While there was a slight pullback on Wall Street yesterday due to higher-than-expected inflation numbers, the Dow has risen to over 44,000 in the past 10 days, while the S&P 500 index has hit new records, breaking through the 6,000 mark at one point.

In another expression of the speculative binge, the price of bitcoin, the main cryptocurrency, surged to $90,000 at one stage, with predictions that it could reach $100,000.

The World Socialist Web Site has explained in its analysis of the US election result that while his victory was facilitated by the Democrats at every turn, at its most fundamental level, the ascension of Trump signifies a violent realignment of the political superstructure with the reality of social relations, in which a tiny financial oligarchy dominates all economic and social relations.

The cabinet appointments made so far by Trump have rapidly confirmed that analysis. They are to be filled by the most virulent representatives of the MAGA agenda for dictatorial forms of rule, exemplified in the nomination of Florida Congressman Matt Gaetz for the post of attorney general, and outright members of the financial oligarchy.

The essential character of the new regime, as the open dictatorship of finance capital, is summed up in the appointment of Tesla chief Elon Musk, the richest man in the world, and biotech and finance mogul Vivek Ramaswamy, who is estimated to have a net worth of $1 billion, to head a department of government efficiency.

Musk has set out the goal of a $2 trillion cut in government spending, directed against vital social services, which he has said will cause “pain.” Trump has declared that the new agency will drive out the “massive waste” that exists in the annual $6.5 trillion of government spending.

This is an expression of the outlook of finance capital, which regards all government spending, except for that on the military as it pursues its fight for global dominance, as “waste” because it diverts resources from society, created by the labor of the working class, which would otherwise be appropriated as profit.

There is another, equally significant aspect of this agenda. It is the scrapping of what remains of the already eviscerated regulations on the operations of finance capital, in particular, the major banks. It has long railed against government regulation and is now celebrating in the expectation that its dreams of unfettered activity could be realized.

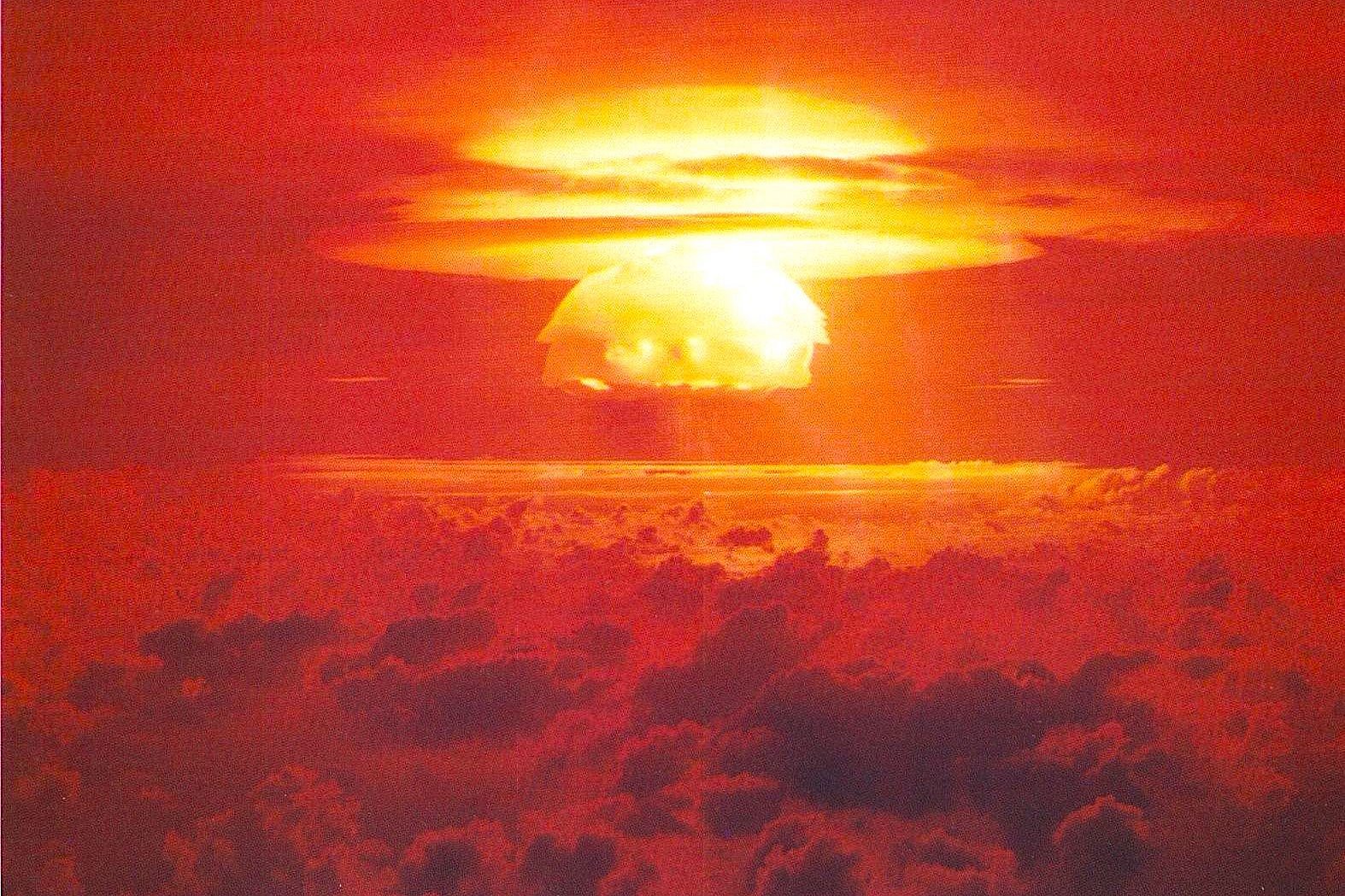

Trump has said the new department will “drive large-scale structural reform and create an entrepreneurial approach to government never seen before.” To underscore what is at stake, he called the initiative “the Manhattan Project” of our time, akin to the development of the atom bomb during World War II. Scheduled to be completed by July 2026, he said it would be “the perfect gift to America” on the 250th anniversary of the Declaration of Independence.

In fact, it will be the exact opposite, dedicated not to the fundamental principle that “all men are created equal” but to further widening already enormous social inequality.

While the wildest dreams of the financial oligarchy seem to be coming true, there is an underlying economic reality that is more powerful than any would-be dictator president and his team.

The escalation of the stock market to record heights is not an expression of the health of the US economy and its prospects for future growth under Trump but of its deeply diseased character.

The accelerated growth of these malignancies is expressed in the rise of bitcoin. A so-called financial “asset” that cannot be used for transactions, except for those of a criminal nature, is reaching new record highs. It has no intrinsic value but is of a speculative character. It has “value” because it is eagerly sought after, and it is eagerly sought after because it is regarded as having “value.”

The same can be said of the stocks now reaching record highs. In March 2009, in the wake of the global financial crisis of 2008, the S&P 500 index stood at 666. Since then, it has risen to around 6,000, a more than nine-fold increase.

GDP, or gross domestic product, which provides some measure of activity in the real economy, was around $14.5 trillion in 2009. Today, it stands at around $29.4 trillion, a two-fold increase.

These figures illustrate the growing divergence between the financial system, driven by parasitism and speculation, and the underlying real economy on which it is based.

No matter how much profit is generated through financial transactions, such as the buying and selling of shares, speculation in currency and commodities markets, debt refinancing, and a myriad of other activities, not a single additional unit of value is created.

But in the final analysis, however much financial assets seem to exist in a world of their own, they represent a claim on the value created by the working class and the surplus value extracted from it in the production process.

This is why, as the financial mountain rises ever higher, there are intensified demands for the heightening of exploitation and the ending of all those measures, such as social services, which even in the most limited fashion are deductions from the wealth available to finance capital.

The measures to be brought forward by Trump did not simply spring out of his fevered brain. They are the product of a historical process consisting of interventions by the capitalist state and its institutions going back decades.

Recent history has seen massive government bailouts of corporations and banks following the 2008 financial crisis, which itself was the outcome of speculation dating back to at least the 1980s.

The Federal Reserve then intervened to lower interest rates to near zero and provided essentially free money for speculation via its quantitative easing program—based on the buying up of government debt.

But even these measures were put into the shade by the measures undertaken with the onset of the COVID-19 pandemic at the beginning of 2020.

Following the freezing of the US Treasury in March 2020, supposedly the safest financial market in the world, the Fed injected some $4 trillion into the financial system in a matter of weeks—at one point spending $1 million a second—to prevent its collapse.

This led to a further concentration of wealth in the hands of an oligarchy comprising figures such as Musk and Jeff Bezos, such that 800 billionaires now possess a combined wealth of $6.2 trillion.

But as a result of these processes, the US has become the most indebted country in history, with almost $36 trillion in debt, where one dollar in every seven of government spending goes toward the interest bill on past debts.

Photo: The New York Stock Exchange © AP Photo / Seth Wenig.

Source: World Socialist Web Site.