Millionaire real estate company head Tim Gurner went viral (not for the first time) for his barefaced remarks earlier this month to fellow capitalists at the Financial Review Property Summit.

In a talk, he claimed that workers have become “arrogant” and as a result need to experience rates of unemployment as high as 40 percent and feel “pain in the economy.”

“We need to remind people that they work for the employer, not the other way around,” Gurner said.

“People decided they didn’t really want to work so much anymore through Covid, and that has had a massive issue on productivity,” he claimed.

In reality, productivity growth has vastly outpaced wage growth since the early 1970s.

Although the mask-off nature of Gurner’s comments may be shocking, they are not too different from the misleading idea of a “labor shortage” that has been circulating the mass media since the pandemic — arguing that pandemic benefits have created a category of workers too proud to work for a living.

As leftist media critic Adam Johnson writes, the “labor shortage” trope employs the notion of worker “laziness” to “normalize and make bipartisan the primary argument for throwing millions off one of the most effective forms of social welfare we’ve seen in decades” — pandemic-era aid.

“A much more elegant way of attracting workers is to simply increase wages by a meaningful amount,” Johnson writes.

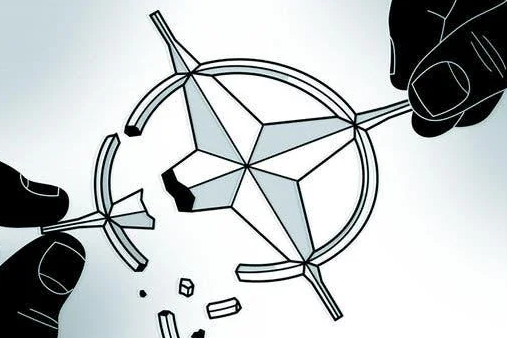

Gurner makes it clear that CEOs don’t want an end to a supposed “shortage” so much as to put all control back in the hands of capital, especially during a resurgence in the labor movement. With UPS Teamsters winning record raises and UAW workers demanding wage increases tied to inflation, workers are demanding a more equal share of the wealth that they create.

Despair as Pandemic Benefits End

But to the U.S. working class, the economic “pain” that Gurner describes is already here.

Recently released U.S. Census data shows that in 2022, the child poverty rate more than doubled — from 5.2 percent (a record low which was a result of pandemic aid) to 12.4 percent.

This enormous increase coincided with the ending of the child tax credit, a federal tax benefit, expanded in 2021, that provided up to $2,000 per year for those with children. When this expanded tax credit expired in December of 2021, 60 percent of parents who received the monthly tax credit reported increased difficulties in paying expenses, financial stress, and affording basic goods.

This month, the Census reported that between 2021 and 2022 the people of the U.S. experienced the highest one-year increase in poverty on record. This increase comes after two years of large declines in poverty due to pandemic-era aid programs, which largely expired beginning in 2022.

Nearly 4 million people lost access to healthcare following the expiration of the pandemic-era expansion of Medicaid, government-subsidized healthcare.

Right now, the tens of millions of children and adults that receive Medicaid or Children’s Health Insurance Program (CHIP) coverage are having their eligibility reviewed and face possible termination of benefits. Sources estimate that by the end of the eligibility review period, between 8 million and 24 million people will lose Medicaid coverage, 2 million to 7 million being children.

According to a report by Moody’s Analytics, the average person in the U.S. is rent burdened, meaning that 30 percent of the median income is required to pay the average rent.

In New York City, one of the most expensive cities to live in but also one of the most populous, the percentage of median income required to pay the rent was 67.8 percent in 2022.

For decades, in fact, median income increases have been unable to keep up with skyrocketing rent increases, with a report by Real Estate Witch (using Housing and Urban Development and Census Bureau data) claiming that rent increases have exceeded income increases by 325 percent since 1985.

How can U.S. workers fight the trend towards impoverishment? Unionized labor is waging bold contract campaigns to reverse decades of wage stagnation, while organizations like the Debt Collective are organizing working people who owe debts for things that should be free, such as medical care and higher education.

Newer labor organizations are building a movement among the lowest paid workers, such as service industry workers. As workers fight back, the rich and powerful couldn’t make it clearer: it’s “us” against “them.”

Photo: U.S. President Joe Biden delivering remarks on the Child Tax Credit on July 15, 2021 © White House / Adam Schultz.

Source: Consortium News.