And again, formal political news – the G20 summit in Bali. But from the point of view of macroeconomics, it is fundamental that in the summit's final communiqué, there was practically nothing about the economy. It is hardly a serious passage: "We will continue to ensure a level playing field and fair competition to help create a favourable trading and investment environment for all."

However, the following paragraph is even stranger: "The G20 countries reaffirm that a non-discriminatory, rules-based, free, fair, open, inclusive, equitable, sustainable and transparent multilateral trading system, embodied in the WTO, is necessary to achieve the common goals of inclusive growth.", innovation, job creation and sustainable development in an open and connected world". Taking into account the "sanctions war", attempts to limit prices for a number of goods (we can recall, for example, US pressure on OPEC + and a proposal to limit prices for Russian exports) and other "innovations", we can only talk about the WTO in the past tense.

The "G20 group", created to solve the global economic problems in 2008-2009 after the "G7 group" admitted its helplessness, itself fell into the same helplessness. Instead of discussing the economy, she began to engage in politics, one that destroys the structure of the same Bretton Woods system that the G20 will defend, represented by at least one of the institutions of this system, the WTO). Well, we will not even comment on the fact that such a result of the summit speaks about the possibilities of the monetary authorities of these same countries to fight the crisis.

Moreover, even in the UK, it was noted that this summit significantly weakened the US's ability to impose its will on other countries. Accordingly, there will be big problems with attempts to curb the crisis, even if the US monetary authorities have ideas on this score.

Macroeconomics

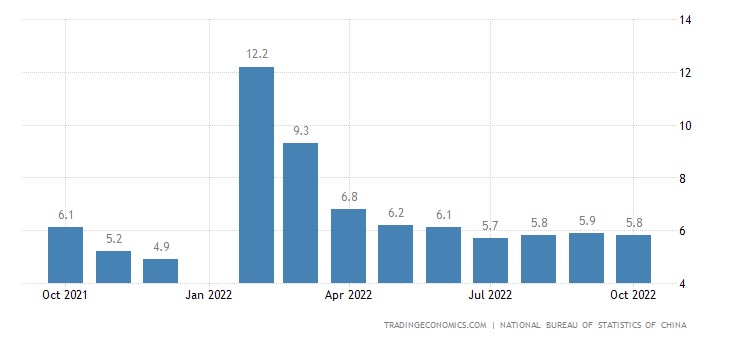

Chinese data for October disappointed. Fixed asset investment slowed down:

Like industrial production:

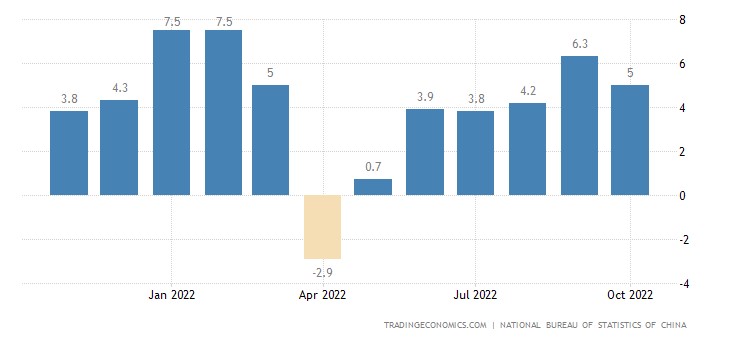

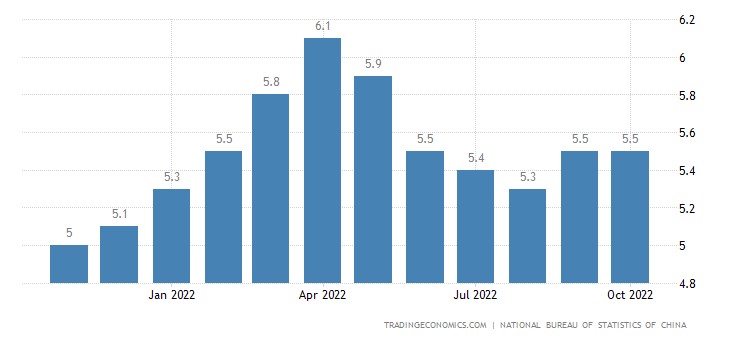

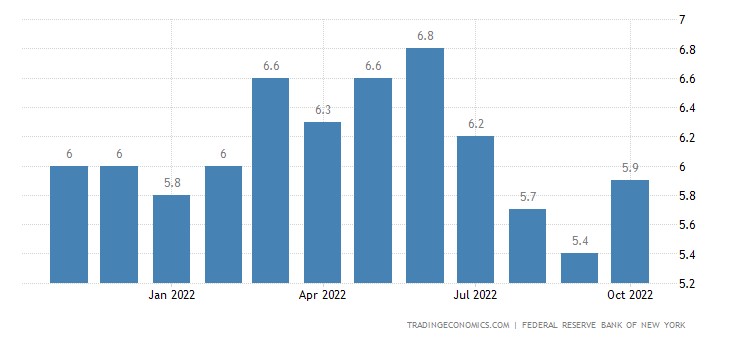

Unemployment rate at 5-month high:

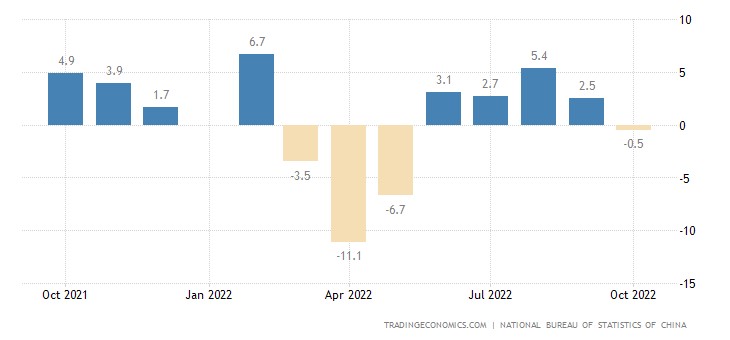

And the volume of retail sales has completely gone into the annual minus:

There is nothing surprising in this (the US and China are two sides of the same coin and are falling together), but the Chinese situation only confirms the general one.

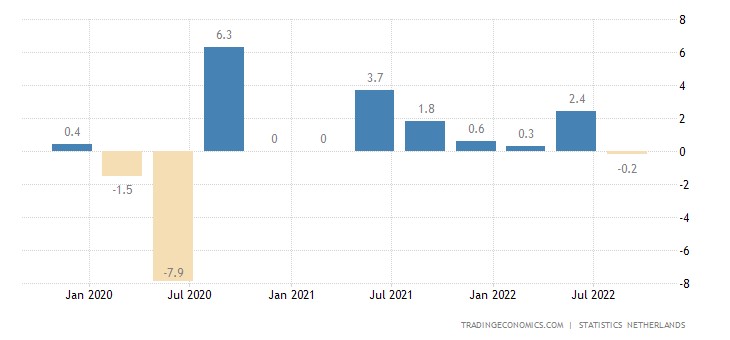

Dutch GDP -0.2% QoQ – 1st decline after 2 years of growth

However, taking into account the underestimated inflation, there may have been no growth for several months.

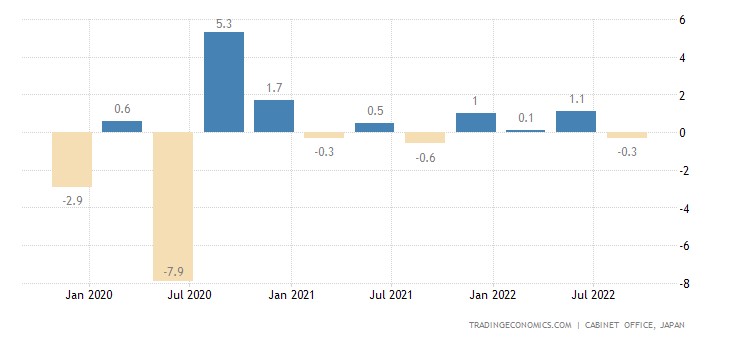

Japan’s GDP -0.3% qoq amid falling external demand:

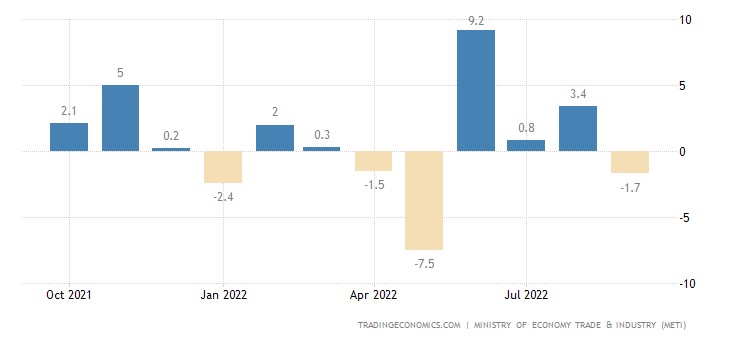

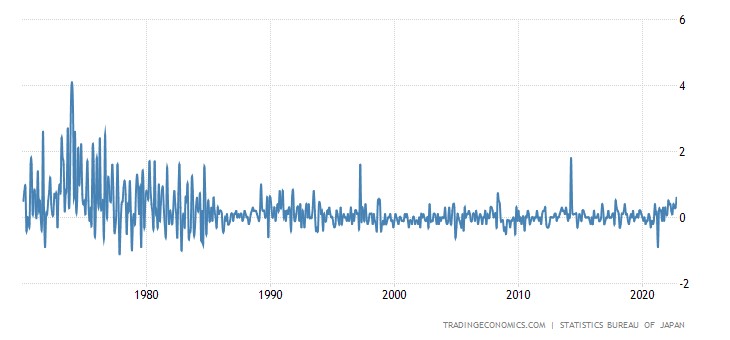

Industrial production in Japan -1.7% per month:

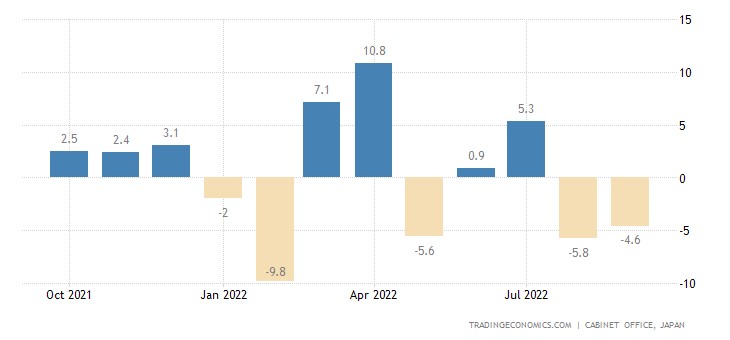

And its machine-building orders (-4.6% per month) have been falling for 2 months in a row:

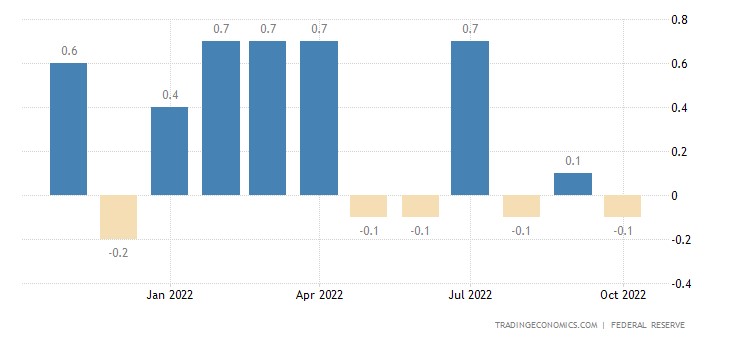

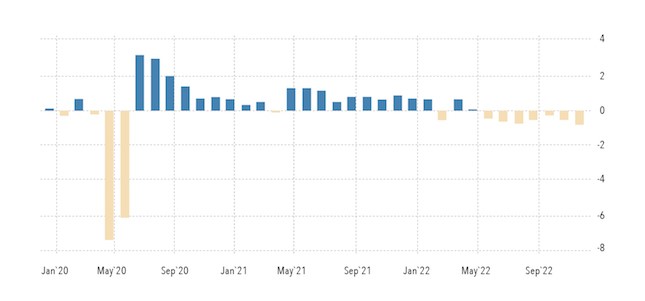

In the US, industrial output is clearly slowing down – over the past six months, 4 minuses and only 2 pluses:

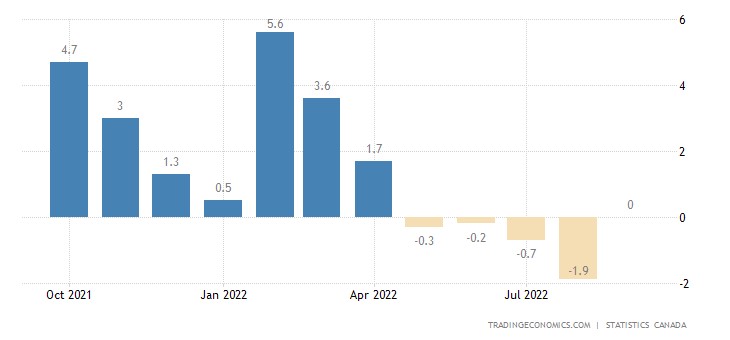

Canadian Manufacturing Sales 0.0% per month – no upside in last 5 months:

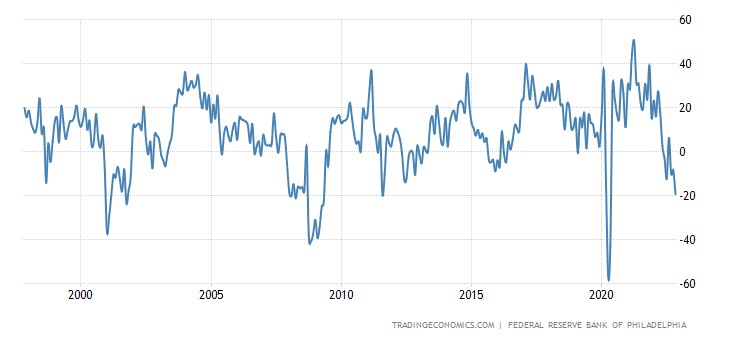

The Philadelphia Fed Index is the worst in 2.5 years, and excluding the covid dip, since 2009:

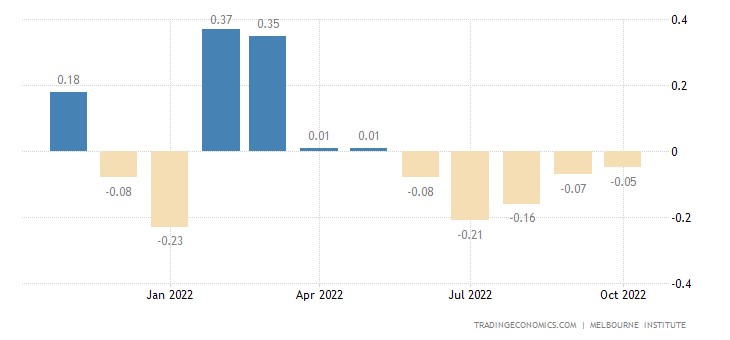

Leading indicators in Australia decline for 5 consecutive months:

And in the USA – 7 months in a row:

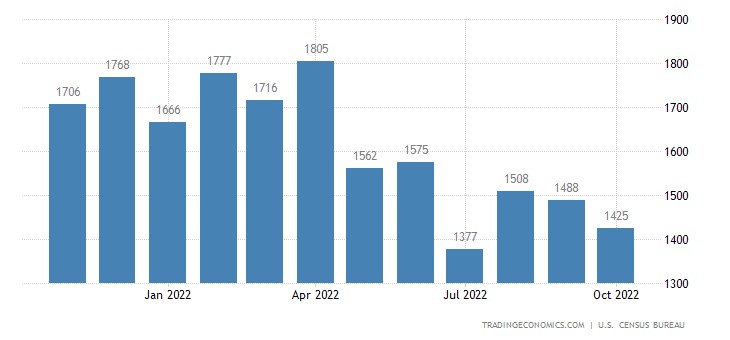

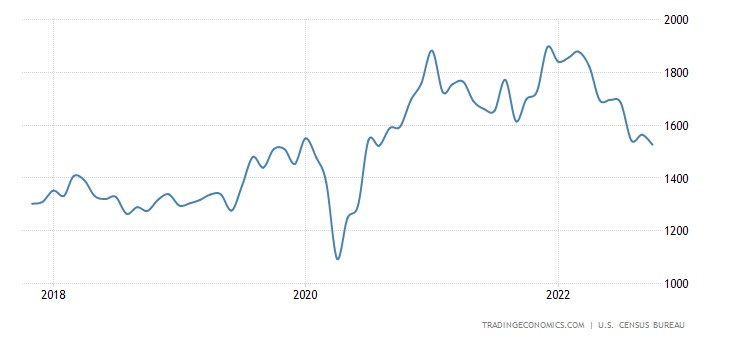

The number of new buildings in the US -4.2% per month and -8.8% per year:

Building permits -2.4% per month and -10.1% per year up to 26-month bottom:

Existing home sales another -5.9% per month – excluding the covid dip, this is an 11-year low:

The housing market index in the US is near covid bottoms, before such numbers were only 10 years ago:

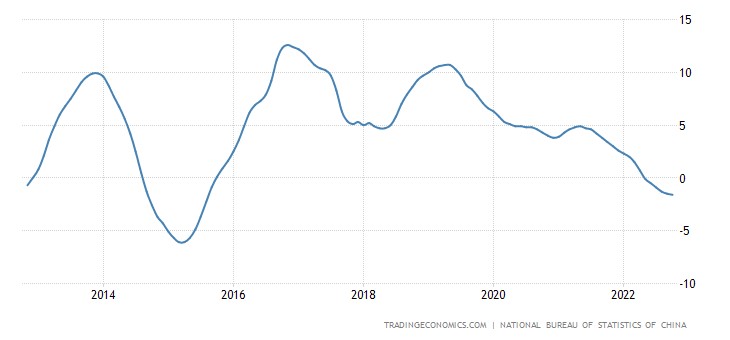

Housing prices in China -1.6% per year – the worst dynamics since August 2015:

Inflation expectations in the US have risen again, with a record monthly jump in gasoline:

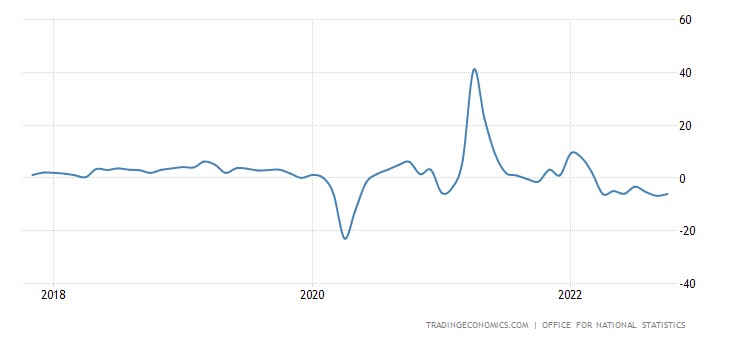

CPI (Consumer Inflation Index) Britain +11.1% per year – a record high:

The “net” (excluding highly volatile components of food and fuel) CPI also has a record (+6.5% per year):

The retail price index (which is more adequate than the CPI) is growing at the fastest pace since 1980 (+14.2% per year):

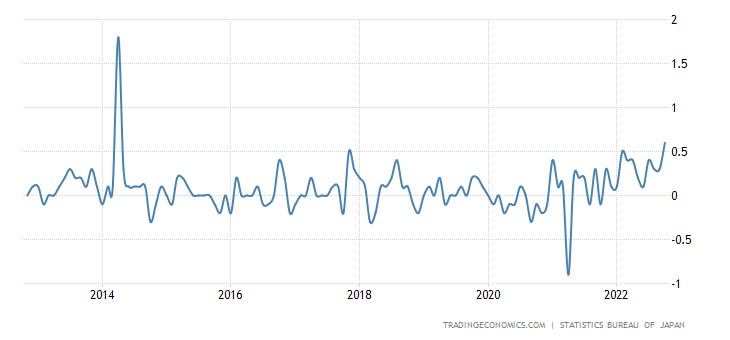

Japan CPI +0.6% per month – maximum since April 2014:

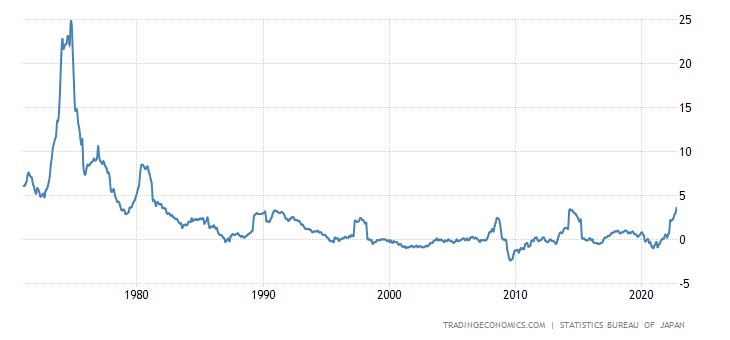

And +3.7% per year – the peak since January 1991:

Without fresh food + 3.6% per year – the highest since February 1982:

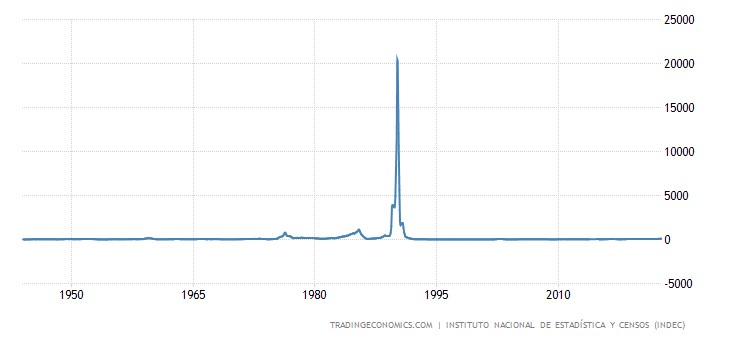

CPI Argentina +88% per year – peak since 1991:

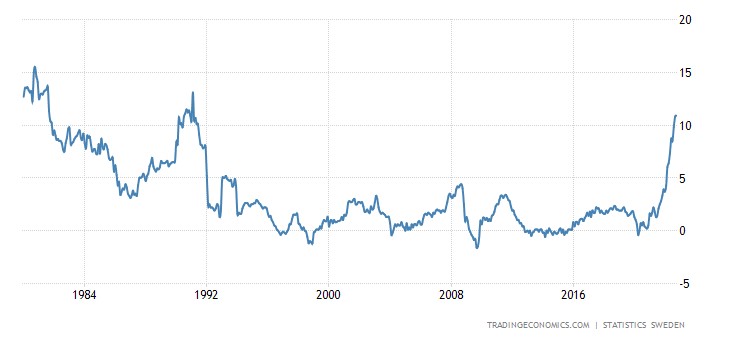

Swedish CPI +10.9% per year – also the highest since 1991:

French CPI +6.2% per year – the highest since 1985:

CPI of Italy +11.8% per year – and here is the maximum since 1985:

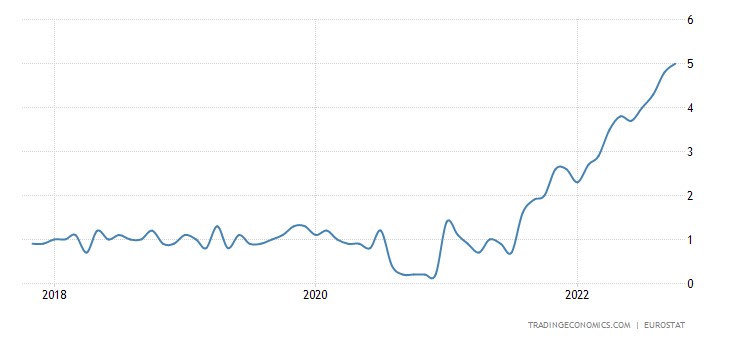

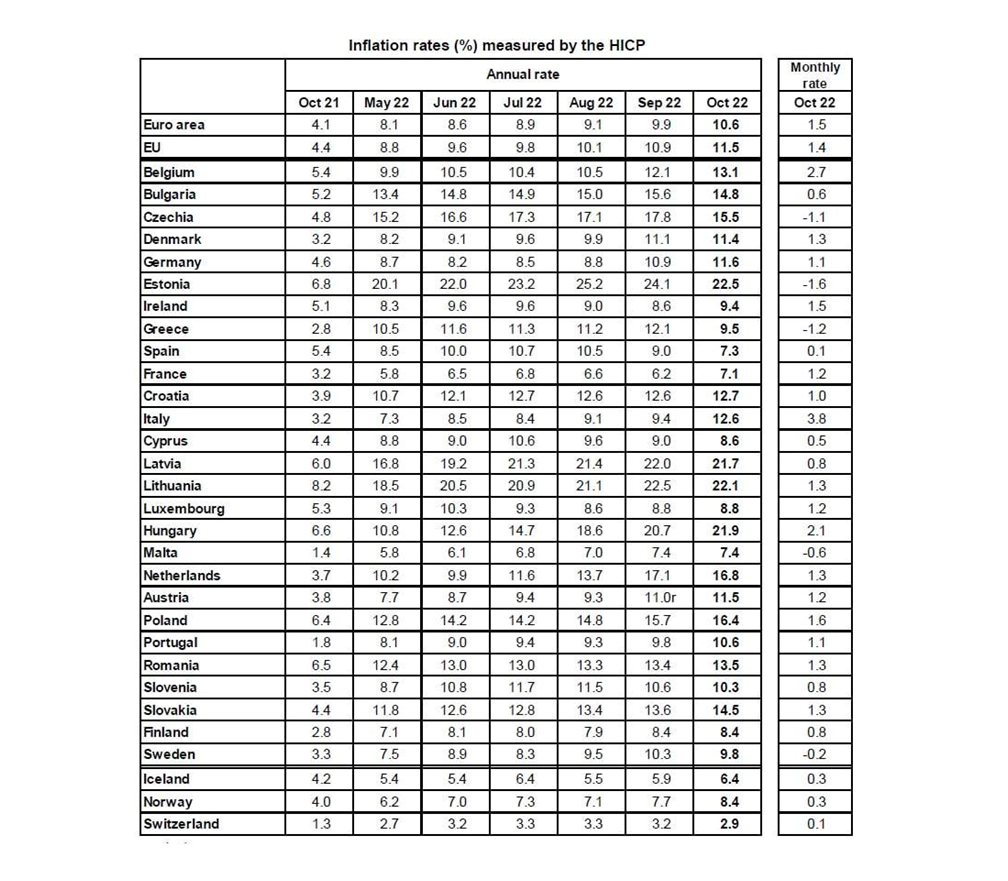

Eurozone CPI +10.6% per year – a record for 32 years of observation:

Record and “net” inflation (+5.0% per year):

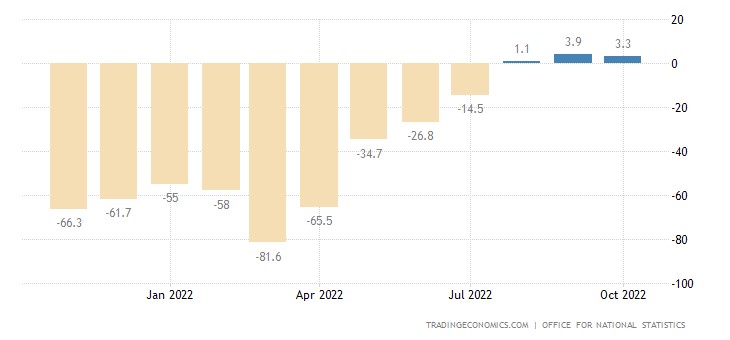

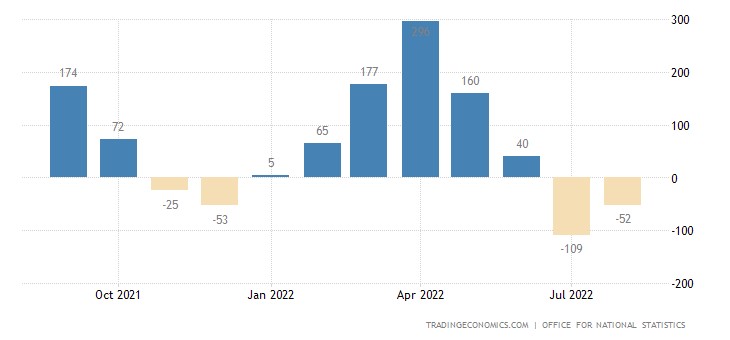

British retail (-6.1% per year) keeps in the red for 7 months in a row:

The number of registered unemployed in Britain is growing for 3 months in a row:

And employment has been declining for 2 months in a row:

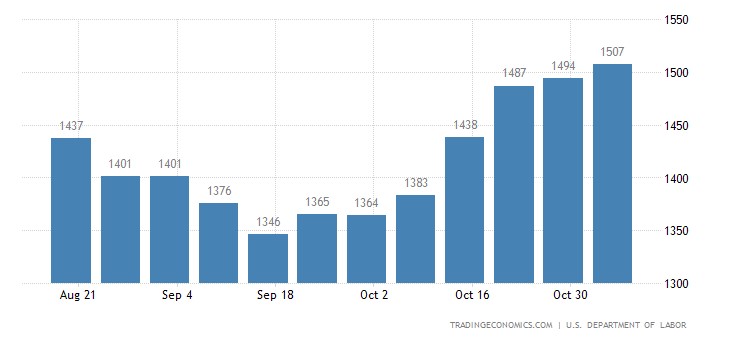

US Unemployment Claims Maximum 8 Months:

The Central Bank of Indonesia raised the rate by 0.50% to 4.75%.

Main conclusions

The number of record inflation rates (which were repeated every week in the summer but have declined somewhat in recent months) pictures that a new wave of structural crisis is beginning. The growth of structural inflation, which should have occurred in connection with the growth of the discount rate in many countries of the world, has already started.

Nevertheless, the leadership of the US and EU monetary authorities, which do not recognize the structural causes of the crisis, has confirmed its course towards tightening monetary policy. Thus, the head of the Reserve Bank of St. Louis, James Bullard, said in his press conference:

"The Fed's rate hike to date has had only a limited impact on observed inflation.

Quotes policy rules suggest rates between 5% and 7%.

Rates need to be raised further to curb inflation.

Even dovish assumptions about the state of monetary policy justify further rate hikes.

If inflation falls, the range of estimates for restrictive policies could be reduced as markets look to lower inflation in 2023.

The policy is not yet considered restrictive enough to bring down inflation."

In other words, it is clearly stated that the Fed will raise the rate, and there is a firm belief that this will give the desired result – a decrease in inflation. In reality, as we see, the effect can be the opposite; ignorance of the theory often leads to such grave errors.

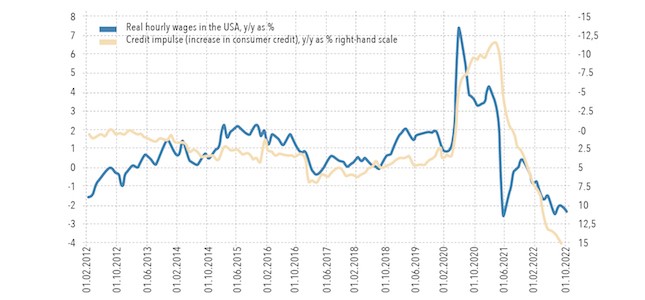

At the same time, not only inflation shows severe systemic problems in the United States. For example, if you look at real wages in the US and the growth in consumer lending, you can see that they have been in a state of correlation since 2014 (the correct scale on the chart is reversed). In other words, the population compensates for the decrease in real wages through the growth of credit debt. We have already paid attention to this point regarding card credit, but since this topic is essential, it makes sense to repeat it in a broader aspect.

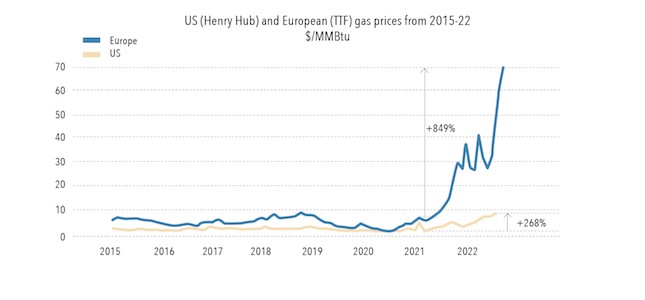

At the same time, the US is quite shamelessly robbing the European Union. Just look at the cost of gas:

As a result, the economic situation in the EU is deteriorating faster than in the US, you can simply add the current inflation figures for individual countries in the region:

In general, it can be stated that the cycle of raising rates did not give any systemic improvement, and therefore the only question that can be asked in this situation is when the monetary authorities of the main developed countries (primarily the United States) will begin to change something in their policies. So far, as we can see, they have no such plans. Moreover, there is not even a desire and / or opportunity to explain to people what is really happening in the world economy.