The accident at Nord Stream pipelines overlapped with the opening ceremony of the Baltic Pipe. The natural gas pipeline will transport gas from Norway to Poland. The launch of direct gas transmission from the Norwegian shelf is a milestone for Poland seeking all means to reduce its dependence on Russian gas supplies.

This pipeline won't substantially impact the EU gas imports but will help redistribute existing resources between the countries. In the current environment, Poland's gas supplies threaten the stability of Germany's imports.

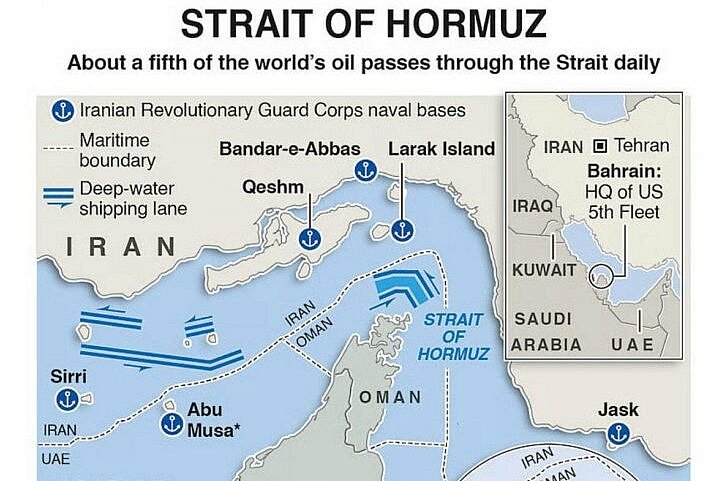

Baltik pipe map. Photo: wikipedia.org

No long-term contracts

In 2016, Poland announced it would not go forward with the long-term gas contracts with Russia. However, the country continued importing gas from Russia through pipelines or in liquefied form. According to the Polish leaders, this change aimed at making the gas import market-based. Long-term contracts tied to oil seemed unfair and non-market.

By and large, Poland's statements did not come as unexpected since the EU has chosen to reject long-term agreements. They were inherently at odds with the market model proposed by Brussels and contradicted the objectives of the Green Deal.

By 2050, the EU aims to become independent from fossil fuels, and by 2030, natural gas in electricity is expected to be replaced mainly by hydrogen. Whether strategic goals of this kind are feasible or not, we will only note that in this "green" context, it makes no sense to sign new contracts to continue gas purchases up to the 2040s.

At the same time, Warsaw seized upon the Baltic Pipe project, which was supposed to secure supplies from Norway. One could say this could contradict those mentioned above "green" logic. If gas is out of need, it does not matter where it comes from. However, in this case, we see a different aspect of the European energy strategy.

A project of public importance

The EU actively encourages the diversification of gas sources and the development of gas transmission capacity to transfer volumes among EU member states. Therefore, the Baltic Pipe project received full support, acquired public interest status, and raised EUR 267 million through the Connecting Europe fund. EU funds, Polish operator Gaz-System, and Danish Energinet, whose investments in the project amount to a minimum of EUR 1.6 billion.

The project has a design capacity of 10 billion cubic metres per year. It is roughly equal to Poland's volume from the Russian Federation. The current Russian-Polish contract terminated somewhat earlier than expected. Warsaw refused to use the rouble-based payment scheme for the gas, so deliveries from Russia ceased this spring.

Poland bought Russian gas from Germany for a while. Later, the Polish part of the Yamal-Europe pipeline was shut down due to the sanctions. The gas supplies through pipeline Nord Stream 1 decreased due to technical problems, which made gas supplies to Germany more complicated.

The Polish public was deeply concerned that the Baltic Pipe under construction had not been secured with any contracts. Finally, Polish oil and gas company PGNiG stated there was a contract with Equinor for 2.4 billion cubic metres per year, around a quarter of the volumes supplied from Russia. The deliveries were planned to start on October 1.

Polskie Górnictwo Naftowe i Gazownictwo is a Polish state-owned oil and gas company engaged in natural gas and oil production, storage and sale.

While appetite is growing, resources are not

Poland needs 20-22 billion cubic metres of gas per year. Coal-fired power plants generate 70-80% of domestic electricity. As part of the Green Deal, Europe shall phase out its dependency on coal as soon as possible. In 2022, the transition got suspended. However, according to the current estimates, most of the EU's coal-fired generation is to be shut down by 2030.

Poland has to increase its gas consumption, as, at this stage, only gas could be a coal substitute in power generation. By 2030, gas consumption can rise to 30 billion cubic metres.

Thus, we conclude that the Baltic Pipe can compensate for the growth in gas demand by the end of the decade, assuming that the bloc members continue pursuing their decarbonisation path.

Most ironically, the resource base for the new Norwegian-Danish-Polish pipeline is Europipe II, which connects Norway and Germany. The capacity of this pipe is 24 billion cubic metres.

According to the existing contractual obligations, in 2022, Poland claims 10% of the volume pumped to Germany. This means that German customers can miss out on 2.4 billion cubic metres at the time when supplies from Russia have been undermined, the LNG terminals, slated to come on stream in the fourth quarter of this year, will only be able to supply 12.5 billion cubic metres, and production in the Netherlands is declining.

Given PGNiG's announced plans, the prospects for German consumers are rather vague. Apart from the main contract with Equinor, the Polish company has concluded several minor agreements, starting in different years.

PGNiG presently claims that in 2023, it will be able to supply at least 6.5 billion cubic metres from Norway to Poland via Baltic Pipe, and in 2024, another 1 billion cubic metres will be added to the amount. And all of it will come from a 100%-fulfilled 24-billion-cubic-metre pipeline from Norway to Germany. Perhaps Denmark, which is going to restore domestic production of natural gas in 2023, will make its contribution, too.

The commissioning of Baltic Pipe does not increase gas supplies to the EU in any way but removes some of the volumes going to the German market. At the current stage, this pipe cannot fully compensate for the fall-out of Russian supplies.

The hasty commissioning of the pipeline, or rather the "opening" before the start of commercial gas supplies, was meant to reassure the public, anxious about the uncertainties over the upcoming heating season. There is growing discontent because people believe the project may not be a viable option to replace Russian gas.