On December 1, the G7 and EU embargo on Russian oil and its price cap came into force, and Europe is entering a period of high uncertainty. Despite the fact that the United States has repeatedly promised to increase oil supplies to replace part of the imports from Russia, data published by the Energy Information Administration (EIA) under the US Department of Energy, data from Eurostat and the International Energy Agency (IEA), and OPEC and BP statistical reports show that the US does not have an excess of oil with which to cover the European deficit.

Rejection of Russian oil

The United States and Great Britain were the first to impose an embargo on Russian oil and petroleum products during the crisis of 2022. Explaining this decision, London reported that the ban would not affect the country's economy in any way, as Russian imports could be easily replaced with supplies from the "highly competitive world market."

Based on the same logic, the European Union adopted the sixth package of sanctions, containing a ban on the import of Russian "black gold" and its processed products. But given the greater dependence on supplies from the Russian Federation than from the partners in the anti-Russian coalition, the adopted restrictions were supposed to come into force this month for oil and from February for petroleum products. Additionally, some countries have been given various kinds of exceptions (due to the "lack of viable alternative supplies").

The IEA predicts that oil production in the Russian Federation will decrease to 10.2 million barrels per day this month, and to 9.5 million barrels per day in February (with the European ban on the import of Russian petroleum products coming into force). Thus, the decrease, according to IEA analysts, should be 17% of the production level from the beginning of 2022.

However, in March 2022, the same experts predicted a drop of 3 million barrels per day, expecting immediate consequences from the cessation of supplies to the United States and a decrease in Russian exports to Europe, as well as to Japan and South Korea.

At the same time, the IEA forecast assumes an increase in oil demand of 2 million barrels per day—up to 99.7 million barrels per day in 2022, and up to 101.8 million barrels per day in 2023. OPEC's forecast is even more optimistic: a growth of 3.1 million barrels per day in 2022 and 2.7 million barrels per day in 2023.

Thus, the expected reduction in production is at odds with the task of maintaining the global balance of supply and demand. The problem could be solved by increasing production outside Russia, but large exporters have, for the most part, declared their technical inability to replace Russia in the event that its volumes leave the world market. In fact, Europe has only received promises from the United States at the political level, while American companies have not confirmed their readiness to provide the EU with oil.

EU Oil Market

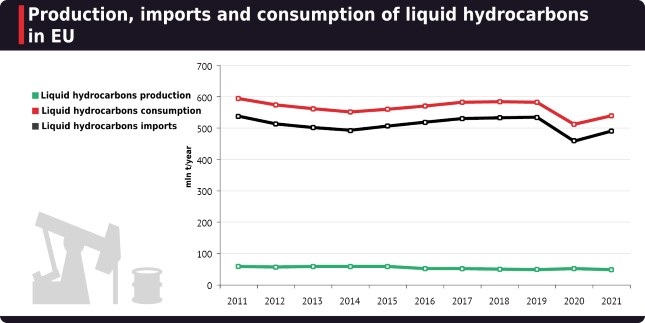

According to the chart below, the European Union is the largest net importer of oil and petroleum products in the world. Already in 2020, crude oil production in the EU dropped below 20 million tonnes, and dependence on imports exceeded 96%.

To close its oil balance, the EU must import about 500 million tonnes of oil and oil products per year. This is approximately equal to 25% of all international trade in oil and oil products.

At the moment, the demand for oil in the European Union is in a contentious position. On the one hand, high prices and economic uncertainty have a negative impact on motor fuel consumption. On the other hand, the demand for "black gold" in the EU may support the transition to petroleum products for electricity generation.

It should be noted that the EU consumption of oil and oil products for its own energy and non-energy needs is about 80% of the total consumption (384 million tonnes in 2020). A quarter of EU crude oil imports came from Russia.

The reduced availability of Russian oil and the need to find alternatives first of all reduces the EU's ability to export oil products, and second, increases the risks for the EU's internal market.

US oil market

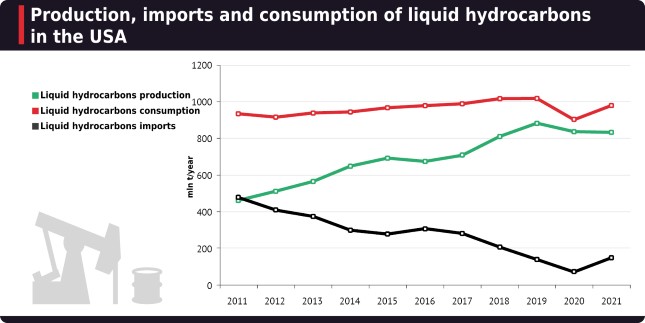

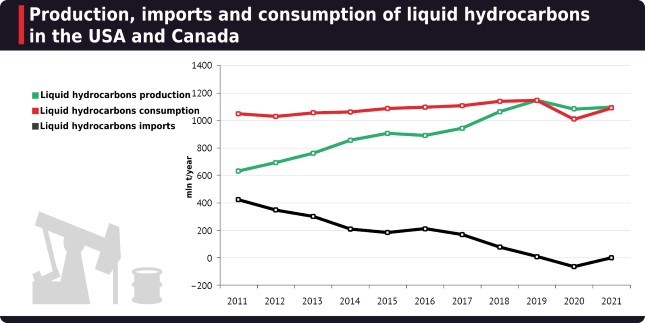

According to the second chart, the US has significantly improved its oil balance in recent years, but still remains a net importer of oil and petroleum products. In 2021, its net imports amounted to 146.5 million tonnes.

By early 2020, the United States' oil and gas sector was in a pre-crisis environment, with sharp cuts in capital expenditures and reduced production forecasts by the EIA. The pandemic and the crisis it caused were the straw that broke the camel's back, bringing about an uncontrollable drop in production.

After the market stabilized in the second half of 2020, world oil prices reached about USD 50 per barrel. This allowed stakeholders to make predictions about the imminent recovery of US production to pre-crisis levels, since the part of production hit by the crisis could be profitable at prices above USD 40 per barrel. The recovery of production in the United States did indeed begin, but its pace was far from what was predicted.

According to the latest EIA report, crude oil exports from the US to Europe rose to record highs in May (up to 1.65 million barrels per day). But this happened against the backdrop of a hardly changing volume of domestic production and a hasty search for a replacement for Russian supplies. Therefore, the growth in flow into Europe was offset by a decrease in crude oil exports from the US to Asia.

The United States can bring the average daily export of crude oil to a stable level of about 3.5-3.8 million barrels (since 2015 and since 2019, this figure has averaged about 3 million). However, although these volumes can replace Russian gas in the European market in theory, this is not feasible in practice.

The EIA forecast assumes that the average level of daily oil production in the United States in 2022 will amount to 12 million barrels, and that in 2023 this figure will increase to 12.6 million. With relatively stable demand for oil from the United States and low production growth dynamics, US producers will not be able to replace the 2 million barrels of Russian crude oil falling out of the European market this month. Moreover, none of the manufacturers have even set such a task. And the political leadership of the United States does not have the tools to accelerate or decelerate the volume of oil produced in the United States in the shortest possible time.

Taking into account the forecast of increased oil demand in the world, new American volumes will not be able to replace Russian oil leaving the European market in 2023. Of course, we are talking about a situation in which Russian "black gold" will not find a market outside the European Union. Otherwise, there will be a further redistribution of logistics chains.

The United States cannot completely replace Russian oil supplies on the EU market. The only option in which this is theoretically possible is a complete ban on US exports to other destinations and the readiness of the European Union to use oil for refining that does not meet the required standards.