In 1806, the French Emperor Napoleon Bonaparte implemented one of the most significant trade blockades in European history, known as the “Continental Blockade.” The underlying cause was a trade conflict between France and Britain. In 1793, Britain, which was at war with France, imposed a naval blockade on French port cities.

So on 21 November, 1806, Napoleon announced the Continental Blockade in Berlin, prohibiting European states under French rule – Prussia, Holland, Spain, Austria, and parts of Italy – from engaging in “all trade and correspondence with the British Isles.” As a result, ships from England or its colonies were not permitted to dock in any of these countries’ ports.

The trade blockade eventually involved almost the entire European continent, and London responded with counter-blockades. Smuggling became rampant, and after the European powers gradually pushed back Napoleon’s troops, the Continental Blockade was lifted in early 1813. The British emerged as the victors, having diverted most of their trade to North America.

"Sanctions from hell"

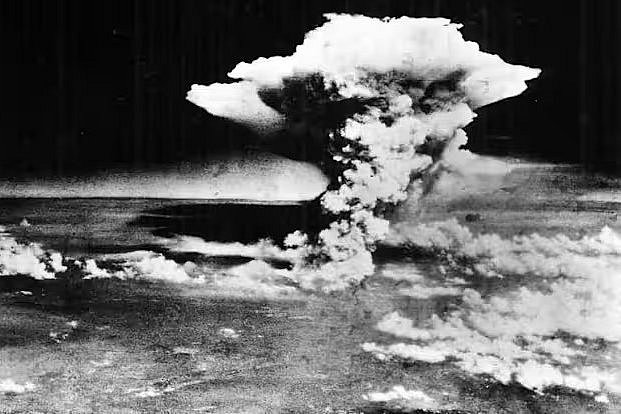

Today, tectonic shifts in trade, similar to those of the past, are taking place across most continents. Russia has been isolated by the collective west through “sanctions from hell,” and has shifted its trade East-South-East, just as the British moved West-North-West over 200 years ago.

As always, smugglers accompany trade wars, as was plainly evident in sanctions efforts against Iraq and Serbia. History is the greatest witness: whether the German “nouveaux-riches” of the 1920s or the Balkans of the 1990s, niche populations always manage to profit from sanctions and blockades.

When the first significant sanctions were imposed on Russia in the aftermath of the 2014 Crimean Crisis, Moscow responded with numerous counter-sanctions, particularly in agriculture.

As a result, food exports from the EU to Russia rapidly declined, while domestic apple and wine production in Russia began to flourish. Russian apple trees have a literary history that stretches back centuries, and sanctions made it crystal clear that there was no need for Austrian apples to travel to Russia. The Russians have since become proud wine drinkers, consuming grapes from their own vineyards.

History repeats itself: When Napoleon’s Continental Blockade cut off large parts of continental Europe from the English colonial goods trade – such as highly popular sugar cane from the Caribbean – this merely boosted beet sugar production, which was handily promoted by Napoleon’s beet sugar-friendly legislation.

Trade wars and innovation

The German word “ersatz” is a term used today in English and French, reflecting the German approach to substituting one good for another, relying on science and innovation rather than raw materials.

This approach was heavily tested during past wars when Germany lacked colonies and had to rely on ersatz materials. Today, that focus has shifted to locating ersatz suppliers of energy to replace Russian oil and gas during the most recent US-European trade war.

Trade wars inevitably trigger innovation and creativity, as seen in the case of China. The Biden administration’s clampdown on exports of advanced technology has not yielded the desired results, as China has made significant progress with hypersonic weapons and nanotechnologies, and today accounts for around 55 percent of global patents filed – more than double that of the US.

While Washington continues to hope that export controls can act as a strategic tool to impose costs on adversaries, in many cases the opposite is true. Chinese companies are simply replacing the technology they have been barred from with their own domestic technical accomplishments.

Limitations and loopholes

Although sanctions rarely perform as intended, the west’s weaponization of currencies, financial services, and insurance coverage continues to grow unabated, with the EU now proposing its eleventh package of sanctions against Russia.

With every sanctions ruling, loopholes and circumvention remain an issue, invariably leading to the constant upgrading of further sanctions. Despite Washington’s extreme belligerence on this front, many US companies have remained in Russia to hedge their bets and observe the local market, including analytical services such as Platts, which provides data on the energy market.

British Petroleum remains a shareholder in Russian energy giant Rosneft – albeit without exercising its vote – and spare parts for German cars in Russia are still traded via third states. As seen in the recent Moscow visit of China’s new Defense Minister Li Shangfu to meet Russian President Vladimir Putin, sanctions often boomerang on those who create them. In this case, they have brought two major US adversary states into an effective alliance.

Economists Patricia Adams and Lawrence Adams recently penned an article for the American Thinker in which they define the west’s sweeping sanctions on Russia as “the most monumental miscalculation in modern history.”

The IMF has raised its forecast for Russia’s economy substantially for the third time in a row – despite sanctions and a slew of other western ‘punishments,’ Russia is expected to see positive growth in both 2023 and 2024. In addition, an unprecedented global trend toward de-dollarization is having a significant impact on energy trades that have long been conducted in the petrodollar, with geopolitical ramifications across West Asia and beyond.

Instead, the petro-yuan is gradually shifting into sight – witnessed this year with the French multinational TotalEnergies’ sale of an Emirati liquefied natural gas (LNG) cargo to China National Offshore Oil Corp, with payment settled in yuan through the Shanghai Petroleum & Gas Exchange (SHPGX).

When the US and its allies blocked access by most Russian banks to the Belgium-based global financial messaging system, SWIFT, and froze some $300 billion in Russian foreign exchange reserves, every government from Riyadh to Beijing understood that such sanctions can happen to them as well.

De-dollarization and war

This realization has prompted many countries to take action to decrease their vulnerability to sanctions, with China creating a new financial infrastructure outside US control and pushing for commodity suppliers to short-circuit the dollar. The establishment of a BRICS bank as a counterweight to the IMF is just one more step in that direction.

It remains to be seen whether the US will view widespread de-dollarization as a national humiliation and yet another pretext to go to (financial) war. But what is certain is that sanctions do not work – with the rare exception of those levied against Apartheid South Africa last century, though perhaps because these sanctions were genuinely a universally agreed upon course of global action.

Western sanctions, in contrast, are a specific coercion instrument used by only a handful of states to force” behavior change” on targeted adversaries, as seen in Iraq, Serbia, Iran, and Venezuela.

Iran, as a case in point

The Islamic Republic of Iran is an old hand at dealing with western financial coercion. It is the most sanctioned country in the world with over 4000 sanctions – until the 2022 Russian-Ukrainian conflict came into focus. Despite the oppressive regime of western economic punishments, Iran has made remarkable progress in both military and scientific fields and has established self-sufficiency milestones in vital sectors of its economy.

Rather than shrinking Iran’s military and technological footprint to conform to western demands, US and EU sanctions have only encouraged the Iranians to deepen their peaceful nuclear program and rapidly develop indigenous ballistic missile capabilities – today, widely regarded as the most advanced in West Asia and North Africa. In addition, the country has made great strides in its domestic production of other sophisticated military hardware, including tanks, submarines, and drones.

It doesn’t stop there. Iran has also made significant advancements in its scientific research and development output, ranking first in West Asia and fifteenth in the world in scientific and technical journal articles. This progress extends from biotechnology to nanotechnology – where Iran is one of only six nations to set industry standards – to aerospace engineering.

Despite the negative impact of sanctions on the Iranian economy, they have been a key driver in spurring on the country’s monumental technological and scientific advancements, making Iranians altogether more self-sufficient and less reliant on foreign imports.

In short, the current approach of western “coercive” diplomacy is dramatically inadequate when it comes to dealing with major powers like Russia and China, nations operating on a wholly different level than the traditional western sanctions targets. True diplomacy is based on mutual respect for sovereignty and non-interference in domestic affairs, as outlined in the UN Charter.

We are now facing a time of great uncertainty, and the conflict in Ukraine has only hastened developments that were already underway for many years. These seismic changes involve a wholesale rebooting of global interactions – from new trade routes, and alternative currencies, to the growing dominance of different languages and cultures. And “sanctions from hell” have played a significant role in driving this shift.

Source: The Cradle.