According to Bloomberg estimates, the March 11 bankruptcy of the Silicon Valley Bank (SVB) was the largest since the global economic crisis of 2008, which was marked by the collapse of several pillars of the American financial system. At the same time, SVB was not alone in its misfortune − Signature Bank and Silvergate Capital went bankrupt simultaneously. Does this mean the beginning of a full-blown recession in the US, or are we dealing with just isolated cases? Let's try to figure it out.

The first one to go

Until the end of last week, the United States seemed to be a kind of bastion of relative economic stability − in contrast to Europe, which has been plunging into the abyss of an economic crisis for about a year now. In the EU countries, GDP dynamics has steadily slowed down throughout 2022. The GDP increased by 0.8% in the first quarter, 0.7% in the second quarter, and 0.3% in the third quarter, and growth stopped in the fourth quarter.

Against this background, the United States looked quite good - the country's economy in October-December 2022 grew by 2.9% (in terms of annual rates), which turned out to be even slightly higher than forecasts (2.6%), although lower than the previous quarter (3.2%). This is quite comparable with the dynamics of Chinese GDP: in the fourth quarter of 2022, it increased by 2.9% year-on-year, and according to the results of the entire previous year, it grew by 3%, which turned out to be worse than the target set by the Chinese authorities at 5, 5%.

Of course, the pace of economic development in the United States is also not particularly impressive, but what is important here is not so much its absolute value, but rather comparison with Europe. Why? Because the main economic competitor of the US is not China or other "Asian tigers", but Europe with its high technologies, accumulated competencies and culture of production. Therefore, over the past decades, the United States has been trying to "disconnect" Europe from Russian oil and gas and thereby undermine its economic potential, increase production costs and make the products of European companies uncompetitive.

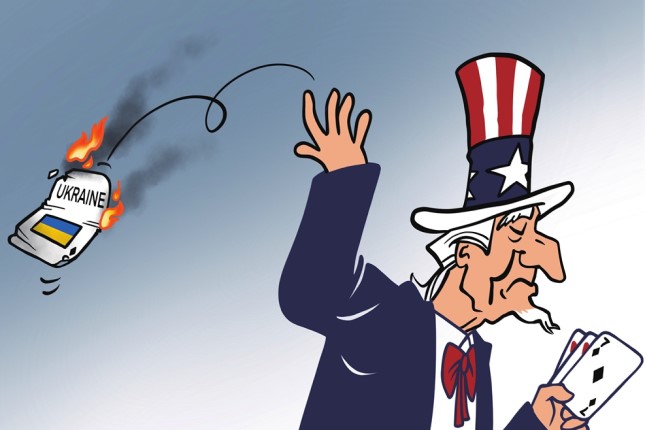

And now, thanks to the unprecedented anti-Russian sanctions and fueling political hysteria, this goal, it would seem, has been achieved − a dangerous competitor has been defeated. To think that Russia was the main object of the American sanctions policy is at least naive…

But the triumph was short-lived, the boomerang returns. The bankruptcy of Silicon Valley Bank may be an isolated case and does not at all mean the onset of a full-scale recession in the United States. The world's reaction to this incident clearly does not correspond to its scale. But in economy, as in politics, isolated and seemingly insignificant events often start, like a snowball, to bring more and more new problems and, as a result, turn into an avalanche that sweeps away everything in its path.

And in the case of SVB, what is important is not the volume of assets of the bank itself and not its role in certain industries, but precisely the fact that its collapse served as a trigger. Finally, appeared a visible embodiment of the hidden fears that have long possessed European investors and were just waiting for a push to come out. And this push followed.

And, apparently, the snowball is growing rapidly. So, the market almost instantly revised its expectations for the Fed rate. According to the aggregate estimates of investors, the probability of its increase in March by 0.50 percentage points decreased from 69% to 57%. And the international rating agency Moody's has worsened the forecast for the US banking system − from stable to negative.

In other words, the bankruptcy of SVB is not the cause, but only one of the possible symbols of the coming recession in the United States. It can take a long time to understand its true premises, to cite clever economic terms, but in the end, it all reduces to the trivial fact − in the midst of a global conflagration, strenuously blown up by the United States, there can hardly remain any place untouched by fire. So why be surprised that it is getting hairy?

Slate under attack

The emerging US recession may have a dual effect on oil prices. On the one hand, a downturn in the US economy could lead to lower energy demand in this leading oil and gas consumer. And this, in turn, will contribute to lower prices for hydrocarbon raw materials. Not surprisingly, this was the first reaction of the oil market to the bankruptcy of American banks.

But, on the other hand, the dynamics of shale oil and gas production directly depends on the state of the US financial system. It is well known that the key to the success of the shale revolution was massive investments in the development of dense reservoirs, with the return of which, to put it mildly, there were problems. The bankruptcy of shale companies is a constant phenomenon in the United States, and the country could afford such a "luxury" only if there was an extremely stable financial system.

In 2023, a number of the largest US companies planned to significantly increase their investments in the exploitation of shale deposits, but at the same time, additional investments should, at best, lead to only a slight increase in production, or even simply to its stabilization.

For example, EOG Resources Inc. announced its intention to invest USD 1.4 billion more in production this year than a year earlier, but its production is expected to grow by only 3%. In turn, Pioneer Natural Resources Co. is ready to increase investments by almost USD 1 trillion, increasing production by 7%.

The most blatant situation is with Marathon Oil Corp., which is going to increase capital investments by about a third only in order to stabilize production at the level of last year. Now, under the threat of recession and stagnation of the banking system, even implementation of these relatively modest plans is jeopardized.

And this is a very worrying long-term trend for global oil and gas markets. The United States, imposing sanctions on its political opponents, proudly promised to take on the role of an alternative supplier. This is especially evident in the gas sector − the United States, having essentially provoked a gas crisis in Europe, tried to hook the Old World on its own LNG. And the European Union took this bait, starting an active transition to overseas liquefied gas.

Experts have previously warned that the future prospects for the shale revolution and increasing hydrocarbon production in the United States are very illusory. And now, given the risk of a financial crisis in America, they are tending to zero. Accordingly, the stagnation of this sector will become a powerful driver of growth in world prices for hydrocarbons.

Return to Russian oil again?

Will these new circumstances force us to reconsider Europe's policy towards Russia and its energy sector? European politicians have begun to give unequivocal signals that it will not be possible to balance the world market without Russian oil. Therefore, the proposals of some leaders, like Estonian, about a sharp reduction in the price cap are perceived at best as inappropriate.

And if the recession in the United States gains momentum, then the question will arise not about tightening, but about easing anti-Russian sanctions. Of course, it is unlikely that the ceiling will be just suddenly dramatically raised – this would mean a loss of face for the West. But its preservation at the current level (or a purely symbolic correction up and down) would be an important signal indicating a revision of the previous policy.

However, the main tool for "returning" Russian oil to Europe is likely to be not manipulations with the price cap, but rather development of a grey market segment. The greater the shortage of hydrocarbons, the less European officials will pay attention to such "trifles" as the country of origin of raw materials. European countries will buy Russian oil, pretending to take it for any other producers' raw materials.