Which concluded on Saturday amid the most serious problems in the US banking system since the 2008 crisis, issued an obligatory statement claiming the global economy had shown “resilience” in the face of COVID, the Ukraine war and inflation.

But after this reassurance, the communiqué said the G7 needed to “remain vigilant and stay agile and flexible in our macroeconomic policy amid heightened uncertainty about the global economic outlook.”

As major central banks raise interest rates in the so-called fight against inflation—directed against suppressing the wage demands of the working class—the statement underlined that government spending must conform with that of the central banks.

“The overall fiscal stance [of governments] should ensure medium-term stability and be coherent with the monetary policy stance amid inflationary pressures,” it said.

In other words, as central banks continue their offensive against the working class, even inducing a recession if that is considered necessary, governments must add to this attack by restricting spending.

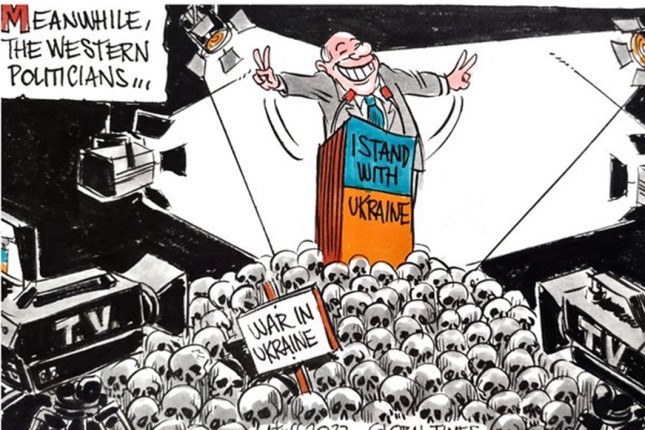

There is, however, one exception to the austerity regime: expenditure on the military and the US-NATO war, which took front place in the official statement.

It began by reiterating “our unwavering support for Ukraine for as long as it takes,” declared it would continue to address Ukraine’s short-term funding needs, and repeated “our unwavering resolve to impose and enforce sanctions and other economic measures” against Russia.

But behind the show of unity, there are clearly tensions developing as financial problems centred in the US, continue to grow and the world economy slows significantly amid differences over the issue of China, the chief source of what limited growth there is globally.

In a statement issued after the meeting the Japanese host finance minister, Shunichi Suzuki, said: “It was a big achievement for us that the G7 was able to strengthen its unity rather than going in separate ways to address major international challenges.” That is, conflicts that no doubt occurred behind closed doors were, at least to some extent, kept out of public view.

The G7 was able to present a united front on the Ukraine war but not on China. In the lead-up to the meeting, US Treasury Secretary Janet Yellen called for “co-ordinated action” by G7 countries against what she called Beijing’s “economic coercion.”

In fact, the US accusation is a projection onto China of its own practices, with the sweeping bans on Chinese acquisition of new technologies aimed at crippling this vital area of its economy.

Following Yellen’s call, China’s foreign ministry issued a statement that it was the victim, not the perpetrator, of coercive measures.

“If any country should be criticised for economic coercion, it should be the United States. The US has been overstretching the concept of national security, abusing export control and taking discriminatory action against foreign companies. This seriously violates the principles of market economy and fair competition,” foreign ministry spokesman Wang Wenbin said.

The foreign ministry backed its claims by citing media reports showing that total US government sanctions, covering 40 countries with almost half the world’s population, had risen by 933 percent between 2000 and 2021 and more than 9400 sanctions had come into effect by the fiscal year of 2021.

On the eve of the G7 meeting, an unnamed senior European Union official expressed confidence to the Financial Times that agreement could be reached on “joint language” regarding investments in China but not “a shared mechanism” with the US.

In the event, the 14-page communiqué made no mention of China. A Japanese finance ministry official said economic coercion had been raised but gave no details.

On the financial front, the statement said the G7 would work closely with regulatory authorities to monitor developments and take the appropriate action to maintain financial stability.

Even as the meeting was being held there were indications the turmoil in the American banking system, which began with the failure of Silicon Valley Bank in March and has resulted in three of the four largest bank failures in US history, is far from over.

The latest bank to come under pressure is PacWest. It shares plunged at the end of last week, bringing the total decline to 80 percent since the beginning of March. The latest slide came after it announced it had lost 9.5 percent of its deposits at the start of this month. The KBW regional bank index fell a further 2.4 percent, after a decline of around 30 percent since the beginning of March, and the shares of other regional banks came under pressure.

The Wall Street Journal reported that concerns over the stability of mid-sized banks would continue until the Federal Deposit Insurance Corporation lifted the deposit insurance limit from $250,000 or even provided insurance for all deposits.

The G7 statement claimed the “financial system is resilient” and had been strengthened by the increased bank regulation introduced after the 2008 crisis.

But apart from the fact that a crisis erupted despite those regulations, there are other potential sources of turmoil in the non-bank financial sector. As a report from the International Monetary Fund issued last month made clear, financial authorities have very little idea of what is taking place in this area of the financial system which has grown in leaps and bounds over the past 15 years.

The statement advanced no concrete proposals to deal with this situation, saying only that it would “continue to prioritize addressing vulnerabilities in non-bank financial intermediation.”

Any measures that are put in place will be as ineffective as those introduced after the 2008 crisis. As the G7 finance ministers met, the FT published a scathing critique by former Bank of England governor Mervyn King of these measures.

“Fifteen years ago,” he wrote, “the collapse of the western banking system led to the adoption of thousands of pages of complex regulations. Yet here we are in the middle of another crisis of confidence in the banks.”

These reforms were “little more than “sticking plaster.”

He noted that this year attention had focused on runs by depositors whereas the financial crisis resulted from the reluctance of wholesale suppliers of finance to roll over their funding.

“The lesson is that any so-called ‘runnable liability’—such as deposits that can be quickly withdrawn or anything that is redeemable on demand—can result in the central bank having to provide liquidity.”

In what amounted to a call for central banks to backstop the entire financial system, King said it made little sense to do what had been done in the US, that is, to “guarantee all deposits in a bank that fails and yet maintain the upper limit on deposit insurance for all the other banks.”

Overall, the G7 gathering of finance ministers provided a glimpse of a system in terminal decay—a meeting dominated by war, coupled with by a deepening crisis of the financial system of global capitalism.

Source: World Socialist Web Site.