If financial institutions are so interconnected that we can’t let them fail, they should be run as publicly owned utilities.

In case we need any more proof, the bailout of the Silicon Valley Bank (SVB) is yet another overt sign that we are operating within a new version of capitalism. The wealthiest among us have little fear of losing money from their most important financial investments. They know they will be bailed out and the rest of us will pick up the tab.

The crisis at SVB has made a mockery of bank deposit insurance and private banking. In the U.S., bank deposits are insured up to $250,000. If the bank fails, those with accounts below that amount are fully protected. But deposits over that amount are not.

The reason is straightforward. If you insure all accounts, no matter their size, bank executives will have every incentive to maximise their profits by investing depositor money in the riskiest, highest-yielding investments they can find.

If they succeed, the bank officers and investors become rich. If they fail, the government makes the depositors whole. It’s a business model with little downside.

This logic has been understood since the first bank insurance was debated and put in place during the 1930s. (President Franklin Roosevelt worried that bank insurance would unfairly subsidise poorly run banks.) So why is this rule being breached now?

The reasons given are many. Small businesses with sums in SVB above $250,000 won’t be able to make payroll. Workers will be laid off. Cutting-edge high-tech enterprises will fail. People will lose confidence and cause bank runs. The entire financial system, it is implied, is so interconnected that a failure of one bank may take down many others, and so on.

But perhaps the major reason in the case of SVB’s bailout has to do with the very wealthy venture capitalists who are invested in many of the tech start-ups that have their money parked in SVB accounts. These VC moguls, many of whom profess to be anti-government libertarians, made it clear to the political establishment that a bailout was required — and immediately!

This time, they didn’t care about bailing out the investors or bank officers. Those days are over. The big money was wrapped up in more than $200 billion in uninsured deposits. Their argument was simple — we are just too important to America for it to allow our operations to suffer financially. We are the backbone of high tech, of innovation, of American economic leadership. (And we put a lot of money into your political campaigns.)

Gutting Regulation

SVB’s failure — and the failure of New York-based Signature Bank that followed — will lead to much hand-wringing about the need to tighten regulations, which were weakened in 2018 during the Trump administration.

SVB lobbied successfully to avoid facing the same regulations as the “systemically important” mega-banks. They wriggled out of some of the strongest provisions of the Dodd-Frank banking legislation, as the bank assets threshold [for those banks affected by the provisions] was increased from $50 billion to $250 billion. (Barney Frank, the Frank in Dodd-Frank, incredibly, supported the weakening of his own bill. He sits on the board of the failed Signature Bank, having received more than $2.4 million in cash and stock awards over the past seven years.)

Former Congressman Barney Frank, D-MA, in 2015. Photo: Brookings Institution / Flickr / CC BY-NC-ND 2.0.

While the need for tighter regulations will dominate the discussion, we are missing the bigger picture. The financial barons and their CEO partners have a stranglehold over our economy: They are too big to fail and too politically important to suffer any appreciable financial harm. We will always bail them out, or the economy will crash, harming millions of working people.

It wasn’t always like this.

After the Great Depression, banking in the U.S. was tightly regulated. One measure of this government control shows up in the income received by bankers. Between WWII and 1980 or so, there was virtually no difference in income between financial and manufacturing professionals.

Reagan-Thatcher Era

That changed in a hurry after the Reagan-Thatcher idea of government captured the minds of most policymakers. The goal was to get the government out of the economy and get its foot off the necks of Wall Street/City financiers. Let them be free to create, free to build, free to drive the economy forward. Let them fund mergers and hostile takeovers that weed out the weak. Let them use corporate money to buy back stocks, manipulate share prices and stuff their own pockets. Let them become rich and richer as they lead us to a brighter, better world.

Once deregulation started, money flowed to the top. In the U.S., the gap between the top 100 CEOs and an average worker was about 40-to-1 in 1980. Today it is closer to 1000-to-1. And as the money flowed upwards, more deregulation followed.

Both political parties tripped over themselves to compete for Wall Street cash. The Democrats, under Bill Clinton, broke through Glass Steagall — the wall created during the New Deal that separated risky investment banking from the insurance industry and commercial banking.

And they deregulated derivatives that allowed for financial betting involving tens of trillions of dollars. It was argued that these bets would stabilise the financial system by spreading risk far and wide.

Instead, it brought the system to its knees. The entire financial system froze in 2008, causing 6 million American workers to lose their jobs in a matter of months due to no fault of their own.

Wall Street, March 2012. Photo: Michael Fleshman.

The government responded by bailing out those banks and basically guaranteeing their profits. It allowed the failed banking executives to stay in control and none of the financial criminals were prosecuted. This announced to all who cared to notice that we had entered a phase of capitalism we could call the Billionaire Bailout Society.

To be sure, new regulations had to be passed to appease a furious public. Dodd-Frank forced the large banks to keep more cash on hand and to go through periodic stress tests. But should a crisis reach those banks, does anyone really believe they will be allowed to fail?

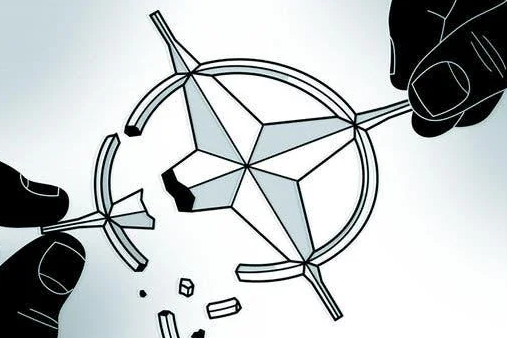

The question to ask right now must go beyond how to re-regulate massive for-profit private banks. The real question is, what will it take to disband the Billionaire Bailout Society?

The SVB event tells us that any bank that is well-connected or simply large enough to cause financial chaos will have its depositors bailed out — all of them. But then, how are such banks free enterprises?

The next step should be obvious. Our only realistic path away from having to bail them out over and over again is to nationalise large parts of the banking system. If these financial institutions are so interconnected that we can’t let them fail, they should be run as publicly owned utilities.

Main photo: Silicon Valley Bank offices in Tempe, Arizona, 2020 © Tony Webster / Flickr / CC BY 2.0.

Source: Consortium News.