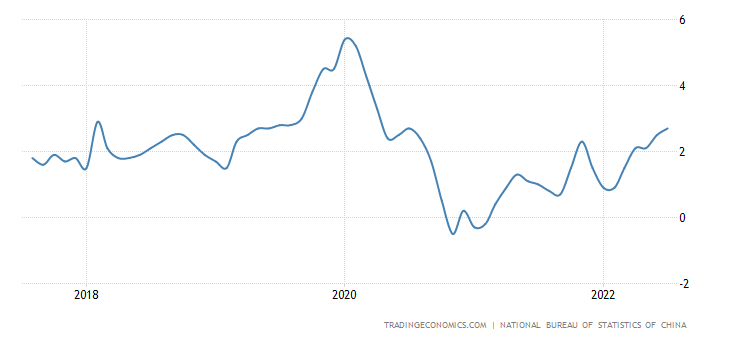

China CPI +2.7% per annum – 2-year high:

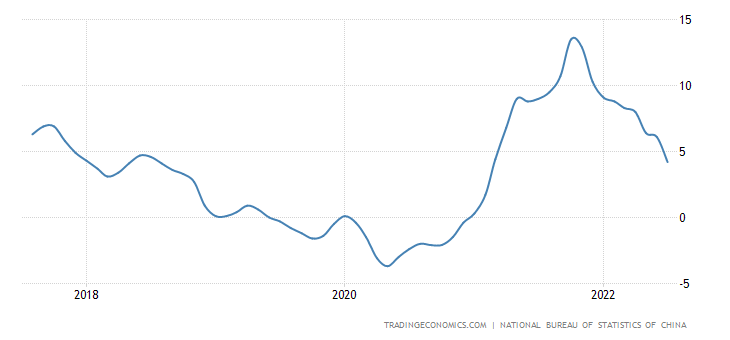

On the other hand, China’s PPI (+4.2% per year) is the lowest in 1.5 years:

Given domestic subsidies in China, this is a serious sign of a slowdown (or even a stop) in economic growth.

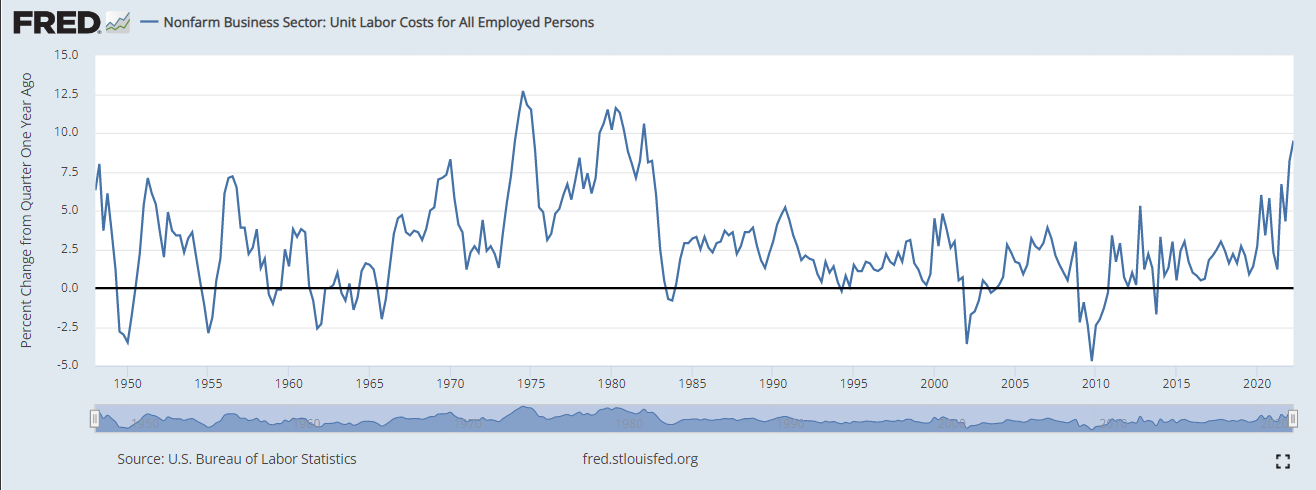

US Unit Labor Cost +9.5% per annum, the highest since early 1982:

It is clear that this is a reaction to inflation. But not all employers are willing to pay such wages. And

growth is still below industrial inflation.

Credit growth in India (+14.5% per year) is approaching the peaks of 2018:

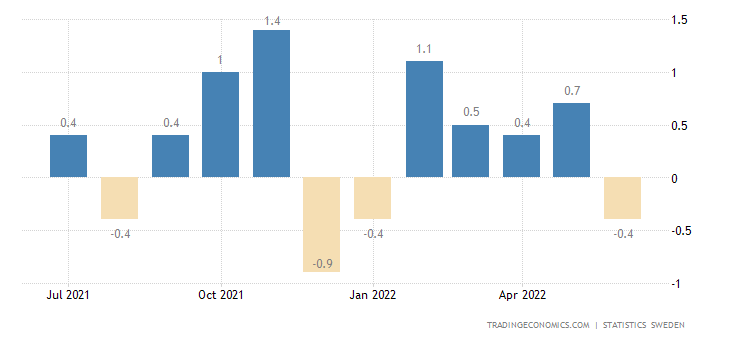

Swedes spending -0.4% per month:

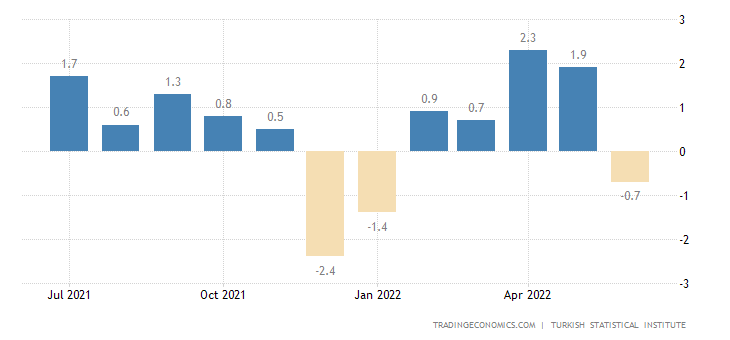

Retail sales in Turkey -0.7% per month:

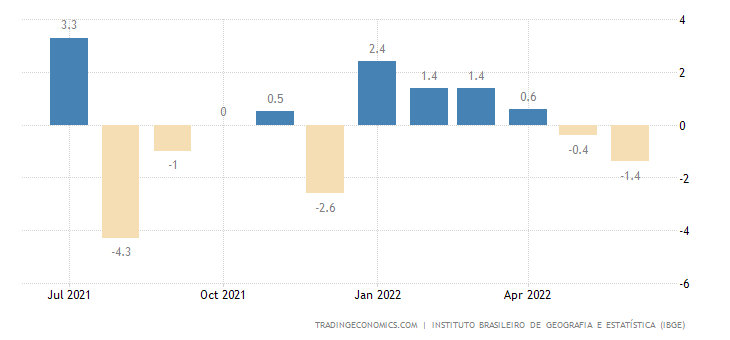

Retail Brazil -1.4% per month – 2nd negative in a row:

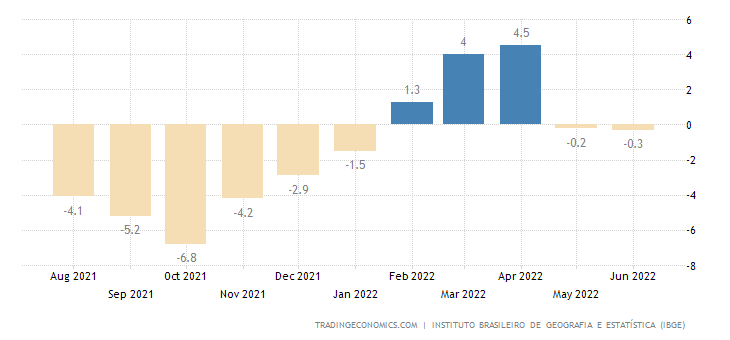

The 2nd negative in a row and in annual dynamics (-0.3%):

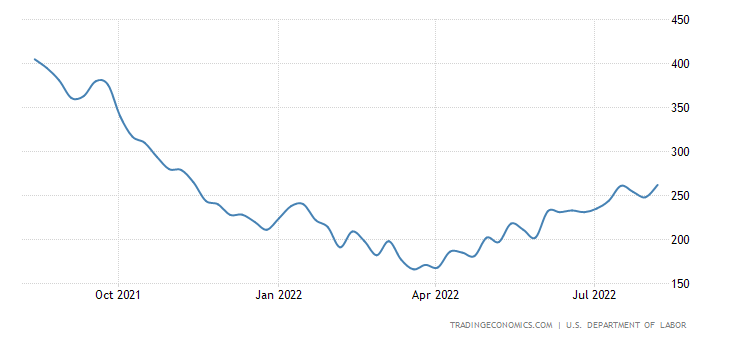

U.S. Initial Jobless Claims Highest for 9 Months:

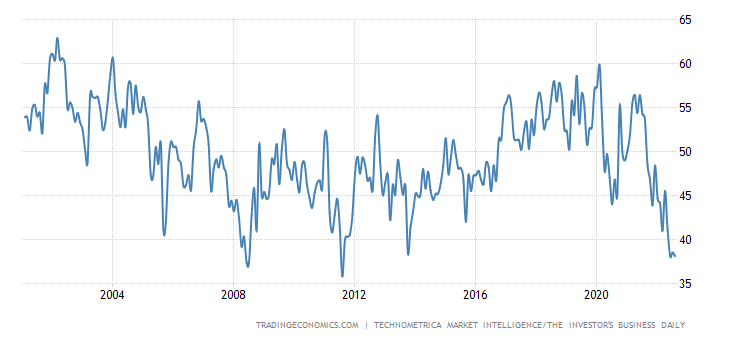

American economic optimism (IBD/TIPP survey) weakest since 2011:

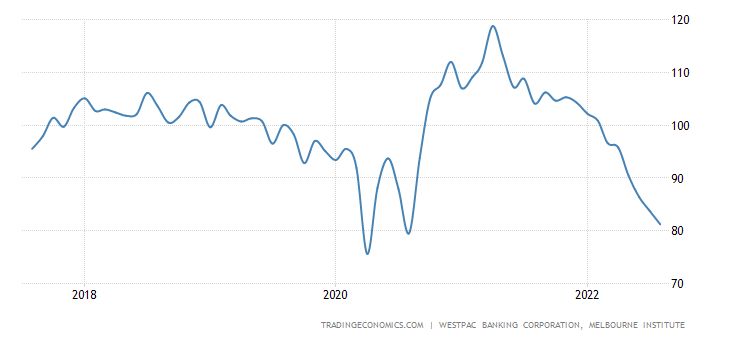

Australian sentiment has been deteriorating for 9 consecutive months, at a 2-year bottom and near 30-year lows:

The Central Bank of Argentina raised the price by 9.5% to 69.5%.

The Central Bank of Mexico raised the interest rate by 0.75% to 8.50%, the highest since 2005.

Main conclusions

On the one hand, it’s summer. On the other hand, the US elections. Stronger – “premierfall” in the application. And, most importantly, a structural crisis, in which a regulated mechanism arises (for example, by increasing or increasing the volume of gas) proposed by the structure do not work, the alleged problems cause price increases with completely different effects (increase in transaction costs). And it is impossible to stop these processes.

More precisely, there have been no such cases in today’s economic history. All three examples resulted in a recession continuing until structural changes led to the return of the economy to an equilibrium state. In full accordance with the liberal theory, by the way.

We have repeatedly noted that we do not give all the statistical data, but only those that reveal some deviations from established trends. It is for this reason that we have paid so much attention to a minor position in the United States – the upward trend has weakened somewhat. If there is no decrease in perception, it will be necessary to understand the reasons while the content of the reasons for this is reduced. So, we will follow the events, we will return to it in early September, when the data for August appears (weekly indicators are too volatile).

Revealing only those global violations, despite the fall of the state, continue to develop.

Main photo: Poster for the William Shakespeare's play "Much Ado About Nothing"