All players of the global energy sector are increasingly finding themselves in a risk zone. The current extent of the turbulence plaguing mankind has not been seen in a long time. Europe appears to have been hit the hardest, as energy supplies from its key exporter, Russia, have dwindled.

Who benefits?

This state of play offers certain advantages to the United States, the world's largest balancing supplier of both oil and gas. This is where the United States is winning, turbulence or no turbulence.

Things seem to be far more complicated with another major geopolitical actor, China. On the one hand, China can now buy Russian energy at a discount. However, China's economy has not been showing the rate of growth it was expected to and is currently in a state of uncertainty precipitated in no small measure by COVID-related restrictions. In that sense, growing energy prices around the world are not boding that well for China.

The recent explosions further amplified the ongoing turbulence on the Nord Stream 1 and Nord Stream 2 gas pipelines. Europe will be hit particularly hard by this incident because the Nord Stream 1 pipeline had continued to be a reliable source of energy (particularly during the winter), despite the sanctions that had been slapped on Russia. And here, again, the United States appears to have the upper hand as Europe is now left with virtually no other choice but to buy LNG from the US.

Exporters tend to be most attracted not to the most populous countries (whose populations may turn out to be too poor and, therefore, unable to buy energy) but to regions with high and stable effective demand for their products. In that sense, Europe, with its higher standards of living, seems to offer the most promise. This explains why exporters of energy resources are gravitating toward the European market in the hope of replacing Russia's declining share.

Coal as the ultimate dominant factor

The share of coal in the global energy balance is currently growing at the fastest rate, replacing other energy resources that are either in short supply or being depleted (both globally and regionally). Europe, for one, upped its coal consumption during the pandemic and its immediate aftermath. While it may appear challenging to revive those coal-producing capacities that had earlier been phased out as part of the EU's "green" agenda, technology-wise it is not all that difficult. After all, Europe has plenty of its own coal deposits.

Energy security considerations will also play an important role here since most of the coal is produced locally versus being imported from abroad. It may be "dirtier," it may not be as efficient as other energy sources, but it is Europe's own. And even when it comes to importing coal, buying coal would still be easier to arrange than purchasing oil or gas.

Even Germany, widely recognised as Europe's economic powerhouse, has been using coal extensively and successfully in recent years to sign that coal is truly a game changer when it comes to rebalancing the structure of the energy mix. This could be a good alternative for Europe, which will be struggling to get through a rough patch of turbulence over the next couple of years and should give the Europeans sufficient time to adapt their national energy systems to the changed reality where one type of fuel gets increasingly substituted by another.

A challenge for Russia

All of this is presenting a very serious challenge for Russia. The way things are going now, Russia needs to pivot from its traditional markets in the West, where it has been quite successful and controlled a large share of the market, approaching 40 per cent in the case of natural gas, to new and often largely unexplored markets in the East. It would be unrealistic to expect Russia to be able to shift huge volumes of product eastward overnight as this would require a lot of investment and time to build new infrastructure. On top of that, Russia's gas will likely face fierce competition from LNG supplied by such rivals as Australia and Qatar.

Additionally, Russia now has a unique opportunity to expand not only into the markets of Northeast Asia but also reach as far out as South Asia, including India. These regions are where "cleaner" gas will gradually squeeze coal as environmental considerations are increasingly relevant both for India and China.

However, another problem is presenting itself in the case of China. Right before our eyes, a market monopsony is emerging, with a single major consumer in a position to dictate prices. In fact, Beijing has been trying to impose its terms on Russia for a long time, but until recently, Russia had had the alternative of selling energy to Europe to find just the right balance between its Western and Asian target markets. However, of late, Russia's dependence on the Chinese market has increased dramatically.

Having said that, the way things are going to unfold going forward will once again depend on the global economic situation as a whole. If China proves to be able to cope with the aftereffects of the COVID-19 pandemic and shows an annual economic growth rate of at least 5 per cent, surplus gas volumes will continue to be in demand in the future.

Incidentally, China had been previously firmly opposed to building a gas pipeline running from Russia through Mongolia, but now there is information that this option is still on the table.

This was confirmed recently when Mongolia's prime minister Luvsannamsrain Oyun-Erdene, speaking at the Eastern Economic Forum in Vladivostok, Russia, announced that all preliminary feasibility studies for the project had been completed and the work on the gas pipeline is expected to be completed by 2029. As a side note, it should be mentioned that shipping energy resources via transit countries is fraught with additional risks and costs.

As for India, it would, in any case, be more secure for Russia to supply its gas there as LNG. Russian authorities had previously floated the idea of building a gas pipeline from Russia to India, but there are plenty of arguments against converting that idea into a reality. The pipeline will be excessively long and have to be routed through transit areas that have not been known as the most stable regions politically. Finally, it will have to cross mountainous terrain along the pipeline's proposed route. It would therefore be preferable to ship liquefied gas by sea, but doing so will require Russia first to build up its own LNG competencies and develop the right technologies.

A matter of technology

The issue of Russia's technological sovereignty can be viewed from several different angles. On the one hand, it cannot be said that Russia is critically dependent on other countries' technologies.

Russia has its own oil production technologies. That said, there are areas, such as natural gas liquefaction, deep-water drilling, or the development of hard-to-recover reserves, where Russia does not yet have the competencies that other major oil and gas producers and service companies do have. Their departure from the Russian market represents a major challenge.

There is also a problem with the lack of digital technologies, including those used for geological exploration. But Russia has stepped up its efforts to cover this gap and appears to be on track to catching up in just a few years' time. However, those few years could prove to be highly challenging.

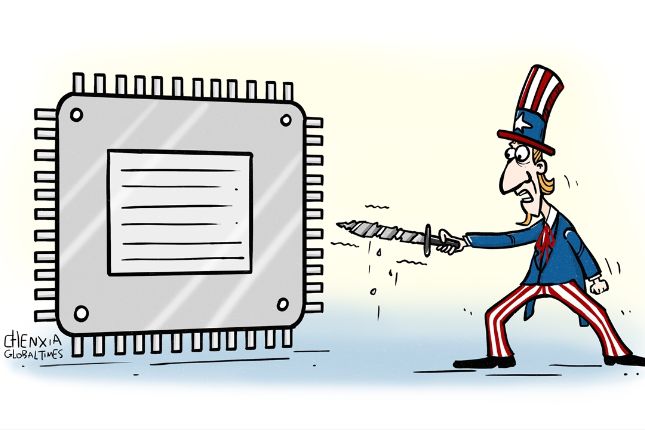

Granted, Russia would still be able to buy the technologies it needs by circumventing the sanctions against it. But at what cost? After all, the longer the path to access technology, the more expensive it becomes. This is what the anti-Russian sanctions are seeking to achieve in the end. The whole point of the sanctions is to hamper Russia's access to technologies as much as possible to cripple the nation's energy sector, the key sector of its economy.

But any economy is akin to a living organism and always finds ways to thrive. It is simply impossible to shut off a country as large as Russia. The challenges Russia faces appear to be quite surmountable over a period of about ten years, nor can it be ruled out that some new cutting-edge technologies would not be developed in the meantime.

There is another side to this. Back in the days of the USSR, Russian researchers did a lot of R&D, but with oil prices climbing as high as they did, it had since become easier for Russia just to buy new technologies abroad instead. As a result, the nation's investments in developing home-grown technologies have stopped.

These days, however, there is a growing demand for domestic research, with many Russian companies stepping up innovation at their R&D facilities and newly created innovation centres. And this is very likely to help Russia's oil and gas industry achieve its coveted technological sovereignty.