Analysts' attention is focused on oil production in the United States today, as everyone remembers how the shale revolution led to an overstocking of the world market in 2014 and contributed to the massive drop from USD 112 per barrel in June to USD 48 per barrel in January 2015.

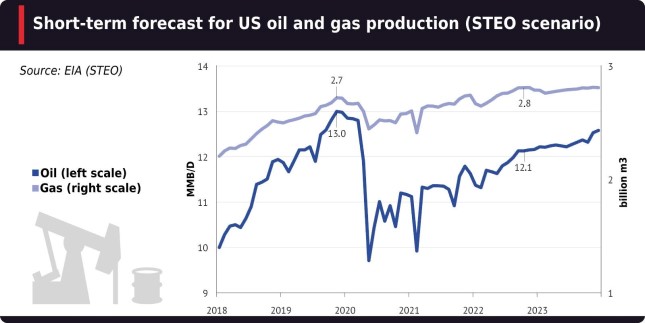

This spring, prices again crossed the threshold of USD 100 per barrel, and the average monthly price of Brent in June amounted to USD 122 per barrel due to Western sanctions against the Russian fuel and energy industry and the containment of OPEC+ production. However, US oil companies are in no hurry to increase production, which allows Russia to compensate for the shortfall in export revenues with high prices in the next few years.

Moody slate

Shale mining plays a major role in developing the US oil and gas industry. Of the 1,526 wells drilled in September of this year, horizontal and directional wells accounted for 87.1%. The total share of horizontal wells in the United States in 2020 amounted to 16.9% (159,000 units), against 9.6% (99,000 units) in 2014. A high proportion of horizontal wells is simply a distinctive feature of the development of shale deposits.

However, the effect of increased drilling volumes is short-lived. The fact is that the profile of shale production is radically different from the development of traditional deposits: peak production occurs in the first few years with a further decrease along the hyperbolic curve. After four years, the production at the well is less than 5% of peak volumes.

In addition, the US oil industry is extremely dependent on external factors, primarily prices. Producers tend to bring wells into production during a period of high prices so that a short production peak coincides with the optimal market conditions. Therefore, production in the US is much more volatile than in countries with a predominance of traditional oil fields, such as Russia and Saudi Arabia.

Has the growth potential been exhausted?

As a "safety cushion," American companies are using drilled but uncompleted Wells (DUCs), which can be put into operation in short order. From July 2020 to October 2022, the number of DUCs fell by half (to 4,400 units), but in May, the decline slowed sharply, and in October of this year, a slight increase (+8 units) was recorded for the first time.

In other words, the potential for production growth "on the old yeast" has, apparently, been exhausted—it is time to really increase the number of DUCs again. In addition, it should be considered that the remaining 4,400 DUCs may be of much lower quality and unprofitable even at the current price level (the average WTI price in October was USD 87.5 per barrel).

Another trend reversal occurred in October, in the number of drilling rigs—an indicator that has been growing steadily since September 2020 in parallel with the recovery of production. But in October, there was a downturn (-1 unit MoM).

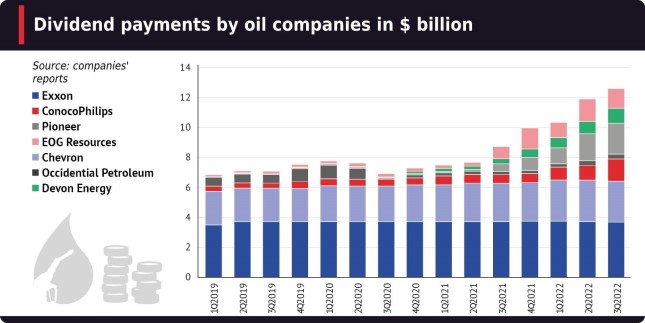

Of course, the October changes are not enough to predict a drop in US production, but on the other hand, nothing indicates the possibility of rapid growth. After a wave of bankruptcies in 2020, US shale companies are choosing to use their massively increased profits to pay dividends and repay long-term obligations rather than to take advantage of investment programmes.

International corporations like ExxonMobil, BP, and Shell are "dividend aristocrats" and have paid shareholders stable amounts in both a loss-making 2020 and a super-profitable 2022. Smaller US shale producers like Chevron, Pioneer, Occidental Petroleum and others have also dramatically increased dividends at the request of shareholders. Based on the rhetoric of the owners, the shale industry has established itself as a volatile and unprofitable asset, hence the desire to monetize investments in a short time. Therefore, increasing production at any cost is not in the interests of the American shale industry.

The cartel runs the show

It can be predicted that US oil production will grow by no more than 5% per year—at least until the next presidential election in 2024 and the further relaxation of the green agenda.

That means market power will belong to the OPEC cartel, which will have a positive effect on prices. Saudi Arabia's refusal to increase production at the request of Joe Biden and the decline in Russian exports in 2023 will force the US to release more oil from strategic reserves (SPR), which have decreased by 34% since the beginning of the year (392 million barrels as of November 11).

The more rapidly the reserves decrease, the more influential OPEC will be, finally cementing the "seller's market." At the same time, national companies are gradually moving away from long-term development, resigning themselves to the inevitability of the development of renewable energy. The growth of investment in production is nothing more than a desire to extract the maximum profit from an unexpected price jump in the industry.