On February 7, London-based multinational corporation BP (formerly British Petroleum) announced its financial results for 2022. The company's results turned out to be weaker compared to its competitors. American oil and gas giants significantly increased their profits by taking advantage of the energy markets. The results can be attributed to BP's failure to implement its green strategy and the loss of its main resource base, a stake in the Russian oil company Rosneft. Moreover, the report indicates that the company has acknowledged the fallacy of the "green transition" strategy and is planning to invest in "oil and gas projects with a short payback cycle. One of the challenges is that there are no significant "free" resources available on the market. There seems to be no other way to improve the position of the British oil and gas flagship than to wage war with the British government and intelligence agencies and get resources (primarily oil) by force. Iranian oil is the only resource significant enough to help BP turn things around quickly. BP's recent actions around Iran may suggest a decision to "reclaim" Iranian oil, from which the company's history originated.

"BP reports record profit in 2022." The UK mass media have covered this issue extensively. Indeed, net income for the year, excluding write-offs and the cost of inventories, stood at USD 27.7 billion, which is more than double that of 2021. The situation for BP, however, does not appear to be as bright as it appears when compared to the results of competing companies for 2022. Exxon, Chevron and Shell reported net profits of USD 55.7 billion, USD 35.5 billion and USD 42.3 billion, respectively. BP's 2022 EBITDA (USD 60.7 billion) was also below its peers (Exxon USD 99.5 billion, Chevron USD 64.6 billion, Shell USD 85.6 billion). However, there might be a classic misrepresentation: net profit is stated in the financial statements as adjusted net profit, excluding write-offs. That is, the de facto write-offs of BP in the amount of 31 billion have not been considered. While the British economy appears to be slipping into recession, a media campaign against "fat oil cats" has been launched, and the company can no longer afford to not pay dividends. By refusing to acknowledge BP's loss of USD 2.5 billion, the media and the expert community either legalise the financial fraud or admit that the write-offs indicated in the statements were fictitious. In this case, the bulk of the write-off is a share in the Russian oil company Rosneft. Is there a reason to write this off? Legally, the withdrawal from Russian equity and joint ventures never occurred as BP did not file a formal withdrawal request with the Russian watchdog. Shares of Rosneft are on BP's balance sheet. Dividends continue to drip into a special Russian account. Thus, without focusing on the loss shown to it and focusing on “record net profit” BP, in fact, recognises its status as a “shadow owner”, as Igor Sechin, CEO of Rosneft, stated earlier this week again at India Energy Week in Bangalore.

In addition to exiting Rosneft's capital, which should account for around USD 24 billion, BP's write-offs also include the disposal of other "dirty" assets. A business in Alaska, a stake in a project in Oman, and North Sea assets have recently been sold by the company. In many cases, exiting mining projects resulted in substantial impairment and loss.

BP's poor financial performance is because it could not fully benefit from favourable market conditions and high oil prices, mainly because its management may have miscalculated the course on green energy.

In 2020, it was announced that BP would become a 100% green company, changing its name from British Petroleum to Beyond Petroleum. Green energy, however, by definition, is subsidised, and its development is at the expense of the traditional oil industry. In addition to making a miscalculation in strategy, BP also lost almost half its resource base. It also announced plans to invest USD 1 billion annually, or USD 8 billion by 2030, in short-cycle oil and gas projects to generate more cash flow without formally rejecting the trendy green agenda. Previously steadily decreasing investments in oil and gas production increased slightly from USD 4.8 billion in 2021 to USD 5.3 billion in 2022. Gas production investments slightly increased from USD 3.18 billion to USD 3.23 billion.

Of course, this isn't much since these figures are almost twice lower than in 2019. Its updated strategy, published on the same day as its annual accounts, displayed benchmarks indicating a comeback.

BP plans to produce 2.5 million barrels per day in 2025 and 2 million barrels per day in 2030, which would amount to a 25% decrease in production from 2019 levels (excluding Rosneft). Previous targets called for a 40% reduction by 2019. According to the forecast, BP expects a 20-30% reduction in emissions by 2030 to 2019 levels, compared to the previous target of 35-40%. In other words, the target has been halved.

The green agenda has been largely sacrificed. Javier Blas, a columnist at Bloomberg Opinion, covering energy and commodities, scoffs at BP's change in strategy: "But this is a company that has gone from "Beyond Petroleum" to "Back into Petroleum."

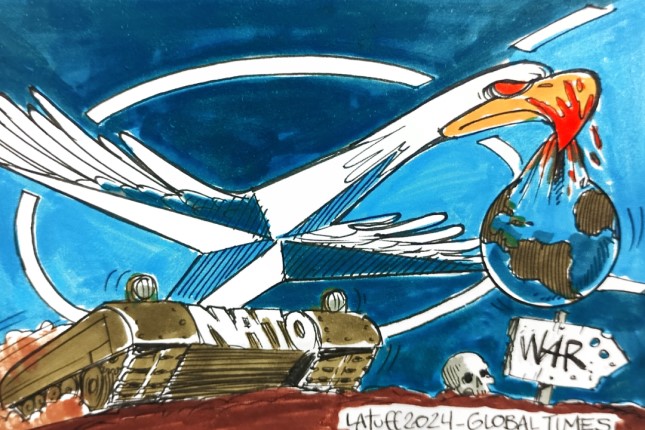

There's nothing funny about this. All these homoeopathic measures will not change the situation substantially and will return BP to the leading position quickly. In the current market, it will be necessary for the company to expand its resource base to generate cash flow and pursue the green agenda. The withdrawal of BP from Rosneft assets could have been cancelled, especially since, as we have already mentioned, it never happened legally. However, in the current situation, BP is unwilling to do this for political reasons. On other platforms, BP will also have difficulty ramping up production quickly. No assets available on the market are comparable in size to producing nearly a million barrels per day. It is only possible to take it by force the old-fashioned way, as it was done in the British Empire. Taking such an asset swiftly is only possible in one country -- Iran. Iran's current oil production capacity is just over 3.8 million barrels per day, with reported production of 2.6 million barrels per day. BP considers Iranian assets to be essentially its own. It was in Persia that British Petroleum, formerly the Anglo-Persian Oil Company, began its history. There, the company produced and processed most of its hydrocarbons for decades, even staging coups when necessary. In the early 1950s, the elected government of Mohammad Mosaddegh nationalized the Iranian oil industry and was overthrown, it is believed, with the assistance of British intelligence and the CIA.

Notably, the turmoil around Iran and British-Iranian relations in 2023 occurred right at the same time as BP's review of its oil strategy. In mid-January, Ali Reza Akbari, the former deputy head of the Ministry of Defence and former director of the Centre for Strategic Studies of the Iranian Ministry of Defence, was executed in Iran for espionage against British MI6, which had been detained in 2019. Additionally, the Ministry of Foreign Affairs of Iran imposed sanctions at the end of January on Richard Dearlove, the former head of MI6, who actively promoted the employment of former high-ranking intelligence officers in BP. Then, at the end of January, a drone strike was conducted by saboteurs on an Iranian military base to which Israel has no connection whatsoever. All of this takes place against the backdrop of a powerful internal struggle. The strategy change of BP may coincide with the surprising increase in pressure on Iran. A destabilized Iran, a fall or military defeat under the blow of the allies could result in the redistribution of the country's oil sector, which would benefit the Anglo-Persian Oil Company's heirs.