Potential default of the US budget. No, we are well aware that this is fiction from an economic point of view: exceeding the public debt threshold does not create any real problems. In the past, it was solved automatically in a few hours, and even some recent stories with a temporary reduction in budget expenditures did not leave any special consequences. Why is this news important to us?

The fact is that the lower house of Congress, the House of Representatives, is now controlled by the Republican Party, which has its own ideas about economic policy (we are not so interested in disagreements over Biden's behaviour). And there is no doubt that the need to raise the national debt limit, which the adoption of a new law can only change, will allow Republicans to start a serious discussion about economic policy with the White House.

In particular, it is possible that as a result of this discussion, the Ministry of Finance and, in general, the monetary authorities will have to explain how they are going to support the real sector of the economy, in particular, the construction sector, how they will protect the economy from inflation in the context of a sharp increase in budget expenditures and, finally, whether it makes sense to raise the rate in such a situation.

We have repeatedly noted that there is no simple answer to these questions, and even a simple discussion of them can cause serious trouble in the financial markets.

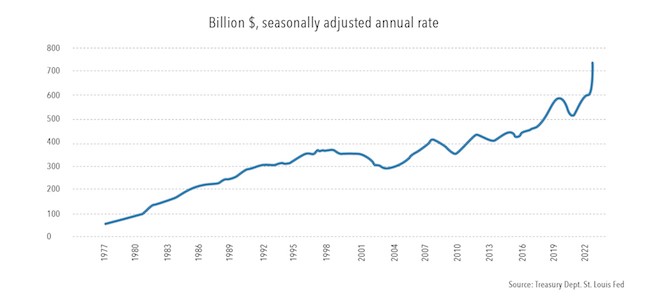

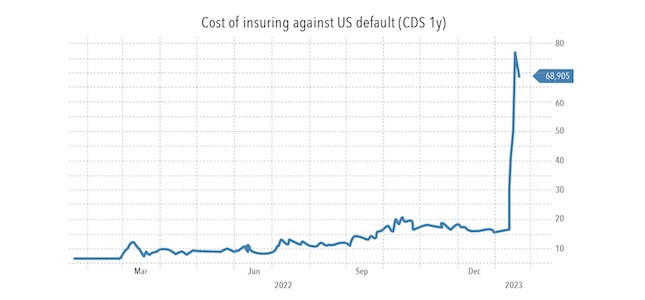

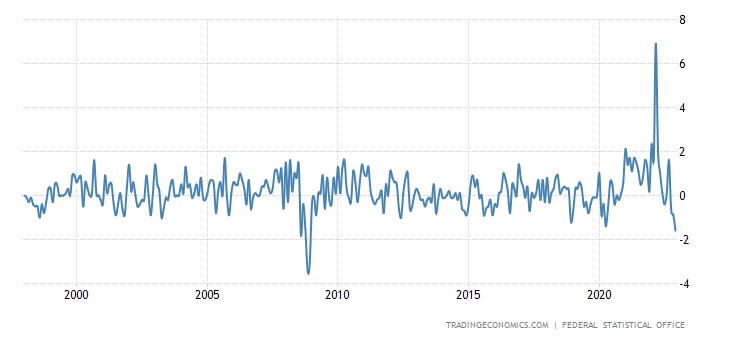

So far, the US monetary authorities have managed to avoid active discussion on this topic. However, the above picture in itself can puzzle anyone. Like the following, showing the cost of insurance against a US default:

So, the current situation with the budget limit can greatly shake the political and financial stability in the United States.

Macroeconomics

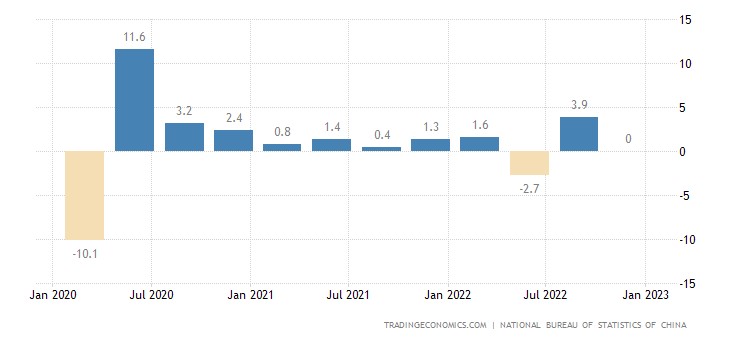

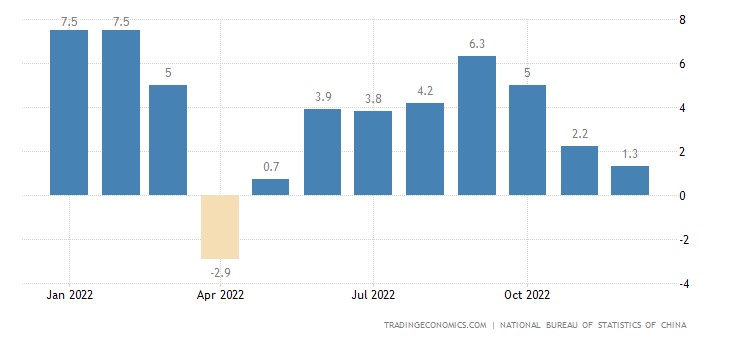

Chinese data expectedly weak: GDP in October-December 0.0% per quarter:

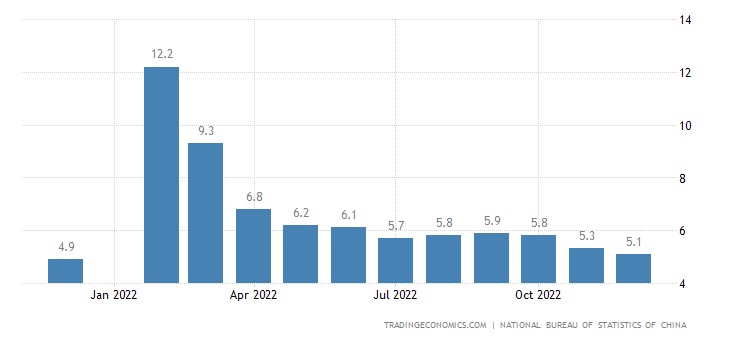

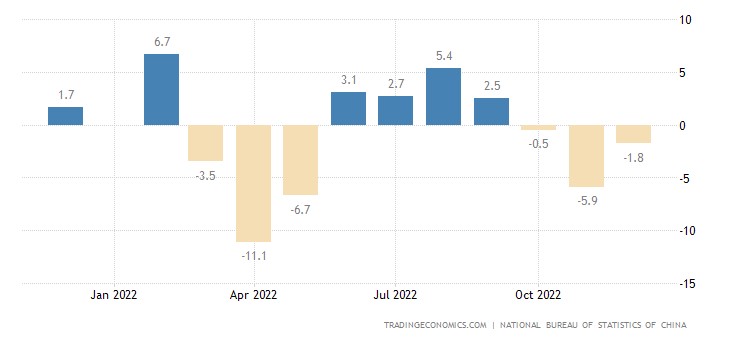

Investment in fixed assets in December +5.1% per year (annual bottom):

industrial production +1.3% per year – 7-month minimum:

Retail sales volume -1.8% per year – the 3rd negative in a row (moreover, even for the whole of 2022 it was -0.2%):

Finally, housing prices -1.5% per year – the 8th minus in a row and the vicinity of the lows since 2015:

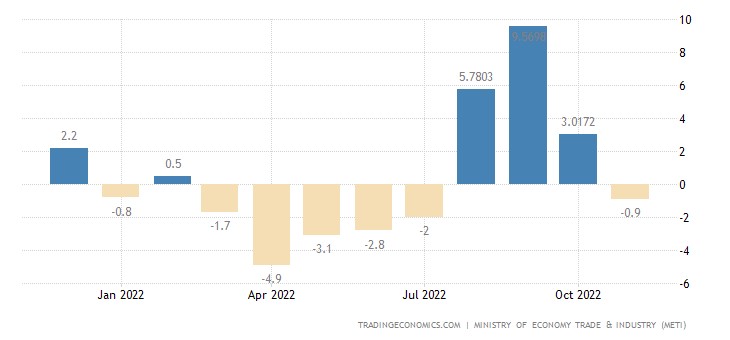

Industrial production in Japan -0.9% per year:

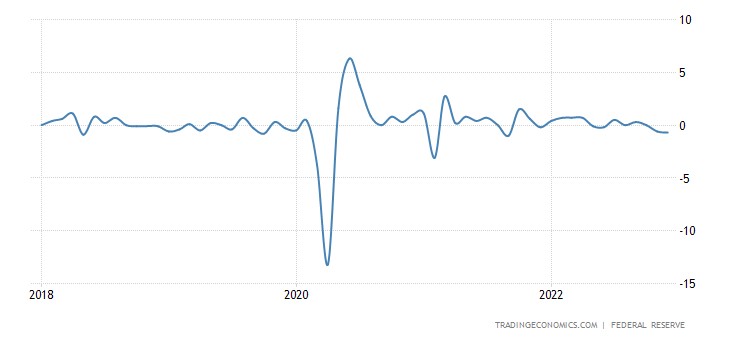

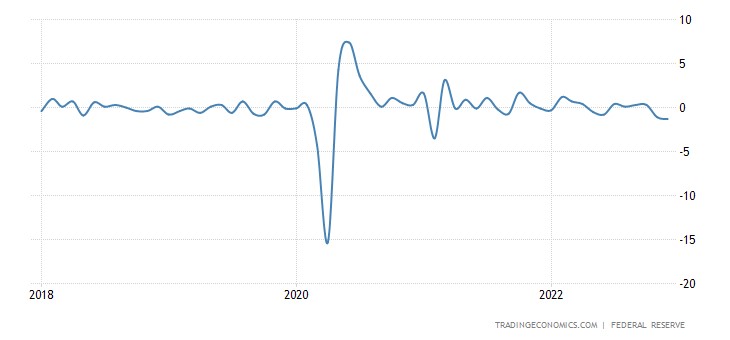

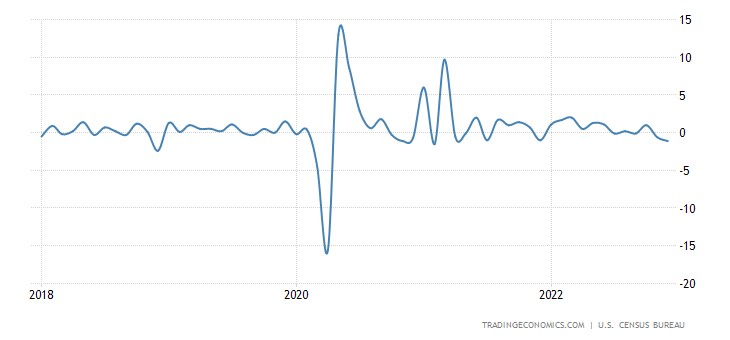

Industrial production in the US -0.7% m/m – 2nd negative in a row and the worst dynamics in 15 months:

In the manufacturing industries -1.3% per month is also the 2nd minus in a row and the bottom for 22 months:

These sectors are already in the annual negative (-0.5% per year), for the first time in almost 2 years:

Note that this is all happening against the backdrop of declining inflation. This suggests that lowering inflation in itself is not a panacea for the crisis. Well, it confirms that the crisis is now going on structural, which smoothly flows from one sector of the economy to another.

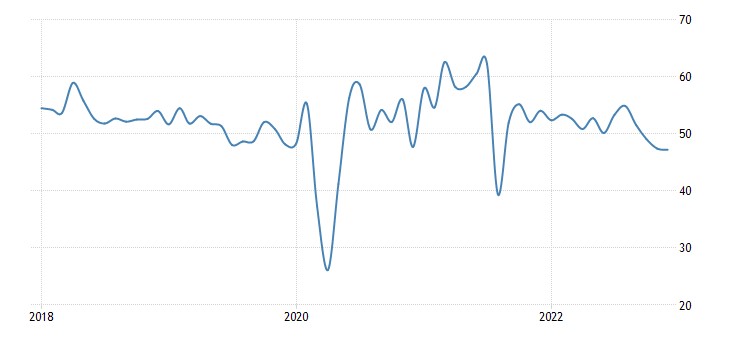

PMI (expert industry index; its value below 50 means stagnation and recession) of New Zealand is the lowest since May 2020:

Business confidence in New Zealand is at its worst in 15 years:

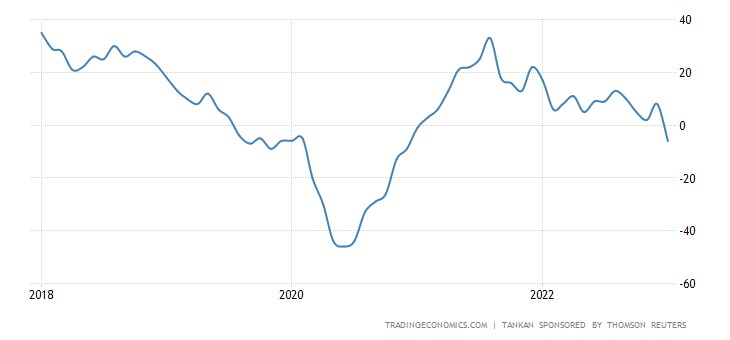

Japanese manufacturers sentiment is worst in 2 years:

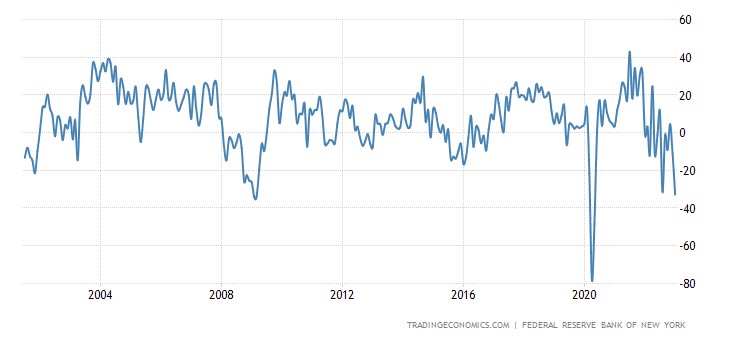

The New York Fed Index (-32.9), excluding the April-May 2020 crash, is the worst in 14 years:

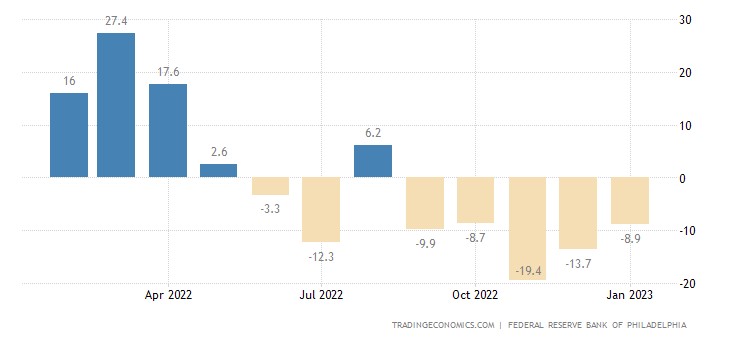

The Philadelphia Fed index is in the red for 5 months in a row:

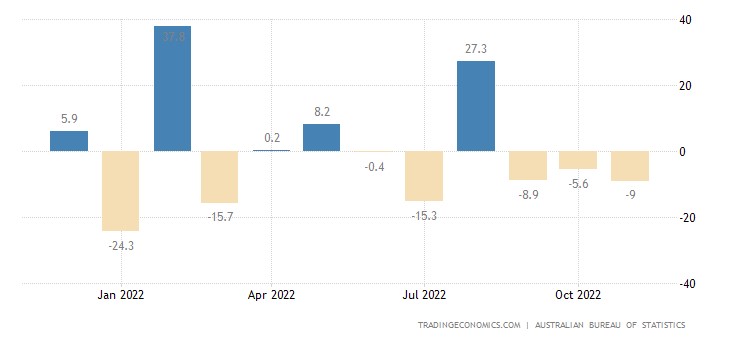

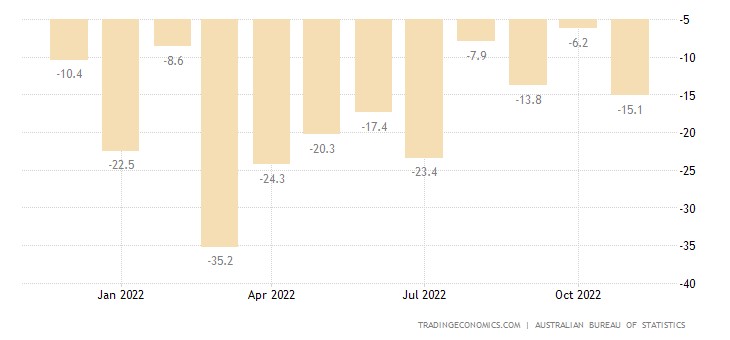

Building permits in Australia -9.0% per month – 3rd negative in a row:

And -15.1% per year – the 14th negative in a row:

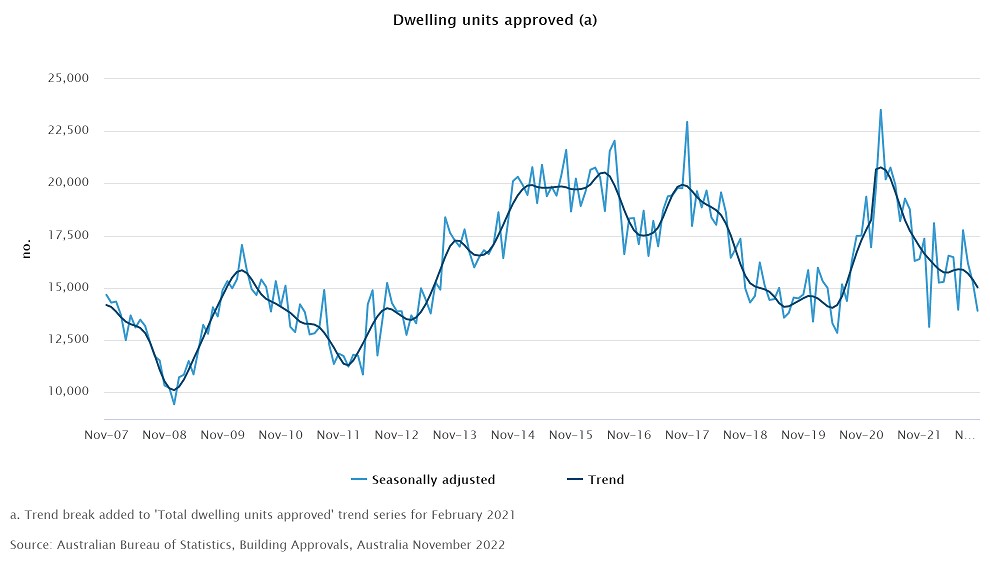

Back to 2009/12 levels:

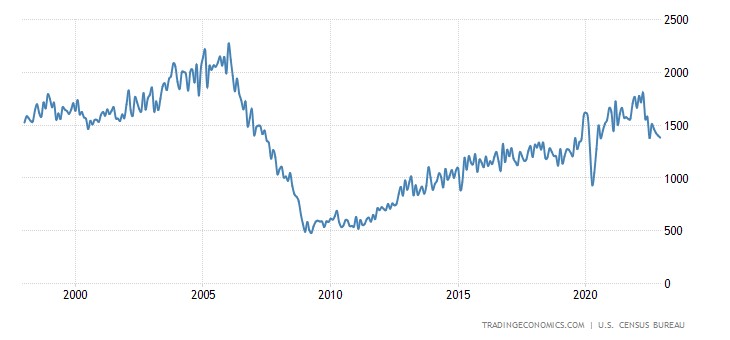

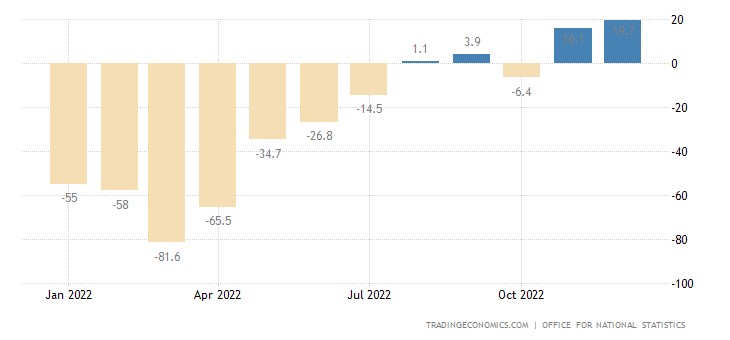

The number of new buildings in the US has been falling for 4 months in a row, in general for 2022 -3% – the 1st minus since 2009:

Building permits minimum for 2.5 years:

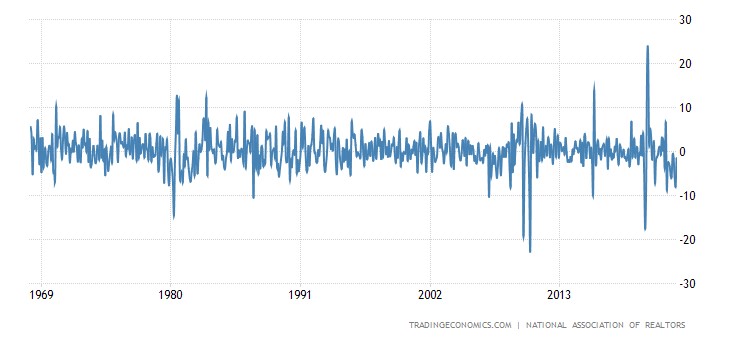

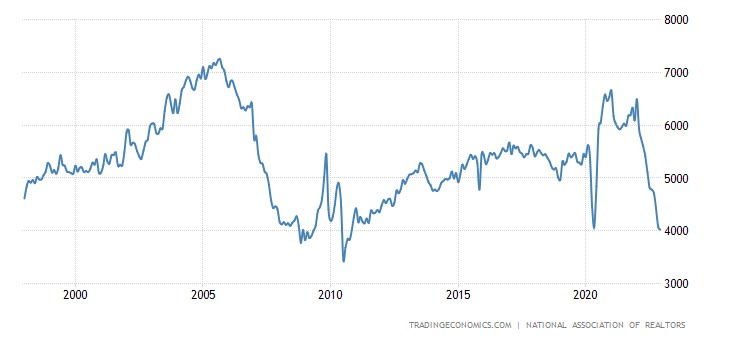

US existing home sales -1.5% m/m – 11th straight minus; The last time this happened was in 1999:

At the same time, the absolute value of sales is the weakest in 12 years:

“Net” (excluding highly volatile food and fuel components) CPI (consumer inflation index) of the eurozone is a record for 32 years of observation (+5.2% per year):

Against the backdrop of declining fuel prices, this may mean that the structural component of inflation in industry has begun to rise again.

Food inflation in New Zealand +11.3% per year – the highest since 1990:

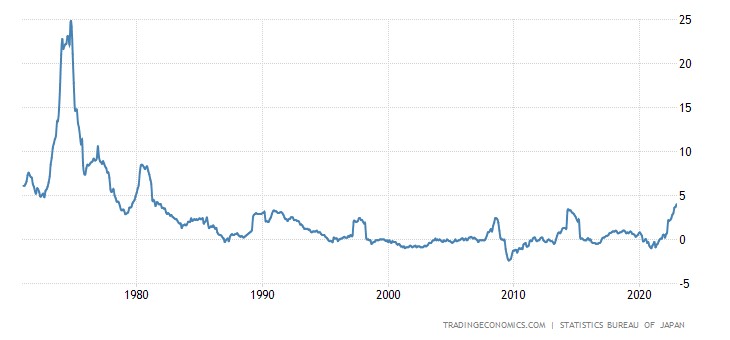

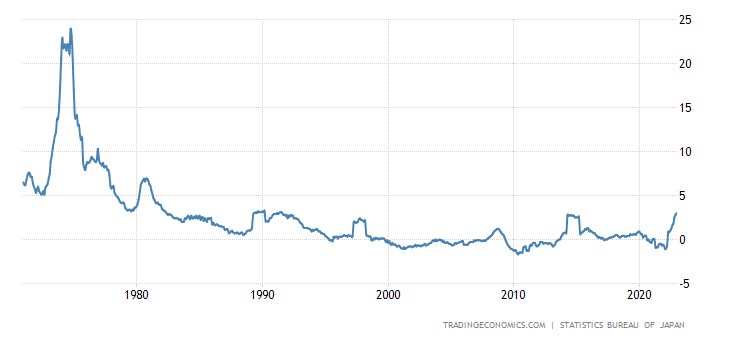

Japan CPI +4.0% pa – 32-year high:

Without fresh food, also +4.0% per year – a 41-year-old peak:

Without food and fuel +3.0% per year – the peak since 1991:

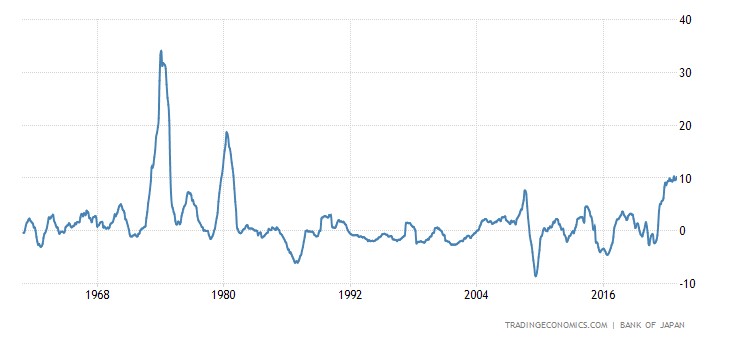

PPI (industrial inflation index) of Japan +10.2% per year – only 0.1% from the 42-year high set 3 months ago:

Wholesale prices in Germany -1.6% per month – the 3rd negative in a row and the strongest drop in 14 years:

On the one hand, this is good, inflation is receding from its peaks. On the other hand, it is a symptom of an intensifying crisis.

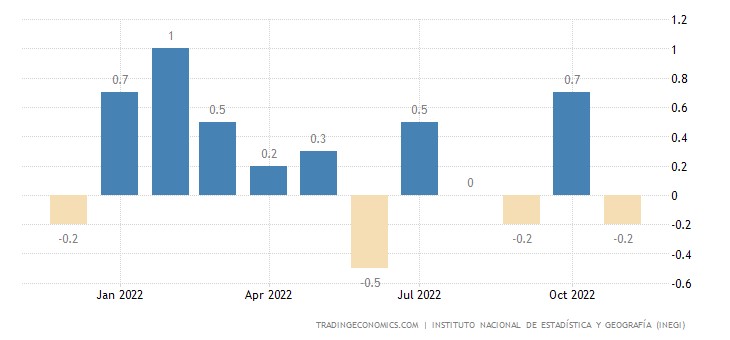

Retail sales in Mexico -0.2% per month:

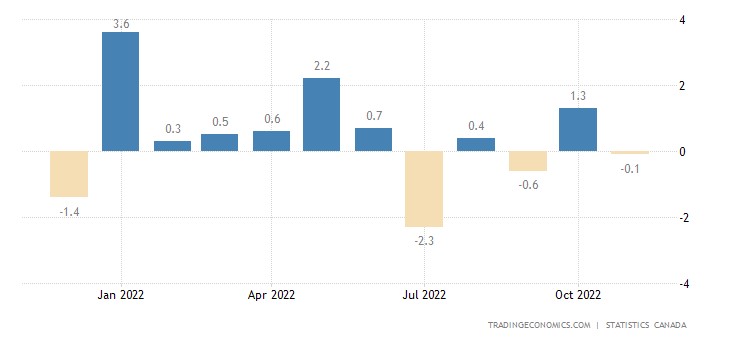

Retail Canada -0.1% per month:

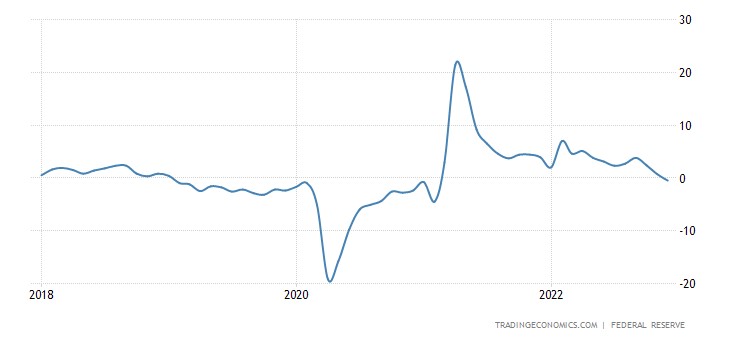

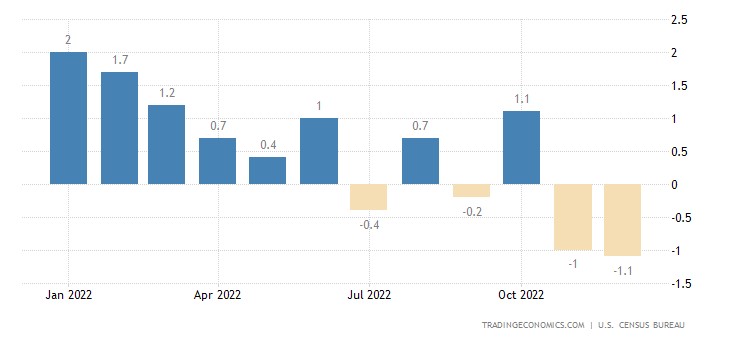

Retail in the US -1.1% per month – the 2nd negative in a row and the worst dynamics for the year:

And without cars (also -1.1% per month) for at least almost 2 years:

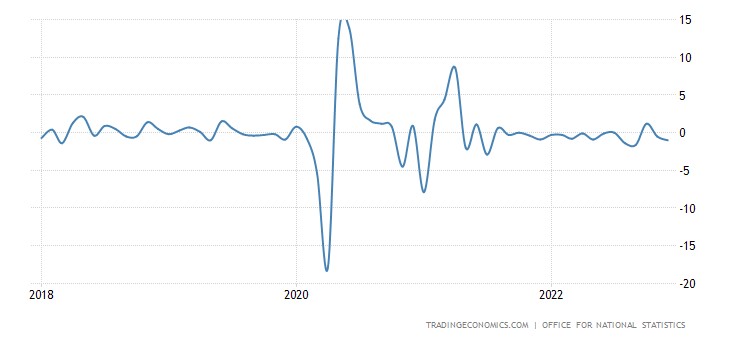

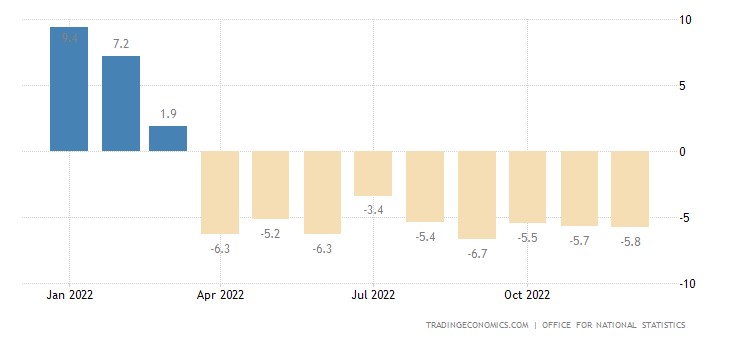

Retail in Britain -1.0% per month – in the last 16 months there was only 1 plus:

And -5.8% per year – the 9th negative in a row:

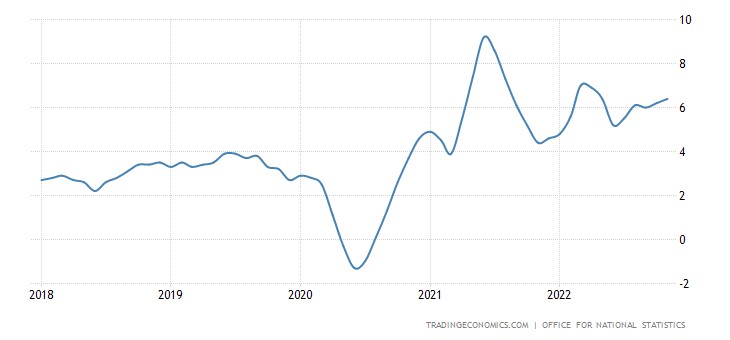

The number of unemployed in Britain is growing at an accelerating rate:

And real wages (-2.4% per year) have been falling for 13 months in a row:

The Bank of Japan left the same monetary policy, the Central Bank of Turkey also did not change anything. Like the Central Bank of China.

But the Central Bank of Indonesia raised the rate by 0.25% to 5.75%.

Main conclusions

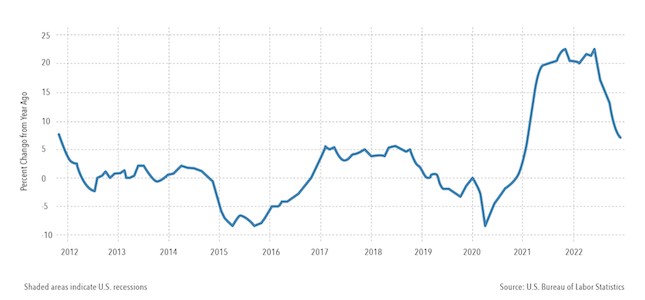

As we noted earlier unpleasant pictures in inflation, today we note a decline in industrial production and the standard of living of the population (a drop in retail sales). Despite the fact that US industrial inflation data came out this week, which turned out to be positive:

Industrial inflation for the full volume of goods (this is not the PPI index) decreased in December, which met the aspirations of the Fed management. But there can be two interpretations here. Powell & Co. expected that lower inflation would improve the economy. But, on the other hand, it is possible that the decline in inflation is a consequence of the ongoing recession in the economy, and then it is rather a negative symptom.

From our point of view, the second option clearly takes place (by the way, as can be seen from the previous section, Germany has a similar situation) and this is not at all a positive circumstance. However, you cannot put your thoughts into other people’s heads, it is unlikely that our logic will be accepted by the leadership of the Fed.

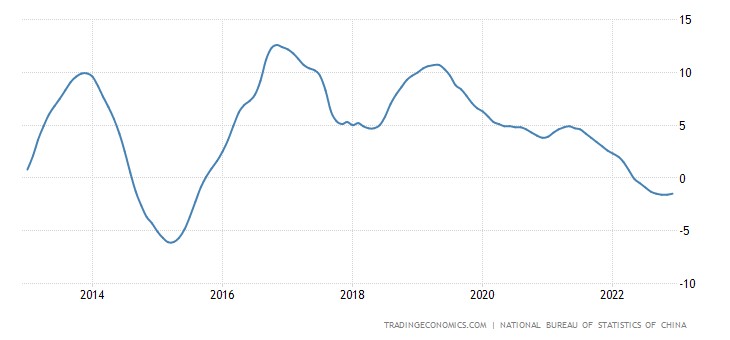

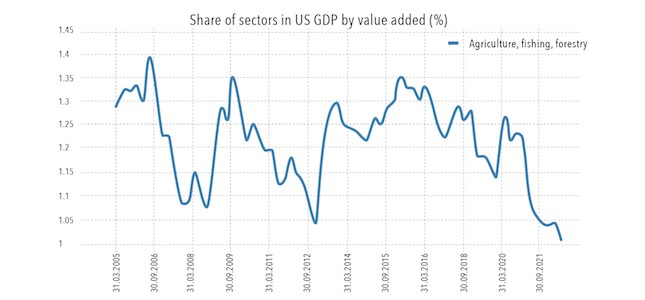

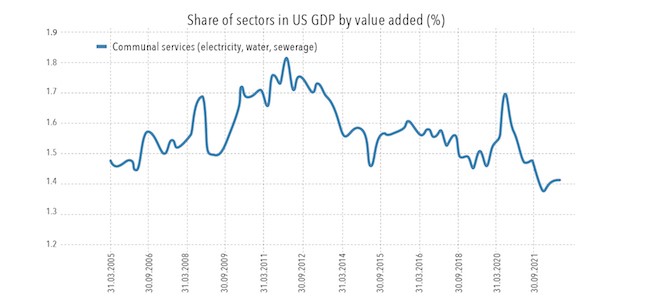

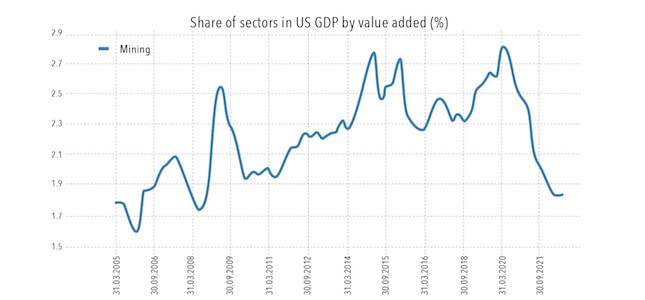

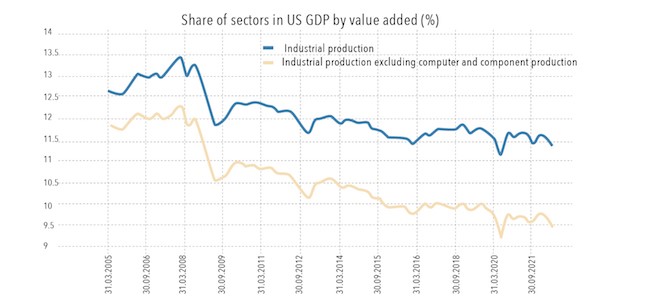

And here it makes sense to say a few words about how the structural crisis manifests itself. Let’s look at the graphs of individual sectors of the US economy in terms of their contribution to GDP, value added:

The share of the manufacturing industry in the US economy in Q3 2016 was 11.6%, remained virtually unchanged for 6 years, and by Q2 2022 the share was 11.3% compared to 13.5% before the 2008 crisis.

A more pronounced trend is in the share of industrial production, excluding the production of computers and components. In Q3 2016 this share in GDP was 10%, now it is 9.5%, before the crisis of 2008 it was 12.3% at the maximum. The trend has been steadily descending for the last 15 years.

Agriculture, fishing, forestry forms only 1% of GDP.

Mineral extraction forms 1.84% of GDP.

Utility (electricity, water supply, sewerage) has a share of 1.4% of GDP.

Thus, the “real”, manufacturing economy forms only 15.6% of the US economy, and excluding the production of computers and components – 13.8%

The accelerated decline began in Q3 2020 and continues to the current moment on the trajectory of the expansion of the digital economy. At the same time, we recall that in the middle of the 20th century, the share of industry was more than 60% in the structure of GDP.

Someone will say that there is nothing wrong with that, it’s just that the United States has built a “post-industrial” economy. The trouble is that the structure of consumption over these decades has changed much less (everyone can check it for themselves), this is clearly seen in the structure of household expenditures. The essence of the structural crisis is precisely that the stimulation of demand has led to an increase in the cost of various kinds of gadgets, which are now rapidly capitalizing without the participation of frequent demand.

The trouble is that the sales chain still ends with private (final) demand. Yes, it was approximated to the future with maximum growth rates and capitalized the digital economy today, taking into account potential future sales. But today it is already clear that demand is falling and this means that the capitalization of digital giants (and non-giants) will soon begin to decline. Layoffs at some supercompanies are an example of this. The structure of the world and the American economy gradually spontaneously returns to a more natural state, in which the structure of the economy (that is, the added value) corresponds to the structure of the final. consumption.

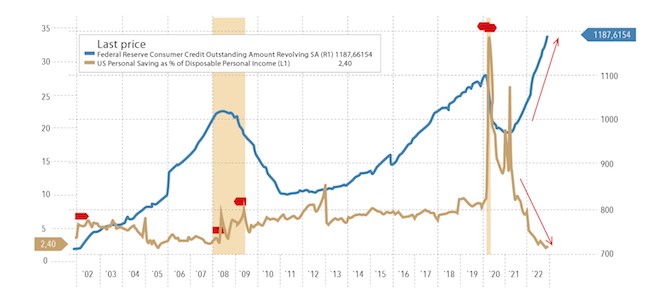

You can add to the pictures of the unbalanced structure of the economy and graphs of private debt and savings:

In general, the decline in inflation may be associated not only with the purely monetary effect of an increase in the cost of credit but also with the cumulative effect of a decrease in GDP (we have already noted that for the United States, the decline in 2022 is 6-8%) and spontaneous corrections structural imbalances. Until recently, the US monetary authorities tried to slow down these natural processes through emission mechanisms, but the suspension of emission again returned the economy to the trajectory of its normal change, that is, an increase in the relative share of the real sector due to a sharp decrease in the volume of capitalization of the digital economy.