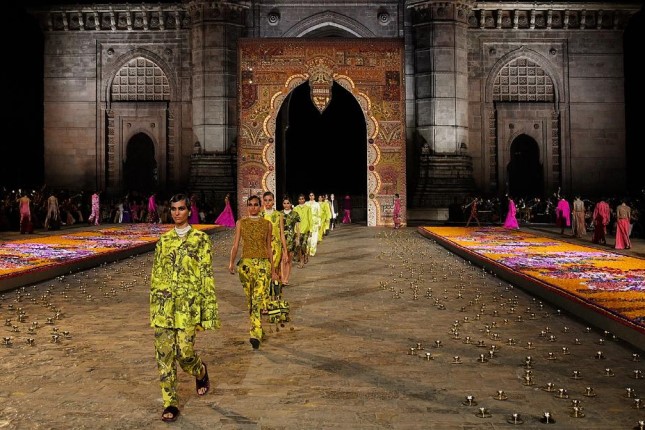

On March 30, Dior organized a landmark fashion event in Mumbai. The Pre-Fall 2023 collection was presented by the French brand against the backdrop of the iconic Gateway of India monument. The audience included prominent Bollywood figures such as Rekha, Sonam Kapoor, Anushka Sharma, model Cara Delevingne and actor Maisie Williams.

The venue provided a clear source of inspiration, with the runway decorated with marigold flowers and diya lamps and the clothing featuring traditional Indian fabrics such as Madras check and Benarasi brocade, mirror work, tie-dye accents, Nehru collars, and kurta tailoring.

Dior's show paid tribute both to India's longstanding contribution to European high fashion production and the growing influence of the country's luxury consumers.

Exploring India's emerging market for luxury brands is becoming a new major trend in the fashion industry. In November 2022, the famous luxury shopping destination DLF Emporio in Delhi became home to the first Valentino boutique in India. Balenciaga is expected to open its first store in the country as early as the end of April 2023. Brands like Gucci, Bottega Veneta, and Burberry have entered earlier.

The reason for such interest is quite apparent. According to the IMF forecast, India's GDP is expected to grow by 7.4 per cent in 2023, twice the world average, making it one of the world's best-performing economies. And according to estimates, by 2030, it will also become the world's third-largest economy.

By 2025 the number of India's ultra-high-net-worth individuals (UHNWIs), people with a fortune of over $30 million, will grow by 63%, reaching almost 12 000.

And accordingly, India's luxury market has also been growing at an impressive speed. Euromonitor estimates the luxury goods market to be worth $8.5 billion in India, and it keeps growing annually by approximately 8%.

Jewellery market

It is no news that luxury is highly valued in Indian culture. But it is also a very conservative market in which jewellery plays the leading role, with gold and diamonds as its two great pillars. India is the largest gold jewellery consumer in the world – second only to China, with a small gap, and the world's third largest consumer of diamond jewellery, despite being a relatively poor country in terms of GPD per capita.

India is responsible for almost 29% of global jewellery consumption, as its market size (in all segments) is estimated at around $100 billion. And international brands like Cartier, Tiffany, Pandora and Swarovski have already started a cut-throat competition with local Indian jewellery brands, which have been so far dominating this market.

However, the Indian jewellery market has a solid national identity and peculiar features.

Firstly, the Indian wedding market accounts for over 50% of jewellery sales. On her wedding day, the Indian bride wears jewellery from head to toe to comply with the traditional bride's dress code and to showcase her family's wealth and status. The sets for high-end events may cost thousands of dollars, while a couture one may reach up to $100,000.

When getting married, Indian brides wear several jewellery pieces, such as anklets, bangles, rings, nose rings, earrings, hair pins, necklaces, and waistbands. Of course, the famous maang tikkas cannot miss from the look – a piece of jewellery on the forehead that gives the bride a glamorous yet classy appeal and sets her apart from the rest. And it remains an open question whether Western brands can understand and deal with this highly traditional set of cultural expectations.

Secondly, Indian consumers prioritize materials over branding. Expensive jewellery with precious gems and metals is considered and purchased predominantly as heirloom jewellery as a means of investment into the long-term prosperity of the family. What matters for such consumers is the type and weight of gold and the diamonds' carats, not the brand's name.

To survive in the competitive Indian market, western jewellery brands will have to work hard to either find their place in this highly traditional centuries-old pattern of jewellery consumption or try to transform it.

Fashion industry

There are many more different nuances that luxury brands need to deal with when it comes to the Indian market.

Traditional clothes are very popular in India, even in big cities like New Dehli, Calcutta, Mumbai or Chennai, and even in most westernized regions like Goa. Most Indian women still prefer wearing sarees and shalwar kameezes to Western-style outfits.

However, the big trend in women's fashion in India is Indo-Western fusion, which combines traditional clothes with a Western touch and is especially popular among the youth. For example, a fashionable Indian woman might take the traditional shalwar kameez and wear the kameez (it's upper part) with jeans, or vice versa – take the pants and wear them with a Western-style blouse. Wearing jeans with a choli, salwar, or kurta is also not uncommon. Or just adding a dupatta to a Western-style outfit.

In India, local traditions in jewellery and clothes matter a lot. Adoption of these traditions seems to be an easy route to connect with Indians not only in India but also with a large diaspora spread all across the world. And so far, western brands that have launched India-specific collections are more successful in entering this promising market.

International brands should strive to understand Indian culture and customs to enhance their relationship-building efforts. This will shorten the distance between new introductions and a sense of familiarity in the market and help earn the consumers' loyalty.

India remains an incredible opportunity for luxury brands. But to become truly successful, they should take the time and try to understand India. And if they do so, who knows? It is quite possible that eventually, they will be more transformed by the Indian market and fashion than influence it.