G7 energy ministers met last Friday to discuss various proposals to deter the energy market crunch, including imposing a price cap on Russian gas and a broader gas price cap. Thus, these talks more and more remind hatching a cartel plot hoping to tame the energy crisis.

Before the meeting, according to the Financial Times, the European Commission outlined two options to cap gas prices. One is to impose a price cap on all imported Russian gas. The other is to divide European countries into two pricing zones: the red zone countries would be able to buy gas at low prices only, while the green – at relatively high prices. The division into the zones would depend on how well the country is supplied with gas. At that moment, the EU seems to favour the latter option.

On paper, the European officials seem to be doing perfectly fine. They have come up with a plan to cap gas and oil prices by allowing Russia to sell them at a price just above the production cost to ensure that Russia can maintain production but does not have enough money for the military operation.

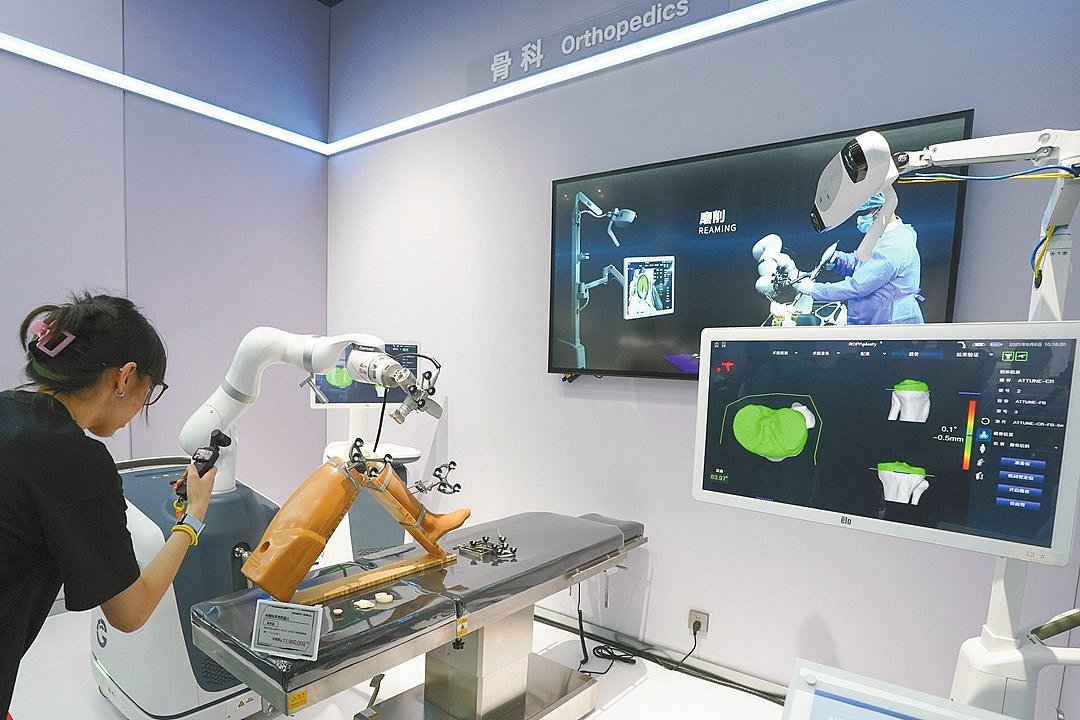

Photo: unsplash.

Should all the buyer countries agree to this measure, the market will continue receiving oil and gas supplies, and the new prices will reduce inflation – this is how it should work in theory. But, as Vladimir Lenin, the world-famous Russian revolutionary, wrote, "theory without practice is pointless". So are the hopes that these measures will work.

The Kremlin has said it will not sell its energy to unfriendly countries that support price controls. In addition, Gazprom Corporation has halted the Nord Stream 1 pipeline for maintenance work. As a result, energy prices rose again. And they are only bound to increase further should the price cap be imposed, as hydrocarbon supplies will fall, pushing oil and gas prices even higher.

In fact, by refusing to sell its energy at artificially low prices, Moscow will not violate its obligations. The long-term contracts concluded with Western buyers specify the cost per barrel of oil and define the formula for calculating the gas price. If the seller does not receive the agreed payment, it does not deliver the product.

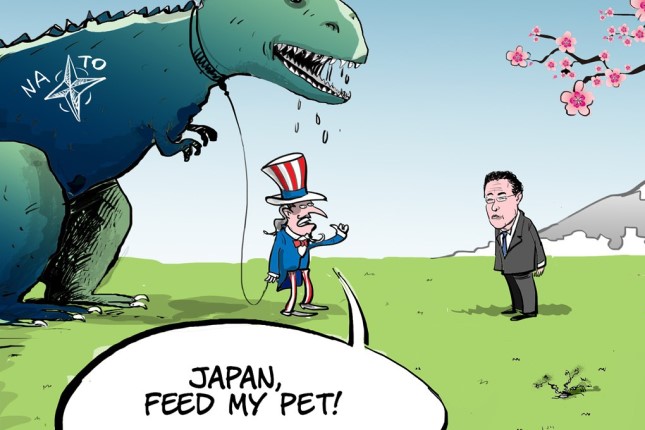

It would have been different if the G7 countries were the only buyers of Russian crude. The scheme might have worked that way, but it is far from the case.

Thirty years ago, the G7 amounted 70% of world GDP, only 45% now. The 35 countries, including China, India, Pakistan and Indonesia, did not support the anti-Russian sanctions. They increased their purchases of Russian energy at a 20-30% discount instead.

Moscow is already trading with them, bypassing the Western financial and transport infrastructure. Russia is working with them through alternative traders and shipping companies. The system is not yet thoroughly tried and tested, but this is a growth disease, and if the West continues to persist, all oil and gas market players will eventually adapt.

China has already pointed out that the gas price cap is a complicated issue and would require prudent consideration. Taking the specifics of Chinese diplomacy, this likely means refusing to participate.

India has said that buying Russian resources is vital for its state security. Regardless of the benefit to the Indian economy due to hydrocarbons purchased at a discount. Moreover, Delhi is also actively purchasing military technology from Moscow. Clearly, India is not looking to quarrel with Moscow.

Photo: incoreinsightlytics.com

As a result, if an energy price ceiling is introduced for a limited range of buyers, countries that support this initiative can lose even more in economic competition with the countries that continue to trade with Russia.

The EU is now compelled to compete for LNG with the premium Asian markets, which comes at a high cost to businesses and consumers.

Would such measures positively impact the market or not – is a big question mark.