Austria’s Chancellor Karl Nehammer caused an uproar this week by saying the following about skyrocketing gas prices: “if we continue in the same spirit, then you will only have two solutions: alcohol or psychotropic drugs. And I say alcohol is normal”.

Georg Friedrichs, head of Germany’s largest regional gas supplier, described the situation with gas in a similar vein, albeit without a trace of irony: «…someone who is young and fit can get through the winter with two sweaters and a little climbing. But it makes sense that we all need to lower the temperature, and see where our pain threshold is”.

Europe's energy sector has long passed its pain threshold, and it would be no exaggeration to state that the EU has entered a period of full-blown energy crisis. There are multiple reasons for this crisis, including a politically driven and hasty “green transition” carried out without feasible technologies coupled with artificially induced supply chain disruptions in response to the COVID-19 pandemic and unprecedented anti-Russian sanctions. On top of that, Europe's policy of systematically phasing out "dirty energy" has cut coal-fired power generation in half since 2015, amid a simultaneous record drop in nuclear power generation by 10%.

Given this, Europe's plan to stop buying 150 to 155 billion cubic meters of natural gas from Russia and substitute it with LNG that LNG carriers would deliver could only have worked under some very distinct and favourable set of circumstances, if at all. In fact, up until a couple of months ago, it had seemed that Europe could be in luck. The US was rapidly ramping up its LNG exports to Europe, with its share of Europe's overall gas imports rising from 6% in September 2021 to 15% in May 2022. Amid this, Russia’s share was declining while still hovering above 24%, which meant that gas continued to be pumped into Europe’s gas storage facilities.

However, the US capacity to export gas was dealt a sudden blow due to an accident at the Freeport LNG plant (with an annual capacity of up to 20 billion cubic meters), causing it to cut its Europe-bound supplies by 15 to 17%. This was followed by Gazprom's decision to curtail its gas supply via the North Stream 1 pipeline following Canada's arrest of one of its turbines, precipitating a major energy imbalance in Europe. The crisis caused by a shortage of US gas supplies was further compounded by another accident at another US LNG plant in Medford, Oklahoma.

By and large, LNG is considered to be a hugely unreliable, very unpredictable and highly finicky energy source. Even assuming that record volumes of gas would continue flowing to Europe unimpeded, getting it from the regasification terminals to its end-users would still be challenging. The reason for this is Europe’s lack of transit pipeline infrastructure. As a result, gas cannot be adequately shipped from the countries in the West of Europe to those in the East, where they are most dependent on pipeline gas.

In addition, most LNG is traded on the spot market rather than sold under long-term contracts causing importing countries to be in perpetual price competition. For European consumers, this means competing with premium Asian markets, where competition is fierce as the region is recovering from the COVID slump. This price competition was the primary factor behind the gas price spike observed at the end of winter and in early spring of this year. Over the recent months, there have been multiple cases when LNG carriers had to change their final destination due to changes in spot sale prices.

Another factor that needs to be considered is the availability of LNG carriers per se. Unlike pipeline gas that flows to the consumers on its own unimpeded, LNG is a challenge to ship. Those who intend to buy LNG should also be prepared to compete for LNG carriers. Shipyards of global leaders in LNG carrier building, such as Japan, South Korea, and to some extent, China, have already secured several years' worth of booked orders. Experts predict a further increase in demand for LNG carriers from shipping companies. Another downside of buying LNG is the need to have liquefaction terminals which will take considerable time to build as it is something you cannot possibly do overnight.

Besides, the existing global LNG production capacity is unlikely to be sufficient to cover all of Europe's gas consumption needs, equal to about 500 billion cubic meters per year. The situation might improve in about 5 years, with additional volumes of LNG hitting the market. All major LNG producers, including Qatar, Australia and the United States, are working hard to ramp up their production capacity.

In addition, Europe is boosting its imports of pipeline gas from Algeria, Azerbaijan and many producers in Africa and the Middle East, which indicates that Europe needs more than its current volumes of imported LNG.

It should also be noted that by reducing its reliance on gas supplies from Russia, Europe will become equally dependent on all these other exporters. And this is even though being a power-hungry yet, extremely energy deficient region, Europe has, for the last 13 years, been making attempts to reduce its dependence on foreign markets and, consequently, to break free from the influence of major suppliers. However, as we can see, the European Union's policies have been the opposite: a dramatic increase in Europe's dependence on the US and on exporters from Central Asia, the Middle East and Africa.

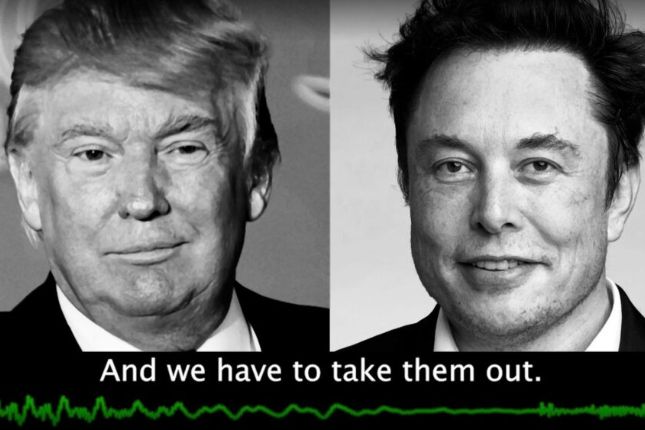

With this in mind, one can begin to understand the reasons behind Canada's belated decision to return the seized Nord Stream turbine. This departure from a seemingly inviolable policy has already been endorsed by Brussels, Ottawa, and even Washington. However, it was only recently that the West had made it clear that values and ideals are worth fighting for, even if it means that one would have to pay the price for doing so. It appears, however, that this rhetoric has failed the test of harsh reality.

When it comes down to whether the Europeans will have to suffer from the summer heat and freeze in the winter, adherence to one's principles gives way to pragmatism. The leaders of the EU are beginning to realize that by consistently marginalizing conventional sources of energy, politicizing their decision to wean Europe off of pipeline gas and banking foolhardily on unproven technologies, they have driven themselves into a dead end that they cannot escape from now without incurring losses. One thing is certain: Europe's reliance on LNG will not help it meet all of its energy needs.