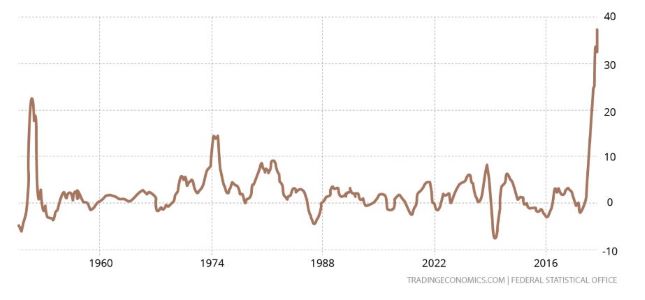

Last week we noted that the decline of US inflation hardly can be a cause for celebration and weekly data confirms this our point of view. At the same time, a similar situation has developed in Germany – the penultimate data turned out to be more pleasant than those that preceded them. But the data released this week are disappointing again, PPI (industrial inflation index) in Germany rose to an unprecedented 37.2% per year in 72 years of statistics:

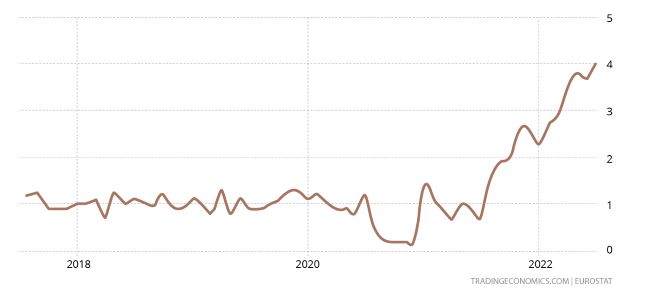

Data on consumer inflation (CPI index) also let us down, though not in Germany, but throughout the eurozone as a whole, + 8.9% per year – a record for 31.5 years of data collection:

“Net” (excluding highly volatile components) CPI +4.0% per year – also a record:

In other words, the picture becomes more or less typical, some small improvements rather quickly give way to a further increase in inflation and/or an intensification of the recession. For a structural crisis this is a normal situation, which, moreover, depends little on the tightening of the policy of the monetary authorities. But for liberal experts this every time turns out to be an unpleasant surprise.

Macroeconomics

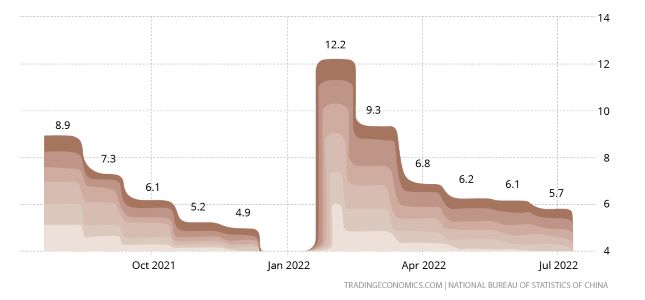

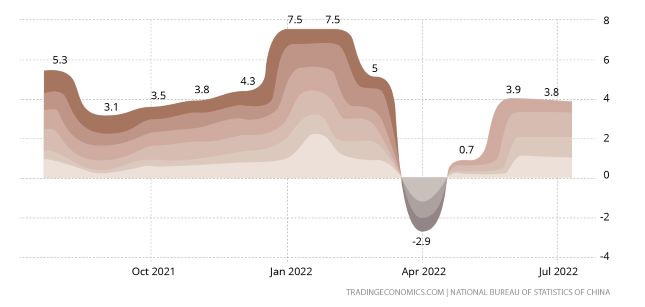

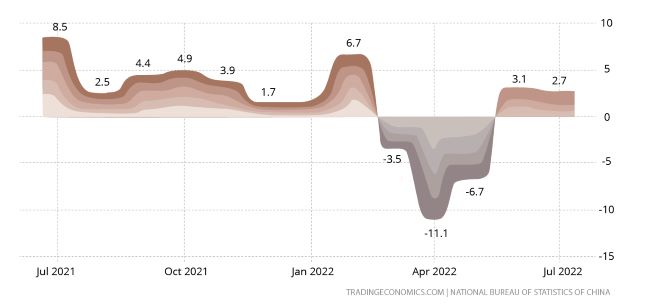

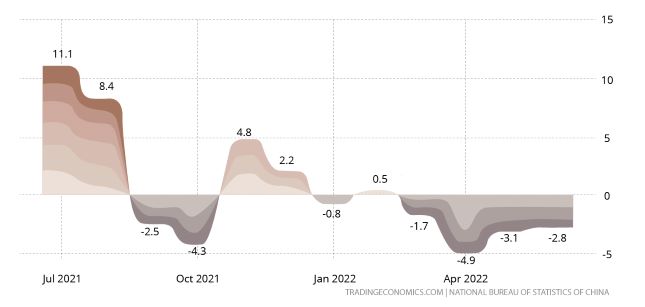

Chinese data for July disappointed. Fixed asset investment is slowing down:

Just like industrial production

Retail sales are also slowing down:

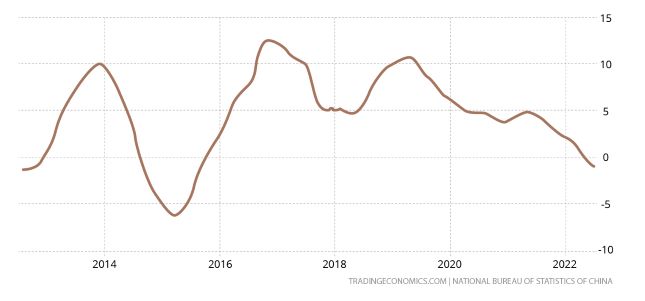

Prices of new buildings -0.9% per year – the worst dynamics in 7 years:

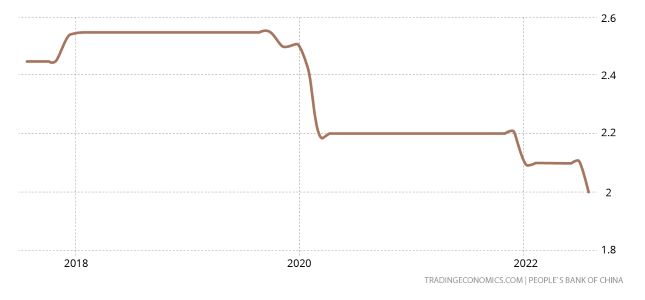

After these data, the Central Bank of China lowered the reverse repo rate to a record low of 2.0%:

It should be noted that Chinese statistics is an extremely complex thing and assessing the degree of its adequacy to reality is a separate art, which few people know. But the general situation is such that the Chinese have to admit to a slowdown in their economy (or to mask the recession that has already begun under a slowdown), because it is no longer possible to portray the usual optimism.

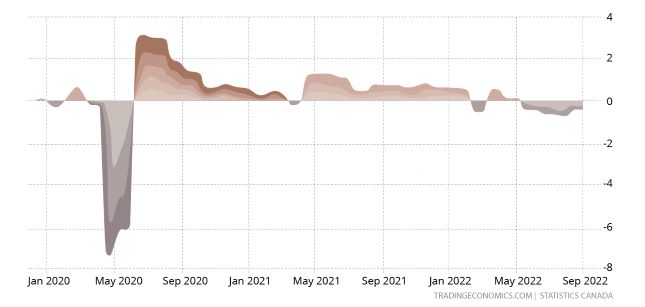

Industrial production in Japan -2.8% per year – 4th negative in a row:

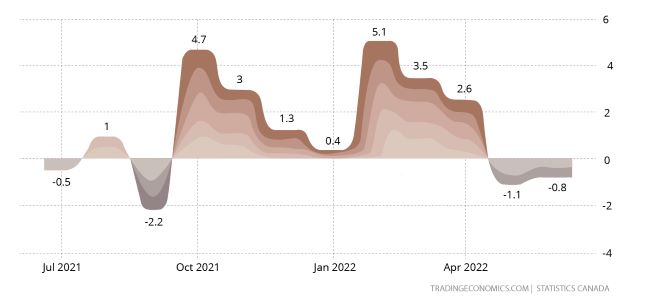

Canadian Manufacturing Sales -0.8% m/m – 2nd straight loss:

German economic sentiment index from ZEW near record lows of 2008:

Same story in the eurozone as a whole:

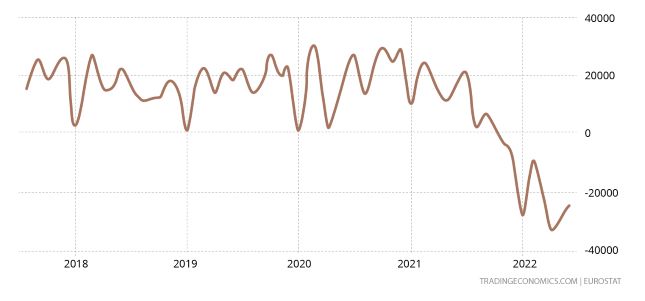

Eurozone trade balance in deficit for 8 consecutive months; over the past year liabilities with Russia have grown 4 times, with China – 2 times:

However, taking into account inflationary indicators, this is not at all surprising!

The New York Fed index fell to the bottom of 2008:

Leading indicators in the US in monthly minus for 4 months in a row:

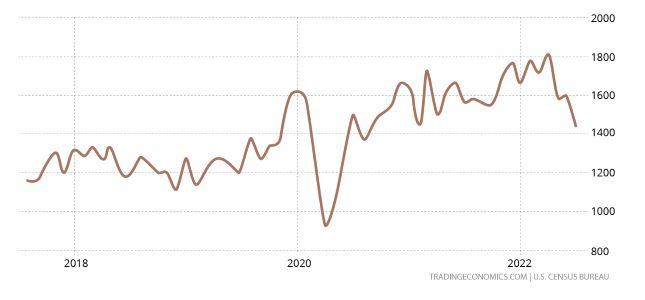

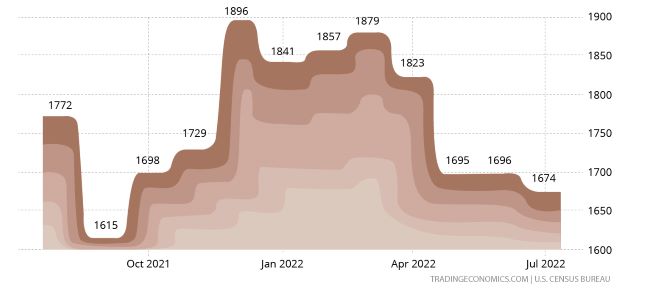

New construction in the US -9.6% per month, to bottom in 1.5 years:

And building permits are 10 months low:

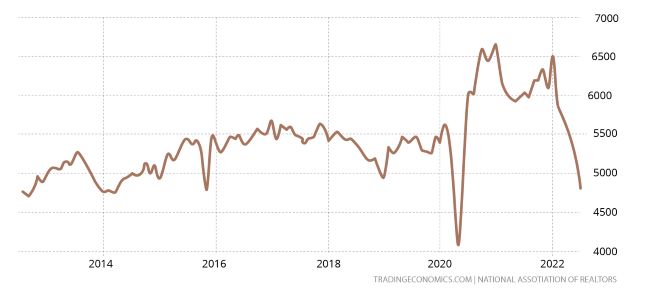

US existing home sales another -5.9% m/m, bottoming since May 2020, below pre-covid levels (such numbers were the norm 10 years ago):

The NAHB housing market index in the US fell below 50 for the first time since 2020; apart from a brief COVID-19 dip (2 months in 2020), this is the lowest since spring 2014:

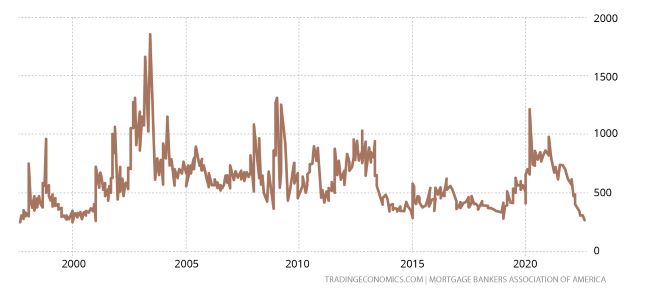

Even lower mortgage interest rates have not prevented mortgage applications from updating the bottom since early 2000:

The joy of last week about the decline in inflation fades somewhat against the backdrop of such news. However, this is not something new for our readers as we have analyzed this situation in detail.

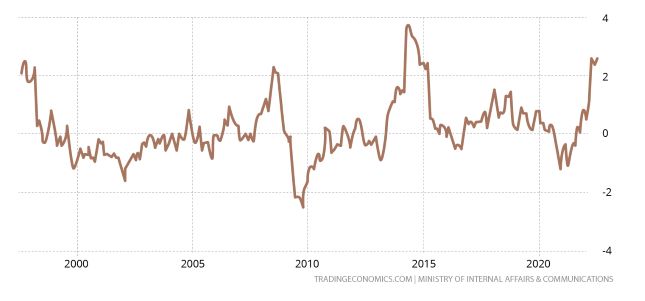

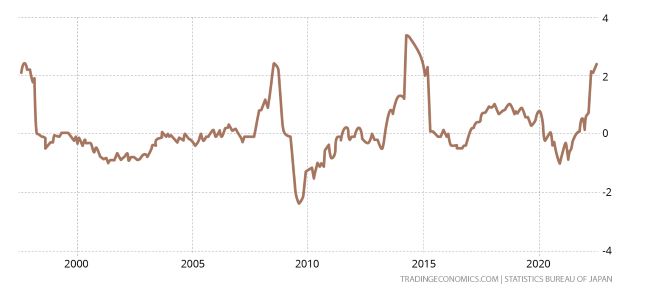

Japan CPI +2.6% per year – maximum since 2014:

“Net” CPI (+2.4% per year) is also at its peak since 2014:

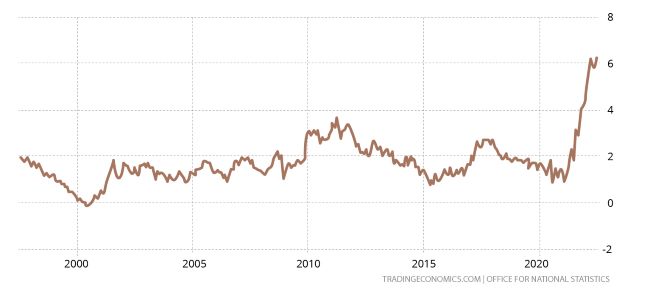

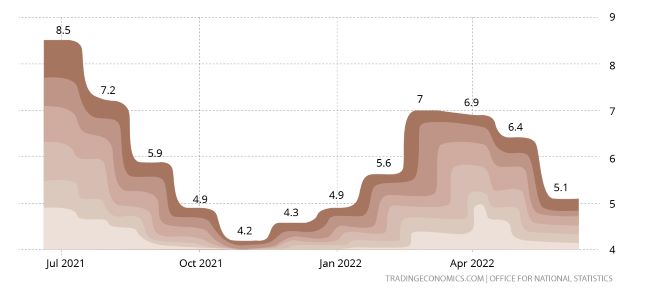

UK CPI +10.1% per year – 40-year high:

Net CPI +6.2% per year – a record for 25 years of observation:

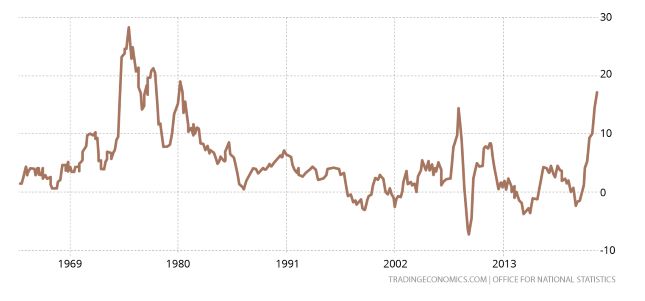

Retail price index +12.3% per year – top since 1981:

UK PPI +17.1% per year – peak since 1980:

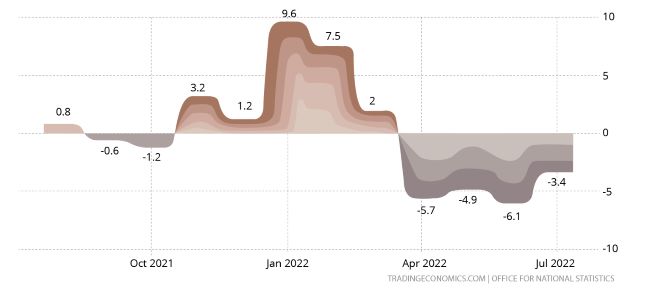

Adjusted for official inflation, UK regular wages -3.0% per annum – historical anti-record:

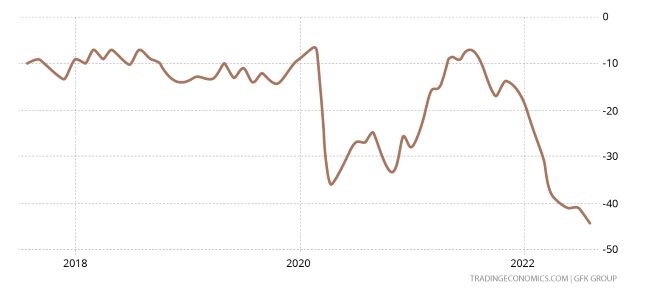

That’s why British consumers are record gloomy

And the volume of retail sales in Britain (-3.4% per year) has been in the annual red for 4 months in a row –

No wonder Johnson couldn’t resist! The only question is what the new prime minister will do, given that no grounds for improving the situation are foreseen!

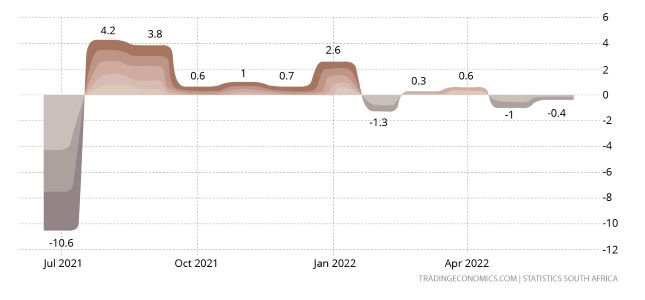

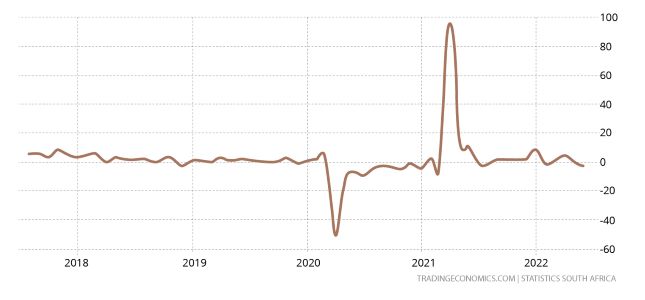

Retail in South Africa -0.4% per month – 2nd negative in a row:

And -2.5% per year – the worst dynamics in 1.5 years:

The Central Bank of New Zealand raised the rate by 0.5% to 3.0%. The Central Bank of Turkey cut the rate by 1% to 13%.

Main conclusions

Summer, after all, has come into its own, there are few non-trivial statistics. Theoretically more data could be given, but they don’t make much sense, they don’t show any trend. So far, it can only be noted that in the EU, the UK and the US negative trends continue without much stopping.

Note that relations between the US and China are deteriorating, which is clearly seen in the volume of US government securities on China’s balance sheet.

There is no doubt that this moment will still manifest itself, while the United States is forced to increase purchases of Chinese goods, since the standard of living of the population, as it was previously is falling. Yes, and the data on real estate confirm this situation. So, we can state that the crisis strategy we formulated a year ago is fully confirmed and consistently implemented, regardless of the actions of the monetary authorities of different countries. As, in fact, it should be within the framework of PEC crises.

Main photo: Cain by Henri Vidal, in the Tuileries Gardens, Paris, 1896