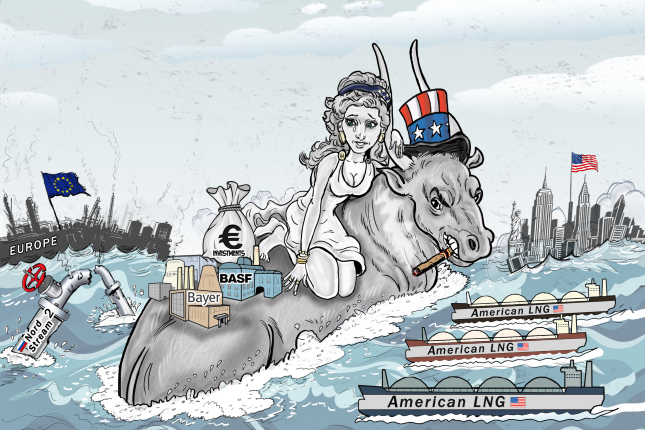

Over the past decades, the European model of prosperity was based on three pillars: cheap energy from Russia, cheap goods from China, and cheap money from the US. Such a system, until very recently, suited all sides.

However, the mutually beneficial chain has been disrupted. These are the Western countries responsible for the global energy crisis, which may ruin the well-being of millions and the ability to heat their homes. This was the leitmotif of the speech by the head of the Russian oil giant Rosneft, Igor Sechin, at the Eurasian Forum in Baku.

According to him, the global energy market could not do without Russia, and the more persistent some Western countries attempt to remove Moscow, the more destructive the consequences for the world economy are. Russia's share in basic resources on a planetary scale amounts to 15 per cent.

With so much energy and raw materials lost, production and consumption will inevitably decline. As a result, it is absurd to isolate Russia from an economic standpoint. Politicians, not economists, now make these decisions.

Igor Sechin, head of the Russian oil company Rosneft.

Energy cooperation with Russia is a pivotal issue for Europe, which faces a dwindling industrial potential without it.

Earlier, Germany bought Russian resources for USD 20 billion and turned them into 2 trillion in added value; now, it spends hundreds of billions of euros to protect its citizens and enterprises, not saying about earning revenue. According to Sechin, the damage to the European Union from its sanctions will reach EUR 1 trillion by the end of the year.

For Europe, the issue is not to survive in winter but the longer-term challenges. Simply put, industries will be degrading with insufficient energy resources, which may lead to deindustrialisation when companies curtail production and relocate abroad.

The primary victims of the energy crisis are metals and mining, chemical, pulp-and-paper and agricultural sectors.

"The potential reduction in output is estimated from 20-45% in the chemical industry to 30‑60% in metallurgy. In Europe, 70 per cent of nitrogen fertiliser production capacities have already been stopped; aluminium production has been reduced by 25 per cent. Europe's rejection of Russian energy supplies threatens from 6.5 to 11.5% of European GDP and about 16 million jobs", said Sechin.

Jobs are emerging in the US. Evonik, a chemical concern, opened a research and development centre in Pennsylvania and invested USD 200 million to build a manufacturing facility in Indiana.

Pharmaceutical giant Bayer is building its USD 100 million technology centre in Boston. Over four years, the chemical conglomerate BASF will invest nearly USD 4 billion in the US economy.

Lufthansa and Siemens are also moving their facilities to Oklahoma.

Oklahoma is a particularly active state in trying to attract German companies, mainly due to cheap energy. There are over 60 German businesses present in the state.

The single energy market is falling apart. As a result of such actions, the "right" countries will receive energy cheaper than the "wrong" ones. Economies with traditionally low dependence on supplies from Russia benefit from the sanctions.