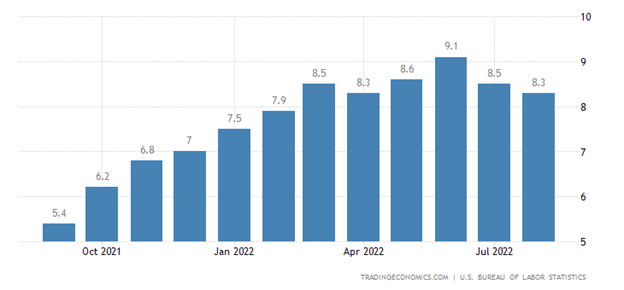

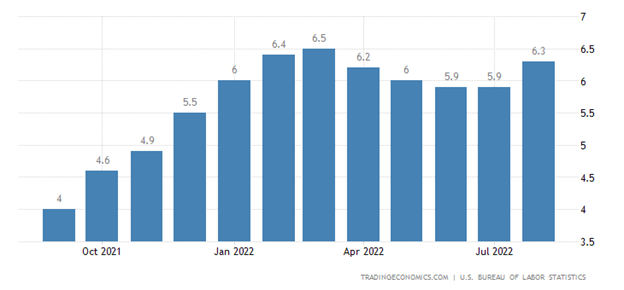

The key event of the week was inflation in the US. And what is surprising – they have improved, the data on consumer inflation (CPI index) in August (year-on-year, that is, August 22 to August 21) – 8.3%, and in July it was 8.5. “Net” (minus the highly volatile components of fuel and food) producer price index (similarly, year on year) – 7.3%, and it was in July – 7.7%. The trick is that the forecast was much better, 8.1% for consumer prices and 7.1% for industrial prices.

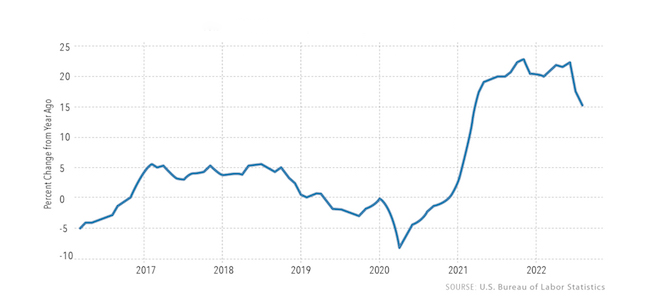

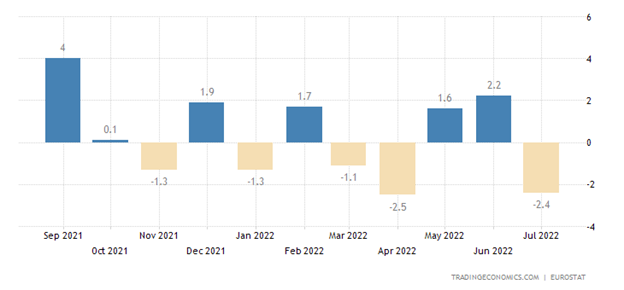

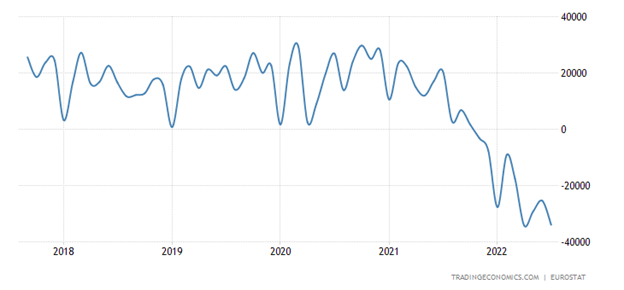

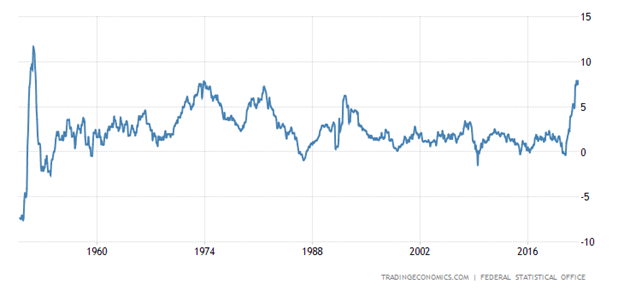

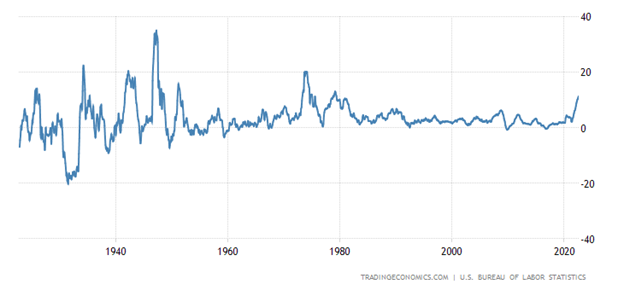

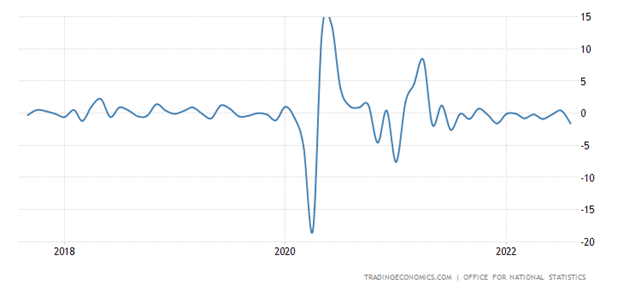

As a result, financial markets collapsed and general optimism fell. But why, after all, there is a real improvement in the situation? And there are two reasons. The first well-known – August, the month of falling business activity, prices always fall, in itself this cannot be a reason for optimism. And the fact that they fell less than expected suggests that the monetary authorities are not quite adequately controlling the situation. But the second one is more complicated. The rate was raised, monetary inflation went down. But the structural component has not gone anywhere. And the models that are used by the US monetary authorities do not see the structural component, respectively, the indicators are underestimated. And yes, inflation has indeed declined, as can be seen from the indicators of the cumulative increase in industrial prices:

Based on these indicators, it is clear that consumer inflation is underestimated, and manufacturers will not work at a loss for a whole year. Of course, the growth in prices for services may lag behind the growth in industrial prices (which reduces consumer inflation), but such a bias cannot be for a long time. Therefore, we would estimate real consumer inflation in the US at the beginning of summer at 15-16 percent, today it has dropped to somewhere around 12 percent.

This, of course, is an expert opinion. But it shows that the difference between real inflation and official figures is quite large (although it has decreased over the past month). What will happen next – we have to look, because, on the one hand, summer (inflation, we recall, August to August), and on the other hand, midterm elections are coming soon. And no one, by the way, can guarantee that cumulative industrial inflation is not underestimated…

Macroeconomics

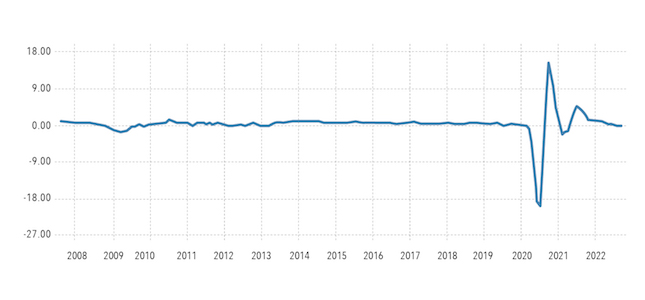

According to NIESR (the National Institute of Economic and Social Research, founded in 1938, is the oldest independent economic research institute in the UK), Britain’s GDP has not grown for 3 consecutive months (-0.1%, 0.0% and -0.2% per month):

Industrial production in Britain showed 2 monthly losses in a row:

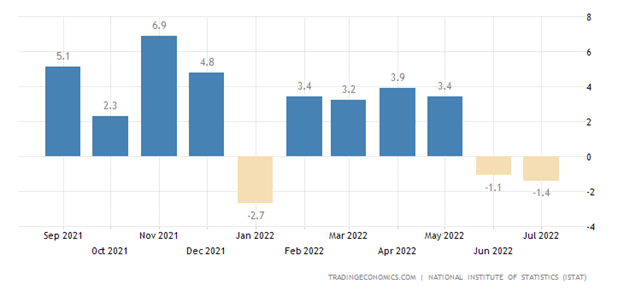

And in Italy, the same 2 minuses in a row already in the annual dynamics:

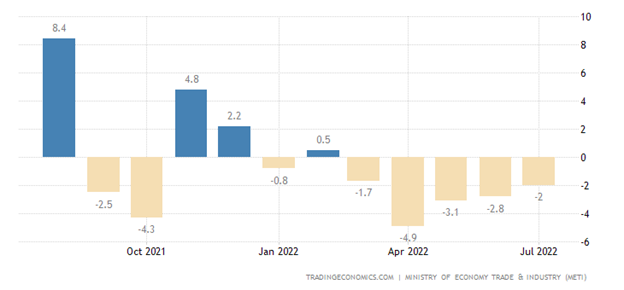

Japan has 5 consecutive annual losses:

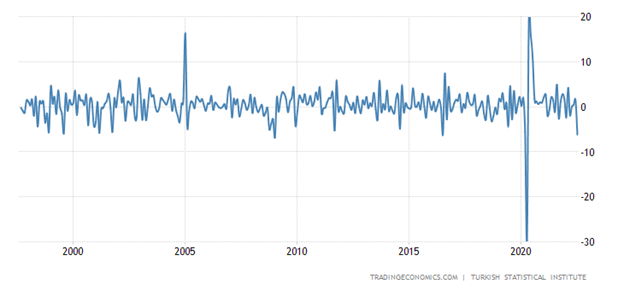

In Turkey, GDP is -6.2% per month – not counting the covid dip in April 2020, this is the bottom since January 2009:

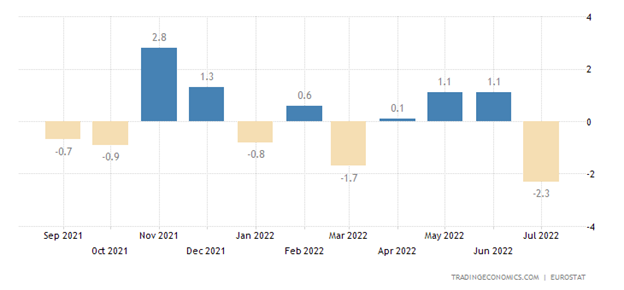

Industrial output in the Eurozone -2.3% per month – the worst dynamics for the year:

And -2.4% per year:

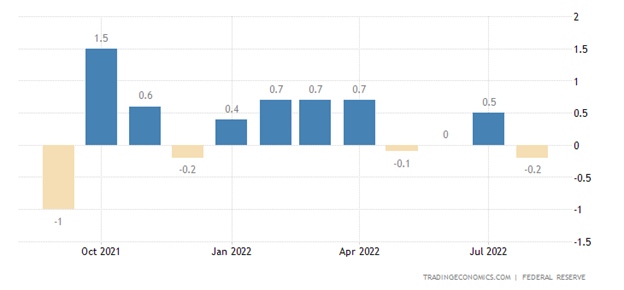

Industrial production in the US returned to a monthly minus (-0.2%) and this is against the backdrop of declining inflation:

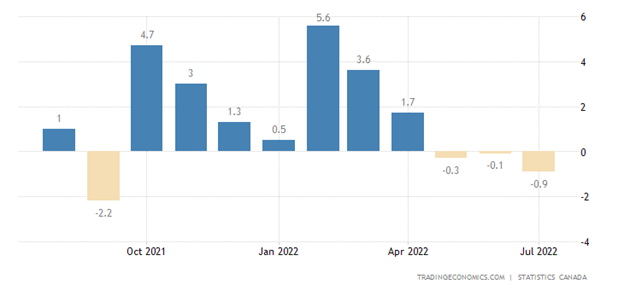

Canada Manufacturing Sales -0.9% m/m – 3rd consecutive negative:

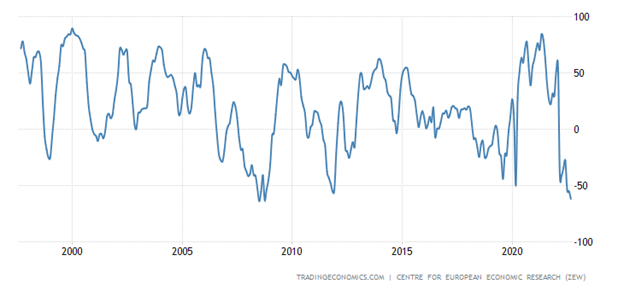

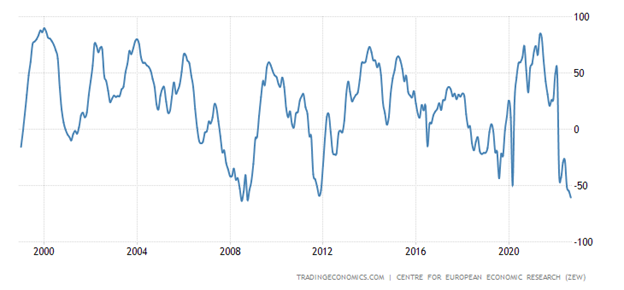

The ZEW economic sentiment index in Germany has come close to a record low of 2008:

The same is true for the eurozone as a whole:

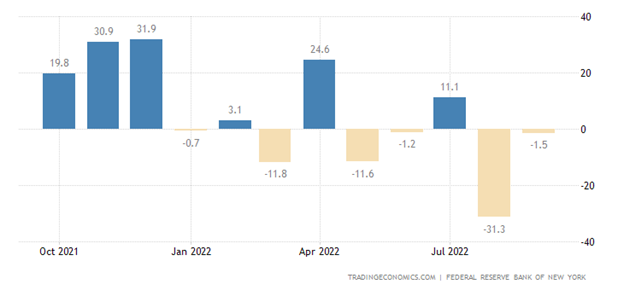

New York Fed index in the red for 2nd month in a row, 4th negative in the last 5 months:

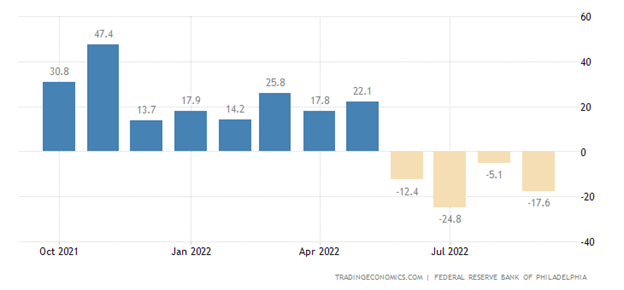

Philadelphia Fed Index 3rd minus in 4 months:

And its new orders component is down 4 months in a row:

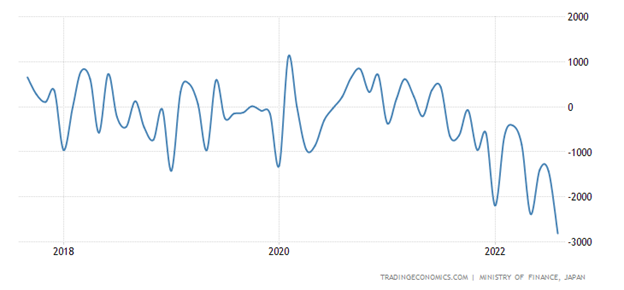

Japan’s trade deficit is record:

Only one step away from the same “achievement” of the eurozone:

New home sales in Australia -16.0% per month and already very close to record bottoms:

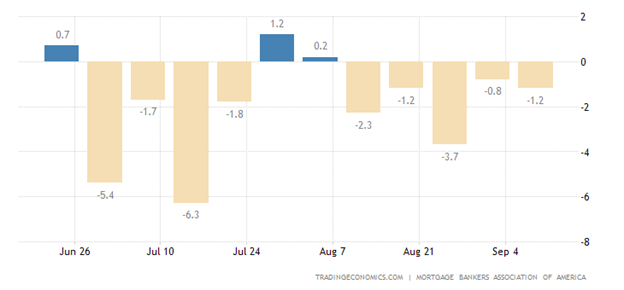

U.S. mortgage applications another -1.2% weekly – 5th negative in a row:

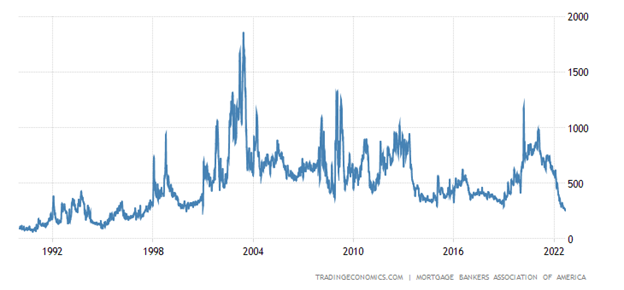

They set a new low since 1999:

Since mortgage rates have updated their peak since 2008 (6.01%):

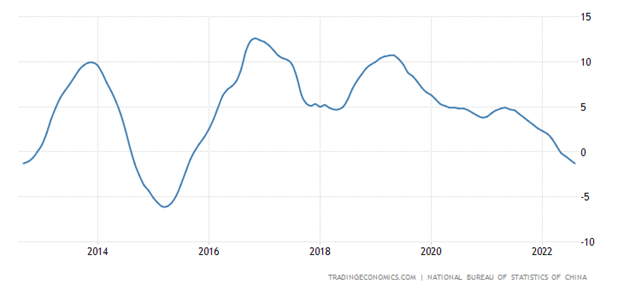

New home prices in China’s 70 largest cities -1.3% per annum: 7-year low:

German CPI +7.9% per year – 70-year high:

Italy CPI +8.4% per year – 36-year high:

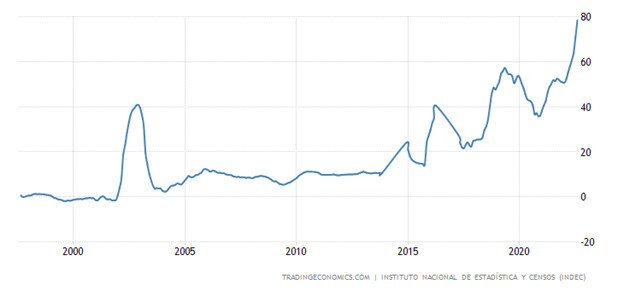

Argentina’s CPI + 78.5% per year – 31-year high:

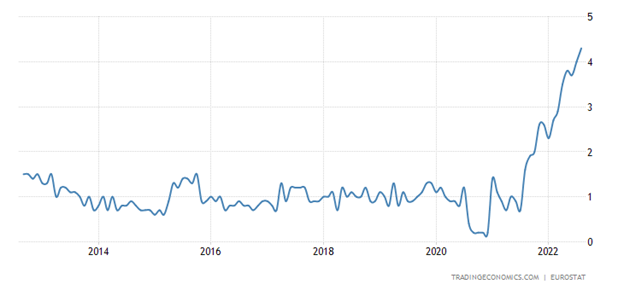

Eurozone CPI +9.1% per year – a record for 32 years of observation:

Net CPI +4.3% per year is also a record:

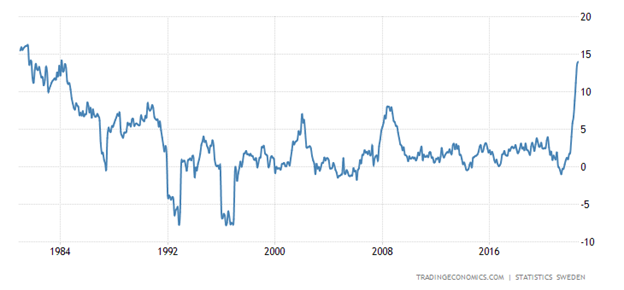

Swedish CPI +9.8% per year – the highest since 1991:

And for food – even since 1984 (+13.5% per year):

“Net” CPI of Britain +6.3% per year – a record for 25 years of observation:

The retail price index, which better reflects the real situation for consumers) was +12.3% per year – the highest since 1980:

US CPI (+8.3% y/y) slowed down weaker than expected:

And the “net” CPI even accelerated as fuel prices, subject to administrative pressure, fell:

At the same time, food has risen in price by 11.4% per year – this is the peak since 1979:

Food inflation in New Zealand +8.3% per year – maximum since 2009:

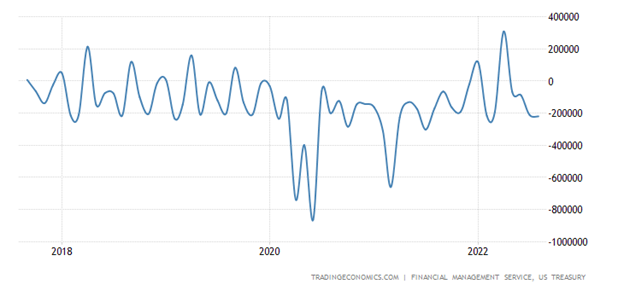

The US budget deficit grew by last year, for August it generally became a record in history:

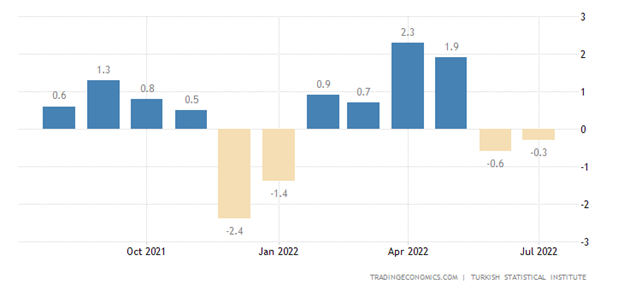

Retail sales in Turkey are falling (-0.3% per month) – 2nd negative in a row:

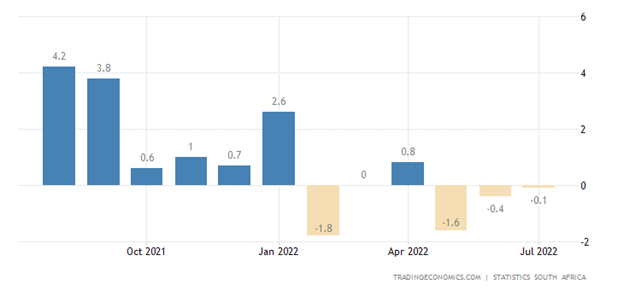

In South Africa -0.1% per month – the 3rd negative in a row:

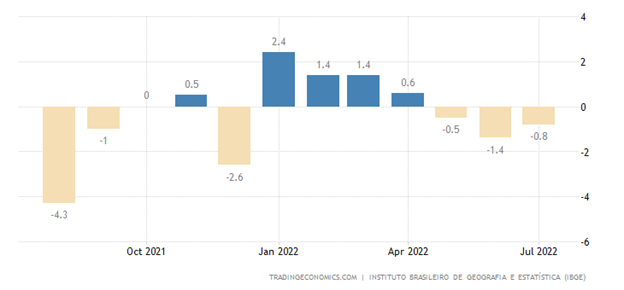

Brazil retail -0.8% per month – 3rd negative in a row:

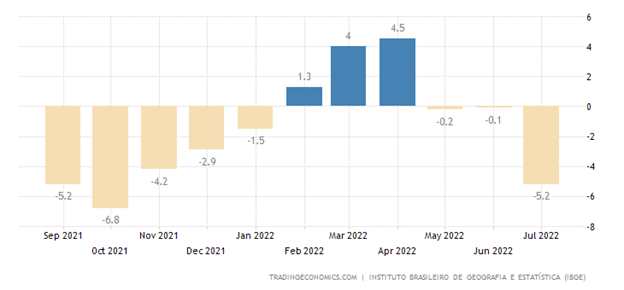

-5.2% per year – also the 3rd minus in a row:

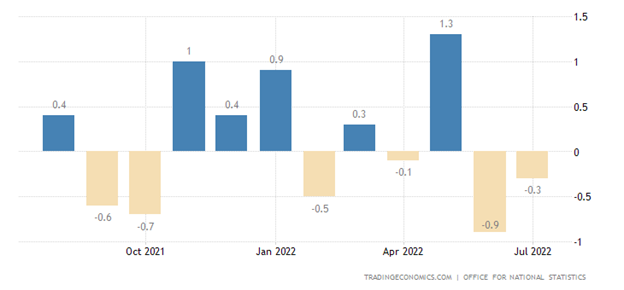

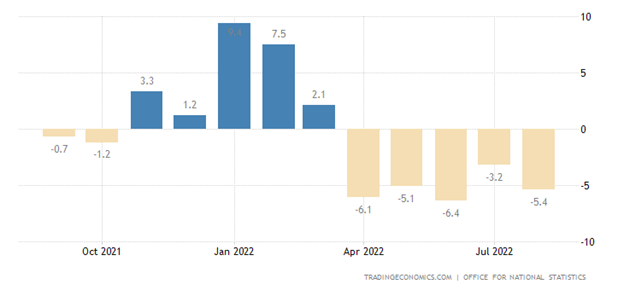

Retail in Britain -1.6% per month – 13-month minimum:

And -5.4% per year — the 5th negative in a row:

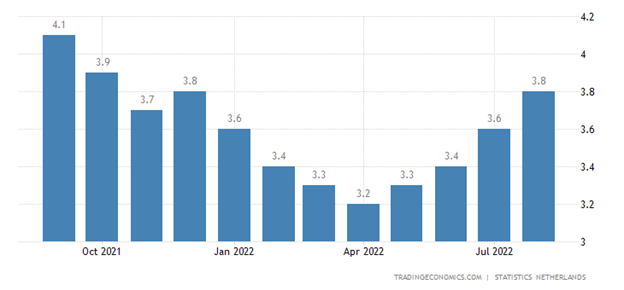

The unemployment rate in the Netherlands is the highest in 10 months:

The Bank of Russia lowered the key rate by 0.5% to 7.5%.

Main conclusions

The structural crisis continues. Moreover, it is becoming more and more difficult for official statisticians who reluctantly try to hide it from the majority of citizens. This is very clearly seen in the indicators of retail sales and GDP, which are already falling in almost all more or less large economies of the world. And this is with underestimated inflation rates.

At the same time, it is becoming more and more difficult to maintain the level of household consumption even at the level at which it is. Recall that filling the budget is possible due to emission – but then problems with inflation begin. And the sale of government securities rests on the fact that they are really unprofitable, the yield on them is much lower than even the official inflation.

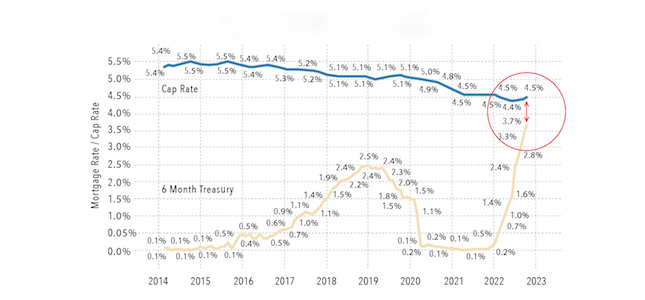

But there is another problem, which is that one of the main markets that support the US economy is facing a giant problem: real estate returns are becoming comparable to government bond returns:

The question is, who would invest in real estate in such a situation, given that the risks in these sectors cannot be compared? It is a question of the US real estate market coming to a halt. Treasury yields would go up because they are below the official inflation rate, and the demand for real estate would go down, so the products on that market would not grow. It should be closed down as a market and taken under government control. How much will that cost the budget?

This is a typical example of a structural crisis: the traditional proportions of profitability and the volume of financial flows in the different sectors are disrupted. Accordingly, the risks, i.e. the costs, rise sharply and provide price increases independent of the monetary policy of the monetary authorities. Roughly speaking, regardless of demand, if your expenses have increased by 15-20%, you cannot reduce prices; you have to raise them ...

There are similar processes in the EU economy, where monetary policy tightening lags behind the US. Inflation is understated, too, with all the inevitable problems. Moreover, as we mentioned in our previous review, if you compare the data from the past few weeks, you will see a very similar overall picture, only the countries with the highest inflation or GDP decline change. Once again, this is a typical structural crisis.

There is no way to stop it. Unless accompanied by emissions, a rate increase will reduce the monetary component of inflation but increase the structural element. If emissions accompany a rate hike, inflation may not fall at all. Without emission, there will inevitably be an accelerated decline in living standards, which will cause socio-political problems... So, politicians in the developed world have to deal with challenging issues in the face of limited information from liberal experts.